SOCIAL

Twitch Continues to Lead in Game Streaming, but YouTube and Facebook are Growing [Infographic]

![Twitch Continues to Lead in Game Streaming, but YouTube and Facebook are Growing [Infographic] twitch continues to lead in game streaming but youtube and facebook are growing infographic](https://articles.entireweb.com/wp-content/uploads/2020/10/twitch-continues-to-lead-in-game-streaming-but-youtube-and-facebook-are-growing-infographic.png)

Streaming is now a huge element of broader web culture, and streamers have become major celebrities in their own right, with millions of young fans now tuning in regularly to see their latest broadcasts and engage with gaming content.

And in 2020, the growth of streaming has accelerated. According to the latest data from Streamlabs, the streaming industry has grown some 91.8% year-over-year, with 7.46 billion hours of content watched across all the major platforms.

If you’re looking to connect with younger audiences, you need to have some understanding of the streaming industry, and its broader impact. Providing some perspective on this, Streamlabs recently published its latest quarterly update, which shows the top streaming platforms, by market share, along with the major eSports events and games of note.

Among the key points:

- YouTube Gaming saw the most growth for hours watched in the quarter

- Facebook Gaming surpassed 1 billion hours watched for the first time

- The majority of viewers and streamers from Mixer, which Microsoft shut down in June, appear to have crossed over to Twitch, adding to its dominance

You can check out the full Streamlabs report here, while the infographic below captures the topline trends.

![Twitch Continues to Lead in Game Streaming, but YouTube and Facebook are Growing [Infographic] Streamlabs gaming report](https://www.socialmediatoday.com/user_media/diveimage/streamlabs_quarterly_report.png)

SOCIAL

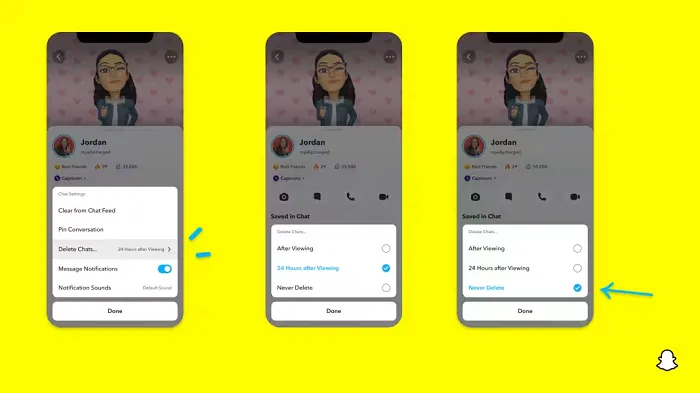

Snapchat Explores New Messaging Retention Feature: A Game-Changer or Risky Move?

In a recent announcement, Snapchat revealed a groundbreaking update that challenges its traditional design ethos. The platform is experimenting with an option that allows users to defy the 24-hour auto-delete rule, a feature synonymous with Snapchat’s ephemeral messaging model.

The proposed change aims to introduce a “Never delete” option in messaging retention settings, aligning Snapchat more closely with conventional messaging apps. While this move may blur Snapchat’s distinctive selling point, Snap appears convinced of its necessity.

According to Snap, the decision stems from user feedback and a commitment to innovation based on user needs. The company aims to provide greater flexibility and control over conversations, catering to the preferences of its community.

Currently undergoing trials in select markets, the new feature empowers users to adjust retention settings on a conversation-by-conversation basis. Flexibility remains paramount, with participants able to modify settings within chats and receive in-chat notifications to ensure transparency.

Snapchat underscores that the default auto-delete feature will persist, reinforcing its design philosophy centered on ephemerality. However, with the app gaining traction as a primary messaging platform, the option offers users a means to preserve longer chat histories.

The update marks a pivotal moment for Snapchat, renowned for its disappearing message premise, especially popular among younger demographics. Retaining this focus has been pivotal to Snapchat’s identity, but the shift suggests a broader strategy aimed at diversifying its user base.

This strategy may appeal particularly to older demographics, potentially extending Snapchat’s relevance as users age. By emulating features of conventional messaging platforms, Snapchat seeks to enhance its appeal and broaden its reach.

Yet, the introduction of message retention poses questions about Snapchat’s uniqueness. While addressing user demands, the risk of diluting Snapchat’s distinctiveness looms large.

As Snapchat ventures into uncharted territory, the outcome of this experiment remains uncertain. Will message retention propel Snapchat to new heights, or will it compromise the platform’s uniqueness?

Only time will tell.

SOCIAL

Catering to specific audience boosts your business, says accountant turned coach

While it is tempting to try to appeal to a broad audience, the founder of alcohol-free coaching service Just the Tonic, Sandra Parker, believes the best thing you can do for your business is focus on your niche. Here’s how she did just that.

When running a business, reaching out to as many clients as possible can be tempting. But it also risks making your marketing “too generic,” warns Sandra Parker, the founder of Just The Tonic Coaching.

“From the very start of my business, I knew exactly who I could help and who I couldn’t,” Parker told My Biggest Lessons.

Parker struggled with alcohol dependence as a young professional. Today, her business targets high-achieving individuals who face challenges similar to those she had early in her career.

“I understand their frustrations, I understand their fears, and I understand their coping mechanisms and the stories they’re telling themselves,” Parker said. “Because of that, I’m able to market very effectively, to speak in a language that they understand, and am able to reach them.”Â

“I believe that it’s really important that you know exactly who your customer or your client is, and you target them, and you resist the temptation to make your marketing too generic to try and reach everyone,” she explained.

“If you speak specifically to your target clients, you will reach them, and I believe that’s the way that you’re going to be more successful.

Watch the video for more of Sandra Parker’s biggest lessons.

SOCIAL

Instagram Tests Live-Stream Games to Enhance Engagement

Instagram’s testing out some new options to help spice up your live-streams in the app, with some live broadcasters now able to select a game that they can play with viewers in-stream.

As you can see in these example screens, posted by Ahmed Ghanem, some creators now have the option to play either “This or That”, a question and answer prompt that you can share with your viewers, or “Trivia”, to generate more engagement within your IG live-streams.

That could be a simple way to spark more conversation and interaction, which could then lead into further engagement opportunities from your live audience.

Meta’s been exploring more ways to make live-streaming a bigger consideration for IG creators, with a view to live-streams potentially catching on with more users.

That includes the gradual expansion of its “Stars” live-stream donation program, giving more creators in more regions a means to accept donations from live-stream viewers, while back in December, Instagram also added some new options to make it easier to go live using third-party tools via desktop PCs.

Live streaming has been a major shift in China, where shopping live-streams, in particular, have led to massive opportunities for streaming platforms. They haven’t caught on in the same way in Western regions, but as TikTok and YouTube look to push live-stream adoption, there is still a chance that they will become a much bigger element in future.

Which is why IG is also trying to stay in touch, and add more ways for its creators to engage via streams. Live-stream games is another element within this, which could make this a better community-building, and potentially sales-driving option.

We’ve asked Instagram for more information on this test, and we’ll update this post if/when we hear back.

-

SEO7 days ago

SEO7 days agoGoogle Limits News Links In California Over Proposed ‘Link Tax’ Law

-

SEARCHENGINES6 days ago

SEARCHENGINES6 days agoGoogle Core Update Volatility, Helpful Content Update Gone, Dangerous Google Search Results & Google Ads Confusion

-

SEARCHENGINES7 days ago

Daily Search Forum Recap: April 12, 2024

-

SEO6 days ago

SEO6 days ago10 Paid Search & PPC Planning Best Practices

-

MARKETING6 days ago

MARKETING6 days ago2 Ways to Take Back the Power in Your Business: Part 2

-

SEARCHENGINES5 days ago

SEARCHENGINES5 days agoWeekend Google Core Ranking Volatility

-

MARKETING5 days ago

MARKETING5 days ago5 Psychological Tactics to Write Better Emails

-

PPC7 days ago

PPC7 days agoCritical Display Error in Brand Safety Metrics On Twitter/X Corrected