The new app is called watchGPT and as I tipped off already, it gives you access to ChatGPT from your Apple Watch. Now the $10,000 question (or more accurately the $3.99 question, as that is the one-time cost of the app) is why having ChatGPT on your wrist is remotely necessary, so let’s dive into what exactly the app can do.

NEWS

Report Claims Decline in News Media Earnings Not Google’s Fault via @sejournal, @martinibuster

New research produced by Accenture and commissioned by Google claims that decline in Western European news industry revenue was largely due to a catastrophic loss of classifieds revenue.

Loss of News Media Revenue

The news industry tends to blame companies like Google and Facebook for their decline in advertising revenue.

I attended the very first Google Zeitgeist Partner Forum conference in 2005, held at Google’s Mountain View headquarters and listened to keynotes from top executives from companies like the New York Times lay the blame for their declining fortunes on Google.

The loss of advertising revenue in the digital age has been a constant theme for over twenty years around the world and many have pointed to Google as a reason.

But the research report contradicts those claims by providing facts that demonstrate that growth in advertising opportunities are not responsible for displacing traditional advertising.

According to the report:

“…a significant majority (64%) of the growth of online advertising has come from new growth rather than displacing the existing markets of traditional advertising.”

Advertisement

Continue Reading Below

Classified Ad Revenue is Largely to Blame?

According to the new research, collapse of advertising revenue is to blame for declining news revenue in Western Europe. According to the research, nearly 50% of the income loss is due to the decline of the print classifieds at the news organizations and the rise of third party classifieds.

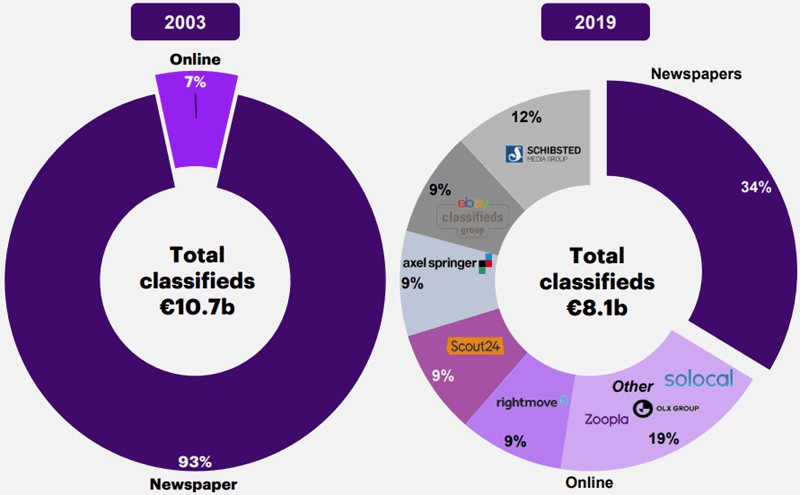

Illustration of Western European News Media Losses

Graph shows that 44% of the decline in Western European ad revenues was due to a loss of classifieds ad earnings

Graph shows that 44% of the decline in Western European ad revenues was due to a loss of classifieds ad earnings

According to the report:

Advertisement

Continue Reading Below

“The data is clear: Almost half of the overall decline of newspaper revenue has come not from Search or social advertising, but from the loss of newspaper classifieds to specialist online players.

…The majority of advertising in newspapers was made of classifieds like selling cars and homes, or listing jobs, and births and deaths notices.

These advertisements, or “classifieds,” contributed €9.9 billion – almost a quarter – of newspaper revenues, and newspapers collected 93% of all classified advertising in 2003.

However, by 2019, only 32% of that revenue was going to newspapers, generating just €2.8 billion, with the drop accounting for 44% of newspapers’ total revenue decline over the period.”

Newspaper Classified Business Picked Up By Specialist Sites

According to the report, Western European news organizations lost their classifieds revenue to niche classified sites that targeted specific verticals.

Print newspapers used to be where consumers and businesses used to advertise autos for sale, job openings, apartments for sale, and even garage sales.

Many of those classified announcements moved to websites that specialized in each of those verticals.

The report named real estate sites Scout24 and Rightmove, job site Totaljobs, and automobile classifieds sites Mobile.de, Automobile.it, Bilbasen and Motors.co.uk as the kinds of sites that are largely responsible for siphoning off classifieds ad revenue.

The report also noted that some of the sites are currently owned or used to be owned by the news media sites themselves.

According to the report:

“Newspapers’ dominance of the classified market has been challenged. The predominant competition has been from ‘pure play’ websites – these focus on specific vertical markets. Online providers gained a two-thirds market share of the classifieds market by 2019.

Many of these pure plays are or were formerly owned by newspaper publishers or media groups. This includes Scandinavian classified business Schibsted, Germany’s Axel Springer, and Spain’s pisos.com, Infoempleo.com and autocasion.com operated by Vocento.”

That means that some of the news organizations complaining about loss of classifieds ad revenue are either still earning it or sold off their classified business.

Advertisement

Continue Reading Below

Although the research report doesn’t explicitly say so, the implication is that the some of blame for the loss of classifieds income is due the actions of the news organizations themselves and some of the complaints about the loss of this business may not have been made in good faith.

News Industry Online Ad Revenue

According to the report, advertising revenue may have declined for print publications (along with their readership) but that online advertising revenue grew from the periods that were researched, from 2003 to 2019.

According to the report:

“…the value of online advertising has grown significantly from €2.2 billion in 2003 to €50.5 billion in 2019, along with growth in all advertising sectors.

But this did not come at the expense of newspaper revenues.”

Are News Organizations Wrong to Blame Google for their Losses?

While this report is about Western European news media, there are interesting facts about Google and Facebook’s role in the decline in Australian news media earnings that may be relevant.

Advertisement

Continue Reading Below

An Australian commission claims that both Google and Facebook have eaten into news organization’s advertising profits.

According to a report in the BBC:

“…an investigation by the commission into the tech firms’ online advertising dominance, which showed that in 2018 for every A$100 (£56; €65) spent by Australian advertisers, A$49 went to Google and A$24 to Facebook.”

The report makes no mention of how much more revenue Western European news media would earn if Google didn’t enjoy a dominant position in online advertising.

The amount of revenue skimmed off by Google and Facebook is not something that was addressed in the Accenture research report commissioned by Google.

As in any dispute between two parties there are always two sides to every story.

It will be interesting to see how news organizations respond to this research.

Citations

Official Google Announcement

Research: What Really Happened to Newspaper Revenue

Link to Accenture report (commissioned by Google)

Western Europe News Media Landscape Trends 2021 (PDF)

Facebook Faces Yet Another Outage: Platform Encounters Technical Issues Again

Uppdated: It seems that today’s issues with Facebook haven’t affected as many users as the last time. A smaller group of people appears to be impacted this time around, which is a relief compared to the larger incident before. Nevertheless, it’s still frustrating for those affected, and hopefully, the issues will be resolved soon by the Facebook team.

Facebook had another problem today (March 20, 2024). According to Downdetector, a website that shows when other websites are not working, many people had trouble using Facebook.

This isn’t the first time Facebook has had issues. Just a little while ago, there was another problem that stopped people from using the site. Today, when people tried to use Facebook, it didn’t work like it should. People couldn’t see their friends’ posts, and sometimes the website wouldn’t even load.

Downdetector, which watches out for problems on websites, showed that lots of people were having trouble with Facebook. People from all over the world said they couldn’t use the site, and they were not happy about it.

When websites like Facebook have problems, it affects a lot of people. It’s not just about not being able to see posts or chat with friends. It can also impact businesses that use Facebook to reach customers.

Since Facebook owns Messenger and Instagram, the problems with Facebook also meant that people had trouble using these apps. It made the situation even more frustrating for many users, who rely on these apps to stay connected with others.

During this recent problem, one thing is obvious: the internet is always changing, and even big websites like Facebook can have problems. While people wait for Facebook to fix the issue, it shows us how easily things online can go wrong. It’s a good reminder that we should have backup plans for staying connected online, just in case something like this happens again.

NEWS

We asked ChatGPT what will be Google (GOOG) stock price for 2030

Investors who have invested in Alphabet Inc. (NASDAQ: GOOG) stock have reaped significant benefits from the company’s robust financial performance over the last five years. Google’s dominance in the online advertising market has been a key driver of the company’s consistent revenue growth and impressive profit margins.

In addition, Google has expanded its operations into related fields such as cloud computing and artificial intelligence. These areas show great promise as future growth drivers, making them increasingly attractive to investors. Notably, Alphabet’s stock price has been rising due to investor interest in the company’s recent initiatives in the fast-developing field of artificial intelligence (AI), adding generative AI features to Gmail and Google Docs.

However, when it comes to predicting the future pricing of a corporation like Google, there are many factors to consider. With this in mind, Finbold turned to the artificial intelligence tool ChatGPT to suggest a likely pricing range for GOOG stock by 2030. Although the tool was unable to give a definitive price range, it did note the following:

“Over the long term, Google has a track record of strong financial performance and has shown an ability to adapt to changing market conditions. As such, it’s reasonable to expect that Google’s stock price may continue to appreciate over time.”

GOOG stock price prediction

While attempting to estimate the price range of future transactions, it is essential to consider a variety of measures in addition to the AI chat tool, which includes deep learning algorithms and stock market experts.

Finbold collected forecasts provided by CoinPriceForecast, a finance prediction tool that utilizes machine self-learning technology, to anticipate Google stock price by the end of 2030 to compare with ChatGPT’s projection.

According to the most recent long-term estimate, which Finbold obtained on March 20, the price of Google will rise beyond $200 in 2030 and touch $247 by the end of the year, which would indicate a 141% gain from today to the end of the year.

Google has been assigned a recommendation of ‘strong buy’ by the majority of analysts working on Wall Street for a more near-term time frame. Significantly, 36 analysts of the 48 have recommended a “strong buy,” while seven people have advocated a “buy.” The remaining five analysts had given a ‘hold’ rating.

The average price projection for Alphabet stock over the last three months has been $125.32; this objective represents a 22.31% upside from its current price. It’s interesting to note that the maximum price forecast for the next year is $160, representing a gain of 56.16% from the stock’s current price of $102.46.

While the outlook for Google stock may be positive, it’s important to keep in mind that some potential challenges and risks could impact its performance, including competition from ChatGPT itself, which could affect Google’s price.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

NEWS

This Apple Watch app brings ChatGPT to your wrist — here’s why you want it

ChatGPT feels like it is everywhere at the moment; the AI-powered tool is rapidly starting to feel like internet connected home devices where you are left wondering if your flower pot really needed Bluetooth. However, after hearing about a new Apple Watch app that brings ChatGPT to your favorite wrist computer, I’m actually convinced this one is worth checking out.

-

PPC6 days ago

PPC6 days ago19 Best SEO Tools in 2024 (For Every Use Case)

-

SEARCHENGINES5 days ago

Daily Search Forum Recap: April 19, 2024

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 18, 2024

-

WORDPRESS6 days ago

WORDPRESS6 days agoHow to Make $5000 of Passive Income Every Month in WordPress

-

SEO7 days ago

SEO7 days ago2024 WordPress Vulnerability Report Shows Errors Sites Keep Making

-

WORDPRESS7 days ago

WORDPRESS7 days ago10 Amazing WordPress Design Resouces – WordPress.com News

-

SEO6 days ago

SEO6 days ago25 WordPress Alternatives Best For SEO

-

WORDPRESS5 days ago

WORDPRESS5 days ago7 Best WooCommerce Points and Rewards Plugins (Free & Paid)