MARKETING

3 Ways Top Enterprise Content Marketers Do Things Differently [New Research]

![3 Ways Top Enterprise Content Marketers Do Things Differently [New Research] 3 Ways Top Enterprise Content Marketers Do Things Differently [New Research]](https://articles.entireweb.com/wp-content/uploads/2022/03/3-Ways-Top-Enterprise-Content-Marketers-Do-Things-Differently-New.png)

What does it take to make a content marketing program successful? Every organization answers that question differently based on its goals.

Still, successful programs tend to share characteristics that can provide directional hints for other content marketers.

CMI’s newly released Enterprise Content Marketing Benchmarks, Budgets, and Trends: Insights for 2022 sponsored by Imagination reveals those clues for marketers at companies with at least 1,000 employees. In this research, top performers are defined as those who say they consider their organization’s content marketing extremely or very successful.

Here’s what top-performing enterprise marketers do differently.

1. They measure content performance (and do it well)

Ninety-three percent of top performers say they measure content performance, and more than half (61%) say they’re doing an excellent or very good job at it.

Why is that remarkable? When you look at the responses from the entire group of enterprise marketers, the measurement picture looks different. A still high percentage (78%) say they measure content performance, but only 36% say they’re doing a very good or excellent job with it.

Click to enlarge

Measuring performance is hard. But it’s one of the most important things content teams must do in 2022, according to CMI chief strategy advisor Robert Rose.

Measuring #content performance is one of the most important things content teams must do in 2022, says @Robert_Rose via @EditorStahl @CMIContent @Contentimagine. Click To Tweet

After all, without measuring performance, you’ll struggle to understand what’s resonating and what needs improvement. And you’ll never be able to prove the value of your content marketing program.

2. They take advantage of content marketing technologies

Top performers had higher adoption rates for nearly every content marketing technology. The biggest differences came in three kinds of technology: content creation/calendaring/collaboration/workflow, customer relationship management (CRM).

Content creation/calendaring/collaboration/workflow

Eighty-nine percent of top performers use content creation/calendaring/collaboration/workflow tools versus 77% of all enterprise respondents.

I’m not surprised to see top performers are more likely to use these tools. Calendaring is an essential part of content marketing strategy. Top performers tend to have larger teams, and tools for organizing processes make collaboration easier and more efficient.

CRM systems

Sixty-two percent of top performers use CRM systems versus 50% of all enterprise respondents. Top-performing businesses tend to be laser-focused on customers. CRM systems provide a central place to manage contacts and the sales process, streamline processes, and improve workflow.

Content performance/recommendation analytics

Forty percent of top performers use content performance/recommendation tools versus 26% of all enterprise respondents. That’s the widest gap we observed (14 percentage points) between top performers and the total set of enterprise respondents.

I see a link between success and measurement. If you can gauge content performance, you can tune and adjust to continue to improve.

Click to enlarge

3. They differentiate their content

In a sea of sameness, differentiation gets your content noticed.

Successful enterprise content marketers know this: Seventy-two percent of top performers say they always or frequently differentiate their content from their competitors’ content. But among the general pool of enterprise marketers surveyed, only 49% do.

Click to enlarge

Top performers seem to differentiate their content not because it’s harder to capture attention but because it gets them results. Only 37% of top performers say it has gotten increasingly difficult to get attention over the last year compared with 49% of all respondents.

How do these top performers differentiate their content? We didn’t ask that directly, but we did find a clue. Top performers attribute their overall content marketing success to “the value our content provides” (70%). And it’s safe to say that valuable content can be a differentiator.

Spend some time figuring out that special content or content experience only your organization can provide.

4. They are focused on their customers

Top performers are more likely to see the full journey of buyers. Seventy percent strongly or somewhat agree their organization provide a consistent experience across the engagement journey. About the same percent (69%) crafts content based on the stages in that journey.

Over 69% of top performers create enterprise #content based on the buyer’s journey and provide a consistent content experience, according to @CMIContent #research via @EditorStahl @Contentimagine. Click To Tweet

In contrast, only half (51%) of all enterprise marketers indicate they provide a consistent experience and/or create content for the stages in the buyer’s journey.

Click to enlarge

Top performers also are more likely to prioritize their audience’s informational needs over their organization’s sales/promotional message (79% vs. 61% for all).

79% of top enterprise content marketers prioritize the audience’s needs over the organization’s message, according to @CMIContent #research via @EditorStahl @Contentimagine. Click To Tweet

The bottom line? Top performers know the true value of content marketing is realized when the customer is put front and center – from content planning through their content experience.

They have even more differences

While the report goes into more detail, the top performers also distinguish themselves by:

- Reporting higher levels of content marketing maturity

- Documenting a content marketing strategy to guide their efforts

- Expecting bigger budget increases in 2022 compared with 2021

- Having more full-time content marketing employees on staff

Even if you can’t secure a bigger budget or more full-time staff, you can still take steps to improve the performance of your content marketing program. Consider the success differentiators you can change. Can you put the audience at the center of the content experience? What about analyzing your available metrics to see what’s working and what isn’t? Are you doing the most with the tech you have?

If your content marketing program isn’t as successful as it could be – even if you already consider it a top performer – you can take steps to make it great or even greater.

What are you doing to propel your content marketing forward in 2022?

Cover image by Joseph Kalinowski/Content Marketing Institute

MARKETING

Battling for Attention in the 2024 Election Year Media Frenzy

As we march closer to the 2024 U.S. presidential election, CMOs and marketing leaders need to prepare for a significant shift in the digital advertising landscape. Election years have always posed unique challenges for advertisers, but the growing dominance of digital media has made the impact more profound than ever before.

In this article, we’ll explore the key factors that will shape the advertising environment in the coming months and provide actionable insights to help you navigate these turbulent waters.

The Digital Battleground

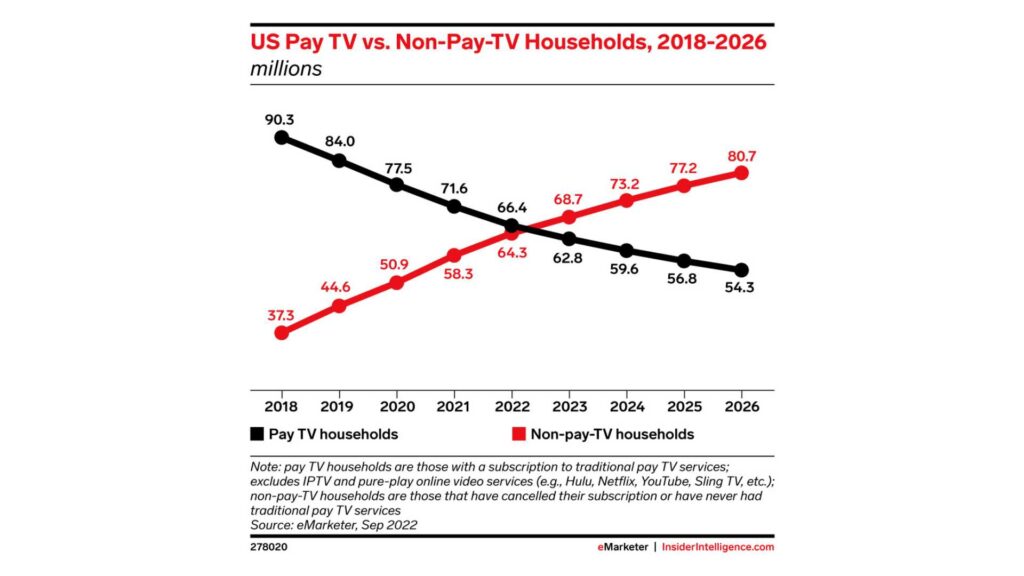

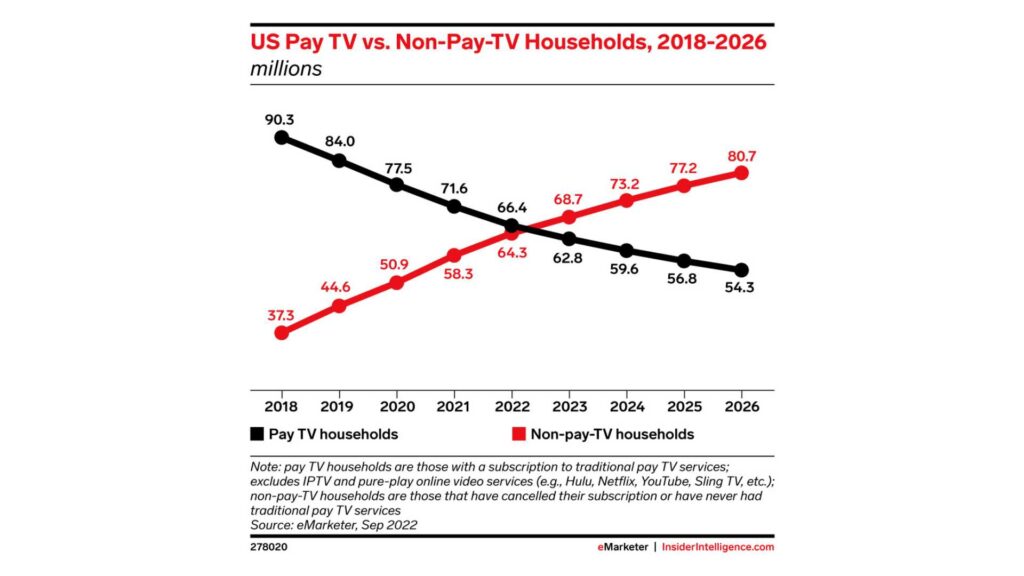

The rise of cord-cutting and the shift towards digital media consumption have fundamentally altered the advertising landscape in recent years. As traditional TV viewership declines, political campaigns have had to adapt their strategies to reach voters where they are spending their time: on digital platforms.

According to a recent report by eMarketer, the number of cord-cutters in the U.S. is expected to reach 65.1 million by the end of 2023, representing a 6.9% increase from 2022. This trend is projected to continue, with the number of cord-cutters reaching 72.2 million by 2025.

Moreover, a survey conducted by Pew Research Center in 2023 found that 62% of U.S. adults do not have a cable or satellite TV subscription, up from 61% in 2022 and 50% in 2019. This data further underscores the accelerating shift away from traditional TV and towards streaming and digital media platforms.

As these trends continue, political advertisers will have no choice but to follow their audiences to digital channels. In the 2022 midterm elections, digital ad spending by political campaigns reached $1.2 billion, a 50% increase from the 2018 midterms. With the 2024 presidential election on the horizon, this figure is expected to grow exponentially, as campaigns compete for the attention of an increasingly digital-first electorate.

For brands and advertisers, this means that the competition for digital ad space will be fiercer than ever before. As political ad spending continues to migrate to platforms like Meta, YouTube, and connected TV, the cost of advertising will likely surge, making it more challenging for non-political advertisers to reach their target audiences.

To navigate this complex and constantly evolving landscape, CMOs and their teams will need to be proactive, data-driven, and willing to experiment with new strategies and channels. By staying ahead of the curve and adapting to the changing media consumption habits of their audiences, brands can position themselves for success in the face of the electoral advertising onslaught.

Rising Costs and Limited Inventory

As political advertisers flood the digital market, the cost of advertising is expected to skyrocket. CPMs (cost per thousand impressions) will likely experience a steady climb throughout the year, with significant spikes anticipated in May, as college students come home from school and become more engaged in political conversations, and around major campaign events like presidential debates.

For media buyers and their teams, this means that the tried-and-true strategies of years past may no longer be sufficient. Brands will need to be nimble, adaptable, and willing to explore new tactics to stay ahead of the game.

Black Friday and Cyber Monday: A Perfect Storm

The challenges of election year advertising will be particularly acute during the critical holiday shopping season. Black Friday and Cyber Monday, which have historically been goldmines for advertisers, will be more expensive and competitive than ever in 2024, as they coincide with the final weeks of the presidential campaign.

To avoid being drowned out by the political noise, brands will need to start planning their holiday campaigns earlier than usual. Building up audiences and crafting compelling creative assets well in advance will be essential to success, as will a willingness to explore alternative channels and tactics. Relying on cold audiences come Q4 will lead to exceptionally high costs that may be detrimental to many businesses.

Navigating the Chaos

While the challenges of election year advertising can seem daunting, there are steps that media buyers and their teams can take to mitigate the impact and even thrive in this environment. Here are a few key strategies to keep in mind:

Start early and plan for contingencies: Begin planning your Q3 and Q4 campaigns as early as possible, with a focus on building up your target audiences and developing a robust library of creative assets.

Be sure to build in contingency budgets to account for potential cost increases, and be prepared to pivot your strategy as the landscape evolves.

Embrace alternative channels: Consider diversifying your media mix to include channels that may be less impacted by political ad spending, such as influencer marketing, podcast advertising, or sponsored content. Investing in owned media channels, like email marketing and mobile apps, can also provide a direct line to your customers without the need to compete for ad space.

Owned channels will be more important than ever. Use cheaper months leading up to the election to build your email lists and existing customer base so that your BF/CM can leverage your owned channels and warm audiences.

Craft compelling, shareable content: In a crowded and noisy advertising environment, creating content that resonates with your target audience will be more important than ever. Focus on developing authentic, engaging content that aligns with your brand values and speaks directly to your customers’ needs and desires.

By tapping into the power of emotional triggers and social proof, you can create content that not only cuts through the clutter but also inspires organic sharing and amplification.

Reflections

The 2024 election year will undoubtedly bring new challenges and complexities to the world of digital advertising. But by staying informed, adaptable, and strategic in your approach, you can navigate this landscape successfully and even find new opportunities for growth and engagement.

As a media buyer or agnecy, your role in steering your brand through these uncharted waters will be critical. By starting your planning early, embracing alternative channels and tactics, and focusing on creating authentic, resonant content, you can not only survive but thrive in the face of election year disruptions.

So while the road ahead may be uncertain, one thing is clear: the brands that approach this challenge with creativity, agility, and a steadfast commitment to their customers will be the ones that emerge stronger on the other side.

MARKETING

Tinuiti Marketing Analytics Recognized by Forrester

Rapid Media Mix Modeling and Proprietary Tech Transform Brand Performance

Tinuiti, the largest independent full-funnel performance marketing agency, has been included in a recent Forrester Research report titled, “The Marketing Analytics Landscape, Q2 2024.” This report comprehensively overviews marketing analytics markets, use cases, and capabilities. B2C marketing leaders can use this research by Principal Analyst Tina Moffett to understand the intersection of marketing analytics capabilities and use cases to determine the vendor or service provider best positioned for their analytics and insights needs. Moffett describes the top marketing analytics markets as advertising agencies, marketing dashboards and business intelligence tools, marketing measurement and optimization platforms and service providers, and media analytics tools.

As an advertising agency, we believe Tinuiti is uniquely positioned to manage advertising campaigns for brands including buying, targeting, and measurement. Our proprietary measurement technology, Bliss Point by Tinuiti, allows us to measure the optimal level of investment to maximize impact and efficiency. According to the Forrester report, “only 30% of B2C marketing decision-makers say their organization uses marketing or media mix modeling (MMM),” so having a partner that knows, embraces, and utilizes MMM is important. As Tina astutely explains, data-driven agencies have amplified their marketing analytics competencies with data science expertise; and proprietary tools; and tailored their marketing analytics techniques based on industry, business, and data challenges.

Our Rapid Media Mix Modeling sets a new standard in the market with its exceptional speed, precision, and transparency. Our patented tech includes Rapid Media Mix Modeling, Always-on Incrementality, Brand Equity, Creative Insights, and Forecasting – it will get you to your Marketing Bliss Point in each channel, across your entire media mix, and your overall brand performance.

As a marketing leader you may ask yourself:

- How much of our marketing budget should we allocate to driving store traffic versus e-commerce traffic?

- How should we allocate our budget by channel to generate the most traffic and revenue possible?

- How many customers did we acquire in a specific region with our media spend?

- What is the impact of seasonality on our media mix?

- How should we adjust our budget accordingly?

- What is the optimal marketing channel mix to maximize brand awareness?

These are just a few of the questions that Bliss Point by Tinuiti can help you answer.

Learn more about our customer-obsessed, product-enabled, and fully integrated approach and how we’ve helped fuel full-funnel outcomes for the world’s most digital-forward brands like Poppi & Toms.

The Landscape report is available online to Forrester customers or for purchase here.

MARKETING

Ecommerce evolution: Blurring the lines between B2B and B2C

Understanding convergence

B2B and B2C ecommerce are two distinct models of online selling. B2B ecommerce is between businesses, such as wholesalers, distributors, and manufacturers. B2C ecommerce refers to transactions between businesses like retailers and consumer brands, directly to individual shoppers.

However, in recent years, the boundaries between these two models have started to fade. This is known as the convergence between B2B and B2C ecommerce and how they are becoming more similar and integrated.

Source: White Paper: The evolution of the B2B Consumer Buyer (ClientPoint, Jan 2024)

What’s driving this change?

Ever increasing customer expectations

Customers today expect the same level of convenience, speed, and personalization in their B2B transactions as they do in their B2C interactions. B2B buyers are increasingly influenced by their B2C experiences. They want research, compare, and purchase products online, seamlessly transitioning between devices and channels. They also prefer to research and purchase online, using multiple devices and channels.

Forrester, 68% of buyers prefer to research on their own, online . Customers today expect the same level of convenience, speed, and personalization in their B2B transactions as they do in their B2C interactions. B2B buyers are increasingly influenced by their B2C experiences. They want research, compare, and purchase products online, seamlessly transitioning between devices and channels. They also prefer to research and purchase online, using multiple devices and channels

Technology and omnichannel strategies

Technology enables B2B and B2C ecommerce platforms to offer more features and functionalities, such as mobile optimization, chatbots, AI, and augmented reality. Omnichannel strategies allow B2B and B2C ecommerce businesses to provide a seamless and consistent customer experience across different touchpoints, such as websites, social media, email, and physical stores.

However, with every great leap forward comes its own set of challenges. The convergence of B2B and B2C markets means increased competition. Businesses now not only have to compete with their traditional rivals, but also with new entrants and disruptors from different sectors. For example, Amazon Business, a B2B ecommerce platform, has become a major threat to many B2B ecommerce businesses, as it offers a wide range of products, low prices, and fast delivery

“Amazon Business has proven that B2B ecommerce can leverage popular B2C-like functionality” argues Joe Albrecht, CEO / Managing Partner, Xngage. . With features like Subscribe-and-Save (auto-replenishment), one-click buying, and curated assortments by job role or work location, they make it easy for B2B buyers to go to their website and never leave. Plus, with exceptional customer service and promotional incentives like Amazon Business Prime Days, they have created a reinforcing loyalty loop.

And yet, according to Barron’s, Amazon Business is only expected to capture 1.5% of the $5.7 Trillion addressable business market by 2025. If other B2B companies can truly become digital-first organizations, they can compete and win in this fragmented space, too.”

If other B2B companies can truly become digital-first organizations, they can also compete and win in this fragmented space

Joe AlbrechtCEO/Managing Partner, XNGAGE

Increasing complexity

Another challenge is the increased complexity and cost of managing a converging ecommerce business. Businesses have to deal with different customer segments, requirements, and expectations, which may require different strategies, processes, and systems. For instance, B2B ecommerce businesses may have to handle more complex transactions, such as bulk orders, contract negotiations, and invoicing, while B2C ecommerce businesses may have to handle more customer service, returns, and loyalty programs. Moreover, B2B and B2C ecommerce businesses must invest in technology and infrastructure to support their convergence efforts, which may increase their operational and maintenance costs.

How to win

Here are a few ways companies can get ahead of the game:

Adopt B2C-like features in B2B platforms

User-friendly design, easy navigation, product reviews, personalization, recommendations, and ratings can help B2B ecommerce businesses to attract and retain more customers, as well as to increase their conversion and retention rates.

According to McKinsey, ecommerce businesses that offer B2C-like features like personalization can increase their revenues by 15% and reduce their costs by 20%. You can do this through personalization of your website with tools like Product Recommendations that help suggest related products to increase sales.

Focus on personalization and customer experience

B2B and B2C ecommerce businesses need to understand their customers’ needs, preferences, and behaviors, and tailor their offerings and interactions accordingly. Personalization and customer experience can help B2B and B2C ecommerce businesses to increase customer satisfaction, loyalty, and advocacy, as well as to improve their brand reputation and competitive advantage. According to a Salesforce report, 88% of customers say that the experience a company provides is as important as its products or services.

Market based on customer insights

Data and analytics can help B2B and B2C ecommerce businesses to gain insights into their customers, markets, competitors, and performance, and to optimize their strategies and operations accordingly. Data and analytics can also help B2B and B2C ecommerce businesses to identify new opportunities, trends, and innovations, and to anticipate and respond to customer needs and expectations. According to McKinsey, data-driven organizations are 23 times more likely to acquire customers, six times more likely to retain customers, and 19 times more likely to be profitable.

What’s next?

The convergence of B2B and B2C ecommerce is not a temporary phenomenon, but a long-term trend that will continue to shape the future of ecommerce. According to Statista, the global B2B ecommerce market is expected to reach $20.9 trillion by 2027, surpassing the B2C ecommerce market, which is expected to reach $10.5 trillion by 2027. Moreover, the report predicts that the convergence of B2B and B2C ecommerce will create new business models, such as B2B2C, B2A (business to anyone), and C2B (consumer to business).

Therefore, B2B and B2C ecommerce businesses need to prepare for the converging ecommerce landscape and take advantage of the opportunities and challenges it presents. Here are some recommendations for B2B and B2C ecommerce businesses to navigate the converging landscape:

- Conduct a thorough analysis of your customers, competitors, and market, and identify the gaps and opportunities for convergence.

- Develop a clear vision and strategy for convergence, and align your goals, objectives, and metrics with it.

- Invest in technology and infrastructure that can support your convergence efforts, such as cloud, mobile, AI, and omnichannel platforms.

- Implement B2C-like features in your B2B platforms, and vice versa, to enhance your customer experience and satisfaction.

- Personalize your offerings and interactions with your customers, and provide them with relevant and valuable content and solutions.

- Leverage data and analytics to optimize your performance and decision making, and to innovate and differentiate your business.

- Collaborate and partner with other B2B and B2C ecommerce businesses, as well as with other stakeholders, such as suppliers, distributors, and customers, to create value and synergy.

- Monitor and evaluate your convergence efforts, and adapt and improve them as needed.

By following these recommendations, B2B and B2C ecommerce businesses can bridge the gap between their models and create a more integrated and seamless ecommerce experience for their customers and themselves.

-

SEARCHENGINES7 days ago

SEARCHENGINES7 days agoGoogle Core Update Volatility, Helpful Content Update Gone, Dangerous Google Search Results & Google Ads Confusion

-

SEO7 days ago

SEO7 days ago10 Paid Search & PPC Planning Best Practices

-

MARKETING5 days ago

MARKETING5 days ago5 Psychological Tactics to Write Better Emails

-

SEARCHENGINES6 days ago

SEARCHENGINES6 days agoWeekend Google Core Ranking Volatility

-

MARKETING6 days ago

MARKETING6 days agoThe power of program management in martech

-

SEO6 days ago

SEO6 days agoWordPress Releases A Performance Plugin For “Near-Instant Load Times”

-

PPC5 days ago

PPC5 days ago20 Neuromarketing Techniques & Triggers for Better-Converting Copy

-

SEARCHENGINES5 days ago

Daily Search Forum Recap: April 15, 2024

![3 Ways Top Enterprise Content Marketers Do Things Differently [New Research] 1646239134 248 3 Ways Top Enterprise Content Marketers Do Things Differently New](https://articles.entireweb.com/wp-content/uploads/2022/03/1646239134_248_3-Ways-Top-Enterprise-Content-Marketers-Do-Things-Differently-New.jpg)

![3 Ways Top Enterprise Content Marketers Do Things Differently [New Research] 1646239134 276 3 Ways Top Enterprise Content Marketers Do Things Differently New](https://articles.entireweb.com/wp-content/uploads/2022/03/1646239134_276_3-Ways-Top-Enterprise-Content-Marketers-Do-Things-Differently-New.jpg)

![3 Ways Top Enterprise Content Marketers Do Things Differently [New Research] 1646239134 742 3 Ways Top Enterprise Content Marketers Do Things Differently New](https://articles.entireweb.com/wp-content/uploads/2022/03/1646239134_742_3-Ways-Top-Enterprise-Content-Marketers-Do-Things-Differently-New.jpg)

![3 Ways Top Enterprise Content Marketers Do Things Differently [New Research] 1646239134 238 3 Ways Top Enterprise Content Marketers Do Things Differently New](https://articles.entireweb.com/wp-content/uploads/2022/03/1646239134_238_3-Ways-Top-Enterprise-Content-Marketers-Do-Things-Differently-New.jpg)

You must be logged in to post a comment Login