The new app is called watchGPT and as I tipped off already, it gives you access to ChatGPT from your Apple Watch. Now the $10,000 question (or more accurately the $3.99 question, as that is the one-time cost of the app) is why having ChatGPT on your wrist is remotely necessary, so let’s dive into what exactly the app can do.

NEWS

Extra Crunch roundup: Guest posts wanted, ‘mango’ seed rounds, Expensify’s tech stack

Prospective contributors regularly ask us about which topics Extra Crunch subscribers would like to hear more about, and the answer is always the same:

- Actionable advice that is backed up by data and/or experience.

- Strategic insights that go beyond best practices and offer specific recommendations readers can try out for themselves.

- Industry analysis that paints a clear picture of the companies, products and services that characterize individual tech sectors.

Our submission guidelines haven’t changed, but Managing Editor Eric Eldon and I wrote a short post that identifies the topics we’re prioritizing at the moment:

- How-to articles for early-stage founders.

- Market analysis of different tech sectors.

- Growth marketing strategies.

- Alternative fundraising.

- Quality of life (personal health, sustainability, proptech, transportation).

If you’re a skillful entrepreneur, founder or investor who’s interested in helping someone else build their business, please read our latest guidelines, then send your ideas to [email protected].

Thanks for reading; I hope you have a great weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Full Extra Crunch articles are only available to members

Use discount code ECFriday to save 20% off a one- or two-year subscription

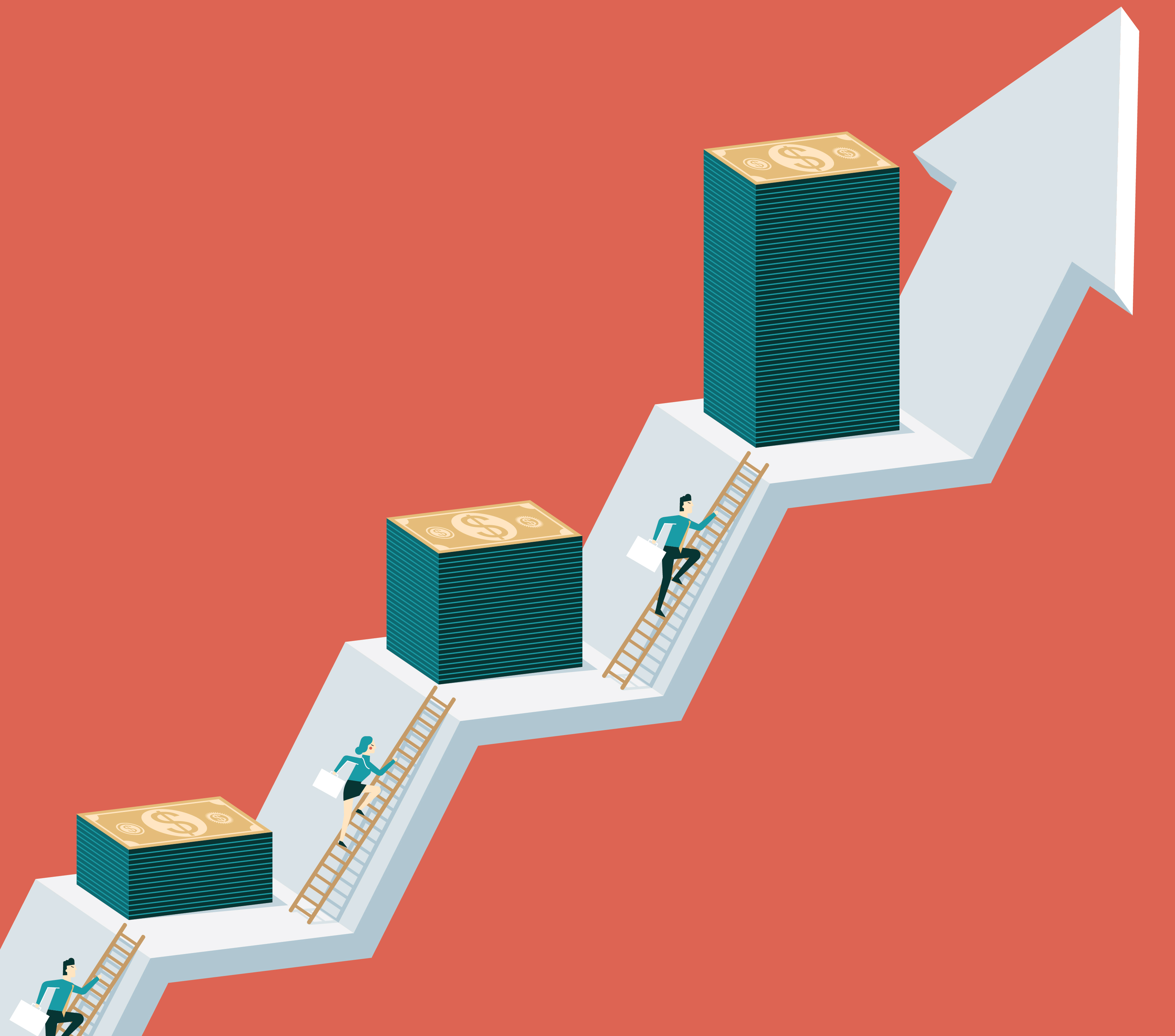

Opting for a debt round can take you from Series A startup to Series B unicorn

Image Credits: olegkalina (opens in a new window) / Getty Images

Debt is a tool, and like any other — be it a hammer or handsaw — it’s extremely valuable when used skillfully but can cause a lot of pain when mismanaged. This is a story about how it can go right.

Mario Ciabarra, the founder and CEO of Quantum Metric, breaks down how his company was on a “tremendous growth curve” — and then the pandemic hit.

“As the weeks following the initial shelter-in-place orders ticked by, the rush toward digital grew exponentially, and opportunities to secure new customers started piling up,” Ciabarra writes. “A solution to our money problems, perhaps? Not so fast — it was a classic case of needing to spend in order to make.”

If companies want to preserve equity, debt can be an advantageous choice. Here’s how Quantum Metric did it.

4 proven approaches to CX strategy that make customers feel loved

Image Credits: mucahiddin / Getty Images

People have been working to optimize customer experiences (CX) since we began selling things to each other.

A famous San Francisco bakery has an exhaust fan at street level; each morning, its neighbors awake to the scent of orange-cinnamon morning buns wafting down the block. Similarly, savvy hairstylists know to greet returning customers by asking if they want a repeat or something new.

Online, CX may encompass anything from recommending the right shoes to AI that knows when to send a frustrated traveler an upgrade for a delayed flight.

In light of Qualtrics’ spinout and IPO and Sprinklr’s recent S-1, Rebecca Liu-Doyle, principal at Insight Partners, describes four key attributes shared by “companies that have upped their CX game.”

Twitter’s acquisition strategy: Eat the public conversation

Image Credits: We Are (opens in a new window) / Getty Images

What is a microblogging service doing buying a social podcasting company and a newsletter tool while also building a live broadcasting sub-app? Is there even a strategy at all?

Yes. Twitter is trying to revitalize itself by adding more contexts for discourse to its repertoire. The result, if everything goes right, will be an influence superapp that hasn’t existed anywhere before. The alternative is nothing less than the destruction of Twitter into a link-forwarding service.

Let’s talk about how Twitter is trying to eat the public conversation.

Reading the IPO market’s tea leaves

Image Credits: Nigel Sussman (opens in a new window)

Although it was a truncated holiday week here in the United States, there was a bushel of IPO news. We sorted through the updates and came up with a series of sentiment calls regarding these public offerings.

Earlier this week, we took a look at:

- Marqeta‘s first IPO price range (fintech).

- 1st Dibs‘ first IPO price range (e-commerce).

- Zeta Global‘s IPO pricing (martech).

- The start of SoFi trading post-SPAC (fintech).

- The latest from BarkBox (e-commerce).

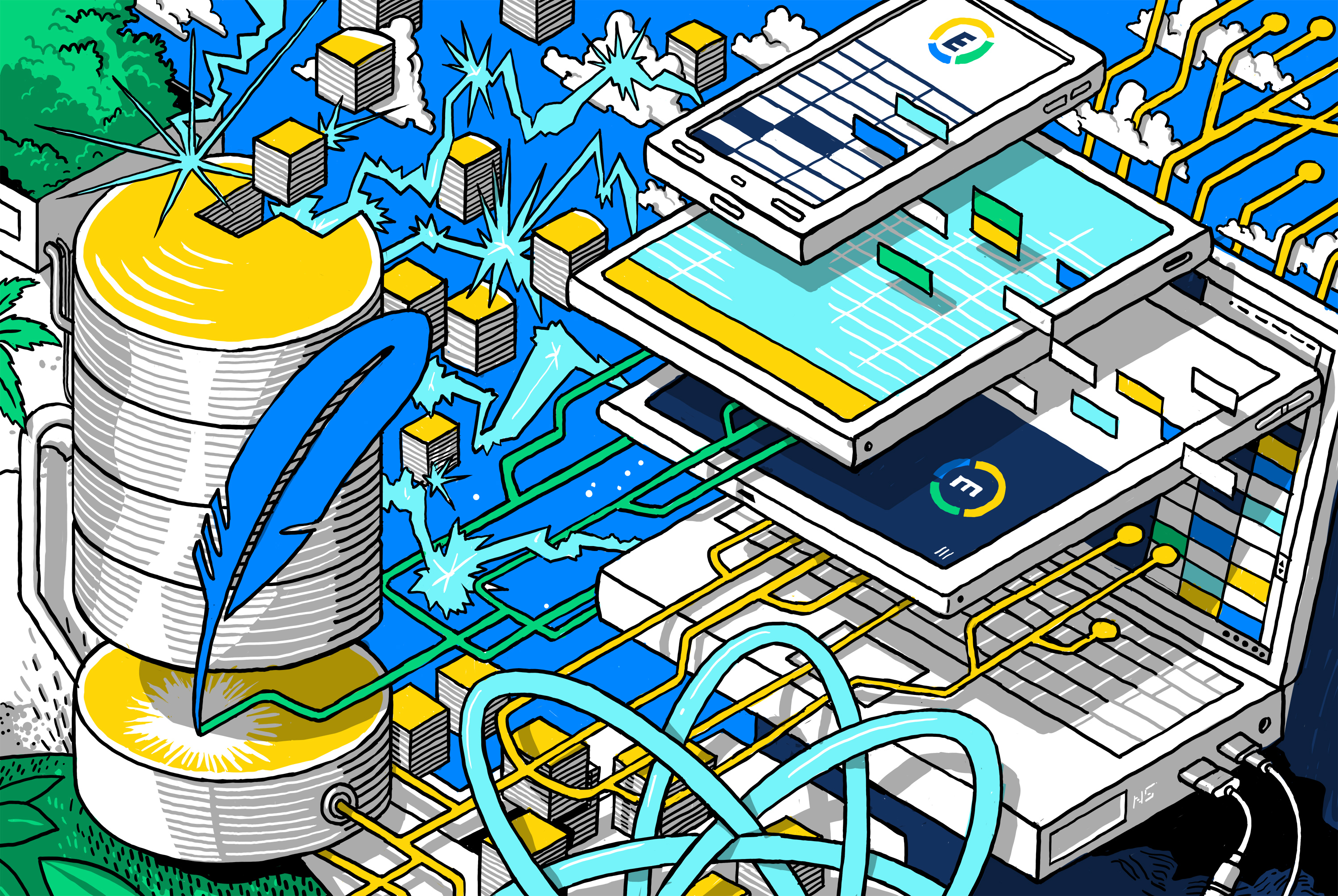

How Expensify hacked its way to a robust, scalable tech stack

Image Credits: Nigel Sussman

Part 4 of Expensify’s EC-1 digs into the company’s engineering and technology, with Anna Heim noting that the group of P2P pirates/hackers set out to build an expense management app by sticking to their gut and making their own rules.

They asked questions few considered, like: Why have lots of employees when you can find a way to get work done and reach impressive profitability with a few? Why work from an office in San Francisco when the internet lets you work from anywhere, even a sailboat in the Caribbean?

It makes sense in a way: If you’re a pirate, to hell with the rules, right?

With that in mind, one could assume Expensify decided to ask itself: Why not build our own totally custom tech stack?

Indeed, Expensify has made several tech decisions that were met with disbelief, but its belief in its own choices has paid off over the years, and the company is ready to IPO any day now.

How much of a tech advantage Expensify enjoys owing to such choices is an open question, but one thing is clear: These choices are key to understanding Expensify and its roadmap. Let’s take a look.

Etsy asks, ‘How do you do, fellow kids?’ with $1.6B Depop purchase

Image Credits: Getty Images

The news this week that e-commerce marketplace Etsy will buy Depop, a startup that provides a secondhand e-commerce marketplace, for more than $1.6 billion may not have made a large impact on the acquiring company’s share price thus far, but it provides a fascinating look into what brands may be willing to pay for access to the Gen Z market.

Etsy is buying Gen Z love. Think about it — Gen Z is probably not the first demographic that comes to mind when you consider Etsy, so you can see why the deal may pencil out in the larger company’s mind.

But it isn’t cheap. The lesson from the Etsy-Depop deal appears to be that large e-commerce players are willing to splash out for youth-approved marketplaces. That’s good news for yet-private companies that are popular with the budding generation.

Confluent’s IPO brings a high-growth, high-burn SaaS model to the public markets

Image Credits: Andriy Onufriyenko / Getty Images

Confluent became the latest company to announce its intent to take the IPO route, officially filing its S-1 paperwork this week.

The company, which has raised over $455 million since it launched in 2014, was most recently valued at just over $4.5 billion when it raised $250 million last April.

What does Confluent do? It built a streaming data platform on top of the open-source Apache Kafka project. In addition to its open-source roots, Confluent has a free tier of its commercial cloud offering to complement its paid products, helping generate top-of-funnel inflows that it converts to sales.

What we can see in Confluent is nearly an old-school, high-burn SaaS business. It has taken on oodles of capital and used it in an increasingly expensive sales model.

How to win consulting, board and deal roles with PE and VC funds

Image Credits: Orla (opens in a new window) / Getty Images

Would you like to work with private equity and venture capital funds?

There are relatively few jobs directly inside private equity and venture capital funds, and those jobs are highly competitive.

However, there are many other ways you can work and earn money within the industry — as a consultant, an interim executive, a board member, a deal executive partnering to buy a company, an executive in residence or as an entrepreneur in residence.

Let’s take a look at the different ways you can work with the investment community.

The existential cost of decelerated growth

Image Credits: Nigel Sussman (opens in a new window)

Even among the most valuable tech shops, shareholder return is concentrated in share price appreciation, and buybacks, which is the same thing to a degree.

Slowly growing tech companies worth single-digit billions can’t play the buyback game to the same degree as the majors. And they are growing more slowly, so even a similar buyback program in relative scale would excite less.

Grow or die, in other words. Or at least grow or come under heavy fire from external investors who want to oust the founder-CEO and “reform” the company. But if you can grow quickly, welcome to the land of milk and honey.

Even among the most valuable tech shops, shareholder return is concentrated in share price appreciation, and buybacks, which is the same thing to a degree.

Slowly growing tech companies worth single-digit billions can’t play the buyback game to the same degree as the majors. And they are growing more slowly, so even a similar buyback program in relative scale would excite less.

Grow or die, in other words. Or at least grow or come under heavy fire from external investors who want to oust the founder-CEO and “reform” the company. But if you can grow quickly, welcome to the land of milk and honey.

Hormonal health is a massive opportunity: Where are the unicorns?

Image Credits: Carol Yepes (opens in a new window) / Getty Images

There is a growing group of entrepreneurs who are betting that hormonal health is the key wedge into the digital health boom.

Hormones are fluctuating, ever-evolving, and diverse — but these founders say they’re also key to solving many health conditions that disproportionately impact women, from diabetes to infertility to mental health challenges.

Many believe it’s that complexity that underscores the opportunity. Hormonal health sits at the center of conversations around personalized medicine and women’s health: By 2025, women’s health could be a $50 billion industry, and by 2026, digital health more broadly is estimated to hit $221 billion.

Still, as funding for women’s health startups drops and stigma continues to impact where venture dollars go, it’s unclear whether the sector will remain in its infancy or hit a true inflection point.

3 lessons we learned after raising $6.3M from 50 investors

Image Credits: sorbetto (opens in a new window)/ Getty Images

Two years ago, founders of calendar assistant platform Reclaim were looking for a “mango” seed round — a boodle of cash large enough to help them transition from the prototype phase to staffing up for a public launch.

Although the team received offers, co-founder Henry Shapiro says the few that materialized were poor options, partially because Reclaim was still pre-product.

“So one summer morning, my co-founder and I sat down in his garage — where we’d been prototyping, pitching and iterating for the past year — and realized that as hard as it was, we would have to walk away entirely and do a full reset on our fundraising strategy,” he writes.

Shapiro shares what he learned from embracing failure and offers three conclusions “every founder should consider before they decide to go out and pitch investors.”

For SaaS startups, differentiation is an iterative process

Image Credits: Kevin Schafer / Getty Images

Although software as a service has been thriving as a sector for years, it has gone into overdrive in the past year as businesses responded to the pandemic by speeding up the migration of important functions to the cloud, ActiveCampaign founder and CEO Jason VandeBoom writes in a guest column.

“We’ve all seen the news of SaaS startups raising large funding rounds, with deal sizes and valuations steadily climbing. But as tech industry watchers know only too well, large funding rounds and valuations are not foolproof indicators of sustainable growth and longevity.”

VandeBoom notes that to scale sustainably, SaaS startups need to “stand apart from the herd at every phase of development. Failure to do so means a poor outcome for founders and investors.”

“As a founder who pivoted from on-premise to SaaS back in 2016, I have focused on scaling my company (most recently crossing 145,000 customers) and in the process, learned quite a bit about making a mark,” VandeBoom writes. “Here is some advice on differentiation at the various stages in the life of a SaaS startup.”

Facebook Faces Yet Another Outage: Platform Encounters Technical Issues Again

Uppdated: It seems that today’s issues with Facebook haven’t affected as many users as the last time. A smaller group of people appears to be impacted this time around, which is a relief compared to the larger incident before. Nevertheless, it’s still frustrating for those affected, and hopefully, the issues will be resolved soon by the Facebook team.

Facebook had another problem today (March 20, 2024). According to Downdetector, a website that shows when other websites are not working, many people had trouble using Facebook.

This isn’t the first time Facebook has had issues. Just a little while ago, there was another problem that stopped people from using the site. Today, when people tried to use Facebook, it didn’t work like it should. People couldn’t see their friends’ posts, and sometimes the website wouldn’t even load.

Downdetector, which watches out for problems on websites, showed that lots of people were having trouble with Facebook. People from all over the world said they couldn’t use the site, and they were not happy about it.

When websites like Facebook have problems, it affects a lot of people. It’s not just about not being able to see posts or chat with friends. It can also impact businesses that use Facebook to reach customers.

Since Facebook owns Messenger and Instagram, the problems with Facebook also meant that people had trouble using these apps. It made the situation even more frustrating for many users, who rely on these apps to stay connected with others.

During this recent problem, one thing is obvious: the internet is always changing, and even big websites like Facebook can have problems. While people wait for Facebook to fix the issue, it shows us how easily things online can go wrong. It’s a good reminder that we should have backup plans for staying connected online, just in case something like this happens again.

NEWS

We asked ChatGPT what will be Google (GOOG) stock price for 2030

Investors who have invested in Alphabet Inc. (NASDAQ: GOOG) stock have reaped significant benefits from the company’s robust financial performance over the last five years. Google’s dominance in the online advertising market has been a key driver of the company’s consistent revenue growth and impressive profit margins.

In addition, Google has expanded its operations into related fields such as cloud computing and artificial intelligence. These areas show great promise as future growth drivers, making them increasingly attractive to investors. Notably, Alphabet’s stock price has been rising due to investor interest in the company’s recent initiatives in the fast-developing field of artificial intelligence (AI), adding generative AI features to Gmail and Google Docs.

However, when it comes to predicting the future pricing of a corporation like Google, there are many factors to consider. With this in mind, Finbold turned to the artificial intelligence tool ChatGPT to suggest a likely pricing range for GOOG stock by 2030. Although the tool was unable to give a definitive price range, it did note the following:

“Over the long term, Google has a track record of strong financial performance and has shown an ability to adapt to changing market conditions. As such, it’s reasonable to expect that Google’s stock price may continue to appreciate over time.”

GOOG stock price prediction

While attempting to estimate the price range of future transactions, it is essential to consider a variety of measures in addition to the AI chat tool, which includes deep learning algorithms and stock market experts.

Finbold collected forecasts provided by CoinPriceForecast, a finance prediction tool that utilizes machine self-learning technology, to anticipate Google stock price by the end of 2030 to compare with ChatGPT’s projection.

According to the most recent long-term estimate, which Finbold obtained on March 20, the price of Google will rise beyond $200 in 2030 and touch $247 by the end of the year, which would indicate a 141% gain from today to the end of the year.

Google has been assigned a recommendation of ‘strong buy’ by the majority of analysts working on Wall Street for a more near-term time frame. Significantly, 36 analysts of the 48 have recommended a “strong buy,” while seven people have advocated a “buy.” The remaining five analysts had given a ‘hold’ rating.

The average price projection for Alphabet stock over the last three months has been $125.32; this objective represents a 22.31% upside from its current price. It’s interesting to note that the maximum price forecast for the next year is $160, representing a gain of 56.16% from the stock’s current price of $102.46.

While the outlook for Google stock may be positive, it’s important to keep in mind that some potential challenges and risks could impact its performance, including competition from ChatGPT itself, which could affect Google’s price.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

NEWS

This Apple Watch app brings ChatGPT to your wrist — here’s why you want it

ChatGPT feels like it is everywhere at the moment; the AI-powered tool is rapidly starting to feel like internet connected home devices where you are left wondering if your flower pot really needed Bluetooth. However, after hearing about a new Apple Watch app that brings ChatGPT to your favorite wrist computer, I’m actually convinced this one is worth checking out.

-

WORDPRESS6 days ago

WORDPRESS6 days agoTurkish startup ikas attracts $20M for its e-commerce platform designed for small businesses

-

PPC7 days ago

PPC7 days ago31 Ready-to-Go Mother’s Day Messages for Social Media, Email, & More

-

PPC6 days ago

PPC6 days agoA History of Google AdWords and Google Ads: Revolutionizing Digital Advertising & Marketing Since 2000

-

MARKETING5 days ago

MARKETING5 days agoRoundel Media Studio: What to Expect From Target’s New Self-Service Platform

-

SEO5 days ago

SEO5 days agoGoogle Limits News Links In California Over Proposed ‘Link Tax’ Law

-

MARKETING6 days ago

MARKETING6 days agoUnlocking the Power of AI Transcription for Enhanced Content Marketing Strategies

-

SEARCHENGINES6 days ago

SEARCHENGINES6 days agoGoogle Search Results Can Be Harmful & Dangerous In Some Cases

-

SEARCHENGINES5 days ago

Daily Search Forum Recap: April 12, 2024