OTHER

Is Meta Platforms Stock Still a Buy After Hitting a New 52-Week High?

Meta Platforms (META 1.95%) was one of the S&P 500‘s hottest stocks last year, rising by an impressive 194% in 2023. It bounced back in a big way after a disappointing 2022 when its share price tanked by 64%.

The stock still shows no sign of slowing down as it recently hit new 52-week highs. Is Meta Platforms’ stock going to generate strong returns yet again this year, or is now the time for investors to consider cashing out?

Why Meta Platforms stock continues to rally

Investors became bearish on Meta Platforms’ business in 2022 as a weak ad market resulted in lackluster sales growth for the company. Towards the end of the year, the company struggled to generate any growth at all. But in recent quarters and amid a more favorable outlook for the economy, the business has been rebounding — in a big way.

META Revenue (Quarterly year-over-year growth), data by YCharts.

With revenue growth back above 20%, Meta has convinced investors that it’s still a top growth stock to own. One thing that could derail these numbers, however, is if the ad market slows down. In the latest quarter, which ended on Sept. 30, 2023, Meta reported that ad impressions on its family of apps segment (which includes Instagram, WhatsApp, Messenger, and Facebook) grew 31% year over year, but the average price per ad declined by 6%.

That’s a fairly high growth rate in ad impressions and may be unsustainable. Other factors that may have influenced that strong growth include companies moving away from TikTok due to government bans and X (formerly known as Twitter) due to policy changes, and spending their ad money on Facebook and Instagram instead. But that kind of growth may be a bit too optimistic to continue to expect this year, especially if a recession takes place and companies scale back their ad spending.

Is Meta Platforms stock too expensive?

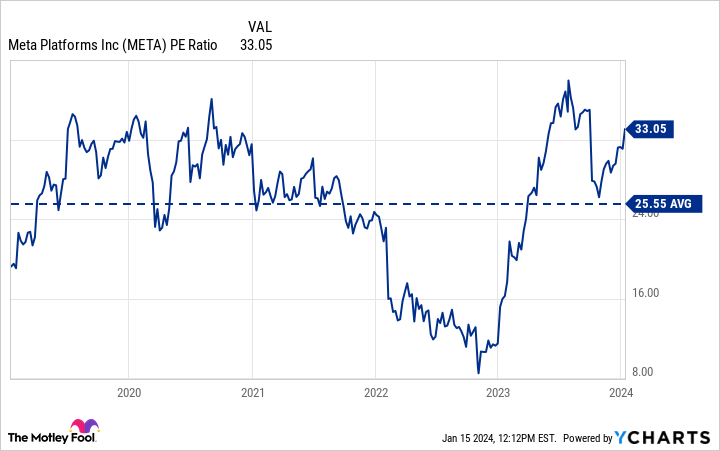

Due to Meta’s run-up in price over the past year, the stock is now trading at a price-to-earnings multiple of 33. That’s a high multiple compared with the stock’s five-year average, which includes some heavy discounts in 2022.

META PE Ratio data by YCharts.

On Wall Street, the consensus analyst price target is about $358 — slightly below its current price — indicating that analysts may be worried about how much more upside could be left for Meta’s stock this year.

Is Meta Platforms stock still a buy in 2024?

If you’ve made a good profit on Meta Platforms over the past year, now may be a good time to consider selling the stock. At a near $1 trillion valuation, Meta looks overpriced given that its growth rate may be unsustainable; investors are currently paying a steep multiple which prices in a lot of future earnings growth, which is by no means a certainty.

To make matters worse, Meta also has a cash-burning metaverse segment, Reality Labs (it incurred operating losses totaling $11.5 billion over the first nine months of 2023), which could be a drag on its bottom line for years to come.

If Meta were to maintain a 20% growth rate or better for the long haul, the stock’s price could prove to be justifiable. But I’m not optimistic that the company can continue to grow at such a high rate, which is why I believe long-term investors are better off looking elsewhere for good growth stocks to buy.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.