AMAZON

The Grind! How to Rank Higher on Amazon

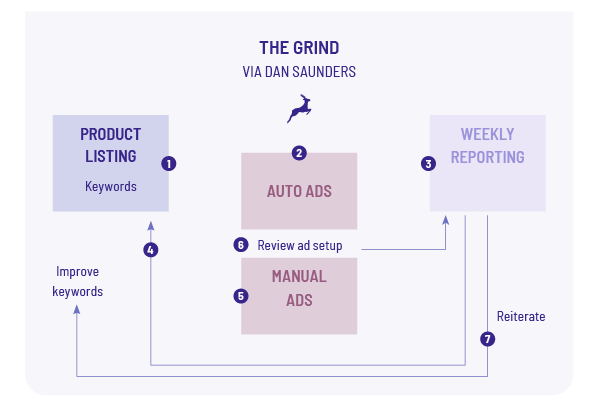

Oh, what a grind it can be to filter through reports to identify the winning and losing keywords, then update campaign settings, create targeted manual ads, include negative keywords and even update product listings sometimes. But hey, it works!

This is one of the most common optimization strategies on Amazon today and it is also one of the most efficient ones. It involves a number of different mechanisms which work together closely. On Amazon, there isn’t a big distance between SEO, CRO and PPC as you often find in relation with search marketing for Google.

We can organize the work on optimizing for Amazon into five key areas that will all help you rank higher on Amazon:

- Organic

- PPC

- CRO

- Outside referrals

- Sales

In terms of organic ranks, content is a very important ranking factor and what you really need to focus on is your product. This is about making your product listings and your brand store look the best.

How to structure your title

Just like it is one of the key elements for good old SEO, the title for your product listing is an important part of your organic optimization.

- Use your keywords in order of importance even if that means putting your brand 2nd.

- Optimise your title readability for mobile, desktops and your ads.

Title Text Lengths

- For desktop organic results use around 115-144 characters.

- PPC will pull 30-33 characters of your product title.

- Organic mobile titles will pull about 55-63 characters.

Back end search terms are by far the most important tool for organic ranking on Amazon. Enter all your keywords that you can’t fit into your product listings and descriptions. It’s not visible to customers but is indexed by Amazon. There are only however, an extra 250 characters available to be indexed. This is where you should include common misspellings however, you don’t need to worry about punctuation, singular or plural words as Amazon will take this into account.

Amazon Keyword Research

For keyword research there are many tools you can use. Ahrefs, Helium 10, JungleScout and Factor A are some of them. You can even use Google Ads!

Amazon PPC

Amazon offers 2 advertising solutions. The Amazon DSP is a programmatic advertising based on CPM (cost per mille) and the Amazon Sponsored Ads solution is based on CPC (cost per click). That’s the one we are interested in!

This is where we can bid you welcome to Amazon Adwords. The Sponsored products solution is primarily based on keyword targeting very similar to Google Ads.

This is the easiest way to drive your sales up on Amazon. Start by running automatic campaign suggested to you by Amazon then transfer the successful keywords to manual PPC campaigns to target your keywords, then pump up the bids to drive exposure. Running your paid activity for a short period at cost or even at a loss will be worthwhile to increase your organic ranking.

- You type in the campaign name, so you can monitor the results.

- Add in how much your daily budget is

- Pick the dates you want your campaign to run.

Now it’s time to set the key words you want to target – again, you have the choice to do this manually or automatically through Amazon. Like on AdWords, you can decide if you want the keywords to match exactly, broadly or as a phrase. A mixture of all three is the best way forward.

PPC boosts your organic, so it’s worth running at an initial loss or, better yet, break even for the initial gains. Plus, you get the added benefit of having an initial surge of data that you can use to refine your own process and learn more about your customers.

It all really depends what your acos (Advertising Cost of Sales – the percent of ad spend divided by the attributed sale). You can see this number in the Keyword section of your advertising tab.

Attributed Sales (how many sales you made that week that are directly linked to your ad) are important. If by the 2nd or 3rd campaign you’re not showing a weekly ROI, there’s a good chance you’ve not targeted the right keywords.

Not only will this cost you money, but it’ll be ruining your CRO on your Amazon account, which is an Amazon Ranking factor. Impressions (the number of times your ads were displayed) are important, but not at the cost of lowering your rankings

CRO

The best tool I can recommend is Sellerly by SEMrush. It offers you the ability to AB test your products and your ads

- Customer reviews: The higher your reviews, the higher Amazon is going to rank you. Like Google, you need to get a few reviews before Amazon starts to rank you against the bigger competitors.

- Image size and quality: Use all the photo spaces you’re slowed and they all must be 1000 x1000 pixels so your buyer can zoom in from all angles.

- Price: Amazon will always values its buyers over its sellers, it will always push the best seller, which is most likely the lowest price to the top, so you need to audit your competitors regularly to see what they are charging.

- Exit rates: If someone looks at your product then immediately exits the Amazon site, Amazon will lower your ranking. If you are in no way misleading, this won’t be a problem.

- Bounce rate: Same as the above, if someone lands on your product then leaves quickly to look at someone else’s, Amazon will penalise you.

- What’s the best way to get conversion? Offer a deal.

The biggest ranking factor of all is Sales and driving traffic from outside of Amazon. These are Amazon’s equivalent to links for Google SEO. The more sales you have, the higher you’ll rank. If you start to outsell your competitors who outrank you for your keywords, Amazon will reward you with a higher ranking. Using Facebook, Twitter and even Google to drive traffic to your product will also help you rank faster and higher on Amazon.

Source : « Marketing on Amazon in 2020 », Innovell February 2020, https://www.innovell.com/amazon-marketing-report/

AMAZON

How Auto-GPT will revolutionize AI chatbots as we know them

Artificial intelligence chatbots such as OpenAI LP’s ChatGPT have reached a fever pitch of popularity recently not just for their ability to hold humanlike conversations, but because they can perform knowledge tasks such as research, searches and content generation.

Now there’s a new contender taking social media by storm that extends the capabilities of OpenAI’s offering by automating its abilities even further: Auto-GPT. It’s part of a new class of AI tools called “autonomous AI agents” that take the power of GPT-3.5 and GPT-4, the generative AI technologies behind ChatGPT, to approach a task, build on its own knowledge, and connect apps and services to automate tasks and perform actions on the behalf of users.

ChatGPT might seem magical to users for its ability to answer questions and produce content based on user prompts, such as summarizing large documents or generating poems and stories or writing computer code. However, it’s limited in what it can do because it’s capable of doing only one task at a time. During a session with ChatGPT, a user can prompt the AI with only one question at a time and refining those prompts or questions can be a slow and tedious journey.

Auto-GPT, created by game developer Toran Bruce Richards, takes away these limitations by allowing users to give the AI an objective and a set of goals to meet. Then it spawns a bot that acts like a person would, using OpenAI’s GPT model to perform AI prompts in order to approach that goal. Along the way, it learns to refine its prompts and questions in order to get better results with every iteration.

It also has internet connectivity in order to gather additional information from searches. Moreover, it has short- and long-term memory through database connections so that it can keep track of sub-tasks. And it uses GPT-4 to produce content such as text or code when required. Auto-GPT is also capable of challenging itself when a task is incomplete and filling in the gaps by changing its own prompts to get better results.

According to Richards, although current AI chatbots are extremely powerful, their inability to refine their own prompts on the fly and automate tasks is a bottleneck. “This inspiration led me to develop Auto-GPT, which can apply GPT-4’s reasoning to broader, more complex problems that require long-term planning and multiple steps,” he told Vice.

Auto-GPT is available as open source on GitHub. It requires an application programming interface key from OpenAI to access GPT-4. And to use it, people will need to install Python and a development environment such as Docker or VS Code with a Dev Container extension. As a result, it might take a little bit of technical knowhow to get going, though there’s extensive setup documentation.

How does it work?

In a text interface, Auto-GPT asks the user to give the AI a name, a role, an objective and up to five goals that it should reach. Each of these defines how the AI agents will approach the action the user wants and how it will deliver the final product.

First, the user sets a name for the AI, such as “RestaurantMappingApp-GPT,” and then set a role, such as “Develop a web app that will provide interactive maps for nearby restaurants.” The user can then set a series of goals, such as “Write a back-end in Python” and “Program a front end in HTML,” or “Offer links to menus if available” and “Link to delivery apps.”

Once the user hits enter, Auto-GPT will begin launching agents, which will produce prompts for GPT-4, then approach the original role and each of the different goals. Finally, it will then begin refining and recursing through the different prompts that will allow it to connect to Google Maps using Python or JavaScript.

It does this by breaking the overall job into smaller tasks to work on each, and it uses a primary monitoring AI bot that acts as a “manager” to make sure that they coordinate. This particular prompt asks the bot to build a somewhat complex app that could go awry if it doesn’t keep track of a number of different moving parts, so it might take a large number of steps to get there.

With each step, each AI instance will “narrate” what it’s doing and even criticize itself in order to refine its prompts depending on its approach toward the given goal. Once it reaches a particular goal, each instance will finalize its process and return its answer back to the main management task.

Trying to get ChatGPT or even the more advanced, subscription-based GPT-4 to do this without supervision would take a large number of manual steps that would have to be attended to by a human being. Auto-GPT does them on its own.

The capabilities of Auto-GPT are beneficial for neophyte developers looking to get ahead in the game, Brandon Jung, vice president of ecosystem at AI-code completion tool provider Tabnine Ltd., told SiliconANGLE.

“One benefit is that it’s a good introduction for those that are new to coding, and it allows for quick prototyping,” Jung said. “For use cases that don’t require exactness or have security concerns, it could speed up the creation process without having to be part of a broader system that includes an expert for review.”

Being able to build apps rapidly, including all the code all at once, from a simple series of text prompts would bring a lot of new templates for code into the hands of developers. Essentially providing them with rapid solutions and foundations to build on. However, they would have to go through a thorough review first before being put into production.

What kind of applications can Auto-GPT be used for?

That’s just one example of Auto-GPT’s capabilities. With its capabilities, it has wide-reaching possibilities that are currently being explored by developers, project managers, AI researchers and anyone else who can download its source code.

“There are numerous examples of people using Auto-GPT to do market research, create business plans, create apps, automate complex tasks in pursuit of a goal, such as planning a meal, identifying recipes and ordering all the ingredients, and even execute transactions on behalf of the user,” Sheldon Monteiro, chief product officer at the digital business transformation firm Publicis Sapient, told SiliconANGLE.

With its ability to search the internet, Auto-GPT can be tasked with quick market research such as “Find me five gaming keyboards under $200 and list their pros and cons.” With its ability to break a task up into multiple subtasks, the autonomous AI could then rapidly search multiple review sites, produce a market research report and come back with a list of gaming keyboards that come in under that amount and supply their prices as well as information about them.

A Twitter user named MOE created an Auto-GPT bot named “Isabella” that can autonomously analyze market data and outsource to other AIs. It does so by using the AI framework Lang-chain to gather data autonomously and do sentiment analysis on different markets.

autogpt was trying to create an app for me, recognized I don’t have Node, googled how to install Node, found a stackoverflow article with link, downloaded it, extracted it, and then spawned the server for me.

My contribution? I watched. pic.twitter.com/2QthbTzTGP

— Varun Mayya (@VarunMayya) April 6, 2023

Because Auto-GPT has access to the internet, and it can take actions on behalf of the user, it can also install applications. In the case of Twitter user Varun Mayya, who ask the bot to build some software, it discovered that he did not have Node.js installed – an environment that allows JavaScript to be run locally instead of in a web browser. As a result, it searched the internet, discovered a StackOverflow tutorial and installed it for him so it could proceed with building the app.

Auto-GPT isn’t the only autonomous agent AI currently available. Another that has come into vogue is BabyAGI, which was created by Yohei Nakajima, a venture capitalist and artificial intelligence researcher. AGI refers to “artificial general intelligence,” a hypothetical type of AI that would have the ability to perform any intellectual task – but no existing AI is anywhere close. BabyAGI is a Python-based task management system that uses the OpenAI API, like Auto-GPT, that prioritizes and builds new tasks toward an objective.

There are also AgentGPT and GodMode, which are much more user-friendly in that they use a web interface instead of needing an installation on a computer, so they can be accessed as a service. These services lower the barrier to entry by making it simple for users because they don’t require any technical knowledge to use and will perform similar tasks to Auto-GPT, such as generating code, answering questions and doing research. However, they can’t write documents to the computer or install software.

Autonomous agents are powerful but experimental

These tools do have drawbacks, however, Monteiro warned. The examples on the internet are cherry-picked and paint the technology in a glowing light. For all the successes, there are a lot of issues that can happen when using it.

“It can get stuck in task loops and get confused,” Monteiro said. “And those task loops can get pretty expensive, very fast with the costs of GPT-4 API calls. Even when it does work as intended, it might take a fairly lengthy sequence of reasoning steps, each of which eats up expensive GPT-4 tokens.”

Accessing GPT-4 can cost money that varies depending on how many tokens are used. Tokens are based on words or parts of phrases sent through the chatbot. Charges range from three cents per 1,000 tokens for prompts to six cents per 1,000 tokens for results. That means using Auto-GPT running through a complex project or getting stuck in a loop unattended could end up costing a few dollars.

At the same time, GPT-4 can be prone to errors, known as “hallucinations,” which could spell trouble during the process. It could come up with totally incorrect or erroneous actions or, worse, produce insecure or disastrously bad code when asked to create an application.

“[Auto-GPT] has the ability to execute on previous output, even if it gets something wrong it keeps going on,” said Bern Elliot, a distinguished vice president analyst at Gartner. “It needs strong controls to avoid it going off the rails and keeping on going. I expect misuse without proper guardrails will cause some damaging unexpected and unintended outcomes.”

The software development side could be equally problematic. Even if Auto-GPT doesn’t make a mistake that causes it to produce broken code, which would cause the software to simply fail, it could create an application riddled with security issues.

“Auto-GPT is not part of a full software development lifecycle — testing, security, et cetera — nor is it integrated into an IDE,” Jung said, warning about the potential issues that could arise from the misuse of the tool. “Abstracting complexity is fine if you are building on a strong foundation. However, these tools are by definition not building strong code and are encouraging bad and insecure code to be pushed into production.”

The future of Auto-GPT and other autonomous agents

Tools such as Auto-GPT, BabyAGI, AgentGPT and GodMode are still experimental, but there are broader implications in how they could be used to replace routine tasks such as vacation planning or shopping, explained Monteiro.

Right now, Microsoft has even developed simple examples of a plugin for Bing Chat. It allows users to ask it to offer them dinner suggestions that will have its AI – which is powered by GPT-4 – will roll up a list of ingredients and then launch Instacart to have them prepared for delivery. Although this is a step in the direction of automation, bots such as Auto-GPT are edging toward a potential future of all-out autonomous behaviors.

A user could ask for Auto-GPT to look through local stores, prepare lists of ingredients, compare prices and quality, set up a shopping cart and even complete orders autonomously. At this experimental point, many users may not be willing to allow the bot to go all the way through with using their credit card and deliver orders all on its own, for fear that it could go haywire and send them several hundred bunches of basil.

A similar future where an AI does this for travel agents using Auto-GPT may not be far away. “Give it your parameters — beach, four-hour max travel, hotel class — and your budget, and it will happily do all the web browsing for you, comparing options in quest of your goal,” said Monteiro. “When it is done, it will present you with its findings, and you can also see how it got there.”

As these tools begin to mature, they have a real chance of providing a way for people to automate away mundane step-by-step tasks that happen on the internet. That could have some interesting implications, especially in e-commerce.

“How will companies adapt when these agents are browsing sites and eliminating your product from the consideration set before a human even sees the brand?” said Monteiro. “From an e-commerce standpoint, if people start using Auto-GPT tools to buy goods and services online, retailers will have to adapt their customer experience.”

* Image: Freepik

AMAZON

The Top 10 Benefits of Amazon AWS Lightsail: Why It’s a Great Choice for Businesses

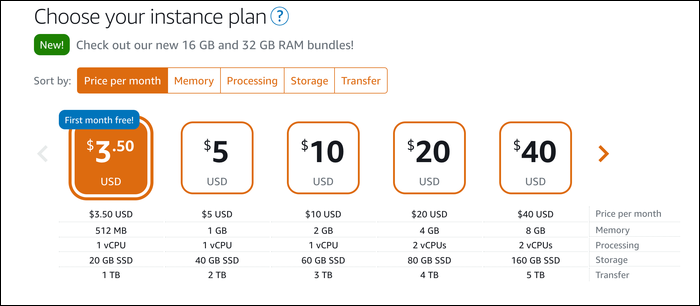

Amazon Web Services (AWS) is a popular cloud computing platform that offers a wide range of services to individuals and businesses alike. One of the services offered by AWS is Amazon Lightsail, which is a simplified and user-friendly way to launch and manage virtual private servers (VPS). In this article, we will discuss the benefits of using Amazon Lightsail for your business.

Cost-effective

One of the primary advantages of using Amazon Lightsail is its cost-effectiveness. The service offers a flat monthly fee for each instance, which makes it easy to predict costs and plan for your budget. Moreover, the pricing is transparent, with no hidden costs or surprises.

User-friendly

Amazon Lightsail is designed to be user-friendly, making it easy for even non-technical users to deploy and manage virtual private servers. The platform provides a simplified control panel that includes pre-configured software packages, such as WordPress, LAMP, and more. These packages are preconfigured, making it easy to deploy and set up a web application in minutes.

Scalable

Amazon Lightsail is designed to be scalable, which means you can easily upgrade your resources as your business grows. The platform provides a range of instance sizes to choose from, with varying CPU, RAM, and storage options. You can also scale up or down as needed, making it easy to manage your resources and costs.

Reliable

Amazon Lightsail is built on top of the AWS infrastructure, which means it benefits from AWS’s robust and reliable cloud infrastructure. This ensures that your applications and data are always available and accessible, with minimal downtime.

Secure

Amazon Lightsail provides a secure and reliable environment for your applications and data. The platform includes a range of security features, such as built-in firewalls, DDoS protection, and SSL/TLS encryption. Moreover, Lightsail instances are isolated from each other, which provides an additional layer of security.

Integrated with AWS services

Amazon Lightsail is fully integrated with other AWS services, making it easy to use Lightsail with other AWS services such as Amazon S3, Amazon RDS, and more. This integration provides a comprehensive cloud computing platform, enabling you to build and run complex applications.

Quick and easy deployment

Amazon Lightsail provides a quick and easy way to deploy web applications, with pre-configured templates for popular applications such as WordPress, Drupal, Joomla, and more. This makes it easy to deploy a web application in just a few clicks, without the need for technical knowledge.

High-performance

Amazon Lightsail instances are built on top of the latest generation of AWS infrastructure, providing high-performance and low-latency connectivity. This ensures that your applications and data are always accessible and responsive, with fast and efficient data transfer.

Easy to manage

Amazon Lightsail provides a simplified management interface, making it easy to manage your virtual private servers. The platform includes tools for monitoring your instances, configuring backups, managing DNS records, and more. Moreover, the platform provides a range of APIs and CLI tools, making it easy to automate management tasks.

Flexible

Amazon Lightsail is flexible, allowing you to choose the operating system and software stack that best suits your needs. The platform supports a range of operating systems, including Ubuntu, Debian, CentOS, and more. Moreover, you can install and configure any software stack that you need, giving you complete control over your environment.

In conclusion, Amazon Lightsail is a cost-effective, user-friendly, scalable, reliable, secure, integrated, quick, high-performance, easy-to-manage, and flexible platform for deploying and managing virtual private servers. If you’re looking for a simplified and efficient way to manage your cloud computing resources, Amazon Lightsail is definitely worth considering.

Get started today with Amazon Lightsail

AMAZON

Binance’s BNB Chain to Offer New Decentralized Storage System

The release of the decentralized storage system’s white paper was having a modest effect on the price of other storage tokens on Wednesday. Filecoin (FIL), storj (STORJ), and arweave (AR) are now trading 2%, 5% and 6%, respectively, above their pre-announcement prices.

-

SEARCHENGINES6 days ago

SEARCHENGINES6 days agoGoogle Core Update Volatility, Helpful Content Update Gone, Dangerous Google Search Results & Google Ads Confusion

-

SEO6 days ago

SEO6 days ago10 Paid Search & PPC Planning Best Practices

-

MARKETING7 days ago

MARKETING7 days ago2 Ways to Take Back the Power in Your Business: Part 2

-

MARKETING5 days ago

MARKETING5 days ago5 Psychological Tactics to Write Better Emails

-

SEARCHENGINES5 days ago

SEARCHENGINES5 days agoWeekend Google Core Ranking Volatility

-

PPC7 days ago

PPC7 days agoCritical Display Error in Brand Safety Metrics On Twitter/X Corrected

-

MARKETING6 days ago

MARKETING6 days agoThe power of program management in martech

-

SEARCHENGINES4 days ago

Daily Search Forum Recap: April 15, 2024

![Amazon Trends & Industry Predictions for Sellers [2024] Amazon Trends & Industry Predictions for Sellers [2024]](https://articles.entireweb.com/wp-content/uploads/2024/01/Amazon-Trends-Industry-Predictions-for-Sellers-2024.webp-400x240.webp)

![Amazon Trends & Industry Predictions for Sellers [2024] Amazon Trends & Industry Predictions for Sellers [2024]](https://articles.entireweb.com/wp-content/uploads/2024/01/Amazon-Trends-Industry-Predictions-for-Sellers-2024.webp-80x80.webp)