MARKETING

Top 10 Most Popular Online Payment Solutions

Today, there’s no better place to make money than online.

Because there are now 4.54 billion internet users, you have access to more than half the population of the globe!

Also, there are tons of ways to earn online.

You can set up an ecommerce store.

You can create a course.

You can offer professional services like content creation, graphic design, or content strategy.

If you already own a business, you can take it online to reach a wider audience.

But no matter how you decide to make money online, you’ll need one thing:

A reliable, safe, user-friendly payment solution.

The good news?

It isn’t hard to find online payment solutions experts love and trust.

Here are 10 of the best online payment solutions you’ll love.

You’ll need a specific online payment solution depending on the kind of business you own.

Take special note of the description below each solution to find out if it’s the one for you.

1. PayPal

Source: paypal.com

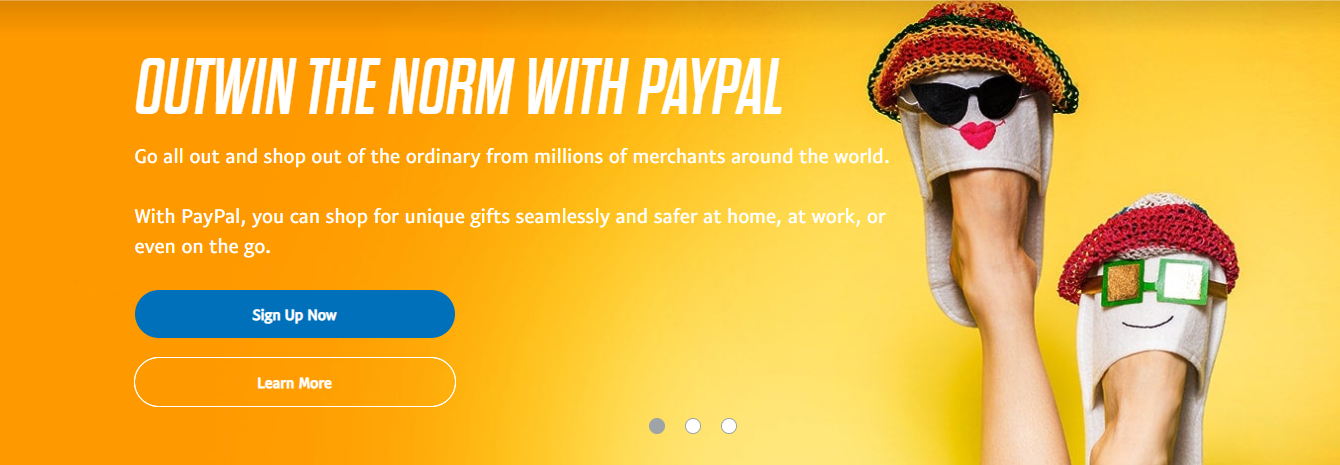

PayPal is huge, with 305 million active users.

It’s also growing rapidly.

In fact, from Q3 to Q4 of 2019 alone, it gained 9.3 million new users!

But if its size and popularity aren’t enough to convince you to use PayPal, here are other facts to get you excited about it.

But if its size and popularity aren’t enough to convince you to use PayPal, here are other facts to get you excited about it.

- PayPal is available in 202 countries.

- As a PayPal user, you can withdraw funds in 56 different currencies.

- PayPal is free – you don’t have to worry about monthly membership fees, annual maintenance, or even a maintaining balance.

- A PayPal account can be connected to multiple debit and credit cards.

- You can purchase items online even if your PayPal balance is zero by connecting it to your current bank account.

- PayPal is safe. You can purchase items online without giving away your financial information.

2. Stripe

Stripe is similar to PayPal because it’s user-friendly, requires no monthly or membership fee, and promises a safe shopping experience.

However, if you’re looking for a customized payment platform, Stripe is the solution for you.

This is because Stripe has special tools and features a developer can use to create a highly personalized payment platform for your company.

These include:

- An advanced fraud-management tool called Stripe Radar.

- Virtual and physical cards for employee expenses.

- Business intelligence based on SQL

If you’re a big company needing custom payment solutions, Stripe is a good choice for you.

3. Amazon Pay

By using Amazon Pay, you can quickly and easily reach out to Amazon users.

These customers can pay for your goods or services simply by logging into their Amazon accounts.

Here are five reasons Amazon Pay is an excellent choice.

- It’s super simple to set up with your site.

- It’s optimized for both mobile and voice search.

- With one account, customers can access thousands of sites.

- You can charge your customers recurring payments like monthly membership fees.

- You can seamlessly offer refunds.

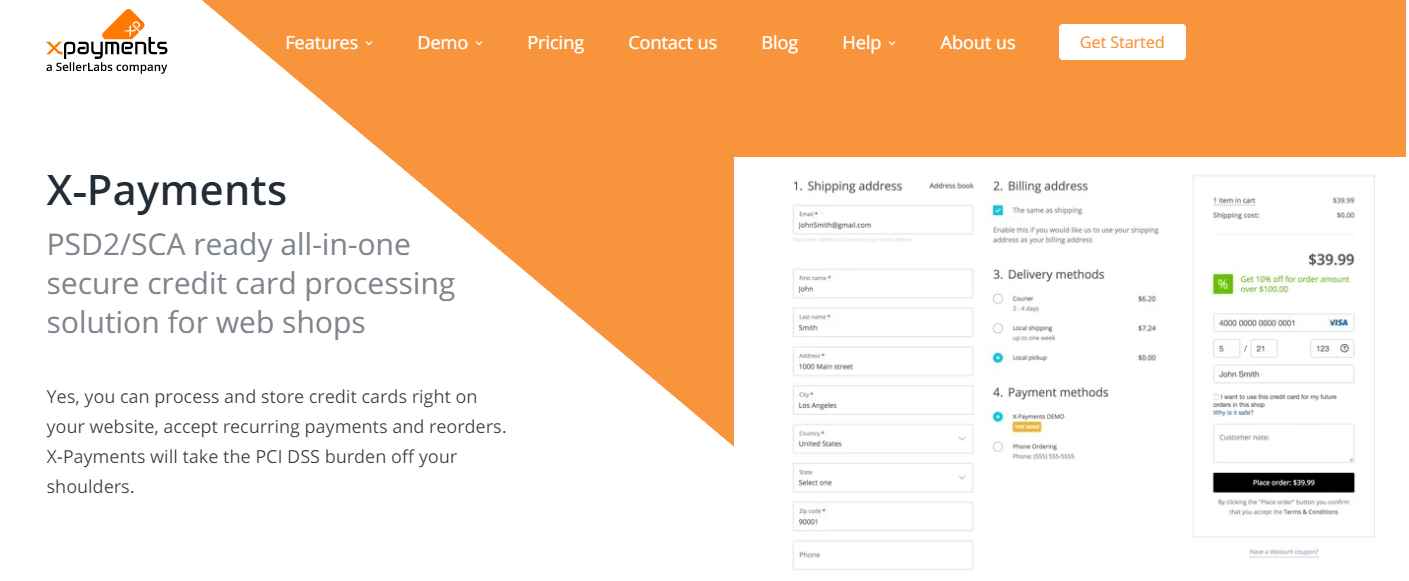

4. X-Payments

If the financial safety and privacy of your customers is your top priority, choose X-Payments as your payment solution.

X-Payments is PCI DSS certified, meaning it passes the Payment Card Industry Data Security Standard.

This is the highest safety level you can get for your customers and your online store.

With X-Payments, you also enjoy:

- The safest credit card information storage.

- Seamless transactions, as customers don’t have to leave your online store to make a payment.

- Processing of over 40 credit cards.

Pricing stars at $42.46 a month for 10,000 transactions processed per year.

5. Braintree

Braintree focuses strategically on mobile users.

Owned by PayPal, it benefits by having access to the millions of people who use the popular payment solution.

So, why should you use Braintree?

- Braintree is trusted by huge digital companies such as Airbnb and Uber.

- It has special tools for fraud detection.

- It can be integrated with Google Pay, Apple Pay, Venmo, and major credit and debit cards.

Right now you’re wondering: if Braintree is owned by PayPal, which one should I use?

The answer is it depends on the kind of business you’re running.

Here are three things to consider when deciding between PayPal and Braintree.

- Although it’s easier to get a PayPal account approved, it’s as easy to have your account flagged and deactivated. It takes longer to set up a Braintree account but once you get one, you’re assured of seamless transactions down the road.

- It’s easier to send large amounts of money in foreign currencies through Braintree.

- Braintree and PayPal offer vastly different products and cater to different markets. Study each one and choose the one that most fits your business.

6. Due

Due isn’t only a payment solution.

It’s a complete system which allows you to:

- Take care of all your invoices in one place.

- Keep organized with all your payment information in one location.

- Enjoy lower rates than credit cards.

7. GoCardless

GoCardless is a wonderful choice if you collect recurring payments from your customers.

For example, you collect monthly subscription fees or offer an online course with monthly payment options.

GoCardless allows you to collect recurring payments automatically.

When you use this platform, it’s also easier for you to track your customers’ payment status.

Standard subscription is free, but you can get a paid subscription if you’re interested in adding your name to your customers’ bank statements or developing your own email notifications and payment pages.

8. SecurePay

Doing business in Australia?

If you’re looking for a payment solution supported by major Australian banks, SecurePay is the one to choose.

SecurePay offers:

- Detailed reports on all payments.

- Easy integration with most shopping carts.

- Quick online payments.

9. Adyen

Adyen is available in 200 countries and supports 250 local payment methods.

It won the Nora Solution Partner Excellence Awards in 2019 for Best Security and Anti-Fraud Solution.

Two huge companies that trust Adyen as their payment solution are Spotify and Microsoft.

10. CyberSource

CyberSource is a top payment solution because of its risk management.

It has more than 300 fraud detectors to ensure your customers and your online store are safe.

CyberSource serves 190 countries and is used by 450,000 businesses across the globe.

How to Choose the Right Payment Solutions for Your Business

The 10 payment solutions mentioned above are the best of the best today.

But how do you choose one to fit your business?

The answer is to dig deep into exactly what you need for your company right now.

For instance, if you’ve just started out and want to test the waters, PayPal is a great option for you.

If you’re a larger company and need a customized platform, you’ll love Stripe’s unique features.

Just as your brand is special, you can find a special payment solution that fits you perfectly.

Image Credits

All screenshots taken by author, March 2020