TECHNOLOGY

Need to take the emotion out of tech evaluation and M&A? Here’s how

In the US, tech mergers and acquisitions remain the most active M&A sector in terms of both value and volume; in the first half of this year, $415.4 billion changed hands in almost 1,300 overall deals, according to White & Case’s M&A Explorer.

Perhaps your company’s technology acquisition is not quite at the financial level of Broadcom shelling out $61 billion for VMware back in May. Still, the importance of these deals from both a monetary and strategic perspective means emotions can become heightened. Not just for the executives on both sides, either; 2009 figures from the China Market Research Group estimated that shareholders are worse off in around 70% of M&A activity, based on hundreds of deals.

“Too often, companies put together matches that look great on paper but are fraught with management and structural problems that end up turning them into busts,” Shaun Rein, founder and managing director of the China Market Research Group, wrote in Forbes at the time.

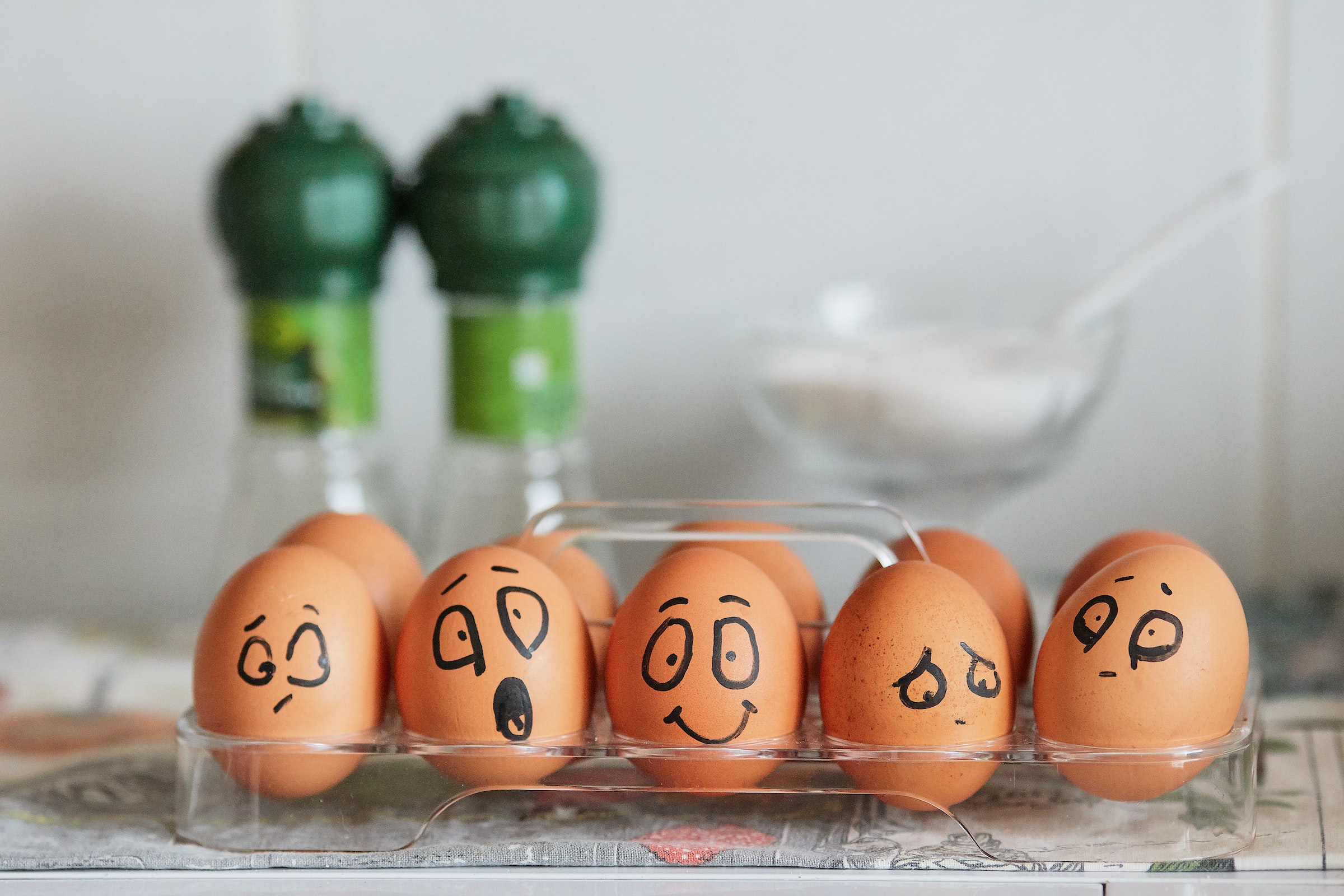

Whether it’s a disparity between strategy and execution, not understanding how a technology will fit into your stack or just a simple clash of cultures, pitfalls and trapdoors abound. Is there a way to navigate this area without the emotion?

The answer is yes. Among the other services it provides, Growth Acceleration Partners (GAP), an Americas-based technology consulting firm, allows organizations to evaluate their proposed offerings with an independent technology assessment. A typical matrix can assess the level of effort (LoE) it would take for your team to improve a particular technology, from overall architecture to cloud, code, and CI/CD – not to mention security – and gives an overall general score out of 10. So for example, if “code review” scores a 2 out of 10, the LoE to get that to a score of 9 or 10 would be high.

“If you can do it yourself, great,” explains Dave Moore, chief innovation officer at GAP. “Most of us don’t have the resources, or the skill sets, or the processes to do it. But making a decision that is so strategic and expensive without [an independent assessment] is dumb.

“What we’re finding on the vast majority of these [deals] is they’re not going well, they’re not scoring well at all,” adds Moore. “So people are pulling back on decisions, whether it’s a partnership or acquisition.”

The assessment can be used for both technology acquisition and internal applications. The latter would, for instance, be perfect for an incoming CTO looking for an impartial assessment of their company’s stack.

“Keep in mind our assessment doesn’t result in ‘I think you should purchase X or not’ – our assessment is ‘here’s how they score in this category’,” explains Moore. “You have everything you need to make a decision on what you think is most important.”

Yet prevention is always better than cure, and vendors can indeed save millions. Emotion can often be the key inhibitor. Moore jokes that one thumbs-down assessment regarding a potential tech acquisition well into eight figures meant he has to ‘wear a bulletproof vest walking down the street’, but the customer is now the ‘happiest on the planet.’ It’s a win-win; the vendor gets the benefit of the expertise, and the consultant gets a glowing initial impression and a greater chance of a longer-standing relationship.

“There’s so much at stake to get it wrong,” concludes Moore of the technology evaluation process. He advocates an ethos from Amazon founder Jeff Bezos on two types of decision-making; a reversible choice on the one hand, and a choice you can’t walk back on the other. These decisions ‘must be made methodically, carefully, slowly, with great deliberation and consultation’, Bezos wrote at the time.

“So for something like this on an acquisition which is not easily reversible, when you want to do your due diligence and have someone that does this [assessment], they know what to look at, and they can do it without the emotion that you would have,” adds Moore.

For more information about Growth Acceleration Partners, please visit www.wearegap.com.

Source link

You must be logged in to post a comment Login