SOCIAL

Twitch Is Predicted to Boost Monthly Users 14% to 37.5M This Year

The facts:

- Twitch will boost its regular viewership 14% to 37.5 million this year and reach about 16% of the U.S. audience for digital video, researcher eMarketer said in its first estimate of the audience size for the Amazon-owned livestreaming platform. Twitch will continue growing to hit 47 million viewers by 2023, according to the forecast.

- Twitch’s growth rate will steadily fall from about 24% last year to 6.3% by 2023 as the livestreaming industry matures and the platform loses audience share to rivals such as Google’s YouTube Gaming, Microsoft’s Mixer and Facebook Gaming, per eMarketer.

- The researcher defines Twitch viewers as internet users of any age who watch its content on any device at least monthly. EMarketer based its estimates on data from research firms, government agencies, media firms and public companies, in addition to interviews with executives at publishers, media buyers and agencies.

Insight:

Social Media Today Editor, Andrew Hutchinson recently noted the growing influence of Twitch that should not be ignored. “You may not watch Twitch content yourself, you may not be interested in gaming live-streams, or gaming culture more generally. But the influence of gaming is massive, and as younger users who’ve grown up with functions like live-streaming move into adulthood, and more viable spending demographics, you can expect the focus on such platforms to evolve in-step.

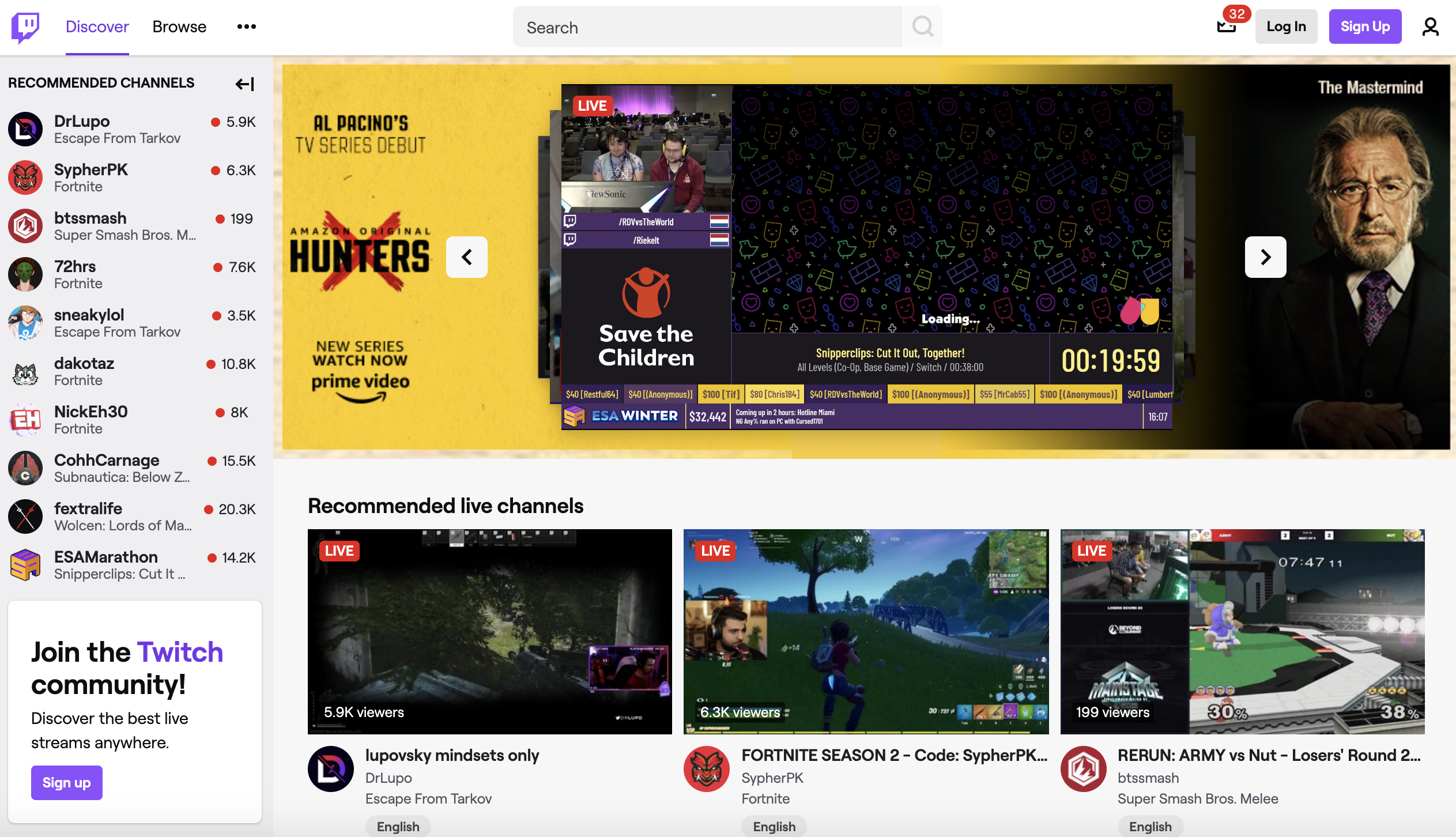

Twitch’s growth is likely to attract greater advertising dollars from mobile marketers looking to reach the platform’s audience of gaming enthusiasts, especially as parent company Amazon works to broaden the variety of livestreamed content and interactive features. The platform is designed to facilitate interaction between content creators who livestream video content and viewers who post comments to message boards. Viewers also can buy virtual currency, called Twitch Bits, to donate money to their favorite streamers. Marketers can participate with direct sponsorships of streamers or by buying ad inserts on Twitch, which currently has a variety of native, display and video ad formats.

“Twitch … is now too big for the internet giants to ignore,” eMarketer Forecasting Analyst Peter Vahle said in a statement. “The big platforms, owned by the likes of Facebook, Google and Microsoft, are competing to sign big deals with popular streamers and esports leagues.”

Meanwhile, Facebook in December boosted viewing times of gaming livestreams by 210% from a year earlier, outpacing the growth for Twitch, YouTube Gaming and Mixer, per a separate study by StreamElements and Arsenal.gg. Facebook Gaming’s recent growth partly reflects its recruitment of influencers such as Jeremy “DisguiseToast” Wang, Corrina Kopf and Gonzalo “ZeRo” Barrios to exclusively carry their livestreams. Mixer last year lured top streamer Tyler “Ninja” Blevins away from Twitch in a multiyear deal estimated around $20 million to $30 million, CNN Business reported.

EMarketer’s latest forecast indicates that Twitch’s audience is growing to rival the viewership of traditional media channels like broadcast TV. The platform’s key advantage is its appeal among younger adult audiences who are harder to reach though traditional media outlets. About 80% of Twitch’s audience is male, and 55% are in the valuable 18- to 34-year-old demographic that’s desirable for advertisers, per Mediakix data.

Twitch last year unveiled its first brand campaign — which included a new logo inspired by its gaming community — while touting its plans to expand its audience and help creators who livestream their gameplay to build a broader following. Twitch was included in a deal between Amazon and the NFL to stream “Thursday Night Football” for the third straight year, and saw strong audience growth during the regular season.