SOCIAL

1 Magnificent Artificial Intelligence (AI) Stock to Buy and Hold Forever

Things can change quickly on the stock market.

It wasn’t that long ago that Meta Platforms (META -0.40%), the parent company of Facebook, was facing serious issues. Revenue was crawling higher, at best, expenses were rising, and the bottom line was moving in the wrong direction. Meta Platforms’ stock declined substantially between mid-2021 and 2022 due to these headwinds.

However, the tech giant has recovered since — in a significant way. Let’s find out why the company’s shares are worth buying and parking in a growth-oriented portfolio for good.

Meta Platforms’ stellar Q4 results

One reason Meta Platforms was able to bounce back was that it initiated cost-cutting efforts, from decreasing the size of its workforce to reducing its real estate footprint. The tech company also ramped up the use of AI on its platform. For instance, Meta’s Reels on Instagram and Facebook — short-form videos in the style of the hugely popular TikTok — use an AI recommendation algorithm to keep users glued to their screens. Meta Platforms was also confident that though the advertising market was suffering, things would return to normal.

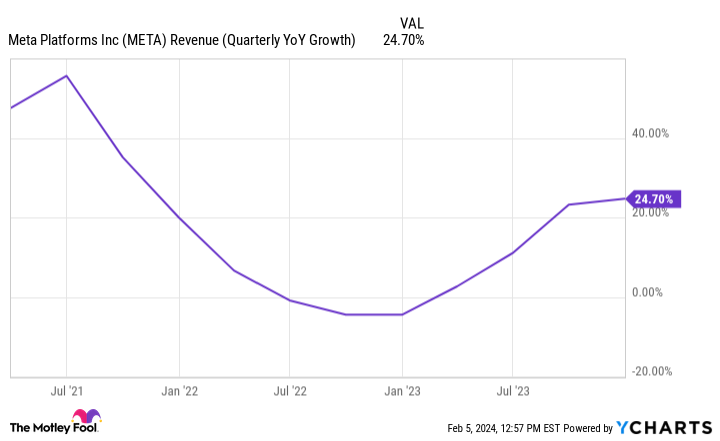

Meta’s hopes and efforts have been handsomely rewarded. The company’s fourth-quarter results make that clear. Meta’s revenue of $40.1 billion jumped by almost 25% year over year.

META Revenue (Quarterly YoY Growth) data by YCharts

We’d have to go back to 2021 to see stronger growth rates for the company’s top line. Meanwhile, Meta Platforms’ costs and expenses declined by 8% to $23.7 billion. The tech giant’s net income came in at about $14 billion, a whopping 201% higher than the year-ago period.

Plenty of growth opportunities

Following its blowout fourth-quarter results, Meta Platforms’ stock shot up, with its market cap exceeding the $1 trillion mark once again. Only a small group has achieved this feat, but it hardly represents a ceiling for the tech company. There is still plenty of fuel left in Meta’s growth engine. The company ended 2023 with 3.98 billion monthly active users, an increase of 6% year over year. That’s more than half the world’s population.

This massive ecosystem represents Meta Platforms’ secret weapon, since it can monetize in umpteen ways. Meta still makes most of its money from advertising. In the fourth quarter, advertising revenue of $38.7 billion accounted for 96.5% of the company’s total revenue. Ad sales grew by 23.8% year over year. Meta Platforms’ “other” revenue of $334 million was 81.5% higher than the year-ago period.

This growth was primarily driven by business messaging on WhatsApp. The company has been doubling down its efforts to monetize WhatsApp through business messaging, among other initiatives. And while they still account for a tiny percentage of its total revenue, this could be a massive opportunity given Meta Platforms’ large ecosystem. And it is just one of the company’s growth initiatives.

The company is also looking to make waves in the fast-growing generative AI market, although that won’t contribute much to its top line soon. Still, Meta Platforms should succeed in complementing its strong advertising business with other meaningful sources of revenue in time.

Meta is now a dividend stock

Meta Platforms gave another reason to love the stock during its Q4 earnings release: The company will initiate a quarterly dividend. It’s too early to tell whether Meta Platforms will become a great dividend stock, although it has some of the qualities necessary for that. Meta Platforms’ underlying business is solid, it has generally generated steady revenue and earnings growth, boasts multiple growth avenues, and benefits from a strong moat from the network effect.

Those factors also make Meta Platforms an excellent stock to buy and hold forever. The tech company might encounter problems as it did in 2021 and 2022. But over the long run, Meta Platforms should deliver market-beating returns to patient and loyal investors.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Meta Platforms. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.