SOCIAL

The Australian Government Looks to Implement New Laws to Make Google and Facebook Pay News Publishers

In what could be a significant move in the broader regulation of the digital eco-sphere, the Australian Government has announced that it’s looking to provide financial assistance to struggling local news organizations by implementing a new, mandatory code of conduct which would require Google and Facebook to share any revenue they generate as a result of news content with the relevant publishers of such material.

As per Australian Treasurer Josh Frydenberg:

“The Government has instructed the Australian Competition and Consumer Commission (ACCC) to develop a mandatory code to address commercial arrangements between digital platforms and news media businesses. Among the elements the code will cover include the sharing of data, ranking and display of news content and the monetization and the sharing of revenue generated from news.”

Treasurer Frydenberg notes that the Australian media sector was already under significant pressure, but that’s now been “exacerbated by a sharp decline in advertising revenue driven by coronavirus”. This, along with inaction from the digital giants in working to provide a more adequate process of compensation for publishers, has prompted the Government to act.

The announcement stems from the ACCC’s 600+ page “Digital Platforms Inquiry” report which was released in June last year. The report covers all aspects of the online media industry, and concerns relating to data-sharing, misinformation, and consumer understanding of how digital platforms operate.

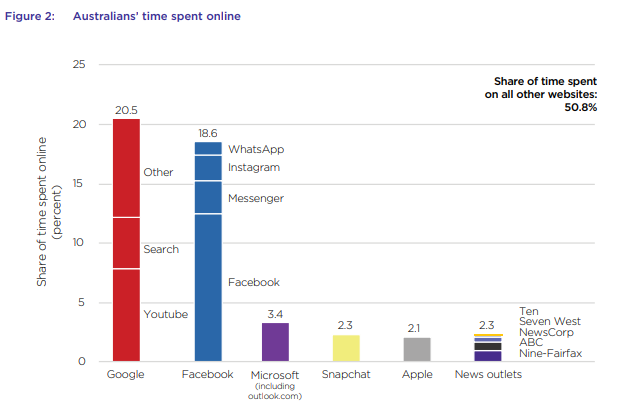

The report breaks down the shifting media landscape, and how Google and Facebook have come to dominate the local advertising market, at the expense, in particular, of print media.

That imbalance prompted the Government to seek alternatives, and with a significant amount of Google and Facebook’s content coming from news publishers, a case can be made for a more mutually beneficial arrangement between them.

As per the report:

“The content produced by news media businesses is also important to digital platforms. For example, between 8 and 14 per cent of Google search results trigger a “Top Stories” result, which typically includes reports from news media websites including niche publications or blogs.”

That said, the ACCC also notes that:

“Google and Facebook each appear to be more important to the major news media businesses than any one news media business is to Google or Facebook.”

That gives the online giants significant power, which is why the Government is now seeking to step in and facilitate an alternative arrangement.

Among the many recommendations, the ACCC calls for both Google and Facebook to:

- Within the limits of data protection and privacy laws, share data with media businesses about users’ consumption of the media business’ news content on the digital platform’s service(s). For example, data collected by Facebook on its platform, or Google on news content published in the AMP format and served from Google’s cache, derived from news content provided by media businesses.

- Give media businesses early warning of significant changes to the ranking or display of news that would be reasonably likely to affect the referral traffic of media businesses.

- Ensure that the digital platform’s actions will not impede news media businesses’ opportunities to appropriately monetize their content on the digital platform’s sites or apps, or on the media businesses’ own sites or apps.

- Where the digital platform obtains value directly or indirectly from content produced by news media businesses, fairly negotiate with news media businesses as to how that revenue should be shared, or how the news media businesses should be compensated.

The final point is the key focus here, though the advanced warning of any algorithm shifts is also significant.

Within its additional notes, the ACCC also calls for the parties to negotiate such deals among themselves:

“The ACCC considers that determining such issues by commercial negotiation, taking into account the unique nature of each commercial relationship, is more appropriate than having a regulator determine aspects of the relationship such as an appropriate price or snippet length.”

Initially, on the official release of the report in December, the Australian Government gave Google and Facebook eleven months to respond to its request for the development of voluntary codes to address these concerns, but as noted, with the COVID-19 pandemic further reducing the capacity for news outlets to generate revenue through traditional means, and a lack of engagement from the online giants with respect to the development of these agreements, the government is now looking to take action, and legislate official rules on news revenue sharing.

Various nations have attempted to implement similar regulation, with less than desirable results.

Last year, France implemented its ‘neighboring rights’ copyright laws, which stipulate that media firms be adequately compensated when their content is used on websites, including in search engine results and on social media platforms. Google responded by saying that it wouldn’t ‘pay for links’, instead setting up an alternate process which meant that it would only display articles, images and videos in search results from media companies that had explicitly allowed it to use such for free. The dispute is still ongoing as to how to resolve the stand-off.

Spain, meanwhile, implemented its own laws around such usage back in 2014, which essentially required news aggregators to pay for a license to use news content. As a result, Google shut down Google News in Spain at the end of 2014, a move that reportedly saw many publishers experience double-digit drops in web traffic.

Given the precedent, it’ll be interesting to see what the outcome is in the Australian market. Based on past history, and its specific inaction in response to the Australian Government’s initial call for negotiation, there’s nothing to indicate that Google will be looking to alter its stance.

If anything, it seems that Google has sought to make a clear example of such cases – if Google negotiates, and allows other nations and publishers to see that such agreements are possible, that could end up costing it billions in fees around the world. As such, in all likelihood, neither Google nor Facebook will be intending to make a switch in their approaches, and will instead seek to alter their processes in accordance with revised local laws.

That could lead to significant changes in the way content is displayed on the digital giants, which, if anything, will only take traffic away from the traditional media players, and provide more instead to less mainstream outlets.

The outcome then could be less reliable news coverage overall – which is another key area of concern raised by the ACCC’s report. As such, the initiative is interesting, and the logic behind the push has merit. But enforcement looks set to remain problematic.

The Australian Government plans to have a draft mandatory code by the end of July, with a final code to be settled soon thereafter.

SOCIAL

Snapchat Explores New Messaging Retention Feature: A Game-Changer or Risky Move?

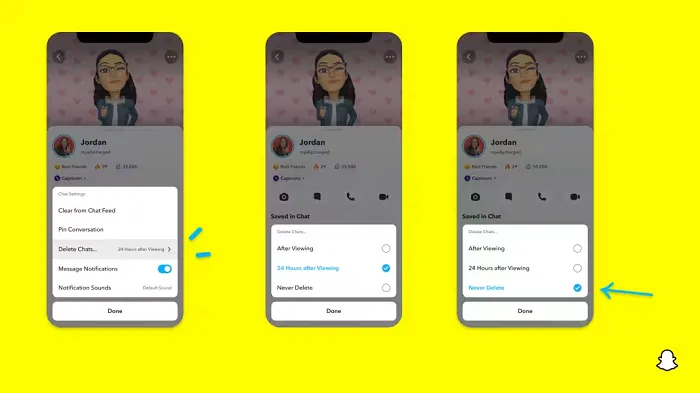

In a recent announcement, Snapchat revealed a groundbreaking update that challenges its traditional design ethos. The platform is experimenting with an option that allows users to defy the 24-hour auto-delete rule, a feature synonymous with Snapchat’s ephemeral messaging model.

The proposed change aims to introduce a “Never delete” option in messaging retention settings, aligning Snapchat more closely with conventional messaging apps. While this move may blur Snapchat’s distinctive selling point, Snap appears convinced of its necessity.

According to Snap, the decision stems from user feedback and a commitment to innovation based on user needs. The company aims to provide greater flexibility and control over conversations, catering to the preferences of its community.

Currently undergoing trials in select markets, the new feature empowers users to adjust retention settings on a conversation-by-conversation basis. Flexibility remains paramount, with participants able to modify settings within chats and receive in-chat notifications to ensure transparency.

Snapchat underscores that the default auto-delete feature will persist, reinforcing its design philosophy centered on ephemerality. However, with the app gaining traction as a primary messaging platform, the option offers users a means to preserve longer chat histories.

The update marks a pivotal moment for Snapchat, renowned for its disappearing message premise, especially popular among younger demographics. Retaining this focus has been pivotal to Snapchat’s identity, but the shift suggests a broader strategy aimed at diversifying its user base.

This strategy may appeal particularly to older demographics, potentially extending Snapchat’s relevance as users age. By emulating features of conventional messaging platforms, Snapchat seeks to enhance its appeal and broaden its reach.

Yet, the introduction of message retention poses questions about Snapchat’s uniqueness. While addressing user demands, the risk of diluting Snapchat’s distinctiveness looms large.

As Snapchat ventures into uncharted territory, the outcome of this experiment remains uncertain. Will message retention propel Snapchat to new heights, or will it compromise the platform’s uniqueness?

Only time will tell.

SOCIAL

Catering to specific audience boosts your business, says accountant turned coach

While it is tempting to try to appeal to a broad audience, the founder of alcohol-free coaching service Just the Tonic, Sandra Parker, believes the best thing you can do for your business is focus on your niche. Here’s how she did just that.

When running a business, reaching out to as many clients as possible can be tempting. But it also risks making your marketing “too generic,” warns Sandra Parker, the founder of Just The Tonic Coaching.

“From the very start of my business, I knew exactly who I could help and who I couldn’t,” Parker told My Biggest Lessons.

Parker struggled with alcohol dependence as a young professional. Today, her business targets high-achieving individuals who face challenges similar to those she had early in her career.

“I understand their frustrations, I understand their fears, and I understand their coping mechanisms and the stories they’re telling themselves,” Parker said. “Because of that, I’m able to market very effectively, to speak in a language that they understand, and am able to reach them.”Â

“I believe that it’s really important that you know exactly who your customer or your client is, and you target them, and you resist the temptation to make your marketing too generic to try and reach everyone,” she explained.

“If you speak specifically to your target clients, you will reach them, and I believe that’s the way that you’re going to be more successful.

Watch the video for more of Sandra Parker’s biggest lessons.

SOCIAL

Instagram Tests Live-Stream Games to Enhance Engagement

Instagram’s testing out some new options to help spice up your live-streams in the app, with some live broadcasters now able to select a game that they can play with viewers in-stream.

As you can see in these example screens, posted by Ahmed Ghanem, some creators now have the option to play either “This or That”, a question and answer prompt that you can share with your viewers, or “Trivia”, to generate more engagement within your IG live-streams.

That could be a simple way to spark more conversation and interaction, which could then lead into further engagement opportunities from your live audience.

Meta’s been exploring more ways to make live-streaming a bigger consideration for IG creators, with a view to live-streams potentially catching on with more users.

That includes the gradual expansion of its “Stars” live-stream donation program, giving more creators in more regions a means to accept donations from live-stream viewers, while back in December, Instagram also added some new options to make it easier to go live using third-party tools via desktop PCs.

Live streaming has been a major shift in China, where shopping live-streams, in particular, have led to massive opportunities for streaming platforms. They haven’t caught on in the same way in Western regions, but as TikTok and YouTube look to push live-stream adoption, there is still a chance that they will become a much bigger element in future.

Which is why IG is also trying to stay in touch, and add more ways for its creators to engage via streams. Live-stream games is another element within this, which could make this a better community-building, and potentially sales-driving option.

We’ve asked Instagram for more information on this test, and we’ll update this post if/when we hear back.

-

MARKETING7 days ago

MARKETING7 days agoRoundel Media Studio: What to Expect From Target’s New Self-Service Platform

-

SEO6 days ago

SEO6 days agoGoogle Limits News Links In California Over Proposed ‘Link Tax’ Law

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 12, 2024

-

SEARCHENGINES5 days ago

SEARCHENGINES5 days agoGoogle Core Update Volatility, Helpful Content Update Gone, Dangerous Google Search Results & Google Ads Confusion

-

SEO5 days ago

SEO5 days ago10 Paid Search & PPC Planning Best Practices

-

SEO7 days ago

SEO7 days agoGoogle Unplugs “Notes on Search” Experiment

-

MARKETING6 days ago

MARKETING6 days ago2 Ways to Take Back the Power in Your Business: Part 2

-

MARKETING4 days ago

MARKETING4 days ago5 Psychological Tactics to Write Better Emails