OTHER

Microsoft Achieves Historic $3 Trillion Valuation, Riding the AI Wave

Microsoft has become the second company ever to achieve a market valuation exceeding $3 trillion.

This significant achievement, driven by the artificial intelligence (AI) boom, cements Microsoft’s position as a technological powerhouse and underscores the transformative impact of AI on the company’s growth trajectory.

Microsoft is Soaring to New Heights

Microsoft’s ascent to the $3 trillion club was propelled by a surge in its stock price, rising by nearly 1.5% to approximately $405 per share. This places Microsoft in rarefied air alongside Apple, the only other company to have reached this historic valuation threshold. The achievement is not only symbolic but also highlights the remarkable financial prowess of tech giants in today’s market landscape.

For context, Microsoft’s market value now surpasses the entire Gross Domestic Product (GDP) of France and closely trails that of the United Kingdom. This meteoric rise is a testament to the company’s resilience, strategic vision, and its pivotal role in the tech industry’s evolution.

AI Enthusiasm is Driving Growth

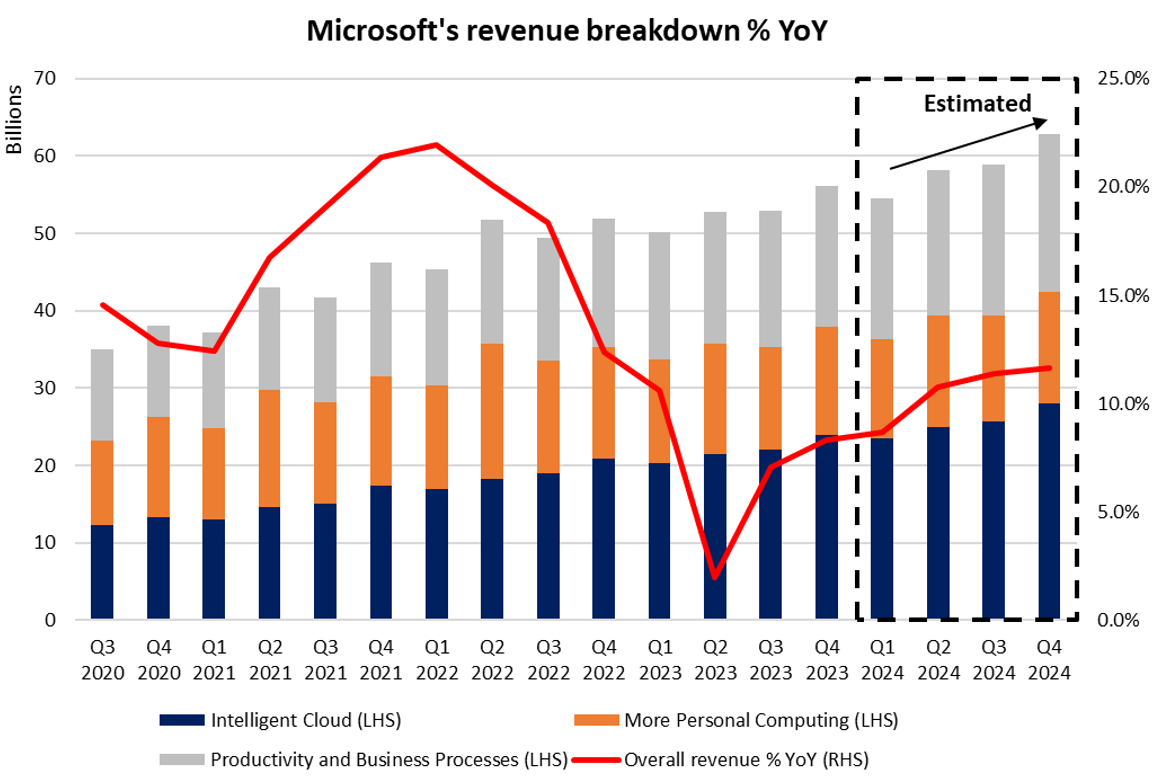

The surge in Microsoft’s stock, up more than 7% year-to-date and around 40% last year, is largely attributed to heightened investor enthusiasm surrounding AI. The company’s CEO, Satya Nadella, demonstrated his commitment to the AI sector with a multibillion-dollar investment in 2023. This strategic move aimed at commercializing AI tools, including the integration of advanced technologies like ChatGPT into Microsoft’s suite of products, has positioned the company at the forefront of the AI revolution.

Nadella’s foresight in recognizing the potential of AI for growth and innovation has been a driving force behind Microsoft’s market success. The company’s collaboration with OpenAI, a leading player in the AI landscape, further solidified its position as a key player in shaping the future of artificial intelligence.

Analysts, recognizing the strategic significance of AI for Microsoft, have predicted further growth for the company. Morgan Stanley analysts, in a recent note, emphasized Microsoft’s strengthening play in AI and adjusted their price target for the stock to $450 from $415. Bank of America analysts echoed this sentiment, projecting more growth for the Washington-based tech giant in the coming quarter with a revised target of $450 per share.

The integration of AI technologies across Microsoft’s product offerings, from cloud services to productivity tools, positions the company to capitalize on the evolving demands of the digital era. As AI continues to reshape industries and drive innovation, Microsoft’s commitment to staying at the forefront of this technological wave reinforces its standing as a global tech leader.

Ever Changing Market Dynamics

Microsoft’s journey to a $3 trillion valuation reflects its resurgence as a dominant force in the technology sector. Having briefly surpassed Apple as the world’s most valuable publicly traded company earlier in January, Microsoft has emerged as a key player in what is colloquially referred to as the “Magnificent 7.” This elite group, including Apple, Nvidia, Amazon, Alphabet, Meta, and Tesla, has been instrumental in propelling markets to record highs.

The influence of these tech giants is profound, with Microsoft alone constituting 7.3% of the S&P 500. Collectively, the Magnificent 7 boast a market capitalization larger than that of entire stock markets of many countries. Microsoft’s significance in this group highlights its role as a market mover and a bellwether for the broader tech landscape.

Microsoft’s Pinnacle in the Tech Landscape

Microsoft’s achievement of a $3 trillion valuation is not just a financial milestone but a reflection of its enduring relevance and adaptability in a rapidly evolving tech landscape. The company’s strategic bets on AI, coupled with effective leadership under Satya Nadella, have propelled it to new heights. As Microsoft continues to shape the future of technology, its journey beyond the $3 trillion mark signifies not only a financial triumph but a testament to its resilience, innovation, and sustained impact on the global tech stage.