SOCIAL

Facebook Adds 100 Million More Users, Reports 11% Revenue Growth Amid COVID-19

Despite COVID-19, an advertiser boycott, and an appearance before US officials over possible antitrust violations. Even amid these varied distractions and impacts, Facebook has once again reported steady growth in its latest earnings report, with the platform now exceeding 3 billion users worldwide across its ‘family of apps’.

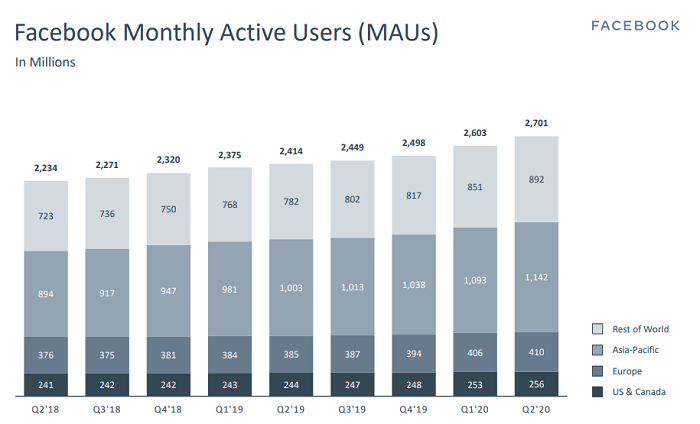

First off, on users – Facebook added another 100 million monthly active users in the Q2, taking it to 2.7b MAU.

Facebook’s MAU growth rate has accelerated in the last two quarters – which makes sense, given that more people are looking for distractions amid the COVID-19 lockdowns. But again, given the outside criticisms and concerns, which have also included broader debate around Facebook’s perceived lax efforts in removing hate speech, you might expect to see an impact on Facebook’s momentum.

Not so, according to these numbers.

As you can see in the chart, Facebook continues to see the majority of its audience growth in the Asia-Pacific market, with India, in particular seeing significant take-up as the developing nation undergoes its own digital shift. Facebook recently made a significant step towards maximizing its opportunities in the region by purchasing a stake in Indian mobile provider Jio, through which it will look to build an eCommerce platform within the Indian market, which could, eventually, make Facebook the key platform for the nation’s billion-plus of citizens.

Worth noting, also, that Facebook, via Instagram, recently launched its TikTok-clone functionality ‘Reels’ in the Indian market, after the Indian Government banned TikTok due to conflicts with the Chinese regime. India was, up till then, TikTok’s second-biggest user market, with some 200 million active Indian users at the time of its removal. That will present another opportunity for Facebook to boost its regional growth.

In terms of daily actives, Facebook is now seeing 1.8b individual log-ins each day.

As you can see from the lower listing, Facebook also continues to see high engagement, with 66% of its monthly active users logging on every day, which has been consistent for several quarters.

The only nuance missing here is time spent – while many people do log onto Facebook regularly, what would be interesting to know is actual time spent, per user, on the platform. Facebook doesn’t release this info as a matter of course, but having that additional context would provide a more accurate view of Facebook usage. The view, among many tech analysts, is that while people do check-in to Facebook to see what family and friends have posted, they’re actually now spending more time in other apps instead.

That additional detail could help to better align ad spend with actual usage – which, really, is probably why Facebook doesn’t release it.

In addition to this, Facebook has also notably crossed the 3b user threshold, at least in terms of usage across its entire ‘Family of Apps’ – i.e. combined, individual active users across Facebook, WhatsApp, Instagram and Messenger.

It’s interesting to consider that, across the entire world, around 440 million users of Facebook’s other apps don’t access Facebook itself (2.7b MAU), and a lot of those, you would imagine, would be on WhatsApp, which is the dominant messaging platform in several major markets.

That means that Facebook still has significant opportunity to further monetize its other platforms, and reach unique users with more ad and business options. As yet, Facebook hasn’t been able to fully implement its monetization strategy for WhatsApp

In terms of revenue, Facebook saw an increase of 11%, bringing in $18b for the quarter.

Not bad, especially considering the slow down in ad spend due to COVID-19 and the current ads boycott, as noted. Of course, the impacts of that boycott won’t be evident till the next quarter, and Facebook has noted that it will see further impacts. It’ll be interesting to see exactly how significant those impacts end up being.

The company’s revenue growth, it’s worth noting, has slowed significantly, but overall, Facebook still beat analyst estimates. Shares in the company rose 8% on the release.

Looking ahead, Facebook says that it expects its third-quarter results to be largely in line with this report, though it does expect to see a slowdown in user growth.

“More recently, we are seeing signs of normalization in user growth and engagement as shelter in-place measures have eased around the world, particularly in developed markets where Facebook’s penetration is higher. Looking forward, as shelter-in-place restrictions continue to ease, we expect the number of Facebook DAUs and MAUs to be flat or slightly down in most regions in the third quarter of 2020 compared to the second quarter of 2020.”

Facebook has seen ongoing user growth for some time, so it’ll be interesting to see the market response to a stalling in this respect, if indeed we do see such.

Also interesting to note this chart:

Facebook’s ‘other’ revenue – i.e. revenue outside of advertising – continues to climb, which would largely be linked to the growth in sales of its Oculus VR devices and Portal smart speakers.

Back in April, Facebook reported that it was struggling to meet rising demand for Oculus headsets, while Portal sales have increased more than 10x during the global lockdowns. It’s still only a fraction of Facebook’s overall revenue pie, but both provide the company with not only one-off sales, but ongoing opportunities for connection, which could become more valuable over time.

The report reflects Facebook’s ongoing stability, which, despite the current protests, seems unlikely to be significantly impacted. While many big name Facebook advertisers have joined the current ad boycott, Facebook still has a large advertiser base – and while disrupting the company’s revenue flow may not have been the main aim of the protest action, it does underline Facebook’s sheer size and scope – which again, underlines the key emphasis of this week’s antitrust hearing.

An interesting point of note in this respect is that most of companies run by the tech CEOs who appeared before the House Judiciary Committee pushed back the release of their latest results till after the hearing. Facebook brought in $18b, while Amazon has taken in $88.9b for the most recent quarter, amid the pandemic, both beating analyst estimates.

You can imagine that both results would not sit well amongst those considering their respective market dominance.

Either way you look at it, it’s an unfathomable amount of money flowing through each company, and definitely, there’s clear evidence that they use their size and scale to dominate their markets. Whether that will be reflected in the eventual findings of the House. we’ll have to wait and see.