SOCIAL

New Legal Challenges Could Further Impact Elon Musk’s Twitter Takeover Push

So as the fifth week of the Elon Musk Twitter takeover drama comes to a close, let’s just check in on how things are progressing.

Oh, it’s bad. Nothing good to see here.

This week, as Musk maintains that his $44 billion takeover offer remains ‘on hold’ due to questions over the accuracy of Twitter’s claim that 5% of its active users are fake, Twitter itself has faced its own drama, connected to the takeover push.

Having already lost several top executives, either directly or indirectly stemming from the pending change in ownership (as well as former CEO Jack Dorsey exiting the company entirely), Twitter is now facing a battle over its board members, with Silver Lake Partners’ Egon Durban resigning from the board after Twitter shareholders blocked his re-election.

Durban was given a Twitter board seat in 2020, following a push by Elliott Management Group to buy up Twitter shares, and force Jack Dorsey out of his position as CEO. Elliott’s view was that Dorsey was underperforming, and it partnered with Silver Lake to put pressure on the company to either improve its bottom line, or accept a change in management.

That lead to Twitter implementing tough new revenue and growth targets, which it recently admitted that it’s not on track to meet.

In addition to his work with Twitter and various other public companies, Durban has also been a longtime ally of Elon Musk, and earlier this week, Twitter shareholders voted to stop Durban from being re-appointed, in a move that many viewed as a statement of protest, of sorts, from Twitter investors.

But as with all things Elon and Twitter, it’s not that simple – today Twitter itself has refused to accept Durban’s resignation.

In a statement to the SEC, Twitter explained that Durban’s board re-election was likely rejected by shareholders due to him also serving on the board of six other publicly traded companies. Durban has vowed to take a step back from these other commitments, which Twitter says is enough to keep him on its team.

As per Twitter:

“While the Board does not believe that Mr. Durban’s other public company directorships will become an impediment if such engagements were to continue, Mr. Durban’s commitment to reduce his board service commitment to five public company boards by the Remediation Date appropriately addresses the concerns raised by stockholders with regard to such engagements. Accordingly, the Board has reached the determination that accepting Mr. Durban’s Tendered Resignation at this time is not in the best interests of the Company.”

Why does Twitter want to keep Durban on? It’s hard to say – especially given that Musk has noted that he’ll be looking to eliminate Twitter’s board if/when he becomes the platform’s owner.

The inclusion of representatives from key investors, however, may ensure Twitter maintains a level of stability, in case the deal goes south.

And there could be another key reason to maintain the link between Twitter’s board and Musk.

On another front, Twitter shareholders are also mulling a class-action lawsuit against Elon Musk over his Twitter takeover push, based on the allegation that Musk has ‘violated California corporate laws on several fronts’ with his Twitter acquisition commentary, effectively engaging in market manipulation.

As reported by CNBC:

“In one potential violation, they claim that Musk financially benefited by delaying required disclosures about his stake in Twitter and by temporarily concealing his plan in early April to become a board member at the social network. Musk also snapped up shares in Twitter, the complaint says, while he knew insider information about the company based on private conversations with board members and executives, including former CEO Jack Dorsey, a longtime friend of Musk’s, and Silver Lake co-CEO Egon Durban, a Twitter board member whose firm had previously invested in SolarCity before Tesla acquired it.”

Maybe that’s why Twitter wants to keep Durban in-house, due to both his past dealings with Musk, which may help ease the deal through, or to assist shareholders in their class action.

Durban’s current participation likely doesn’t hold any additional legal clout in this respect, but there may be some linkage between these two aspects of the increasingly messy Twitter deal.

And yes, there is still a possibility that the Musk takeover may not happen.

Musk himself has repeatedly and publicly vowed that he will not pay for the company unless it can convince him that its data on fake profiles is accurate – though Twitter maintains that there’s no such thing as the deal being ‘on hold’ and it’s continuing to prepare for the final transaction to be approved.

But there may also be other complications, with the SEC now investigating Musk’s conduct in the lead-up to his Twitter takeover push. Add to that his many public criticisms and disclosures, which border on market manipulation (as per the proposed shareholder action) and there could well be a breakpoint for Musk’s Twitter deal, where authorities simply veto the process entirely due to his conduct.

Could that be Musk’s plan? Various analysts have suggested that Musk is looking for a way out of the acquisition, and while the overall sentiment is that Musk will, eventually, be forced to pay-up, and take ownership of the app, there are still some legal cracks that he could explore that could end the transaction.

Which would be a disaster for Twitter.

While investors are unhappy with Musk right now, especially since his various comments and critiques have tanked the stock, Musk walking away would leave Twitter in a much lesser state, with many product leaders gone, and a declining share price that would be difficult to correct, given the various questions raised by Musk about its processes.

Could Twitter get itself back on track, and back to growth, if Musk were to abandon his takeover push?

In essence, Musk walking away would be a big, public statement that Twitter is not a good investment, and as the media hype dies down, that could see interest in the app decline even further, harming growth for, potentially, years to come.

Maybe that, then, is Musk’s real intent here – to harm the company so much that it has no choice but to accept a lower offer price, which could save Elon himself millions in his takeover bid.

Either way, right now, it’s not looking good, and there are many moving parts that must be keeping current Twitter CEO Parag Agrawal up at night.

It still seems like the Elon era is coming, but when, exactly, is a whole other question.

SOCIAL

Snapchat Explores New Messaging Retention Feature: A Game-Changer or Risky Move?

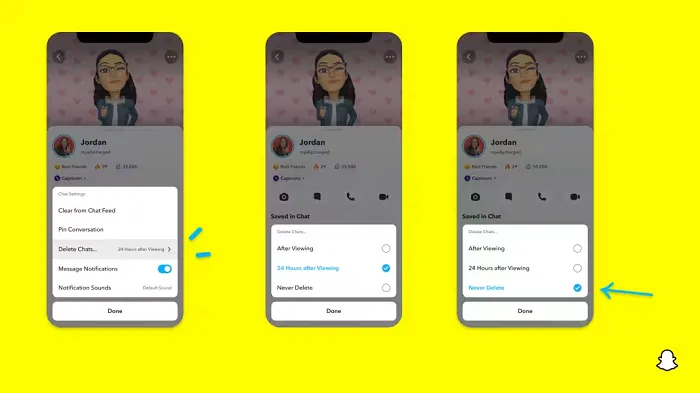

In a recent announcement, Snapchat revealed a groundbreaking update that challenges its traditional design ethos. The platform is experimenting with an option that allows users to defy the 24-hour auto-delete rule, a feature synonymous with Snapchat’s ephemeral messaging model.

The proposed change aims to introduce a “Never delete” option in messaging retention settings, aligning Snapchat more closely with conventional messaging apps. While this move may blur Snapchat’s distinctive selling point, Snap appears convinced of its necessity.

According to Snap, the decision stems from user feedback and a commitment to innovation based on user needs. The company aims to provide greater flexibility and control over conversations, catering to the preferences of its community.

Currently undergoing trials in select markets, the new feature empowers users to adjust retention settings on a conversation-by-conversation basis. Flexibility remains paramount, with participants able to modify settings within chats and receive in-chat notifications to ensure transparency.

Snapchat underscores that the default auto-delete feature will persist, reinforcing its design philosophy centered on ephemerality. However, with the app gaining traction as a primary messaging platform, the option offers users a means to preserve longer chat histories.

The update marks a pivotal moment for Snapchat, renowned for its disappearing message premise, especially popular among younger demographics. Retaining this focus has been pivotal to Snapchat’s identity, but the shift suggests a broader strategy aimed at diversifying its user base.

This strategy may appeal particularly to older demographics, potentially extending Snapchat’s relevance as users age. By emulating features of conventional messaging platforms, Snapchat seeks to enhance its appeal and broaden its reach.

Yet, the introduction of message retention poses questions about Snapchat’s uniqueness. While addressing user demands, the risk of diluting Snapchat’s distinctiveness looms large.

As Snapchat ventures into uncharted territory, the outcome of this experiment remains uncertain. Will message retention propel Snapchat to new heights, or will it compromise the platform’s uniqueness?

Only time will tell.

SOCIAL

Catering to specific audience boosts your business, says accountant turned coach

While it is tempting to try to appeal to a broad audience, the founder of alcohol-free coaching service Just the Tonic, Sandra Parker, believes the best thing you can do for your business is focus on your niche. Here’s how she did just that.

When running a business, reaching out to as many clients as possible can be tempting. But it also risks making your marketing “too generic,” warns Sandra Parker, the founder of Just The Tonic Coaching.

“From the very start of my business, I knew exactly who I could help and who I couldn’t,” Parker told My Biggest Lessons.

Parker struggled with alcohol dependence as a young professional. Today, her business targets high-achieving individuals who face challenges similar to those she had early in her career.

“I understand their frustrations, I understand their fears, and I understand their coping mechanisms and the stories they’re telling themselves,” Parker said. “Because of that, I’m able to market very effectively, to speak in a language that they understand, and am able to reach them.”Â

“I believe that it’s really important that you know exactly who your customer or your client is, and you target them, and you resist the temptation to make your marketing too generic to try and reach everyone,” she explained.

“If you speak specifically to your target clients, you will reach them, and I believe that’s the way that you’re going to be more successful.

Watch the video for more of Sandra Parker’s biggest lessons.

SOCIAL

Instagram Tests Live-Stream Games to Enhance Engagement

Instagram’s testing out some new options to help spice up your live-streams in the app, with some live broadcasters now able to select a game that they can play with viewers in-stream.

As you can see in these example screens, posted by Ahmed Ghanem, some creators now have the option to play either “This or That”, a question and answer prompt that you can share with your viewers, or “Trivia”, to generate more engagement within your IG live-streams.

That could be a simple way to spark more conversation and interaction, which could then lead into further engagement opportunities from your live audience.

Meta’s been exploring more ways to make live-streaming a bigger consideration for IG creators, with a view to live-streams potentially catching on with more users.

That includes the gradual expansion of its “Stars” live-stream donation program, giving more creators in more regions a means to accept donations from live-stream viewers, while back in December, Instagram also added some new options to make it easier to go live using third-party tools via desktop PCs.

Live streaming has been a major shift in China, where shopping live-streams, in particular, have led to massive opportunities for streaming platforms. They haven’t caught on in the same way in Western regions, but as TikTok and YouTube look to push live-stream adoption, there is still a chance that they will become a much bigger element in future.

Which is why IG is also trying to stay in touch, and add more ways for its creators to engage via streams. Live-stream games is another element within this, which could make this a better community-building, and potentially sales-driving option.

We’ve asked Instagram for more information on this test, and we’ll update this post if/when we hear back.

-

PPC4 days ago

PPC4 days ago19 Best SEO Tools in 2024 (For Every Use Case)

-

PPC7 days ago

PPC7 days ago4 New Google Ads Performance Max Updates: What You Need to Know

-

MARKETING7 days ago

MARKETING7 days agoWill Google Buy HubSpot? | Content Marketing Institute

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 16, 2024

-

SEO6 days ago

SEO6 days agoGoogle Clarifies Vacation Rental Structured Data

-

MARKETING6 days ago

MARKETING6 days agoStreamlining Processes for Increased Efficiency and Results

-

SEARCHENGINES5 days ago

Daily Search Forum Recap: April 17, 2024

-

PPC7 days ago

PPC7 days agoHow to Collect & Use Customer Data the Right (& Ethical) Way

You must be logged in to post a comment Login