AFFILIATE MARKETING

Paysafe’s Debt Makes The Stock Risky (NYSE:PSFE)

Mananya Kaewthawee/iStock via Getty Images

Paysafe Limited (NYSE:PSFE) is a payment processor. The company has had a rough time as Paysafe’s debt burden eats away the company’s entire operating profit, and as the company has had to writedown its assets. I believe the company’s underlying cash flows are somewhat better than the company’s earnings let investors believe, which is why I have a hold-rating for the stock.

The Company

Paysafe operates under several brands, such as Paysafecard, Income Access, Neteller and Skrill. Most of the company’s brands are payment platforms. For example, Skrill processes global payments, making money transfers between countries and currencies easier. Income Access, on the other hand, is an affiliate marketing software solution, used mostly by online gambling websites:

Income Access’ Clients (incomeaccess.com)

Gambling partners are important for Paysafe’s payment platforms like Neteller and Skrill, too – many gambling sites offer deposits and withdrawals through these platforms.

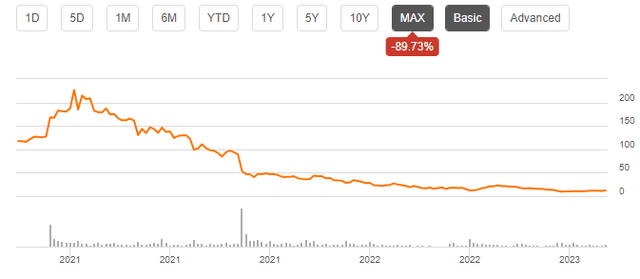

Since the company became public, it has deteriorated investors’ investment value, as the stock has fallen by 90% from late 2020 levels:

Paysafe Stock Chart (Seeking Alpha)

The fall doesn’t seem to have an end in sight, as the company’s year-to-date performance is at -34%.

Financials

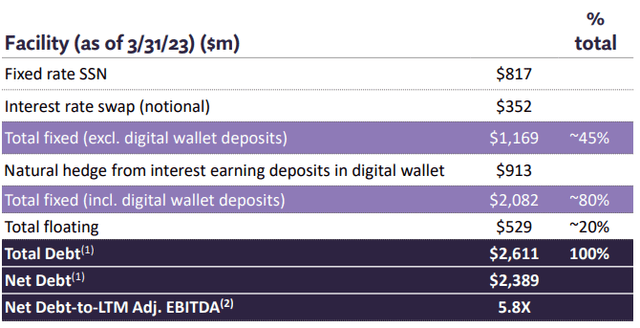

Paysafe’s balance sheet is a very worrying one – the company holds $2611 million in long-term debt, of which $10 million is in the current portion of the debt. A good part of this debt is in interest-earning deposits in customers’ digital wallets:

Paysafe’s Debts (Paysafe Q1 2023 Earnings Presentation)

The company has $222 million in cash, which puts the company’s net debt at $2389 million – compared to Paysafe’s market capitalization of $689 million at the share price of $12.04, I believe this is an unhealthy amount.

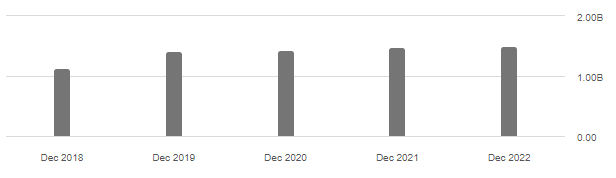

Paysafe’s revenues have grown slightly with a compounded annual rate of 7% from 2018 to 2022:

Revenues (Seeking Alpha)

This is boosted by the company’s acquisition of viafintech and Safetypay – the company doesn’t seem to grow organically, which should be concerning for investors. The company is guiding towards a growth of 6-7% in the current year though, with no M&A activity in the trailing twelve months. This sparks hope that the company could be able to grow organically in the future.

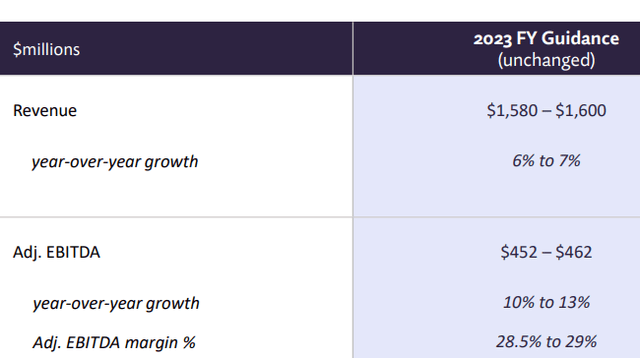

2023 Guidance (Paysafe Q1 2023 Earnings Presentation)

The company’s operating margin has fell throughout the years – in 2018, the company’s operating margin was 14.2%, whereas today it stands at 3.9% with trailing numbers. The margin is showing some signs of improvement, as in Q1 the company’s operating margin was 9.1% compared to last year’s 4.2% – the guidance has adjusted EBITDA growing 10-13%, more than the anticipated revenue growth.

Paysafe’s cash flows are better than their operating profit lets investors believe, though. The company has a trailing amount of $261 million in amortization of goodwill related to the company’s acquisitions, worsening operating profit without affecting cash flows. The company does have $147 million in purchases of intangible assets in the last twelve months, worsening cash flows. These investments don’t show in Paysafe’s operating profit though, as the company’s depreciation for 2022 is only $6.5 million. In total, the company’s cash flows should be around $100 million better than their EBIT would let believe.

All these factors combined lead to the fact that interest expenses eat away the shareholders’ current earnings – in the trailing twelve months, the company’s EBIT is $59 million, and interest expenses are $138 million. I believe Paysafe should still be able to manage its debt if the operations do not worsen, as Paysafe’s cash flows are still quite healthy.

Upcoming Earnings

The company reports its Q2 earnings on August 15th. I believe investors should have a close eye on the company’s revenue growth – a growing revenue would improve Paysafe’s operations significantly as I believe margins should grow with scale. Analysts currently expect a growth of 4.3% for Q2, coupled with an adjusted EBITDA margin that grows by a percentage point – the company’s revenues estimate is $395 million and adjusted EBITDA estimate $111 million.

Valuation

Paysafe’s valuation is very hard to get a grasp of with the large amounts of amortizations, writedowns, and restructuring costs. The most significant figure in my opinion is free cash flow – the company currently trails at a MCAP/Levered FCF -ratio of 5.43, below its historical figures:

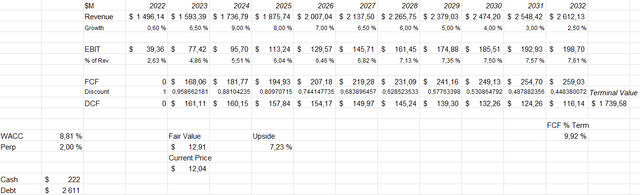

To further demonstrate the valuation, I modelled a discounted cash flow model as usual. The valuation is quite difficult as the company holds such a significant amount of debt, but the model does give some approximation.

For the estimates I input a growth of 6.5% in revenues – the midpoint of Paysafe’s current guidance. Going forward, in the model I estimate Paysafe’s growth to accelerate slightly into 9% in 2024, with a slow fade into 2% in perpetual growth. In addition, I believe the company should continue to expand its margin through growth – in the model I estimate an EBIT margin of 10.21% for the company. These expectations make up a DCF model with a fair value estimate of $12.91, a price that is 7% above the current price:

DCF Model of Paysafe (Author’s Calculation)

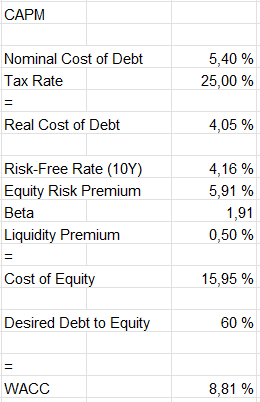

I used a weighted average cost of capital of 8.81% in the model, derived from a capital asset pricing model:

CAPM of Paysafe (Author’s Calculation)

Paysafe tells that its interest rate is 5.4% with partly fixed interest-rate debts, which I use in the CAPM. The long-term debt-to-equity ratio is hard to assume, but I’m inputting a figure of 60% – if the company is able to pay off some of its debts, I believe this could represent a medium-to-long term rate.

I use the United States’ 10-year bond yield of 4.16% as the risk-free rate on the cost of equity side. The equity risk premium of 5.91% is Professor Aswath Damodaran’s estimate for the United States. I add a 0.5% liquidity premium to address the stock’s liquidity.

The payment processor’s beta stands at 1.91 according to Yahoo Finance. I believe a payment processor’s operations shouldn’t be very cyclical in nature – especially considering the company’s positioning in the defensive gambling industry. I attribute the high beta to the company’s high amount of debt, which leverages shareholders’ risk to economic downturns – if Paysafe manages to pay off a significant portion of its debts, the beta should be significantly lower in the future in my opinion.

For the time being, I have the beta at 1.91 in the model, crafting a cost of equity of 15.95% and a significantly lower WACC of 8.81% relating to the company’s large amount of debt.

Closing Remarks

At $12.04 a share, I believe Paysafe could be a good investment. The company’s future depends on its ability to pay off the currently large debt balance. If operations improve with increasing revenues, the company could create shareholder value. With the currently heightened risk profile, though, I have a hold-rating for the stock.

![How AEO Will Impact Your Business's Google Visibility in 2026 Why Your Small Business’s Google Visibility in 2026 Depends on AEO [Webinar]](https://articles.entireweb.com/wp-content/uploads/2026/01/How-AEO-Will-Impact-Your-Businesss-Google-Visibility-in-2026-400x240.png)

![How AEO Will Impact Your Business's Google Visibility in 2026 Why Your Small Business’s Google Visibility in 2026 Depends on AEO [Webinar]](https://articles.entireweb.com/wp-content/uploads/2026/01/How-AEO-Will-Impact-Your-Businesss-Google-Visibility-in-2026-80x80.png)