SEO

A Complete Guide to Competitive Intelligence

In the business world, risks and opportunities are everywhere. For example, an industry trend may be sweeping the market for a limited time and favor early adopters, while a competitor that went bust can be a good source for acquiring new customers.

These types of news are not readily available, and by the time you purchase expensive analyst reports, they’re already outdated. So how do you make sure you understand your competition and stay ahead of market trends in a way that’s proactive and doesn’t break the bank?

Competitive intelligence is the answer to ensuring your business doesn’t get caught off guard. Notably, it’s not all data collection. Rather, it’s also about enabling the entire team to win through an actionable and repeatable process.

In this guide, you’ll learn the following:

Competitive intelligence (CI) is the process of gathering, analyzing, and sharing information about competitors, customers, and other market indicators to increase a company’s competitive edge.

It involves a coordinated competitive intelligence program and a centralized collection of data from various sources.

To succeed in business, knowing your competitors’ moves is not enough. Companies also need to be aware of market trends and how those changes will impact stakeholders. For example, unforeseen events in your industry may be cutting your financial gains this quarter.

This is where competitive intelligence steps in as a process to make more informed business decisions, reducing the uncertainty of external events. CI can also help you to:

- Generate more revenue.

- Spot growth opportunities early on.

- Anticipate market shifts with confidence.

- Develop counter-strategies for each of your competitors.

- Benchmark against competitors to discover areas of improvement.

- Measure brand perception in the eyes of your customers.

- Streamline product launches.

All these points can be effectively translated into a competitive intelligence program. But first, let’s look at what you came here for: competitive intelligence sources.

Like any system, the quality of the data you put into your CI program is a good predictor of its success. In the end, your goal is to create a complete profile of your competitor.

To do so, here are eight competitive intelligence sources that you can use today:

Your competitor’s website

It’s no surprise that a good starting point to gather competitive intel is to check out your competitor’s website.

Pay close attention to these:

- Positioning and messaging changes

- Solutions and vertical pages

- Pricing

- Product updates

First, go over the homepage and any marketing-related pages. Have they changed their tagline? What customer logos are they featuring? What buyer personas are they targeting? Signals like these will show you how your competitor wants to be perceived in the customers’ minds and what verticals they are pushing for.

You can learn a lot by analyzing your competitor’s homepage.

Second, move on to the product-related pages, particularly the pricing page. But don’t just settle for the price. Dig deeper. Find out the trial period length, pricing model, onboarding costs, etc.

Your competitor’s FAQ can also be a source of intel—not just for sales reps but also for marketers who can create marketing assets focused on solving difficult-to-solve pain points.

Content

Your competitor’s content is a trove of insights for showing what customers they’re looking for and where they seek to develop thought leadership.

Pay close attention to these:

- Type of content and format

- Frequency of posting

- Keywords and SEO

- Overall CTAs

For example, posting four case studies in a row is a clear indicator of their priorities on chasing a buyer persona. At the same time, the posting frequency can be used as a benchmark to create a sound content strategy.

Here’s how to check your competitor’s posting frequency in Ahrefs, using Asana as an example. I’ve chosen Asana because it’s probably a company you already know and use.

- Go to Ahrefs’ Content Explorer

- Plug in your competitor’s blog URL and switch the search mode to In URL

- Check the published vs. republished ratio in relation to yours

The real challenge is identifying the knowledge gaps between your content. You can then take advantage and develop informative content for keywords that your competitor doesn’t rank for to improve your search ranking.

Here’s how to do it in Ahrefs using the Content Gap tool, using the same Asana example:

- Plug your website into Ahrefs’ Site Explorer

- Go to the Content Gap report and enter your competitor’s website

From this screenshot, we see that Paymo (an Asana competitor) is already ranking for “working remotely” and “fun team building activities”—topics that Asana could target.

Social media

Another valuable competitive source is social media. Although sometimes overwhelming, messages and mentions go a long way in pointing out competing campaign patterns.

Pay close attention to these:

- What channels the competitor is active on

- Frequency of posting

- Who they follow

- Ads

Now, social media ROI is hard to quantify and platform-dependent. The lesson here is to analyze key strategies you can steal from your competition and spot potential pain points. For example, one of your competitors may use Twitter to answer customer inquiries. Let’s look at a conversation from Asana’s Twitter.

@asana I love your product, but it would be really cool if you could list subtasks so that those outstanding were positioned at the top. Even better if it was in due date order.

— Gary Butterfield (@GaryBPT) March 10, 2022

The paint point is clear: There is no possibility to sort subtasks within a task. While this may be an edge case, you may find out that it’s a deal-breaker for large organizations that work with many subtasks.

So if you were a competitor, you could arm your sales reps with this information and formulate a few questions (in a battle card) that would lead prospects to this weakness.

Besides showing your competitor’s employees, LinkedIn is another go-to platform that gives you a feeling about your competitor’s culture, future webinars, and overall content used to promote its brand.

Customer reviews

Customer reviews, either testimonials or case studies, are living proof of a company’s value. They are perhaps the most honest source of external competitive intel.

Pay close attention to these:

- B2B review platforms (Capterra, G2, TrustRadius)

- Analyst reports (Forrester, Gartner)

- Question platforms (Quora, Reddit)

B2B review platforms like Capterra, G2, and TrustRadius are a good starting point to identify what kind of customers your competitor sells to, their buyer journeys, pain points, and satisfaction ratings. You want to pay particular attention to negative reviews that can be brought up in sales conversations.

Next in line, analyst reports like Gartner’s Magic Quadrant and Forrester’s Wave will give you hints on your competitor’s market presence, vision, and how well they execute the said vision. These reports will also hint at the industry and business size your competitor caters to, as they also include anonymous customer reviews.

Source: Cheetah Transformation.

Finally, question platforms such as Quora and Reddit are a great way to see the main concerns and buying process of your competitor’s customers. You can even go undercover and ask an anonymous question about your industry to gauge how well people understand the market.

Resellers

Resellers are equally important for CI as customer reviews and analyst reports, especially since they’re from an intermediary acting on behalf of your competitor.

Pay close attention to these:

- Pricing structures

- Conditions for upsales

- Free add-ons

Resellers sell your competitor’s products and assist with market analysis reports on how to sell them better. If you’ve built a relationship with them, you can get your hands on these reports and gain access to your competitor’s selling strategy.

For example, you may find that your competitors are hitting their enterprise clients hard with storage overcharges. Or that they’re increasing their prices with every yearly renewal. This type of information wins sales deals when you’re head-to-head against a market leader or a competitor with better market exposure.

Don’t forget to also look at what extras they offer with each package. You can match your competitor’s offering and add other services on top to make your product more appealing.

Press

An easily accessible way of conducting competitive research is to go through a company’s news, events, and press releases.

Pay close attention to these:

- Press releases

- Events

- Financial results reports

A company’s news page is a quick teller of its overall direction—whether it has received new funding, wants to tackle new markets, or has acquired a market leader. Some even have public financial reports that can give you the edge to act toward market shifts proactively.

The news page is just one piece of the puzzle. You can research publishers already covering your competition but not your business. Build relationships with them. And who knows? You may get access to a bigger platform to spread the word about your product.

Here’s an easy way to do this using Ahrefs:

- Plug your competitor’s website into Site Explorer

- Go to Backlink profile, then choose Referring Domains

- Check DoFollow links only and Exclude subdomains

It looks like Asana’s competitor, Paymo, has some press coverage for writerraccess.com—a service for covering copywriters. And we’ve got our hands on a reseller too.

Events are also an opportunity to spy on your competition ethically. Find out what events they attend, how regularly, and the messages used on booths, banners, flyers, t‑shirts, and other swag.

Some may even sponsor events to reinforce their brand to a specific customer segment. This will give you an idea about what events to join and the messages to use for brand awareness.

HR

Your competitor’s employees—perhaps the most overlooked CI resource—and their HR practices are the best barometer for a competitor’s growth.

Pay close attention to these:

- About Us page/Careers page

- Job positions by department

- C‑level hires

- Feedback on culture, salaries, and interviews (Glassdoor)

No one is more well-versed in your competitor’s strengths and weaknesses than their employees. And while the employees may be loyal, they are still having discussions and leaving trails behind that can serve as competitive ammunition.

You can check the overall job satisfaction of current and former employees on Glassdoor. What are the pros and cons of the competitor’s culture? What does the interview process look like? Average salaries? Questions like these can put your HR in a better position to address weaknesses when hiring similar candidates.

Another great place to dig for competitive intel is your competitor’s About Us page or Careers page. The gist is to look beyond job posting details, such as the location, role, and requirements.

If a job goes unfilled for a long time, this probably means the competitor has lots of things going on and needs a high-level specialist to take over the workload.

Similarly, if different positions are advertised within the same department, this can mean they’re putting all their efforts into a specific business area. Are they hiring more engineers? A new product may be just around the corner. Are marketers and customer success reps in high demand? Expansion is close.

Your customers and colleagues

Finally, it’s time to talk about the most accessible source of internal intel: your customers and colleagues.

Before choosing your business, your customers have gone through many hoops trialing other competitors. As a result, they’ll know the problems your competition is trying to solve and what works and doesn’t within the context of their vertical, saving you precious time on research.

One way to extract this information is to get it directly from customers through interviews or surveys. The other is to contact your colleagues.

Check each department for new insights they can share with you. Sales can inform you about common objections, support has intel on the top recurring questions, product knows all feature differentiators, and marketing can advise what collaterals have more priority. Your goal is to pick key takeaways as you carefully comb through the data.

Unfortunately, data will be spread across CRMs, support chat tools, and notes for most cases. A better solution is to use dedicated competitive intelligence tools that centralize this type of data, which brings us to the next point.

A competitive intelligence program needs to be scalable enough to arm every employee with the correct intel and processes for their role.

We’re not talking only about C‑level executives but also sales reps, marketers, and engineers that can benefit from these insights to better fight objections, reach new audiences, and optimize product launches.

The good news is that CI programs are now more affordable than ever—even for SMBs with small budgets—given how easy it is to find information online.

So without further ado, here are the most important steps that go into building an effective CI program:

1. Identify your direct competitors

You may think you don’t have any competitors. But if you’re solving a problem, chances are someone else has already thought about solving it.

In fact, Crayon’s 2022 survey has shown that companies of all sizes experience an 18% increase in competitors every year. The average number of new competitors is 29 in 2020.

Knowing which competitors to keep tabs on is critical for the success of a CI program, but that’s not so obvious. Hence, we need to kick things off with some terminology:

- Direct competitors act in the same market as yours and sell similar products. It’s usually a zero-sum game: If customers don’t buy from you, they buy from them. Think Burger King vs. McDonald’s.

- Indirect competitors act in the same market but sell different products that satisfy the same need. Think Burger King vs. KFC. They are both fast-food restaurants that curb hunger differently.

- Replacement competitors don’t act in the same market, but they can replace your product to satisfy the same need. Think Burger King vs. Beyond Meat (vegan) burgers.

Now that competitor types are clear, gather a list of 5–10 direct competitors and five indirect competitors.

Replacement competitors shouldn’t be your concern unless there are various ways to solve the problem your product is trying to solve.

A reliable way to find your competition is to check if you’re targeting the same keywords. Here’s a quick method using Ahrefs (with Asana as the example):

- Plug your website into Site Explorer.

- Go to Organic search and choose Competing Domains

- Check the Common keywords column

It looks like Asana has the most overlapping keywords with Monday.com.

2. Establish key objectives and metrics for each stakeholder

With your direct competitors mapped out, it’s time to set your key objectives and metrics. This goes hand in hand with identifying the stakeholders you need to get buy-in for the CI program.

A good starting point is to ask the C‑level executives what competitive threats keep them busy at night. This action won’t justify the need for a CI program, but it will point you to the departments that can solve them.

Remember, each function represents a touchpoint between your business and the customer, providing different perspectives of the buying journey.

Let’s look at the most common CI stakeholders and an example goal for each:

- Sales – Increase win rates in competitive deals

- Marketing – Create actionable battle cards

- Engineering – Build true differentiators

- Customer success/support – Retain customers

- C‑level executives – Analyze adjacent EMEA markets to break into

Now, this doesn’t mean goals do not overlap. On the contrary, improved positioning can bring in more leads, while a product that stands out can significantly increase customer retention.

The takeaway at this step is to find out the job roles that will contribute to the CI program and effective ways to measure it.

3. Gather data

Data collection is the foundation and perhaps most time-consuming part of any CI program. The challenge lies in finding qualitative insights to support your team members within their job roles.

We’ve already gone through competitive intelligence resources. On a meta level, though, know that you can categorize them into two data types.

There is external data. It’s the low-hanging fruit type of information available online, sitting on your competitor’s website, social media, review platforms, analyst reports, etc. Albeit harder to dig for, resellers are also a valid source of data on how users interact with your competitor’s product and their main offering’s strengths and weaknesses.

We also have internal data. It’s information that already exists within your business, such as call notes from a sales rep or a competitor’s pricing list sent to one of your customers.

Even though the latter is more qualitative, both are ethical and should be used together to arrive at actionable insights.

4. Analyze data

Great. You’ve identified your direct competitor, established CI goals and metrics, and probably spent a few hours gathering competitive intel.

What follows is transforming that raw data into actual deliverables (aka sales and marketing assets) and feeding them to the right stakeholders.

By far, the most common CI deliverable is the battle card, a sales asset that packs short insights about a specific competitor with the goal of “depositioning” them. Your sales team will love these cards, as long as they’re not too overwhelming and formulated word for word to be consumed right before a sales call.

While there’s no secret recipe on how to craft a battle card, an actionable one should include the following sections:

- Your competitor’s profile

- Quick dismisses to disqualify the competitor early on

- Arguments for why you win and why you lose

- Objection handling answers

- A list of landmine topics that put your competitor in a bad light

For more information on how to create more inclusive battle cards, Klue has already written extensively about a battle card framework.

Battle cards aside, other popular CI deliverables are product sheets—1:1 feature comparisons between your product and your competitor’s product—and executive slide decks to inform executives about the long-term strategy.

How many you can deliver will largely depend on your marketing team’s size and budget. This is only half of the story, though. Equally important is how and when you deliver them.

5. Share insights with key stakeholders

Competitive intelligence has no value if it sits in a corner and doesn’t impact stakeholders.

At the final step of the CI program, your job is twofold: (1) identify your stakeholder’s preferred communication channels and (2) increase the frequency of delivering competitive insights.

For the first endeavor, ask your stakeholders how they communicate. Sales reps may be more inclined to hang out in Slack channels, while executives probably rely heavily on email. Always meet them on their turf to ensure that information is consumed on time.

As for the second one, consider sharing competitive insights during daily and weekly stand-ups. According to a study by Crayon, businesses that do so frequently have seen a direct revenue impact; in the study, 69% of the respondents share competitive intent daily and 72% do so weekly.

Ultimately, sharing competitive insights is an ongoing process that will reinforce the adoption of a CI program and guarantee its success.

By now, you’ve probably realized how time-consuming competitive research is.

It doesn’t have to be. Even though you may not have a CI function, let alone a budget, you can collect, analyze, and share data about competitors with affordable, competitive software.

Owler

Best for: Digging into a company’s history

Pricing: Free trial available; paid plans start from $35/month

Alternative: Crunchbase

With a community of 3.5 million crowd-sourced users, Owler has the largest and most up-to-date data set of company insights.

This means you can surface all sorts of strategic information like funding, acquisitions, and the latest news to understand how a competitor has grown over time. The tool even goes the extra mile and compiles a brief analysis of your competitors.

You can also follow companies to receive daily or real-time notifications about their most relevant content, including press releases, blog articles, social media posts, or product videos.

Visualping

Best for: Monitoring website changes

Pricing: Free trial available; paid plans start from $10/month (personal account) and $50/month (business account)

Alternatives: Change Tower, Competitors App

Visualping is a competitive intelligence tool for monitoring website changes.

All you have to do is enter a competitor’s URL, select the website area you wish to monitor, the threshold of changes (1%, 10%, 25%, 50%), frequency checks (every day, week, month), and your email address to receive the alerts. Quite simple? You bet. But effective in identifying more subtle messaging and visual changes.

This is not all. Visualping also trains bots to perform actions on your behalf, such as entering passwords or clicking on elements, saving you time during the competitive research process.

Ahrefs

Best for: Analyzing website traffic and SEO

Pricing: Paid plans start from $83/month, but you can use Ahrefs Webmaster Tools for free

Alternatives: None

Ahrefs is an industry-leading SEO and marketing tool that can help you uncover a competitor’s website traffic and reverse-engineer their efforts.

Here are some of its most popular competitive intelligence tools:

- Site Explorer – Research competitor backlinks and get publishers to cover you too

- Content Gap tool – Find keywords that a competitor ranks for that you don’t

- Ads – Deconstruct your competitor’s ads from ad copy to CTAs

- Email alerts – Stay in the loop about new backlinks and mentions of your competitor

Social Searcher

Best for: Comparing social media strategies

Pricing: Free trial available; paid plans start from €3.49/month for 200 searches/day

Alternatives: Talkwalker, Rival IQ

Social Searcher works like a search engine for social media, gathering mentions about your competitor’s brand.

The tool crawls data across 11 social media networks, displaying keywords, post types, and users. In addition, its “audience insights” feature gives you hints about the preferred post types, publishing times, and go-to social media channels of your competitor’s customers.

But perhaps the most vital feature in its arsenal is the sentiment analysis report, making it easy to spot negative feedback about your competitor’s products and services. You can translate these weaknesses into sales enablement material later on.

SendView

Best for: Tracking competitor email marketing

Pricing: Plans start from $49/month for 10 company newsletters

Alternative: Owletter

SendView is an excellent tool for tracking your competitor’s email marketing efforts.

The process goes something like this: You create a separate email address and then subscribe to your competitor’s newsletter. After that, all emails go straight into SendView without bloating your inbox.

On top of this, you can access each email to analyze its subject line length, word count, email provider, spam score, source code, and whether or not it’s mobile-friendly. These are all valuable sources of inspiration for optimizing email marketing campaigns that resonate with your audience.

Final thoughts

Despite the abundant information about markets and competitors, teams today are hungrier than ever for knowledge and guidance—whether that’s ways to do an SEO competitor analysis or conduct a market analysis from A to Z (including mystery shopping).

Competitive intelligence is the long-awaited answer to navigate the business world with more clarity. Don’t think of it as a one-off action. Rather, see it as an ongoing process that equips every team member with information relevant to their job role and tools to make better business decisions.

Feel free to use this guide to start your own CI program or to convince your executive board about the importance of competitive intelligence.

Got questions? Ping me on Twitter.

SEO

An In-Depth Guide And Best Practices For Mobile SEO

Over the years, search engines have encouraged businesses to improve mobile experience on their websites. More than 60% of web traffic comes from mobile, and in some cases based on the industry, mobile traffic can reach up to 90%.

Since Google has completed its switch to mobile-first indexing, the question is no longer “if” your website should be optimized for mobile, but how well it is adapted to meet these criteria. A new challenge has emerged for SEO professionals with the introduction of Interaction to Next Paint (INP), which replaced First Input Delay (FID) starting March, 12 2024.

Thus, understanding mobile SEO’s latest advancements, especially with the shift to INP, is crucial. This guide offers practical steps to optimize your site effectively for today’s mobile-focused SEO requirements.

What Is Mobile SEO And Why Is It Important?

The goal of mobile SEO is to optimize your website to attain better visibility in search engine results specifically tailored for mobile devices.

This form of SEO not only aims to boost search engine rankings, but also prioritizes enhancing mobile user experience through both content and technology.

While, in many ways, mobile SEO and traditional SEO share similar practices, additional steps related to site rendering and content are required to meet the needs of mobile users and the speed requirements of mobile devices.

Does this need to be a priority for your website? How urgent is it?

Consider this: 58% of the world’s web traffic comes from mobile devices.

If you aren’t focused on mobile users, there is a good chance you’re missing out on a tremendous amount of traffic.

Mobile-First Indexing

Additionally, as of 2023, Google has switched its crawlers to a mobile-first indexing priority.

This means that the mobile experience of your site is critical to maintaining efficient indexing, which is the step before ranking algorithms come into play.

Read more: Where We Are Today With Google’s Mobile-First Index

How Much Of Your Traffic Is From Mobile?

How much traffic potential you have with mobile users can depend on various factors, including your industry (B2B sites might attract primarily desktop users, for example) and the search intent your content addresses (users might prefer desktop for larger purchases, for example).

Regardless of where your industry and the search intent of your users might be, the future will demand that you optimize your site experience for mobile devices.

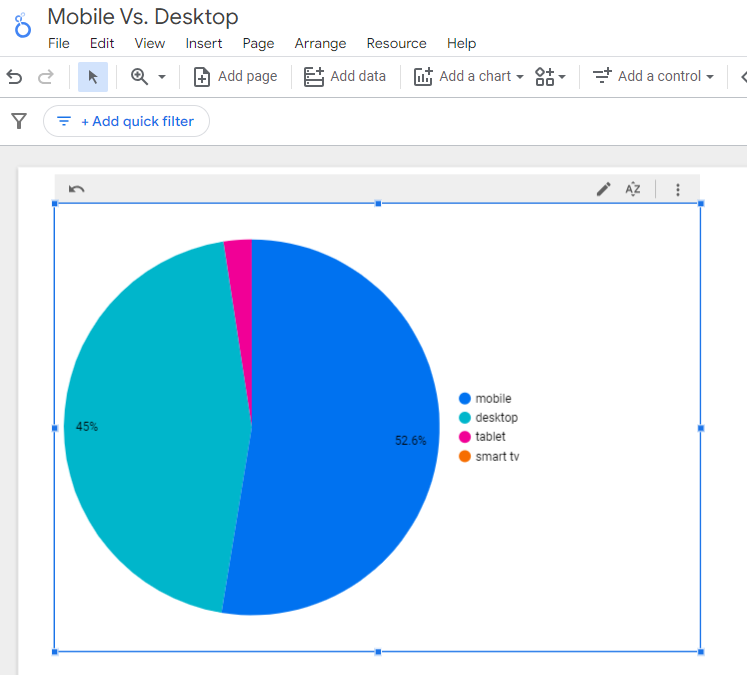

How can you assess your current mix of mobile vs. desktop users?

An easy way to see what percentage of your users is on mobile is to go into Google Analytics 4.

- Click Reports in the left column.

- Click on the Insights icon on the right side of the screen.

- Scroll down to Suggested Questions and click on it.

- Click on Technology.

- Click on Top Device model by Users.

- Then click on Top Device category by Users under Related Results.

- The breakdown of Top Device category will match the date range selected at the top of GA4.

You can also set up a report in Looker Studio.

- Add your site to the Data source.

- Add Device category to the Dimension field.

- Add 30-day active users to the Metric field.

- Click on Chart to select the view that works best for you.

Screenshot from Looker Studio, March 2024

Screenshot from Looker Studio, March 2024You can add more Dimensions to really dig into the data to see which pages attract which type of users, what the mobile-to-desktop mix is by country, which search engines send the most mobile users, and so much more.

Read more: Why Mobile And Desktop Rankings Are Different

How To Check If Your Site Is Mobile-Friendly

Now that you know how to build a report on mobile and desktop usage, you need to figure out if your site is optimized for mobile traffic.

While Google removed the mobile-friendly testing tool from Google Search Console in December 2023, there are still a number of useful tools for evaluating your site for mobile users.

Bing still has a mobile-friendly testing tool that will tell you the following:

- Viewport is configured correctly.

- Page content fits device width.

- Text on the page is readable.

- Links and tap targets are sufficiently large and touch-friendly.

- Any other issues detected.

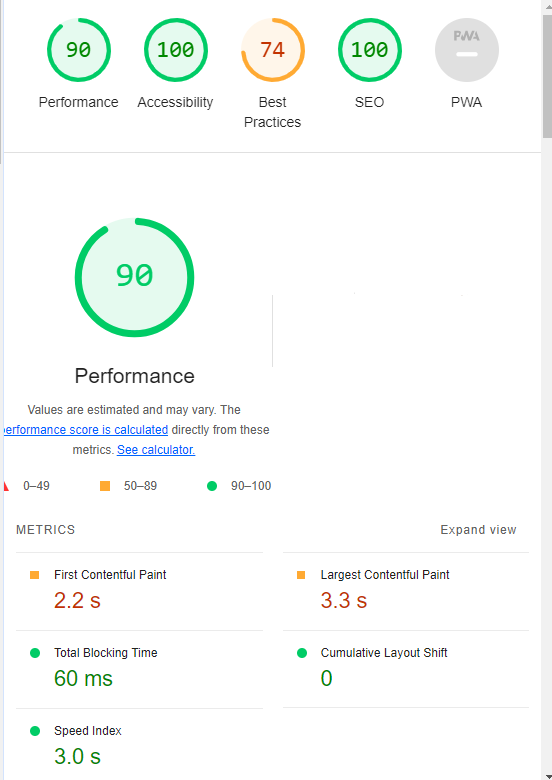

Google’s Lighthouse Chrome extension provides you with an evaluation of your site’s performance across several factors, including load times, accessibility, and SEO.

To use, install the Lighthouse Chrome extension.

- Go to your website in your browser.

- Click on the orange lighthouse icon in your browser’s address bar.

- Click Generate Report.

- A new tab will open and display your scores once the evaluation is complete.

Screenshot from Lighthouse, March 2024

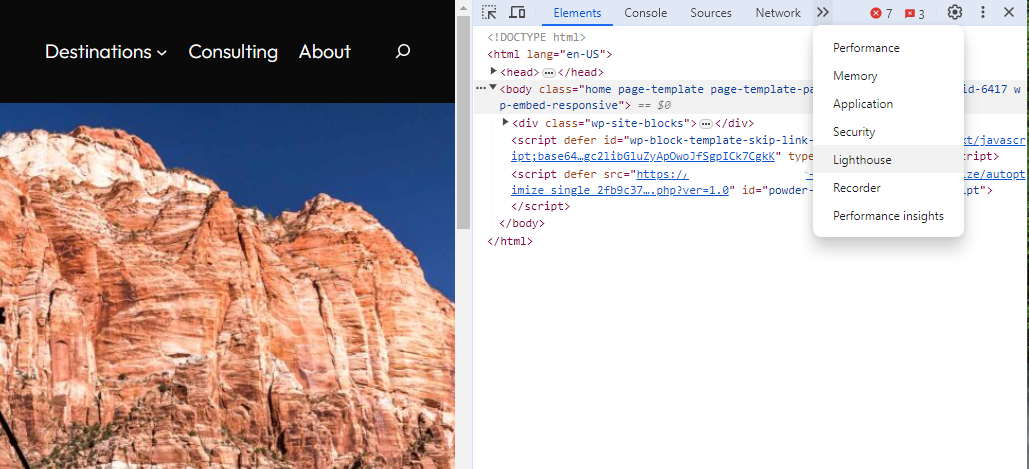

Screenshot from Lighthouse, March 2024You can also use the Lighthouse report in Developer Tools in Chrome.

- Simply click on the three dots next to the address bar.

- Select “More Tools.”

- Select Developer Tools.

- Click on the Lighthouse tab.

- Choose “Mobile” and click the “Analyze page load” button.

Screenshot from Lighthouse, March 2024

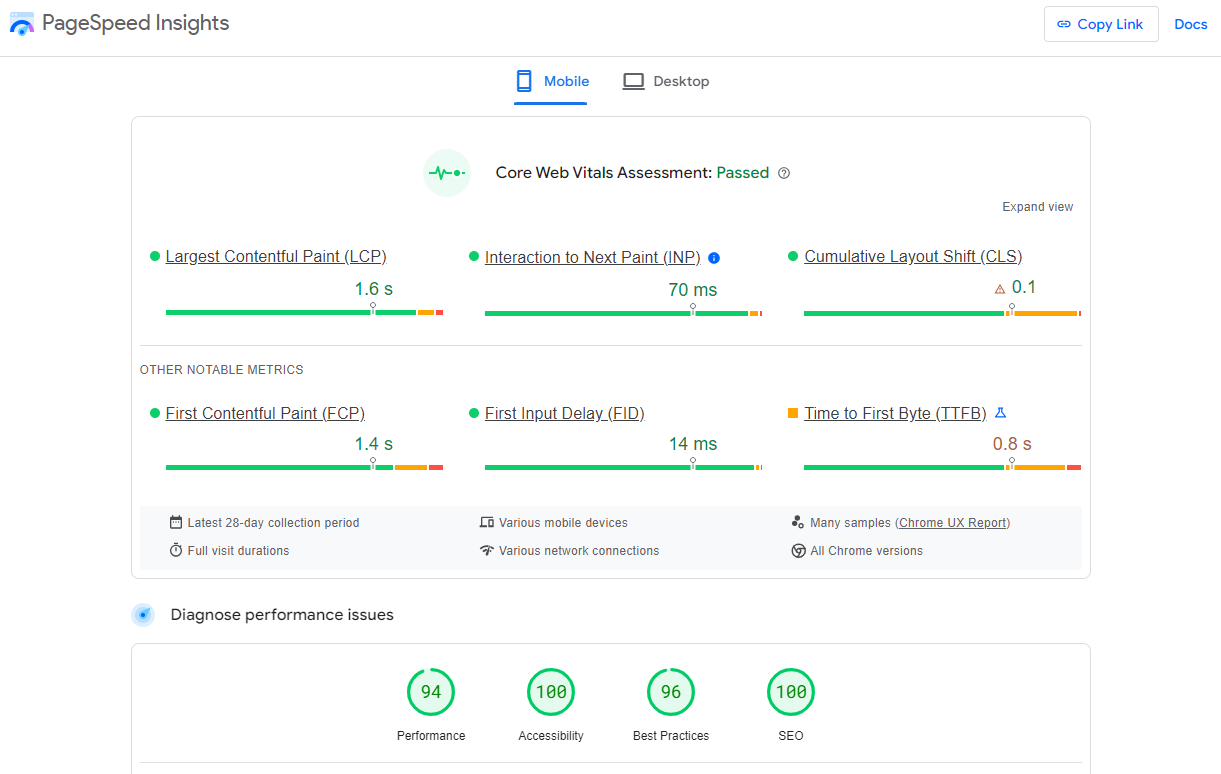

Screenshot from Lighthouse, March 2024Another option that Google offers is the PageSpeed Insights (PSI) tool. Simply add your URL into the field and click Analyze.

PSI will integrate any Core Web Vitals scores into the resulting view so you can see what your users are experiencing when they come to your site.

Screenshot from PageSpeed Insights, March 2024

Screenshot from PageSpeed Insights, March 2024Other tools, like WebPageTest.org, will graphically display the processes and load times for everything it takes to display your webpages.

With this information, you can see which processes block the loading of your pages, which ones take the longest to load, and how this affects your overall page load times.

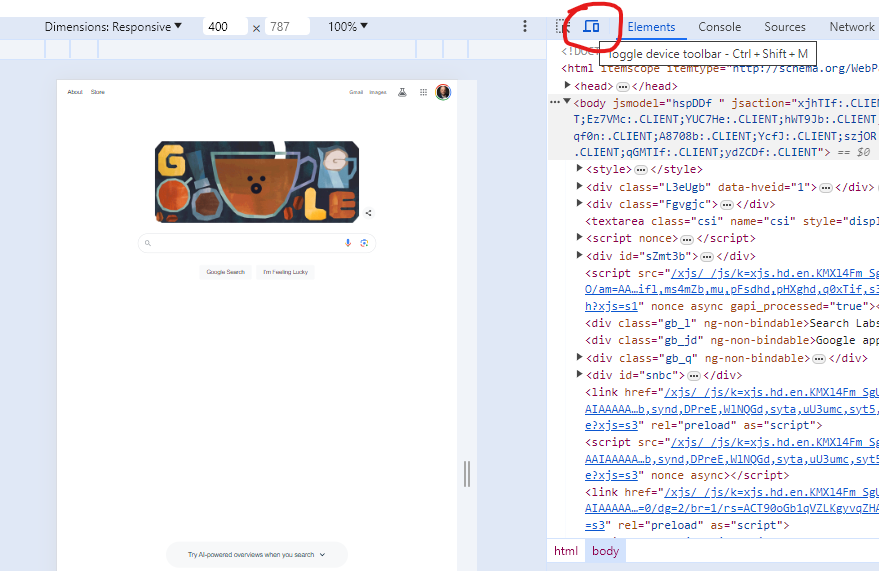

You can also emulate the mobile experience by using Developer Tools in Chrome, which allows you to switch back and forth between a desktop and mobile experience.

Screenshot from Google Chrome Developer Tools, March 2024

Screenshot from Google Chrome Developer Tools, March 2024Lastly, use your own mobile device to load and navigate your website:

- Does it take forever to load?

- Are you able to navigate your site to find the most important information?

- Is it easy to add something to cart?

- Can you read the text?

Read more: Google PageSpeed Insights Reports: A Technical Guide

How To Optimize Your Site Mobile-First

With all these tools, keep an eye on the Performance and Accessibility scores, as these directly affect mobile users.

Expand each section within the PageSpeed Insights report to see what elements are affecting your score.

These sections can give your developers their marching orders for optimizing the mobile experience.

While mobile speeds for cellular networks have steadily improved around the world (the average speed in the U.S. has jumped to 27.06 Mbps from 11.14 Mbps in just eight years), speed and usability for mobile users are at a premium.

Read more: Top 7 SEO Benefits Of Responsive Web Design

Best Practices For Mobile Optimization

Unlike traditional SEO, which can focus heavily on ensuring that you are using the language of your users as it relates to the intersection of your products/services and their needs, optimizing for mobile SEO can seem very technical SEO-heavy.

While you still need to be focused on matching your content with the needs of the user, mobile search optimization will require the aid of your developers and designers to be fully effective.

Below are several key factors in mobile SEO to keep in mind as you’re optimizing your site.

Site Rendering

How your site responds to different devices is one of the most important elements in mobile SEO.

The two most common approaches to this are responsive design and dynamic serving.

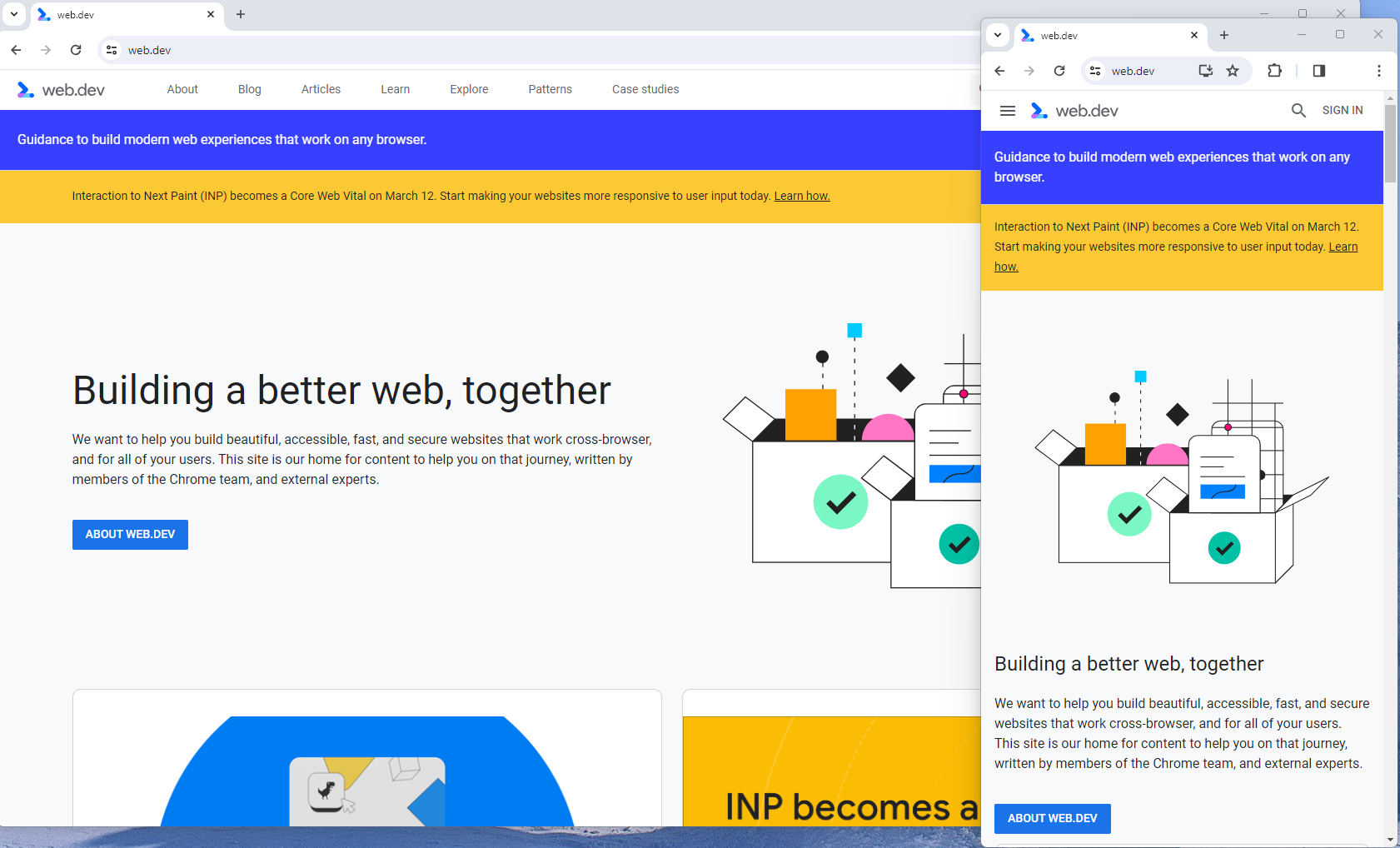

Responsive design is the most common of the two options.

Using your site’s cascading style sheets (CSS) and flexible layouts, as well as responsive content delivery networks (CDN) and modern image file types, responsive design allows your site to adjust to a variety of screen sizes, orientations, and resolutions.

With the responsive design, elements on the page adjust in size and location based on the size of the screen.

You can simply resize the window of your desktop browser and see how this works.

Screenshot from web.dev, March 2024

Screenshot from web.dev, March 2024This is the approach that Google recommends.

Adaptive design, also known as dynamic serving, consists of multiple fixed layouts that are dynamically served to the user based on their device.

Sites can have a separate layout for desktop, smartphone, and tablet users. Each design can be modified to remove functionality that may not make sense for certain device types.

This is a less efficient approach, but it does give sites more control over what each device sees.

While these will not be covered here, two other options:

- Progressive Web Apps (PWA), which can seamlessly integrate into a mobile app.

- Separate mobile site/URL (which is no longer recommended).

Read more: An Introduction To Rendering For SEO

Interaction to Next Paint (INP)

Google has introduced Interaction to Next Paint (INP) as a more comprehensive measure of user experience, succeeding First Input Delay. While FID measures the time from when a user first interacts with your page (e.g., clicking a link, tapping a button) to the time when the browser is actually able to begin processing event handlers in response to that interaction. INP, on the other hand, broadens the scope by measuring the responsiveness of a website throughout the entire lifespan of a page, not just first interaction.

Note that actions such as hovering and scrolling do not influence INP, however, keyboard-driven scrolling or navigational actions are considered keystrokes that may activate events measured by INP but not scrolling which is happeing due to interaction.

Scrolling may indirectly affect INP, for example in scenarios where users scroll through content, and additional content is lazy-loaded from the API. While the act of scrolling itself isn’t included in the INP calculation, the processing, necessary for loading additional content, can create contention on the main thread, thereby increasing interaction latency and adversely affecting the INP score.

What qualifies as an optimal INP score?

- An INP under 200ms indicates good responsiveness.

- Between 200ms and 500ms needs improvement.

- Over 500ms means page has poor responsiveness.

and these are common issues causing poor INP scores:

- Long JavaScript Tasks: Heavy JavaScript execution can block the main thread, delaying the browser’s ability to respond to user interactions. Thus break long JS tasks into smaller chunks by using scheduler API.

- Large DOM (HTML) Size: A large DOM ( starting from 1500 elements) can severely impact a website’s interactive performance. Every additional DOM element increases the work required to render pages and respond to user interactions.

- Inefficient Event Callbacks: Event handlers that execute lengthy or complex operations can significantly affect INP scores. Poorly optimized callbacks attached to user interactions, like clicks, keypress or taps, can block the main thread, delaying the browser’s ability to render visual feedback promptly. For example when handlers perform heavy computations or initiate synchronous network requests such on clicks.

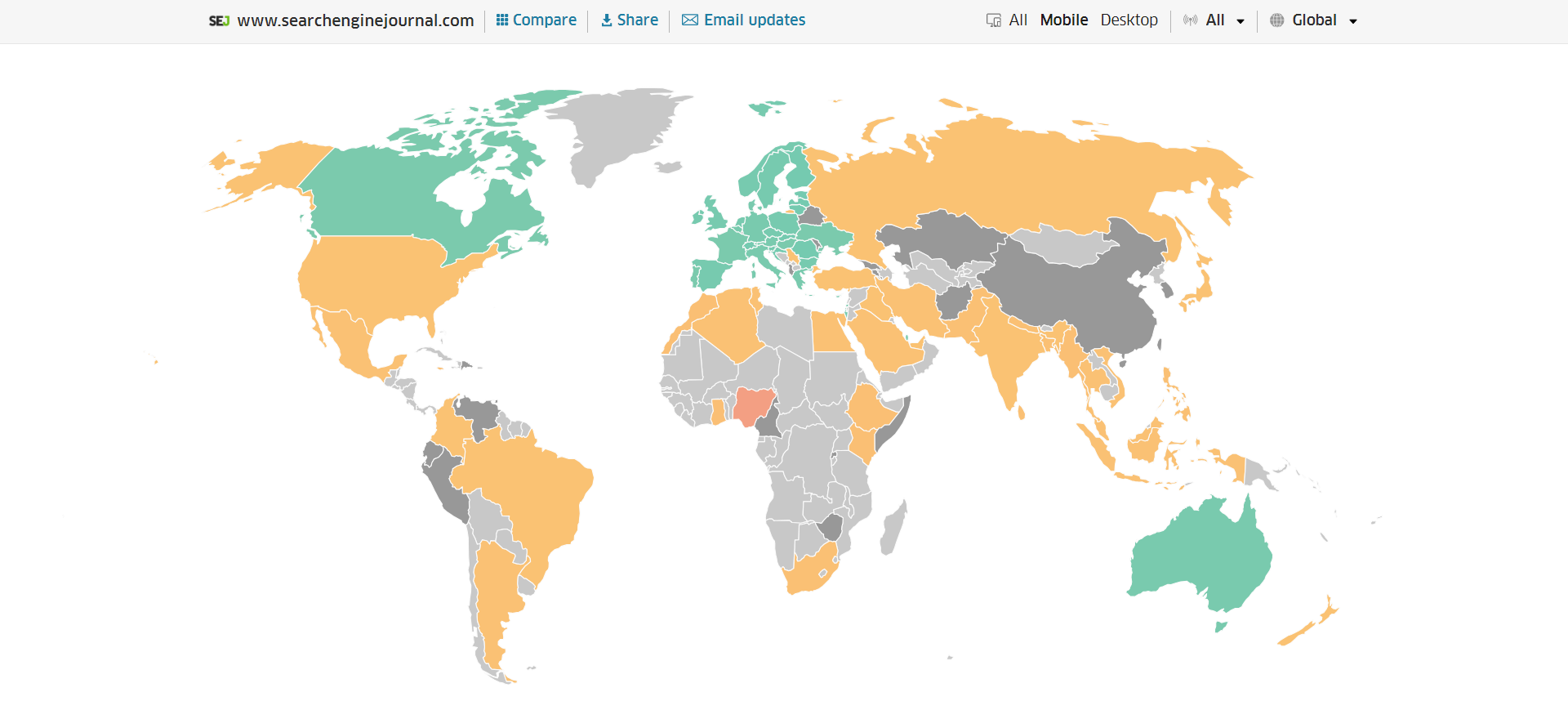

and you can troubleshoot INP issues using free and paid tools.

As a good starting point I would recommend to check your INP scores by geos via treo.sh which will give you a great high level insights where you struggle with most.

INP scores by Geos

INP scores by GeosRead more: How To Improve Interaction To Next Paint (INP)

Image Optimization

Images add a lot of value to the content on your site and can greatly affect the user experience.

From page speeds to image quality, you could adversely affect the user experience if you haven’t optimized your images.

This is especially true for the mobile experience. Images need to adjust to smaller screens, varying resolutions, and screen orientation.

- Use responsive images

- Implement lazy loading

- Compress your images (use WebP)

- Add your images into sitemap

Optimizing images is an entire science, and I advise you to read our comprehensive guide on image SEO how to implement the mentioned recommendations.

Avoid Intrusive Interstitials

Google rarely uses concrete language to state that something is a ranking factor or will result in a penalty, so you know it means business about intrusive interstitials in the mobile experience.

Intrusive interstitials are basically pop-ups on a page that prevent the user from seeing content on the page.

John Mueller, Google’s Senior Search Analyst, stated that they are specifically interested in the first interaction a user has after clicking on a search result.

Not all pop-ups are considered bad. Interstitial types that are considered “intrusive” by Google include:

- Pop-ups that cover most or all of the page content.

- Non-responsive interstitials or pop-ups that are impossible for mobile users to close.

- Pop-ups that are not triggered by a user action, such as a scroll or a click.

Read more: 7 Tips To Keep Pop-Ups From Harming Your SEO

Structured Data

Most of the tips provided in this guide so far are focused on usability and speed and have an additive effect, but there are changes that can directly influence how your site appears in mobile search results.

Search engine results pages (SERPs) haven’t been the “10 blue links” in a very long time.

They now reflect the diversity of search intent, showing a variety of different sections to meet the needs of users. Local Pack, shopping listing ads, video content, and more dominate the mobile search experience.

As a result, it’s more important than ever to provide structured data markup to the search engines, so they can display rich results for users.

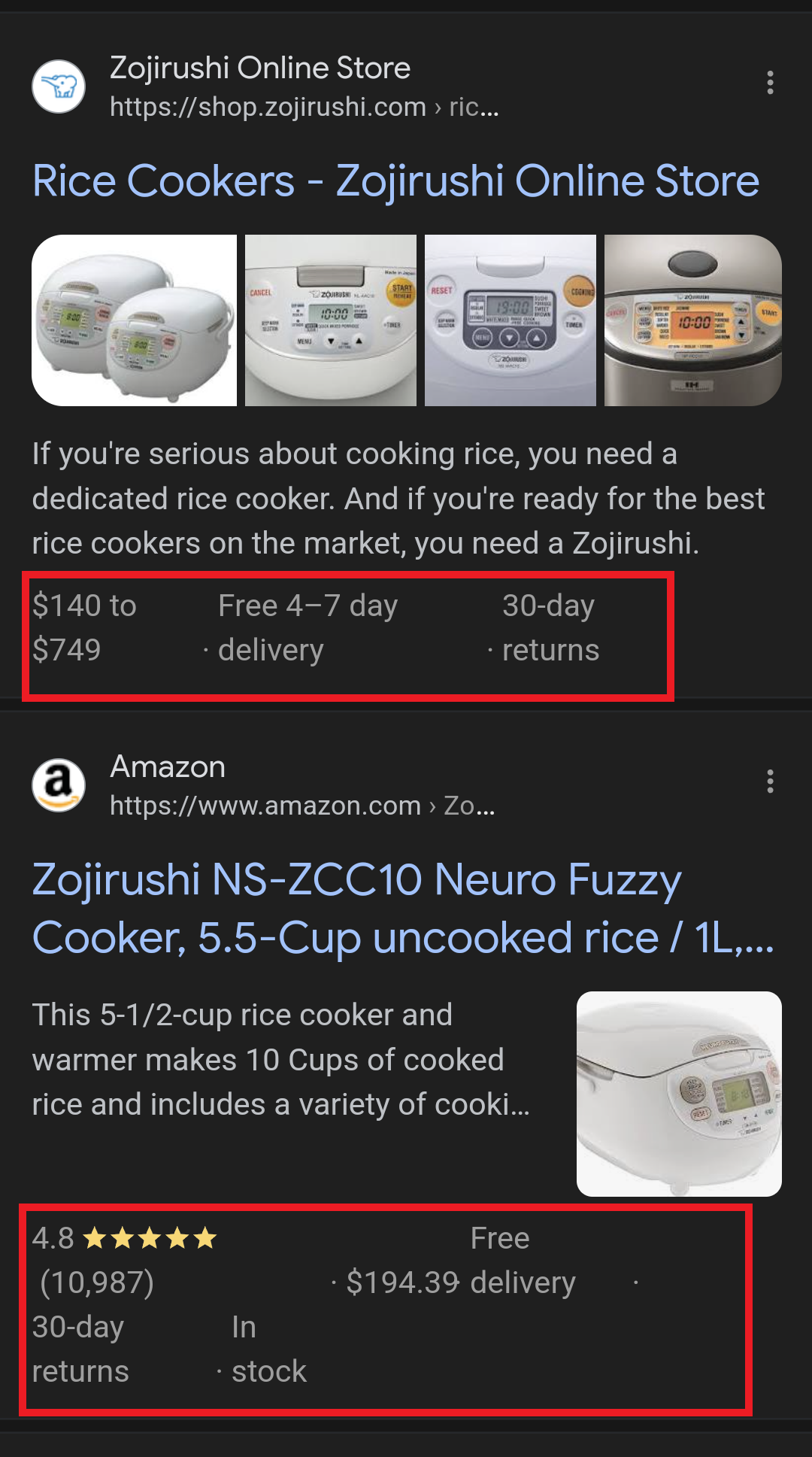

In this example, you can see that both Zojirushi and Amazon have included structured data for their rice cookers, and Google is displaying rich results for both.

Screenshot from search for [Japanese rice cookers], Google, March 2024

Screenshot from search for [Japanese rice cookers], Google, March 2024Adding structured data markup to your site can influence how well your site shows up for local searches and product-related searches.

Using JSON-LD, you can mark up the business, product, and services data on your pages in Schema markup.

If you use WordPress as the content management system for your site, there are several plugins available that will automatically mark up your content with structured data.

Read more: What Structured Data To Use And Where To Use It?

Content Style

When you think about your mobile users and the screens on their devices, this can greatly influence how you write your content.

Rather than long, detailed paragraphs, mobile users prefer concise writing styles for mobile reading.

Each key point in your content should be a single line of text that easily fits on a mobile screen.

Your font sizes should adjust to the screen’s resolution to avoid eye strain for your users.

If possible, allow for a dark or dim mode for your site to further reduce eye strain.

Headers should be concise and address the searcher’s intent. Rather than lengthy section headers, keep it simple.

Finally, make sure that your text renders in a font size that’s readable.

Read more: 10 Tips For Creating Mobile-Friendly Content

Tap Targets

As important as text size, the tap targets on your pages should be sized and laid out appropriately.

Tap targets include navigation elements, links, form fields, and buttons like “Add to Cart” buttons.

Targets smaller than 48 pixels by 48 pixels and targets that overlap or are overlapped by other page elements will be called out in the Lighthouse report.

Tap targets are essential to the mobile user experience, especially for ecommerce websites, so optimizing them is vital to the health of your online business.

Read more: Google’s Lighthouse SEO Audit Tool Now Measures Tap Target Spacing

Prioritizing These Tips

If you have delayed making your site mobile-friendly until now, this guide may feel overwhelming. As a result, you may not know what to prioritize first.

As with so many other optimizations in SEO, it’s important to understand which changes will have the greatest impact, and this is just as true for mobile SEO.

Think of SEO as a framework in which your site’s technical aspects are the foundation of your content. Without a solid foundation, even the best content may struggle to rank.

- Responsive or Dynamic Rendering: If your site requires the user to zoom and scroll right or left to read the content on your pages, no number of other optimizations can help you. This should be first on your list.

- Content Style: Rethink how your users will consume your content online. Avoid very long paragraphs. “Brevity is the soul of wit,” to quote Shakespeare.

- Image Optimization: Begin migrating your images to next-gen image formats and optimize your content display network for speed and responsiveness.

- Tap Targets: A site that prevents users from navigating or converting into sales won’t be in business long. Make navigation, links, and buttons usable for them.

- Structured Data: While this element ranks last in priority on this list, rich results can improve your chances of receiving traffic from a search engine, so add this to your to-do list once you’ve completed the other optimizations.

Summary

From How Search Works, “Google’s mission is to organize the world’s information and make it universally accessible and useful.”

If Google’s primary mission is focused on making all the world’s information accessible and useful, then you know they will prefer surfacing sites that align with that vision.

Since a growing percentage of users are on mobile devices, you may want to infer the word “everywhere” added to the end of the mission statement.

Are you missing out on traffic from mobile devices because of a poor mobile experience?

If you hope to remain relevant, make mobile SEO a priority now.

Featured Image: Paulo Bobita/Search Engine Journal

SEO

HARO Has Been Dead for a While

I know nothing about the new tool. I haven’t tried it. But after trying to use HARO recently, I can’t say I’m surprised or saddened by its death. It’s been a walking corpse for a while.

I used HARO way back in the day to build links. It worked. But a couple of months ago, I experienced the platform from the other side when I decided to try to source some “expert” insights for our posts.

After just a few minutes of work, I got hundreds of pitches:

So, I grabbed a cup of coffee and began to work through them. It didn’t take long before I lost the will to live. Every other pitch seemed like nothing more than lazy AI-generated nonsense from someone who definitely wasn’t an expert.

Here’s one of them:

Seriously. Who writes like that? I’m a self-confessed dullard (any fellow Dull Men’s Club members here?), and even I’m not that dull…

I don’t think I looked through more than 30-40 of the responses. I just couldn’t bring myself to do it. It felt like having a conversation with ChatGPT… and not a very good one!

Despite only reviewing a few dozen of the many pitches I received, one stood out to me:

Believe it or not, this response came from a past client of mine who runs an SEO agency in the UK. Given how knowledgeable and experienced he is (he actually taught me a lot about SEO back in the day when I used to hassle him with questions on Skype), this pitch rang alarm bells for two reasons:

- I truly doubt he spends his time replying to HARO queries

- I know for a fact he’s no fan of Neil Patel (sorry, Neil, but I’m sure you’re aware of your reputation at this point!)

So… I decided to confront him 😉

Here’s what he said:

Shocker.

I pressed him for more details:

I’m getting a really good deal and paying per link rather than the typical £xxxx per month for X number of pitches. […] The responses as you’ve seen are not ideal but that’s a risk I’m prepared to take as realistically I dont have the time to do it myself. He’s not native english, but I have had to have a word with him a few times about clearly using AI. On the low cost ones I don’t care but on authority sites it needs to be more refined.

I think this pretty much sums up the state of HARO before its death. Most “pitches” were just AI answers from SEOs trying to build links for their clients.

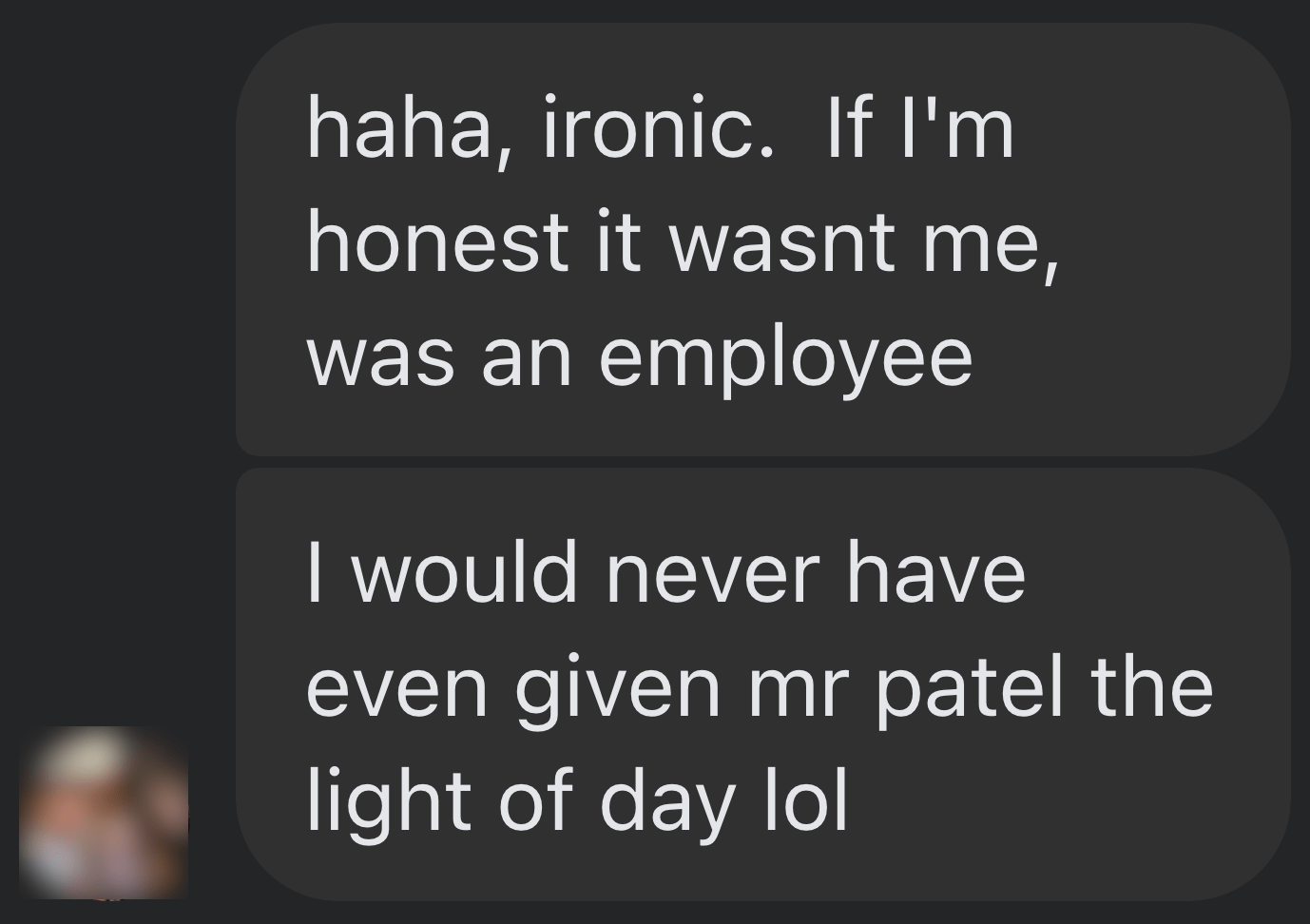

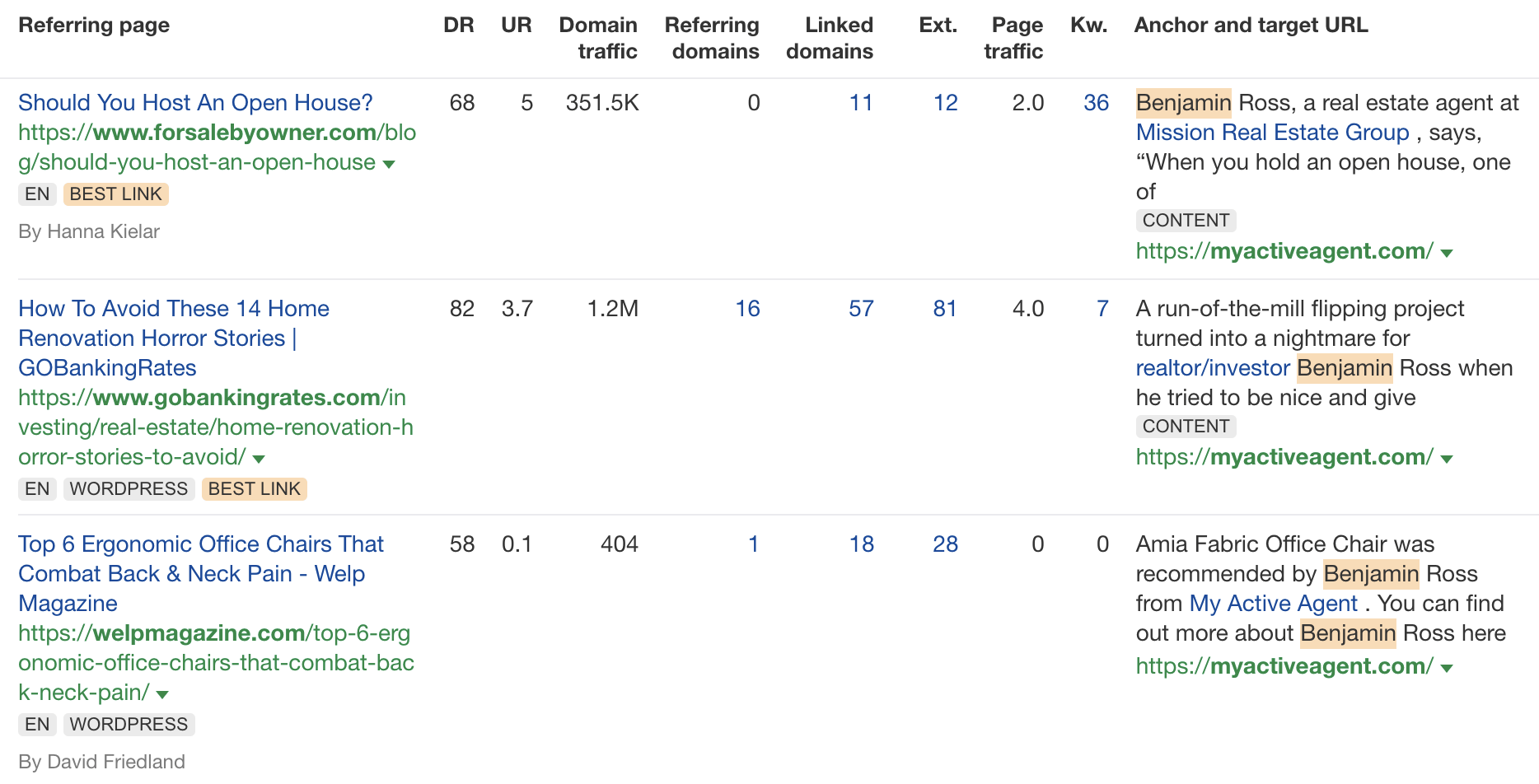

Don’t get me wrong. I’m not throwing shade here. I know that good links are hard to come by, so you have to do what works. And the reality is that HARO did work. Just look at the example below. You can tell from the anchor and surrounding text in Ahrefs that these links were almost certainly built with HARO:

But this was the problem. HARO worked so well back in the day that it was only a matter of time before spammers and the #scale crew ruined it for everyone. That’s what happened, and now HARO is no more. So…

If you’re a link builder, I think it’s time to admit that HARO link building is dead and move on.

No tactic works well forever. It’s the law of sh**ty clickthroughs. This is why you don’t see SEOs having huge success with tactics like broken link building anymore. They’ve moved on to more innovative tactics or, dare I say it, are just buying links.

Sidenote.

Talking of buying links, here’s something to ponder: if Connectively charges for pitches, are links built through those pitches technically paid? If so, do they violate Google’s spam policies? It’s a murky old world this SEO lark, eh?

If you’re a journalist, Connectively might be worth a shot. But with experts being charged for pitches, you probably won’t get as many responses. That might be a good thing. You might get less spam. Or you might just get spammed by SEOs with deep pockets. The jury’s out for now.

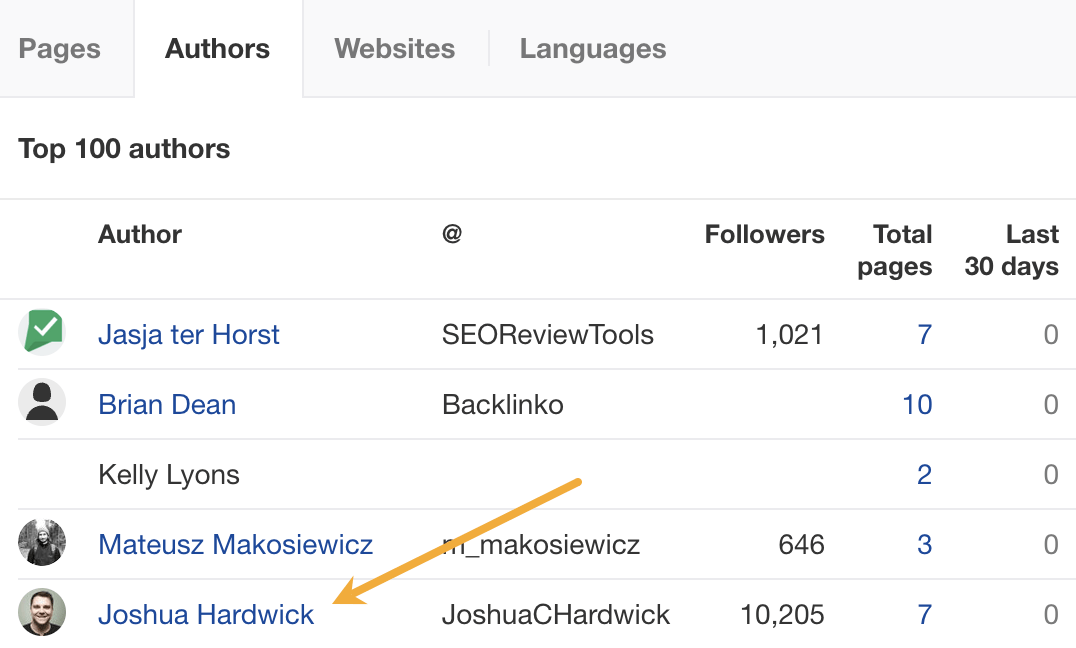

My advice? Look for alternative methods like finding and reaching out to experts directly. You can easily use tools like Content Explorer to find folks who’ve written lots of content about the topic and are likely to be experts.

For example, if you look for content with “backlinks” in the title and go to the Authors tab, you might see a familiar name. 😉

I don’t know if I’d call myself an expert, but I’d be happy to give you a quote if you reached out on social media or emailed me (here’s how to find my email address).

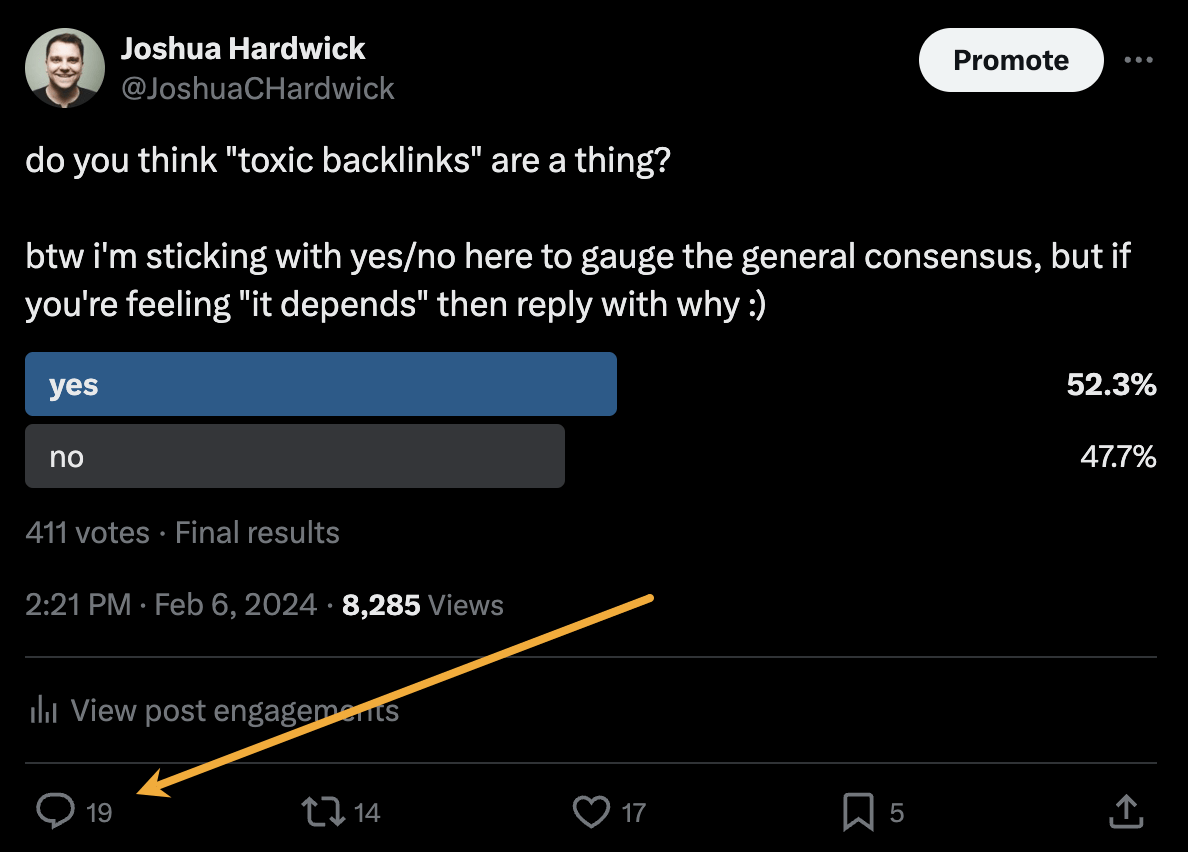

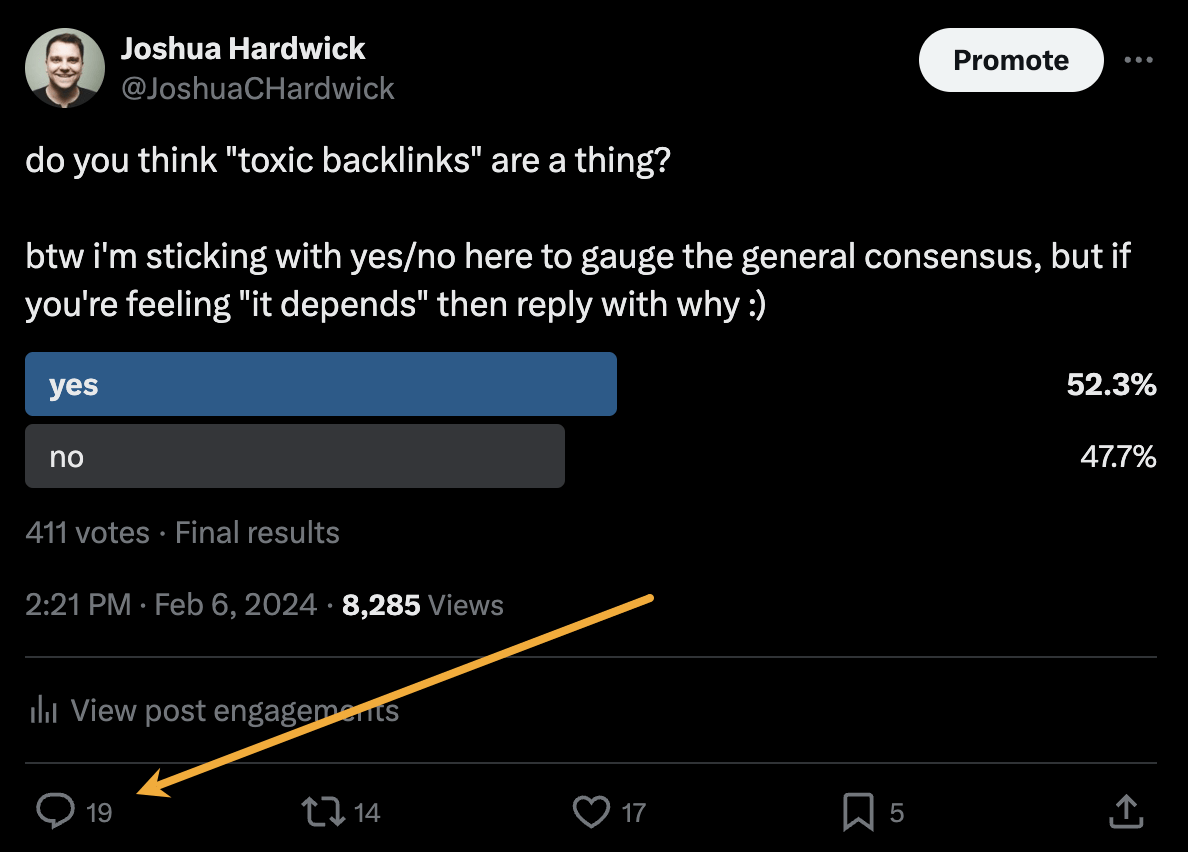

Alternatively, you can bait your audience into giving you their insights on social media. I did this recently with a poll on X and included many of the responses in my guide to toxic backlinks.

Either of these options is quicker than using HARO because you don’t have to sift through hundreds of responses looking for a needle in a haystack. If you disagree with me and still love HARO, feel free to tell me why on X 😉

SEO

Google Clarifies Vacation Rental Structured Data

Google’s structured data documentation for vacation rentals was recently updated to require more specific data in a change that is more of a clarification than it is a change in requirements. This change was made without any formal announcement or notation in the developer pages changelog.

Vacation Rentals Structured Data

These specific structured data types makes vacation rental information eligible for rich results that are specific to these kinds of rentals. However it’s not available to all websites. Vacation rental owners are required to be connected to a Google Technical Account Manager and have access to the Google Hotel Center platform.

VacationRental Structured Data Type Definitions

The primary changes were made to the structured data property type definitions where Google defines what the required and recommended property types are.

The changes to the documentation is in the section governing the Recommended properties and represents a clarification of the recommendations rather than a change in what Google requires.

The primary changes were made to the structured data type definitions where Google defines what the required and recommended property types are.

The changes to the documentation is in the section governing the Recommended properties and represents a clarification of the recommendations rather than a change in what Google requires.

Address Schema.org property

This is a subtle change but it’s important because it now represents a recommendation that requires more precise data.

This is what was recommended before:

“streetAddress”: “1600 Amphitheatre Pkwy.”

This is what it now recommends:

“streetAddress”: “1600 Amphitheatre Pkwy, Unit 6E”

Address Property Change Description

The most substantial change is to the description of what the “address” property is, becoming more descriptive and precise about what is recommended.

The description before the change:

PostalAddress

Information about the street address of the listing. Include all properties that apply to your country.

The description after the change:

PostalAddress

The full, physical location of the vacation rental.

Provide the street address, city, state or region, and postal code for the vacation rental. If applicable, provide the unit or apartment number.

Note that P.O. boxes or other mailing-only addresses are not considered full, physical addresses.

This is repeated in the section for address.streetAddress property

This is what it recommended before:

address.streetAddress Text

The full street address of your vacation listing.

And this is what it recommends now:

address.streetAddress Text

The full street address of your vacation listing, including the unit or apartment number if applicable.

Clarification And Not A Change

Although these updates don’t represent a change in Google’s guidance they are nonetheless important because they offer clearer guidance with less ambiguity as to what is recommended.

Read the updated structured data guidance:

Vacation rental (VacationRental) structured data

Featured Image by Shutterstock/New Africa

-

WORDPRESS7 days ago

WORDPRESS7 days agoTurkish startup ikas attracts $20M for its e-commerce platform designed for small businesses

-

MARKETING6 days ago

MARKETING6 days agoRoundel Media Studio: What to Expect From Target’s New Self-Service Platform

-

SEO6 days ago

SEO6 days agoGoogle Limits News Links In California Over Proposed ‘Link Tax’ Law

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 12, 2024

-

SEO5 days ago

SEO5 days ago10 Paid Search & PPC Planning Best Practices

-

SEARCHENGINES5 days ago

SEARCHENGINES5 days agoGoogle Core Update Volatility, Helpful Content Update Gone, Dangerous Google Search Results & Google Ads Confusion

-

SEO7 days ago

SEO7 days agoGoogle Unplugs “Notes on Search” Experiment

-

MARKETING5 days ago

MARKETING5 days ago2 Ways to Take Back the Power in Your Business: Part 2

You must be logged in to post a comment Login