SOCIAL

Snap Has a Brand New $300 Million Annual Business, and It’s Already Grown 40% Since September

It may describe itself simply as a technology company, but the primary moneymaker for Snap (SNAP -1.04%) is its popular Snapchat app. And with 750 million people using Snapchat every month around the world, it’s fair to say the app is a huge success.

Snap generates revenue from this enormous Snapchat user base by displaying ads. Of its 750 million monthly users, over 400 million use it every day, on average. And its user base is heavily concentrated in younger-age demographics. Management believes this is a desirable target audience for advertisers, which is why it believes it can grow ad revenue long term.

There’s been a problem, however, with this plan lately. While Snap’s user base and ad impressions are up, its ad revenue is struggling. In the third quarter of 2023, the company’s effective cost per thousand impressions (eCPM) — a measure of ad rates — was down 5% year over year.

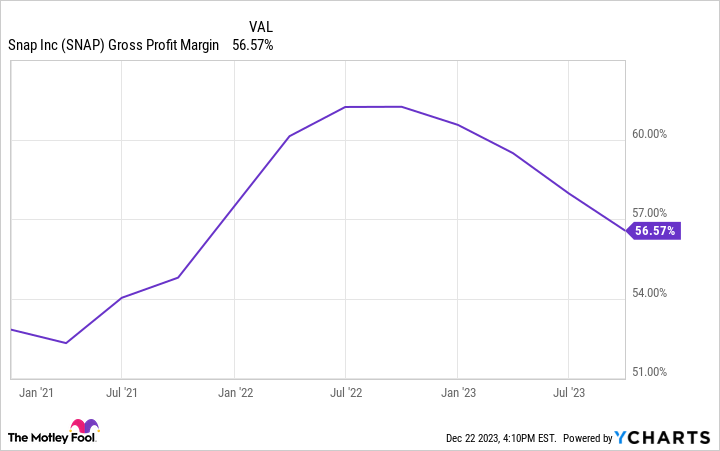

Advertisers aren’t as willing to shell out money in the current economic environment, and Snap consequently isn’t growing as it once was, as the chart below shows.

Data by YCharts.

In light of ad revenue struggles, Snap may have just stumbled upon a business idea that will completely change its financials for the better. It’s a model that other successful companies have proven can work.

Snap’s new $300 million business

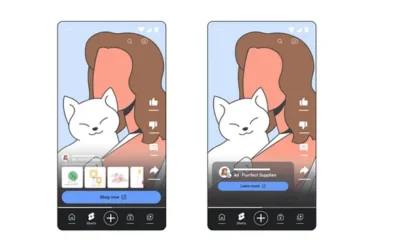

In mid-2022, Snap introduced a subscription tier to its Snapchat app. The service costs $3.99 per month and gives users access to additional features. And it’s growing like crazy.

In September, Snapchat+ had about 5 million subscribers — not bad considering it had only launched a little more than one year prior. But in December, the company said it now has 7 million subscribers. That’s about 40% growth in under three months.

At $3.99 per month, this puts Snapchat+ at an annual run rate over $300 million. Therefore, with Snap’s $4.5 billion in total trailing-12-month revenue, Snapchat+ is already a meaningful revenue stream for the company.

In my view, Snap is following the pattern of other ad-based platform businesses such as Spotify and Duolingo. Both of these companies discovered how much more powerful subscription revenue can be compared to free ad-based tiers.

For example, as of Q3 2023, Spotify had 574 million monthly active users, of which 226 million pay for an ad-free experience — just 39% of the user base. However, paying users accounted for a whopping 87% of its revenue during the quarter.

For its part, Duolingo has the same dynamic. There are 83.1 million people who use the language-learning app on a monthly basis, but only 5.8 million users pay as of the end of Q3 2023. But subscription revenue was 77% of the total.

With both Spotify and Duolingo, only a small subset of users pay, but these paying users account for the majority of the top line.

What to watch with Snap

Hypothetically, what would happen if just 5% of Snap’s user base started paying for Snapchat+? In that scenario, the company would be pulling in an impressive $1.8 billion in annual subscription revenue.

It’s easy to see how this could be a big deal for Snap, especially if its current rate of adoption holds strong in coming quarters and years.

However, there is a catch to all of this. Snap’s gross margin has been dropping ever since Snapchat+ launched, and it could be related.

Data by YCharts.

In Q3, Snap’s infrastructure costs were up 51% year over year and 16% quarter over quarter. In short, the company’s investments in artificial intelligence (AI) and augmented reality (AR) come with increased costs. And some of the perks of being a Snapchat+ subscriber are gaining access to AI and AR tools.

Assuming the subscription tier takes off and Snapchat eventually reins in infrastructure spending, this is something that can completely revolutionize Snap’s business. Revenue growth could soar as more users start paying, and Snap would avoid the ups and downs of the ad market.

It’s too early to say whether or not this is a game changer for Snap. But the stock should definitely be on your watch list because a subscription tier is the kind of thing that could indeed improve its long-term prospects.