Nasdaq Bear Market: 5 Phenomenal Growth Stocks You’ll Regret Not Buying on the Dip

Every so often, Wall Street sends a reminder to the investing community that stocks can go down just as easily as they can climb. Last year, all three major U.S. indexes produced their worst single-year returns since the financial crisis, with the growth-driven Nasdaq Composite (^IXIC -0.74%) taking it on the chin with a decline of 33%.

But where there’s a bear market, there’s always opportunity for long-term investors. Even though we can’t predict when bear markets will start or how much they’ll ultimately decline, we do know that, eventually, every bear market is cleared away by a bull market rally. This will be the fate of the current Nasdaq bear market decline.

Image source: Getty Images.

A bear market can be an especially smart time to buy into innovative growth stocks beaten down by emotion-driven trading. What follows are five phenomenal growth stocks you’ll regret not buying on the Nasdaq bear market dip.

Meta Platforms

The first stellar growth stock you can confidently buy during the Nasdaq bear market swoon is social media giant Meta Platforms (META -4.55%). Although recessionary fears are weighing on near-term ad spending, Meta is well positioned to deliver for its shareholders over the long run.

Last year, all but $3 billion of Meta’s $116.6 billion in total sales came from advertising. While downturns are a normal part of the economic cycle, it’s worth noting that recessions have lasted just two months to 18 months since the end of World War II. By comparison, periods of economic expansion are known to go on for years. For an ad-driven company like Meta, these disproportionately long expansions should allow it to take full advantage of strong ad-pricing power.

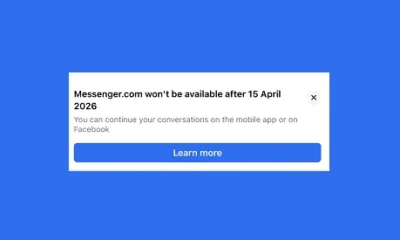

To add to this point, Meta Platforms owns four of the most popular social media apps on the planet — Facebook, Facebook Messenger, WhatsApp, and Instagram. The company’s family of apps attracted 3.74 billion unique monthly visitors during the fourth quarter, which effectively represents more than half of the world’s adult population. As the clear leader in social media engagement, Meta has the upper hand with advertisers when it comes to ad pricing.

Investors should also appreciate Meta’s cash-rich balance sheet — $30.8 billion in net cash — and its ability to pull levers. With losses rising at metaverse/virtual reality-focused operating segment Reality Labs, Meta pared back its full-year operating expenses forecast for this year by $5 billion at the midpoint, as well as approved an up to $40 billion share repurchase program.

Lovesac

A second marvelous growth stock you’ll regret not snagging during the Nasdaq bear market decline is furniture retailer Lovesac (LOVE -4.48%). Despite furniture being a generally slow-growing, cyclical industry, Lovesac offers catalysts intended to turn this stodgy industry upside down.

The biggest differentiating factor for Lovesac is the company’s furniture. Approximately 90% of Lovesac’s net sales derive from sactionals — modular couches that can be rearranged in a multitude of ways to fit virtually any living space. Sactionals can be fitted with a number of upgrades (surround sound or wireless charging stations), come with more than 200 different cover options, and the yarn used in these covers is made entirely from recycled plastic water bottles. Lovesac’s products sit within their own niche.

The next key point is that Lovesac leans on a variety of sales channels. The company’s omnichannel sales platform relies on a combination of physical stores in 40 states, online sales, popup showrooms, and showroom partnerships to move its products. Being able to pivot to online sales has helped lower overhead expenses, which has been a positive for the company’s operating margin.

Furthermore, Lovesac’s target audience tends to be middle-to-upper-income consumers. Higher-earning consumers are less likely to be shaken by rising inflation or economic weakness. In other words, Lovesac can weather an economic downturn better than its peers.

Image source: Getty Images.

JD.com

The third phenomenal growth stock ripe for the picking during the Nasdaq bear market drop is China-based e-commerce stock JD.com (JD -2.41%). Even though investing in China stocks comes with added risks, a number of short-term headwinds have recently been addressed.

For much of the past three years, China-based companies have been stymied by the country’s zero-COVID-19 strategy, which led to unpredictable lockdowns and ongoing supply chain problems. In December, following a wave of protests, China finally reopened its economy. While the ramp-up could be bumpy at times, with China’s residents now having to build up natural or vaccine-based immunity to COVID, this move will ultimately be a positive in terms of getting China’s generally faster-growing economy back on track.

In addition to benefiting from a reopened China, JD.com stands out from its peers for having more control over its operating expenses. Whereas third-party marketplaces are dominant on Alibaba, the nation’s largest e-commerce marketplace, JD.com’s marketplace is predominantly focused on direct-to-consumer sales. With JD controlling both the inventory and logistics, it has more ability to pull levers, as needed, to adjust its operating margin.

What’s more, JD is moving beyond just retail sales. The company’s logistics operations, JD Health segment, and even Dada, which covers local deliveries, are ways for JD to expand its sales verticals and further increase its organic growth rate.

Cresco Labs

A fourth impressive growth stock you’ll regret not adding during the Nasdaq bear market fall is U.S. marijuana company Cresco Labs (CRLBF -1.76%). Although pot stocks have lost their buzz due to the lack of cannabis reform on Capitol Hill, Cresco has the tools and intangibles to thrive, even if lawmakers continue to drag their feet.

As of last week, Cresco Labs was operating 63 dispensaries in legalized states across the country. While it does have a presence in high-dollar markets like California and Colorado, it’s predominantly positioned itself for growth in limited-license states, such as Pennsylvania, Virginia, and Ohio. States where regulators purposely limit retail license issuance allow smaller players like Cresco a fair chance to build up their brands and secure a loyal following of customers.

A potentially game-changing move for Cresco is its pending all-share acquisition of Columbia Care. The deal would increase Cresco’s presence to 18 states, as well as give it a dispensary footprint of more than 130 stores after taking divestments into account. This broad presence would quickly position Cresco to take advantage of any cannabis reforms at the federal level.

However, what makes Cresco Labs a particularly intriguing investment is its industry-leading wholesale operations. Though wholesale cannabis margins are, indeed, lower than the retail side of the equation, Cresco is more than making up for what it’s losing in margin with volume. It holds one of only a few cannabis distribution licenses in California, the nation’s top market for legal weed sales. This allows Cresco to place its proprietary products in dispensaries throughout the state.

Palo Alto Networks

The fifth phenomenal growth stock you’ll regret not buying during the Nasdaq bear market dip is cybersecurity stock Palo Alto Networks (PANW -0.34%). In spite of fears that a recession could materialize and slow demand for cybersecurity products, Palo Alto remains one of the smartest and safest buys for growth-seeking investors.

The key reason investors can count on Palo Alto is the company’s clear-cut focus on cloud-based software-as-a-service (SaaS) cybersecurity solutions. In less than five years, Palo Alto has shifted from generating around 61% of its revenue from cloud-based subscriptions and support to nearly 79% through the first six months of fiscal 2023.

Emphasizing cloud-based SaaS cybersecurity solutions comes with a number of advantages for Palo Alto. The margins associated with subscriptions are notably higher than physical firewall products, and subscriptions are more likely to keep clients loyal to its services. Also, cloud-based solutions tend to be more effective at recognizing and responding to potential threats.

The proof is in the pudding that this next-generation security shift is working. Next-gen security annual recurring revenue rose 63% to $2.33 billion in the quarter ended Jan. 31, 2023, with Prisma Cloud adoption demonstrating especially strong growth. The number of customers purchasing four or more cloud modules more than doubled year over year.

This organic growth, coupled with bolt-on acquisitions, is the ideal recipe for Palo Alto Networks to continue to outperform.