MARKETING

Why You Struggle To Prove Content ROI

Measuring content ROI is a near impossible task.

Too often, that statement ends the conversation about proving the value of content marketing. But the difficulty in tying content directly to the bottom line doesn’t mean content marketing isn’t a contributor to a business’ success.

The failure to understand that too often leads to the demise or weakening of content marketing support.

Why is the ROI of content marketing so problematic? Because the premise too often is that content marketing should feed directly to the bottom line. Many see the “return” in ROI as synonymous with “sales revenue.”

Sound familiar? If that’s the challenge you face at your brand, let’s explore a few options to overcome it.

Traditional #ROI may be difficult to prove– but it’s still worth it to explain #ContentMarketing value in business terms, says @AnnGynn via @CMIContent. Click To Tweet

Think about why you’re measuring content’s value

A couple of years ago, Ahrefs CMO Tim Soulo shared a tweet thread listing the benefits the company knows it gets from its content marketing. Yet Ahrefs never intertwines return on investment and content marketing. Here’s how he explained why they don’t:

“We won’t track how many leads we get from our articles organically, let alone what is the CPA of running paid traffic to our articles. Measuring those things would be just the tip of the iceberg,” he wrote.

“And let’s say we measured those numbers and they turned out terrible …? We wouldn’t halt our content marketing operations anyway! We KNOW that it works for us, no matter what those ‘isolated’ numbers say.”

It’s a great lesson in measurement. Think about what will change based on the numbers. If the answer is nothing, consider measuring something else.

But most executives expect numbers. And content marketing leaders need to provide them.

Explain content marketing (and marketing content)

Even people who work in marketing get confused about the difference between content marketing and other content used in marketing. No wonder executives operating outside marketing wouldn’t know the distinction.

Before you try one of the options below, consider hosting a conversation to explain the difference between content used in marketing and content marketing to key stakeholders.

What’s content used in marketing?

Content used in marketing usually focuses on the sale. Think product pages, sales promotions, customer service instructions, ads, and other content designed to lead to a transaction – a sale.

What’s content marketing?

As CMI defines it, content marketing is:

A strategic marketing approach focused on creating and distributing valuable, relevant, and consistent content to attract and retain a clearly defined audience – and, ultimately, to drive profitable customer action.

Think blogs, newsletters, guides, video and audio shows, and other content designed to inform, educate, or entertain. Sales aren’t the immediate goal (though, of course, they can and should be part of the “profitable customer action” that’s the ultimate goal.)

Content marketing aims to build an audience. Some of the people this content attracts will convert to customers. But those conversions represent only part of the value content marketing offers.

The audience represents an asset with quantifiable value, says Robert Rose, CMI’s chief strategy advisor. (Robert explains how to model the value of the audience asset in this article.)

Start with (what else?) specific goals

Though you can prepare your execs to think beyond traditional ROI assessment, you need to show how you’ll measure your content marketing’s impact.

Start by setting appropriate goals for your content marketing program. It’s not enough to say, “increase brand awareness” or “educate audiences.” Be specific: identify the goal, the target audience, the metric used to measure progress, the number you strive to achieve, and the timeframe in which you plan to complete it.

Here’s an example of a goal that covers each of those elements:

Our content marketing goal is to increase brand awareness online among women between the ages of 25 and 45. We intend to achieve a 10% increase in unique visits to our blog from this group in each quarter of 2023.

TIP: Make sure your content marketing goals align with your brand’s business goals. The example above only makes sense if the brand’s business goal is to increase sales within that target audience.

The more you speak the language of business, measurement, and success, the more likely business leaders will understand these essential points: Content marketing isn’t easily evaluated by traditional ROI. But it’s not far from a fuzzy nice-to-have – it’s vital to the business.

Make sure you use business terms to describe the value of #ContentMarketing, says @AnnGynn via @CMIContent. Click To Tweet

Redefine your content marketing strategy

CMI’s annual research shows the same top three goals for content marketing year after year: brand awareness, building credibility/trust, and educating audiences.

In our most recent study, at least 72% of marketers cited those goals.

In the same survey, sales-related goals ranked further down the list. Here’s how they factored for B2B marketers:

- 5 – generating demands/leads (67%)

- 6 – nurture subscribers/audiences/leads (54%)

- 8 – generate sales/revenue (42%)

If you must operate under the premise that a return on investment means how your content marketing affects your bottom line, adjust the goals of your content marketing strategy. Focus on leads and sales.

If you make this switch, remember that your editorial approach will need to change, too. Don’t forget to adjust your metrics to align with your new goals. Website traffic and social media analytics shouldn’t be at the top of your list (they might not even be on your list.)

Invest in an attribution model

Of course, content marketing should have an impact on revenue. After all, why do it if it isn’t helping the business? But it’s not a direct line.

If your executives expect you to connect the dots to the bottom line, you must invest resources – experts, tools, and time – to develop a multi-touch attribution model.

By taking this route, you can keep using your current content marketing strategy until the data tells you it isn’t working for your brand’s business goals.

The first component to invest in is someone who loves data. Interest in content marketing is a secondary requirement. (Traditionally, too many content marketing teams make metrics an afterthought or last step in strategy and hiring.)

Look for someone who appreciates solving analytics puzzles and knows how to translate numbers into useful data for the content marketing team and the company’s executives.

A few years ago, Content Marketing World speaker Katrina Neal shared the three analytics categories where data scientists can be helpful:

- Descriptive (what’s happened)

- Prescriptive (what’s happening in real-time/near future)

- Predictive (what’s going to happen and how you should react).

Once you have analytics talent in place, your team is ready to develop an attribution model for your content marketing. An attribution model follows a person’s content touchpoints and what actions they take.

This illustration shows a multi-point attribution model that reveals a person downloaded an e-book, read an email newsletter, had a badge scanned at a trade show, and attended a webinar before becoming a customer. (You can read more about this model in Pawan Deshpande’s article Marketing Attribution Models: A Primer for Content Marketers.)

Some companies use a single-touch attribution model that gives all credit for the sale to a single interaction (even if the customer has interacted with the content in multiple ways.) For example, say the person in the example above becomes a customer, buying $280 in products. In attributing the sale, a single-touch model would designate the webinar attendance as the only touch that matters. Thus, the webinar attendance value for that person would be $280.

TIP: In a single-touch model, the first or last touchpoint usually gets credit for the value.

A single-touch attribution model is better than nothing, but it doesn’t work for a comprehensive content marketing program. A multi-touch attribution model better reflects the value of interactions over time, which are the hallmark of a content marketing approach.

A multi-touch attribution model better reflects the value of interactions over time, which are the hallmark of a #ContentMarketing approach, says @AnnGynn via @CMIContent. Click To Tweet

With multi-touch attribution, a $280 sale gets attributed to four content marketing tactics. Using a linear multi-touch model, each tactic has the same value – $70.

In a weighted multi-touch model, the values vary based on the perceived importance of each touchpoint. For example, you might set up your model to assign 30% of the value to the first touch (in this case, the e-book) and 15% to reading the newsletter. The tradeshow interaction gets 20%, and the last step before the sale – webinar attendance – gets 35%.

In this model, each content marketing tactic has a dollar value – an indicator of its contribution to the sale.

This multi-touch attribution model I’ve used here focuses on a single sale. But you can create more complex variations of the models that look at lifetime value, repeat customer value, and so on.

Pivot from content marketing

If a strategy overhaul or a better approach to analytics and attribution modeling won’t work for your brand, stop doing content marketing. You’ll never have the long-term support necessary for success. Content marketing – building and growing an audience – takes time. (CMI founder Joe Pulizzi has estimated it takes at least 12 to 18 months to show results.)

It takes 12 to 18 months to build an audience with #ContentMarketing, according to @JoePulizzi via @AnnGynn @CMIContent. Click To Tweet

Shift your content marketing resources to focus on content created for general marketing purposes. By focusing your resources on that type of content, you can better connect your work to the bottom line – and get the necessary, ongoing support from leadership.

And if you want to bring content marketing back into the fold (or keep your existing audience), figure out how to create a minimum viable content initiative that can happen alongside the team’s marketing content work.

If you can show that marketing significantly impacts the bottom line, the executive team is more likely to support your content marketing MVP – and possibly more down the road.

HANDPICKED RELATED CONTENT:

Cover image by Joseph Kalinowski/Content Marketing Institute

MARKETING

2 Ways to Take Back the Power in Your Business: Part 2

Before we dive into the second way to assume power in your business, let’s revisit Part 1.

Who informs your marketing strategy?

YOU, with your carefully curated strategy informed by data and deep knowledge of your brand and audience? Or any of the 3 Cs below?

- Competitors: Their advertising and digital presence and seemingly never-ending budgets consume the landscape.

- Colleagues: Their tried-and-true proven tactics or lessons learned.

- Customers: Their calls, requests, and ideas.

Considering any of the above is not bad, in fact, it can be very wise! However, listening quickly becomes devastating if it lends to their running our business or marketing department.

It’s time we move from defense to offense, sitting in the driver’s seat rather than allowing any of the 3 Cs to control.

It is one thing to learn from and entirely another to be controlled by.

In Part 1, we explored how knowing what we want is critical to regaining power.

1) Knowing what you want protects the bottom line.

2) Knowing what you want protects you from the 3 Cs.

3) Knowing what you want protects you from running on auto-pilot.

You can read Part 1 here; in the meantime, let’s dive in!

How to Regain Control of Your Business: Knowing Who You Are

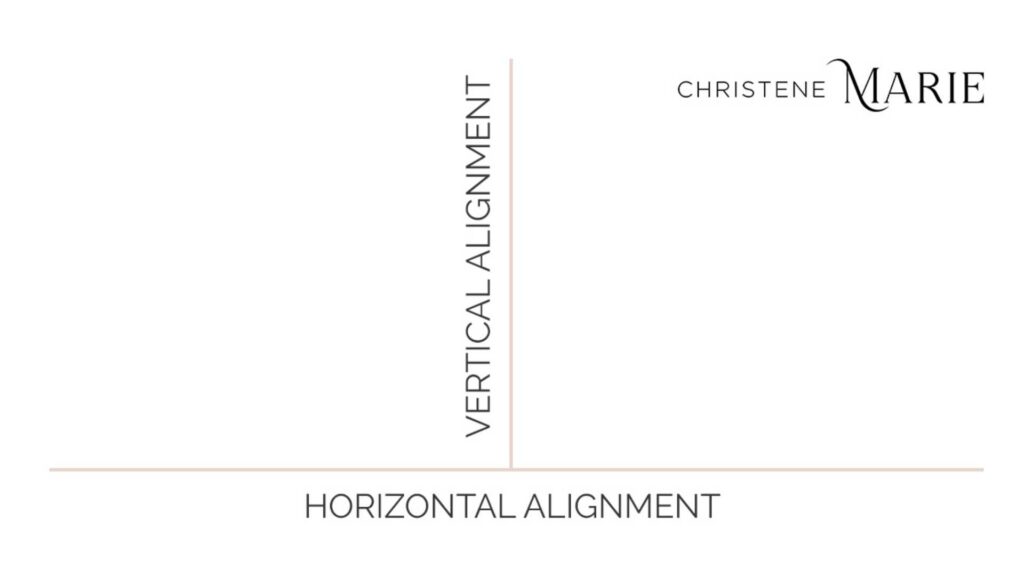

Vertical alignment is a favorite concept of mine, coined over the last two years throughout my personal journey of knowing self.

Consider the diagram below.

Vertical alignment is the state of internal being centered with who you are at your core.

Horizontal alignment is the state of external doing engaged with the world around you.

In a state of vertical alignment, your business operates from its core center, predicated on its mission, values, and brand. It is authentic and confident and cuts through the noise because it is entirely unique from every competitor in the market.

From this vertical alignment, your business is positioned for horizontal alignment to fulfill the integrity of its intended services, instituted processes, and promised results.

A strong brand is not only differentiated in the market by its vertical alignment but delivers consistently and reliably in terms of its products, offerings, and services and also in terms of the customer experience by its horizontal alignment.

Let’s examine what knowing who you are looks like in application, as well as some habits to implement with your team to strengthen vertical alignment.

1) Knowing who You are Protects You from Horizontal Voices.

The strength of “Who We Are” predicates the ability to maintain vertical alignment when something threatens your stability. When a colleague proposes a tactic that is not aligned with your values. When the customer comes calling with ideas that will knock you off course as bandwidth is limited or the budget is tight.

I was on a call with a gal from my Mastermind when I mentioned a retreat I am excited to launch in the coming months.

I shared that I was considering its positioning, given its curriculum is rooted in emotional intelligence (EQ) to inform personal brand development. The retreat serves C-Suite, but as EQ is not a common conversation among this audience, I was considering the best positioning.

She advised, “Sell them solely on the business aspects, and then sneak attack with the EQ when they’re at the retreat!”

At first blush, it sounds reasonable. After all, there’s a reason why the phrase, “Sell the people what they want, give them what they need,” is popular.

Horizontal advice and counsel can produce a wealth of knowledge. However, we must always approach the horizontal landscape – the external – powered by vertical alignment – centered internally with the core of who we are.

Upon considering my values of who I am and the vision of what I want for this event, I realized the lack of transparency is not in alignment with my values nor setting the right expectations for the experience.

Sure, maybe I would get more sales; however, my bottom line — what I want — is not just sales. I want transformation on an emotional level. I want C-Suite execs to leave powered from a place of emotional intelligence to decrease decisions made out of alignment with who they are or executing tactics rooted in guilt, not vision.

Ultimately, one of my core values is authenticity, and I must make business decisions accordingly.

2) Knowing who You are Protects You from Reactivity.

Operating from vertical alignment maintains focus on the bottom line and the strategy to achieve it. From this position, you are protected from reacting to the horizontal pressures of the 3 Cs: Competitors, Colleagues, and Customers.

This does not mean you do not adjust tactics or learn.

However, your approach to adjustments is proactive direction, not reactive deviations. To do this, consider the following questions:

First: How does their (any one of the 3 Cs) tactic measure against my proven track record of success?

If your colleague promotes adding newsletters to your strategy, lean in and ask, “Why?”

- What are their outcomes?

- What metrics are they tracking for success?

- What is their bottom line against yours?

- How do newsletters fit into their strategy and stage(s) of the customer journey?

Always consider your historical track record of success first and foremost.

Have you tried newsletters in the past? Is their audience different from yours? Why are newsletters good for them when they did not prove profitable for you?

Operate with your head up and your eyes open.

Maintain focus on your bottom line and ask questions. Revisit your data, and don’t just take their word for it.

2. Am I allocating time in my schedule?

I had coffee with the former CEO of Jiffy Lube, who built the empire that it is today.

He could not emphasize more how critical it is to allocate time for thinking. Just being — not doing — and thinking about your business or department.

Especially for senior leaders or business owners, but even still for junior staff.

The time and space to be fosters creative thinking, new ideas, and energy. Some of my best campaigns are conjured on a walk or in the shower.

Kasim Aslam, founder of the world’s #1 Google Ads agency and a dear friend of mine, is a machine when it comes to hacks and habits. He encouraged me to take an audit of my calendar over the last 30 days to assess how I spend time.

“Create three buckets,” he said. “Organize them by the following:

- Tasks that Generate Revenue

- Tasks that Cost Me Money

- Tasks that Didn’t Earn Anything”

He and I chatted after I completed this exercise, and I added one to the list: Tasks that are Life-Giving.

Friends — if we are running empty, exhausted, or emotionally depleted, our creative and strategic wherewithal will be significantly diminished. We are holistic creatures and, therefore, must nurture our mind, body, soul, and spirit to maintain optimum capacity for impact.

I shared this hack with a friend of mine. Not only did she identify meetings that were costing her money and thus needed to be eliminated, but she also identified that particular meetings could actually turn revenue-generating! She spent a good amount of time each month facilitating introductions; now, she is adding Strategic Partnerships to her suite of services.

ACTION: Analyze your calendar’s last 30-60 days against the list above.

Include what is life-giving!

How are you spending your time? What is the data showing you? Are you on the path to achieving what you want and living in alignment with who you want to be?

Share with your team or business partner for the purpose of accountability, and implement practical changes accordingly.

Finally, remember: If you will not protect your time, no one else will.

3) Knowing who You are Protects You from Lack.

“What are you proud of?” someone asked me last year.

“Nothing!” I reply too quickly. “I know I’m not living up to my potential or operating in the full capacity I could be.”

They looked at me in shock. “You need to read The Gap And The Gain.”

I silently rolled my eyes.

I already knew the premise of the book, or I thought I did. I mused: My vision is so big, and I have so much to accomplish. The thought of solely focusing on “my wins” sounded like an excuse to abdicate personal responsibility.

But I acquiesced.

The premise of this book is to measure one’s self from where they started and the success from that place to where they are today — the gains — rather than from where they hope to get and the seemingly never-ending distance — the gap.

Ultimately, Dr. Benjamin Hardy and Dan Sullivan encourage changing perspectives to assign success, considering the starting point rather than the destination.

The book opens with the following story:

Dan Jensen was an Olympic speed skater, notably the fastest in the world. But in each game spanning a decade, Jansen could not catch a break. “Flukes” — even tragedy with the death of his sister in the early morning of the 1988 Olympics — continued to disrupt the prediction of him being favored as the winner.

The 1994 Olympics were the last of his career. He had one more shot.

Preceding his last Olympics in 1994, Jansen adjusted his mindset. He focused on every single person who invested in him, leading to this moment. He considered just how very lucky he was to even participate in the first place. He thought about his love for the sport itself, all of which led to an overwhelming realization of just how much he had gained throughout his life.

He raced the 1994 Olympic games differently, as his mindset powering every stride was one of confidence and gratitude — predicated on the gains rather than the gap in his life.

This race secured him his first and only gold medal and broke a world record, simultaneously proving one of the most emotional wins in Olympic history.

Friends, knowing who we are on the personal and professional level, can protect us from those voices of shame or guilt that creep in.

PERSONAL ACTION: Create two columns. On one side, create a list of where you were when you started your business or your position at your company. Include skills and networks and even feelings about where you were in life. On the other side, outline where you are today.

Look at how far you’ve come.

COMPANY ACTION: Implement a quarterly meeting to review the past three months. Where did you start? Where are you now?

Celebrate the gain!

Only from this place of gain mindset, can you create goals for the next quarter predicated on where you are today.

Ultimately, my hope for you is that you deliver exceptional and memorable experiences laced with empathy toward the customer (horizontally aligned) yet powered by the authenticity of the brand (vertically aligned).

Aligning vertically maintains our focus on the bottom line and powers horizontal fulfillment.

Want to get certified in Content Marketing?

Leverage the tools and channels to predictably and profitably drive awareness, leads, sales, and referrals—EVERYTHING you need to know to become a true master of digital marketing. Click Here

Granted, there will be strategic times and seasons for adjustment; however, these changes are to be made on the heels of consulting who we are as a brand — not in reaction to the horizontal landscape of what is the latest and greatest in the industry.

In Conclusion…

Taking back control of your business and marketing strategies requires a conscious effort to resist external pressures and realign with what you want and who you are.

Final thoughts as we wrap up:

First, identify the root issue(s).

Consider which of the 3 Cs holds the most power: be it competition, colleagues, or customers.

Second, align vertically.

Vertical alignment facilitates individuality in the market and ensures you — and I — stand out and shine while serving our customers well.

Third, keep the bottom line in view.

Implement a routine that keeps you and your team focused on what matters most, and then create the cascading strategy necessary to accomplish it.

Fourth, maintain your mindsets.

Who You Are includes values for the internal culture. Guide your team in acknowledging the progress made along the way and embracing the gains to operate from a position of strength and confidence.

Fifth, maintain humility.

I cannot emphasize enough the importance of humility and being open to what others are doing. However, horizontal alignment must come after vertical alignment. Otherwise, we will be at the mercy of the whims and fads of everyone around us. Humility allows us to be open to external inputs and vertically aligned at the same time.

Buckle up, friends! It’s time to take back the wheel and drive our businesses forward.

The power lies with you and me.

MARKETING

Roundel Media Studio: What to Expect From Target’s New Self-Service Platform

Roundel™ Media Studio (RMS) has arrived, revolutionizing Target’s advertising game. This self-service platform offers seamless activation, management, and analysis of Target Product Ads, with more solutions on the horizon.

Powered by first-party data from both in-store and online shoppers, RMS provides new audience insights. Coupled with Target’s new loyalty program, Circle 360, advertisers gain precision targeting like never before.

But Target isn’t stopping there. With the rollout of a paid membership program on April 7th, bundling Target Circle, the Circle Card, and Shipt delivery, Target is elevating its media and membership offerings to rival the likes of Walmart and Amazon.

Curious to learn more? We sat down with our experts at Tinuiti to dive deeper into the potential implications of this platform for brands and advertisers alike.

What is Roundel Media Studio?

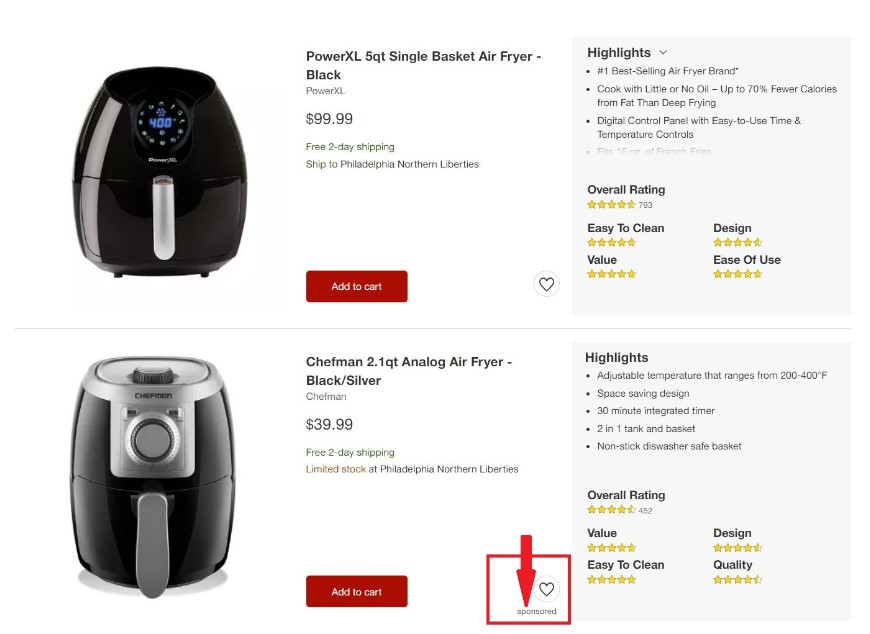

Roundel™ Media Studio is an integrated platform that consolidates various solutions and tools offered by Roundel™. At its core, it kicks off with our sponsored product ads, known as Target Product Ads by Roundel™.

Image Source: Target.com

This comprehensive platform grants access to the complete range of Target Product Ad placements, featuring tailored slots like “More to Consider” and “Frequently Bought Together” to enhance relevance and personalization.

Moreover, Roundel™ Media Studio operates without any DSP or access fees for Target Product Ads, ensuring that your media budget is optimized to deliver greater efficiency, more clicks, and ultimately, increased sales.

“One of the larger benefits of the transition is that advertisers have an opportunity to capitalize on the additional dollars saved by switching to RMS. Without the 20% fee, brands can re-invest those funds to scale campaigns or optimize budgets, all without having to allocate more funds which drives better results. Roundel™ is putting more control in the hands of advertisers by introducing this new self-service platform.”

– Averie Lynch, Specialist, Strategic Services at Tinuiti

To summarize, key benefits of using RMS include:

- No Access or DSP Fees

- All Target Product Ads Inventory

- 1st Price Auction with Existing Floor Prices

- Closed Loop Sales & Attribution

- Billing via Criteo Insertion Order

- Access Using Partners Online

How to access Roundel Media Studio

According to Target, there’s 3 steps to access Roundel™ Media Studio:

Step 1. Check that you have a Partners Online (POL) account for access. Don’t have one? Reach out to your POL admin to get set up with an account (reach out if you need help locating your organization’s admin).

Step 2. Once you have gotten access to POL, reach out to your Roundel representative who will grant you access to the platform.

Step 3. Users can access Roundel™ Media Studio in 2 ways:

Roundel Media Studio Best Practices

Target offers a variety of tips on how to best leverage their latest offering to drive performance.

Let’s take a look at the latest best practices for strategies such as maximizing efficiency or driving sales revenue.

Recommended bidding tactics for maximizing efficiency:

- Set your line-item optimizer to Revenue for the highest return on ad spend (ROAS) or to Conversions for the lowest Cost per Order (CPO).

- Since the Revenue and Conversions optimizers modulate the CPC you enter to maximize performance, it is useful to set a CPC cap to make sure that your bid will not exceed the maximum amount you wish to pay. The CPC cap should always remain at least 30% above the bid you enter to allow the engine to optimize effectively.

- Set your bids competitively to balance scale and performance (ROAS or CPO) targets.

- Optimize bids with respect to your CPO targets: lower CPCs slightly to increase efficiency, or raise them to increase scale

Recommended bidding tactics for maximizing sales revenue:

- Set the line-item optimizer to Revenue.

- Set bids to maximize scale and competitiveness while staying above KPI thresholds. Since the Revenue optimizer modulates the CPC you enter to maximize performance, it is useful to set a CPC cap to make sure that your bid will not exceed the maximum amount you wish to pay.

- Adjust your bids progressively and preferably at the product level: filter the top products by Spend and then slightly reduce any bids that have a ROAS below your threshold.

- In general, slightly lower CPC to increase efficiency or raise CPC to increase win rates and therefore increase sell-through.

Takeaways & Next Steps

This is just the start for RMS. In the future, Tinuiti will continue its partnership with Roundel to refine features and introduce additional ad types and functionalities.

When exploring any new advertising opportunity, the best results are typically realized when partnering with a performance marketing agency that understands the unique landscape. Our team boasts years of hands-on experience advertising in new and established marketplaces, including Amazon, Walmart, and Target. Working directly with Roundel, we ensure our clients’ ads harness the full functionality and features Target has to offer, with results-oriented scalability baked in.

Ready to learn more about how we can help your brand? Reach out to us today!

MARKETING

Unlocking the Power of AI Transcription for Enhanced Content Marketing Strategies

Have you noticed how artificial intelligence (AI) is slowly integrating into, well, everything? Then it won’t surprise you to hear that it’s also infiltrated content marketing.

How can AI enhance your content marketing? Through AI transcription.

Want to learn how?

Why AI Transcription is Revolutionary

AI transcription is transforming the way we access and interact with information. Here’s how it’s changing the game:

Rapid Content Transformation

Imagine turning a one-hour podcast or webinar into a comprehensive text document in minutes.

AI transcription allows for quick conversion of long-form audio and video content, making it a breeze to repurpose these materials into articles, blogs, or reports.

This means you’re spending a lot less time working on making your content as accessible as possible—the AI is doing it for you—and more time on simply creating new content.

Inclusivity and Accessibility

By providing a text version of audio and video content, AI transcription breaks down barriers for people with hearing impairments. This widens your audience.

It also aids non-native speakers in understanding the content better by allowing them to read along, improving comprehension and engagement.

Content Amplification

With AI transcription, a single piece of content can be repurposed into a multitude of formats.

For example, a transcribed interview can be used to create an in-depth blog post, several engaging social media posts, and even quotes for infographics. This not only amplifies your content’s reach but also maximizes the return on investment for every piece of content created.

SEO Benefits

Transcripts can be a goldmine for SEO. They are rich in keywords spoken naturally during conversations. Including these transcripts on your website or blog can significantly improve your search engine ranking by providing more content for search engines to index.

Real-Time Engagement

With real-time transcription services, audiences can follow along with live events, like conferences or webinars, through captions. This enhances the interactive experience and viewers don’t miss out on important information.

AI transcription is revolutionary because it democratizes content, making it accessible and usable in a variety of formats. It caters to a global audience, and multiplies the impact of the original content, all while improving SEO and user engagement.

Integrating AI Successfully

To truly tap into the power of AI transcription, you need a game plan. It starts with picking the right AI transcription service—one that’s not only accurate but also savvy with the lingo of your field.

Here’s how you can integrate AI transcription into your workflow like a pro:

Record Quality Content

The clearer your audio or video recording, the better your transcription will be. Invest in good recording equipment, minimize background noise, and ensure speakers articulate clearly. Think of it as laying the groundwork for flawless transcription.

Transcribe with AI

Once you have your high-quality recording, it’s time to let the AI work its magic. Upload your file to AI technology like Clipto and let it transform your spoken words into written text. This step is where the tech shines, turning hours of audio into text in minutes.

Edit and Polish

AI is smart, but it’s not perfect. Review the transcript for any errors or awkward phrasings. Adjust any text you need to. This editing process ensures the final product is not only accurate but also engaging and readable.

Incorporate into Your Strategy

Now that you have your polished transcript, use it to upgrade your marketing materials. Transcripts can be repurposed into blog posts, social media content, eBooks, or even used to enhance video and podcast SEO by providing searchable text.

AI transcription is a dynamic tool that can extend your capabilities. By treating AI as a collaborative partner, you can enhance your content marketing efforts, making your message clearer, more accessible, and far-reaching. Integrating AI transcription allows you to engage with your audience on multiple levels.

Spicing Up Your Content with AI Transcription

Let’s get real—AI transcription is more than just a fancy way of turning chatter into text. It’s a secret weapon in your content marketing arsenal.

Boosting Quality and Nailing Relevance

Think about it: when you transcribe your audio and video goodies, you’re capturing every little detail and nuance that might have slipped by unnoticed. Here’s the scoop:

- Accuracy is Key: With AI, you can nail the exactness of your content, catching the subtle hints and expressions that give it flavor.

- SEO Magic: Those transcripts are like SEO gold, stuffed with keywords that naturally pop up in conversation, giving your site’s visibility a hearty push.

And the cherry on top? AI transcription can sort out the big themes in your content, keeping your marketing vibe consistent and spot-on across all platforms.

Digging into Data

Now, here comes the detective work. AI transcription lays out all the juicy data about what your audience loves (and doesn’t). With this goldmine of info, you can:

- Analyze Engagement: Spot the hotspots in your videos or podcasts where people hang on every word—and where they hit the fast-forward button. This insight is like a roadmap to your audience’s heart.

- Strategize with Confidence: Armed with data, you can tweak your topics, amp up engagement, and keep your audience coming back for more.

So, by turning your spoken content into text, you’re not just filling up space. You’re diving deep into the analytics pool for a smarter, more data-driven approach to content marketing. It’s about getting down to the nitty-gritty of what your audience really likes, making every word you publish count.

Bottom Line

It’s clear that AI transcription is not just a fleeting trend but a robust ally in the realm of content marketing. Equipped with tools to make your message not only heard but felt across the globe.

From crafting precision-packed text that search engines adore to unveiling layers of audience insights waiting to be explored, AI transcription is your go-to for making every piece of content count.

-

PPC5 days ago

PPC5 days agoHow 6 SEO Experts Are Navigating Google Update Chaos

-

MARKETING7 days ago

MARKETING7 days ago12 Facebook Ad Metrics Worth Your Attention

-

SEARCHENGINES5 days ago

SEARCHENGINES5 days agoBing Search Testing Removing Cache Link From Search Results

-

MARKETING5 days ago

MARKETING5 days ago60 Remote Work Stats to Know in 2024

-

SEO7 days ago

SEO7 days agoThe Essential Guide To Using Images Legally Online

-

WORDPRESS4 days ago

WORDPRESS4 days ago10 WordPress Influencers to Follow in 2024 – WordPress.com News

-

SEARCHENGINES7 days ago

SEARCHENGINES7 days agoOngoing Google March Core Update, Googlebot To Crawl Less, Pay For Google Search AI & More

-

SEO6 days ago

SEO6 days agoGoogle Explains How It Chooses Canonical Webpages

You must be logged in to post a comment Login