SOCIAL

TikTok Continues to Gain Momentum, But Challenges Remain in Maximizing the App’s Growth

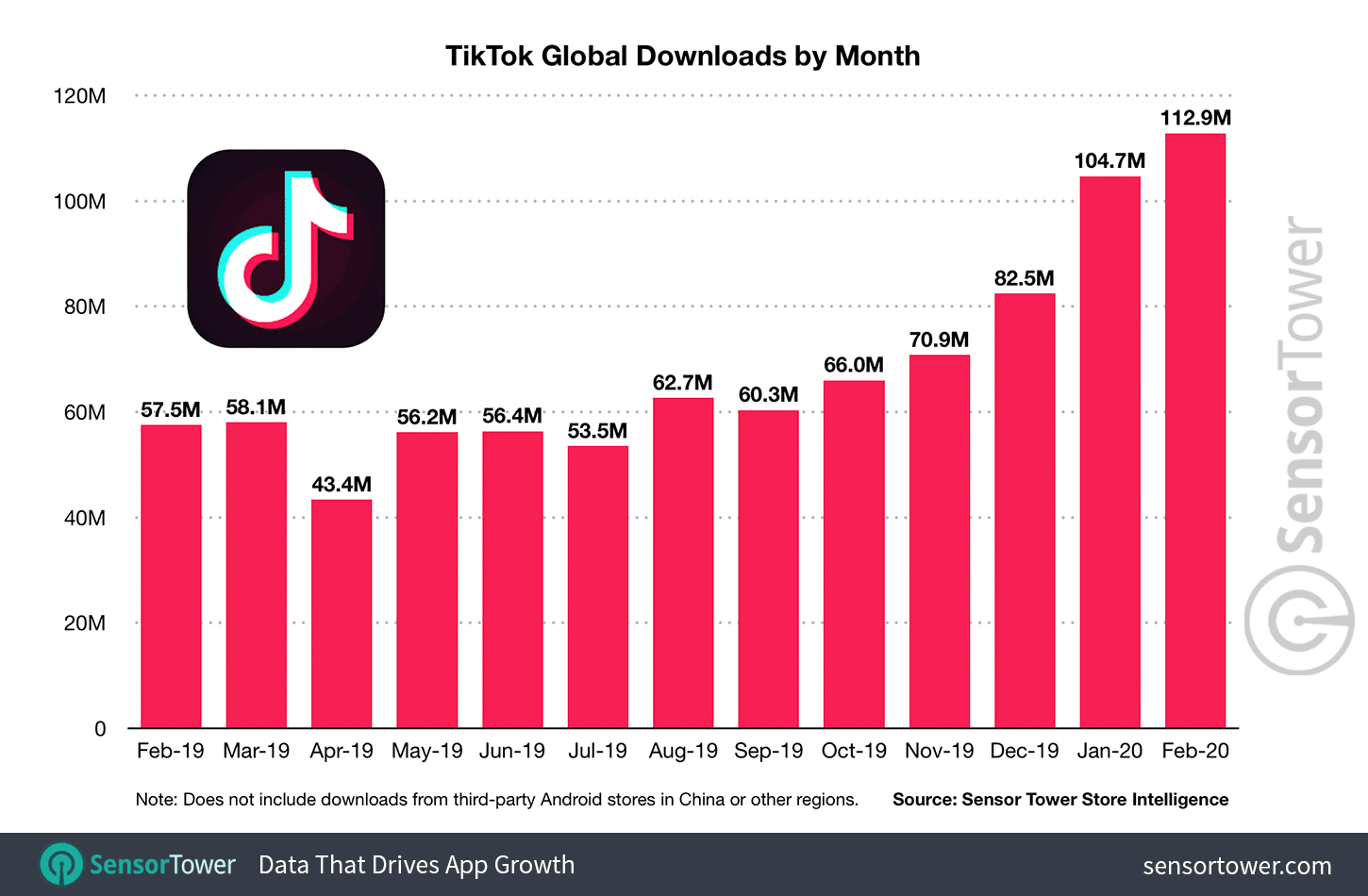

Despite various content moderation and data privacy concerns, TikTok continues to gain momentum, with the latest data from app analytics firm SensorTower showing that February 2020 was TikTok’s best performing month, in terms of total app downloads, to date.

As per SensorTower:

“TikTok was downloaded by close to 113 million App Store and Google Play users worldwide in February, making it the app’s best month ever for both installs and revenue according to Sensor Tower Store Intelligence estimates.”

SensorTower further notes that TikTok was the most downloaded non-game app worldwide last month, outperforming both WhatsApp and Facebook. TikTok installs are up 96% year-over-year, with the COVID-19 outbreak seemingly fueling increased adoption as people look to keep themselves entertained while reducing their time spent in public.

In total, TikTok is now closing in on 2 billion lifetime installs, which is a huge number, and should represent significant opportunity for brand outreach and engagement. But there is a little more to the upfront data than it may seem – so before you latch onto that 2 billion installs count and pit TikTok against Facebook, it’s worth breaking the figures down to understand exactly what they represent.

First off, app installs are not active users. Various reports on TikTok have seemingly equated the two, but having 2 billion people download and install your app is not the equivalent of getting 2 billion users active and engaged on your platform on a regular basis. If TikTok had 2 billion active users, it would be the second-biggest social platform in the world, and closing fast on Facebook. But it doesn’t.

The only official number we have on TikTok’s global user base is that the app reached 500 million active users back in 2018, with the majority of them using the Chinese version of the app, called ‘Douyin’. Since then, TikTok has not been forthcoming about its actual user count.

Which makes sense – much of the narrative around TikTok has been pumped up by download counts, which, as noted, are close to reaching 2 billion. If TikTok were to come out and say that it actually has, say, 700 million monthly active users, that would only work to water down those download stats – but realistically, this is probably closer to the truth, while the audience geographic split is also important to understand.

Breaking down the data, based on the estimates and figures that have been made available, TikTok seems to have:

Other nations follow in lower user counts from there, but as you can see, the regional splits are relevant in TikTok’s overall download and usage counts. Yes, TikTok is very popular, but from an advertising and marketing perspective, it may not be comparable, at least in Western markets, to most other platforms in terms of relevant audience reach.

Indeed, in SensorTower’s extended breakdown of TikTok’s revenue information, it notes that:

“TikTok also saw its highest-ever monthly user spending in February, with the $50.4 million it generated equalling a 784.2% YoY increase. This made it the third highest-grossing non-game app worldwide for the month behind Tinder and YouTube.”

Which is an amazing result, but again, the regional split here is significant.

“China – where TikTok is known as Douyin – was responsible for the majority of this spending with nearly $46 million, or 91% of all revenue for the month. The U.S. ranked No. 2 with $3 million, while Great Britain came in third, with $216,000.”

So, again, TikTok is driving user interest and action, but possibly not as much as you would expect in your local market, based on the hype and top-line download counts.

That’s not to say that TikTok isn’t growing its audience base in all regions, and becoming a more relevant consideration for marketers. But it is worth noting that, by comparison, the app is not on the same level as even Snapchat (86m North American DAUs) in terms of reach to the US market at this stage, putting it well behind Twitter Facebook, Instagram, and others.

This is the key question for TikTok. Yes, it has momentum and hype, and yes, the download figures are encouraging. But can TikTok make short-form video into a relevant, viable and engaging option?

Vine, the first short-form video app of this type, eventually buckled because it wasn’t able to monetize effectively – with Vine’s main content offering being only six-seconds in length, at most, that made it increasingly difficult for Vine to implement ads, as users would either skip by them or ignore them in-stream. Eventually, Vine’s inability to monetize effectively left it unable to create a viable revenue funnel for its top creators, who subsequently migrated to YouTube, Instagram and Facebook, where they could post longer-form content, and make real money from ads.

Vine did try to counter this, adding longer-form videos and pre-roll ads in its dying months, but with its top creators moving on, their fans shifted with them.

While Twitter often gets the blame for Vine’s failure, really, it was the inability for the company to effectively monetize that lead to its demise – and Twitter couldn’t do a lot about that.

Which then leads to TikTok.

Sure, TikTok has people’s attention, it has users tuning in, and it is growing. But Vine had 200 million active users at peak, and it couldn’t map out a revenue-generation framework. Will TikTok eventually fare any better?

As noted, it’s still not generating significant revenue in the US, and it’s still spending big on promotion. At some stage, it will need to establish a means for its top creators to monetize.

In China, Douyin has moved into eCommerce as a means to add in revenue options, which is how it’s seen such significant revenue growth in that region.

Will the same work in the US market?

TikTok is already testing eCommerce tools and external links, in order to provide more revenue generation options for creators, while it’s also got its own influencer marketing marketplace, which it recently opened up to more businesses.

Basically, TikTok knows that it needs to move fast and build a real revenue generation pipeline for these popular users – because if it doesn’t, they’ll take their talents elsewhere, and their established audiences with them. Then TikTok will go the same way as Vine.

So while it seems like all the momentum is with TikTok, and massive numbers like ‘a billion downloads’ are regularly thrown around, there’s more to it than the surface figures. And that’s critical to note in terms of brand use, and the future viability of the platform more broadly.

SOCIAL

Snapchat Explores New Messaging Retention Feature: A Game-Changer or Risky Move?

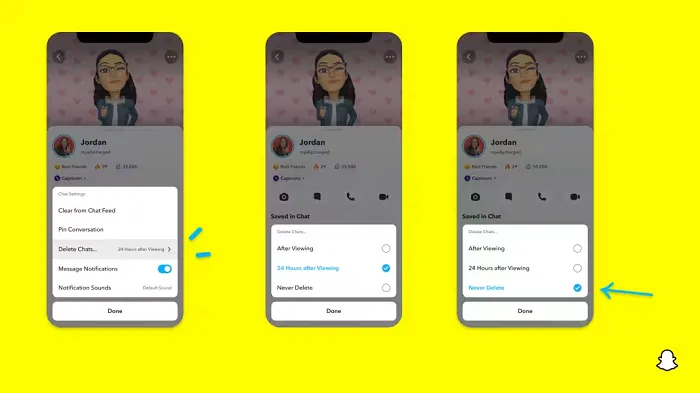

In a recent announcement, Snapchat revealed a groundbreaking update that challenges its traditional design ethos. The platform is experimenting with an option that allows users to defy the 24-hour auto-delete rule, a feature synonymous with Snapchat’s ephemeral messaging model.

The proposed change aims to introduce a “Never delete” option in messaging retention settings, aligning Snapchat more closely with conventional messaging apps. While this move may blur Snapchat’s distinctive selling point, Snap appears convinced of its necessity.

According to Snap, the decision stems from user feedback and a commitment to innovation based on user needs. The company aims to provide greater flexibility and control over conversations, catering to the preferences of its community.

Currently undergoing trials in select markets, the new feature empowers users to adjust retention settings on a conversation-by-conversation basis. Flexibility remains paramount, with participants able to modify settings within chats and receive in-chat notifications to ensure transparency.

Snapchat underscores that the default auto-delete feature will persist, reinforcing its design philosophy centered on ephemerality. However, with the app gaining traction as a primary messaging platform, the option offers users a means to preserve longer chat histories.

The update marks a pivotal moment for Snapchat, renowned for its disappearing message premise, especially popular among younger demographics. Retaining this focus has been pivotal to Snapchat’s identity, but the shift suggests a broader strategy aimed at diversifying its user base.

This strategy may appeal particularly to older demographics, potentially extending Snapchat’s relevance as users age. By emulating features of conventional messaging platforms, Snapchat seeks to enhance its appeal and broaden its reach.

Yet, the introduction of message retention poses questions about Snapchat’s uniqueness. While addressing user demands, the risk of diluting Snapchat’s distinctiveness looms large.

As Snapchat ventures into uncharted territory, the outcome of this experiment remains uncertain. Will message retention propel Snapchat to new heights, or will it compromise the platform’s uniqueness?

Only time will tell.

SOCIAL

Catering to specific audience boosts your business, says accountant turned coach

While it is tempting to try to appeal to a broad audience, the founder of alcohol-free coaching service Just the Tonic, Sandra Parker, believes the best thing you can do for your business is focus on your niche. Here’s how she did just that.

When running a business, reaching out to as many clients as possible can be tempting. But it also risks making your marketing “too generic,” warns Sandra Parker, the founder of Just The Tonic Coaching.

“From the very start of my business, I knew exactly who I could help and who I couldn’t,” Parker told My Biggest Lessons.

Parker struggled with alcohol dependence as a young professional. Today, her business targets high-achieving individuals who face challenges similar to those she had early in her career.

“I understand their frustrations, I understand their fears, and I understand their coping mechanisms and the stories they’re telling themselves,” Parker said. “Because of that, I’m able to market very effectively, to speak in a language that they understand, and am able to reach them.”Â

“I believe that it’s really important that you know exactly who your customer or your client is, and you target them, and you resist the temptation to make your marketing too generic to try and reach everyone,” she explained.

“If you speak specifically to your target clients, you will reach them, and I believe that’s the way that you’re going to be more successful.

Watch the video for more of Sandra Parker’s biggest lessons.

SOCIAL

Instagram Tests Live-Stream Games to Enhance Engagement

Instagram’s testing out some new options to help spice up your live-streams in the app, with some live broadcasters now able to select a game that they can play with viewers in-stream.

As you can see in these example screens, posted by Ahmed Ghanem, some creators now have the option to play either “This or That”, a question and answer prompt that you can share with your viewers, or “Trivia”, to generate more engagement within your IG live-streams.

That could be a simple way to spark more conversation and interaction, which could then lead into further engagement opportunities from your live audience.

Meta’s been exploring more ways to make live-streaming a bigger consideration for IG creators, with a view to live-streams potentially catching on with more users.

That includes the gradual expansion of its “Stars” live-stream donation program, giving more creators in more regions a means to accept donations from live-stream viewers, while back in December, Instagram also added some new options to make it easier to go live using third-party tools via desktop PCs.

Live streaming has been a major shift in China, where shopping live-streams, in particular, have led to massive opportunities for streaming platforms. They haven’t caught on in the same way in Western regions, but as TikTok and YouTube look to push live-stream adoption, there is still a chance that they will become a much bigger element in future.

Which is why IG is also trying to stay in touch, and add more ways for its creators to engage via streams. Live-stream games is another element within this, which could make this a better community-building, and potentially sales-driving option.

We’ve asked Instagram for more information on this test, and we’ll update this post if/when we hear back.

-

SEO7 days ago

SEO7 days agoGoogle Limits News Links In California Over Proposed ‘Link Tax’ Law

-

SEARCHENGINES6 days ago

SEARCHENGINES6 days agoGoogle Core Update Volatility, Helpful Content Update Gone, Dangerous Google Search Results & Google Ads Confusion

-

SEO6 days ago

SEO6 days ago10 Paid Search & PPC Planning Best Practices

-

MARKETING7 days ago

MARKETING7 days ago2 Ways to Take Back the Power in Your Business: Part 2

-

MARKETING5 days ago

MARKETING5 days ago5 Psychological Tactics to Write Better Emails

-

SEARCHENGINES5 days ago

SEARCHENGINES5 days agoWeekend Google Core Ranking Volatility

-

PPC7 days ago

PPC7 days agoCritical Display Error in Brand Safety Metrics On Twitter/X Corrected

-

MARKETING6 days ago

MARKETING6 days agoThe power of program management in martech