PPC

Five Crucial Aspects of the Most Popular PPC Ad Platforms

Nowadays, it’s rare to find a business that isn’t trying to bolster its online presence, and PPC platforms often play crucial roles in those digital marketing pushes. However, choosing the right platform to showcase your brand and snag potential leads effectively isn’t always easy.

As a newbie in the world of paid media, navigating your way around all the major PPC platforms can be pretty confusing. Especially when you need to figure out which features and options would fit your company’s needs — it’s hardly the same to advertise through optimized explainer videos as it is using CTA-ready static ads!

So, to help you find the best tool for the job, we’ve broken down five critical aspects of the most popular PPC platforms around to make sure you find one (or more) with the features you need to help your online marketing strategy grow.

Google Ads

As the biggest and most popular PPC platform used today, Google Ads has become a cost-effective way for many businesses to reach target audiences through paid media. With online marketplaces becoming overly saturated with competitors, many digital marketers turn to Google Ads to break through the noise and generate brand awareness.

Here are some of the key aspects you need to know about this PPC ad platform:

Reach

If there’s one thing you can expect from the world’s most used search engine, is that it obtains a massive reach. Generating more than 40 thousand search queries every second and 1.2 trillion each year, there isn’t a search engine or platform out there that can offer the audience potential that Google Ads can.

Ad Formats

- Text ads

- Image ads

- Video ads

- Responsive ads

- Product Shopping ads

- Showcase Shopping ads

- Call-only ads

- App promotion ads

Ad Placements

- Ads appear within Google search engine results and other Google search sites.

- They also appear on websites that are a part of Google’s Display Network.

Pricing

Ad costs are unique to businesses as they are dependent on the details of a campaign and ad settings like budget, bid, keywords, and targeting. It also considers performance in the Google ad auction, focusing on its Quality Score and Ad Rank. Having said all that, an average estimate for ad costs would be as follows:

- Average ad spend $9000 to $10,000 per month on big campaigns.

- Average cost-per-click on the Google Search Network: $1 to $2

- Average cost-per-click on the Google Display Network: Less than $1

- Google Ads Management: 12-30% of ad spend per month

- PPC Management Tools: $15 to $800 per month.

Pro

- Great exposure: What business would happily pass up the opportunity to rank high on the Internet’s largest search engine? When used successfully, Google ads can bring in a massive amount of traffic to your online presence.

Con

- Can’t neglect SEO: When ranking ads, Google considers websites that have quality landing pages and relevant content. So, optimization is still a big part of getting good Google Ads campaign results.

Microsoft Advertising

Did you know that the Microsoft Search Network accounts for more than 35% of desktop searches in the U.S alone? As Google ads’ strongest competitor in terms of paid search, Microsoft Ads has established itself as a worthy alternative.

Reach

The platform allows marketers to reach more than 20 million monthly unique searchers on its network.

Ad Formats

- Microsoft Advertising in Bing Smart Search

- Microsoft Audience Ads

- Microsoft Product Ads

- Microsoft Dynamic Search Ads

- Microsoft Responsive Search Ads

- Microsoft Expanded Text Ads

Pricing

Microsoft ads are similar in structure and purpose to Google Ads, as the platform also relies heavily on search queries to target people. Hence, you will also need to use a bidding system for specific keywords to determine your ad rank.

- The average cost per click (CPC) on Bing is $1.54.

- The cost per keyword depends on the keywords within your ad and your bid.

Ad Placements

- Search ads will appear on the search results page on search engines such as Bing, AOL, and Yahoo.

- Since Bing, AOL and Yahoo are partner sites, these ads will appear on websites within their network as well.

Pro

- Higher reach for desktop users: Brands can use Microsoft ads to reach more than 40 million desktop users that Google cannot.

Con

- Less flexible ads: Compared to Google ads, Microsoft ads only allow for one to two headlines instead of three, and fewer characters with 80 instead of 90.

YouTube Advertising

Being the second-most popular search engine on the planet, YouTube is accessed by almost one-third of the Internet’s users, and it stands as the best PPC platform to advertise through the use of quality video content like high-quality explainer videos.

Reach

YouTube receives an average of 14 billion views per month, that’s more than Instagram and Facebook receive combined. With so many frequent visitors, the platform gives businesses the potential to reach 2.56 billion users.

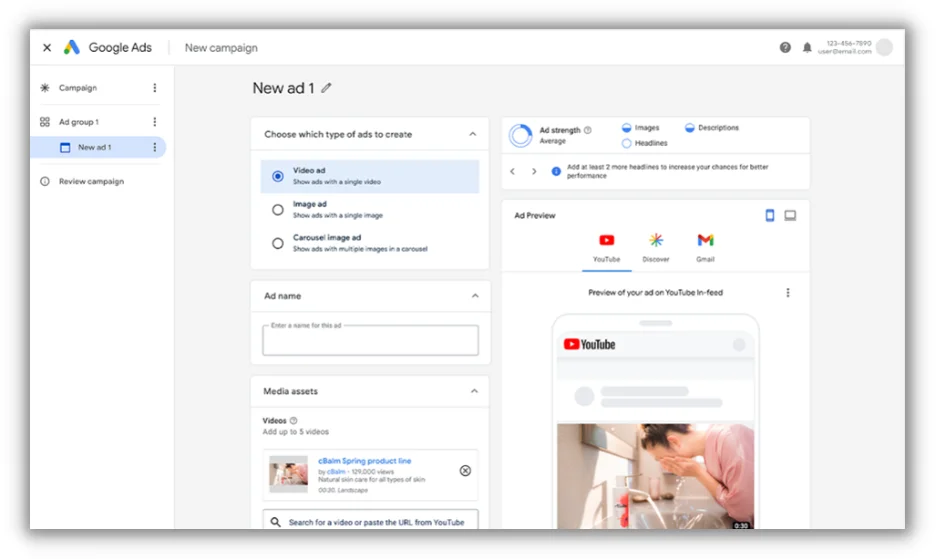

Ad Formats

- Skippable in-stream ads

- Non-skippable in-stream ads

- In-feed video ads

- Bumper ads

- Outstream ads

- Masthead ads

Pricing

- The cost of YouTube ads depends on your ad format, bid, bidding selection, and targeting options. However, the average cost per ad click or view lies between $0.10 to $0.30.

Ad Placements

- YouTube search results.

- YouTube videos.

- Video partners within their Display Network.

Pro

- Massive reach: Since over 80% of internet users in the U.S use YouTube on a regular basis, it serves as the perfect platform to target key audiences.

Con

- Disruptive ads: If your ad isn’t engaging, many users will see it as a nuisance interrupting their current viewing and clicking the skip button asap.

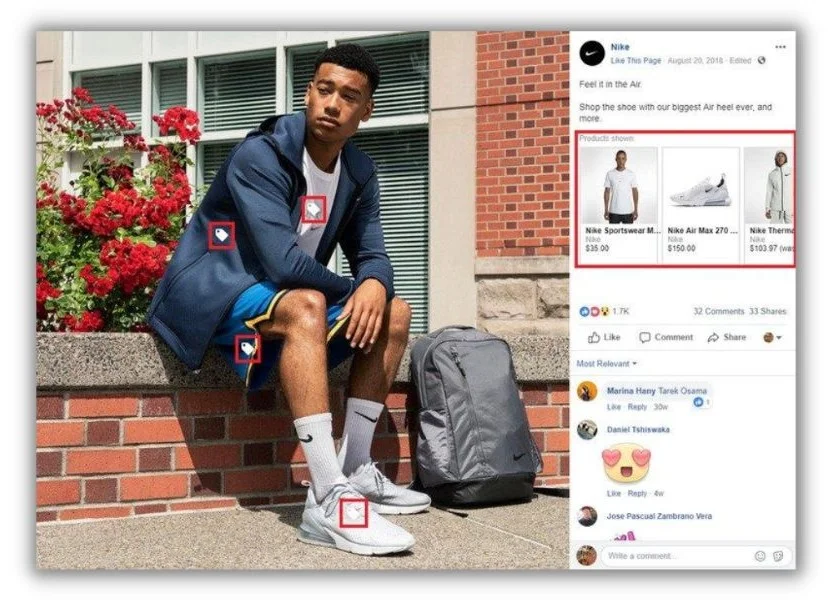

Facebook Ads

77% of Internet users are active on at least one Meta platform, Facebook being one of the most popular. Social media automation is rising to the top of most marketing strategies, with social ads becoming the next best thing to paid search ads. Digital marketers don’t only use Facebook ads because of its cost efficiency but because of its ability to accurately position their ads in front of specific target audiences.

Reach

As one of the few social giants, Facebook hosts an audience of 2.91 billion monthly users with an ad reach of 2.11 billion.

Ad Formats

- App ads

- Domain ads

- Mobile app ads

- Offer ads

- Page-like ads

- Page post link ads

- Page post photo ads

- Page post text ads

- Page post video ads

- Sponsored stories

Pricing

The cost of Facebook ads depends on your bidding model, campaign objective, audience, and quality score. An average estimate for ad costs would be as follows:

- Average cost-per-click (CPC): $0.97

- Average cost-per-thousand-impressions (CPM): $7.19

- Average cost-per-like (CPL): $1.07

- Average cost-per-download (CPA): $5.47

Ad Placements

- In the right-hand column of the user’s feed.

- Within the user’s newsfeed.

- Facebook marketplace.

- The user’s Messenger inbox.

Pro

- Detailed targeting: Your ads will be shown to people who are more likely to find them useful. With an engaging call to action, your potential leads will be one click away from your landings and conversion funnel elements. Facebook ad’s interface also allows you to select interests your audience may have to improve its targeting accuracy.

Con

- More competition: With thousands of businesses dedicated to using Facebook Ads exclusively, you’ll find yourself competing for popular keywords and paying higher ad costs when bidding for them.

Instagram Ads

What’s something every marketer knows about Instagram? Visuals, visuals, visuals! Instagram ads stand as the ideal PPC platform to draw in new audiences through ads that use eye-catching graphics and short, creative, visually captivating videos.

Reach

Instagram is the second-fastest-growing social media network nearing one billion monthly active users and has the potential to reach an average of 1.2 billion users.

Ad Format

- Image feed ads

- Story image ads

- Video feed ads

- Video story ads

- Carousel feed ads

- Canvas story ads

Pricing

On average, Instagram advertising costs sit between $0.20 to $6.70. They depend on your bidding model and cost-per-impressions (CPM). An average estimate for ad costs would be as follows:

- Average cost-per-click (CPC): $0.20 to $2.

- Average cost-per-impression (CPM): $6.70 per 1000 impressions.

- Average cost-per-engagement (CPE): $0.01 to $0.05

Ad Placements

- In the feed and/or the stories section of Instagram.

Pro

- Unobtrusive ads: Promoted ads appear seamlessly on users’ feeds and stories, making them great for generating brand awareness in unobtrusive ways.

Con

- Limited demographic reach: Instagram is not a great platform to target the older demographics as the majority of users are aged between 18-and 29.

Twitter Ads

Lastly, we get to the world’s seventh favorite social media platform. While Twitter ads may not rule the PPC sector, it comes with a few unique benefits, such as easily reaching target audiences and generating higher click-through rates. If your audience is predominantly on Twitter, it serves as an indispensable advertising platform.

Reach

The platform has 330 million active users, and of those users, 145 million are reachable through ads.

Ad Format

- Promoted tweets

- Promoted accounts

- Promoted trends

Pricing

Pricing depends on the ad format

- Promoted tweets: $0.50-$2.00 per action.

- Promoted accounts: $2-$4 per follow.

- Promoted trends: $200,000 per day.

Ad Placements

- Any promoted content will appear only once, near the top of (or within) a user’s feed.

Pro

- Less competition and cheaper ad costs: Since Twitter ads are less competitive when compared to other PPC platforms, clicks and impressions are much cheaper, and your target audiences will be easier to reach.

Con

- Hard to navigate: The Twitter ads interface isn’t renowned for being user-friendly, especially when having to simultaneously deal with a slow server. It’ll take quite a bit of practice before you get used to launching ads.

The first step to navigating any PPC platform is understanding the basics behind how it structures its ads. Knowing this will allow you to apply the knowledge to your paid media strategy and predict whether the platform will successfully draw in key audiences.

It’s important to remember that nobody (and we mean nobody) becomes a PPC specialist overnight. However, with a bit of practice, and some trial and error, you can learn how to master different ad platforms and use their services to help drive traffic to your business.

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘798354844174730’);

fbq(‘track’, ‘PageView’);

!function(f,b,e,v,n,t,s){if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n;

n.push=n;n.loaded=!0;n.version=’2.0′;n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)}(window,

document,’script’,’https://connect.facebook.net/en_US/fbevents.js’);

Source link

PPC

9 Ecommerce Trends to Boost Your Business in 2024

This year’s ecommerce trends feel a little oxymoronic. Machines and software are helping do more jobs, even communicating directly with shoppers. At the same time, consumers are heading towards online experiences that give them the personalized, human interactions of in-person buying.

As disparate as the rapid adaptation of technology and the longing for person-to-person retail seem, the two goals are actually coming together in unexpected ways.

Let’s unpack the specific trends ecommerce brands and marketers will face, and explore how to make sure you’re taking advantage of them.

Contents

- Conversational marketing becomes table stakes for ecommerce brands

- Ecommerce businesses will find new uses for AR

- More sellers slide into their customers’ DMs

- Gen Z spurs shift to social shopping

- Live commerce bridges the gap between online and in-person shopping

- Subscription services solidify customer loyalty

- AI fuels customized buying journeys

- Dynamic, personalized websites go mainstream

- Ecommerce brands will launch more data-gathering campaigns

9 ecommerce trends to monitor in 2024

These are the most high-profile ecommerce marketing trends we see headed our way this year. Learn them to stay in tune with customers and ahead of competitors.

1. Conversational marketing becomes table stakes for ecommerce brands

Conversational marketing is a strategy where businesses have two-way communication with customers in real time. Those one-to-one interactions can happen with live agents, but a lot of conversational marketing growth will occur with AI-powered chatbots.

For example, one study suggests that by 2028, around $72 billion in retail spending will happen through chatbot interactions. For context, that’s a 470% increase compared to the $12 billion in chatbot sales from 2023.

Two factors are fueling this ecommerce trend: generative AI and consumers’ desire for fast answers.

Generative AI models like ChatGPT use natural language processing to understand conversational queries. That’s helped chatbots become highly successful sales agents that can guide website visitors through their buying journey.

For most consumers, the most significant upside of using chatbots is the 24/7 availability of information. Instead of waiting until regular business hours, shoppers can jump in when inspiration strikes and get all the information they need to make an informed purchase.

The great news is chatbots are becoming less expensive and easier to launch, so expect to see them gain traction in smaller businesses. You can launch your own chatbot in a jiffy.

💡 Conversational marketing relies on great calls to action. Download this free guide to get inspired by dozens of high-performing CTA phrases.

2. Ecommerce businesses will find new uses for AR

The virtual reality (VR) craze hit its peak when Facebook rebranded as Meta, a signal that the social media giant was turning its vast resources towards developing online worlds known loosely as the metaverse. Despite some optimistic forecasts, most of us still aren’t guiding our avatars down digital promenades in search of the next digital deal. And with Meta still losing millions on its big VR bet, it’s unlikely to happen any time soon.

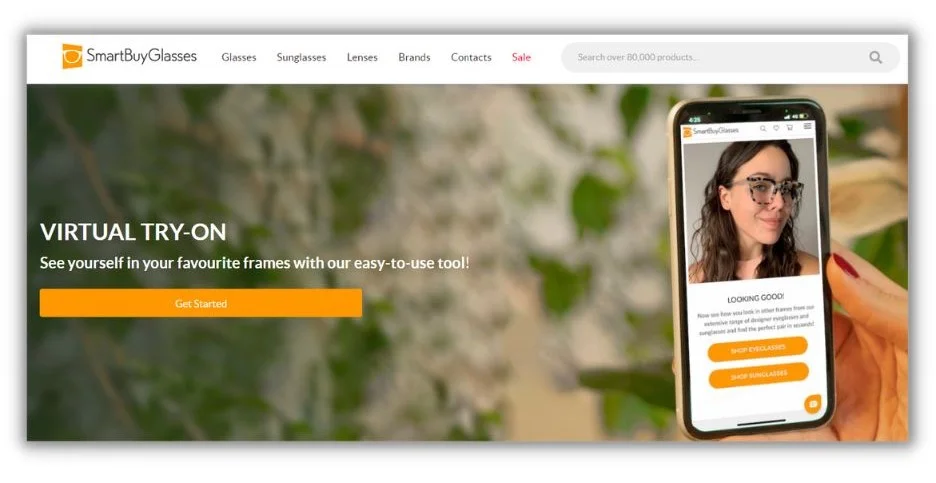

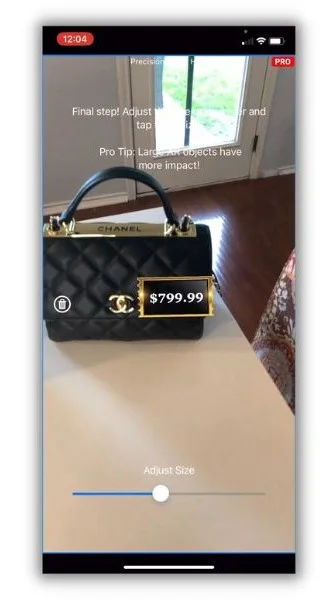

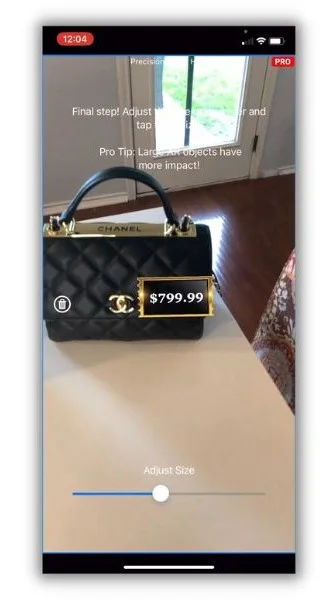

However, an interesting movement in ecommerce is taking advantage of augmented reality, VR’s cousin that overlays digital imagery on real-world environments in real time.

AR has become very accessible, even offered as free features like stickers and polls on social media platforms. Expect to see online retailers and brands taking advantage of AR in new ways. For example, fashion brands use AR to help mobile shoppers see how they’ll look in this season’s styles.

Users snap a picture in the brand’s app, and AR adds the products. Clothing brands, household goods, and even car dealers are all using AR to help buyers make a purchase decision.

Other retailers are using AR to highlight product details, like price tags or features, in promotional videos.

With AR’s near-zero cost for these use cases and more app developers building creative AR solutions, expect to see it used more often and by a wider variety of ecommerce businesses.

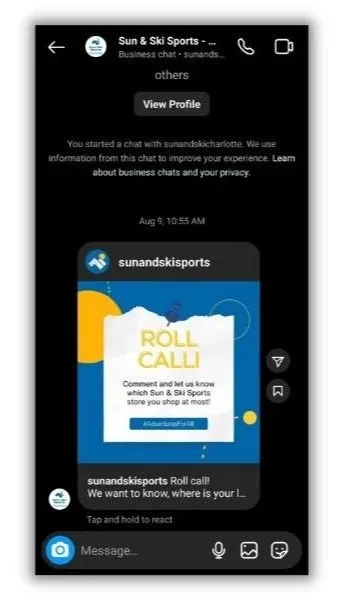

3. More sellers slide into their customers’ DMs

Direct messaging, like the DMs on your Instagram or TikTok account, is ideal for brands to interact with customers and fans one-on-one. You can send links, images, and product videos. Plus, it doesn’t cost anything to send a DM. That’s why we’ll see more brands connect with their customers in direct message apps this year.

Because of their private nature, DMs are a great place to have conversations about customer concerns. You can even use them as a lead generation channel as an alternative to collecting email addresses on your website.

A word of warning if you want to try this trend out for yourself. If you start messaging random people, you’ll definitely get blocked and probably reported. Always ask before contacting someone in their DMs. Offer a reason, like giving someone a personal discount code or asking them to share their experience with your products (free user-generated content!).

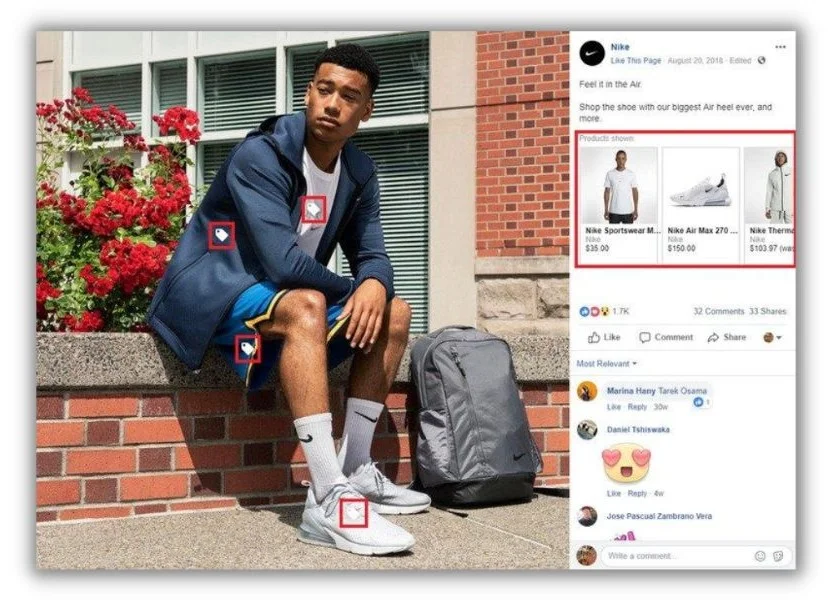

4. Gen Z spurs shift to social shopping

At first, social media marketing was mainly a brand awareness play. Sellers could share their wares in organic and paid posts and then offer links to their e-commerce shops.

Jumping from one platform to the next adds friction to the sales process. With social shopping, consumers can click on the products they see in a post and complete the purchase without leaving their favorite social media apps.

Revenue from social commerce could hit the trillion (with a “T”) dollar mark in the next few years. Younger adults lead the charge, with nearly three-quarters of 18 to 34-year-olds saying they’ve made a purchase from social commerce. But the trend is also permeating through all generations—around 25% of consumers over 65 said they’ve bought through that channel as well. With that kind of cross-generational spread, we expect to see a lot a lot more sales through social selling activities.

🛑 Download the newly updated All-Star Advertising Playbook to get expert-level tips for all four of the most lucrative advertising channels.

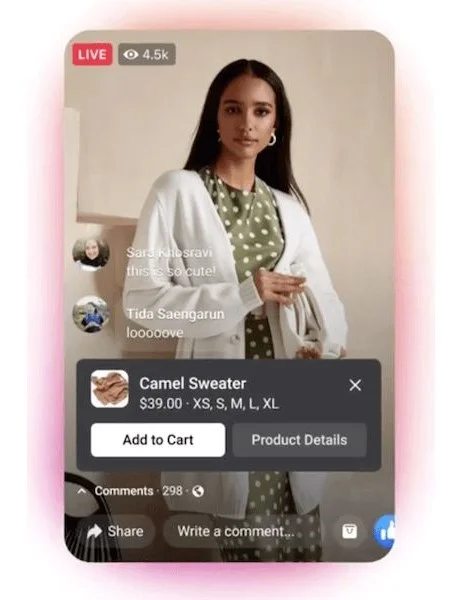

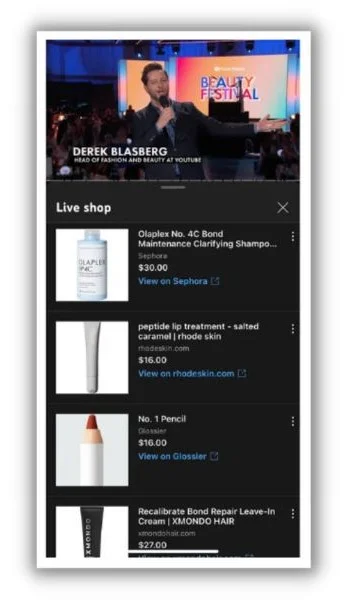

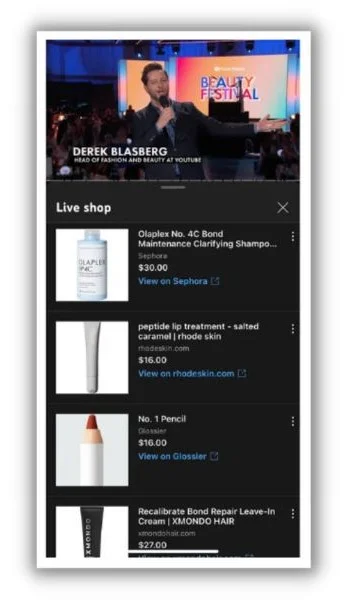

5. Live commerce bridges the gap between online and in-person shopping

If QVC and social shopping had a love child, it would be live commerce. During a live commerce event, a host interacts with viewers via video on a social media platform. Those viewers can then purchase the products on offer right from the video.

Live commerce offers the best parts of in-store shopping without fighting traffic or searching for a parking space. Shoppers get instant answers from a knowledgeable brand representative or influencer right from their living room.

The most popular social media apps are participating in this trend. Instagram and TikTok offer live shopping features, and YouTube inked a deal with Shopify to let creators add shoppable links to videos.

While the most common format for live shopping involves one or two representatives on screen touting the brand’s latest and greatest, there’s another interesting way to use this tactic. Say you’re launching a new line of cosmetics. You could have a launch party and let viewers buy what they see on their screens.

The live commerce trend is expected to grow significantly in the near term, with some suggesting it could account for 20% of all ecommerce sales. Since conversion rates at live shopping events can reach 30%, ecommerce brands would be wise to take advantage of this trend.

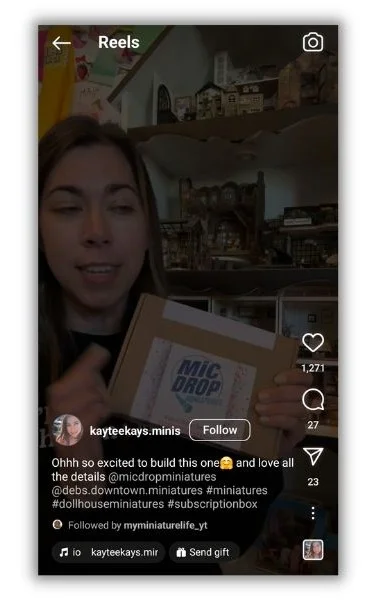

6. Subscription services solidify customer loyalty

Buy almost any consumable from Amazon, and you’ll be asked if you’d like to save a few dollars by subscribing to auto-refill your order. The initial loss in profit to the seller is well worth the higher potential of repeat business. And the buyer sees the savings as a no-brainer since they’ll need more of the product later.

The trend goes beyond monthly dog food or cosmetics deliveries (although those are common). Now, you can get a regular delivery of all sorts of themed products, like miniature items for your doll house or train set.

Savings and customer loyalty are powerful win-wins that are likely to motivate sellers and shoppers to keep the trend going. 77% of consumers say they spend up to $499 annually on subscriptions, and 41% say they’ll add more in the next year.

7. AI fuels customized buying journeys

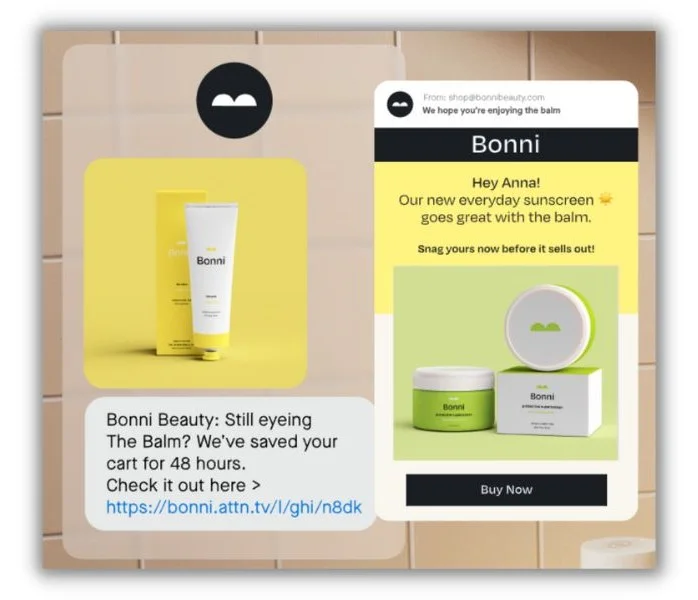

In general, AI is a big trend for all marketers. There are many ways ecommerce brands and marketers can use artificial intelligence to boost their businesses. One that’s emerging as particularly useful is having AI create complex, personalized customer journeys.

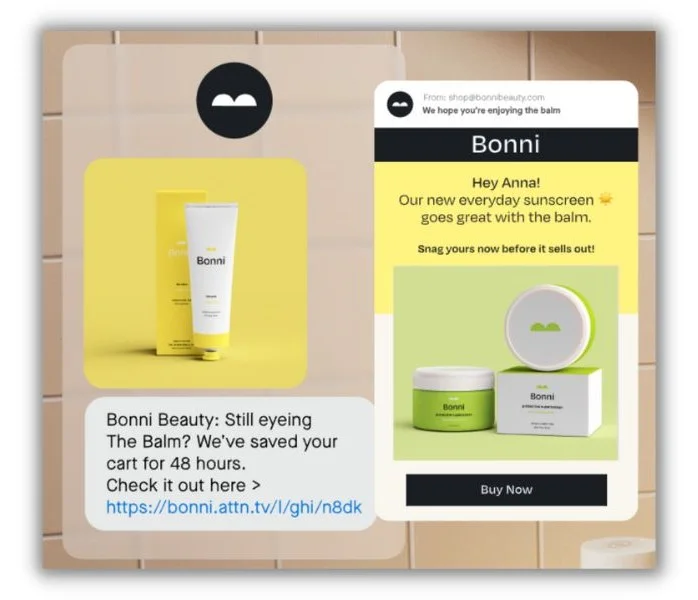

Here’s an example. Say you send marketing texts to your customers, reminding them of sales and new products. If each text of those campaigns were personalized to the individual based on their prior behavior, you’d close a lot more sales. But it’d be nearly impossible to do manually when you’re promoting hundreds of products to thousands of customers.

That’s where marketing experts are applying AI. Using its machine learning capabilities, AI can “remember” how customers reacted to previous messages, which products they bought, and how they interacted with your website. Then, it can create a custom campaign for each text subscriber.

Personalization is a well-documented marketing strategy that often lifts revenue by up to 25%. Brands that use advanced personalization strategies say they see a 200% return on the investment.

In the coming year, we’ll see many more retailers and brands use AI to construct personalized buying journeys through promotional emails, texts, and social media, individually and across multiple channels.

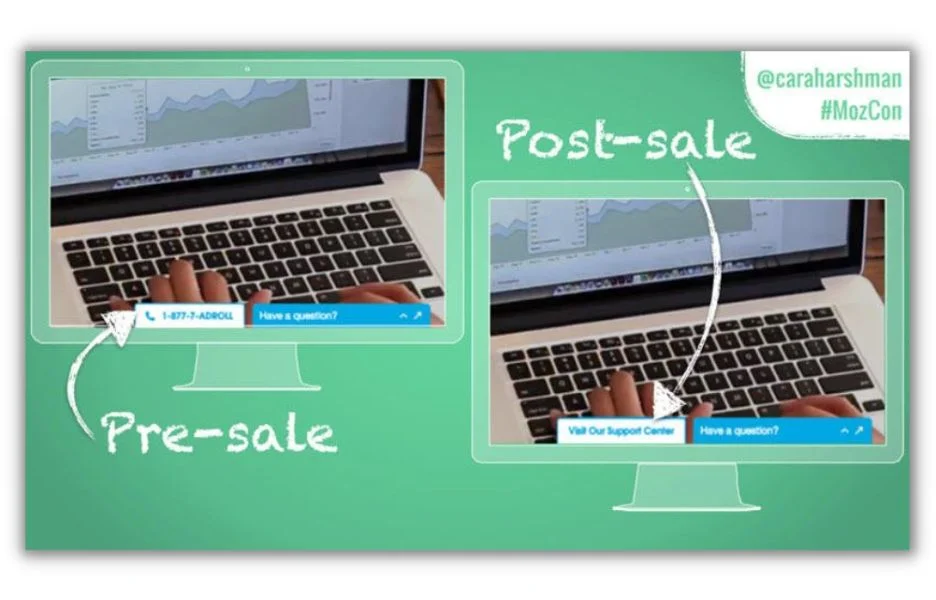

8. Dynamic, personalized websites go mainstream

Personalization has been the playground of ad campaigns for a while. But what if every person who visited your promotional landing page or home page saw a version that best suited their needs? That’s what dynamic landing pages and websites offer.

Here’s a simple example where someone considering your product sees a different home page than someone who bought it.

Dynamic landing pages aren’t new. What’s changed is the scale and scope of personalization available with new AI-powered techniques, making them more attractive to ecommerce shops with many product and sales pages.

Let’s say you have a website with hundreds of sales and conversion pages. AI can analyze huge amounts of data about your products and customer behavior. Then, generative AI can quickly create conversational copy or calls to action for each of those pages that are more relevant to each segment of your target market.

Most marketers that use personalized landing pages report a lift in engagement compared to static versions. Plus, 91% of customers said they felt more connected with websites featuring dynamic pages, especially those that provided personalized offers and product recommendations.

9. Ecommerce brands will launch more data-gathering campaigns

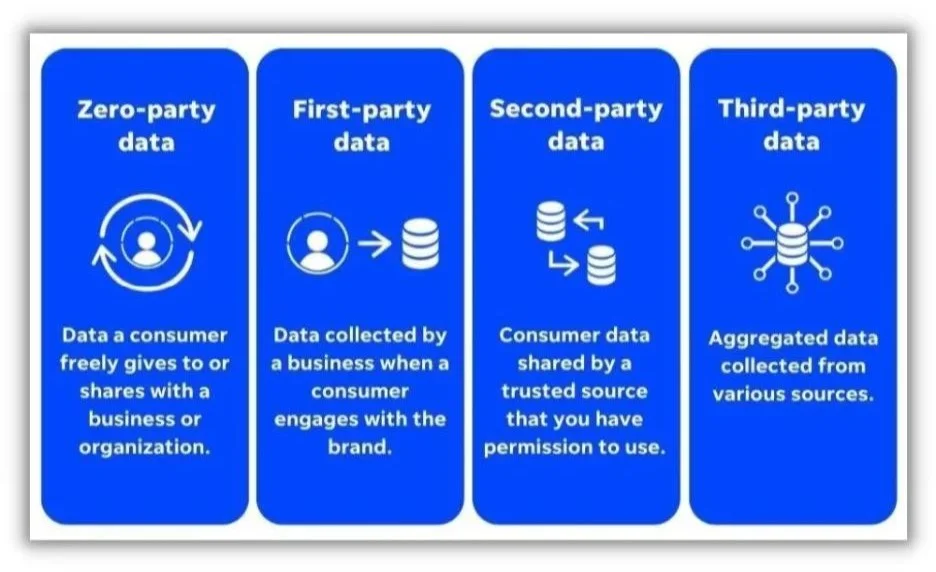

Many of the trends we’ve discussed require extensive data about your customers. Gathering this information has pros and cons. Some shoppers love the personalization it provides, while others are rightfully concerned about their privacy.

In light of these concerns, lawmakers and big platforms are making it harder to collect data without direct user consent. Google has finally ended the use of third-party cookies. Some US states and European governments require websites to give visitors a choice to opt in or opt out of being tracked by cookies.

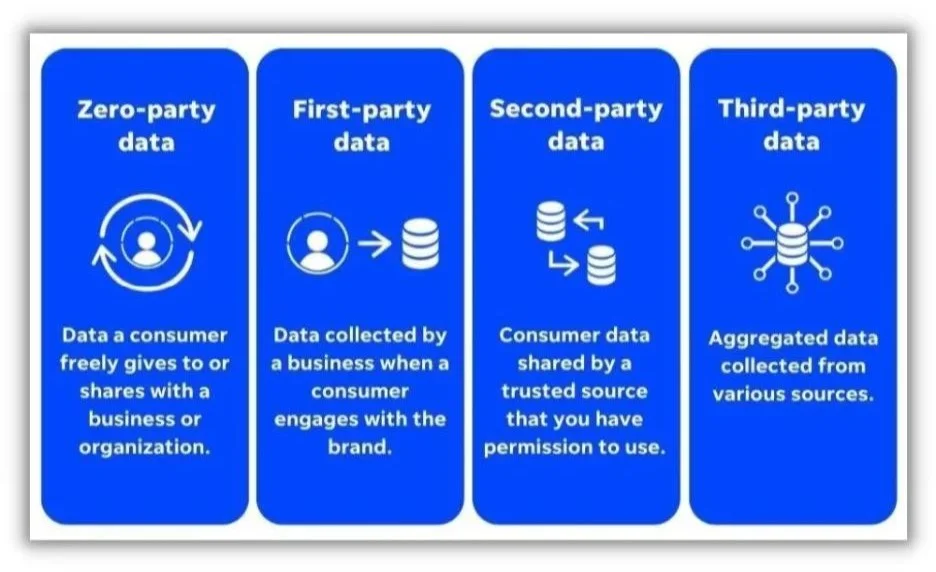

With much less third-party data, ecommerce marketers will need to become really good at convincing shoppers to give up their information willingly, also known as zero-party data.

In the coming months and years, we’ll see more creative campaigns designed to collect data from willing website visitors and customers ethically. These may be contests, newsletter subscriptions, surveys, or even discounts and free products.

However it’s done, collecting zero-party data is a big ecommerce marketing trend that almost every retailer and brand needs to be aware of.

What is the future of the ecommerce industry?

To say last year was one of change for ecommerce stores and marketers is a drastic understatement. With the rapid development of new AI marketing tools, customers’ shift to new sales channels, and potential regulations that can change how everyone does business online, it’s nearly impossible to guess the future of ecommerce with 100% clarity.

But if you look at the trends ramping up now, you’ll see a few themes that hint at the future. Customers want in-store experiences from online shopping. They’ll choose lower-friction purchase options over clicking through multiple apps and websites. And they’d prefer personalized interactions as long as their privacy remains protected.

While you mull over what’s to come for ecommerce stores, have a look at these other marketing trends for further insights:

PPC

10 Most Effective Franchise Marketing Strategies

Who doesn’t like a bit of a challenge? While it’s always rewarding to take on new marketing endeavors, certain businesses, like franchises, feel the heat more than others.

Whether you’re a food and beverage franchise, a multi-location dealership, a national real estate group, an enterprise bank, or anything in between, you know that managing marketing efforts across the board can sometimes feel like an uphill battle.

In this guide, we’ll help you address common marketing speedbumps multi-location businesses encounter and share 10 of the most effective franchise marketing strategies.

Contents

What is franchise marketing?

Franchise marketing means promoting your business across all your franchised locations. Essentially, any effort you’re putting into growing your franchise is considered franchise marketing. This can mean marketing efforts at a top branding level all the way down to marketing for specific locations.

Benefits of franchise marketing

Here are a few reasons franchise marketing is so important:

- A new franchise location opens every eight minutes during the course of any given business day. This doesn’t even account for the new businesses opened every day.

- 42% of franchise marketing professionals and multi-location business owners feel traditional marketing channels, like TV placements and PR, are no longer worth the investment.

- 55% of multi-location businesses believe that social media is the leading franchise marketing channel they rely on.

Clearly, there is plenty of competition and opportunity within the franchise and multi-location industries, meaning franchise marketing is crucial to stand out and grow.

However, keeping up with your franchise marketing is easier said than done. Let’s resolve some franchise marketing pain points next.

10 franchise marketing strategies

Managing your franchise marketing can be a juggling act. As the classic saying goes “No pain, no gain!” Let’s dive right into how you can turn 10 major franchise marketing pains into marketing gains:

1. Maintain brand consistency throughout your franchise marketing

It’s no secret that one of the biggest challenges franchise marketers face is location managers or franchisees that go rogue—especially when it comes to branding and brand consistency. But until a teleportation or cloning device gets invented, you’re unfortunately unable to be at all your locations to guide them through their marketing (despite how much you wish you could). This makes maintaining brand consistency across all locations a difficult task.

But brand consistency is extremely important for the success of your franchise marketing. We know that 71% of consumers say they’re more likely to buy a product or service from a brand they recognize. Plus, we can’t forget about the age-old marketing “rule of seven” which states that people need to see information about a business at least seven times before they become a customer.

So brand consistency isn’t just a “nice-to-have” element in your franchise marketing plan, it’s a need-to-have!

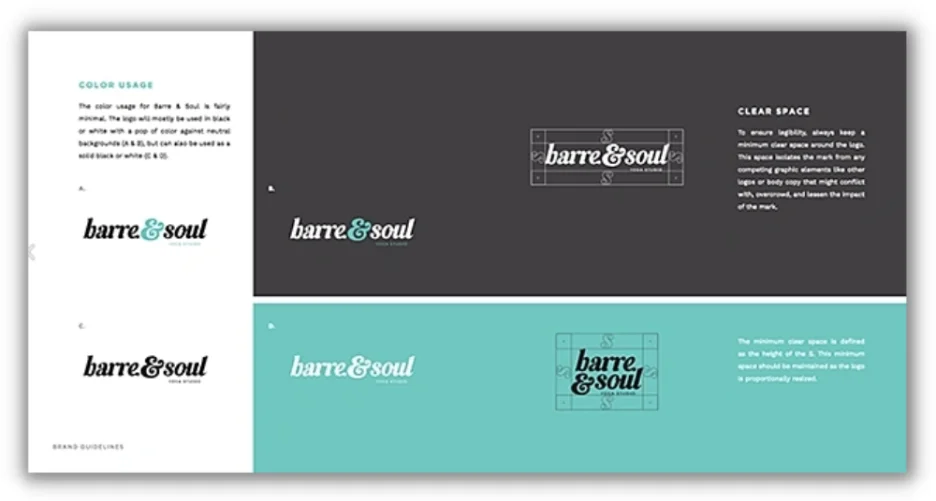

How to approach it: The first thing you should do is create a brand style guide. Once you have your style guide in place, you can use it across all locations. If you already have one in place, now is the time to revisit! The more thorough your brand guidelines the better.

Here’s our list of what should go into your brand guidelines:

- Company logo in various sizes and color options (black and white, thumbnail size, banner size etc.)

- Your business’s colors in hex codes

- Your selected fonts in regular, bold, and italics

- Your chosen grammar, mechanics, and style preferences (including punctuation, capitalization, and abbreviation)

- Blog post title preferences

- Image styles and sizes for digital and print materials

- Your business’s boilerplate and mission statement

- Preferred tone and voice

- Social media best practices by platform

An example of brand guidelines.

Brand guidelines will keep your brand consistent and empower your location owners to create their own marketing collateral while knowing they have a cheat sheet to help them along the way.

📚 Free guide >> 12 Secrets to a Higher Click-Through Rate (& Lower Costs!)

2. Identify your customer base across locations

Let’s face it—your local customers’ interests at your Boston location will be different from those in your Houston location which differs from those in your San Diego location, and so on!

If you generalize your target audience without consideration for how their lifestyles differ by location, not only does that lack of inclusivity limit your reach, but it also gives your customers a less personalized marketing experience.

However, 80% of consumers are more likely to make a purchase when brands offer personalized experiences. So identifying your target audience across locations now to deliver a personalized experience at each location later is a marketing tactic you won’t want to miss out on.

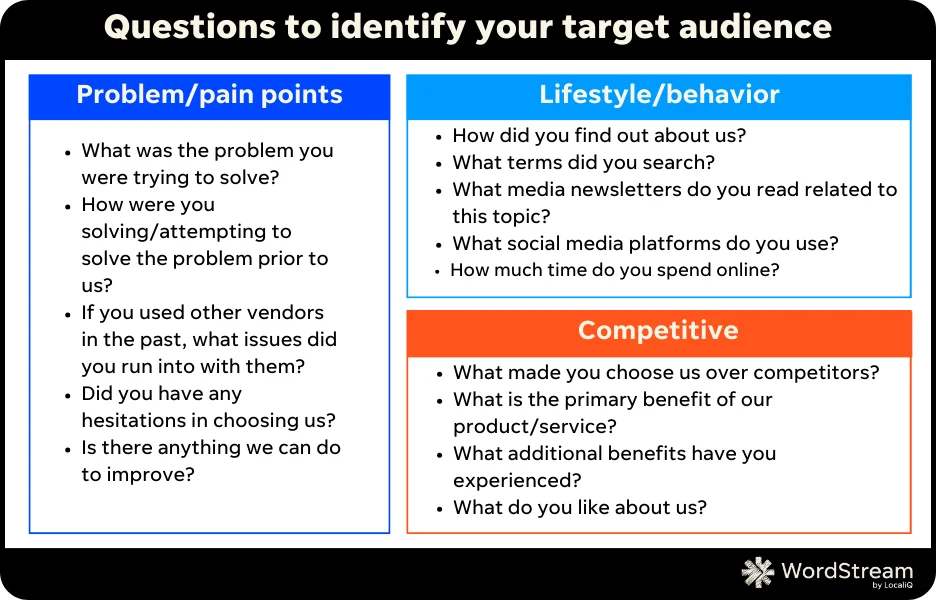

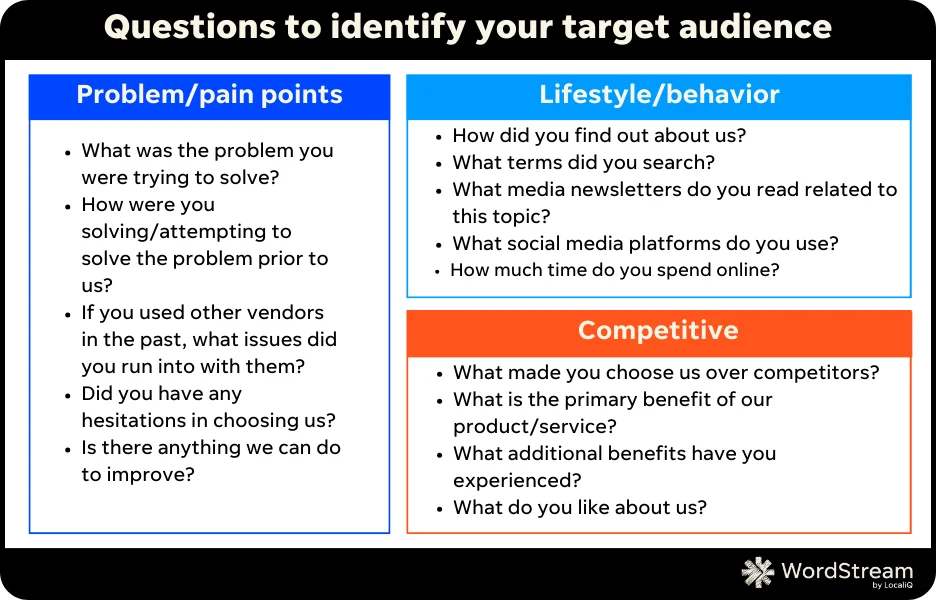

How to approach it: Taking time to identify your target audience across all locations when your plate is already full is easier said than done. A more efficient way to execute this is to look at your target audience from a bird’s eye view and zoom in from there.

Once you identify what makes up your target audience at a high level you can take it down to the regional level. From there, you can use free online tools like Google Trends to understand the interest of topics by location to see how your messaging may slightly differ between regions.

Another workaround would be to create marketing collateral that’s diverse enough to speak to all customers regardless of lifestyle. A healthy mix of both, however, will give your customers that localized experience while saving you as much time and resources as possible.

3. Know your solution options (+ which ones your brand needs)

There’s an infinite amount of value your franchise has to offer its customers. Add that on top of your many convenient locations, a diverse range of employees, and audience segments, you’ll find it can be challenging to know how to deliver all this information to your potential customers in the best way.

With so many potential marketing channels to choose from, how do you know which strategies will be most effective? And how can you communicate your chosen strategies’ effectiveness to your franchise managers?

How to approach it: We’ve broken down the top marketing channels for franchise businesses into a few core pillars. Introduce your franchisees to the following and encourage them to try it for their own benefit:

Search engine optimization

SEO is at the core of any strong marketing plan for good reason—it’s free! Not only do clicks from organic search results come at no cost to you, but with 90% of consumers searching online before making a purchase digitally or in-store, SEO can help each of your locations grow sales faster.

Search advertising

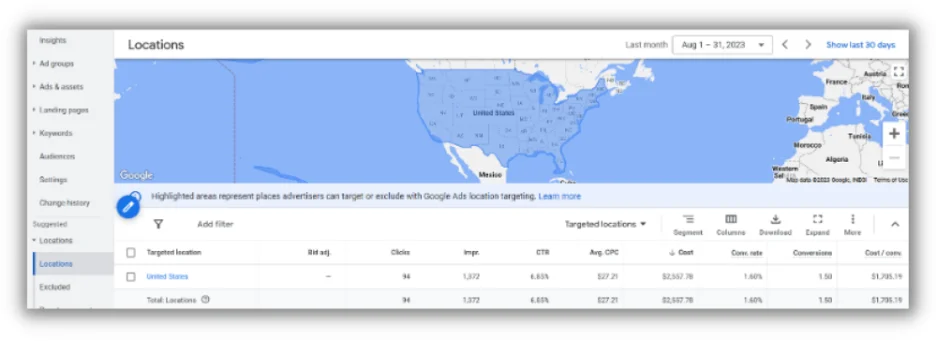

With search advertising, there are now more options than ever for dynamic location targeting at the ad copy and campaign setting level, so your chances of pulling in a click from a select location’s local customer is nearly guaranteed.

An example of a search ad for a local Ford dealership.

Search advertising ensures you’re showing to potential customers when it matters—as they’re searching on top search engines like Google and Bing. Plus, paid search ads can increase brand awareness by up to 80%. If you have a location that’s struggling to pull in new customers, paid search ads are the best route for making it known to potential customers that you’re in their area with lots to offer.

🛑 Worried you’re wasting spend in Google Ads? Find out with a free, instant audit >> Google Ads Performance Grader

Video/OTT

Video marketing on YouTube or via OTT (over-the-top) streaming allows your franchise or multi-location business to create engaging content for exclusively targeted audiences. Even though you may be juggling various locations and customer bases, you can segment your video marketing in hyper-specific ways to ensure each location gets a piece of the pie.

Plus, video marketing can grow revenue nearly 50% faster and pull in 66% more qualified leads per year than businesses that don’t use video.

Display

Display ads give you a way to target your audience on sites across the web—when they’re not even actively searching for your business. This increases awareness for your brand. If your branch managers notice a dip in sales, display ads could be the solution since consumers who are retargeted via display ads are 70% more likely to convert.

Social

With 3.5 billion active social media users worldwide, it’s no secret that social media marketing is a must if you want to heighten your chances of reaching all the potential customers around each of your locations.

The beauty of social media marketing is that you can get results regardless of whether you decide to go the free or paid route. So if you’re struggling to get all your franchisees on board with one marketing strategy, social media marketing is an accommodating solution with endless options that can fit any locations’ budget (or lack thereof).

Of course, there are additional marketing channels you should consider as part of your strategy. Take a look at all the basics of local marketing to find out what would work for you.

4. Get all locations on board with the right strategy

Speaking of budgets, with multiple franchises, it can be tough to get them on the same page with the marketing spend and strategy that you encourage. Each location has its own needs and budget which you want to accommodate within your recommended marketing plan.

It gets trickier when you want to save yourself time by creating an easily transferrable franchise marketing strategy that can apply store to store but also is flexible enough to not have one set budget applied.

How to approach it: The first thing you’ll want to look at is all the free and low-cost marketing options available. Small businesses have been doing this for years, but for a larger enterprise, this feels counterintuitive. However, the kicker of franchise marketing is it’s the same concept as local marketing—just multiplied.

When you present your location owners with low-cost or free options, they’ll have no reason to not want to implement them. Some examples could be setting them up with a social media account for regular posts or facilitating online workshops to foster their SEO expertise.

With that said, we know that a mix of marketing channels maximizes your chances of results. Ideally, you’ll want your location managers to get on board with allocating some of their revenue toward a marketing budget. The best way to encourage this is to research statistics to display the ROI if they were to go for it and to provide co-op funds from corporate if possible. For example, paid advertising returns $2 for every $1 spent–a 200% ROI.

It’s helpful to keep in mind that marketing budgets don’t have to be huge. It doesn’t always take a lot of money to make a big impact, but a little can go a long way!

5. Evaluate your options for franchise marketing execution

While some franchises are fine with individual locations running their marketing strategies themselves, others opt to streamline marketing from one central team or group for all locations.

Both options present their own sets of challenges. If you’re managing the marketing strategies for all locations, you have a big job—you must not only execute a successful multi-channel marketing strategy that includes optimizing campaigns, writing ad copy, and deploying offers, but you have to do that for different areas and audiences.

If you allow franchisees to run their marketing themselves, you have to worry about brand consistency, optimized spend, and a lack of control around results.

How to approach it: It doesn’t have to feel like a lose-lose situation when you choose which route out of the two you want to take. As mentioned above, both managing marketing for your locations versus letting them manage it comes with pros and cons.

To identify what’s best for your brand, we recommend doing a self-evaluation with the following questions:

- How much extra time do I have to oversee my locations’ marketing strategies?

- How much time do my location owners have to put into marketing?

- Would implementing marketing at the location level require any training?

- What types of marketing channels do I need to have running at each franchise location? Can each location handle those themselves?

- Has my company struggled with brand consistency in the past?

- How would I measure the success if I ran the marketing for all franchise locations? How would those locations measure and report on their own success?

- How frequently would I expect to change up the marketing strategy?

- Is it easy for me to consistently communicate with all of my locations?

Depending on your answers, you’ll end up leaning towards one over the other. However, if you’re still unsure then that’s totally fine! Another option would be to involve a marketing partner to help oversee your franchise marketing strategies along with you. That way you won’t have all the locations’ marketing on your shoulders, and you can leverage a resource that has every marketing tool needed at its fingertips.

Whatever you decide, finding the right tool to track your marketing across locations and channels will be crucial for measuring success. (We’ll talk more about this in a minute!)

6. Create a strong local SEO strategy

You need to focus on SEO that is both national and local. National often comes naturally to many franchise businesses at this point, but without a strong local SEO approach, you won’t be able to show up for searches when and where it counts.

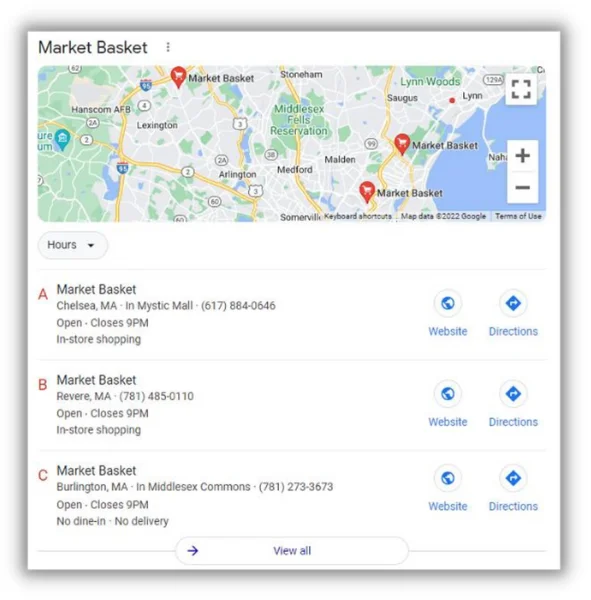

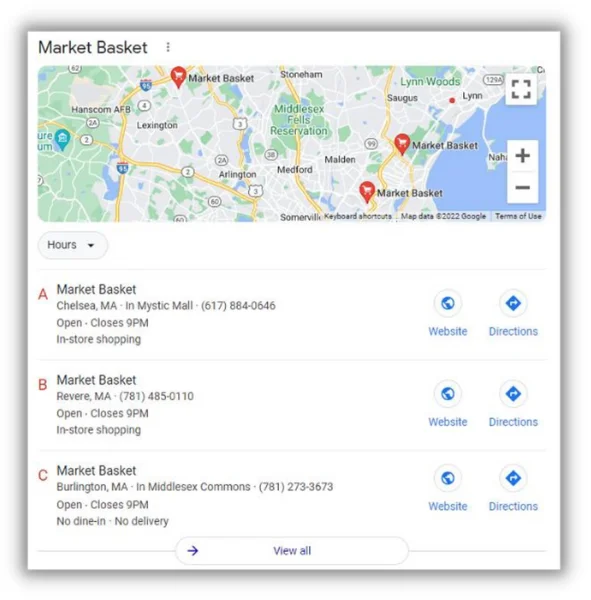

How to approach it: The easiest way to complement your national SEO with a local SEO strategy is to include keywords related to your locations within your content—this can be easily done through location pages on your website. The next quick fix for multi-location SEO is to invest in listings management so local listings are accurate for each location to help drive leads. It may seem minor, but 64% of consumers have used Google Business Profiles to find contact details for a local business.

Additionally, try to position your brand as a partner to each of your locations by creating local-friendly blog content. Brainstorm a blog topic that’s specific to each one of your locations, and you’ll save time on your editorial calendar planning while also staying consistent with local content!

You can also quickly research other local businesses to link to for resources within your content to build trust with your local audiences. That said, maintain a friendly presence in your local communities by encouraging location managers to participate in local events to trigger brand awareness for searches later.

This multi-location business has Google Business Profile listings for each store location to fit local SEO needs.

🔎 Need help finding the right keywords for your local SEO strategy? Try our Free Keyword Tool!

7. Be sure to stand out from the competition (including your own franchisees!)

Franchises have a unique competitor set in that while you compete with other local businesses and large brands, you might also compete with your own locations. For example, you might have two locations down the block from each other that own two completely different territories but could be competing for the same customers. One major hurdle every franchise must jump over is how to run marketing at each location without stepping on one another’s toes—all while stepping on the competition’s toes!

How to approach it: We can’t stress enough how important geo-targeting is to your multi-location or franchise marketing. Geo-targeting is a way to ensure that one location’s marketing collateral doesn’t slip onto the screens of consumers in another location’s territory. When you run ad campaigns with geotargeting you’re maximizing the overall growth of your business by handing out a fair, even slice of the cake (or in this case, audience) to each store.

As for standing out from the competition, geotargeting can also help here if you want to identify and target their locations too. Otherwise, bidding on competitors’ branded keywords will help to ensure your brand shows when folks are looking for your competition. That way you can sweep the competition’s customers away and bring them to your locations.

8. Solidify reporting for all locations, solutions, AND channels

Let’s get this straight: your business has multiple locations, offering multiple products or services, overseen by multiple managers, marketing to multiple different audiences, through multiple different channels. What a handful!

You don’t have time to loop in hundreds of data points into one performance tracking sheet. You need some way to ensure that all your franchise marketing efforts maintain a growth track with proven KPIs.

How to approach it: For this instance, technology is your new best friend! Take advantage of digital tools that aggregate reporting across platforms, locations, and more to report on what matters. A few things you should ask yourself while scouting a reporting solution include:

- Do you want your location managers to have access?

- What performance metrics matter most to your multi-location business?

- What does a positive performance look like for you at the national level? At the local level?

- What channels need to be tracked? How will they be tracked consistently across locations?

- What timeframes will you be looking to run reports on?

- What types of downloadable or shareable files, if any, will you want for your reports?

9. Educate your franchisees on franchise marketing

You and your franchisees are busy running a national brand at the local level—you all don’t have time for in-person pieces of training on all your marketing technology and best practices! Never mind the fact that gathering the resources to help location owners understand your brand’s marketing plan is a feat in and of itself.

How to approach it: Have fun with it and get creative with your training! You can hold training online after hours to make it easy for all your branch managers to attend.

Another way to make marketing education more accessible across locations is to create various training materials. For example, you can shoot or share quick “how-to” YouTube videos for visual learners. For busy location owners short on time, you can write and email training articles that they can read in bits throughout the day.

The more training material, the better. If your schedule is so jam-packed you can’t even begin to think about running training or creating training materials, leveraging a marketing partner to facilitate training for you is another great option.

10. Communicate with your marketing partners

You may have one agency helping with social that has a totally different approach than your in-house team managing paid search. Or each location might be working with their own team or consultant. How do you keep multiple teams and marketing partners aligned?

How to approach it: If you’re struggling to keep track of all your marketing solutions, then it may be worth it to find a marketing partner that can bundle all your needs into one. When you leverage a marketing partner that can house all your channels and reports under one roof it’s easier to maintain consistency and performance tracking.

In the meantime, though, communication is key! Be sure to hold regular meetings with your in-house team, your location managers, and your agencies to maintain consistent cohesion across channels.

This is also another opportunity to distribute your style guide to all marketing partners so that there’s no confusion across agencies, marketing associates, or consultants on what your brand’s voice is.

Solve these franchise marketing puzzles today to decode a brighter tomorrow

If there’s one thing we can take away from all 10 of these franchise marketing tips is that the more you can plan ahead and communicate with your locations, the easier your job will be later. Plus, no matter your goals, channels, or audiences, there’s a solution out there that can work for your franchise.

With a bit of creativity and finesse, you can make your franchise marketing strategy do the heavy lifting for you. Putting in the time to square away your challenges now is worth the time it will save you later.

To recap, here are the top franchise marketing tips we talked about:

- Prioritize brand consistency throughout your franchise marketing

- Get to know your customers across locations

- Consider all your franchise marketing channel options

- Get all your locations on board with your overall franchise marketing strategy

- Evaluate your options for franchise marketing execution

- Ensure your local and national SEO strategies align

- Try to stand out from your franchise marketing competition

- Be sure to have clear reporting in place

- Train your locations on your franchise marketing efforts

- Consistently communicate with your marketing partners

PPC

Biggest Trends, Challenges, & Strategies for Success

Pay per click (PPC) advertising is a big deal in digital marketing, especially in the retail world. As 2024 heats up, we’re not just talking about simple ad placements and bids; it’s all about smart technology, understanding your customers, and getting creative with your strategies.

Whether you’re a pro in digital marketing or just starting to explore ecommerce ads, keeping up with PPC trends is crucial. This guide is here to help you out.

Contents

Biggest trends in PPC for retail

Let’s dive into the PPC scene for retail in 2024. Things are getting exciting with Google’s ad platform evolving rapidly, especially with its use of AI and machine learning.

Increased use of AI and machine learning

Often, we talk about AI as if it’s one big thing, but it’s more nuanced. AI is the broader concept of machines being able to carry out tasks in a way that we’d consider “smart.” Within this, machine learning is a specific subset of AI that trains a machine how to learn. In the PPC world, this distinction is key.

This year, AI will be transitioning away from merely a novelty. It is becoming smarter, a trend we can refer to as Smart AI. This new phase of AI is more targeted and informed, indicating a significant evolution in how AI systems are developed and applied.

🤖 Want to use AI the right way? Free download >> Emergency Guide to AI in Marketing

AI in ad targeting

AI’s role in PPC is about understanding and predicting. It sifts through tons of data to figure out what consumers are looking for, then predicts their buying patterns. This means your retail PPC ads are more likely to show up for people who are genuinely interested in what you’re selling.

Machine learning in real-time optimization

Machine learning steps in to continuously improve how your retail ads perform. It adjusts bids, manages budgets, and identifies trends that you might not notice. It’s like having an assistant who’s always optimizing your campaigns, ensuring they reach the right audience effectively.

Mastering these technologies is crucial for digital marketers in retail. It’s not just about using these tools; it’s about understanding them deeply and leveraging their strengths to boost your PPC campaigns.

Top PPC strategies for retail in 2024

Here are four essential PPC strategies for retail digital marketers:

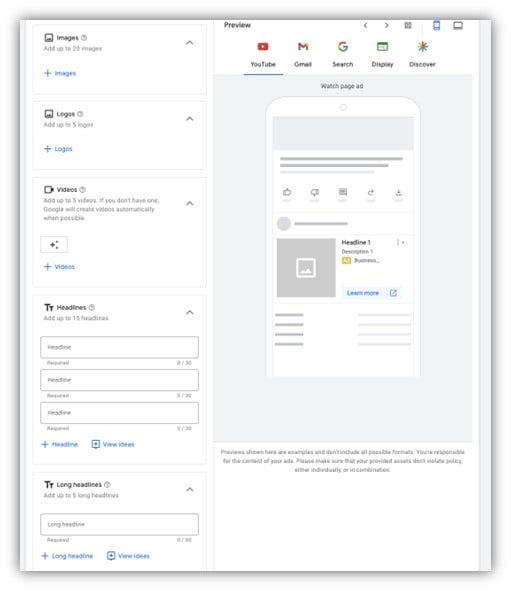

1. Try Demand Gen campaigns

Recently, Discovery Ads campaigns were automatically upgraded to the Demand Gen campaign type in Google Ads.

Demand Gen is more than just an upgrade–it’s a game-changer in winning social budgets for Google. Early testers have shown that Demand Gen campaigns deliver better performance when compared to Discovery Ads. That means more qualified traffic, more conversions, and more growth for your business or clients.

2. Embrace automation and smart bidding with Performance Max

In the realm of PPC, automation is crucial. Performance Max, a feature of Google’s automated bidding system, helps optimize ad placements across various channels. At the same time, new Demand Gen formats on Google platforms are changing the game. By using these engaging and visually appealing ads, you can attract potential customers right at the onset of their search journey.

Combining Performance Max with innovative ad formats ensures your ads are not only seen but also resonate with your target audience.

3. Experiment with AI

AI, specifically through tools like FeedGen, is revolutionizing how product feeds are optimized. By employing Google Cloud’s Large Language Models, like Bard, FeedGen enhances product titles, descriptions, and attributes, offering a unique way to experiment with AI in your marketing strategy. For integration instructions, visit here.

4. Explore ecommerce on diverse platforms with cross-channel and omnichannel strategies

Expand your PPC horizons beyond Google Shopping. Embrace the dynamic advertising opportunities on platforms like TikTok, Facebook, and Instagram. Each of these platforms caters to different audience segments and offers unique ways to engage with potential customers.

Integrating these platforms into your advertising mix, alongside traditional channels, creates a holistic and impactful PPC strategy for retail that aligns with the multifaceted nature of today’s consumer behavior.

Implementing these strategies in your PPC campaigns can lead to more effective and engaging marketing efforts, keeping you ahead in the competitive retail sector of 2024.

🛑 Worried you’re wasting spend in Google Ads? Find out with a free, instant audit >> Google Ads Performance Grader

Common challenges and solutions in PPC for retail

Let’s take a look at the common PPC challenges (and the solutions to these challenges) that retail advertisers run into.

Challenge 1: Ad saturation and viewer fatigue

The digital world is awash with ads, making it a challenge for retailers to stand out and capture attention, often leading to viewer fatigue.

Solutions

- Create unique, engaging content: Develop content that answers potential customer queries, positioning your brand as a solution at the top of the funnel. Focus on being helpful and informative.

- Try dynamic ad formats and personalization: Use diverse ad formats and tailor your messaging to connect more effectively with your audience. Personalization can help break through the clutter.

- Experiment and test: Try different creative approaches to discover what resonates best with your audience. Keep your content fresh and engaging.

- Apply the 80/20 rule: Dedicate most of your content to educate and engage (80%) rather than direct selling (20%). This approach can build trust and provide value to your audience.

- Be consistent with content creation: Regular updates and new content can keep your audience engaged and interested.

- Monitor and adapt based on metrics: Regularly check your campaign metrics to understand what’s working. Analyze data like click-through rates, conversion rates, and engagement levels. Double down on strategies and content types that show success. Being data-driven in your approach allows you to refine your tactics continuously and do more of what works best.

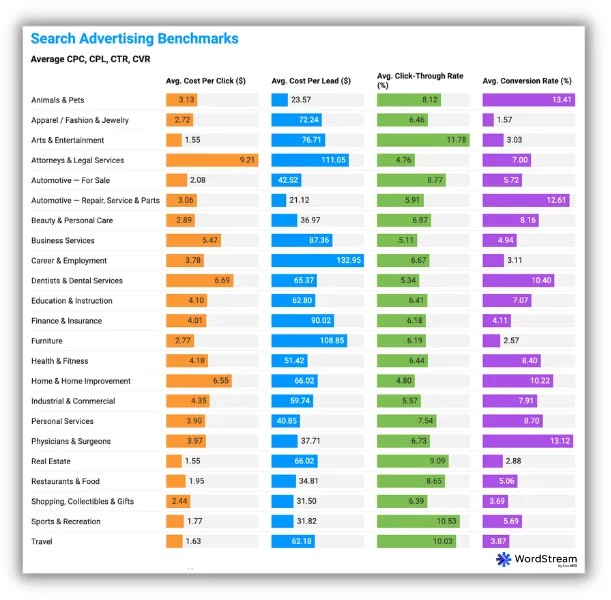

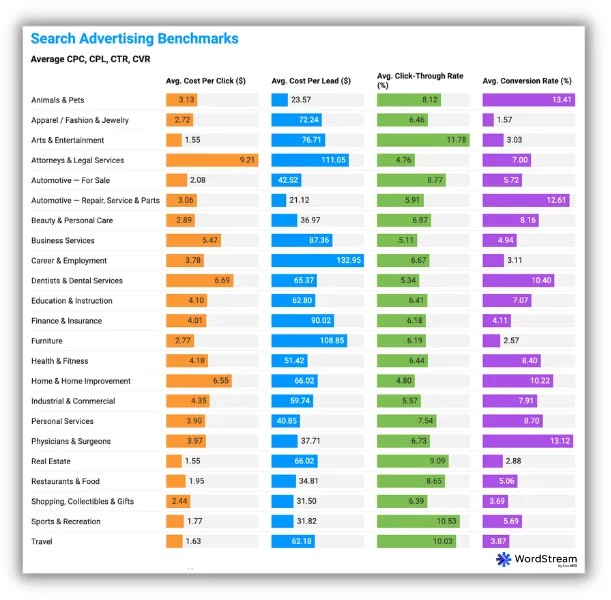

Take a look at our search advertising benchmarks to see how your metrics compare.

By combining these strategies, retailers can better navigate the challenges of ad saturation and viewer fatigue, making their PPC campaigns more effective, engaging, and relevant to their target audience.

Challenge 2: Balancing automation and human insight

While automation in PPC is powerful, an over-reliance on it, such as solely depending on Google Ads’ auto-apply settings, can lead to missed opportunities for optimization. Automation can sometimes miss the subtleties that a professional digital marketer can catch.

Solutions

- Think of AI and automation as assistants, not replacements. As a professional digital marketer, your experience and insights are invaluable. Use automation tools for efficiency but maintain control and oversight for strategic decisions.

- Regularly review the performance of your campaigns with a critical eye. Remember, the auto-apply settings in Google Ads might not always align with your unique goals.

Your role is to guide these tools, making manual adjustments and infusing your campaigns with the strategic depth that only human experience can provide.

Challenge 3: Measuring and attributing ROI accurately

Accurately tracking the return on investment (ROI) from PPC campaigns can be complex, especially when dealing with multiple channels and customer touchpoints.

Solution

Invest in advanced analytics tools like Google Analytics 4 (GA4), which is designed with privacy in mind. GA4 offers features such as default IP anonymization, region-specific controls for features like Google Signals, and the ability to mark events as non-personalized ads. Additionally, you can set shorter data retention periods and have more accurate data deletion options, including deleting data for individual users upon request.

These features not only enhance privacy compliance but also provide a clearer understanding of attribution models. This approach allows for more effective tracking of the customer journey and helps in attributing conversions accurately to the right campaigns, all while maintaining user privacy.

Challenge 4: Keeping up with rapid technological changes

The pace of change in PPC tools and algorithms can be overwhelming, especially for smaller retailers with limited resources.

Solution

Stay informed about industry trends and updates. Consider joining online communities, attending webinars, or collaborating with digital marketing experts to keep your strategies current.

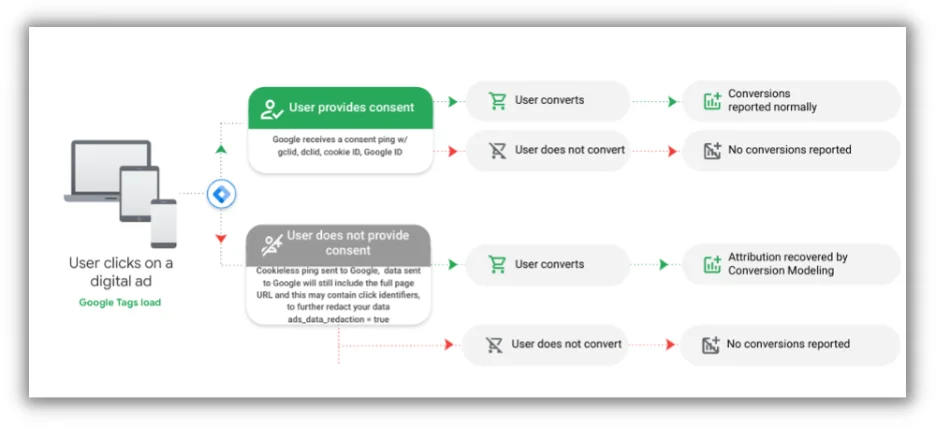

Challenge 5: Navigating privacy regulations and data restrictions

Retailers are increasingly challenged by the need to balance effective ad targeting with strict privacy regulations like GDPR and CCPA.

Solution

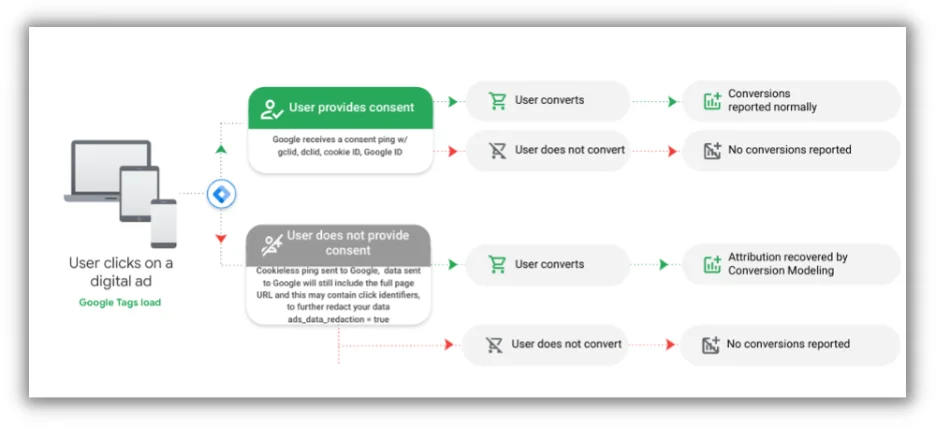

Emphasize transparency and user consent in your advertising strategies. Utilize Google’s Consent Mode and adopt a consent management platform to ensure compliance with privacy laws.

By leveraging contextual targeting and first-party data, you can still deliver personalized experiences while respecting user privacy. Investing in privacy-compliant tools and practices not only builds trust with your audience but also ensures the sustainability of your ad campaigns in a privacy-focused world.

Make the most of your PPC for retail campaigns

Navigating the PPC landscape in 2024, especially in the retail sector, is both challenging and exciting. The key to success lies in striking the right balance between leveraging advanced technology and maintaining the human touch that defines your brand. By focusing on creating unique, engaging content that educates and resonates with your audience, personalizing your messaging, and using dynamic ad formats, you can stand out in a crowded digital space. Remember, it’s not just about catching the eye but also about building lasting relationships with your customers.

Embrace tools like Google’s Performance Max and AI-enhanced solutions like FeedGen for efficiency and effectiveness, but don’t forget the value of your professional insight and experience. Always be ready to adapt, innovate, and refine your strategies based on real data and customer feedback.

In the fast-changing digital marketing world, thriving retailers recognize the need to adapt, embrace new tech, and stay true to customer values.

Here’s to making your PPC retail campaigns impactful, not just successful!

-

PPC6 days ago

PPC6 days ago19 Best SEO Tools in 2024 (For Every Use Case)

-

MARKETING7 days ago

MARKETING7 days agoEcommerce evolution: Blurring the lines between B2B and B2C

-

SEARCHENGINES5 days ago

Daily Search Forum Recap: April 19, 2024

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 18, 2024

-

WORDPRESS6 days ago

WORDPRESS6 days agoHow to Make $5000 of Passive Income Every Month in WordPress

-

SEO7 days ago

SEO7 days ago2024 WordPress Vulnerability Report Shows Errors Sites Keep Making

-

WORDPRESS6 days ago

WORDPRESS6 days ago10 Amazing WordPress Design Resouces – WordPress.com News

-

SEO6 days ago

SEO6 days ago25 WordPress Alternatives Best For SEO

You must be logged in to post a comment Login