It’s harder than ever to be a startup, as funding becomes scarcer and valuations of growth companies take a hit.

But more UK entrepreneurs continue to emerge, including social media influencers who are trying their hand at running a business.

We speak to Pembroke Venture Capital Trust manager Simon Porter about how the portfolio, which has a large exposure to consumer companies, is weathering the economic gloom, and why he thinks influencers might be a bright spot.

Simon Porter: The Pembroke VCT manager is investing in consumer companies and thinks influencer-led businesses can provide good returns

Pembroke VCT was one of the earlier players in the VCT world and since its launch in 2012 it has raised over £196million, as of September 2022.

It invests in young, privately owned startups across six broad sectors, including food and hospitality, wellness and design.

‘I think there is a funding gap of sorts, which I think Pembroke actually plugs fairly elegantly’ says Porter.

‘A business starts with founders’ capital, then friends and family, then angel investors. Then there’s usually a gap between angels and bigger institutions, which I think is historically where Pembroke has been.’

Its strategy has reaped some high-profile rewards. In 2020, Pembroke invested £2million in meal kit company Pasta Evangelists which proved to be a hit during the pandemic.

It was snapped up by Italian firm Barilla Group and the exit represented a 2.3 times return in the twelve months since Pembroke’s initial investment.

Last year, Pembroke sold its investment in fashion brand ME+EM to private equity firm Highland Europe, achieving a return of 16 times the original investment.

These successes have come after years of refining the strategy with Porter admitting: ‘I think in the very early days, we probably backed [startups] slightly too early.’

He says Pembroke has exited six or seven businesses at a loss in its history – ‘a lot were legacy businesses… but we learned lessons.’

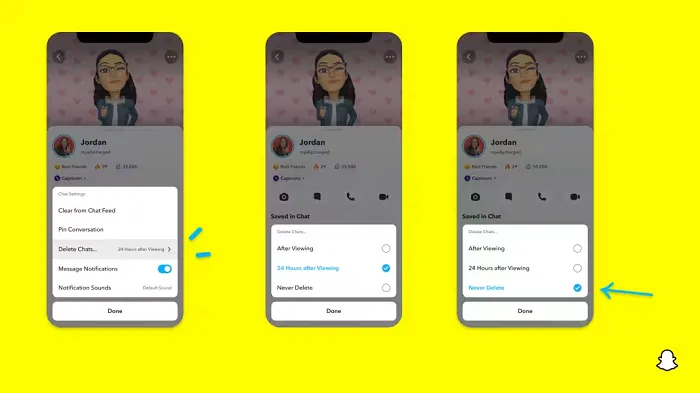

Why Pembroke is making a bet on social media influencers

Pembroke has largely invested across consumer brands that have some experience in their given fields, but now it is looking to social media influencers to help boost returns.

In October, Pembroke invested £1million into make-up brand VIEVE, which was founded by influencer Jamie Genevieve in 2020.

‘She’s got 3million or so followers who are incredibly engaged with her products – it’s a natural recommendation engine. Whenever she does a pop up it sells out within hours,’ says Porter.

‘It’s also an interesting take on a reasonably legacy sector – there hasn’t been a huge amount of innovation and [make up] is dominated by the big brands.

‘So these guys are a bit of a disruptor in some senses but creating high quality products without brand mark-up. It’s led by someone who’s incredibly engaging with a loyal following who help the brand in terms of reach and also help her refine the next product.’

Where other brands in the portfolio might not have such a loyal following, influencer-led businesses have a ready-made customer base willing to buy products provided they know their audience.

Porter highlights activewear brand TALA, led by influencer Grace Beverley, which it invested in last February.

‘She’s got a huge number of followers but she’s very good at using her influencer status. She’ll design a range, have a sample made, put it on her Instagram and take pre-orders. She takes them and gets stuff made in the factories.

Pembroke VCT recently invested in influencer Jamie Genevieve’s beauty brand VIEVE

‘Unlike any other fashion business she has pretty favourable working capital. She didn’t have to tie money into stock because she meets orders she’s already received.

‘She really knows her customers and they’re incredibly evangelical about the project.’

Social media influencers have a shelf life though, and Pembroke knows that better than most, after overseeing the winding down of Alexa Chung’s own brand.

‘It clearly wasn’t working, it’s a very difficult space. One of the problems was her audience, weren’t necessarily her customers. Your average followers are in their mid 20s, your price point probably isn’t aligned enough.

‘There’s always a risk with an influencer-led business having their name above the door.’

How Pembroke VCT is faring amid economic gloom

The portfolio had its fair share of challenges during the pandemic given its exposure to consumer companies, but Porter remains upbeat about the health of the portfolio.

He highlights Secret Food Tours, a company which relies on travel and tourism, which had to ‘essentially mothball and relaunch… [but] now they’re doing record-breaking numbers.’

‘Other companies on paper would have struggled have but most of it has been pretty temporary and they’ve been able to scale up pretty quickly since. For some companies Covid was actually an opportunity.

That is not to say that Pembroke has been immune to the changes across the startup landscape as the economy started to open up again.

Winner: One of the biggest success stories has been Pasta Evangelists, which was bought by Barilla after just a year after Pembroke’s investment

While attention has been on the huge hits to listed tech firms and the accompanying layoffs, early stage startups are also facing heat from the fall in valuations as interest rates rise.

In Pembroke’s latest results, in the six months to September 2022, the firm said it had made a loss of £5million with investment revaluations amounting to a net cost of £3.3million.

It said it had reduced valuations in six companies, including Chucs Restaurants, Kinteract, and Stitch and Story, but the value of six of its other portfolio companies, including Five Guys, had increased.

‘Our resilience in the portfolio was, as everyone else’s, was tested in Covid. I’m pleased to say it does perform exceptionally well and I think a lot of that was a testament to our founders and to VCTs in general.’

The total return per share has inched up steadily since the pandemic, from 121.3p in March 2020 to 151p by March 2022. It dipped to 147.6p by June 2022, according to its most recent filings, and it has raised its target dividend from 3p to 5p.

‘The returns for both us and the founders is how we help and wrap around them from day one to exit,’ says Porter. ‘We will help the teams put in the next level of people, say a CFO or a really good non exec or chair. It will give [them] the best chance of success… and give everyone the chance of a good return.

‘We want to help them put in place the people they need to deliver that vision. We’ve got a bank of more than 100 really good industry non execs. They don’t need the work quite frankly but have a real passion for this space and want to get involved in helping small businesses.’

Money maker: Pembroke’s latest results revealed that the value of six of its portfolio companies, including burger chain Five Guys, had increased

Will more cash for VCTs dilute the portfolio?

Despite the tough economic outlook and a difficult period for wider small-cap investing, appetite for VCTs has held up well.

VCTs issued shares to the value of £1.12billion in the last tax year, a 68 per cent increase, and it is likely to rise again this year.

This is largely because of the increased tax burden as a result of frozen thresholds. More experienced investors are now looking to VCTs, which offer 30 per cent income tax relief.

Porter thinks that while investors are appealed by the tax relief, they’re also increasingly interested in the UK startup space.

‘I think a lot of big companies have lost their ability to innovate. Our own founders started off somewhere like Deliveroo, and had a great idea for business. But it’s not an environment that really fosters innovation, and they can’t really launch in-house so they leave to set up their own business.

‘There is increasing coverage of small British businesses being acquired by big players who want their technology, ambition, vision, and entrepreneurial element.’

A lot of big companies have lost their ability to innovate

Pembroke itself has seen increased appetite among investors: last April the fund raised a record £46million and launched a new offer to raise up to £60million.

The success of the likes of Pasta Evangelists will have no doubt raised its profile, but Porter thinks it’s as much about about the type of companies Pembroke invests in.

‘[Investors] walk past a Five Guys and say ‘I’m an investor in that via Pembroke!’ A number of our brands you can see on a daily basis. There’s a lot more personal interest in companies.

‘We often have investors come to us to make introductions on behalf of our company, because they just tend to be interested in seeing them succeed.’

But with increased money into VCTs, they might be at risk of diluting their portfolios given they are bound by rules to deploy a certain amount of capital over a period.

Could they end up overpaying for companies or sacrifice the quality of businesses they’re investing in?

‘It’s certainly not a problem we have and we’re very much a raise and deploy type of fund. We raise what we can deploy essentially. Then we come back to the market a year later, so we don’t sit on cash.

‘We think it’s good for our investors who are paying us a management fee to manage money rather than sit on cash on the balance sheet.

‘I think some funds are probably a bit less choosy or fighting over a deal… which I guess is where your pipeline management comes in as a fund.

‘We’re historically incredibly lucky in that most of the companies we look at come directly to us. It’s a function of how we were founded but we’re fortunate to see a lot of deals many of which the market doesn’t.’

You must be logged in to post a comment Login