SEO

Competitive Analysis: A Comprehensive 9-Step Guide

A competitive analysis is one of the most important pieces of work you’ll do, especially if you’re starting with a new client or employer.

It’s a vital component of a successful SEO strategy.

As SEO pros, how can we do our jobs if we don’t understand the lay of the land?

The knowledge we gain from a competitor analysis makes us much better, more informed consultants. It helps us pinpoint areas of opportunities and threats.

These are some of the questions that competitor analysis can help us answer.

Gaining context on the competitive landscape:

- What can we learn from our competitors?

- Why do we believe competitors rank well?

- What aren’t competitors doing that we can take advantage of?

Providing valuable business intelligence:

- Who are the most visible competitors? Is there a distinction between ‘traditional competitors’ and ‘SEO competitors’?

- Do they perform well for transactional or informational terms? Or both?

- Are competitors growing their brand awareness?

Showing what a competitor is doing better than you is one of the best ways to get stakeholder buy-in.

Need help getting started with your competitive analysis? I created a checklist with everything you need – and in this article, we’ll cover a comprehensive nine-step guide to conducting your own analysis.

Make sure you make a copy of the checklist to edit your own version.

How To Use The Checklist

I’ve split the checklist into two sections:

Domain-Wide Analysis

These sections focus on domain (or subdomain) level analysis and aim to uncover a domain’s relative strength or performance.

For example, backlink data.

Page Type Analysis

These sections focus on specific page type analysis. For instance, assessing the UX, design, and content of a page type.

Page types can include:

- Homepage.

- Category, product, or service pages.

- Blog/guide pages.

When working through page type sections, view samples of different page types for your site and your competitors.

Additionally, ensure that you compare the same page types for a fair comparison.

For example, you wouldn’t want to compare a product page from one site against a category page on another site.

Task Notes

For some checklist items, task notes are provided to help with the analysis.

There are also “Opportunities” and “Threats” columns that you can use to brain dump things you notice during the analysis. I find it a great way to free up headspace and organize notes you might return to.

Now, let’s dive into the nine steps to conducting a competitive analysis.

1. Identifying The Search Landscape

This part of the analysis will show the competitive landscape based on estimated traffic share.

This will form the foundation of your analysis.

What You’ll Look At

- Who are your search competitors?

- Estimated traffic share (segmented by intent and topics).

Gathering Your Data

For this section, you’ll need:

Requirement 1: A relevant, non-branded keyword research list with associated search volumes.

Requirement 2: Keywords classified by intent and topics.

If you don’t have an extensive keyword research list and/or there isn’t intent classification, you can do a bit of quick and dirty research:

Enter your domain into a tool like Semrush or Ahrefs.

In Semrush, there is a “Main Organic Competitors” feature; in Ahrefs, the same feature is called “Competing domains.”

The video below demonstrates how to enter a domain into Semrush to see organic competitors:

- Select the top performing competitors (2–5 competitors will do). You’ll be entering these domains into either Semrush or Ahrefs to extract the keywords they rank for.

- To help speed up the intent classification, extract the keywords and ranking URLs that a blog subfolder, i.e., exampledomain.com/blog/ (or subdomain, i.e., blog.example.com), ranks for. You can then classify these keywords as “informational.”

- Enter the domains again, but exclude the blog subfolders this time. These keywords can be classified as “transactional.”

I also recommend setting the tools to only extract keywords that rank between positions 1-20 to help avoid pulling through irrelevant keywords.

You may need to spend several hours refining that initial list to ensure it makes sense.

Semrush has a feature that defines the intent of keywords when you export them. This can also help speed up the eyeballing of your keyword list.

Unless you’re going to spend hours classifying keywords by topics, you might have to give topic classification a miss. It’s not the end of the world for this task.

Requirement 3: Click-through rates (CTRs) to get estimated traffic share. Advanced Web Ranking is my go-to choice for getting CTR values.

The formula you need to apply to get estimated traffic share is:

CTR * keyword search volume = estimated traffic share.

Your ‘search landscape’ data might look something like the below:

- Only one domain is shown in the screenshot, but the tab should contain all ranks, ranking URLs, and estimated traffic for all domains analyzed, including your own domain.

Requirement 4: Finally, segment your data and create your visuals.

How To Use The Insights Gained From This Section

Some common takeaways include:

- Outlining who the leaders are when it comes to estimated traffic. Do they perform well for both informational and transactional keywords?

- Understanding what topics competitors perform well for.

- Understanding whether competitors have invested in informational content.

- Evaluating whether any of the insights should be considered a threat.

To bring some color to the outcomes, I worked with a client whose competitor had clearly invested in informational content.

The chart below illustrates that the content was estimated to generate significant monthly traffic.

Screenshot from Ahrefs, August 2022

Screenshot from Ahrefs, August 2022This was considered a threat (and opportunity) and helped advance the buy-in to develop a content strategy.

Remember that showcasing what competitors are doing better is often one of the best ways to get stakeholder buy-in.

2. Backlink Profile

This part of the analysis will outline the strength of competitor sites from a backlink perspective.

While backlinks aren’t as influential as they used to be, they’re still a core part of Google’s ranking algorithms.

What You’ll Look At

- Overall domain link profile strength.

- Homepage link profile strength.

- Correlations between link quality and ranking in positions 1-3.

- Who’s acquiring more linking domains over time?

Gathering Your Data

Majestic SEO is my go-to tool for backlink data and, therefore, will be the choice of tool for the metrics we want to analyze.

However, feel free to use comparative metrics from other tools.

For this section, you’ll need:

Requirement 1: Overall domain Trust Flow and referring domains for each domain you’re analyzing.

Requirement 2: Homepage Trust Flow and referring domains for each domain you’re analyzing.

Requirement 3: Average Trust Flow of URLs that have keywords ranking in positions 1–3 and the count of ranking keywords in positions 1–3.

You’ll need to return to your search landscape spreadsheet and pull through Trust Flow scores for each URL.

Majestic has a Bulk Backlink feature that will allow you to get Trust Flow URL data, or you could even use Screaming Frog to sync to the Majestic API.

And your search landscape tab should have the keyword ranks for each domain you’re analyzing. From that, you can pull through the count of ranking keywords in positions 1–3 for each domain.

Requirement 4: To view monthly referring domain link acquisition over time in Majestic, click Tools > Compare Domains > Backlink History.

The interface and selected options will look something like the below:

Screenshot from Majestic, August 2022

Screenshot from Majestic, August 2022I often select Cumulative for the View mode option, which shows ever-increasing link totals. This can help see clearer trends as to whether a particular domain is acquiring links at a faster pace.

Make sure you select Historic Index as well, as it will allow you to see historic link data trends going back years.

How To Use The Insights Gained From This Section

Some common takeaways include:

- Identifying who might have a ranking edge due to stronger link profiles.

- The need to invest in tactical link building if there’s a correlation between link quality and ranking in positions 1–3.

- Evaluating the threat of competitors acquiring links faster than your site.

As illustrated by the chart below, a competitor (blue line) had acquired links faster than my client (purple line) for several years.

Screenshot from Majestic, August 2022

Screenshot from Majestic, August 2022Over time, this could hurt SEO and potentially brand awareness.

Showcasing this data helped facilitate further investment in link building activities.

3. Brand Awareness

This section looks at how your brand awareness stacks up against competitors.

The importance of brand awareness is indisputable; Think of things like brand association and recall.

It can also indirectly benefit SEO.

For instance, the more people that are aware of your brand, the more likely they are to link to you or search for your brand, to begin with.

A more debatable theory is the direct link between brand awareness and rankings.

Regardless, given the impact brand awareness can have on a business, it’s useful to know how you stack up against competitors.

What You’ll Look At

- Who has the strongest brand awareness?

- Who has the strongest product/service association?

From this, you can get an idea of:

- If you’re ahead of your competitors.

- If your competitors are closing the gap or further increasing their brand awareness.

- If competitors have a topical authority advantage.

Gathering Your Data

Google Trends is the tool of choice to use here.

For this section, you’ll need:

Requirement 1: To add {brand name} into Google Trends (e.g. “boohoo”).

Requirement 2: To add {brand name} {product / service} into Google Trends (e.g “boohoo dresses”).

You can manually use the Google Trends interface to get these insights, and the output will look like the below:

Screenshot for Google Trends, August 2022

Screenshot for Google Trends, August 2022However, automating the process using Python and the Google Trends API is the way to go if you need to scale a large data set.

How To Use The Insights Gained From This Section

Some common takeaways include:

- Identifying that competitors have a potential ranking advantage for certain topics.

- The need to invest in brand-building activities to close (or increase) the gap on competitors.

4. Internal Linking

This section looks at how sites are using internal linking to their advantage.

We all know the importance of internal linking.

Whether it’s to pass on PageRank or to help Google better understand your content, it’s a vital part of SEO.

What You’ll Look At

- Do competitors use the main navigation and footer to link to strategically important pages?

- Do competitors link to topically relevant pages? For example, a TV category page would link to different types of TVs, different brands of TVs, etc.

- Are there links to supporting informational content?

- The use of descriptive anchor text.

Gathering Your Data

This will require a bit of manual digging and running crawls to scale insights.

How To Use The Insights Gained From This Section

Some common takeaways include:

- Better internal linking to topically relevant pages.

- Recommending linking to informational pages from transactional pages (and vice versa) to improve the perceived value of pages to users and Google.

- Optimizing the top-level navigation to better support key pages through PageRank distribution. Particularly valid if users navigate to these pages in large numbers.

5. On-Page Optimization

On-page optimization has been a foundation of SEO since its inception and continues to be one of the most influential means of moving the needle.

This section will look at on-page elements such as title tags.

Internal linking and content have their own dedicated sections.

Gathering Your Data

This section falls under page type analysis.

You can use the search landscape tab to categorize different page types quickly, or you could use a crawler tool, such as Screaming Frog, to get a deeper view of the different page types a site has.

I recommend using a crawler tool (list mode or crawl) to extract on-page elements for efficiency.

How To Use The Insights Gained From This Section

Some common takeaways include:

- Recommending to keep the title or headings tags shorter and/or descriptive of pages.

- Testing CTAs in title tags and meta descriptions (e.g., “Free Delivery,” “Lowest Prices,” etc.)

- The need for descriptive alt text to encourage image thumbnails in search results.

6. UX, Design, And Content

This section examines whether a site’s UX, design, and content make it easy to understand and navigate.

In essence, we want to know how useful and engaging the user experience of a site is.

Does the user experience make it easy for a user to complete an action?

Or is the site difficult to understand and navigate – and, therefore, more likely to lead to a bounce back to search results?

The link between user engagement metrics (think pogo-sticking and CTR) and the impact on SEO have long been debated.

At the very least, it’s fair to argue there’s an indirect link with SEO.

For instance, a site that provides a good user experience is more likely to get a backlink, return visits, and so on.

However, beyond SEO, we know a site with a good user experience has a better chance of affecting the bottom line.

Overall, it’s an important area to assess.

What You’ll Look At

- Assessing if the content is useful for users.

- Assessing if the content answers users’ questions and fulfills their needs.

- Assessing if the content is easy to understand and read.

Gathering Your Data

Notably, this part of the analysis is qualitative heavy and incorporates elements of Google’s Search Quality Rater Guidelines (QRGs). This is a nice summary of the guidelines if you want to learn more.

This section falls under page type analysis, so you’ll want to look at and compare pages manually.

Avoid analyzing blog/guide content for this part. The importance of informational content means it’s worthy of its own dedicated section.

You can use the search landscape tab to categorize different page types quickly, or you could use a crawler tool, such as Screaming Frog, to get a deeper view of the different page types a site has.

How To Use The Insights Gained From This Section

Some common takeaways include:

- Highlighting the need to make the proposition clear and easy to understand.

- The need to break up large blocks of text and sections into digestible formats.

- The need to use relevant, non-generic imagery.

One client had used a lot of stock images.

This is a poor practice in general, as people have to work harder to understand what is being offered, which can negatively impact the conversion rate.

This was compounded by competitors who used relevant, high-quality imagery.

When we updated imagery to be more relevant, we generated more thumbnail images in search results and took up more real estate.

7. Blog/Guide Content

In this section, you’ll review and compare informational content produced by competitors.

Informational content is important. It can have a range of benefits, including:

- Diversifying traffic.

- Brand building. The more people that land on a certain brand’s blog or see their blog ranking in search results, the more likely they are to search for the brand directly.

- Passive link building.

- Building retargeting lists for paid media.

What You’ll Look At

- The UX and design of content.

- Quality of content.

- The credibility of authors.

- How content is syndicated.

- The effectiveness of the content in acquiring links.

Gathering Your Data

This section is largely qualitative-focused.

You’ll manually review blog homepages and a sample of different content pieces.

However, this section can be a great opportunity to combine qualitative and quantitative insights, which can be an impactful way to really hammer home the story you’re trying to tell.

I love data as much as the next SEO professional, but I think we can bury our heads in spreadsheets a little too deep sometimes.

How To Use The Insights Gained From This Section

Some common takeaways include:

- Recommending using varied types of content (e.g., video, when it makes sense).

- Improving the UX/design of the blog.

- Showcasing how useful informational content can be in generating links.

The last takeaway can be an ideal chance to combine qualitative and quantitative insights.

For example, comparing the quality of UX and content (qualitative) with how many links competitor informational content generates relative to your own (quantitative) can tell a compelling story.

While I can’t show the qualitative aspects, the chart below tells a story in its own right.

Screenshot from Majestic, August 2022

Screenshot from Majestic, August 2022This further reinforced the need to invest in informational content for a client.

8. Core Web Vitals

In this section, you’ll review how performance stacks ups against competitors.

Improving Core Web Vitals (CWV) has been a priority for many sites since it became a core part of Google’s page experience update.

The relationship between performance and conversion is also well documented.

What You’ll Look At

CWV Chrome UX data for your site and competitors for the below metrics:

Gathering Your Data

There are many existing guides out there that detail the process of extracting CWV data, including this CWV auditing guide, so I won’t go into the details.

However, to clarify, you’ll need to extract CWV performance for both your competitors and your own site.

This is another page type section. If you’ve worked through the UX, design, and content sections, you should already have categorized pages by page type.

How To Use The Insights Gained From This Section

Some common takeaways include:

- Opportunity sizing. If you perform relatively well (and better than your competitors), then happy days! You know it’s not an area of priority. Conversely, the opposite is also valid.

- Highlighting the specific CWV metrics that require improvement, particularly if they fall within the ‘red’ range.

- The need to perform a dedicated CWV audit to provide recommendations to improve performance.

Once again, it’s a lot easier to get stakeholder buy-in for further audits when you can showcase competitors are performing better for these metrics.

9. Structured Data

This section looks at the structured data markup competitors use to enhance their search result snippet.

Enhancing the way your listing stands out in search results is a great way to take up more real estate and increase your CTR.

What You’ll Look At

Structured data markup that enhances search result snippets, for example:

Gathering Your Data

Screaming Frog is your friend once again.

You can simply select some configurations that will extract structured data on pages when running a crawl of your competitors.

To configure Screaming Frog, click Configuration > Spider > Extraction > Click the Structured Data options:

How To Use The Insights Gained From This Section

Some common takeaways include:

- Learning the different types of structured data markup types competitors use to enhance their search result snippet.

- The different page types competitors implement structured data on.

- The lack of structured data used by competitors.

The last takeaway is often an interesting insight.

It comes back to what I mentioned at the beginning of the article: What aren’t competitors doing that we can take advantage of?

In my experience, identifying a means to one-up competitors helped prioritize implementing structured data across key page types for a client.

This wouldn’t have been the case had I not shown a clear area of opportunity.

Conclusion

Competitor analysis is a fundamental task you must carry out if you want to create a truly impactful SEO strategy – and be the best consultant you can be for your client.

You can ascertain which challenges and threats need your immediate attention, which opportunities you can jump on for maximum value, and also provide clear business intelligence to help your team get buy-in from clients.

Now you can really get to work, start digging into areas of opportunity and create a real impact for your brand or team.

More resources:

Featured Image: Tero Vesalainen/Shutterstock

SEO

Measuring Content Impact Across The Customer Journey

Understanding the impact of your content at every touchpoint of the customer journey is essential – but that’s easier said than done. From attracting potential leads to nurturing them into loyal customers, there are many touchpoints to look into.

So how do you identify and take advantage of these opportunities for growth?

Watch this on-demand webinar and learn a comprehensive approach for measuring the value of your content initiatives, so you can optimize resource allocation for maximum impact.

You’ll learn:

- Fresh methods for measuring your content’s impact.

- Fascinating insights using first-touch attribution, and how it differs from the usual last-touch perspective.

- Ways to persuade decision-makers to invest in more content by showcasing its value convincingly.

With Bill Franklin and Oliver Tani of DAC Group, we unravel the nuances of attribution modeling, emphasizing the significance of layering first-touch and last-touch attribution within your measurement strategy.

Check out these insights to help you craft compelling content tailored to each stage, using an approach rooted in first-hand experience to ensure your content resonates.

Whether you’re a seasoned marketer or new to content measurement, this webinar promises valuable insights and actionable tactics to elevate your SEO game and optimize your content initiatives for success.

View the slides below or check out the full webinar for all the details.

SEO

How to Find and Use Competitor Keywords

Competitor keywords are the keywords your rivals rank for in Google’s search results. They may rank organically or pay for Google Ads to rank in the paid results.

Knowing your competitors’ keywords is the easiest form of keyword research. If your competitors rank for or target particular keywords, it might be worth it for you to target them, too.

There is no way to see your competitors’ keywords without a tool like Ahrefs, which has a database of keywords and the sites that rank for them. As far as we know, Ahrefs has the biggest database of these keywords.

How to find all the keywords your competitor ranks for

- Go to Ahrefs’ Site Explorer

- Enter your competitor’s domain

- Go to the Organic keywords report

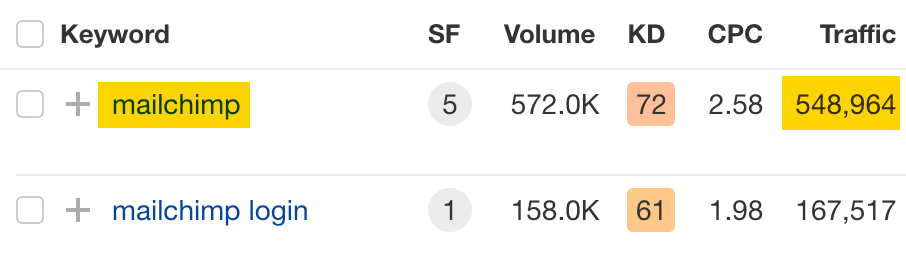

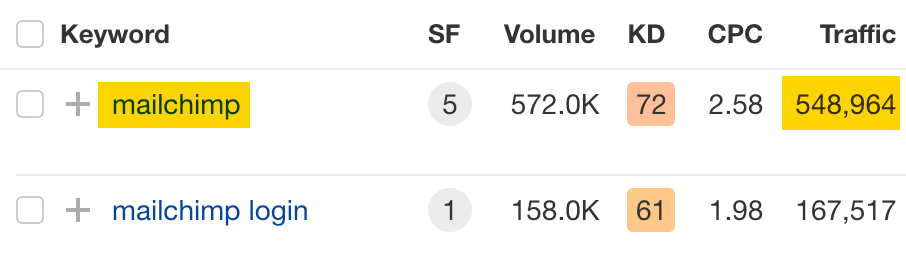

The report is sorted by traffic to show you the keywords sending your competitor the most visits. For example, Mailchimp gets most of its organic traffic from the keyword “mailchimp.”

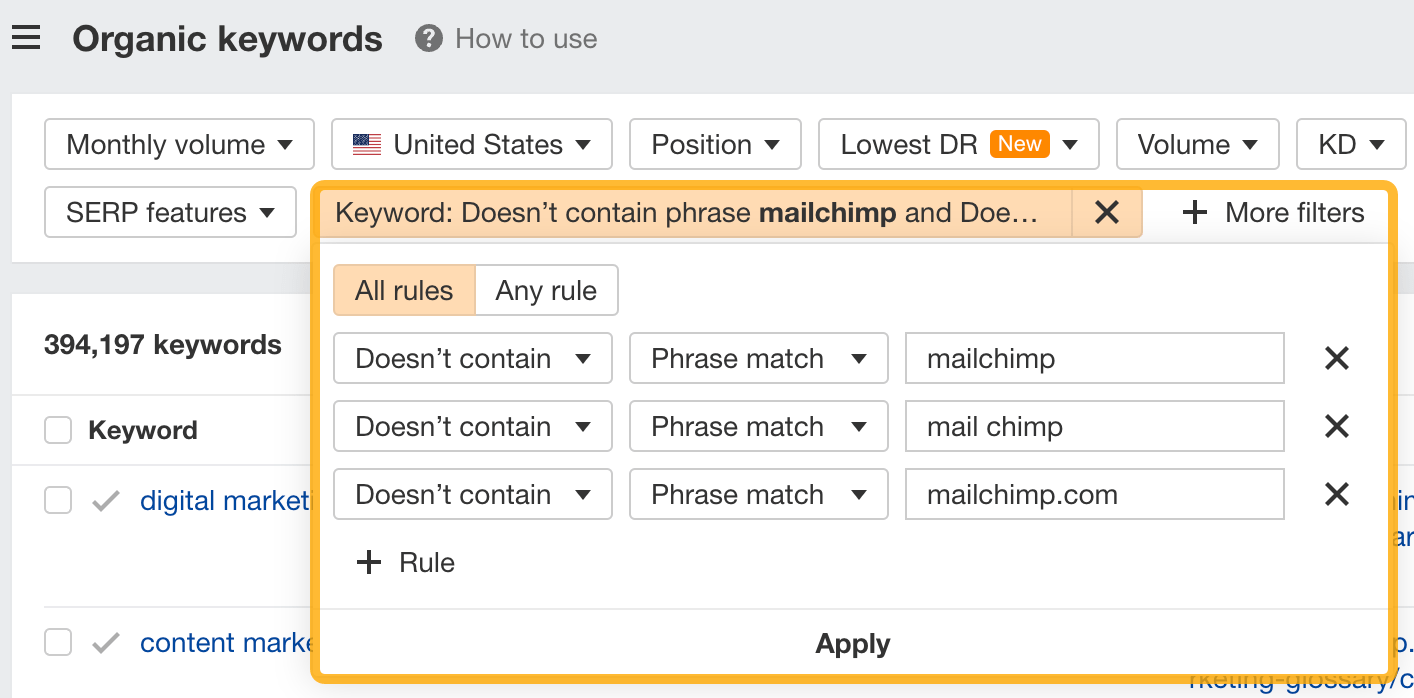

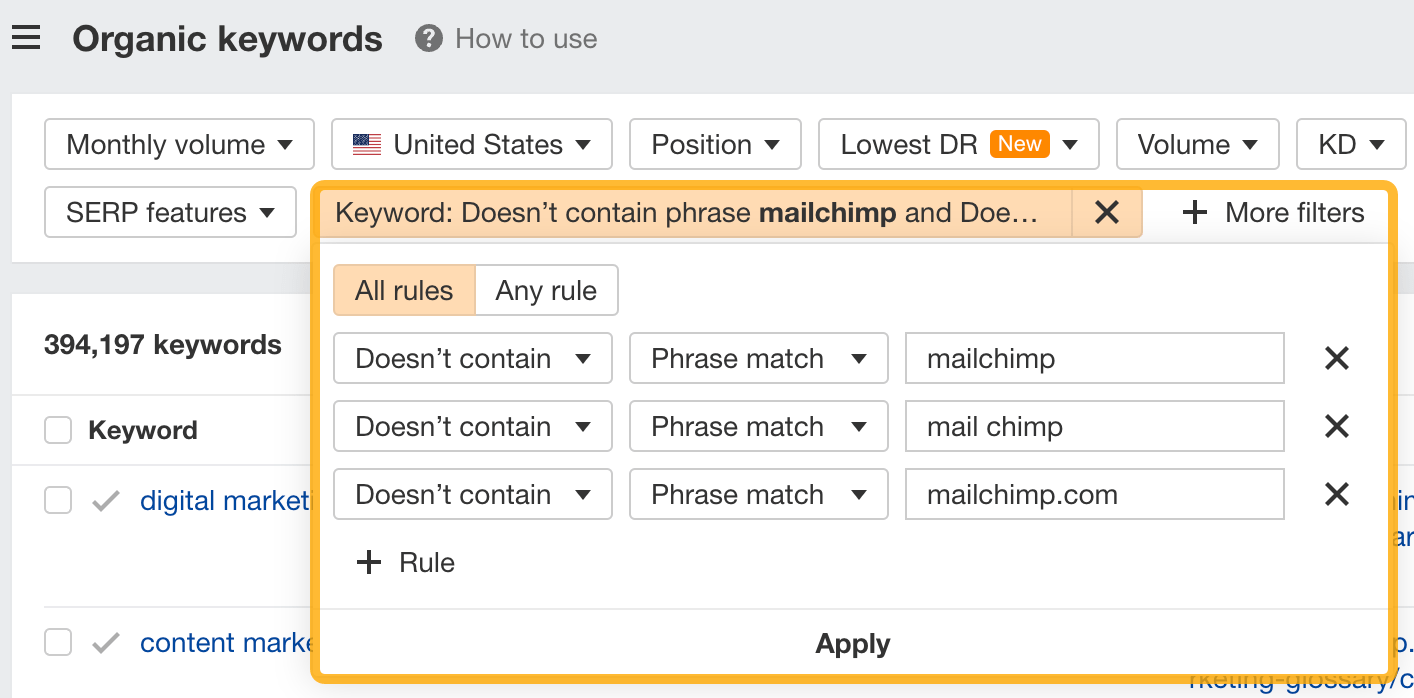

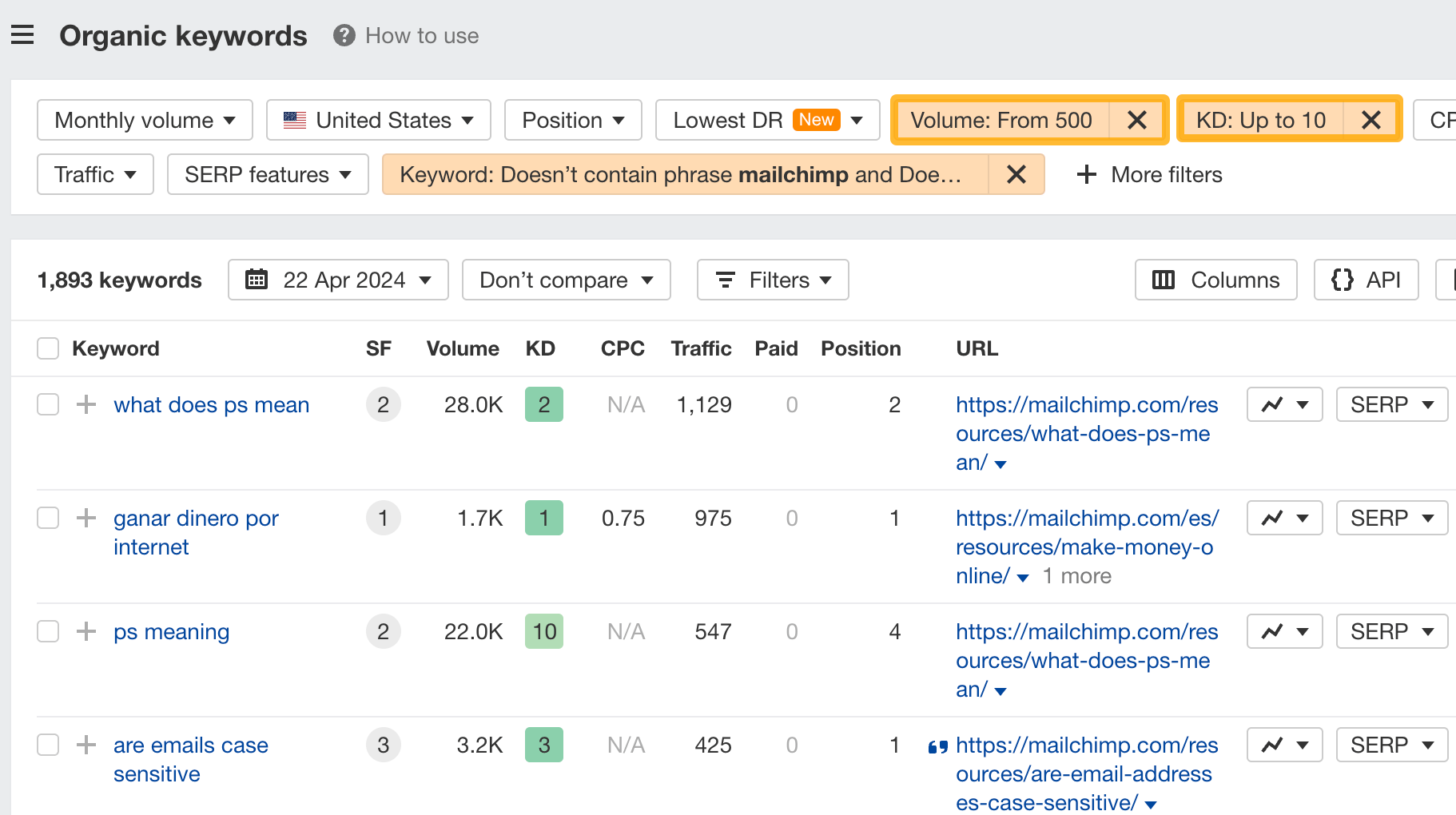

Since you’re unlikely to rank for your competitor’s brand, you might want to exclude branded keywords from the report. You can do this by adding a Keyword > Doesn’t contain filter. In this example, we’ll filter out keywords containing “mailchimp” or any potential misspellings:

If you’re a new brand competing with one that’s established, you might also want to look for popular low-difficulty keywords. You can do this by setting the Volume filter to a minimum of 500 and the KD filter to a maximum of 10.

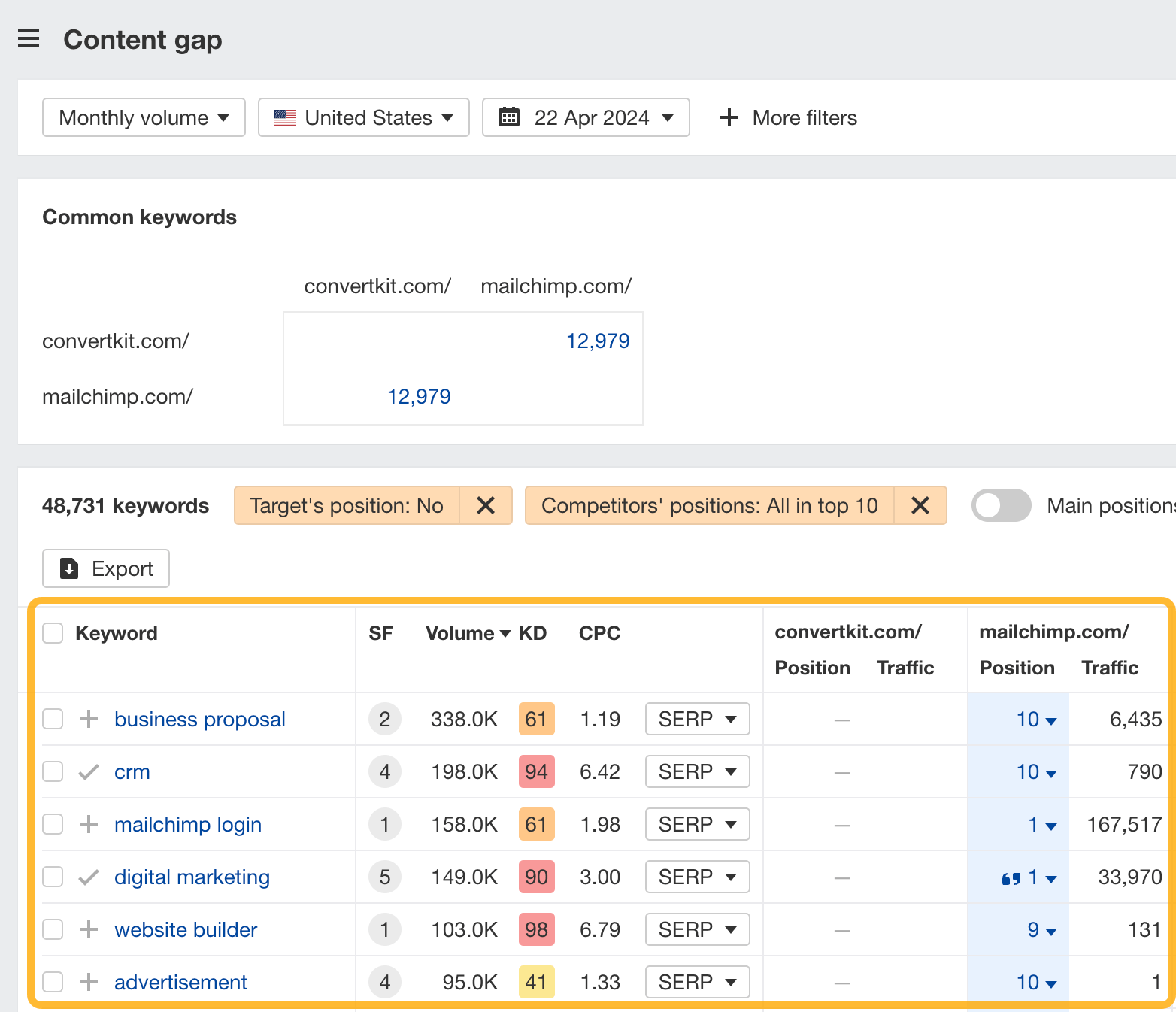

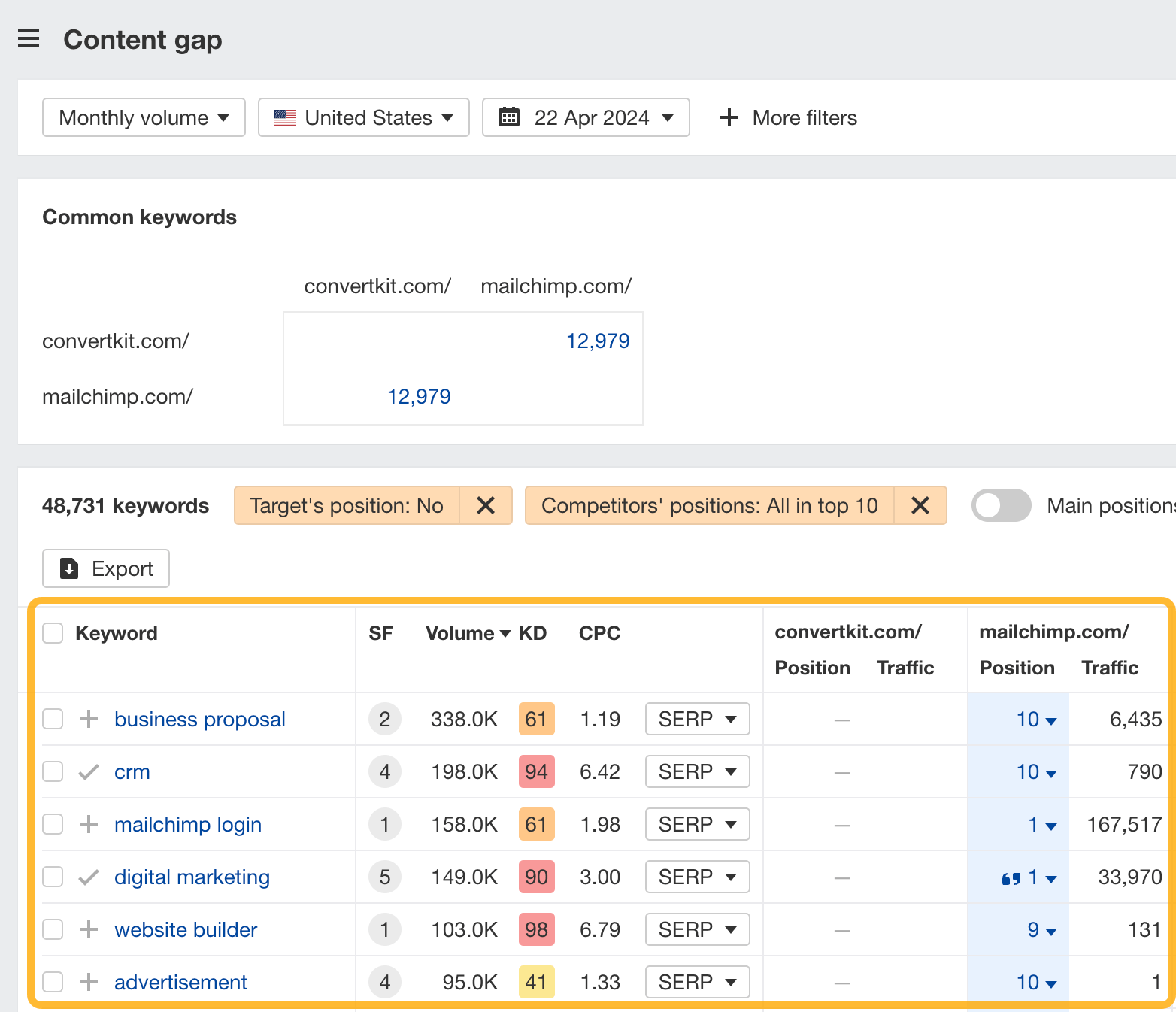

How to find keywords your competitor ranks for, but you don’t

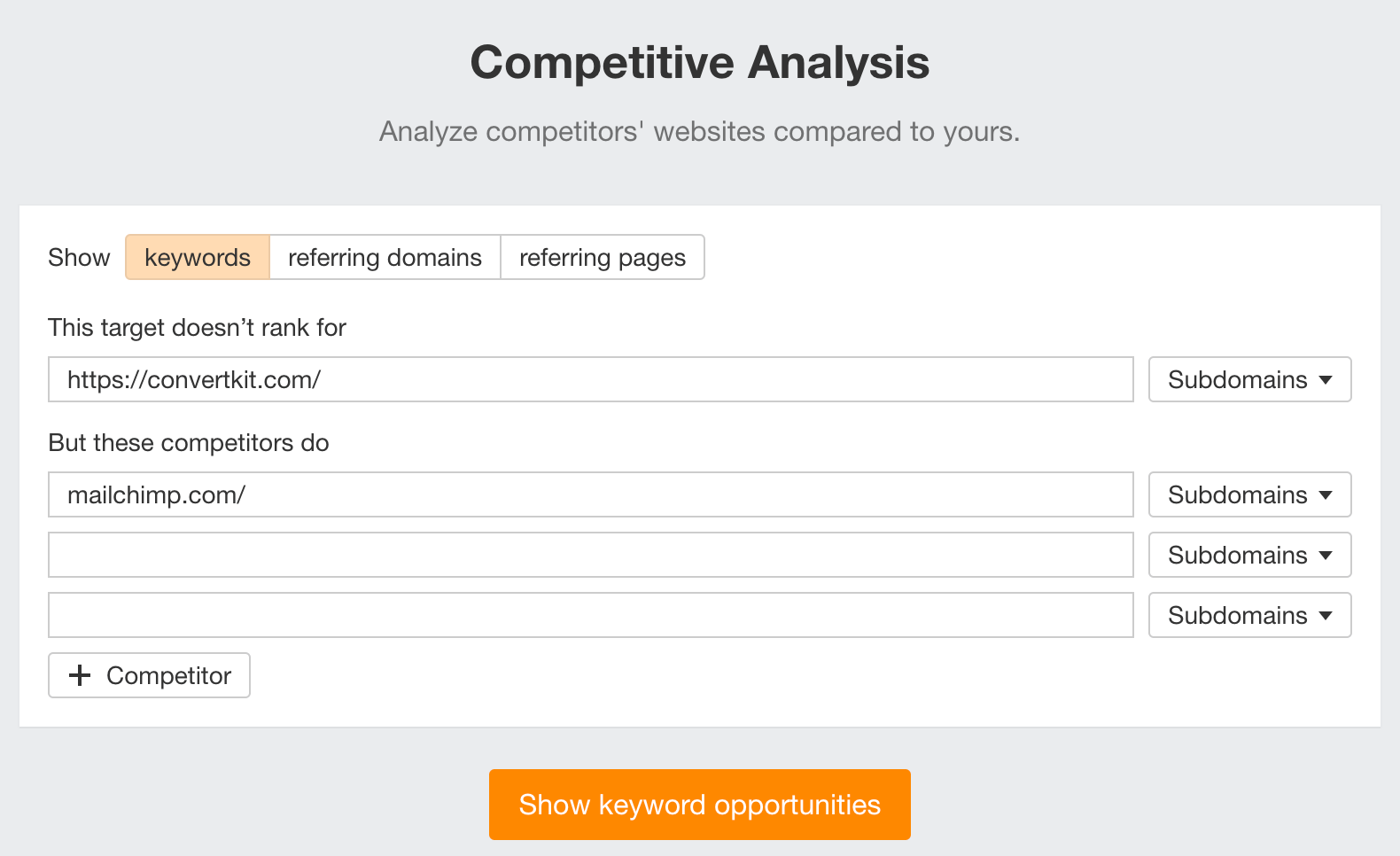

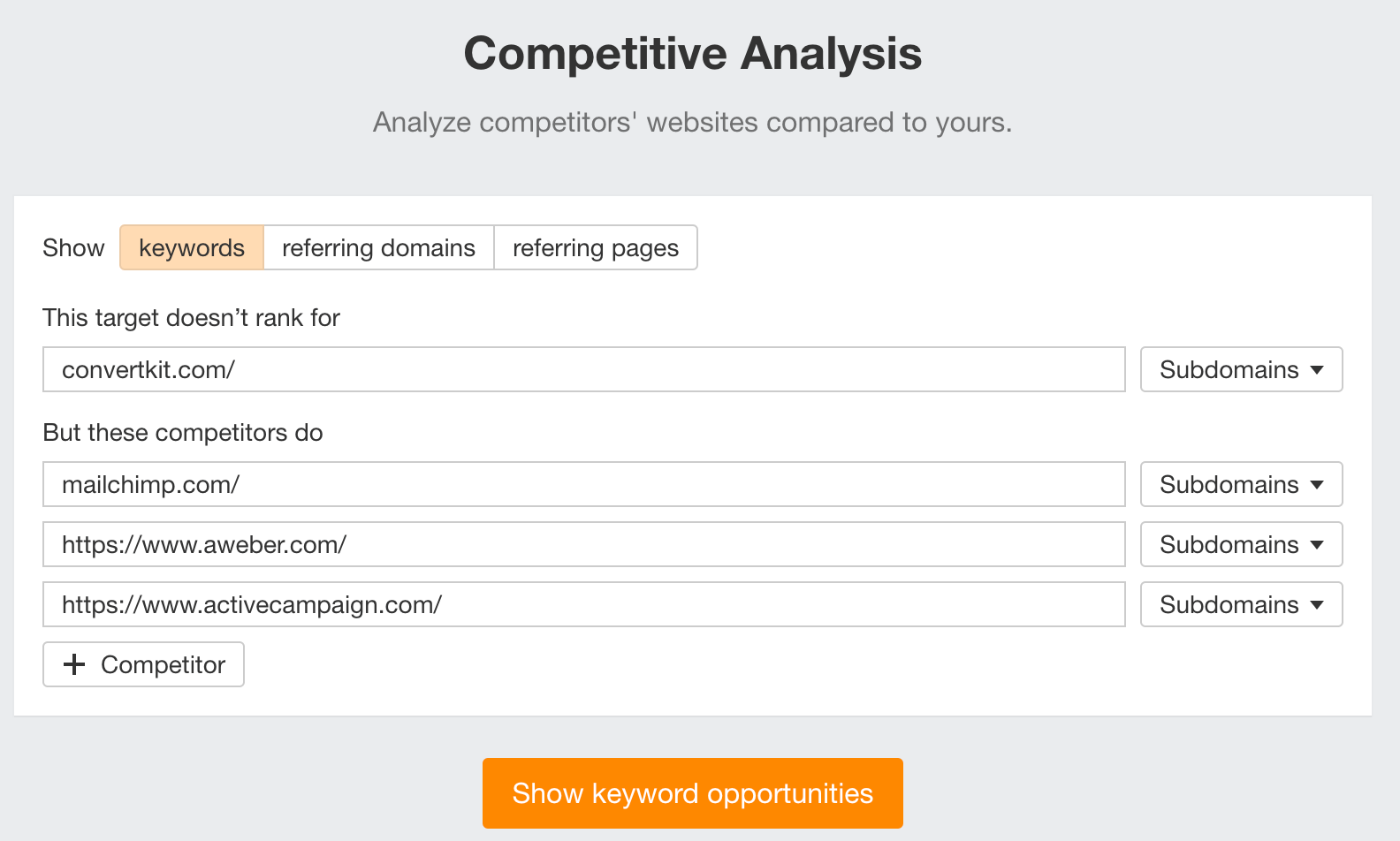

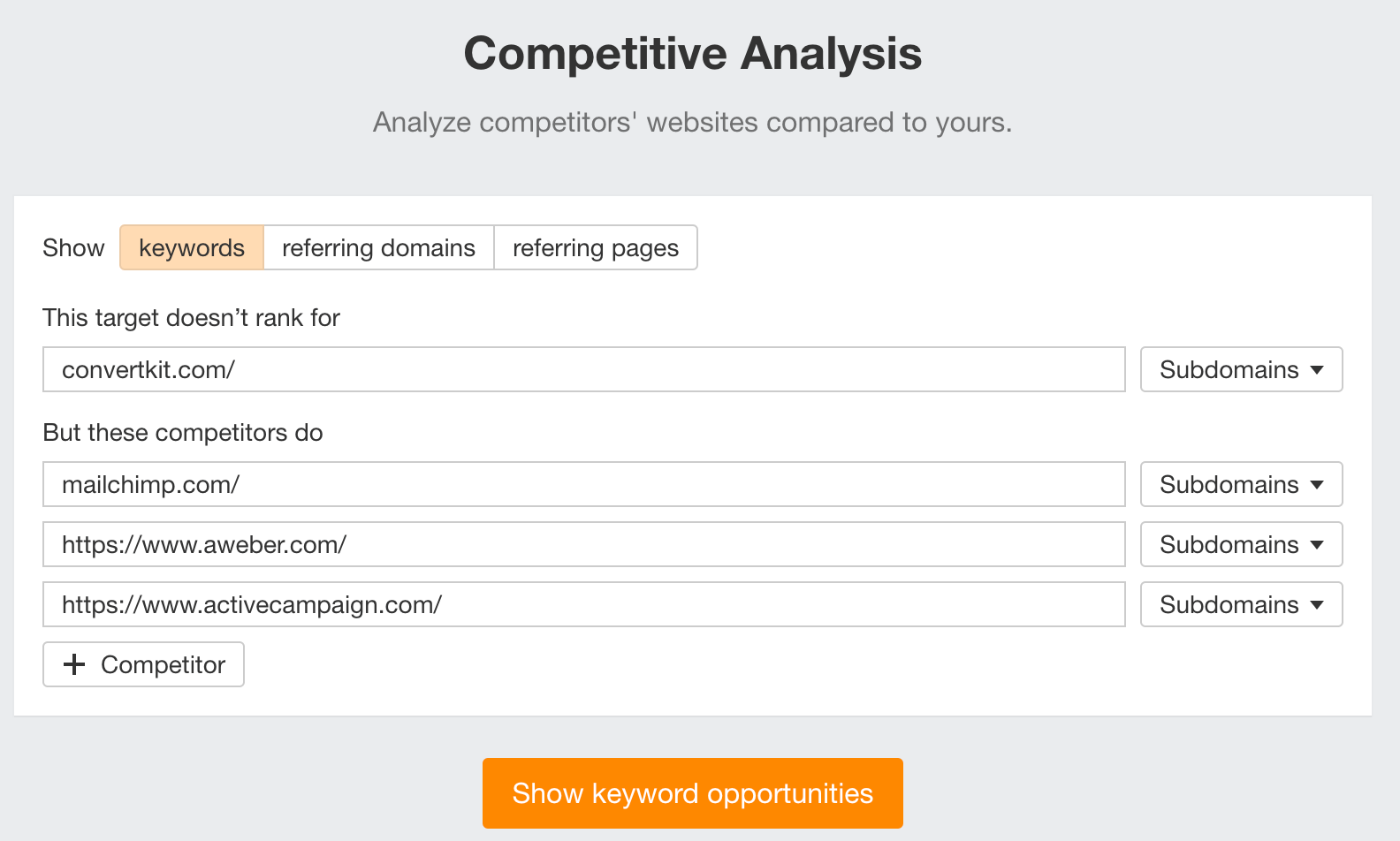

- Go to Competitive Analysis

- Enter your domain in the This target doesn’t rank for section

- Enter your competitor’s domain in the But these competitors do section

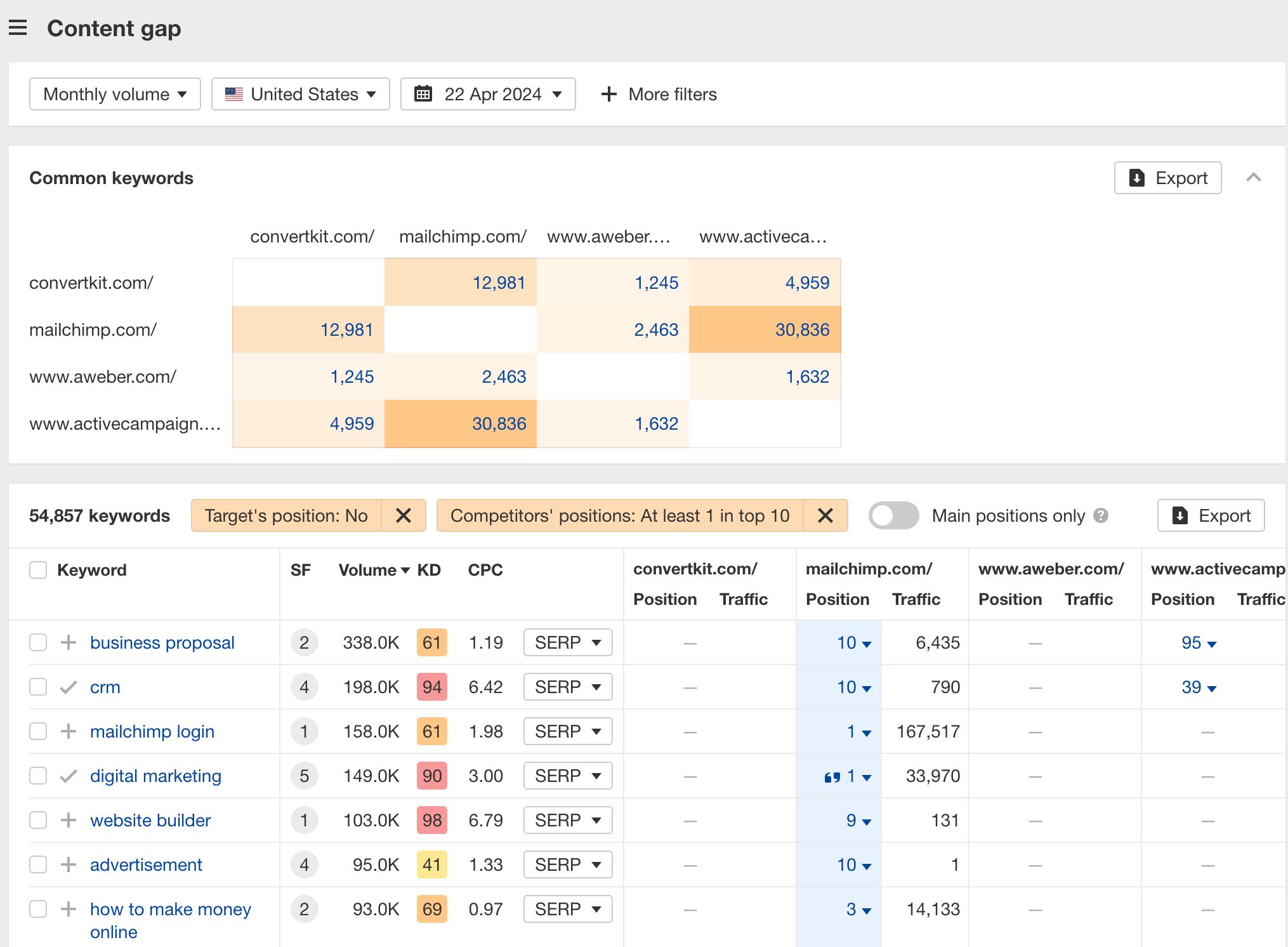

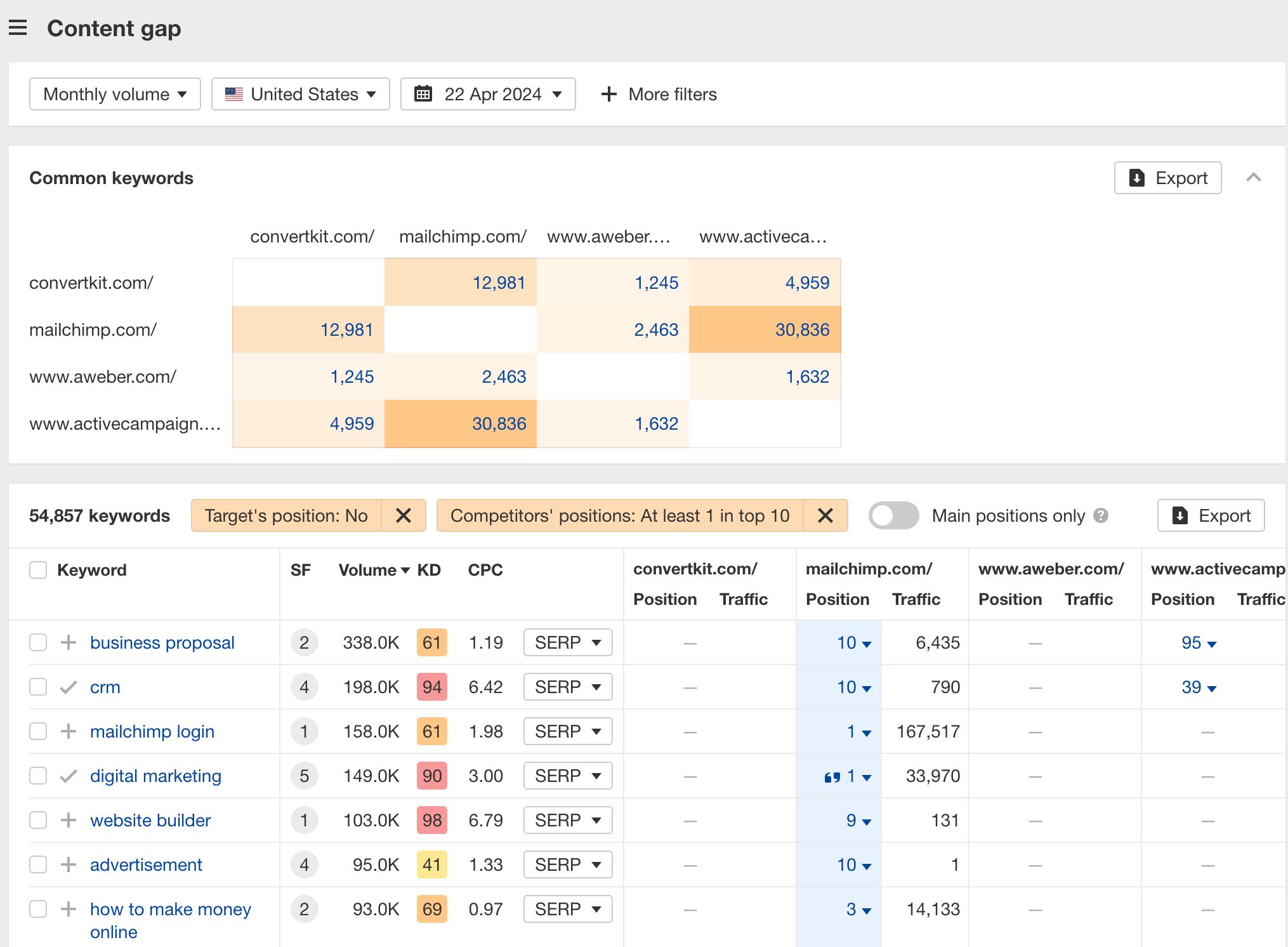

Hit “Show keyword opportunities,” and you’ll see all the keywords your competitor ranks for, but you don’t.

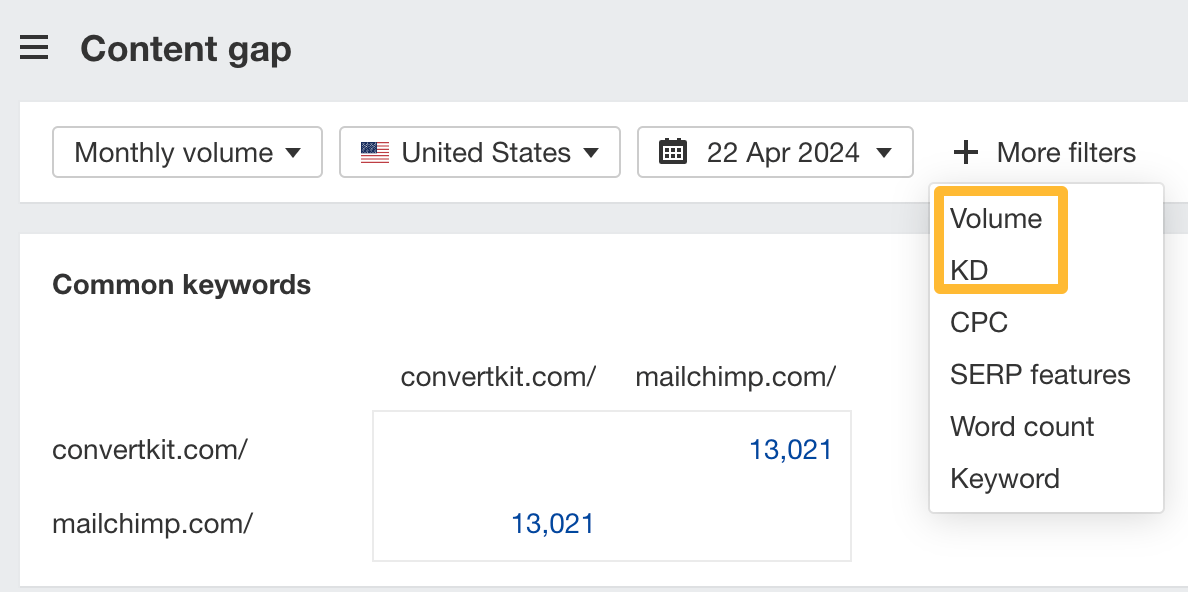

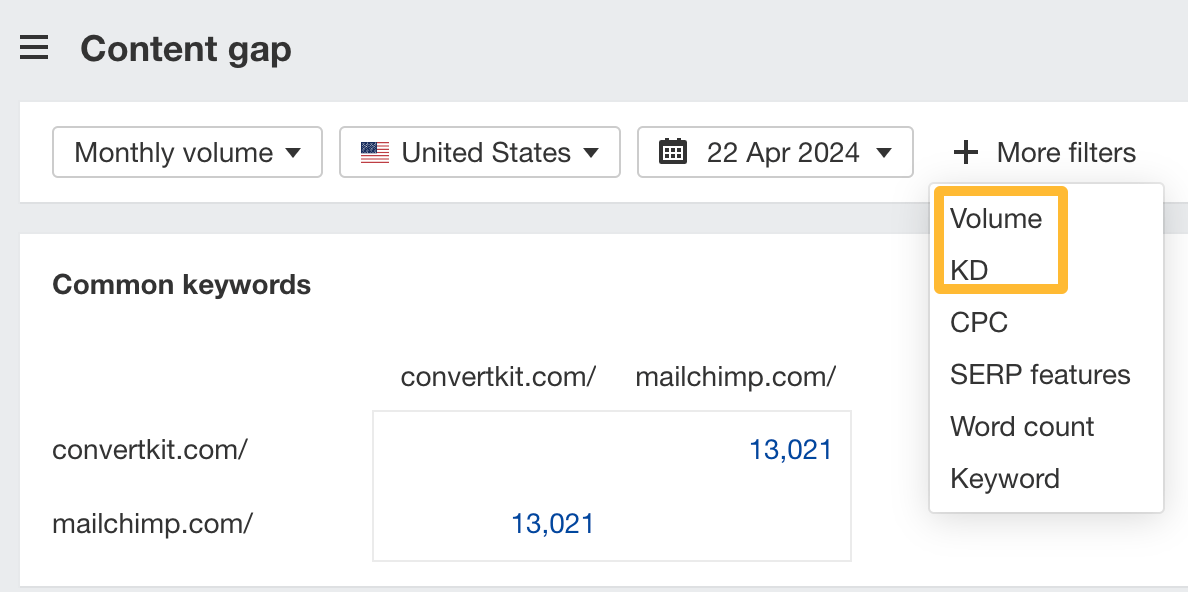

You can also add a Volume and KD filter to find popular, low-difficulty keywords in this report.

How to find keywords multiple competitors rank for, but you don’t

- Go to Competitive Analysis

- Enter your domain in the This target doesn’t rank for section

- Enter the domains of multiple competitors in the But these competitors do section

You’ll see all the keywords that at least one of these competitors ranks for, but you don’t.

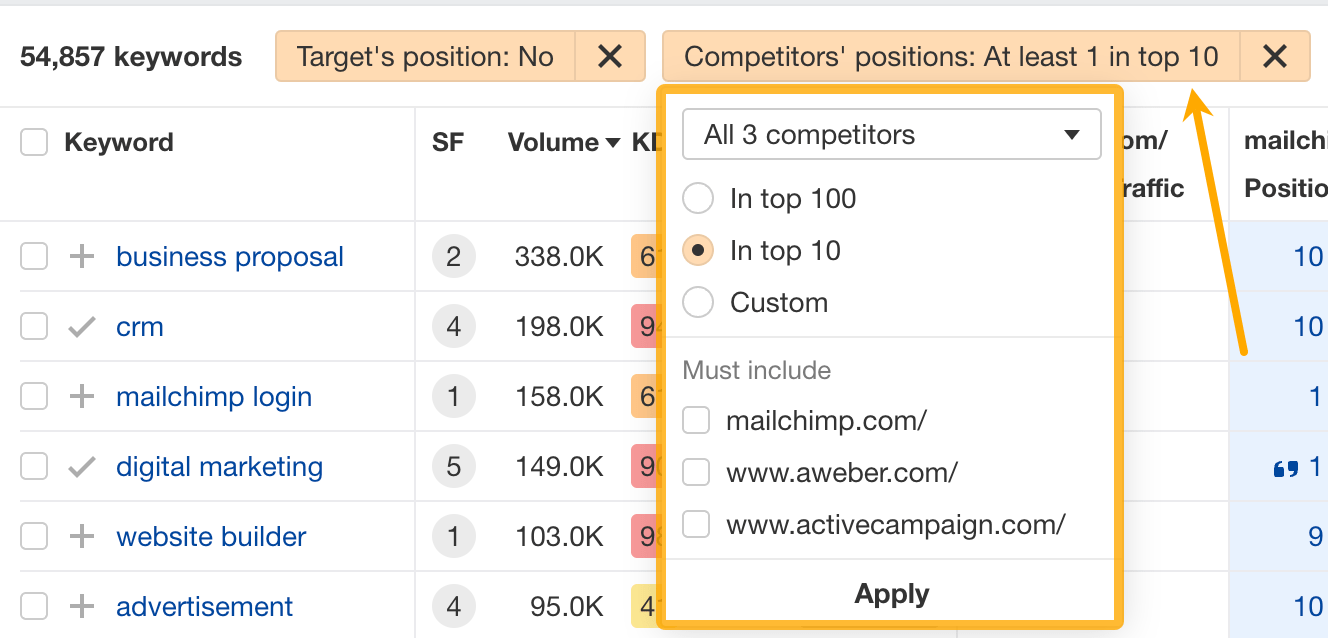

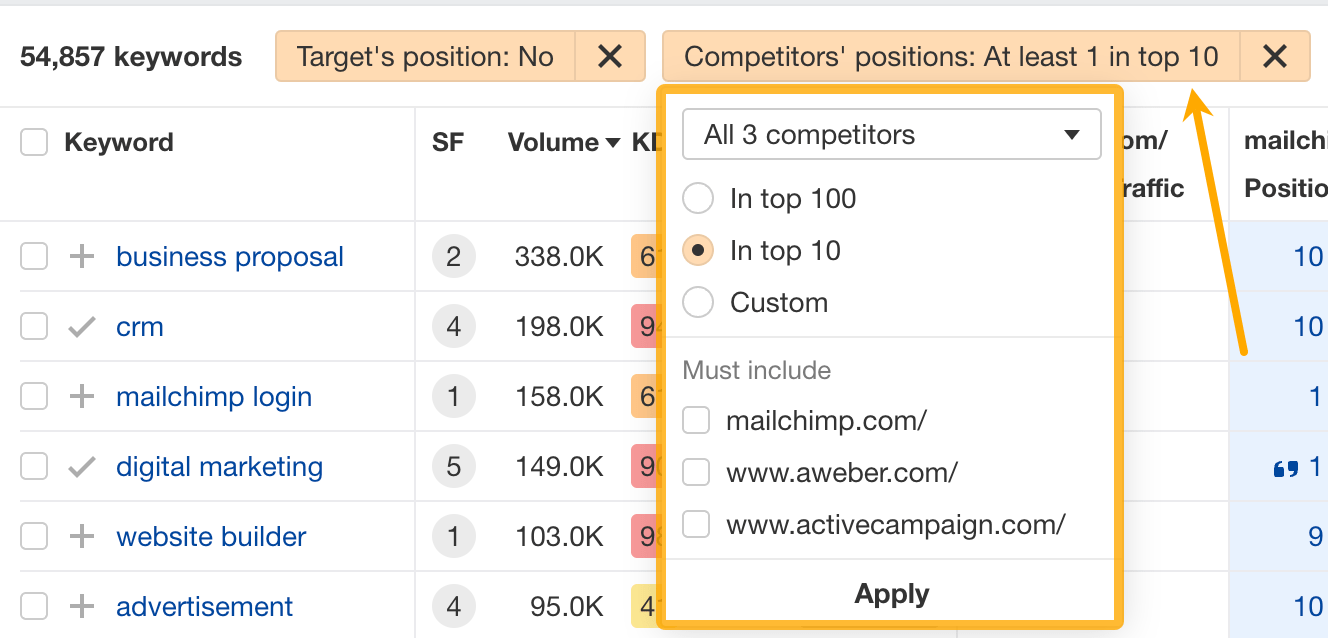

You can also narrow the list down to keywords that all competitors rank for. Click on the Competitors’ positions filter and choose All 3 competitors:

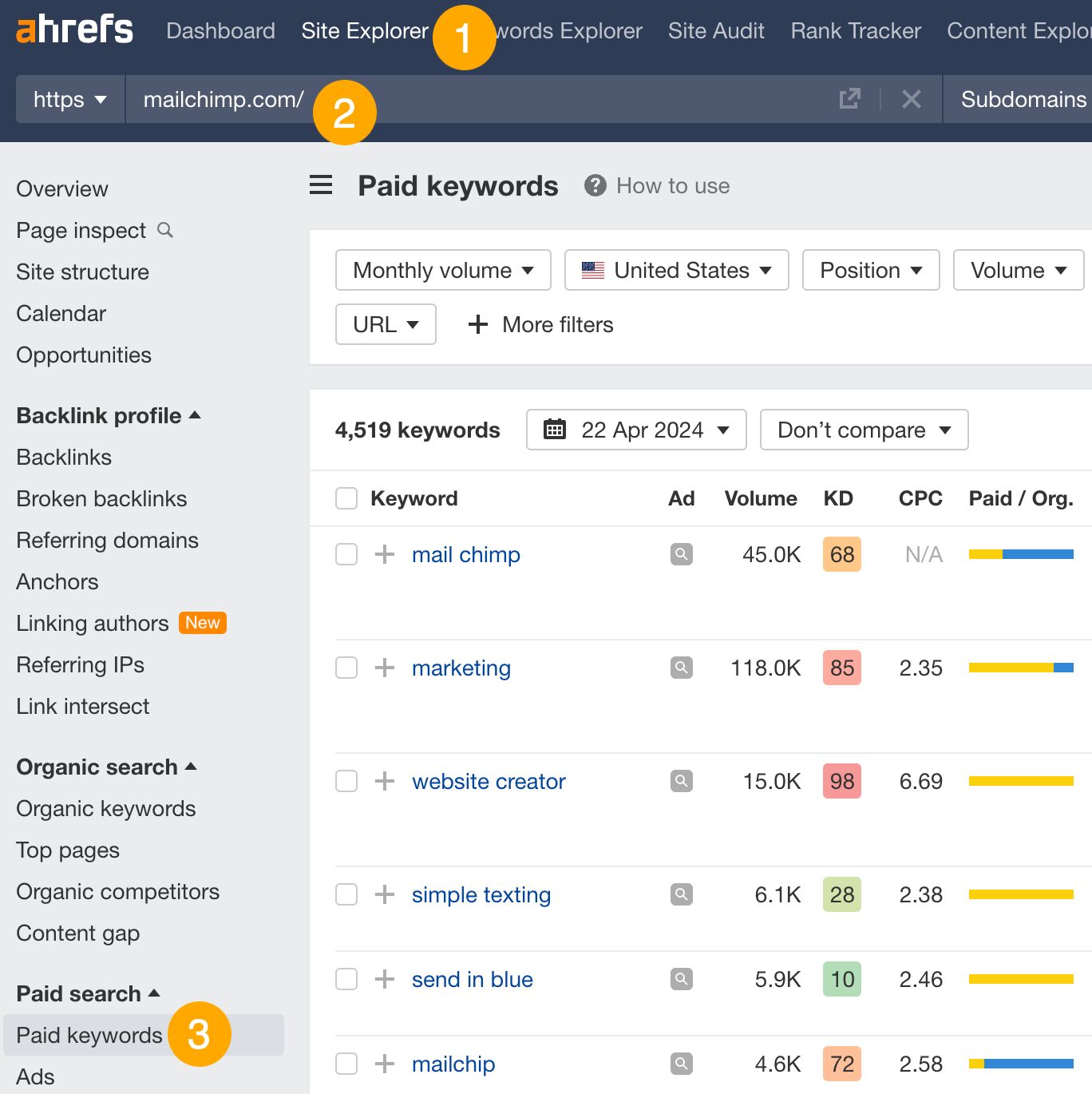

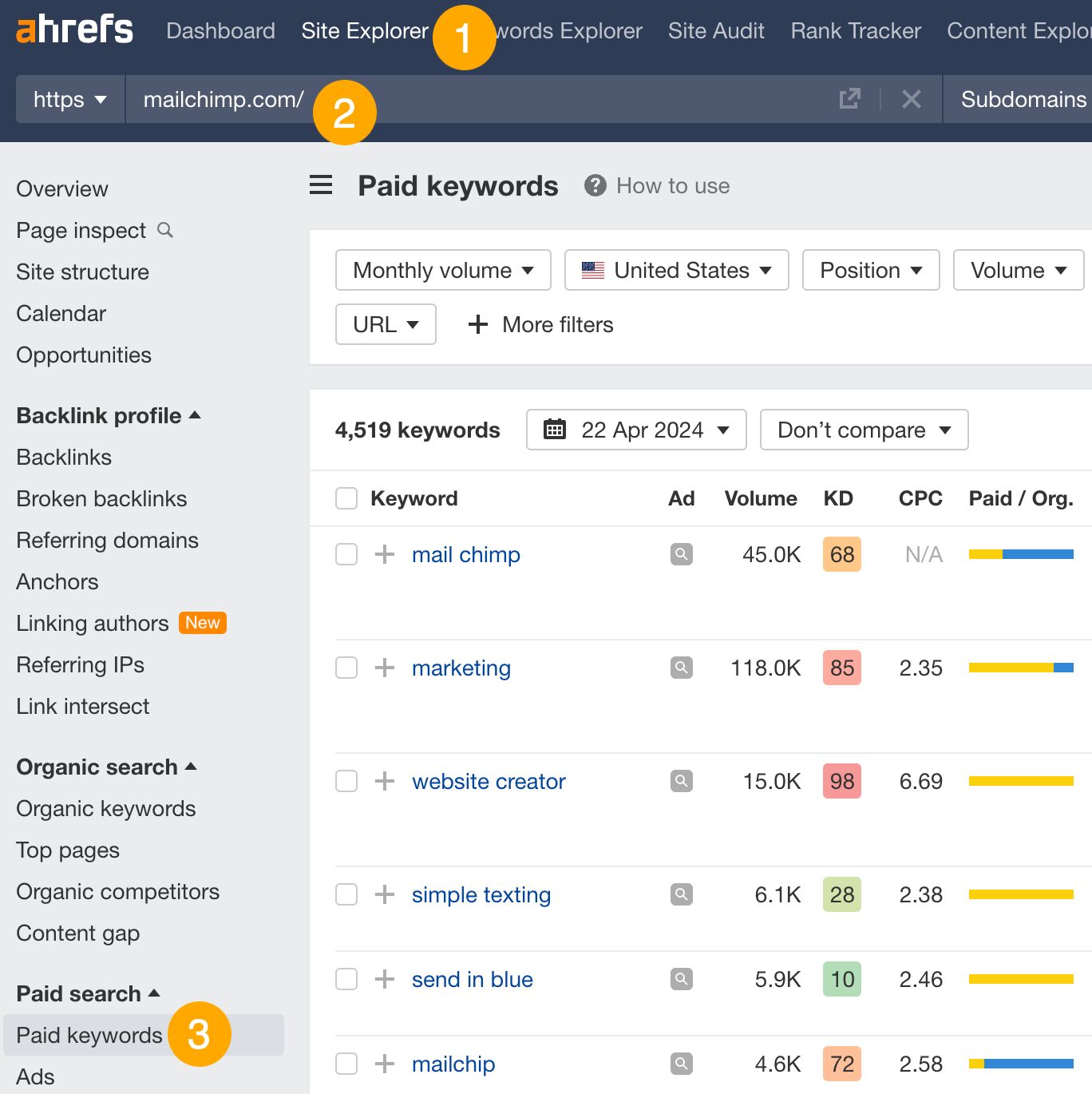

- Go to Ahrefs’ Site Explorer

- Enter your competitor’s domain

- Go to the Paid keywords report

This report shows you the keywords your competitors are targeting via Google Ads.

Since your competitor is paying for traffic from these keywords, it may indicate that they’re profitable for them—and could be for you, too.

You know what keywords your competitors are ranking for or bidding on. But what do you do with them? There are basically three options.

1. Create pages to target these keywords

You can only rank for keywords if you have content about them. So, the most straightforward thing you can do for competitors’ keywords you want to rank for is to create pages to target them.

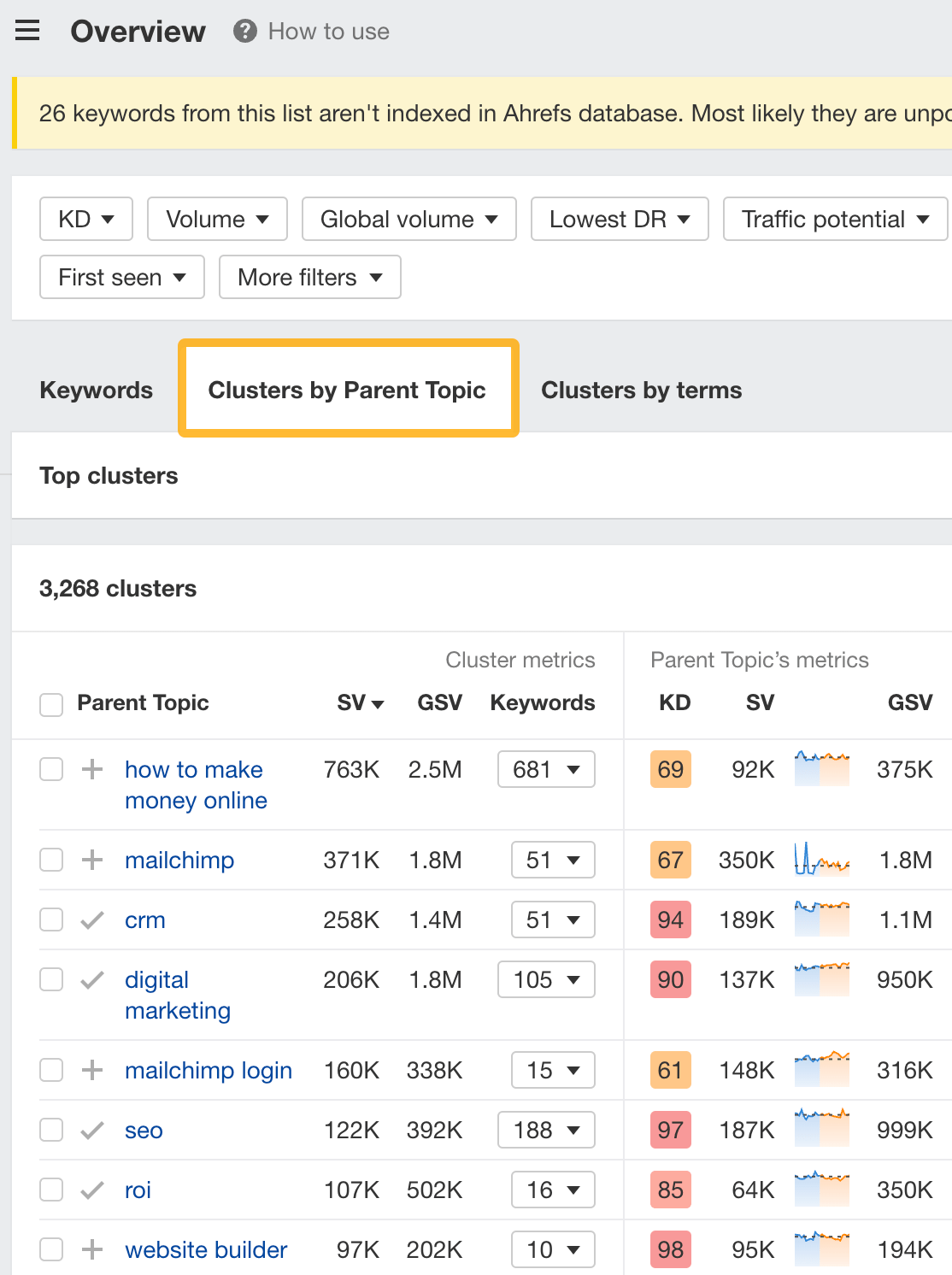

However, before you do this, it’s worth clustering your competitor’s keywords by Parent Topic. This will group keywords that mean the same or similar things so you can target them all with one page.

Here’s how to do that:

- Export your competitor’s keywords, either from the Organic Keywords or Content Gap report

- Paste them into Keywords Explorer

- Click the “Clusters by Parent Topic” tab

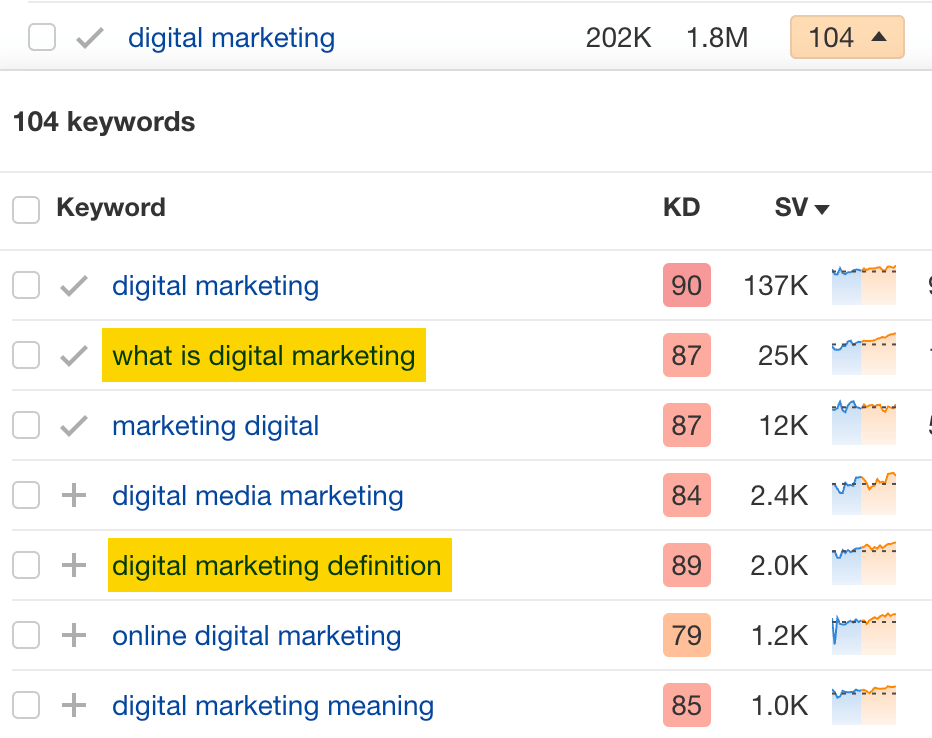

For example, MailChimp ranks for keywords like “what is digital marketing” and “digital marketing definition.” These and many others get clustered under the Parent Topic of “digital marketing” because people searching for them are all looking for the same thing: a definition of digital marketing. You only need to create one page to potentially rank for all these keywords.

2. Optimize existing content by filling subtopics

You don’t always need to create new content to rank for competitors’ keywords. Sometimes, you can optimize the content you already have to rank for them.

How do you know which keywords you can do this for? Try this:

- Export your competitor’s keywords

- Paste them into Keywords Explorer

- Click the “Clusters by Parent Topic” tab

- Look for Parent Topics you already have content about

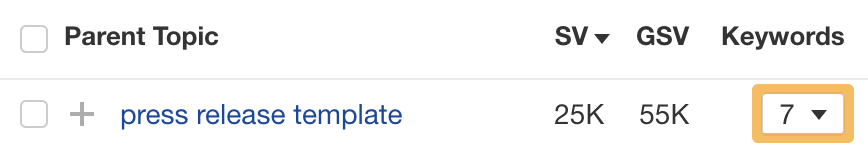

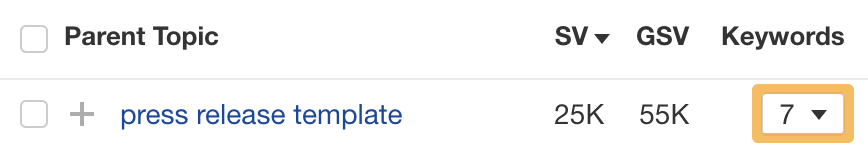

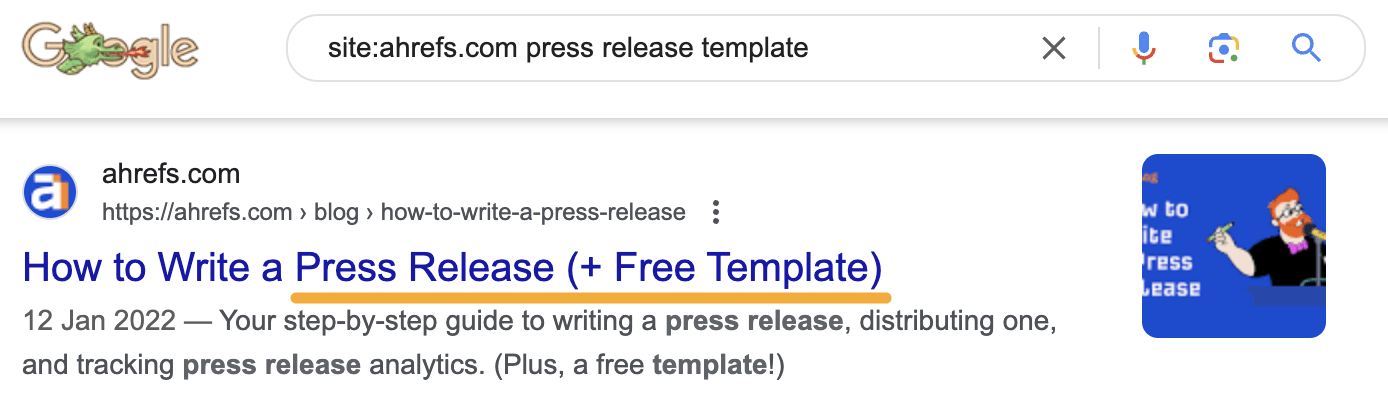

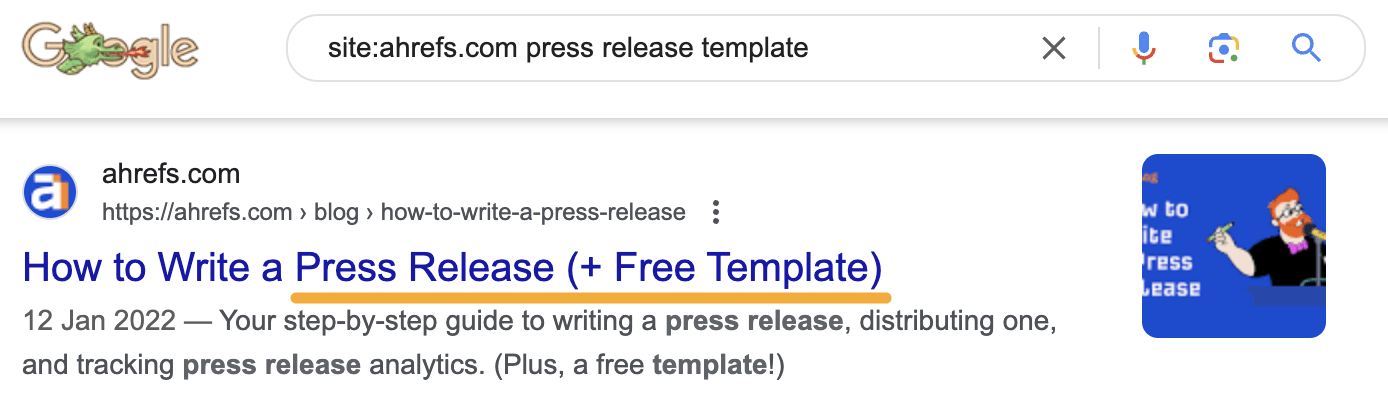

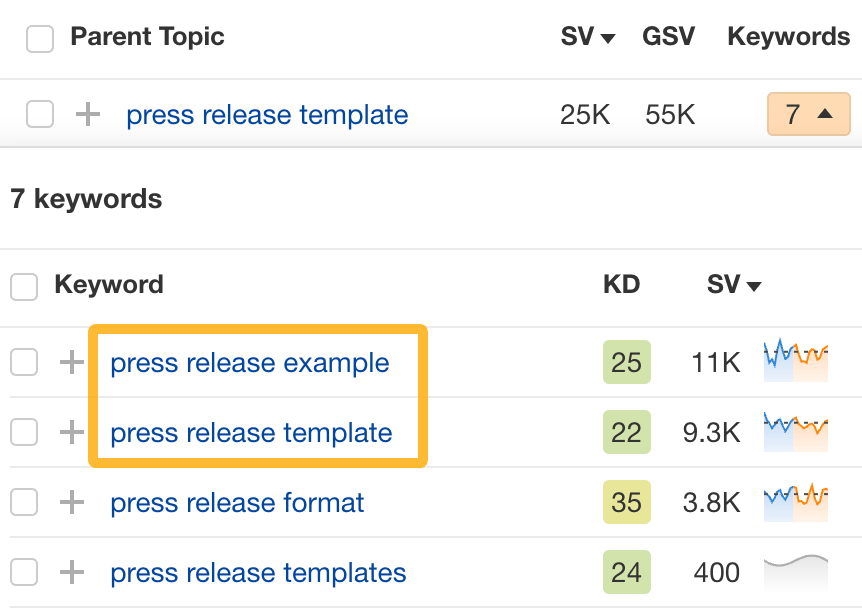

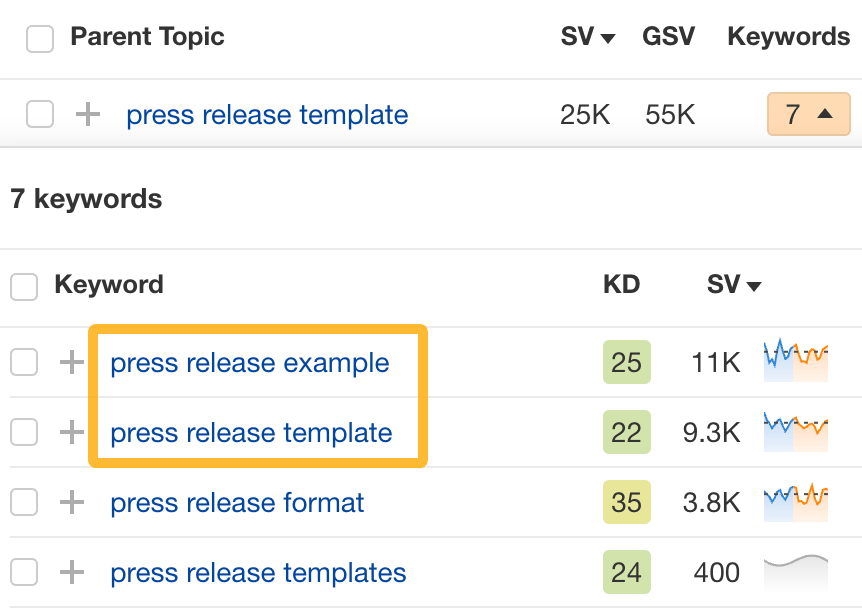

For example, if we analyze our competitor, we can see that seven keywords they rank for fall under the Parent Topic of “press release template.”

If we search our site, we see that we already have a page about this topic.

If we click the caret and check the keywords in the cluster, we see keywords like “press release example” and “press release format.”

To rank for the keywords in the cluster, we can probably optimize the page we already have by adding sections about the subtopics of “press release examples” and “press release format.”

3. Target these keywords with Google Ads

Paid keywords are the simplest—look through the report and see if there are any relevant keywords you might want to target, too.

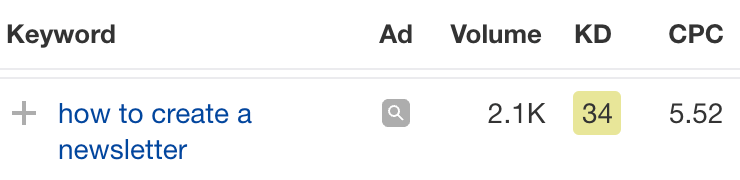

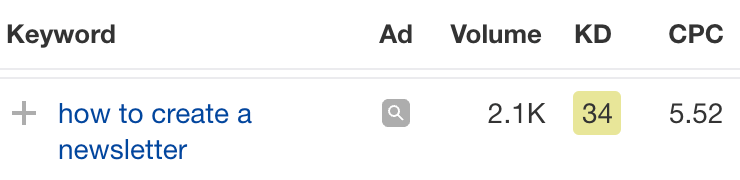

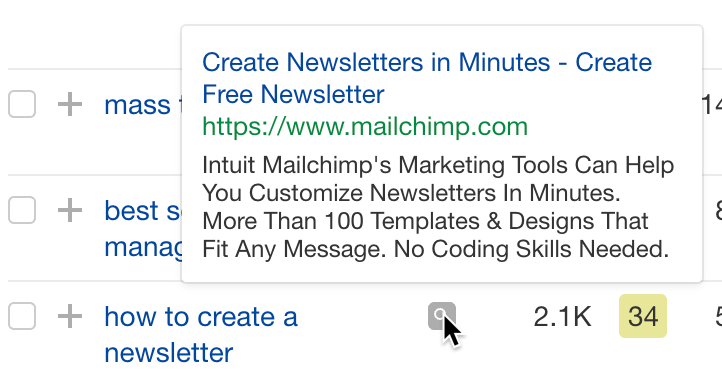

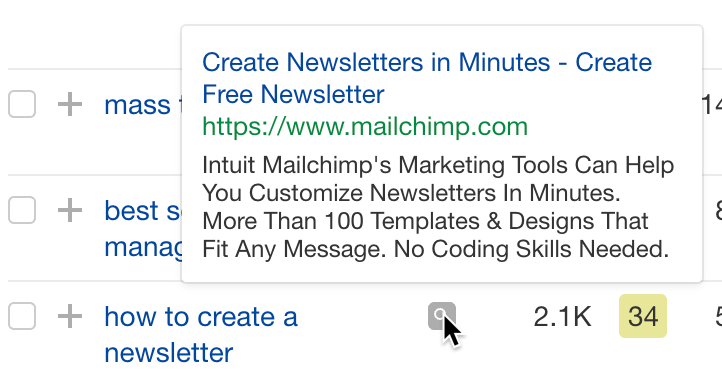

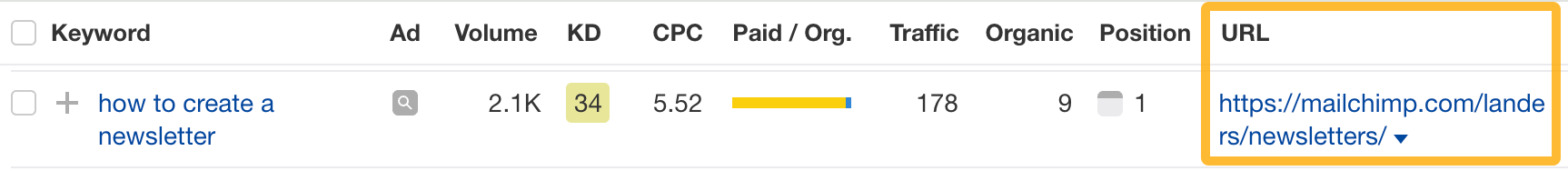

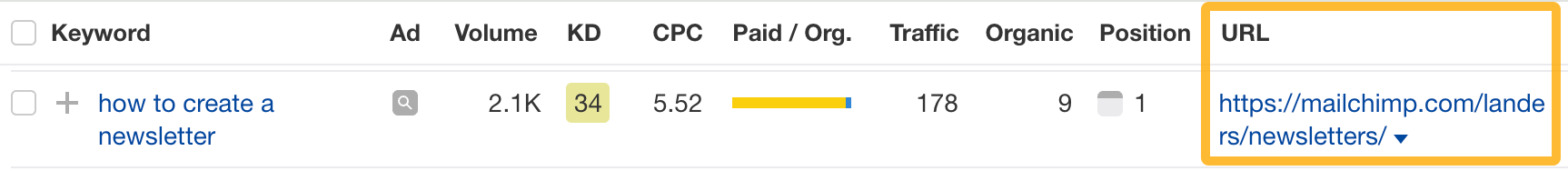

For example, Mailchimp is bidding for the keyword “how to create a newsletter.”

If you’re ConvertKit, you may also want to target this keyword since it’s relevant.

If you decide to target the same keyword via Google Ads, you can hover over the magnifying glass to see the ads your competitor is using.

You can also see the landing page your competitor directs ad traffic to under the URL column.

Learn more

Check out more tutorials on how to do competitor keyword analysis:

SEO

Google Confirms Links Are Not That Important

Google’s Gary Illyes confirmed at a recent search marketing conference that Google needs very few links, adding to the growing body of evidence that publishers need to focus on other factors. Gary tweeted confirmation that he indeed say those words.

Background Of Links For Ranking

Links were discovered in the late 1990’s to be a good signal for search engines to use for validating how authoritative a website is and then Google discovered soon after that anchor text could be used to provide semantic signals about what a webpage was about.

One of the most important research papers was Authoritative Sources in a Hyperlinked Environment by Jon M. Kleinberg, published around 1998 (link to research paper at the end of the article). The main discovery of this research paper is that there is too many web pages and there was no objective way to filter search results for quality in order to rank web pages for a subjective idea of relevance.

The author of the research paper discovered that links could be used as an objective filter for authoritativeness.

Kleinberg wrote:

“To provide effective search methods under these conditions, one needs a way to filter, from among a huge collection of relevant pages, a small set of the most “authoritative” or ‘definitive’ ones.”

This is the most influential research paper on links because it kick-started more research on ways to use links beyond as an authority metric but as a subjective metric for relevance.

Objective is something factual. Subjective is something that’s closer to an opinion. The founders of Google discovered how to use the subjective opinions of the Internet as a relevance metric for what to rank in the search results.

What Larry Page and Sergey Brin discovered and shared in their research paper (The Anatomy of a Large-Scale Hypertextual Web Search Engine – link at end of this article) was that it was possible to harness the power of anchor text to determine the subjective opinion of relevance from actual humans. It was essentially crowdsourcing the opinions of millions of website expressed through the link structure between each webpage.

What Did Gary Illyes Say About Links In 2024?

At a recent search conference in Bulgaria, Google’s Gary Illyes made a comment about how Google doesn’t really need that many links and how Google has made links less important.

Patrick Stox tweeted about what he heard at the search conference:

” ‘We need very few links to rank pages… Over the years we’ve made links less important.’ @methode #serpconf2024″

Google’s Gary Illyes tweeted a confirmation of that statement:

“I shouldn’t have said that… I definitely shouldn’t have said that”

Why Links Matter Less

The initial state of anchor text when Google first used links for ranking purposes was absolutely non-spammy, which is why it was so useful. Hyperlinks were primarily used as a way to send traffic from one website to another website.

But by 2004 or 2005 Google was using statistical analysis to detect manipulated links, then around 2004 “powered-by” links in website footers stopped passing anchor text value, and by 2006 links close to the words “advertising” stopped passing link value, links from directories stopped passing ranking value and by 2012 Google deployed a massive link algorithm called Penguin that destroyed the rankings of likely millions of websites, many of which were using guest posting.

The link signal eventually became so bad that Google decided in 2019 to selectively use nofollow links for ranking purposes. Google’s Gary Illyes confirmed that the change to nofollow was made because of the link signal.

Google Explicitly Confirms That Links Matter Less

In 2023 Google’s Gary Illyes shared at a PubCon Austin that links were not even in the top 3 of ranking factors. Then in March 2024, coinciding with the March 2024 Core Algorithm Update, Google updated their spam policies documentation to downplay the importance of links for ranking purposes.

The documentation previously said:

“Google uses links as an important factor in determining the relevancy of web pages.”

The update to the documentation that mentioned links was updated to remove the word important.

Links are not just listed as just another factor:

“Google uses links as a factor in determining the relevancy of web pages.”

At the beginning of April Google’s John Mueller advised that there are more useful SEO activities to engage on than links.

Mueller explained:

“There are more important things for websites nowadays, and over-focusing on links will often result in you wasting your time doing things that don’t make your website better overall”

Finally, Gary Illyes explicitly said that Google needs very few links to rank webpages and confirmed it.

I shouldn’t have said that… I definitely shouldn’t have said that

— Gary 鯨理/경리 Illyes (so official, trust me) (@methode) April 19, 2024

Why Google Doesn’t Need Links

The reason why Google doesn’t need many links is likely because of the extent of AI and natural language undertanding that Google uses in their algorithms. Google must be highly confident in its algorithm to be able to explicitly say that they don’t need it.

Way back when Google implemented the nofollow into the algorithm there were many link builders who sold comment spam links who continued to lie that comment spam still worked. As someone who started link building at the very beginning of modern SEO (I was the moderator of the link building forum at the #1 SEO forum of that time), I can say with confidence that links have stopped playing much of a role in rankings beginning several years ago, which is why I stopped about five or six years ago.

Read the research papers

Authoritative Sources in a Hyperlinked Environment – Jon M. Kleinberg (PDF)

The Anatomy of a Large-Scale Hypertextual Web Search Engine

Featured Image by Shutterstock/RYO Alexandre

-

PPC4 days ago

PPC4 days ago19 Best SEO Tools in 2024 (For Every Use Case)

-

MARKETING7 days ago

MARKETING7 days agoWill Google Buy HubSpot? | Content Marketing Institute

-

SEARCHENGINES7 days ago

Daily Search Forum Recap: April 16, 2024

-

SEO7 days ago

SEO7 days agoGoogle Clarifies Vacation Rental Structured Data

-

MARKETING6 days ago

MARKETING6 days agoStreamlining Processes for Increased Efficiency and Results

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 17, 2024

-

SEO6 days ago

SEO6 days agoAn In-Depth Guide And Best Practices For Mobile SEO

-

PPC6 days ago

PPC6 days ago97 Marvelous May Content Ideas for Blog Posts, Videos, & More

You must be logged in to post a comment Login