PPC

Retail Search is the New PPC

“Amazon Ads, why?”. It all started for me back in 2018 when I interviewed some of the world’s leading PPC experts and surveyed award-winning paid search agencies. They were all doing Google Shopping campaigns but what about Amazon Ads? Very few of them invested there.

Since then, Amazon Ads has caught up on both Meta and Google. The advertising revenue of Amazon represents 7% of its business. But those 7% already correspond to almost 20% of Google Ads. It’s on fire.

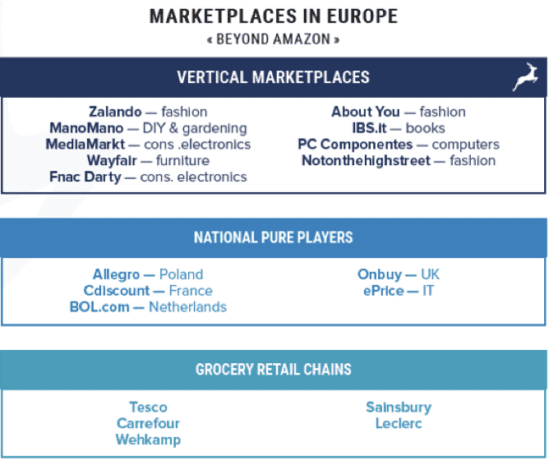

But it is not all about Amazon. When you dive deeper into the online retail marketing space, you quickly find out that retail search is not the only advertising lever there, and that Amazon is not the only player. Beneath the surface, you will find a a whole new world of what we call “Retail Media”: advertising during the consumer journey in retail sites, marketplaces and even beyond. It is both the digital version of trade marketing, it is the “paid search” of product search, and it is a challenger to programmatic advertising. And whereas Amazon is popularising it, there are plenty of other players in the market. Especially in Europe.

(Source: “State of Retail Media in 2022: Europe”, Innovell 2022)

State of retail media in Europe

We researched the retail media market for the newest Innovell report: “State of Retail Media in 2022: Europe” and uncovered an extremely dynamic business sector with phenomenal growth rates and new entrants every few months. There were 6 main reasons for the massive growth of retail media as we shall see below.

Obviously, the hypergrowth that ecommerce is experiencing makes the “media” itself grow, because that media is ecommerce activity. The more time consumers spend on retail platforms and marketplaces, the larger the ad inventory of retail media becomes. And as marketers, we know it quite well: users are spending a heck of an amount of time before they purchase something online, aren’t they? These online window shoppers are being monetized via retail media.

And ecommerce platforms are pushing for it. Many retail sites are expanding from brand-centered ecommerce platforms to category-focused marketplaces. This has given unicorn start-ups such as Mirakl an amazing playground to develop in, as it provides the technical platform for that endeavour.

Along with marketplace investments come a desire to monetize, and retailers are looking to Amazon’s 5% of GMV (Gross Merchandise Value) revenue from advertising for inspiration. Another 5% of margin could make a huge difference in the retail business, where low margins and high volumes have long been the norm.

But brands are pushing retail media too. They were used to investing in trade marketing to stimulate retail sales, and the new digital version of digital advertising during the consumer journey has proven to be a sales activator too.

From an organisational perspective, it is much easier to justify retail media investments with measurable impact than trade marketing budgets that are being poured into periodical retail negotiation to theoretically boost sales.

And finally, users are changing their behaviour too. We frequently hear of new surveys showing how users no longer start their product search journeys on Google but have shifted to Amazon. Users, of course, have erratic behavior and will start their journey in all sorts of places and even search simultaneously in several channels. One thing is certain though, product search is convenient and easy on Amazon and if you are a Prime member, your purchases will be delivered tomorrow. Retail search is on the rise for sure.

Show me the money

Easy, you take budget from your Google Ads and Facebook campaigns and put them into Amazon, right? Well, not really. We found hardly any evidence of that happening. Those budget streams are rarely connected directly.

The quarterly reports of the other ad platforms are not showing signs of budget transfer either. During the past few years of Amazon Ads booming, Google Ads has been increasing its own growth too. And the recent difficulties for Meta were caused by something entirely different, namely Apple’s cookie gate. A recent study from McKinsey confirms this. It estimates that 80% of retail media budgets are likely to be “net new” rather than transfers from existing advertising budgets. (Source: https://www.mckinsey.com/business-functions/growth-marketing-and-sales/our-insights/busted-five-myths-about-retail-media)

Retail media is trade marketing digitally transformed

One of the sources for retail media funding is the shift from trade marketing. Trade marketing has existed almost since the outset of retail itself.

But where trade marketing is something that is often discussed in quarterly or annual distribution negotiations as a compensation form, retail media can be invested and optimized in real-time. And more importantly, its impact is measurable and can be put in relation to incremental value it generates.

(Purchase) data is the new oil

Retail media has product search as its engine and purchase data as its fuel. We hear often enough that “data is the new oil”, but perhaps it is in reality purchase data, a refined form of data, which could show the real value of data, as it allows advertisers to perform high quality targeting.

Most of the experts we interviewed for our report insisted on the quality and actionability of the data issued from retail. Both data from online ad platforms on marketplaces and offline from retail outlets capable of understanding the purchasing patterns via behavioural data.

Retail media is a challenger to programmatic advertising

Retail search is already a new PPC contender growing faster than most of its competitors. But on top of that, the promise of audience targeting on the basis of purchasing data from the same retail media platforms is a potential contender to win the programmatic space. Remains to be seen whether the data really is that good. If indeed it is, the epicenter of programmatic advertising could well shift towards retail-data-driven platforms in the future.

On 19 July on Hero Conf London, we will dive deeper into retail media and explore the many local pureplayers, vertical marketplaces and hybrid on- and offline grocery chains occupying the retail media space together with Amazon in Europe.

We will also propose a five-step approach to winning on retail media for brands. It applies both to those who have not started their journey and those who are already active in retail media on one or more marketplaces.

In this session you will learn:

– What the drivers of “retail media” are

– What Amazon and other marketplaces have in stock for marketers in 2022

– If and how you should position retail media in your PPC strategy

You must be logged in to post a comment Login