PPC

Retail Search is the New PPC

“Amazon Ads, why?”. It all started for me back in 2018 when I interviewed some of the world’s leading PPC experts and surveyed award-winning paid search agencies. They were all doing Google Shopping campaigns but what about Amazon Ads? Very few of them invested there.

Since then, Amazon Ads has caught up on both Meta and Google. The advertising revenue of Amazon represents 7% of its business. But those 7% already correspond to almost 20% of Google Ads. It’s on fire.

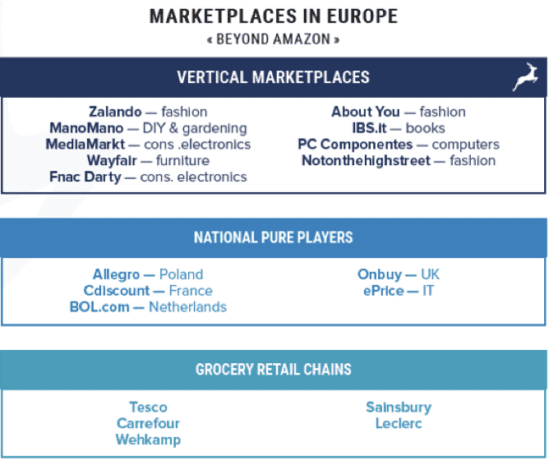

But it is not all about Amazon. When you dive deeper into the online retail marketing space, you quickly find out that retail search is not the only advertising lever there, and that Amazon is not the only player. Beneath the surface, you will find a a whole new world of what we call “Retail Media”: advertising during the consumer journey in retail sites, marketplaces and even beyond. It is both the digital version of trade marketing, it is the “paid search” of product search, and it is a challenger to programmatic advertising. And whereas Amazon is popularising it, there are plenty of other players in the market. Especially in Europe.

(Source: “State of Retail Media in 2022: Europe”, Innovell 2022)

State of retail media in Europe

We researched the retail media market for the newest Innovell report: “State of Retail Media in 2022: Europe” and uncovered an extremely dynamic business sector with phenomenal growth rates and new entrants every few months. There were 6 main reasons for the massive growth of retail media as we shall see below.

Obviously, the hypergrowth that ecommerce is experiencing makes the “media” itself grow, because that media is ecommerce activity. The more time consumers spend on retail platforms and marketplaces, the larger the ad inventory of retail media becomes. And as marketers, we know it quite well: users are spending a heck of an amount of time before they purchase something online, aren’t they? These online window shoppers are being monetized via retail media.

And ecommerce platforms are pushing for it. Many retail sites are expanding from brand-centered ecommerce platforms to category-focused marketplaces. This has given unicorn start-ups such as Mirakl an amazing playground to develop in, as it provides the technical platform for that endeavour.

Along with marketplace investments come a desire to monetize, and retailers are looking to Amazon’s 5% of GMV (Gross Merchandise Value) revenue from advertising for inspiration. Another 5% of margin could make a huge difference in the retail business, where low margins and high volumes have long been the norm.

But brands are pushing retail media too. They were used to investing in trade marketing to stimulate retail sales, and the new digital version of digital advertising during the consumer journey has proven to be a sales activator too.

From an organisational perspective, it is much easier to justify retail media investments with measurable impact than trade marketing budgets that are being poured into periodical retail negotiation to theoretically boost sales.

And finally, users are changing their behaviour too. We frequently hear of new surveys showing how users no longer start their product search journeys on Google but have shifted to Amazon. Users, of course, have erratic behavior and will start their journey in all sorts of places and even search simultaneously in several channels. One thing is certain though, product search is convenient and easy on Amazon and if you are a Prime member, your purchases will be delivered tomorrow. Retail search is on the rise for sure.

Show me the money

Easy, you take budget from your Google Ads and Facebook campaigns and put them into Amazon, right? Well, not really. We found hardly any evidence of that happening. Those budget streams are rarely connected directly.

The quarterly reports of the other ad platforms are not showing signs of budget transfer either. During the past few years of Amazon Ads booming, Google Ads has been increasing its own growth too. And the recent difficulties for Meta were caused by something entirely different, namely Apple’s cookie gate. A recent study from McKinsey confirms this. It estimates that 80% of retail media budgets are likely to be “net new” rather than transfers from existing advertising budgets. (Source: https://www.mckinsey.com/business-functions/growth-marketing-and-sales/our-insights/busted-five-myths-about-retail-media)

Retail media is trade marketing digitally transformed

One of the sources for retail media funding is the shift from trade marketing. Trade marketing has existed almost since the outset of retail itself.

But where trade marketing is something that is often discussed in quarterly or annual distribution negotiations as a compensation form, retail media can be invested and optimized in real-time. And more importantly, its impact is measurable and can be put in relation to incremental value it generates.

(Purchase) data is the new oil

Retail media has product search as its engine and purchase data as its fuel. We hear often enough that “data is the new oil”, but perhaps it is in reality purchase data, a refined form of data, which could show the real value of data, as it allows advertisers to perform high quality targeting.

Most of the experts we interviewed for our report insisted on the quality and actionability of the data issued from retail. Both data from online ad platforms on marketplaces and offline from retail outlets capable of understanding the purchasing patterns via behavioural data.

Retail media is a challenger to programmatic advertising

Retail search is already a new PPC contender growing faster than most of its competitors. But on top of that, the promise of audience targeting on the basis of purchasing data from the same retail media platforms is a potential contender to win the programmatic space. Remains to be seen whether the data really is that good. If indeed it is, the epicenter of programmatic advertising could well shift towards retail-data-driven platforms in the future.

On 19 July on Hero Conf London, we will dive deeper into retail media and explore the many local pureplayers, vertical marketplaces and hybrid on- and offline grocery chains occupying the retail media space together with Amazon in Europe.

We will also propose a five-step approach to winning on retail media for brands. It applies both to those who have not started their journey and those who are already active in retail media on one or more marketplaces.

In this session you will learn:

– What the drivers of “retail media” are

– What Amazon and other marketplaces have in stock for marketers in 2022

– If and how you should position retail media in your PPC strategy

PPC

Biggest Trends, Challenges, & Strategies for Success

Pay per click (PPC) advertising is a big deal in digital marketing, especially in the retail world. As 2024 heats up, we’re not just talking about simple ad placements and bids; it’s all about smart technology, understanding your customers, and getting creative with your strategies.

Whether you’re a pro in digital marketing or just starting to explore ecommerce ads, keeping up with PPC trends is crucial. This guide is here to help you out.

Contents

Biggest trends in PPC for retail

Let’s dive into the PPC scene for retail in 2024. Things are getting exciting with Google’s ad platform evolving rapidly, especially with its use of AI and machine learning.

Increased use of AI and machine learning

Often, we talk about AI as if it’s one big thing, but it’s more nuanced. AI is the broader concept of machines being able to carry out tasks in a way that we’d consider “smart.” Within this, machine learning is a specific subset of AI that trains a machine how to learn. In the PPC world, this distinction is key.

This year, AI will be transitioning away from merely a novelty. It is becoming smarter, a trend we can refer to as Smart AI. This new phase of AI is more targeted and informed, indicating a significant evolution in how AI systems are developed and applied.

🤖 Want to use AI the right way? Free download >> Emergency Guide to AI in Marketing

AI in ad targeting

AI’s role in PPC is about understanding and predicting. It sifts through tons of data to figure out what consumers are looking for, then predicts their buying patterns. This means your retail PPC ads are more likely to show up for people who are genuinely interested in what you’re selling.

Machine learning in real-time optimization

Machine learning steps in to continuously improve how your retail ads perform. It adjusts bids, manages budgets, and identifies trends that you might not notice. It’s like having an assistant who’s always optimizing your campaigns, ensuring they reach the right audience effectively.

Mastering these technologies is crucial for digital marketers in retail. It’s not just about using these tools; it’s about understanding them deeply and leveraging their strengths to boost your PPC campaigns.

Top PPC strategies for retail in 2024

Here are four essential PPC strategies for retail digital marketers:

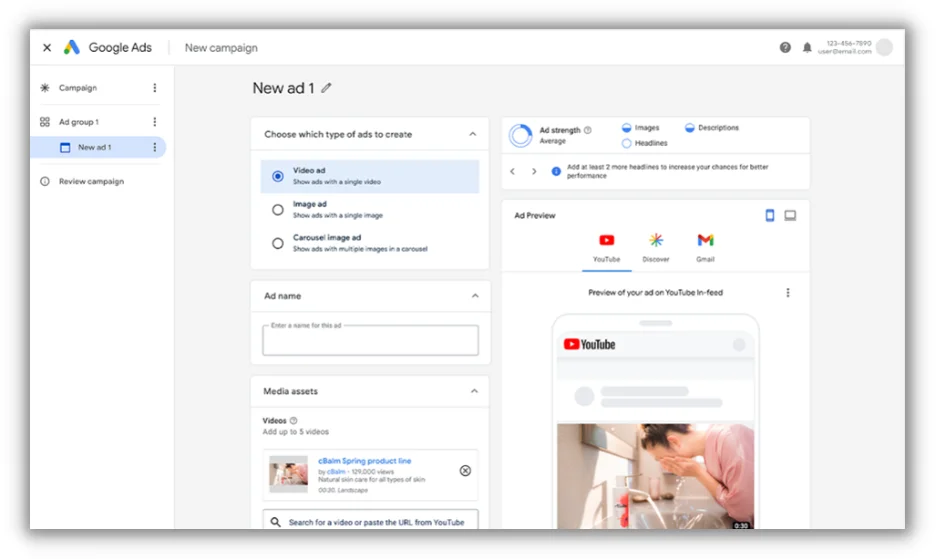

1. Try Demand Gen campaigns

Recently, Discovery Ads campaigns were automatically upgraded to the Demand Gen campaign type in Google Ads.

Demand Gen is more than just an upgrade–it’s a game-changer in winning social budgets for Google. Early testers have shown that Demand Gen campaigns deliver better performance when compared to Discovery Ads. That means more qualified traffic, more conversions, and more growth for your business or clients.

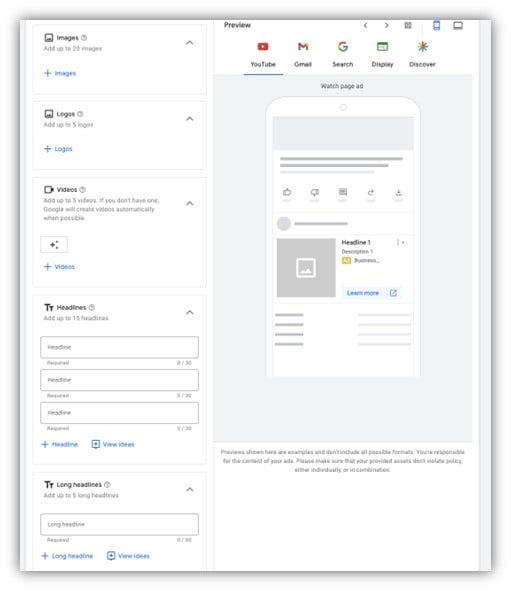

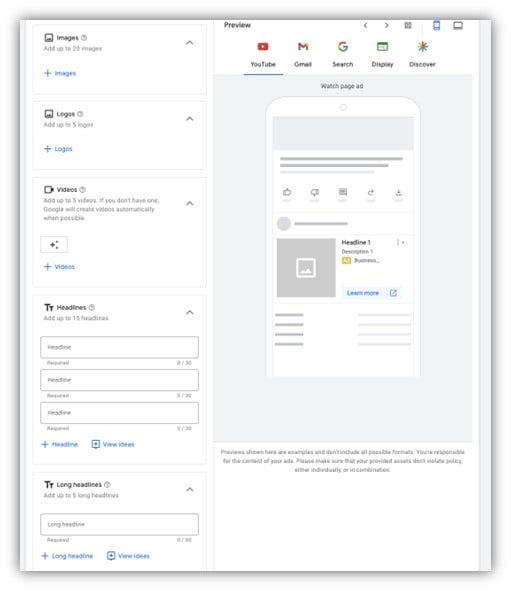

2. Embrace automation and smart bidding with Performance Max

In the realm of PPC, automation is crucial. Performance Max, a feature of Google’s automated bidding system, helps optimize ad placements across various channels. At the same time, new Demand Gen formats on Google platforms are changing the game. By using these engaging and visually appealing ads, you can attract potential customers right at the onset of their search journey.

Combining Performance Max with innovative ad formats ensures your ads are not only seen but also resonate with your target audience.

3. Experiment with AI

AI, specifically through tools like FeedGen, is revolutionizing how product feeds are optimized. By employing Google Cloud’s Large Language Models, like Bard, FeedGen enhances product titles, descriptions, and attributes, offering a unique way to experiment with AI in your marketing strategy. For integration instructions, visit here.

4. Explore ecommerce on diverse platforms with cross-channel and omnichannel strategies

Expand your PPC horizons beyond Google Shopping. Embrace the dynamic advertising opportunities on platforms like TikTok, Facebook, and Instagram. Each of these platforms caters to different audience segments and offers unique ways to engage with potential customers.

Integrating these platforms into your advertising mix, alongside traditional channels, creates a holistic and impactful PPC strategy for retail that aligns with the multifaceted nature of today’s consumer behavior.

Implementing these strategies in your PPC campaigns can lead to more effective and engaging marketing efforts, keeping you ahead in the competitive retail sector of 2024.

🛑 Worried you’re wasting spend in Google Ads? Find out with a free, instant audit >> Google Ads Performance Grader

Common challenges and solutions in PPC for retail

Let’s take a look at the common PPC challenges (and the solutions to these challenges) that retail advertisers run into.

Challenge 1: Ad saturation and viewer fatigue

The digital world is awash with ads, making it a challenge for retailers to stand out and capture attention, often leading to viewer fatigue.

Solutions

- Create unique, engaging content: Develop content that answers potential customer queries, positioning your brand as a solution at the top of the funnel. Focus on being helpful and informative.

- Try dynamic ad formats and personalization: Use diverse ad formats and tailor your messaging to connect more effectively with your audience. Personalization can help break through the clutter.

- Experiment and test: Try different creative approaches to discover what resonates best with your audience. Keep your content fresh and engaging.

- Apply the 80/20 rule: Dedicate most of your content to educate and engage (80%) rather than direct selling (20%). This approach can build trust and provide value to your audience.

- Be consistent with content creation: Regular updates and new content can keep your audience engaged and interested.

- Monitor and adapt based on metrics: Regularly check your campaign metrics to understand what’s working. Analyze data like click-through rates, conversion rates, and engagement levels. Double down on strategies and content types that show success. Being data-driven in your approach allows you to refine your tactics continuously and do more of what works best.

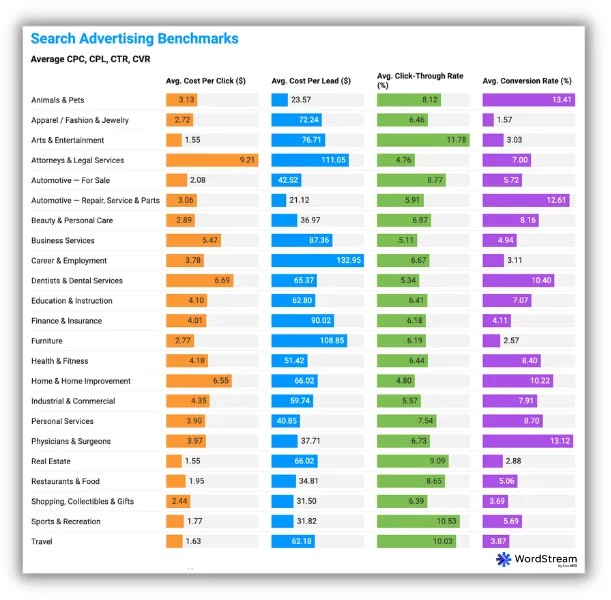

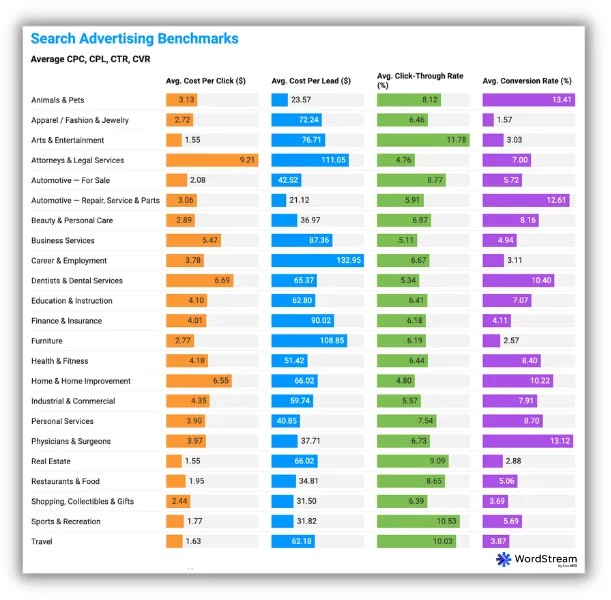

Take a look at our search advertising benchmarks to see how your metrics compare.

By combining these strategies, retailers can better navigate the challenges of ad saturation and viewer fatigue, making their PPC campaigns more effective, engaging, and relevant to their target audience.

Challenge 2: Balancing automation and human insight

While automation in PPC is powerful, an over-reliance on it, such as solely depending on Google Ads’ auto-apply settings, can lead to missed opportunities for optimization. Automation can sometimes miss the subtleties that a professional digital marketer can catch.

Solutions

- Think of AI and automation as assistants, not replacements. As a professional digital marketer, your experience and insights are invaluable. Use automation tools for efficiency but maintain control and oversight for strategic decisions.

- Regularly review the performance of your campaigns with a critical eye. Remember, the auto-apply settings in Google Ads might not always align with your unique goals.

Your role is to guide these tools, making manual adjustments and infusing your campaigns with the strategic depth that only human experience can provide.

Challenge 3: Measuring and attributing ROI accurately

Accurately tracking the return on investment (ROI) from PPC campaigns can be complex, especially when dealing with multiple channels and customer touchpoints.

Solution

Invest in advanced analytics tools like Google Analytics 4 (GA4), which is designed with privacy in mind. GA4 offers features such as default IP anonymization, region-specific controls for features like Google Signals, and the ability to mark events as non-personalized ads. Additionally, you can set shorter data retention periods and have more accurate data deletion options, including deleting data for individual users upon request.

These features not only enhance privacy compliance but also provide a clearer understanding of attribution models. This approach allows for more effective tracking of the customer journey and helps in attributing conversions accurately to the right campaigns, all while maintaining user privacy.

Challenge 4: Keeping up with rapid technological changes

The pace of change in PPC tools and algorithms can be overwhelming, especially for smaller retailers with limited resources.

Solution

Stay informed about industry trends and updates. Consider joining online communities, attending webinars, or collaborating with digital marketing experts to keep your strategies current.

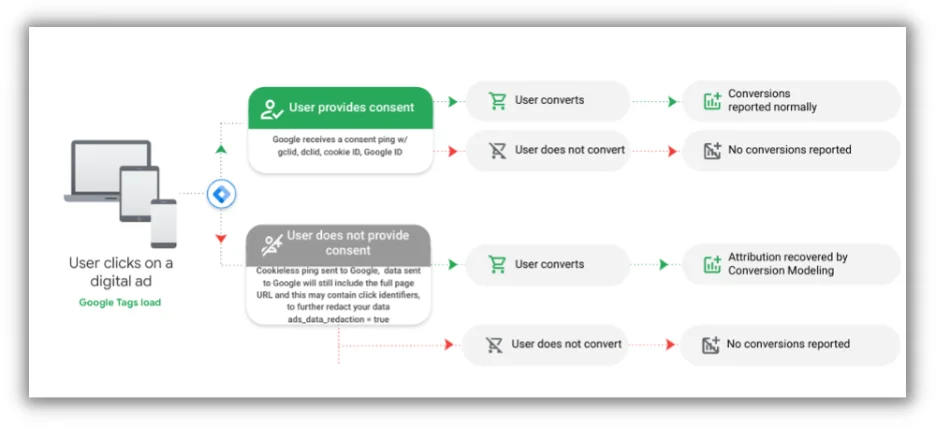

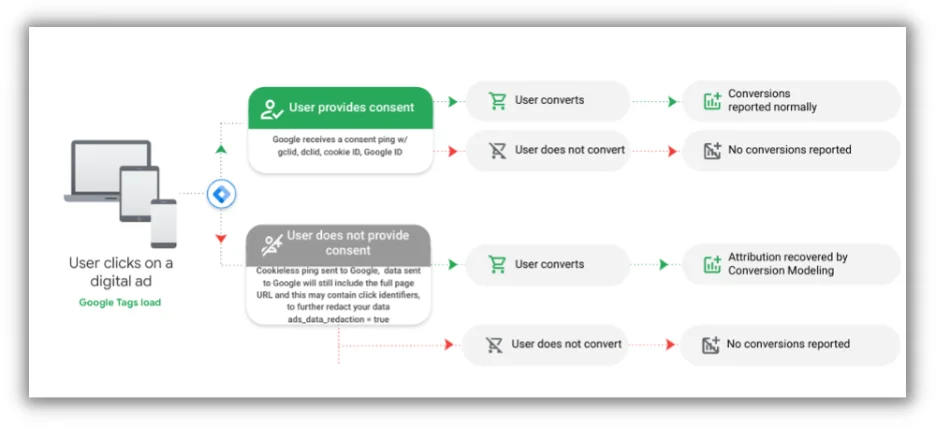

Challenge 5: Navigating privacy regulations and data restrictions

Retailers are increasingly challenged by the need to balance effective ad targeting with strict privacy regulations like GDPR and CCPA.

Solution

Emphasize transparency and user consent in your advertising strategies. Utilize Google’s Consent Mode and adopt a consent management platform to ensure compliance with privacy laws.

By leveraging contextual targeting and first-party data, you can still deliver personalized experiences while respecting user privacy. Investing in privacy-compliant tools and practices not only builds trust with your audience but also ensures the sustainability of your ad campaigns in a privacy-focused world.

Make the most of your PPC for retail campaigns

Navigating the PPC landscape in 2024, especially in the retail sector, is both challenging and exciting. The key to success lies in striking the right balance between leveraging advanced technology and maintaining the human touch that defines your brand. By focusing on creating unique, engaging content that educates and resonates with your audience, personalizing your messaging, and using dynamic ad formats, you can stand out in a crowded digital space. Remember, it’s not just about catching the eye but also about building lasting relationships with your customers.

Embrace tools like Google’s Performance Max and AI-enhanced solutions like FeedGen for efficiency and effectiveness, but don’t forget the value of your professional insight and experience. Always be ready to adapt, innovate, and refine your strategies based on real data and customer feedback.

In the fast-changing digital marketing world, thriving retailers recognize the need to adapt, embrace new tech, and stay true to customer values.

Here’s to making your PPC retail campaigns impactful, not just successful!

PPC

19 Best SEO Tools in 2024 (For Every Use Case)

Whether you’re a local mom-and-pop shop or a multinational enterprise, SEO is still the best play for long-term traffic growth and lead generation. A single optimized blog post, web page, or video can attract thousands of qualified visitors for years—and you don’t have to spend a dime to promote it.

That said, SEO isn’t easy. Every marketer knows how valuable the top of a Google results page is, and it keeps getting harder to own that real estate.

That’s why we’ve trialed, tested, and categorized the best SEO tools available in 2024. Whether you’re publishing your first blog post or optimizing a 5,000-page website, there are SEO tools here to help.

Contents

What are SEO tools?

In broad terms, SEO tools are software that helps you automate, streamline, or support your SEO strategy.

More specifically, SEO tools can help with:

SEO tools come in a few varieties. Some are feature-rich, comprehensive software with several tools to tackle many SEO tasks. Ahrefs is a good example of a comprehensive SEO tool since it helps with on-page SEO, off-page SEO, site audits, and more. Our Keyword Tool is a point-solution since it has one function—to help you find the best SEO keywords to target.

What is the most effective tool for SEO?

That’s like asking, “What’s the best vehicle?” Do you want to haul a lot of people, a lot of stuff, or do you just want to go fast?

Like car shopping, picking your SEO tool starts with understanding your needs. Here are some questions to consider:

- Are you new to SEO or a power user of SEO tools?

- What’s your budget?

- Do you have specific jobs to do, like auditing a blog with 5,000 posts or doing initial keyword research?

- How big is the team that’ll use the SEO tool?

- What type of organization is it (a marketing agency, affiliate marketing group, ecommerce shop, SaaS company, etc.)?

While each use case has its own set of needs, there are a few foundational characteristics we used to compile our best SEO tools list, including:

- User experience: Is the interface and workflow intuitive? Does the design help new users find what they need quickly?

- Value: Does the cost justify the software’s capability? Is it competitively priced versus similar tools?

- Feature/use-case fit: Does the tool have everything you’ll need to complete the task it’s built for?

- User feedback: Positive reviews and high ratings on sites like G2 and Capterra.

Best free SEO tools

These SEO tools are either completely free or have a robust free tier with plenty of functionality.

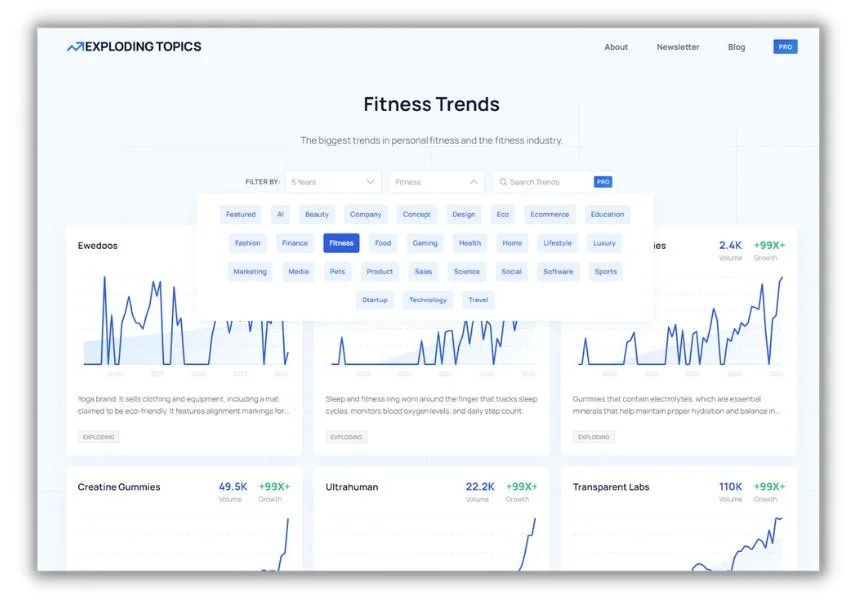

1. Exploding Topics for SEO keyword trends

Exploding Topics is a neat little tool that helps you get in early on soon-to-be popular topics. The tool constantly scans the web, looking for increasing patterns of searches and mentions for any specific term.

Note that you can’t enter any old search term to see what’s trending. But you can choose from a bunch of topics that may be important to your brand.

The data doesn’t just come from search engines (although the software does “listen” to millions of searches). When you see a trending topic, it’s because it’s also been mentioned, commented on, and discussed all over the internet. That’s why this tool is good at exposing not just what people search for but also what they’ll likely search for in the near future.

There’s no cost to pop in anytime and see what’s trending for each category. The paid plans start at $39 and give you tracking, alerts, and detailed reports (like tracking specific product categories).

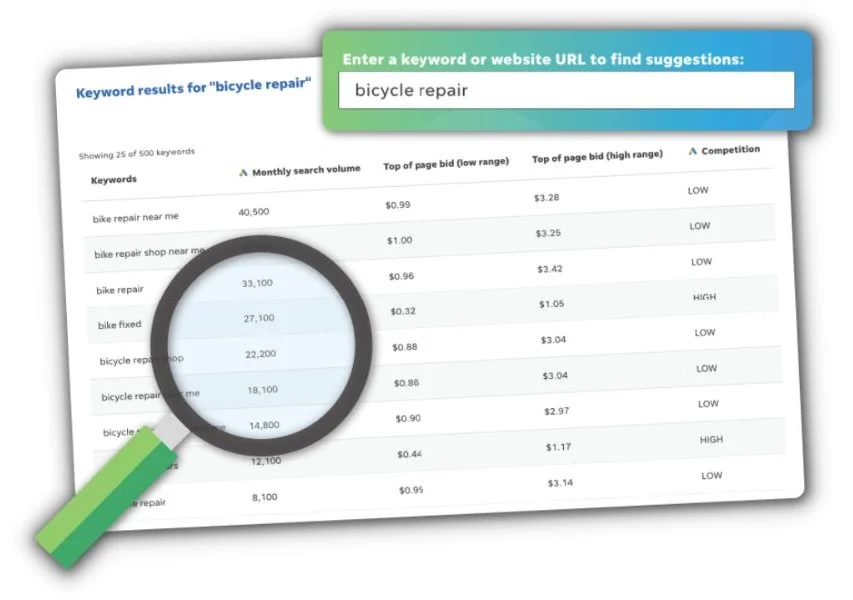

2. WordStream’s Free Keyword Tool for unlimited keyword research

One of the hardest parts of SEO is finding keywords with the right balance of search volume and low difficulty. Our Free Keyword Tool helps you overcome that hurdle by quickly surfacing a list of relevant keywords and the data you need to pick the best options.

I like to use it once I’ve brainstormed a list of seed keywords (terms I think people might search for). Just drop the word or phrase in the search bar, and you will get a list of related terms, plus their monthly search volumes and competition levels. It’s pretty easy to spot those high-volume, low-competition keyword unicorns.

The price of the tool is in the name. It’s always free for an unlimited number of searches.

3. Animalz Revive for refreshing SEO content

Over time, SEO blog posts often lose their ranking to new content. Revive, from the content marketing agency Animalz, locates these decaying assets on your blog.

The tool works by reviewing your Google Analytics (you have to give it access) to spot blog posts with a downward traffic trend. Once it’s finished, you’ll get an emailed report with a list of content that could rank and get more traffic once it’s refreshed.

The tool is free, but you do have to give up your email address to access it.

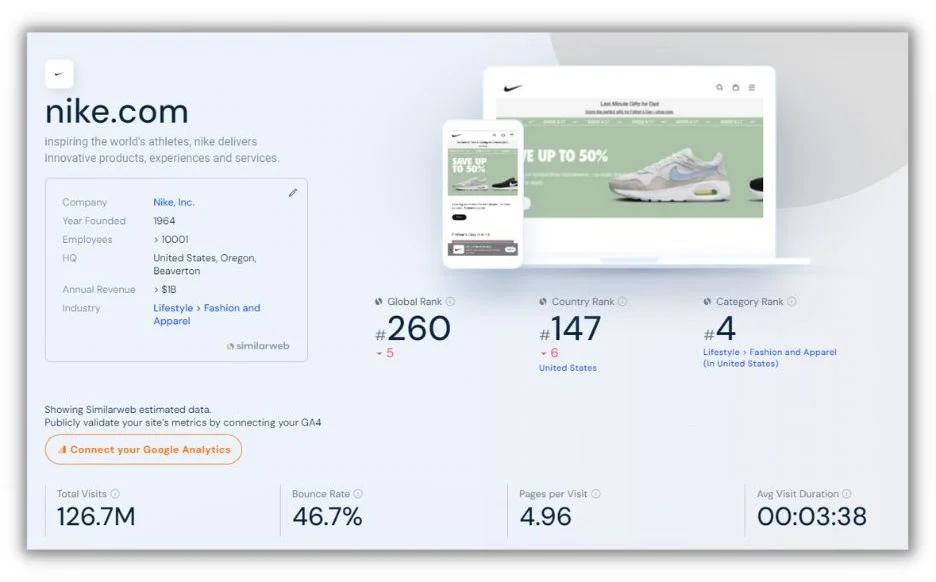

4. Similarweb for competitive SEO analysis

Similarweb gives you a sneak peek at the performance and ranking of any public website on the internet. Its free version is surprisingly comprehensive.

Enter a URL and scroll to see estimated traffic and engagement stats, site traffic demographics, traffic sources, and more. You can even compare two websites side-by-side.

I wouldn’t take Similarweb data as gospel. It pulls “digital signals” from millions of locations across the internet and creates statistically significant estimates. It’s excellent for directional insights, though. If five of my competitors show a lower bounce rate than the pages I’m working on, it’s a signal that I need to make some user experience improvements.

Basic website analysis is free on Similarweb. There are several data points, like top outgoing links and referral traffic sources, you’ll have to pay for.

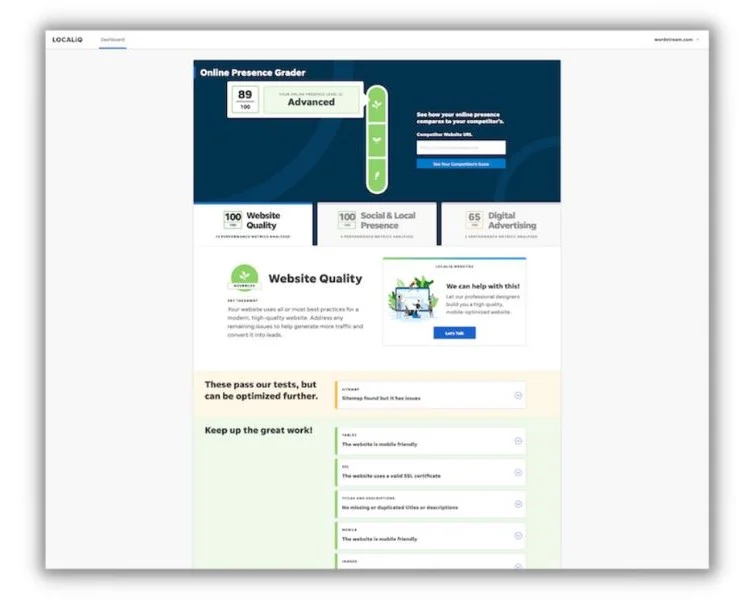

5. LocaliQ’s Website Grader for free SEO audits

If you need a quick, easy-to-understand website audit, LocaliQ’s Free Website Grader will do the trick.

Even though it’s a free tool, you get a lot of information. For example, in your report you’ll see:

- Technical SEO: Site security, site speed, mobile optimization

- On-page SEO: Metadata, word count, alt text

- Off-page SEO: Links from other sources

It’s plenty enough to create a good checklist of SEO improvements.

Free reports are delivered by email, and you can run them as often as you like.

Best AI-powered SEO tools

Many of the tools in this guide have some type of built-in AI functionality for SEO. But we found a few that stand out for their use of AI’s ability to process huge amounts of data and generate SEO insights.

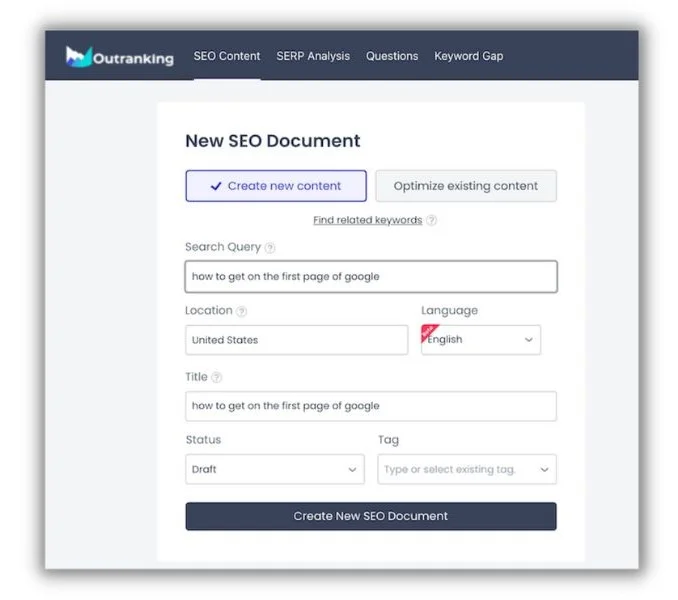

6. Outranking for SEO outlines

There are loads of generative AI content tools out there now. What sets Outranking apart is that it’s focused on helping you create content that’ll rank well on search engines.

With a free account, you can input a search query, location, language, and title, and it will generate an SEO outline that you can customize. It’s really helpful if you regularly write content briefs for others to complete. Like any generative AI content tool, double-check the output and add your own voice.

Outranking pricing tiers start at $29 monthly for five new SEO documents and AI-assisted SEO optimization for existing content.

7. CanIRank for keyword competition

CanIRank is a personalized keyword difficulty tracker on steroids. It reviews your website’s existing SEO clout and then tells you if you can rank for specific keywords.

Here’s the real magic of CanIRank. It doesn’t just tell you which keywords to target; it leverages AI to give you specific steps to help your content rank higher.

CanIRank lets you review one website for free (plus get five keywords and SEO reports daily without paying). The paid plans for more websites and keyword reports start at $49/month.

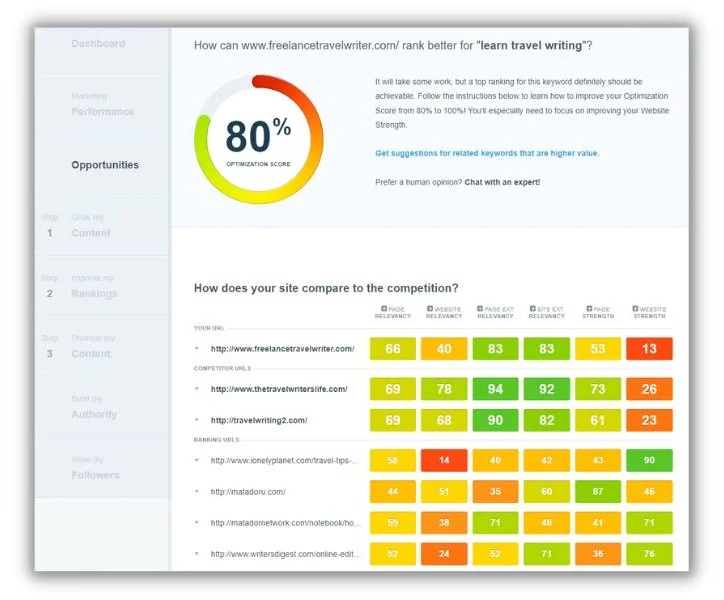

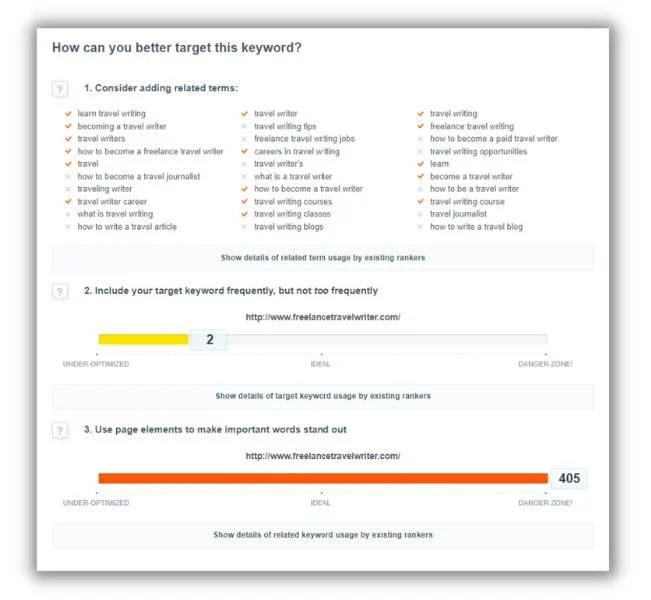

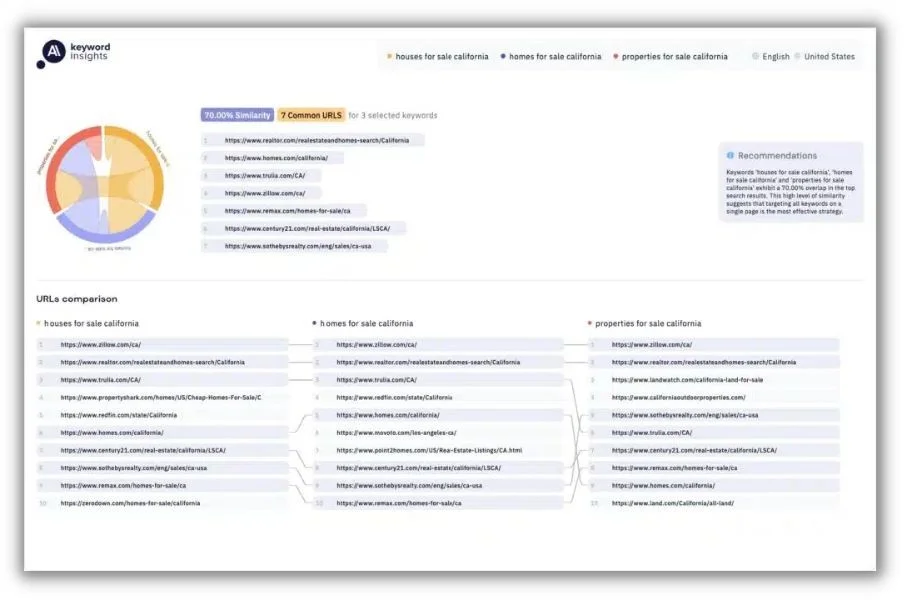

8. Keyword Insights for keyword clustering

Keyword Insights is a paid keyword research tool that uses AI in two interesting ways. First, it uses algorithms and machine learning to locate clusters of topics from a single keyword.

Keyword clusters help you target multiple longtail keywords in a single post or a linked group of posts. Google sees your exhaustive coverage as topical authority on the subject and bumps you to the top of the SERPs for those related keywords.

Then, once you have a keyword cluster defined, Keyword Insights uses AI to generate a brief or outline based on the existing posts in the SERP plus data from Reddit, Quora, and People Also Ask boxes.

A note of warning here. Generative outline creators like Keyword Insights are a great way to create a base outline quickly. But to earn your spot on the SERPs, make sure you add something extra like personal experience, expert quotes, or another facet of the topic other SERP leaders don’t have.

Keyword Insights offers a four-day trial for $1. Monthly paid plans start at $58.

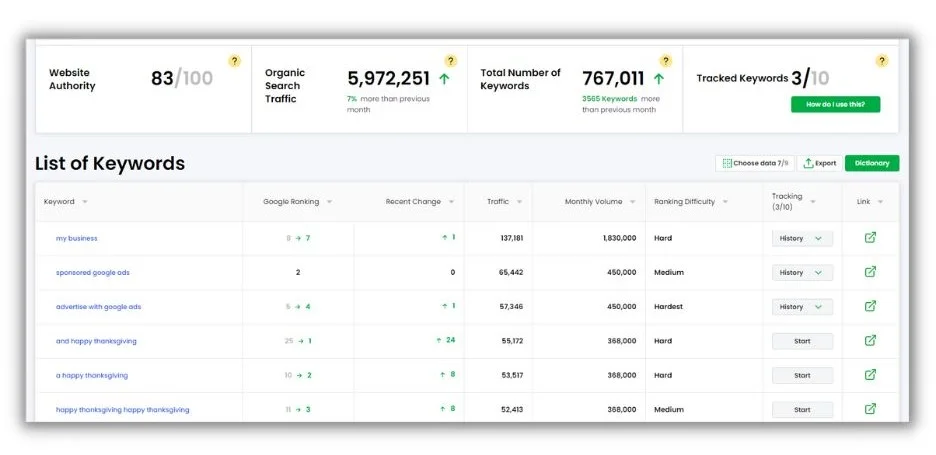

9. Diib for keyword and rank monitoring

Google SERPs are in constant flux. You can gain or lose page-one ranking for any given keyword in a day. Diib uses predictive AI to monitor all sorts of SEO vitals for your website, but the keyword tracking will keep you abreast of turbulent search pages.

With Diib, you can add high-priority keywords to a monitoring list. It’ll show you those at the top of your keyword reports and let you see their history of performance on the SERP. But the best part is that the tool will also notify you when your rankings change for those keywords. The heads-up lets you take action, like updating the page’s UX or adding new information.

The pricing provided to us was an initial $99 startup fee and $14.99 for each subsequent month.

🛑 Get the free Guide to AI in Marketing and learn the most effective ways to use AI (and the ways you shouldn’t be).

Best local SEO tools

It’s cliche but true: Local SEO is critical for location-based businesses. 77% of people say they’ve used Google to find businesses like a coffee shop, dentist, or HVAC tech nearby. These tools are designed to ensure that you show up on SERPs when those people need you.

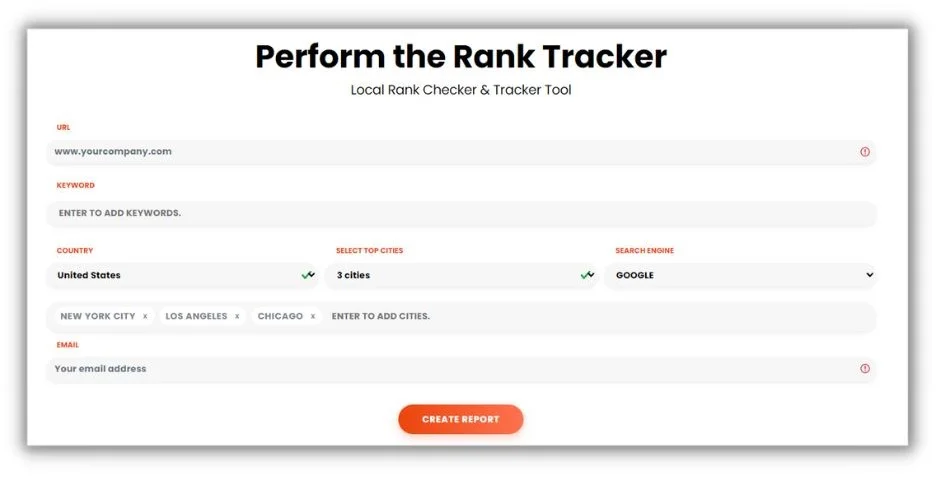

10. GeoRanker for location-specific SEO tracking

If your customers come from a specific geography, you need to know if your website ranks for relevant keywords in that location. GeoRanker has a feature that lets you track that.

Once you fill out the form, GeoRanker returns a report showing the position—in real-time—your website holds for your target keywords in the cities or countries you’ve picked. You can also see how your rankings have changed and learn where your competitors land on those SERPs.

The tool would be really handy for multi-location businesses, as it allows you to get data for each city you have a presence in.

GeoRanker also has a location-dependent SERP checker that shows the top 100 results for a keyword in different cities. For example, “coffee shop” will have different results in Chicago vs. Phoenix.

GeoRanker gives you limited access to its tools for free, with a monthly subscription plan starting at $99.

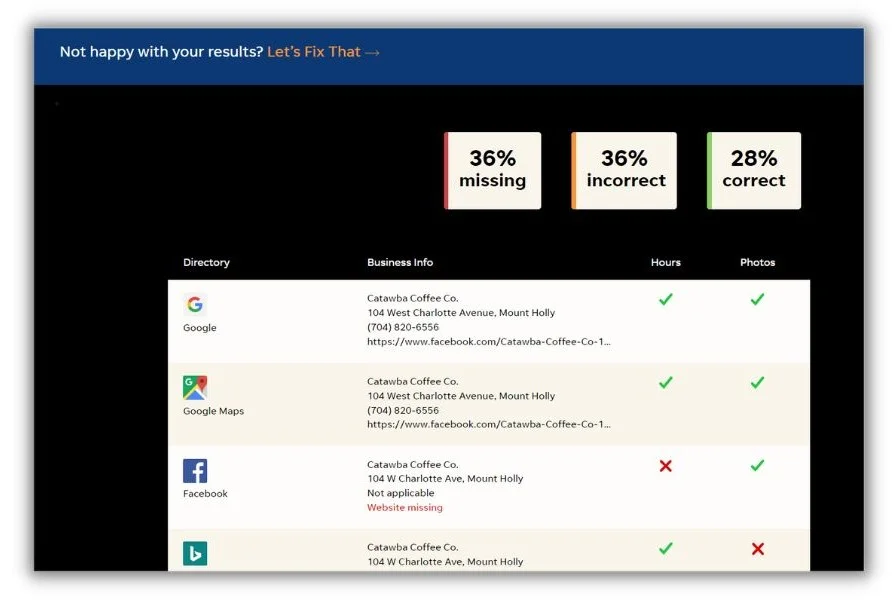

11. LocaliQ’s Free Business Listings Grader for directory audits

Online business directories like Yelp and Google Business Profiles are like the digital age’s answer to the Yellow Pages. If you want your local business found online, you need updated, correct information on your listings in those directories. LocaliQ’s Free Business Listings Grader lets you instantly verify your business listing on 20+ online directories.

The Listing Grader is very easy to use. Just enter your company’s name, street address, and postal code, and then the Grader will check it against what’s currently shown on apps like Waze, eLocal, and dozens of other locations. It’s a great way to check many business listings at once.

LocaliQ’s Listings Grader is free for an unlimited number of reports.

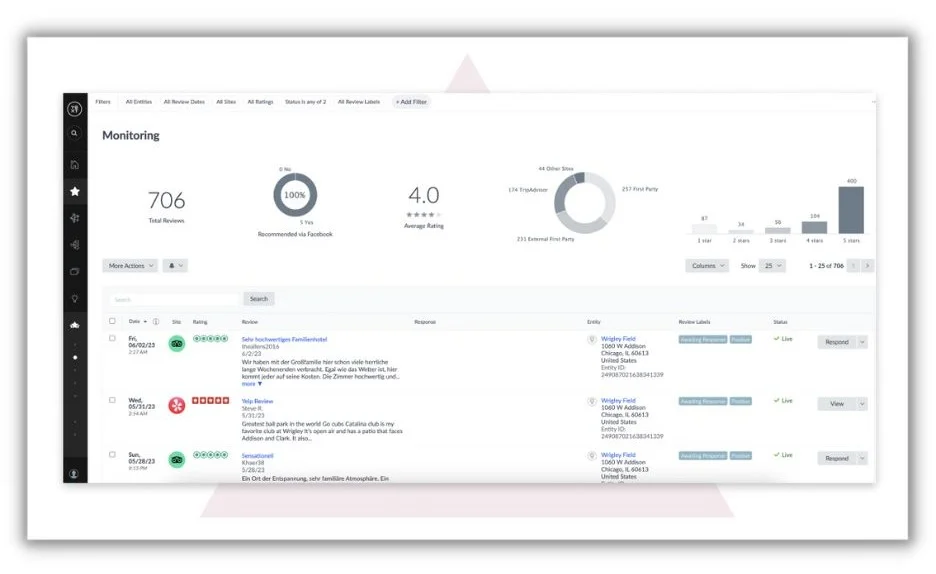

12. Yext for review monitoring

Reviews can directly affect how your business appears in local searches. Yext has several features to help you manage your online presence and reputation, but I really like its review management functionality for local SEO.

Using API integrations, Yext pulls reviews from all over the web and places them on your dashboard. From there, you can see how people rate your business and what they’ve written. You can also set up notifications so you always know when a new review comes in.

Besides monitoring reviews, Yext lets you respond to (via auto-responder or manually), request, and analyze reviews for their sentiment.

Yext pricing is on request.

Best Google SEO tools

If you succeed in SEO, then Google succeeds. So it’s created an impressive list of tools to help you research, optimize, and analyze all aspects of your website’s ability to rank. These three tools are free, so I’ve not included pricing information individually.

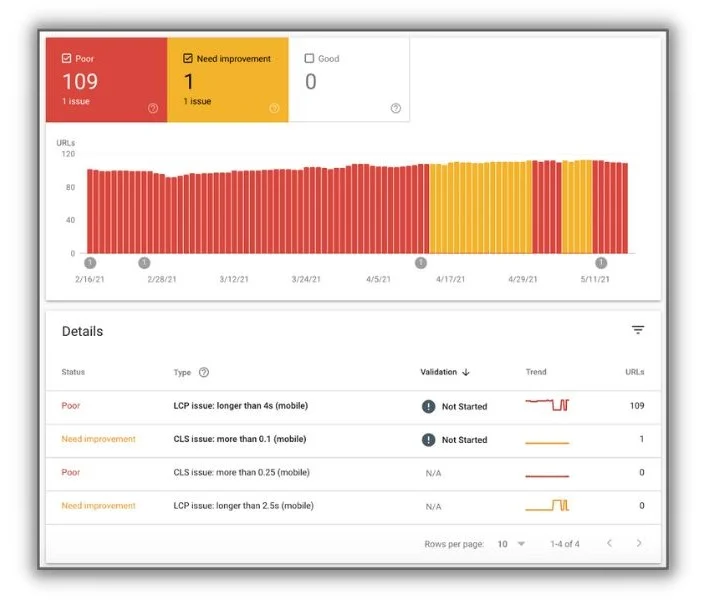

13. Search Console for technical SEO

Technical SEO sounds daunting (and it can be). But Google Search Console helps you track and visualize several aspects of your technical SEO, making it easier to understand and improve.

Here are a few ways you can use GSC to see which technical aspects of your website are hurting or helping your SEO:

- Confirm that Google’s crawlers are properly indexing your web pages

- Monitor and troubleshoot your Web Core Vitals or mobile usability issues

- Submit sitemaps

- See security issues

We wrote a guide explaining how to use Google Search Console for technical SEO.

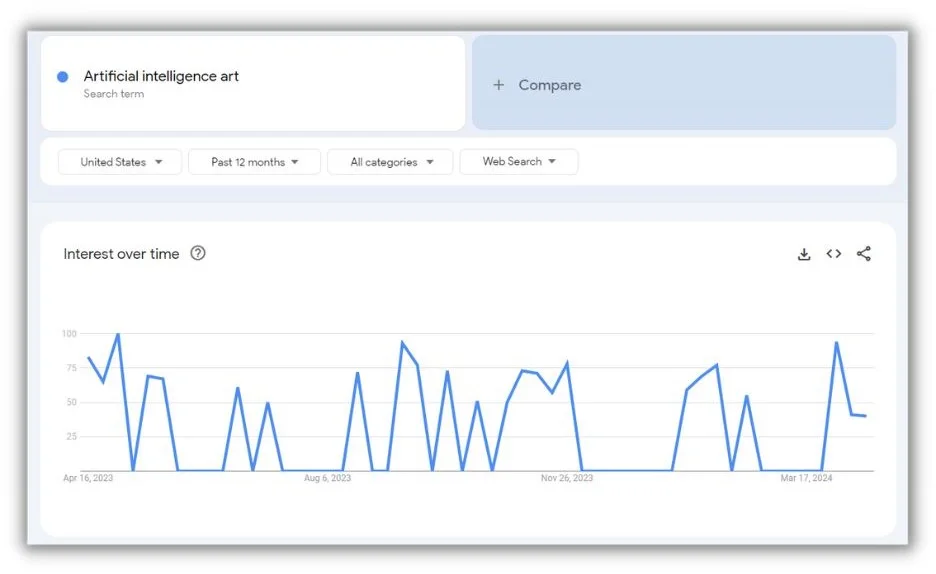

14. Google Trends for timely keyword planning

Google Trends tells you how often a word or phrase is entered into Google relative to the total volume of searches over a set time. Essentially, it’s a real-time keyword popularity report.

On Search Trends, you won’t see the total number of searches for a keyword. Instead, you’ll see how the search volume changes over time, using the highest and lowest search volumes for context.

You can change the time period, region, and type of search (image, news, Google Shopping, etc.) to see how they affect the trend. You’ll also get a graphical representation of the region you’ve chosen (U.S., worldwide, etc.) that shows the relative searches in each subregion. You even get related terms to inform your keyword strategy.

This guide will help you use Google Trends to its fullest.

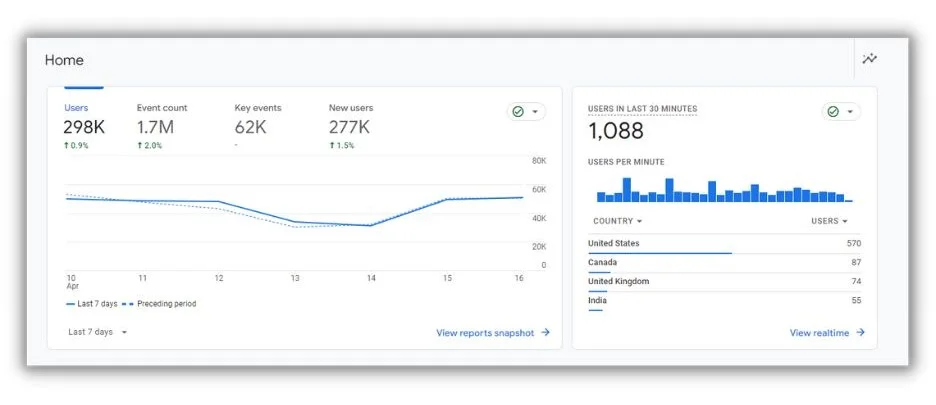

15. Google Analytics 4 for SEO performance tracking

Google Analytics 4 (GA4) is a platform that tracks how people arrive at and interact with pages on your website.

There’s an incredible amount of data that can be parsed in hundreds of ways on GA4. A few of the most valuable insights for SEO are:

- How much of the traffic to your site and individual pages comes from organic search

- Which blog posts and pages get the most traffic

- Which pages are losing traffic from search engines

GA4 is the latest iteration of Google’s analytics platform. Here are a few ways GA4 differs from Universal Analytics, its most recent predecessor.

Best paid SEO tools

If you have the budget, these SEO tools combine rich functionality with excellent user experience. While they all charge a fee, we’ve chosen those that provide the best bang for your buck.

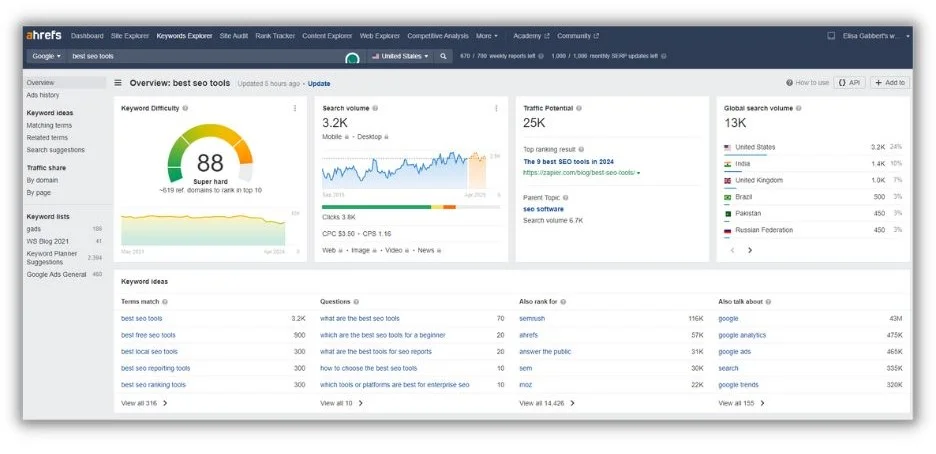

16. Ahrefs for best overall functionality for the money

I’ve used Ahrefs for years for keyword research, rank tracking, competitor analysis, and several other essential SEO tasks. Ahrefs edges out its competition based on the value of what you get, especially for light to moderate SEO users.

I could write a few thousand words trying to cover all the tricks and tools embedded in Ahrefs’ platform. But for now, here are a few of the functions I use most often to give you a feel for what it can do for you:

- Site Explorer: Enter any website or webpage URL, and Ahrefs will tell you its ranking for specific keywords, how many backlinks it has, where they’re from, estimated traffic, and much more.

- Keywords Explorer: See search volume, difficulty, and which pages rank for any keyword.

- Competitive analysis: Get a list of keywords your website doesn’t rank for, but your competitors do.

Ahrefs pricing starts at $99 per month, with the $199-per-month Standard Plan being what most average users will likely need.

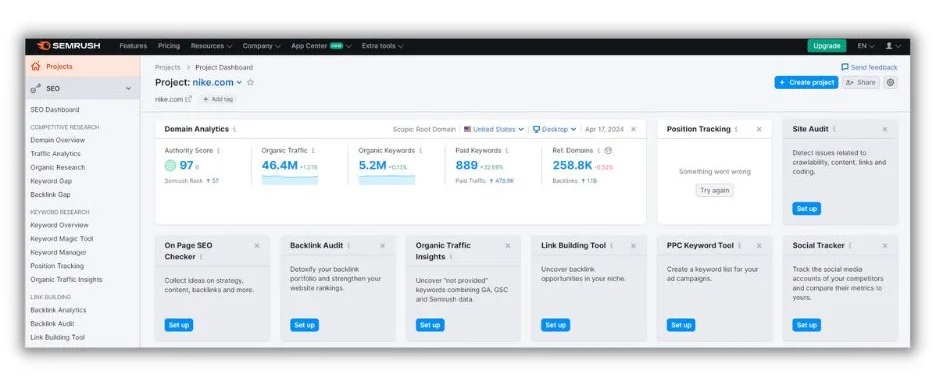

17. Semrush for hardcore SEOs

While Ahrefs is a good value for many SEOs, Semrush delivers more detailed and in-depth data in several areas, making it a better fit for highly technical users.

Take keyword research, for example. Semrush gives you search volume trends, Google PPC keyword data, keyword intent, and search volume and difficulty.

Ahrefs also shines in its technical SEO audit reporting and has a few more rank-tracking features.

Semrush pricing starts at $129.95 (just make it $130!) per month, and its mid-priced plan is $249.95 monthly.

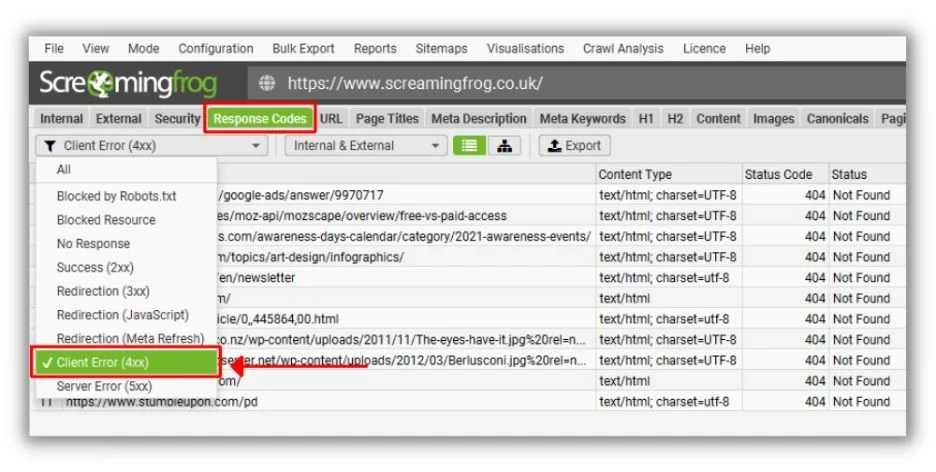

18. Screaming Frog for finding common SEO issues

Screaming Frog works like Google Search Console in that it crawls (hops?) through your website, looking for things that might hurt its performance. The difference is in the issues Screaming Frog looks for and the insights it offers to fix them.

The learning curve for Screaming Frog is a little steep for non-technical SEOs. But if you’ve ever been involved in an SEO audit, it won’t take long to catch on. Once you do, you’ll quickly find things like broken links, problematic titles and meta tags, and incorrect redirects. You can also generate XML sitemaps and site visualizations.

A free version of Screaming Frog lets you crawl up to 500 URLs. The paid plan costs $249 per year and adds functionality like audit scheduling and a near-duplicate content checker. It also allows for unlimited URL crawls.

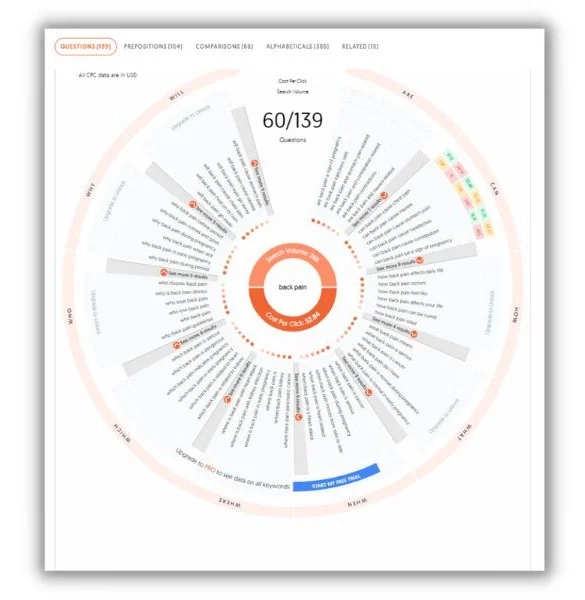

19. AnswerThePublic for topic ideation

AnswerThePublic is a content topic idea generator. It’s different from keyword research tools because it pulls ideas directly from Google’s drop-down, autocomplete queries (like when you enter “back pain” and Google suggests “…relief” and “…causes”). Then, it presents those keyword variations visually.

Once you’ve entered a root keyword, AnswerThePublic will tell you all the standard information about it, such as volume and the cost per click for search ads. Scroll through the report, and you’ll see a preposition report (keyword variations using “is,” “to,” “with,” and so on). Keep scrolling, and there’s a report that compares the cost-per-click and search volume for several related keywords.

AnswerThePublic has added Bing, TikTok, Amazon, and YouTube to the sites you can target for keyword research.

Once you register, you’ll get three keyword reports per day for free, although some of the data is withheld. Monthly paid plans start at $9, and a lifetime plan starts at $99.

The best SEO tools in 2024

Despite some rumors to the contrary, SEO remains one of the most valuable long-term marketing strategies for driving traffic and generating leads for your business.

But it continues to get more competitive. Manual keyword guessing and piecemeal SEO audits won’t put you in a great position to rank on SERPs. With the right SEO tools in your kit, you’ll punch way above your weight against much larger websites.

Here’s a recap of the best SEO tools available by use case:

- Exploding Topics for SEO keyword trends

- WordStream’s Free Keyword Tool for unlimited keyword research

- Animalz Revive for refreshing SEO content

- Similarweb for competitive SEO analysis

- LocaliQ’s Website Grader for free SEO audits

- Outranking for SEO outlines

- CanIRank for keyword competition

- Keyword insights for keyword clustering

- Diib for keyword and rank monitoring

- GeoRanker for location-specific SEO tracking

- LocaliQ’s Free Business Listings Grader for directory audits

- Yext for review monitoring

- Search Console for technical SEO

- Google Trends for timely keyword planning

- Google Analytics 4 for SEO performance tracking

- Ahrefs for best overall functionality for the money

- Semrush for hardcore SEOs

- Screaming Frog for finding common SEO issues

- AnswerThePublic for topic ideation

PPC

97 Marvelous May Content Ideas for Blog Posts, Videos, & More

Author Fennel Hudson once wrote, “May, more than any other month of the year, wants us to feel most alive.”

You can imagine strolling through a field of newly bloomed wildflowers or feeling the breeze from your open windows on a road trip.

We’ve curated a collection of May content ideas for just about every channel—blogs, social posts, email, and video—designed to engage your audience during this special time of year.

Contents

💡 Want to plan the rest of your year in one place? Get the 2024 Marketing Calendar for ideas, tips, and trends for every month of the year.

May holiday content ideas

There’s lots to celebrate this month, from moms to Mexican culture. These May holiday content ideas will get you in front of your audience right when they’re ready to enjoy the big day.

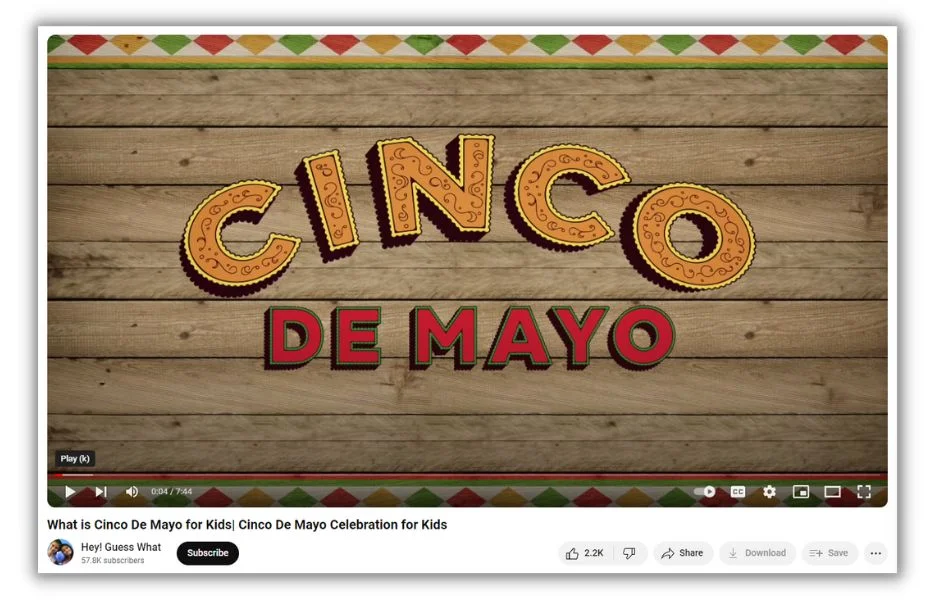

Cinco de Mayo (May 5)

Officially, Cinco de Mayo commemorates Mexico’s military victory over France at the Battle of Puebla in 1862. Colloquially, it’s a day to appreciate Mexican culture.

Here’s a really cool content idea for this holiday: create a video with activities for kids showcasing Mexico’s traditional music, food, and history.

This is an ambitious project, for sure. You don’t have to go that big. There are several other ways you can fiesta on your feeds this Cinco de Mayo.

- Create a calendar of local Cinco de Mayo events.

- Write a blog post about traditional foods and links to recipes.

- Ask followers to comment with their favorite Mexican restaurants.

- Share a list of Mexican heritage centers and museums if there are some in your area, then tag their accounts in the post for extra reach.

- Post a video with examples of traditional Mexican music or images of traditional Mexican dress.

Mother’s Day (May 12)

Moms are the often-unsung heroes in our lives. We’d include the people who step up as stepmoms and mother figures to so many of us on that list.

For all they do, moms deserve a special day. You can help your customers give it to them by publishing a gift guide with ideas for every type of mom.

That’s just the tip of the ideation iceberg for Mother’s Day content. Try asking questions on social media or sharing favorite Mother’s Day memories.

- Ask people to share their favorite mom-ism (Like “because I said so”).

- Make some funny “A day in the life of a busy mom” videos.

- Write up a list of stores and restaurants offering Mother’s Day specials.

- Have moms comment on their favorite Mother’s Day ever.

- Show followers how to make the perfect breakfast in bed.

Here’s even more inspiration for your Mother’s Day social media posts.

🛑 Get a full year of social media posts in this Copy & Paste Social Media Calendar.

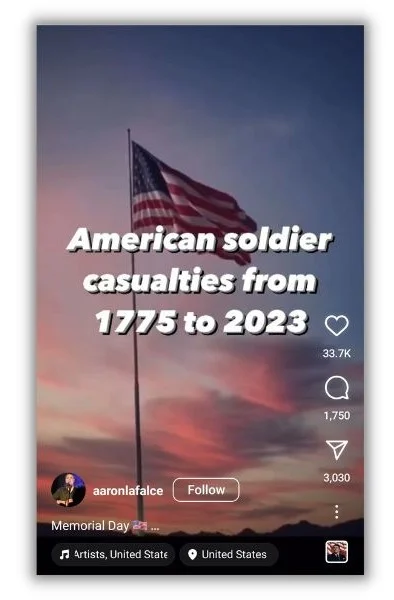

Memorial Day (May 27)

Memorial Day messaging has an interesting bifurcation. The meaning behind the day is a somber reminder of the military men and women who gave their lives in service of our country. At the same time, Memorial weekend is the unofficial start of summer, full of pool parties and barbeques.

If you want to address the first theme, an Instagram Reel highlighting the day’s history is a great choice.

There are plenty of ways to engage your audience with the second theme. Promotions, party planning, and cooking tips are all popular options.

- Send your email subscribers a plan for the perfect Memorial Day party with lists of supplies, decoration ideas, and sample menus (use these Memorial Day subject lines).

- Simply share your Memorial Day hours in a social media post.

- Share a list of weekend road trip ideas, small towns to visit, historical sites to see, etc.

- Curate some refreshing summertime cocktail and mocktail recipes and publish them in a blog post.

- Run a Memorial Day promotion with discounts, BOGO offers, or free shipping.

Pop culture May content ideas

Pop culture social media posts are engagement gold (people love their fandoms!). May is full of days dedicated to popular books, movies, and more. Lean into those topics, and you’ll attract many people to your posts.

Harry Potter Day (May 2)

Harry Potter is an enduring cultural phenomenon, with fans flocking to themed conventions, parks, and events. Not to mention, #harrypotterday has nearly 38k posts on Instagram alone.

How can you engage this energetic audience of Hogwarts lovers? How about a funny video asking, “What if the world of Harry Potter existed in real life?”

This is such a fun theme to explore. There are lots of visual and interactive content ideas you can use on Harry Potter Day.

- Run an Instagram poll asking followers which Hogwarts house they belong in (and connect each answer to one of your products).

- Ask followers to comment on their favorite HP books, movies, or scenes.

- Share Harry Potter little-known facts and behind-the-scenes stories.

- Hold a Harry Potter dress-up day for your staff or customers and share the photos on your social media feeds.

Star Wars Day (May 4)

“May the Fourth (be with you)” has become a yearly celebration of all things Sith, Skywalker, and space scoundrels. Like Harry Potter fans, Star Wars devotees will surely like, love, and share your Star Wars content.

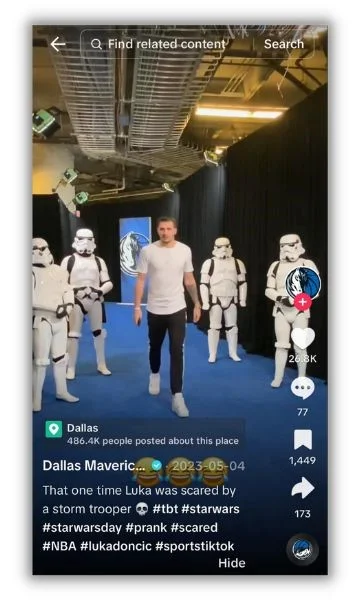

The Dallas Mavericks played a little prank by stationing several Storm Troopers outside of a press conference. They looked like statues and startled players as they walked by.

Costume events in various forms are great ideas for Star Wars Day, but there is a galaxy full of other ways to share the force.

- Hold a Star Wars trivia contest and Instagram giveaway, awarding prizes to the people who answer obscure questions the fastest.

- Ask followers to share pics of their pets dressed as Star Wars characters (here are more tips on gathering user-generated content).

- Create a how-to video with some Star Wars-themed crafts and activities

- Use the right hashtags like #maythefourth, #starwarsday, and #maythefourthbewithyou

Kentucky Derby (May 4)

Speaking of dressing up, May is also home to the most famous horse race of all time, the Kentucky Derby. And this event is all about seersucker suites and ornate headwear.

Anyone can join the fun, but if you work in the fashion, travel, or lifestyle industries, you should focus on Derby content.

Of course, party tips and mint julep recipes are great options, but don’t stop there. These content ideas will have your May marketing off and running.

- Work with an influencer to create a “Get ready with me” post that shows everything from make-up to hat choices to transportation for the big Derby party.

- Host an online watch party.

- Create a bingo card of typical things you’ll see during the Kentucky Derby.

- Ask people to pick the race winner and randomly choose one to win a prize.

More May pop cultural content ideas

This is just the beginning of the May content ideas you can create around pop-cultural events. Have fun with these themed days:

- Paranormal Day (May 3)

- National Space Day (May 3)

- National Golf Day (May 10)

- National Twilight Zone Day (May 11)

- National Limerick Day (May 12)

- National Classic Movie Day (May 16)

- National Talk Like Yoda Day (May 21)

- Sherlock Holmes Day (May 22)

Social awareness May content ideas

You have a platform and a mission. May is a great time to bring them together and show support for some of the several important causes highlighted this month.

Mental Health Awareness Month

Fortunately, people are having more open conversations about their mental health, but the stigma isn’t completely gone. Mental Health Awareness Month is about continuing those discussions and sharing education so everyone can thrive.

Save a few spots in your May content calendar to spread the message and promote good mental health.

Education, empathy, and accessibility are important themes for Mental Health Awareness Month. Consider them as you share content that helps your audience understand what mental health means to them.

- Invite a mental health professional to manage your social media feeds for the day, offering tips on stress reduction, conflict resolution, and other common challenges.

- Share links and phone numbers to mental health resources and care providers.

- Create a music playlist of calming music.

- If you’re comfortable with it, share a personal story of your own mental health journey.

- Promote events like 5Ks and awareness walks that support mental health organizations and missions.

National Nurses Day (May 6)

Nursing is an incredibly demanding and critical profession. Some content devoted to appreciating amazing nurses is well warranted.

You don’t need an elaborate post or to work in the medical field to express your support for nurses.

There are actually two nurse-related holidays in May: National Nurses Day (May 12) and International Nurses Day (May 13). You’ll need a few content ideas to fill out both days.

- List a few types of nurses and explain what those specialties do.

- Offer nurses an extra discount, or have a giveaway specifically for nurses.

- Create a list of the freebies and discounts offered to nurses by local or online shops.

- Share ways your followers can show support for the nurses in their lives.

National Rescue Dog Day (May 20)

“Adopt, don’t shop” is a common motto for dog rescues nationwide. The idea is that there is an overabundance of rescue pups available, and many are in less-than-ideal situations. Your May content can help connect these beautiful dogs with a new furever home.

I mean, look at that face!

The great thing about content for this awareness day is that people love posts with pics of pets. So, use these ideas to do some good while gaining visibility for your brand.

- This day is ripe for user-generated content, so ask your followers to share images or videos of their rescue dogs.

- Partner with local rescue organizations to feature dogs that need a good home.

- Create a list of volunteer opportunities at dog shelters, or, even better, organize a volunteer day.

- Ask a dog trainer to give training tips for new rescue dogs to help your new followers feel more comfortable adopting a pup.

Other awareness May content ideas

Still not enough ideas for you? No worries, there are plenty more to go. Choose a few great causes from this list and use them to fill in the blanks.

- ALS Awareness Month

- Brain Cancer Awareness Month

- Cancer Research Month

- National Lyme Disease Awareness Month

- National Skilled Trades Day (May 1)

- National Public Radio Day (May 3)

- International Firefighters Day (May 4)

- National Teacher Appreciation Day (May 7)

- National Ovarian Cancer Day (May 8)

- World Red Cross and Red Crescent Day (May 8)

- National Small Business Day (May 10) (Small Business Week April 28 to May 4)

- National Hospital Day (May 12)

- International Day Against Homophobia, Transphobia, and Biphobia (May 17)

- Global Accessibility Awareness Day (May 18)

- World Multiple Sclerosis Day (May 20)

- World Hunger Day (May 28)

Food and drink May content ideas

Beverages and nibbles are always content crowdpleasers because, well, everyone eats and drinks. Get a few of these ideas in your content mix this May for an extra hit of attention.

National Give Someone a Cupcake Day (May 8)

Some say cupcakes are just muffins with better makeup, but we say they’re a confection worth commemorating. National Give Someone a Cupcake Day lets you honor this handheld sweet treat while sharing a little joy.

If you have a physical location, hand out a few dozen of the best cupcakes you can find and promote the event on social media. If you’re not a local business, there are still ways to spread the joy of a perfectly iced walking cake.

- Share the secrets of your staff’s favorite cupcake recipes or go-to bakeries.

- Ask followers to tag you in videos of them giving their family and friends cupcakes.

- Ask a baker to write healthier alternatives to some ingredients in typical cupcake recipes, like processed sugar and flour, and then share them in a post.

- Post a funny cupcake image and challenge people to suggest captions for it.

National Barbecue Day (May 16)

People are proud of their regional barbeque. Whether it’s Texas, Memphis, or the Carolinas, everyone knows their ‘que is the best and is willing to make fun of every other version.

Where there’s good-natured ribbing (pun intended), there’s lots of engagement on social media posts. Take advantage by posting about the “best” barbeque on May 16th.

Here are a handful of ways to get the ‘que conversation started in your May content:

- Poll people about their favorite cooking method or sauce.

- Create an infographic of barbeque styles.

- Write a blog post detailing the best BBQ restaurants in your city.

- Share interesting facts about BBQ (like that the world record-holder ate over 13 pounds of ribs in 12 minutes).

Eat More Fruits and Vegetables Day (May 21)

It can’t all be roasted meat and icing. You have to include some produce, too. And that’s what Eat More Fruits and Vegetables Day is all about.

Although it may not be as fun as other food-related holidays, you can still create interesting, helpful content.

- Partner with other local businesses, such as gyms, massage therapists, nutritionists, and health food stores, to promote an online health fair.

- Create a chart listing the main health benefits of several fruits and vegetables.

- Promote local farms and farmers’ markets.

- Share a list of produce growing locally and when it’s in season.

- Work with a local restaurant to curate several easy, healthy recipes featuring in-season fruits and vegetables.

Other food and drink content ideas

Hardly a week goes by in May without several days dedicated to one food or another. You could even have a social media post listing them all. Or, pick a few from the list and create some mouth-watering content around it.

- American Cheese Month

- National Chocolate Parfait Day (May 1)

- National Truffle Day (May 2)

- National Coconut Cream Pie Day (May 8)

- International Hummus Day (May 13)

- National Chocolate Chip Day (May 15)

- National Mushroom Hunting Day (May 17)

- National Pizza Party Day (May 17)

- World Baking Day (May 19)

- National Wine Day (May 25)

Warm up your marketing channels with these May content ideas

There’s a palpable buzz in May that’s fueled by thoughts of outdoor gatherings, road trips, and days playing at the pool. When your May content matches that vibe, you’ll stand out in feeds, inboxes, and Google searches. And if you want all of your marketing efforts to generate more leads and sales, see how our marketing solutions can help any day of the year!

For more May marketing ideas, check out these posts:

-

PPC4 days ago

PPC4 days ago19 Best SEO Tools in 2024 (For Every Use Case)

-

MARKETING7 days ago

MARKETING7 days agoWill Google Buy HubSpot? | Content Marketing Institute

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 16, 2024

-

SEO6 days ago

SEO6 days agoGoogle Clarifies Vacation Rental Structured Data

-

MARKETING6 days ago

MARKETING6 days agoStreamlining Processes for Increased Efficiency and Results

-

SEARCHENGINES5 days ago

Daily Search Forum Recap: April 17, 2024

-

PPC7 days ago

PPC7 days agoHow to Collect & Use Customer Data the Right (& Ethical) Way

-

SEO6 days ago

SEO6 days agoAn In-Depth Guide And Best Practices For Mobile SEO

You must be logged in to post a comment Login