SOCIAL

Facebook Acquires Video Commerce Startup ‘Packagd’ to Help Boost In-Stream Buying Options

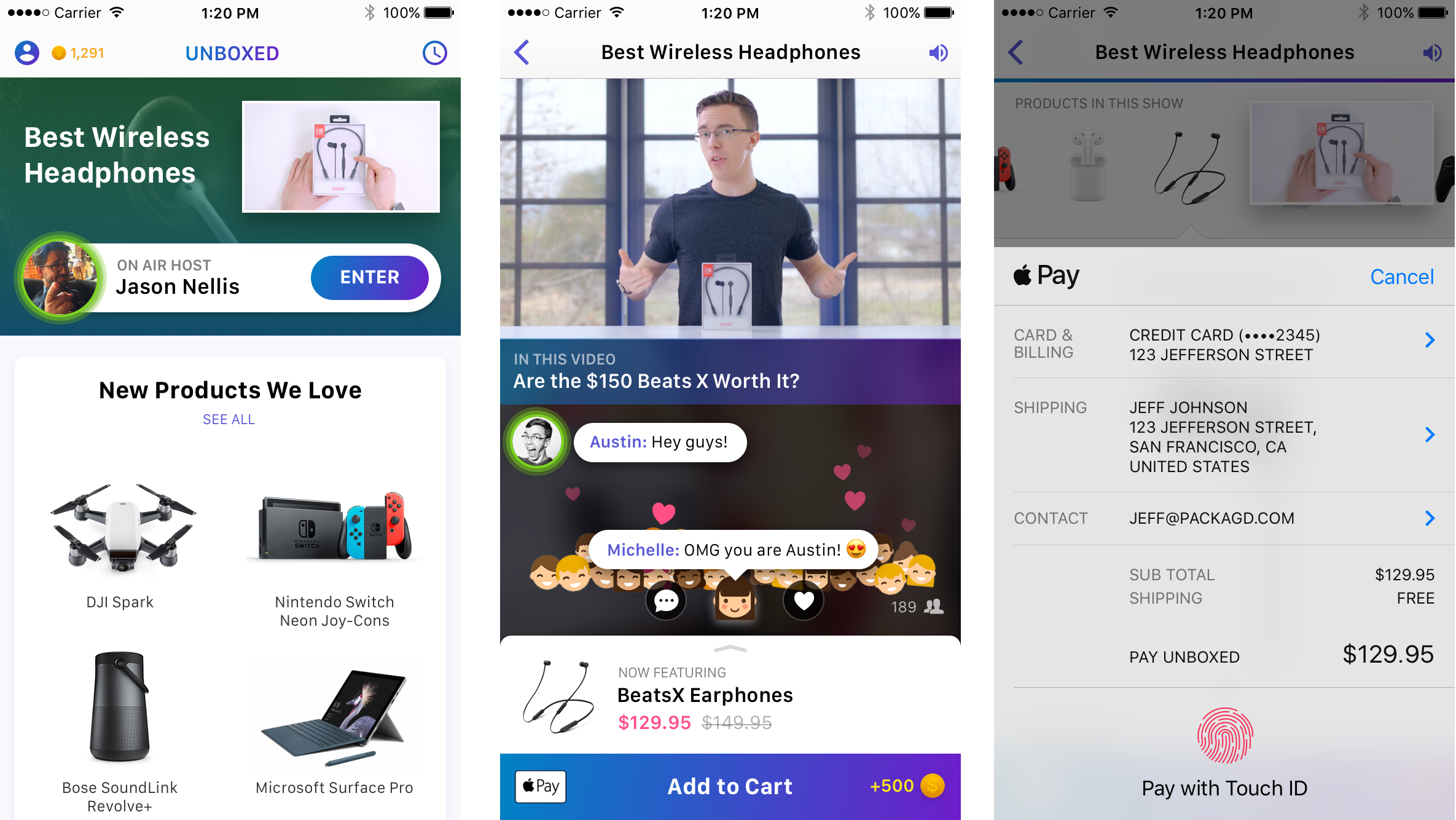

As part of its burgeoning eCommerce push, earlier this year, Facebook acquired video commerce startup Packagd, which, prior to the acquisition, had been focused on enabling users to make direct purchases of products via live-stream, unboxing-type videos.

As reported by Bloomberg, Facebook quietly purchased Packagd to help build a new live shopping feature inside its Marketplace product.

As per Bloomberg:

“The social media company bought Packagd, a five-person company founded by Eric Feng, a former partner with Kleiner Perkins Caufield & Byers, and most of the startup’s team joined Facebook in September. Packagd was building a shopping product for YouTube videos. “Think of it as a re-imagination of QVC or a home shopping network,” Feng said in a 2017 interview with Bloomberg Television’s Emily Chang.”

Facebook has confirmed the purchase, saying that the company is “exploring ways to let buyers easily ask questions and place orders within a live video broadcast.”

The option sounds very similar to a short-lived live-stream buying project which Facebook piloted late last year. In that experiment, selected users in Thailand were given access to a dedicated Facebook Live mode which enabled Pages to showcase products in their stream, which viewers could then purchase via screenshots.

Facebook told TechCrunch at the time that the process emerged from feedback, specifically from Thai users, which supported the use of Live video as a more effective means of showcasing products and facilitating consumer queries in real-time.

That project has since been halted, but the acquisition of Packagd shows that Facebook is not done with this idea, and that it still sees significant potential in utilizing live video as a means to further encourage on-platform purchases.

eCommerce is set to be a big deal for Facebook in 2020.

First off, you have payments – throughout 2019, we’ve seen Facebook working to build its own, on-platform cryptocurrency, with a view to facilitating fee-free funds transfer within its network. The idea here is that once people are moving money around within Facebook’s system, it will make it much easier for them to also use those funds to make on-platform purchases. And while its cryptocurrency plans still have a few hurdles to overcome, Facebook is expanding access to other options, like Facebook Pay and WhatsApp Pay, which will both, eventually, also extend to Instagram.

From there, Facebook then needs to build up its on-platform buying options. The acquisition of Packagd is the latest on this front, but back in June, Facebook also acquired Indian marketplace app Meesho, which connects sellers with customers through WhatsApp, and already has more than 2 million users.

India – and it’s 1.4 billion increasingly connected citizens – looks set to play a key role in Facebook’s eCommerce expansion, while East Asian markets, like Thailand, also seem ripe for the next phase of the company’s online shopping push.

In this sense, the viability of Facebook’s Libra crytocurrency, or even its Marketplace eCommerce tools, within western markets may not be indicative of overall success. Facebook doesn’t need these tools to catch on in the US, necessarily, as there are billions of users in emerging markets, where the ease of use of such tools could provide far greater benefit, and therefore, see far higher take-up.

And if Facebook can expand the utility of its platform into payments, shopping, then further into bill payments, banking, etc. That could make the platform a much more critical layer in the broader tech infrastructure of these regions, a key component in everyday life.

Definitely, Facebook would love to hold such influence in all regions, but it’s best placed to do so in emerging markets – and potentially become the essential app for many, many more users.