Few WordPress features offer more return on your learning investment than block patterns.

WORDPRESS

New WordPress Plugin Allows Publishers to Earn ETH for Ad Space

WordPress publishers can now interact with Ether as a new plugin for the leading cryptocurrency is now live. Known as “EthereumAds,” the new plugin was launched on December 10. Per the plugin descriptions, users can now sell ad space on their blogs and websites and get paid in Ether using smart contracts.

Give Ads, Earn ETH

The plugin essentially opens ad space upon installation and auction space every two weeks. The highest bidder gets the ad space, and they pay into your account.

EthereumAds works for all kinds of online platforms- websites, blogs, and billboards. Users can earn commissions on ads, regardless of whether their content is crypto-related or not.

The EthereumAds website shows how the service works in greater detail. It’s a bit like Google Adsense but without the tedious application process. It seems the EthereumAds runs as a plug and play. You don’t need any serious registration process here. But, you’ll need an Ethereum wallet to receive your earnings.

It’s unlikely that publishers will abandon the tried and trusted Adsense in favor of the new kid on the block. But, EthereumAds still represent a breath of fresh air. Google’s Adsense has had a frigid history with the crypto space. Last January, Decenter, a major smart contract auditing firm, accused Google of blacklisting keywords mentioning Ethereum on its advertising platform.

Decenter explained that they were a group of developers working with smart contracts and security audits. The company pointed out that its developers saw error messages when trying to use the “Ethereum security audits” and “Ethereum development services” keywords. In response, the Google Ads official account answered:

“Although we wouldn’t be able to preemptively confirm if your keyword is eligible to trigger ads, we’d recommend that you refer to the ‘Cryptocurrencies’ section of our Policy on Financial products and services.”

The search engine giant further added that crypto exchanges could advertise on AdSense if they targeted users in Japan and the United States. So, the rejection was most likely due to Decenter targeting some other regions with their searches.

Liberating Ad-Hungry Crypto Companies from Google

The AdSense platform has also been accused of running ads for fraudulent crypto platforms. In April, crypto exchange CoinCorner reported that the ad platform was running ads for its phishing clone site, CoinCornerr.com.

Molly Spiers, the exchange’s marketing manager, told news sources that they had noticed the first fraudulent ad after searching for “CoinCorner” on Google.com and Google.co.uk. While CoinCorner themselves have struggled to place ads on Google for years, the phishing site had little to no problems getting in.

Now that EthereumAds is available, crypto companies should be able to effectively run their ads without having to deal with Google’s endless bureaucracy. However, the plugin will also need a system to separate legitimate crypto firms from phishing sites like CoinCornerr.com.

Author: Jimmy Aki

Jimmy has been following the development of blockchain for several years, and he is optimistic about its potential to democratize the financial system.

WORDPRESS

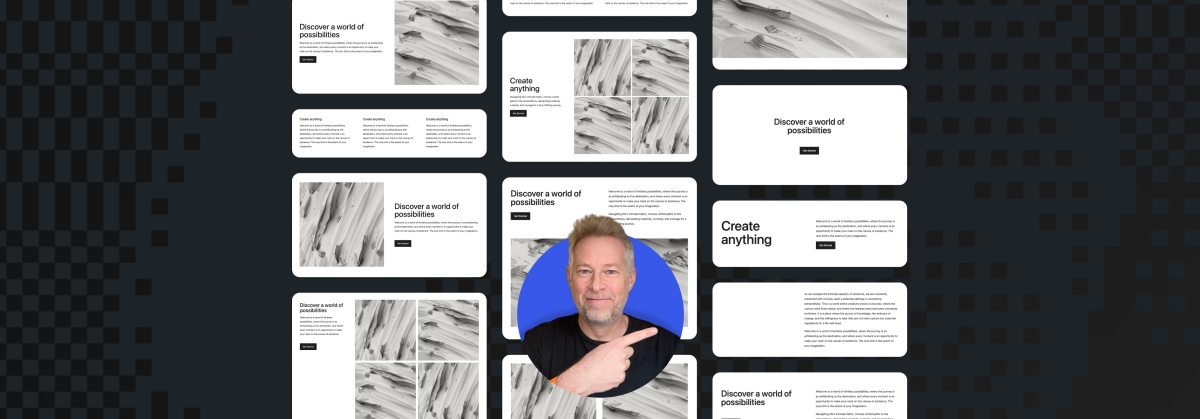

WordPress Block Patterns Give You Superpowers – WordPress.com News

With the power of block patterns you’ll be a WordPress superstar in no time, whether you’re an establish pro or just starting out. Block patterns are professionally designed layouts that you can add your site in a single click. What makes them especially powerful is that once they’re inserted, you can edit and customize every aspect. (Or, you can leave them be!)

In today’s Build and Beyond video, Jamie Marsland walks you through everything you need to go to become a block pattern expert, in under four minutes.

Get started on your site today with a free trial:

Join 110.2M other subscribers

WORDPRESS

Astra Theme Coupon 2024 (Apr) [40% Discount, Save $400]

![Astra Theme Coupon 2024 (Apr) [40% Discount, Save $400] Astra Pricing Plans on discounts](https://articles.entireweb.com/wp-content/uploads/2024/04/1713797772_611_Astra-Theme-Coupon-2024-Apr-40-Discount-Save-400.png)

Do you want higher discount on kartra?? We are excited to announce that our Astra Theme Coupon Codes are now available!

Astra is a well-liked, multifunctional WordPress theme that is frequently used by bloggers, companies, and online shops among the other themes.

It is a thin, quick, adaptable, and somewhat pricey theme that offers customers a simple base on which to create their websites.

So if you are thinking about buying astra theme, This article will be a gold mine for you.

In this article, we are sharing every single detail related to Astra Theme Coupon, So you can get the maximum discount on their plan.

Astra Offers Summary:

| Total Coupons | 7 Offers |

| Maximum Discount | Up to 50% OFF |

| Maximum Saving | Up to $400 |

| Astra Plans For Offer | Annual and Lifetime |

| Money-Back Guarantee Offer | 14 Days |

New Offers on Astra-

Lastest Astra Theme Coupons

Best for Individual Site or Bloggers.

Astra Pro Coupon – For Lifetime Plan Value for Money

Get All Astra Pro Features with 100+ Templates and Unlimited Sites License. This One-time Investment can save you hundreds of dollars later.

Best for Individual Site or Bloggers, Business Site. (Most Selected)

Best Plan for Freelancers and New Web Designers.

Best Plan for Freelancers and New Web Designers. (Our Recommendation for Business)

Best Plan for Agencies and StartUps.

Best Plan for Agencies and StartUps.

Astra New Year 2024 Sale

Astra is celebrating 1 Million Installations and Offering up to 63% Off on their Plans. (Default offer from the WP Astra)

Save Big with Astra Special Sale on Every Plan. [Maximum Saving]

Note: Some coupon codes may have restrictions and are only valid for specific packages.

Easy Steps To Follow-

How To Use Coupon To Get Astra Discount

Here are some simple steps that you can follow and get discount on any Astra theme plans:

Step 1: Choose the Astra Theme package that you wish to purchase. There are three options available: Astra Pro, Essential Bundle, and Growth Bundle.

![Astra Theme Coupon 2024 (Apr) [40% Discount, Save $400] Astra Pricing Plans on discounts](https://articles.entireweb.com/wp-content/uploads/2024/04/1713797772_611_Astra-Theme-Coupon-2024-Apr-40-Discount-Save-400.png)

Step 2: Add the desired package to your cart and proceed to checkout.

Step 3: On the checkout page, you will find a coupon code box where you can enter the coupon code.

Step 4: Enter the coupon code in the designated field and click on the “Apply Coupon” button.

![Astra Theme Coupon 2024 (Apr) [40% Discount, Save $400] Astra Theme Coupon Code on checkout](https://articles.entireweb.com/wp-content/uploads/2024/04/1713797773_676_Astra-Theme-Coupon-2024-Apr-40-Discount-Save-400.png)

Step 5: Once the coupon code is applied, you will see the discount reflected in the final price.

Step 6: Complete the payment process and make the purchase.

It’s that simple! By using the Astra Promo Code, you can save a considerable amount on your purchase of the Astra Theme. Make sure to use the coupon code before it expires to take advantage of the discount.

Choose The Best Plan For You-

Astra Theme Plans With Discount

Here we are sharing all the details of astra theme plans, so you can choose the best plan for you and get dicount:

Astra Pro offers hundreds of customization options to simplify and accelerate the process of creating your desired website. Normally priced at:-

- $59 per year or

- $299 for a lifetime,

But you can take advantage of our Astra theme coupon Codes and save $12 annually or $72 for a lifetime purchase by getting Astra Pro for $47 per year or $227 for a lifetime.

With Astra Pro, you will have access to numerous features that will elevate your website to new heights. These include:-

- Advance Header Builder,

- Advance Blog Layouts,

- Sticky Header,

- Custom Layouts & Hooks,

- Advance Typography,

- Advanced Colors Options,

- Mega Menu,

- Global Color Palettes,

- Advance Footer Builder,

- WooCommerce Controls,

- Native AMP Support,

- White Label,

- Product Updates,

- Premium Support,

- Unlimited Website Usage,

- Extensive Training,

- Risk-Free Guarantee.

The Essential Bundle from Astra Theme offers a complete solution for building exceptional websites. This Bundle comes with premium website templates and addons to enhance your preferred page builder.

Essential Bundle have two payment option:

- a one-time payment of $677.

- an annual payment of $137.

But you can take advantage of our Astra Coupon Code and save $32 annually or $172 for a lifetime purchase.

With the Essential Bundle, you will have access to all the necessary tools to create stunning and functional websites that stand out from the competition, including:-

- Astra Pro (i.e. all features of Astra Pro),

- 180+ Premium Starter Templates,

- WP Portfolio Plugin,

- Choice of One Page Builder Addon,

- Ultimate Addons for Elementor OR Ultimate Addons for Beaver Builder,

- Product Updates,

- Premium Support,

- Unlimited Website Usage,

- Extensive Training,

- Risk-Free Guarantee.

The Growth Bundle from Astra Theme is the most sought-after choice among users, providing a complete set of tools required to establish and expand your online business.

Growth Bundle have two payment option:

- An annual payment of $187

- A one-time payment of $937

But you can take advantage of our Astra Discount Code and save $62 annually or $7312 for a lifetime purchase.

The Growth Bundle grants access to everything you need to take your business to the next level, including:-

- Everything in Essential Bundle, and

- Convert Pro Plugin,

- Schema Pro Plugin,

- Ultimate Addons for Beaver Builder,

- Ultimate Addons for Elementor,

- Spectra Pro (Coming Soon),

- SkillJet Academy Membership,

- Our Future Products,

- Product Updates,

- Premium Support,

- Unlimited Website Usage,

- Extensive Training,

- Risk-Free Guarantee.

Points To Keep in Mind-

Astra Terms and Policy For Coupons

This section refers to the terms and conditions associated with the use of coupons offered by Astra Theme. so here are some points that you should keep in mind while applying coupon on Astra plans:

- Coupon Validity: Coupons may have a specific expiration date and can only be redeemed within that time frame.

- Eligibility: Some coupons may only be available to new customers or certain users, while others may be available to everyone.

- Coupon Usage: Coupons may only be used once per customer and may not be combined with any other offers or discounts.

- Discount Amount: Coupons may provide a fixed dollar amount off the purchase price or a percentage off.

- Product Restrictions: Some coupons might only be usable for a particular product or set of products.

- Payment Method: Some coupons might only be redeemed with specific payment options, like PayPal or a credit card.

- Terms and Conditions: Coupons are subject to Astra Theme’s terms and conditions, which include but are not limited to its refund policy and privacy policy.

- Changes and Updates: Astra Theme reserves the right to modify or discontinue coupons at any time without prior notice.

Our Opinion-

Conclusion- WP Astra Theme Coupon 2024

Astra is a robust and adaptable WordPress theme that is ideal for online stores, enterprises, and bloggers. It is the best option for anyone wishing to create a website that looks professional thanks to its responsive design, user-friendly interface, and vast selection of pre-designed themes.

Users can build up an online store quickly and easily with the help of the rich customization options and WooCommerce connection available in the Astra Pro version.

An excellent option for anyone wishing to develop a website, Astra’s many plans offer a solution for various demands and budgets.

With our Astra theme discount code, you’ll be able to build a beautiful, fast, and user-friendly website that meets all of your needs without breaking the bank. Don’t miss out on this opportunity to take advantage of our Astra discount and create the website of your dreams.

Frequently Asked Question

Quries Related To Astra Coupon

How can I use the Astra discount code?

The Astra Coupon Code is a unique promotional code that Astra Theme provides to its clients. Simply enter the code in the corresponding field during checkout when ordering Astra Pro or Growth Bundle to use it. Your total will be adjusted automatically to reflect the savings.

How frequently are new Astra promo codes released?

Astra discount codes are frequently provided during special sales and occasions, such holidays or the introduction of new products. The Astra website should always be checked, though, for the most recent deals and discounts.

How much discount will I get with the Astra Coupon Code?

The amount of discount you receive with an discount code varies depending on the offer. You can expect to save anywhere from 10% to 50% off the regular price of Astra Pro or Growth Bundle.

Can I use the Astra theme discount Code on renewals or upgrades?

Yes, the Astra discount code can be used for both renewals and upgrades of Astra Pro or Growth Bundle.

How many coupons I can use on single purchase?

On Astra Theme, you can apply only one coupon on single purchase, and you can apply your next coupon on another purchse

Does Astra Provide any Lifetime offer?

Yes, Astra provide lifetime offer on both Pro and bundle plan, so you can make one time payment and enjoy lifetime.

Does Astra Offeres any student discount?

No, astra does not offer any student discount, as a student you can use our astra coupon and get discount on any plan you want.

WORDPRESS

Elementor Pro Discount (Apr 2024) [70% OFF, Save $150]

![Elementor Pro Discount (Apr 2024) [70% OFF, Save $150] Elementor Coupon](https://articles.entireweb.com/wp-content/uploads/2024/04/1713729377_Elementor-Pro-Discount-Apr-2024-70-OFF-Save-150.png)

Looking For the highest discount on Elementor Pro?? We have the latest and most active Elementor coupon, so you can buy Elementor at a discounted price.

If you are someone who wants to buy a plugin that helps you to create a website as easily as possible then we can say, nothing better than Elementor.

In this article, we are sharing all the details that will help you to get a discount on Elementor.

So you can buy this tool at a discounted price.

Elementor Offers Summary:

| Total Coupons | 14 Offers |

| Max Discount | 70% Discount |

| New Offer Price | $59/month |

| Total Saving | Up to $200 |

| Money-back Guarantee Offers | Yes |

Latest & Active Offers-

Elementor Coupons 2024

Elementor Pro Plugin

$59-$399

Get Elementor Pro Plugins at the Best Price.

Elementor PRO Plans have a Flat Price, It offers Discounts and Deals only on Some Occasion.

$

Elementor Page Builder Plugin Coupons:

Get a Discount on Elementor Personal Plan to Create Amazing Pages/Posts on 1 Website with 50+ Pro Widgets + 300+ Pro Templates with support & update. (10+ Website Kits)

Best for Individual Blogger and Business Sites.

Get a Discount on Elementor Personal Plan to Create Amazing Pages/Post on 3 Websites with 50+ Pro Widgets + 300+ Pro Templates with support & update. (10+ Website Kits)

Best for bloggers who own 1+ sites and bloggers.

Get a Discount on Elementor Personal Plan to Create Amazing Pages/Post on 25 Websites with 50+ Pro Widgets + 300+ Pro Templates with support & updates. (10+ Website Kits)

Best for Web Designers and Freelancers.

Get a Discount on Elementor Agency Plan to Create Amazing Pages/Posts on 1,000 Websites with All PRO Features & VIP Support. (New 10+ Website Kits)

Best for Developers, Web Agencies, and Freelancers with Client Management.

Elementor Hosting Plans Coupons:

Website: 1

Storage: 10 GB

Monthly Visits: 25,000

Bandwidth: 30GB/mo

New Plan from Elementor, Host Elementor Website with Elementor.

Website: 1

Storage: 20 GB

Monthly Visits: 50,000

Bandwidth: 50GB/mo

New Plan from Elementor, Host Elementor Website with Elementor.

Website: 3

Storage: 25 GB

Monthly Visits: 5,000

Bandwidth: 75GB/mo

New Plan from Elementor, Host Elementor Website with Elementor.

Website: 10

Storage: 40 GB

Monthly Visits: 100,000

Bandwidth: 100GB/mo

New Plan from Elementor, Host Elementor Website with Elementor.

Host your 1 Website with Elementor Hosting Solution and Get Elementor Pro Plugin also. Elementor hosting has all the essential features for your optimized website.

New Plan from Elementor, Host Elementor Website with Elementor.

Elementor Non-Profit Discount

Elementor Pro offers the same pricing plans for everyone, Non-profits or organizations can avail of its regular offers and discounts.

Easy Steps To Follow-

How To Apply Coupon And Get Discount

After getting some of the best coupons from the above coupon list, it is also important to learn how to use these coupons and get a discount on your favorite plan.

So in this section, you mentioned some steps that you can follow, and get a discount on Elementor plans.

Step1. Visit To Official Website:

Start by visiting the official Elementor website and go to their pricing section.

Step2. Choose Your Plan:

Select the Elementor plan you want to purchase. Elementor offers both a free version and paid plans with additional features and support. Choose the plan that aligns with your requirements.

![Elementor Pro Discount (Apr 2024) [70% OFF, Save $150] Elementor Plugin Pricing For Coupon](https://articles.entireweb.com/wp-content/uploads/2024/04/1713729367_34_Elementor-Pro-Discount-Apr-2024-70-OFF-Save-150.png)

After selecting your desired plan, click on the “Buy Now” button to proceed to the checkout page.

Step4. Add Your Coupon:

On the checkout page, you’ll find a field labeled “Enter code”, Enter the coupon code you have in this field.

![Elementor Pro Discount (Apr 2024) [70% OFF, Save $150] Applying Coupon on elementor checkout page](https://articles.entireweb.com/wp-content/uploads/2024/04/1713729367_937_Elementor-Pro-Discount-Apr-2024-70-OFF-Save-150.png)

After entering the coupon code, click on the “Apply” button next to the coupon code box. The discount associated with the coupon code will be applied to your total purchase price.

Step6. Review Your Order Summary:

Review your order summary to ensure the discount has been applied correctly. Once you’re satisfied, proceed to enter your payment details and complete the purchase.

You are done!!

Choose The Best Plan-

Elementor Plans For Coupon

![Elementor Pro Discount (Apr 2024) [70% OFF, Save $150] Elementor plans for coupons](https://articles.entireweb.com/wp-content/uploads/2024/04/1713729368_26_Elementor-Pro-Discount-Apr-2024-70-OFF-Save-150.png)

Here we are sharing some best plans for you, Elementor Pro offers a range of plans designed to cater to various needs, from basic website creation to managing a large number of sites for agencies.

The Essential plan is the entry-level option, which is ideal for individuals looking to build a single basic website. It includes access to 50 Pro Widgets, Theme Builder, Dynamic Content, Form Builder, Popup Builder, and more.

Premium support is also part of the package, ensuring users can get help when they need it. this plan will cost you $59 per year

The Advanced plan offers up to 3 sites. It includes all the features of the Essential plan, plus additional Pro Widgets, bringing the total to 82. This plan is suited for professionals and those looking to create e-commerce websites.

This plan is particularly beneficial for eCommerce websites, as it includes WooCommerce Builder, which allows for the creation of custom product pages, and other E-commerce features. this plan will cost you $99 per year.

Expert plan is made for freelancers who manage multiple sites, the Expert plan allows for up to 25 sites. It shares the same features as the Advanced plan but increases the number of sites significantly.

This plan is ideal for those who require advanced customization options, integrations, and the ability to support e-commerce on a larger scale. this plan will cost you $199 per year.

For larger operations, the Agency plan allows for up to 1000 sites, It includes all the features available in the Expert plan, This plan is made for high-growth agencies that require premium support and resources to manage their online presence effectively. This plan will cost you $399 per year.

Additional Information-

Why Choose Elementor Pro?

As we have discussed Elementor Pro coupons and getting this tool at a discounted price, is it worth trying this tool?? So in this section, we mentioned some features that will help you decide, whether elementor is made for you, or not.

![Elementor Pro Discount (Apr 2024) [70% OFF, Save $150] Why Choose Elementor Pro?](https://articles.entireweb.com/wp-content/uploads/2024/04/1713729369_979_Elementor-Pro-Discount-Apr-2024-70-OFF-Save-150.png)

1. Drag-and-Drop Editor:

Elementor Pro gives you a super easy way to design your website using a drag-and-drop editor. It’s like playing with building blocks, you just drag elements like text, images, buttons, and more onto your page and arrange them however you want.

2. Templates Library:

With Elementor Pro, you get access to a library of ready-made templates for different parts of your website, like headers, footers, and entire page layouts. You can choose a template that fits your style and customize it to make it your own.

3. Theme Builder:

This feature lets you create custom designs for every part of your website, including headers, footers, and archive pages. You can design these templates once and apply them across your entire site, giving it a consistent look and feel.

4. WooCommerce Builder:

If you’re running an online store with WooCommerce, Elementor Pro makes it easy to design your product pages and checkout process. You can customize every aspect of your store’s design to match your brand and attract more customers.

5. Popup Builder:

Elementor Pro includes a powerful popup builder that allows you to create eye-catching popups for your website. Whether you want to promote a special offer, grow your email list, or get feedback from visitors, you can design beautiful popups that grab attention without being annoying.

6. Advanced Widgets:

In addition to the basic elements like text and images, Elementor Pro includes a variety of advanced widgets to help you create more dynamic and interactive content. These widgets let you add things like testimonials, pricing tables, countdown timers, and more to your pages with ease.

7. WooCommerce Integration:

If you’re running an online store using WooCommerce, Elementor Pro offers specialized features tailored to e-commerce needs. You can design stunning product pages, custom checkout forms, and engaging product galleries to showcase your merchandise effectively.

8. Support and Updates:

When you upgrade to Elementor Pro, you gain access to a dedicated support team ready to assist you with any questions or issues you may encounter along the way.

Additionally, you’ll receive regular updates packed with new features, enhancements, and bug fixes, ensuring that your website stays current, secure, and optimized for performance.

Frequently Asked Questions-

Queries Related To Elementor Coupon

Are there any Elementor promo codes for first-time users?

There are no specific coupons for first-time users, but As a first-time user, you can try the elementor free plan and experience this tool.

What is the maximum discount on elementor?

You can get up to 70% discount on elementor plans.

How to find the latest Elementor coupons?

To get updated with the latest discounts and coupons, you have to follow GoForTrial Social Media Profiles.

How to use Elementor promo code?

Using a promo code is a very easy process, simply you have to choose a plan and move to the checkout page, you will see the “enter coupon code” box so there you have to enter your coupon and get a discount.

Can I use more than one coupon on one purchase?

No, you can use only one coupon at once, another coupon you can use on the second purchase.

Does elementor provide any lifetime offers?

No, Elementor does not provide any lifetime offer, you can only buy monthly and yearly plans.

What if the elementor coupon doesn’t work?

Every coupon has come expiration date, so most of the time when a coupon expires then it does work, so try to find a new coupon.

What is the upcoming sale on elementor?

Summer sale will be the upcoming sale on elementor, so if you are looking for a huge discount, then you can wait for the summer sale.

-

PPC5 days ago

PPC5 days ago19 Best SEO Tools in 2024 (For Every Use Case)

-

MARKETING6 days ago

MARKETING6 days agoStreamlining Processes for Increased Efficiency and Results

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 17, 2024

-

SEO6 days ago

SEO6 days agoAn In-Depth Guide And Best Practices For Mobile SEO

-

PPC6 days ago

PPC6 days ago97 Marvelous May Content Ideas for Blog Posts, Videos, & More

-

SEARCHENGINES5 days ago

Daily Search Forum Recap: April 18, 2024

-

MARKETING6 days ago

MARKETING6 days agoEcommerce evolution: Blurring the lines between B2B and B2C

-

SEARCHENGINES4 days ago

Daily Search Forum Recap: April 19, 2024

![Astra Theme Coupon 2024 (Apr) [40% Discount, Save $400] Astra Pricing Plans on discounts](https://articles.entireweb.com/wp-content/uploads/2024/04/1713797772_611_Astra-Theme-Coupon-2024-Apr-40-Discount-Save-400-400x240.png)

![Astra Theme Coupon 2024 (Apr) [40% Discount, Save $400] Astra Pricing Plans on discounts](https://articles.entireweb.com/wp-content/uploads/2024/04/1713797772_611_Astra-Theme-Coupon-2024-Apr-40-Discount-Save-400-80x80.png)

![Elementor Pro Discount (Apr 2024) [70% OFF, Save $150] Elementor Coupon](https://articles.entireweb.com/wp-content/uploads/2024/04/1713729377_Elementor-Pro-Discount-Apr-2024-70-OFF-Save-150-400x240.png)

![Elementor Pro Discount (Apr 2024) [70% OFF, Save $150] Elementor Coupon](https://articles.entireweb.com/wp-content/uploads/2024/04/1713729377_Elementor-Pro-Discount-Apr-2024-70-OFF-Save-150-80x80.png)

![Elementor Pro Discount (Apr 2024) [70% OFF, Save $150] Elementor Pro Plugin](https://articles.entireweb.com/wp-content/uploads/2024/04/1713729367_79_Elementor-Pro-Discount-Apr-2024-70-OFF-Save-150.png)