MARKETING

Analytics: What Sources are Stealing Your Paid Revenue Attribution?

“Where should we attribute revenue?” is a question every digital marketer has asked themselves at some point. In two different accounts, we found that referral and affiliate websites were receiving revenue credit for paid-initiated traffic. These two clients both use Analytics revenue for the account’s target ROAS goals rather than the platforms. At times, we had to pull back our paid spend when Analytics dipped under the target goal. After further analysis, I wondered if we should reconsider the attribution approach.

In one account, we noticed a 90% increase in revenue attributed to referral websites month-over-month. This caught my attention because this was a significant increase.

I investigated what sources were contributing to the increase in referral traffic. Sometimes, platforms or banks appear under referrals. Sometimes, payment processing websites appear under Referrals, such as PayPal or to Affirm. These types of sources are not responsible for driving the traffic and are common referral exclusions. This means Analytics would ignore these sessions and give the credit to the previous interaction.

Analytics Attributing Revenue to Referral Sources

If we drill down into the referral websites, we can see that many of the websites receiving revenue credit are coupon websites.

Many times, the coupons do not even work on these websites, but Analytics will still credit the purchase to these domains if the user clicks the link that directs them back to the website.

If we look at the Paid-Initiated paths that end with referrals, the coupon websites received $39,062 in revenue.

If we look specifically at Referral-initiated paths, out of the $87,729 in revenue, the coupon websites were only responsible for initiating 6 visits with $4,701 in revenue.

After a discussion with the client, they believed these coupon websites were not valuable and often did not have valid coupons. So, we made the decision to exclude these coupon websites to avoid having them interfere with our marketing objectives.

Analytics Attributing Revenue to Other Advertising

In the second account, we noticed it became increasingly difficult to hit their target ROAS goals during the summer. However, since this immediately followed the distribution of the first round of stimulus checks, we believed this attributed to the spike in revenue. They also had some larger coupon promotions on their website during the spring months.

As you can see in this month-over-month trend, ROAS dropped below 300% starting in June. The value the platforms were reporting revenue $250k higher than what Analytics was reporting.

A few months ago, Analytics had revenue bucketed as other, and it was often the last interaction in Analytics. This channel was responsible for 14% of the revenue in Analytics for 8 months.

All of the revenue under Other Advertising was being attributed to a CJ Affiliates source. This started around the same time the account began to struggle meeting its ROAS goals.

Analytics Paid-Initiated Traffic and Other Advertising

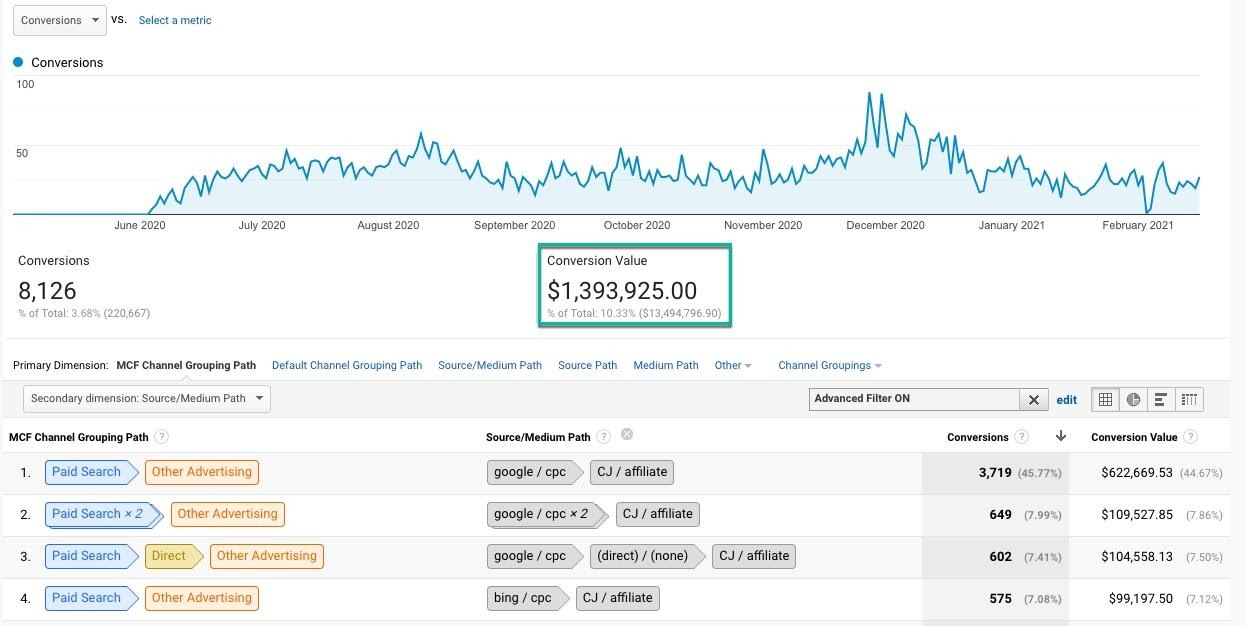

In the Multi-Channel Funnels in the Top Conversion paths, it shows that $1.4M out of the $2.5M of paid-initiated traffic was attributed to Other Advertising (CJ Affiliates). Most of this revenue would have been attributed to Paid Search if the affiliate source was not present.

Note: This report is filtered to conversion types as transactions only. It is also filtered for traffic that begins with Paid Search and ends with Other Advertising.

During one conversation with the client, we all agreed while the affiliates may be contributing to the revenue, but the question was exactly how much. If we change up the filters to show traffic that Begins with Other Advertising, we can see this channel is only responsible for driving traffic that resulted in 281 transactions and $47,268 in revenue.

So, in this case, while we could say the affiliate program is assisting in the searchers making the purchase, it does not appear to be the primary channel driving searchers to the website. So, Analytics attributing 100% of the revenue in MCF is greatly devaluing Paid Search traffic’s role.

Google Analytics – Last Click Attribution

Another important consideration is how Analytics is reporting conversions and revenue. By default, Analytics is set up to give the last non-direct visit 100% of the conversions or revenue credit. One issue with this model is the user journey is complex; assigning all the credit to the “last touchpoint” may undervalue other sources.

In the paid-initiated traffic, we can see they visit the coupon or affiliate websites right before making a purchase, and then the revenue is attributed to the coupon websites. Sometimes we see the searcher visit multiple coupon websites in the same session. Also, we can see that some revenue was attributed to the Affirm payment option for when searchers prefer to make payments over time.

For example, if a person clicks to your website from a Paid ad, then returns as a coupon ‘referral’ or ‘other advertising’ traffic to convert, Analytics will report 1 transaction for Referral or Other Advertising. The Multi-Channel Funnels report will show 1 conversion with the path paid search > referral. Paid search will get 1 assisted conversion.

In the Last Interaction attribution model, the last touchpoint—in this case, the Referral channel—would receive 100% of the credit for the sale.

In the following scenarios, the final touchpoint will get 100% of the credit in Analytics’ Last Click model unless it is Direct and then it gives credit to the previous source.

In the scenarios above, the last click may be the reason you purchased, but it is not the reason you were interested in the first place. It may be worth considering upgrading your attribution model to something that gives more credit to other touchpoints along the journey. This type of attribution makes it difficult to assign credit where credit is due.

Let’s say we updated it to a Position-Based model. The attribution credit would look something like this with 40% attributed to the first and last touchpoints and 20% divided to anything in between.

In Google Ads, most of us have moved away from the Last Click attribution model. This article From Last Click to Position-Based: An Attribution Test does a great job of discussing how changing the model impacted Google Ads campaigns. If your account has enough clicks and conversions, then the Data Driven Model will be an available option.

Model Comparison Tool

You can use the Model Comparison Tool in Analytics or it is called the Model Comparison Explorer in Analytics 360. They can be found under Conversions > Multi-Channel Funnels > Model Comparison Tool.

In the above scenario, the channels that would benefit the most are Paid Search, Organic Search, and Social Network. This data shows us that these paths may begin the journey more often and the Last Click model is not giving them the credit they may be entitled to receive.

You can also use the Attribution Beta in Analytics to explore the difference in the models without changing the settings.

Analytics Attribution Revenue to Referral Spam Coupon Websites

In this case, we see a large portion of the revenue is being attributed to coupon websites. These websites dominate the search results when you look for coupons for many brands. Oftentimes these coupons do not work, but searchers will try to get a promotion. You can see some ads are offering discounts for Macy’s here.

One option might be to switch to another attribution model in Analytics. If the Data-Driven Attribution model is available this might be the best option. Your account would need to meet specific criteria for this option to be available. Another option would be to switch to Position-Based for conversions that involve multiple touchpoints.

Another option might be to create a special coupon page for your website that is not easily found on your website. Then you can set up a Brand Coupon ad group and target these discount terms to bring searchers back to your website with a valid coupon. While some people may continue checking out without a coupon, others may choose to abandon their cart.

Conclusion

It may be time to really think about how we are attribution revenue in Analytics. The searcher’s journey can often be complex. Is the Last Click approach attributing too much revenue to sources that are less valuable? Are these referral sources devaluing your marketing efforts? Even if you decide you are not ready to rethink the attribution model in Analytics, it would be worth the time to deep dive into the list of referral sources getting credit for revenue. Maybe some of these referral sources could be excluded to give you a better vantage point of what is contributing the most.

MARKETING

Ecommerce evolution: Blurring the lines between B2B and B2C

Understanding convergence

B2B and B2C ecommerce are two distinct models of online selling. B2B ecommerce is between businesses, such as wholesalers, distributors, and manufacturers. B2C ecommerce refers to transactions between businesses like retailers and consumer brands, directly to individual shoppers.

However, in recent years, the boundaries between these two models have started to fade. This is known as the convergence between B2B and B2C ecommerce and how they are becoming more similar and integrated.

Source: White Paper: The evolution of the B2B Consumer Buyer (ClientPoint, Jan 2024)

What’s driving this change?

Ever increasing customer expectations

Customers today expect the same level of convenience, speed, and personalization in their B2B transactions as they do in their B2C interactions. B2B buyers are increasingly influenced by their B2C experiences. They want research, compare, and purchase products online, seamlessly transitioning between devices and channels. They also prefer to research and purchase online, using multiple devices and channels.

Forrester, 68% of buyers prefer to research on their own, online . Customers today expect the same level of convenience, speed, and personalization in their B2B transactions as they do in their B2C interactions. B2B buyers are increasingly influenced by their B2C experiences. They want research, compare, and purchase products online, seamlessly transitioning between devices and channels. They also prefer to research and purchase online, using multiple devices and channels

Technology and omnichannel strategies

Technology enables B2B and B2C ecommerce platforms to offer more features and functionalities, such as mobile optimization, chatbots, AI, and augmented reality. Omnichannel strategies allow B2B and B2C ecommerce businesses to provide a seamless and consistent customer experience across different touchpoints, such as websites, social media, email, and physical stores.

However, with every great leap forward comes its own set of challenges. The convergence of B2B and B2C markets means increased competition. Businesses now not only have to compete with their traditional rivals, but also with new entrants and disruptors from different sectors. For example, Amazon Business, a B2B ecommerce platform, has become a major threat to many B2B ecommerce businesses, as it offers a wide range of products, low prices, and fast delivery

“Amazon Business has proven that B2B ecommerce can leverage popular B2C-like functionality” argues Joe Albrecht, CEO / Managing Partner, Xngage. . With features like Subscribe-and-Save (auto-replenishment), one-click buying, and curated assortments by job role or work location, they make it easy for B2B buyers to go to their website and never leave. Plus, with exceptional customer service and promotional incentives like Amazon Business Prime Days, they have created a reinforcing loyalty loop.

And yet, according to Barron’s, Amazon Business is only expected to capture 1.5% of the $5.7 Trillion addressable business market by 2025. If other B2B companies can truly become digital-first organizations, they can compete and win in this fragmented space, too.”

If other B2B companies can truly become digital-first organizations, they can also compete and win in this fragmented space

Joe AlbrechtCEO/Managing Partner, XNGAGE

Increasing complexity

Another challenge is the increased complexity and cost of managing a converging ecommerce business. Businesses have to deal with different customer segments, requirements, and expectations, which may require different strategies, processes, and systems. For instance, B2B ecommerce businesses may have to handle more complex transactions, such as bulk orders, contract negotiations, and invoicing, while B2C ecommerce businesses may have to handle more customer service, returns, and loyalty programs. Moreover, B2B and B2C ecommerce businesses must invest in technology and infrastructure to support their convergence efforts, which may increase their operational and maintenance costs.

How to win

Here are a few ways companies can get ahead of the game:

Adopt B2C-like features in B2B platforms

User-friendly design, easy navigation, product reviews, personalization, recommendations, and ratings can help B2B ecommerce businesses to attract and retain more customers, as well as to increase their conversion and retention rates.

According to McKinsey, ecommerce businesses that offer B2C-like features like personalization can increase their revenues by 15% and reduce their costs by 20%. You can do this through personalization of your website with tools like Product Recommendations that help suggest related products to increase sales.

Focus on personalization and customer experience

B2B and B2C ecommerce businesses need to understand their customers’ needs, preferences, and behaviors, and tailor their offerings and interactions accordingly. Personalization and customer experience can help B2B and B2C ecommerce businesses to increase customer satisfaction, loyalty, and advocacy, as well as to improve their brand reputation and competitive advantage. According to a Salesforce report, 88% of customers say that the experience a company provides is as important as its products or services.

Market based on customer insights

Data and analytics can help B2B and B2C ecommerce businesses to gain insights into their customers, markets, competitors, and performance, and to optimize their strategies and operations accordingly. Data and analytics can also help B2B and B2C ecommerce businesses to identify new opportunities, trends, and innovations, and to anticipate and respond to customer needs and expectations. According to McKinsey, data-driven organizations are 23 times more likely to acquire customers, six times more likely to retain customers, and 19 times more likely to be profitable.

What’s next?

The convergence of B2B and B2C ecommerce is not a temporary phenomenon, but a long-term trend that will continue to shape the future of ecommerce. According to Statista, the global B2B ecommerce market is expected to reach $20.9 trillion by 2027, surpassing the B2C ecommerce market, which is expected to reach $10.5 trillion by 2027. Moreover, the report predicts that the convergence of B2B and B2C ecommerce will create new business models, such as B2B2C, B2A (business to anyone), and C2B (consumer to business).

Therefore, B2B and B2C ecommerce businesses need to prepare for the converging ecommerce landscape and take advantage of the opportunities and challenges it presents. Here are some recommendations for B2B and B2C ecommerce businesses to navigate the converging landscape:

- Conduct a thorough analysis of your customers, competitors, and market, and identify the gaps and opportunities for convergence.

- Develop a clear vision and strategy for convergence, and align your goals, objectives, and metrics with it.

- Invest in technology and infrastructure that can support your convergence efforts, such as cloud, mobile, AI, and omnichannel platforms.

- Implement B2C-like features in your B2B platforms, and vice versa, to enhance your customer experience and satisfaction.

- Personalize your offerings and interactions with your customers, and provide them with relevant and valuable content and solutions.

- Leverage data and analytics to optimize your performance and decision making, and to innovate and differentiate your business.

- Collaborate and partner with other B2B and B2C ecommerce businesses, as well as with other stakeholders, such as suppliers, distributors, and customers, to create value and synergy.

- Monitor and evaluate your convergence efforts, and adapt and improve them as needed.

By following these recommendations, B2B and B2C ecommerce businesses can bridge the gap between their models and create a more integrated and seamless ecommerce experience for their customers and themselves.

MARKETING

Streamlining Processes for Increased Efficiency and Results

How can businesses succeed nowadays when technology rules? With competition getting tougher and customers changing their preferences often, it’s a challenge. But using marketing automation can help make things easier and get better results. And in the future, it’s going to be even more important for all kinds of businesses.

So, let’s discuss how businesses can leverage marketing automation to stay ahead and thrive.

Benefits of automation marketing automation to boost your efforts

First, let’s explore the benefits of marketing automation to supercharge your efforts:

Marketing automation simplifies repetitive tasks, saving time and effort.

With automated workflows, processes become more efficient, leading to better productivity. For instance, automation not only streamlines tasks like email campaigns but also optimizes website speed, ensuring a seamless user experience. A faster website not only enhances customer satisfaction but also positively impacts search engine rankings, driving more organic traffic and ultimately boosting conversions.

Automation allows for precise targeting, reaching the right audience with personalized messages.

With automated workflows, processes become more efficient, leading to better productivity. A great example of automated workflow is Pipedrive & WhatsApp Integration in which an automated welcome message pops up on their WhatsApp

within seconds once a potential customer expresses interest in your business.

Increases ROI

By optimizing campaigns and reducing manual labor, automation can significantly improve return on investment.

Leveraging automation enables businesses to scale their marketing efforts effectively, driving growth and success. Additionally, incorporating lead scoring into automated marketing processes can streamline the identification of high-potential prospects, further optimizing resource allocation and maximizing conversion rates.

Harnessing the power of marketing automation can revolutionize your marketing strategy, leading to increased efficiency, higher returns, and sustainable growth in today’s competitive market. So, why wait? Start automating your marketing efforts today and propel your business to new heights, moreover if you have just learned ways on how to create an online business

How marketing automation can simplify operations and increase efficiency

Understanding the Change

Marketing automation has evolved significantly over time, from basic email marketing campaigns to sophisticated platforms that can manage entire marketing strategies. This progress has been fueled by advances in technology, particularly artificial intelligence (AI) and machine learning, making automation smarter and more adaptable.

One of the main reasons for this shift is the vast amount of data available to marketers today. From understanding customer demographics to analyzing behavior, the sheer volume of data is staggering. Marketing automation platforms use this data to create highly personalized and targeted campaigns, allowing businesses to connect with their audience on a deeper level.

The Emergence of AI-Powered Automation

In the future, AI-powered automation will play an even bigger role in marketing strategies. AI algorithms can analyze huge amounts of data in real-time, helping marketers identify trends, predict consumer behavior, and optimize campaigns as they go. This agility and responsiveness are crucial in today’s fast-moving digital world, where opportunities come and go in the blink of an eye. For example, we’re witnessing the rise of AI-based tools from AI website builders, to AI logo generators and even more, showing that we’re competing with time and efficiency.

Combining AI-powered automation with WordPress management services streamlines marketing efforts, enabling quick adaptation to changing trends and efficient management of online presence.

Moreover, AI can take care of routine tasks like content creation, scheduling, and testing, giving marketers more time to focus on strategic activities. By automating these repetitive tasks, businesses can work more efficiently, leading to better outcomes. AI can create social media ads tailored to specific demographics and preferences, ensuring that the content resonates with the target audience. With the help of an AI ad maker tool, businesses can efficiently produce high-quality advertisements that drive engagement and conversions across various social media platforms.

Personalization on a Large Scale

Personalization has always been important in marketing, and automation is making it possible on a larger scale. By using AI and machine learning, marketers can create tailored experiences for each customer based on their preferences, behaviors, and past interactions with the brand.

This level of personalization not only boosts customer satisfaction but also increases engagement and loyalty. When consumers feel understood and valued, they are more likely to become loyal customers and brand advocates. As automation technology continues to evolve, we can expect personalization to become even more advanced, enabling businesses to forge deeper connections with their audience. As your company has tiny homes for sale California, personalized experiences will ensure each customer finds their perfect fit, fostering lasting connections.

Integration Across Channels

Another trend shaping the future of marketing automation is the integration of multiple channels into a cohesive strategy. Today’s consumers interact with brands across various touchpoints, from social media and email to websites and mobile apps. Marketing automation platforms that can seamlessly integrate these channels and deliver consistent messaging will have a competitive edge. When creating a comparison website it’s important to ensure that the platform effectively aggregates data from diverse sources and presents it in a user-friendly manner, empowering consumers to make informed decisions.

Omni-channel integration not only betters the customer experience but also provides marketers with a comprehensive view of the customer journey. By tracking interactions across channels, businesses can gain valuable insights into how consumers engage with their brand, allowing them to refine their marketing strategies for maximum impact. Lastly, integrating SEO services into omni-channel strategies boosts visibility and helps businesses better understand and engage with their customers across different platforms.

The Human Element

While automation offers many benefits, it’s crucial not to overlook the human aspect of marketing. Despite advances in AI and machine learning, there are still elements of marketing that require human creativity, empathy, and strategic thinking.

Successful marketing automation strikes a balance between technology and human expertise. By using automation to handle routine tasks and data analysis, marketers can focus on what they do best – storytelling, building relationships, and driving innovation.

Conclusion

The future of marketing automation looks promising, offering improved efficiency and results for businesses of all sizes.

As AI continues to advance and consumer expectations change, automation will play an increasingly vital role in keeping businesses competitive.

By embracing automation technologies, marketers can simplify processes, deliver more personalized experiences, and ultimately, achieve their business goals more effectively than ever before.

MARKETING

Will Google Buy HubSpot? | Content Marketing Institute

Google + HubSpot. Is it a thing?

This week, a flurry of news came down about Google’s consideration of purchasing HubSpot.

The prospect dismayed some. It delighted others.

But is it likely? Is it even possible? What would it mean for marketers? What does the consideration even mean for marketers?

Well, we asked CMI’s chief strategy advisor, Robert Rose, for his take. Watch this video or read on:

Why Alphabet may want HubSpot

Alphabet, the parent company of Google, apparently is contemplating the acquisition of inbound marketing giant HubSpot.

The potential price could be in the range of $30 billion to $40 billion. That would make Alphabet’s largest acquisition by far. The current deal holding that title happened in 2011 when it acquired Motorola Mobility for more than $12 billion. It later sold it to Lenovo for less than $3 billion.

If the HubSpot deal happens, it would not be in character with what the classic evil villain has been doing for the past 20 years.

At first glance, you might think the deal would make no sense. Why would Google want to spend three times as much as it’s ever spent to get into the inbound marketing — the CRM and marketing automation business?

At a second glance, it makes a ton of sense.

I don’t know if you’ve noticed, but I and others at CMI spend a lot of time discussing privacy, owned media, and the deprecation of the third-party cookie. I just talked about it two weeks ago. It’s really happening.

All that oxygen being sucked out of the ad tech space presents a compelling case that Alphabet should diversify from third-party data and classic surveillance-based marketing.

Yes, this potential acquisition is about data. HubSpot would give Alphabet the keys to the kingdom of 205,000 business customers — and their customers’ data that almost certainly numbers in the tens of millions. Alphabet would also gain access to the content, marketing, and sales information those customers consumed.

Conversely, the deal would provide an immediate tip of the spear for HubSpot clients to create more targeted programs in the Alphabet ecosystem and upload their data to drive even more personalized experiences on their own properties and connect them to the Google Workspace infrastructure.

When you add in the idea of Gemini, you can start to see how Google might monetize its generative AI tool beyond figuring out how to use it on ads on search results pages.

What acquisition could mean for HubSpot customers

I may be stretching here but imagine this world. As a Hubspoogle customer, you can access an interface that prioritizes your owned media data (e.g., your website, your e-commerce catalog, blog) when Google’s Gemini answers a question).

Recent reports also say Google may put up a paywall around the new premium features of its artificial intelligence-powered Search Generative Experience. Imagine this as the new gating for marketing. In other words, users can subscribe to Google’s AI for free, but Hubspoogle customers can access that data and use it to create targeted offers.

The acquisition of HubSpot would immediately make Google Workspace a more robust competitor to Microsoft 365 Office for small- and medium-sized businesses as they would receive the ADDED capability of inbound marketing.

But in the world of rented land where Google is the landlord, the government will take notice of the acquisition. But — and it’s a big but, I cannot lie (yes, I just did that). The big but is whether this acquisition dance can happen without going afoul of regulatory issues.

Some analysts say it should be no problem. Others say, “Yeah, it wouldn’t go.” Either way, would anybody touch it in an election year? That’s a whole other story.

What marketers should realize

So, what’s my takeaway?

It’s a remote chance that Google will jump on this hard, but stranger things have happened. It would be an exciting disruption in the market.

The sure bet is this. The acquisition conversation — as if you needed more data points — says getting good at owned media to attract and build audiences and using that first-party data to provide better communication and collaboration with your customers are a must.

It’s just a matter of time until Google makes a move. They might just be testing the waters now, but they will move here. But no matter what they do, if you have your customer data house in order, you’ll be primed for success.

HANDPICKED RELATED CONTENT:

Cover image by Joseph Kalinowski/Content Marketing Institute

-

MARKETING7 days ago

MARKETING7 days agoRoundel Media Studio: What to Expect From Target’s New Self-Service Platform

-

SEO6 days ago

SEO6 days agoGoogle Limits News Links In California Over Proposed ‘Link Tax’ Law

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 12, 2024

-

SEARCHENGINES5 days ago

SEARCHENGINES5 days agoGoogle Core Update Volatility, Helpful Content Update Gone, Dangerous Google Search Results & Google Ads Confusion

-

SEO5 days ago

SEO5 days ago10 Paid Search & PPC Planning Best Practices

-

SEO7 days ago

SEO7 days agoGoogle Unplugs “Notes on Search” Experiment

-

MARKETING6 days ago

MARKETING6 days ago2 Ways to Take Back the Power in Your Business: Part 2

-

MARKETING4 days ago

MARKETING4 days ago5 Psychological Tactics to Write Better Emails