AFFILIATE MARKETING

Paysafe’s Debt Makes The Stock Risky (NYSE:PSFE)

Mananya Kaewthawee/iStock via Getty Images

Paysafe Limited (NYSE:PSFE) is a payment processor. The company has had a rough time as Paysafe’s debt burden eats away the company’s entire operating profit, and as the company has had to writedown its assets. I believe the company’s underlying cash flows are somewhat better than the company’s earnings let investors believe, which is why I have a hold-rating for the stock.

The Company

Paysafe operates under several brands, such as Paysafecard, Income Access, Neteller and Skrill. Most of the company’s brands are payment platforms. For example, Skrill processes global payments, making money transfers between countries and currencies easier. Income Access, on the other hand, is an affiliate marketing software solution, used mostly by online gambling websites:

Income Access’ Clients (incomeaccess.com)

Gambling partners are important for Paysafe’s payment platforms like Neteller and Skrill, too – many gambling sites offer deposits and withdrawals through these platforms.

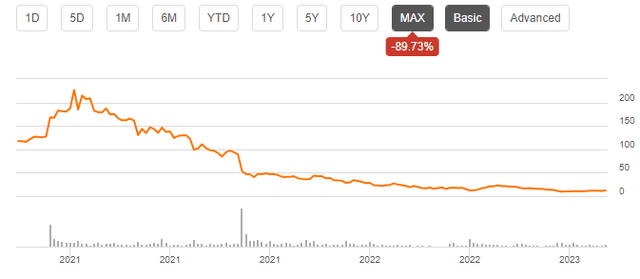

Since the company became public, it has deteriorated investors’ investment value, as the stock has fallen by 90% from late 2020 levels:

Paysafe Stock Chart (Seeking Alpha)

The fall doesn’t seem to have an end in sight, as the company’s year-to-date performance is at -34%.

Financials

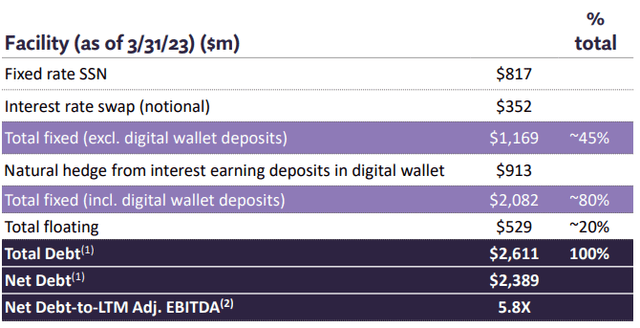

Paysafe’s balance sheet is a very worrying one – the company holds $2611 million in long-term debt, of which $10 million is in the current portion of the debt. A good part of this debt is in interest-earning deposits in customers’ digital wallets:

Paysafe’s Debts (Paysafe Q1 2023 Earnings Presentation)

The company has $222 million in cash, which puts the company’s net debt at $2389 million – compared to Paysafe’s market capitalization of $689 million at the share price of $12.04, I believe this is an unhealthy amount.

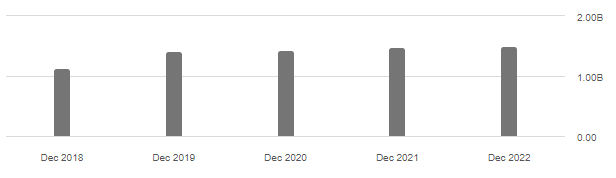

Paysafe’s revenues have grown slightly with a compounded annual rate of 7% from 2018 to 2022:

Revenues (Seeking Alpha)

This is boosted by the company’s acquisition of viafintech and Safetypay – the company doesn’t seem to grow organically, which should be concerning for investors. The company is guiding towards a growth of 6-7% in the current year though, with no M&A activity in the trailing twelve months. This sparks hope that the company could be able to grow organically in the future.

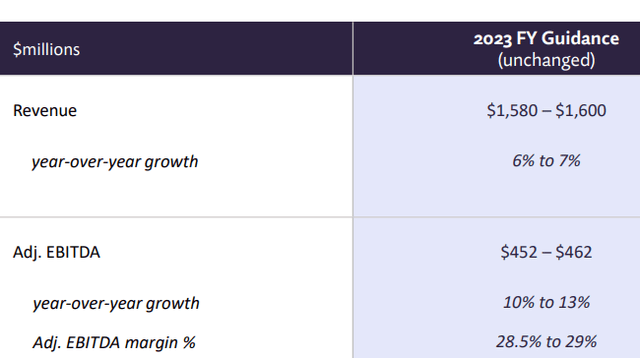

2023 Guidance (Paysafe Q1 2023 Earnings Presentation)

The company’s operating margin has fell throughout the years – in 2018, the company’s operating margin was 14.2%, whereas today it stands at 3.9% with trailing numbers. The margin is showing some signs of improvement, as in Q1 the company’s operating margin was 9.1% compared to last year’s 4.2% – the guidance has adjusted EBITDA growing 10-13%, more than the anticipated revenue growth.

Paysafe’s cash flows are better than their operating profit lets investors believe, though. The company has a trailing amount of $261 million in amortization of goodwill related to the company’s acquisitions, worsening operating profit without affecting cash flows. The company does have $147 million in purchases of intangible assets in the last twelve months, worsening cash flows. These investments don’t show in Paysafe’s operating profit though, as the company’s depreciation for 2022 is only $6.5 million. In total, the company’s cash flows should be around $100 million better than their EBIT would let believe.

All these factors combined lead to the fact that interest expenses eat away the shareholders’ current earnings – in the trailing twelve months, the company’s EBIT is $59 million, and interest expenses are $138 million. I believe Paysafe should still be able to manage its debt if the operations do not worsen, as Paysafe’s cash flows are still quite healthy.

Upcoming Earnings

The company reports its Q2 earnings on August 15th. I believe investors should have a close eye on the company’s revenue growth – a growing revenue would improve Paysafe’s operations significantly as I believe margins should grow with scale. Analysts currently expect a growth of 4.3% for Q2, coupled with an adjusted EBITDA margin that grows by a percentage point – the company’s revenues estimate is $395 million and adjusted EBITDA estimate $111 million.

Valuation

Paysafe’s valuation is very hard to get a grasp of with the large amounts of amortizations, writedowns, and restructuring costs. The most significant figure in my opinion is free cash flow – the company currently trails at a MCAP/Levered FCF -ratio of 5.43, below its historical figures:

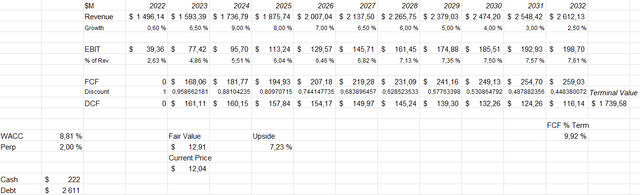

To further demonstrate the valuation, I modelled a discounted cash flow model as usual. The valuation is quite difficult as the company holds such a significant amount of debt, but the model does give some approximation.

For the estimates I input a growth of 6.5% in revenues – the midpoint of Paysafe’s current guidance. Going forward, in the model I estimate Paysafe’s growth to accelerate slightly into 9% in 2024, with a slow fade into 2% in perpetual growth. In addition, I believe the company should continue to expand its margin through growth – in the model I estimate an EBIT margin of 10.21% for the company. These expectations make up a DCF model with a fair value estimate of $12.91, a price that is 7% above the current price:

DCF Model of Paysafe (Author’s Calculation)

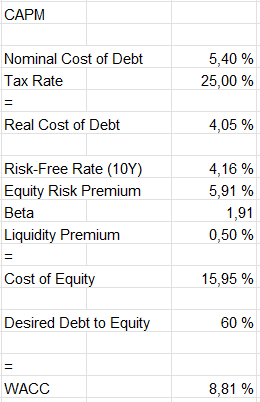

I used a weighted average cost of capital of 8.81% in the model, derived from a capital asset pricing model:

CAPM of Paysafe (Author’s Calculation)

Paysafe tells that its interest rate is 5.4% with partly fixed interest-rate debts, which I use in the CAPM. The long-term debt-to-equity ratio is hard to assume, but I’m inputting a figure of 60% – if the company is able to pay off some of its debts, I believe this could represent a medium-to-long term rate.

I use the United States’ 10-year bond yield of 4.16% as the risk-free rate on the cost of equity side. The equity risk premium of 5.91% is Professor Aswath Damodaran’s estimate for the United States. I add a 0.5% liquidity premium to address the stock’s liquidity.

The payment processor’s beta stands at 1.91 according to Yahoo Finance. I believe a payment processor’s operations shouldn’t be very cyclical in nature – especially considering the company’s positioning in the defensive gambling industry. I attribute the high beta to the company’s high amount of debt, which leverages shareholders’ risk to economic downturns – if Paysafe manages to pay off a significant portion of its debts, the beta should be significantly lower in the future in my opinion.

For the time being, I have the beta at 1.91 in the model, crafting a cost of equity of 15.95% and a significantly lower WACC of 8.81% relating to the company’s large amount of debt.

Closing Remarks

At $12.04 a share, I believe Paysafe could be a good investment. The company’s future depends on its ability to pay off the currently large debt balance. If operations improve with increasing revenues, the company could create shareholder value. With the currently heightened risk profile, though, I have a hold-rating for the stock.

AFFILIATE MARKETING

How to Make Hard Decisions Or Run The Risk of a Hard Life

Entrepreneurship is an endless series of hard decisions. I’m sure you’re facing one right now. Sadly, I can’t give you the right answer — but I can offer you something new to consider.

To really appreciate this, I first want to tell you about someone who faced a gut-wrenching choice of his own.

I’ll call him Steve. He’d stolen things, served time in prison, and wanted to turn his life around. Finding a job was hard, but he eventually landed some freelance work for a big company. He threw himself into it, outworking everyone and getting noticed.

The rest of this article is locked.

Join Entrepreneur+ today for access.

AFFILIATE MARKETING

6 Non-Negotiables for Women in Power

Opinions expressed by Entrepreneur contributors are their own.

As I’ve started to reach new growth milestones in my business, I’ve had this growing realization: Knowing your non-negotiables isn’t just important; it’s essential. Not having them clear? Well, that’s a straight ticket to Discontent City, which, let me tell you, doesn’t do any favors for your success, present or future.

It’s way too easy to let things slide, isn’t it? You make excuses for others (and yourself) and turn a blind eye to signs that all’s not well because, hey, losing a client sounds like a nightmare, right? Or maybe you’re so dazzled by what could be that you compromise what is without even realizing it.

These thoughts have been swirling in my head ever since I attended the Black Women’s Power Summit. The stories I heard from these incredible women, who’ve faced and conquered massive hurdles to secure their spots in positions of power, really hit home.

Here are six non-negotiables from myself and some of the powerful women we all look up to that will help you maintain your success and help you push through to the next level.

Related: Stepping Into Your Power as a Female Leader

1. Have uncomfortable conversations immediately

Let’s have uncomfortable conversations. I used to dodge them like a pro. But, facing them head-on? That’s where the magic happens. More often than not, I’d find out I was missing a piece of the puzzle. Whether they changed my view or cleared the air, those talks always left me feeling lighter, ready to focus on what matters.

2. Wait 24 hours before making decisions fueled by emotion

And here’s a rule I live by now: If a decision is riding on a wave of emotion, I hit pause for 24 hours. It’s amazing what a little time can do for perspective.

3. Don’t accept less than the energy you bring

Accepting less than I’m giving? No more. That’s true for work and life. Steering clear of toxic people sounds obvious, but we’ve all been there, keeping someone around when, deep down, we know they’re just bringing drama and draining our energy.

Related: 5 Women Entrepreneurs Share Their Top Advice for Finding Your Path to Career Success

4. Don’t be afraid to ask things that enable you to show up as your best

When national talk show host and actress Sherri Shepherd was asked to be on tour with Babyface, the local glam team was not equipped to style a woman of color. The team could not style her wig, and the foundation didn’t match her skin. Can you imagine having to host a large-scale event, looking up at the monitor, and being distracted because the reflection is not of your standard?

As women, it’s often implied that asking for anything more than what is provided is considered “high maintenance.” Don’t be afraid to ask for what you need to show up as your best self, and don’t expect anyone to understand your request as they’re not on your path and they’re not the ones who have to show up in your shoes.

5. Understand that work-life balance is a lie

I listened to Thausandra Brown Duckett, CEO of TIAA, talk about how work-life balance is a lie. Her suggestion is to treat your life like a diversified portfolio. She said work-life balance is a lie because it never reconciles. She suggests living your life like a diversity portfolio. Write down everything that matters to you, and allocate based on your priorities. Over time, you will outperform in all areas. Do not put all your time or energy into one thing. Don’t forget to give yourself the grace to recalibrate your portfolio as needed.

6. There must be incentives to innovate

And there’s one gem I picked from Thai Randolph, who co-founded HartBeat Productions with Kevin Hart, that’s become a mantra for me: She said that in every opportunity, there must be something intrapreneurial. What that looks like is having the opportunity to build things, break things and scale things. There has to be a real incentive to innovate.

Related: 5 Trailblazing Black Women Entrepreneurs Share How They’re Breaking Barriers — And How You Can Too

Honestly, my non-negotiables aren’t groundbreaking, but ever since I’ve put them front and center, communicated them to my team and decided to live by them, the difference has been transformational. Thanks to these non-negotiables, my company, Society22 PR, made it on Inc.’s Fastest Growing Companies list, and we have been able to nurture a company culture that’s beyond what I dreamed.

So yes, these reflections on my non-negotiables have reshaped my approach to business. It’s not just about setting boundaries; it’s about creating a space where you, your team and your business can thrive. And let me tell you, the result has been pretty great.

AFFILIATE MARKETING

How to Build and Maintain Strong Agency-Client Relationships

Opinions expressed by Entrepreneur contributors are their own.

For marketing, advertising and PR firms, the relationships built between the company and clients are critical for driving repeated business, sustained growth and positive word of mouth. Maintaining these vital relationships is becoming increasingly difficult due to a fiercely competitive market where clients are looking for higher engagement, lower costs and better quality products and services.

The good news is that maintaining strong relationships with your clients is well-known to promote high retention rates and better revenue. One study found that customers who form a strong emotional connection with a brand have a 300% higher lifetime value compared to consumers who failed to build a relationship. For agency leaders, it’s important to have strategies in place to build and foster strong, long-lasting relationships with your clients.

Related: How to Make Your Clients Love Working With You

1. Set clear expectations and deliver on your promises

One of the best ways to build a relationship with your customers is by always delivering superior products and services. However, accomplishing this starts at the beginning of the relationship by setting clear expectations on what they can expect. Being transparent about the intended outcome, delivery timeframes and communication helps avoid any frustration that might come from misunderstandings or misaligned expectations.

For new firms, it’s especially important to impress your potential clients. Unfortunately, too many companies make big promises that they can’t successfully deliver. By overpromising, you set your customer up for potential disappointment. Instead, always offer realistic expectations with the intention of over-delivering. The customer will be impressed when you are able to deliver the marketing campaign in three weeks when you originally set an expectation of 25 business days. You might even throw in an unexpected freebie or perk that they weren’t expecting. By always keeping your promises and over-delivering when possible, you’ll build a relationship based on trust and will be recognized as a reliable business partner.

2. Focus on creating value first

Selling your services is an important part of growing revenue for your business. However, focusing solely on what you can get out of your customers could be sabotaging your ability to build strong relationships with your clients. Instead, focus on first providing them with value. This starts well before you sign your first contract. When clients see tangible value and benefits immediately from working with your business, they are more likely to reciprocate by remaining loyal customers to your company.

3. Communication, communication, communication

Sustaining an ongoing relationship with your clients requires connecting on a regular basis, even if they aren’t ready to purchase from you again. The problem is that many companies focus on connecting with their clients only when they want to make a new sale. This isn’t an effective way to build strong customer relationships because it can be perceived that you only care about them when they have something you want (i.e., their money).

Taking the time to check in with your clients on a regular basis is a great way to maintain a strong relationship. This also helps eliminate tension and remove the defenses that come up when every contact ends up being a sales pitch. These check-ins can be in-person meetings, phone calls or even a simple email.

It’s important to understand that no two clients are the same. Finding ways to tailor your communication to their preferences and needs lets the client know that you understand their needs, challenges and goals.

Related: 4 Tips to Forge Winning Client Relationships for the Long-Term

4. Own your mistakes

From time to time, your agency is going to make a mistake or upset a customer. That’s unavoidable. You’re going to miss a deadline, deliver an advertisement that should have never made it past the quality control process or drop the ball entirely. How your business responds to these issues can make a huge difference with your customers. Owning the mistake, being transparent about what happened and proactively working on a solution, lets them know that you care about resolving the issue.

Delivering difficult news or discussion challenges is never easy. By demonstrating your willingness to address challenges head-on and find mutually beneficial solutions, you’ll strengthen your client relationships and position yourself for long-term success.

5. Learn from failure through continuous improvement

Sometimes, you’ll lose clients no matter what your business does. This can be painful, especially if it’s a major client that generates a significant portion of your revenue. While the goal is to retain your clients, there is a silver lining to client turnover. As frustrating as it might be, always try to part ways on good terms. You never know when they might decide to come back to your business. A good way to do this is by offering them some form of value on their way out. For example, if you operate a digital marketing firm, you show good faith by supporting their transition to the next agency.

Also, taking the time to understand why they are leaving can highlight opportunities for improvement. Over time, taking action on these lessons can greatly strengthen your processes and ensure you avoid any roadblocks to building and sustaining long-term customer relationships.

Related: 5 Ways Your Agency Can Improve the Client Experience

Acquiring new customers is not only challenging, but expensive as well. It’s much more effective to spend time retaining the customers you have. By building strong customer relationships, entrepreneurs can protect their revenue and position their companies for growth and success despite operating in the competitive world of marketing, advertising and PR.

-

MARKETING6 days ago

MARKETING6 days agoNavigating the Video Marketing Maze: Short-Form vs. Long-Form

-

SEO7 days ago

SEO7 days agoGoogle March 2024 Core Update Officially Completed A Week Ago

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 26, 2024

-

WORDPRESS7 days ago

WORDPRESS7 days agoNew WordPress.com Themes for April 2024 – WordPress.com News

-

SEARCHENGINES4 days ago

Daily Search Forum Recap: April 29, 2024

-

SEARCHENGINES5 days ago

SEARCHENGINES5 days agoOffline For Last Days Of Passover 5784

-

MARKETING5 days ago

MARKETING5 days agoMicrosoft unveils a new small language model

-

PPC4 days ago

PPC4 days agoHow to Promote Your Digital Marketing Agency: 4 Growth Strategies