SOCIAL

Are we heading for a social media exodus?

Social media operators face a conundrum dealing with content labeled satire, which may also be harmful misinformation. — © AFP

Are people growing tired of social media, or are the concerns over online privacy hitting home? There are some trends that suggest this is the case. But what would happen if there was a mass exodus from social media platforms?

A survey from VPNOverview.com into the UK found that 43 percent of Facebook users are considering leaving the platform or have considered doing so in the past year. The data for the study was drawn from Statista. The survey also considers other platforms and the potential exit rates, although the reasons for people seeking to exit are not detailed (and these are likely to be varied).

What would be the impact of this? For Facebook there would be a loss of revenue. However, even if four in ten Facebook users quit, the social media giant would still have more users than Instagram (24.4 million UK users) or Twitter (13.7 million UK users). In 2021, Facebook suffered several outages and also rebranded its parent company as ‘Meta’.

However, considering that Facebook has 44.8 million daily active users in the UK, if all 43 percent of users (19.26 million people) each decided to quit, Facebook be left with 25.53 million users. That would put Facebook three other social networks based on their current number of daily active users: YouTube, which has 39 million, WhatsApp, which has 30 million, and LinkedIn, which has 27.5 million.

In terms of other social media platforms and the inclination to quit or to stay among users, the data reveals:

Tumblr has the second-highest percentage of users who wish to take a break from the platform. The site has a total of 9.5 million users, while 39 percent (3.7 million) have considered leaving. If this happened, this would leave 5.79 million users.

Taking third place on the ‘digital detox’ list is Snapchat with 37 percent (6.91 million) of its users thinking about leaving the app. As a result, its user count of 18.7 million would drop to 11.78 million.

Twitter currently has around 13.7 million users, and a total of 31 percent (4.24 million) are looking to take a break from the app – the fourth-highest percentage in the study, which would leave Twitter with 9.45 million UK users.

Following fifth is TikTok, with an estimated 3.7 million users on the platform, 30 percent of which are looking to take a detox, which equates to 1.11 million people.

Source link

SOCIAL

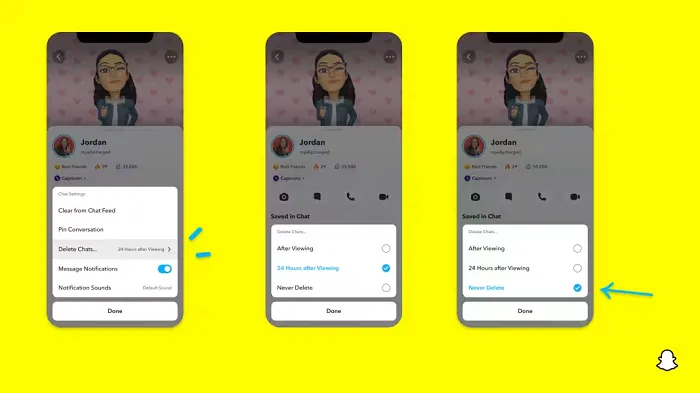

Snapchat Explores New Messaging Retention Feature: A Game-Changer or Risky Move?

In a recent announcement, Snapchat revealed a groundbreaking update that challenges its traditional design ethos. The platform is experimenting with an option that allows users to defy the 24-hour auto-delete rule, a feature synonymous with Snapchat’s ephemeral messaging model.

The proposed change aims to introduce a “Never delete” option in messaging retention settings, aligning Snapchat more closely with conventional messaging apps. While this move may blur Snapchat’s distinctive selling point, Snap appears convinced of its necessity.

According to Snap, the decision stems from user feedback and a commitment to innovation based on user needs. The company aims to provide greater flexibility and control over conversations, catering to the preferences of its community.

Currently undergoing trials in select markets, the new feature empowers users to adjust retention settings on a conversation-by-conversation basis. Flexibility remains paramount, with participants able to modify settings within chats and receive in-chat notifications to ensure transparency.

Snapchat underscores that the default auto-delete feature will persist, reinforcing its design philosophy centered on ephemerality. However, with the app gaining traction as a primary messaging platform, the option offers users a means to preserve longer chat histories.

The update marks a pivotal moment for Snapchat, renowned for its disappearing message premise, especially popular among younger demographics. Retaining this focus has been pivotal to Snapchat’s identity, but the shift suggests a broader strategy aimed at diversifying its user base.

This strategy may appeal particularly to older demographics, potentially extending Snapchat’s relevance as users age. By emulating features of conventional messaging platforms, Snapchat seeks to enhance its appeal and broaden its reach.

Yet, the introduction of message retention poses questions about Snapchat’s uniqueness. While addressing user demands, the risk of diluting Snapchat’s distinctiveness looms large.

As Snapchat ventures into uncharted territory, the outcome of this experiment remains uncertain. Will message retention propel Snapchat to new heights, or will it compromise the platform’s uniqueness?

Only time will tell.

SOCIAL

Catering to specific audience boosts your business, says accountant turned coach

While it is tempting to try to appeal to a broad audience, the founder of alcohol-free coaching service Just the Tonic, Sandra Parker, believes the best thing you can do for your business is focus on your niche. Here’s how she did just that.

When running a business, reaching out to as many clients as possible can be tempting. But it also risks making your marketing “too generic,” warns Sandra Parker, the founder of Just The Tonic Coaching.

“From the very start of my business, I knew exactly who I could help and who I couldn’t,” Parker told My Biggest Lessons.

Parker struggled with alcohol dependence as a young professional. Today, her business targets high-achieving individuals who face challenges similar to those she had early in her career.

“I understand their frustrations, I understand their fears, and I understand their coping mechanisms and the stories they’re telling themselves,” Parker said. “Because of that, I’m able to market very effectively, to speak in a language that they understand, and am able to reach them.”Â

“I believe that it’s really important that you know exactly who your customer or your client is, and you target them, and you resist the temptation to make your marketing too generic to try and reach everyone,” she explained.

“If you speak specifically to your target clients, you will reach them, and I believe that’s the way that you’re going to be more successful.

Watch the video for more of Sandra Parker’s biggest lessons.

SOCIAL

Instagram Tests Live-Stream Games to Enhance Engagement

Instagram’s testing out some new options to help spice up your live-streams in the app, with some live broadcasters now able to select a game that they can play with viewers in-stream.

As you can see in these example screens, posted by Ahmed Ghanem, some creators now have the option to play either “This or That”, a question and answer prompt that you can share with your viewers, or “Trivia”, to generate more engagement within your IG live-streams.

That could be a simple way to spark more conversation and interaction, which could then lead into further engagement opportunities from your live audience.

Meta’s been exploring more ways to make live-streaming a bigger consideration for IG creators, with a view to live-streams potentially catching on with more users.

That includes the gradual expansion of its “Stars” live-stream donation program, giving more creators in more regions a means to accept donations from live-stream viewers, while back in December, Instagram also added some new options to make it easier to go live using third-party tools via desktop PCs.

Live streaming has been a major shift in China, where shopping live-streams, in particular, have led to massive opportunities for streaming platforms. They haven’t caught on in the same way in Western regions, but as TikTok and YouTube look to push live-stream adoption, there is still a chance that they will become a much bigger element in future.

Which is why IG is also trying to stay in touch, and add more ways for its creators to engage via streams. Live-stream games is another element within this, which could make this a better community-building, and potentially sales-driving option.

We’ve asked Instagram for more information on this test, and we’ll update this post if/when we hear back.

-

PPC6 days ago

PPC6 days ago19 Best SEO Tools in 2024 (For Every Use Case)

-

MARKETING7 days ago

MARKETING7 days agoEcommerce evolution: Blurring the lines between B2B and B2C

-

SEARCHENGINES5 days ago

Daily Search Forum Recap: April 19, 2024

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 18, 2024

-

WORDPRESS6 days ago

WORDPRESS6 days agoHow to Make $5000 of Passive Income Every Month in WordPress

-

SEO6 days ago

SEO6 days ago2024 WordPress Vulnerability Report Shows Errors Sites Keep Making

-

WORDPRESS6 days ago

WORDPRESS6 days ago10 Amazing WordPress Design Resouces – WordPress.com News

-

WORDPRESS7 days ago

[GET] The7 Website And Ecommerce Builder For WordPress

You must be logged in to post a comment Login