SOCIAL

TikTok’s Latest Ad Targeting Provisions Reflect Increasing Revenue Pressure on the App

This has certainly raised some eyebrows among social media and privacy analysts.

Today, TikTok has started showing users in Europe, the UK and Switzerland new, in-app notifications informing them of changes to its data collection policies.

As you can see in these examples, shared by social media expert Matt Navarra, TikTok is changing the way it uses people’s data within its ad targeting systems.

More specifically, TikTok explains that:

“If you are 18 or over and in the EEA, the UK, or Switzerland, TikTok is making a legal change to how it will use your on-TikTok activity to personalize your ads. Under applicable data protection law, companies like TikTok must have a legal basis for processing your information. Historically, TikTok asked you for your “consent” to use your on-TikTok activity and off-TikTok activity to serve you personalized ads. From 13 July 2022 TikTok will rely on its “legitimate interests” as its legal basis to use on-TikTok activity to personalize the ads of users who are 18 or over.”

Note the inverted commas around ‘consent’. Seems like a red flag in itself.

Essentially, TikTok’s saying that if you have not consented to personalized ads in the past, which TikTok has to allow as part of the EU’s data privacy provisions, you’ll soon get a form of personalized ads anyway, based on your in-app activity. TikTok appears to be looking to use a technicality to maximize the performance of its ads, even among users who have opted out of personalized targeting.

Which is not surprising, I guess, but it does point to the increasing pressure within TikTok to start making real money from the app – which could result in more ads being shown to users over time.

While Twitter remains in ownership limbo, and Meta is diverting more and more of its resources into its metaverse push, it seems, on the face of it, like TikTok is currently the only platform on a clear upward trajectory, with usage counts rising, more ad dollars coming in, and new programs designed to capitalize on the rise of eCommerce and the Creator Economy.

TikTok, at least right now, is the clear winner in the social media sphere are present, right?

Well, maybe not as much as you’d think.

In recent months, TikTok owner ByteDance has faced a range of new challenges, including, most notably, a change in the regulations relating to data and algorithm usage in China.

As per The South China Morning Post:

“As with many Chinese tech companies, ByteDance’s prospects for profit growth in the domestic market remain clouded by tightened regulations. The central government has become more intrusive in regulating short video content. A new law governing the use of recommendation algorithms went into effect in March.”

CCP regulators, increasingly frustrated at their inability to reign in content within these apps, have sought to exert more control, which has extended to all of ByteDance’s key income sources.

That increased regulatory scrutiny has already wiped $100 billion from the value of ByteDance, forcing the company to consider sell-offs, staff cuts and more as it works to right the ship.

That pressure has also extended to TikTok, which, aside from these new data usage changes, has also been looking to enforce more China-centric style policies in terms of what’s expected of employees, and the content that it allows in the app.

ByteDance executive Joshua Ma, who had been working with TikTok’s UK eCommerce team, was recently forced to stand down after trying to impose tough working conditions on staff, in order to hasten its expansion.

As reported by The Financial Times:

“The launch of TikTok’s livestream shopping feature in the UK triggered a staff exodus from the London ecommerce team. Some staff complained of an aggressive company culture, with unrealistic targets and expectations that run counter to British working practices. Staff said they were expected to frequently work more than 12 hours a day, starting early to accommodate calls with China and ending late as livestreams were more successful in the evening, with overtime celebrated in internal communications. Some members of the ecommerce team were removed from client accounts after going on annual leave.”

Ma has also stated that he ‘doesn’t believe’ in maternity leave, which was also reported by The Financial Times, and which, incidentally, led to another issue on the content side, with TikTok then reportedly considering a move to censor keywords such as ‘Financial Times’, ‘Joshua Ma’, ‘maternity’, and ‘toxic’ on the platform in order to weaken the Financial Times report’s impact.

TikTok says that this ban was never implemented, but it highlights a fundamental concern within TikTok’s approach, in that a first instinct of at least some execs was to seek to silence criticism and dissent.

And you’d have to assume that at least some of this extends from the pressure being exerted on the company’s Beijing HQ.

How this new data usage policy relates is unclear, but with TikTok still only contributing around a third of ByteDance’s overall revenue, despite its global reach, you can imagine that ByteDance will be increasingly keen to squeeze more cash out of the app – and sooner, rather than later.

Which remains a challenge. ByteDance has seen big revenue success with the Chinese version of TikTok (called ‘Douyin’) by implementing eCommerce integrations, primarily driven by the take up of live-stream commerce in China.

According to ByteDance, over 20 million individual content creators and live-streaming hosts are now generating income from its apps, with total live shopping revenues in the Chinese market set to reach $423 billion this year. That’s more than the entire GDP of Ireland.

But the CCP’s crackdown is also impacting this element, with a bigger push to catch out influencers that haven’t been fulfilling their tax burden, which has already impacted many local streaming stars.

Add to this the fact that more brands are reconsidering their relationships with streamers (due to influencers demanding ever-more attractive deals), and the signs indicate that a reckoning is coming for the booming sector, which will again impact ByteDance.

It’s also not great for its push on the same with TikTok. Despite its popularity, TikTok is still developing a more equitable business process, especially in regards to ensuring its top stars get paid. TikTok’s expected to bring in around $11.6 billion in ad revenue this year, but it still doesn’t have an effective means to redistribute that to creators, which could, eventually, see many of them drift off to YouTube and Instagram instead.

TikTok is working on this, as noted, but a key focus, as it has been in China, is live-stream commerce, which it’s hoping will become a golden goose in western regions as well. But it hasn’t yet, and many Chinese trends haven’t translated to other markets in the past – and it could well be that TikTok creators just want to get paid for making videos, which they can’t do on TikTok, but they can via YouTube’s Partner Program.

Could that see more creators losing interest in the platform, and taking their audiences with them? That’s what eventually killed off Vine, and it remains a genuine possibility for TikTok as well. Which is why TikTok is desperate to get back into India, where it’s still banned, while it’s also looking to implement more ad options and tools to maximize its revenue intake while it can.

Essentially, when viewed on a broader scope, you can see how the increasing pressure on ByteDance is weighing on TikTok as well, and will likely force it to push forward with various revenue tools, including more ads, which poses a big risk for its growth potential.

That’s not to say TikTok’s on the way out just yet. Far from it, but there are signs there, and there are concerns that you may not recognize when looking at its growth numbers in isolation.

Maybe there are ways around it – maybe TikTok could get sold off and operate as a separate entity, or maybe its commerce options will be a hit and facilitate bigger business opportunities for the app.

Either way, you can expect to see more changes in the app as the pressure mounts on its parent business.

SOCIAL

Snapchat Explores New Messaging Retention Feature: A Game-Changer or Risky Move?

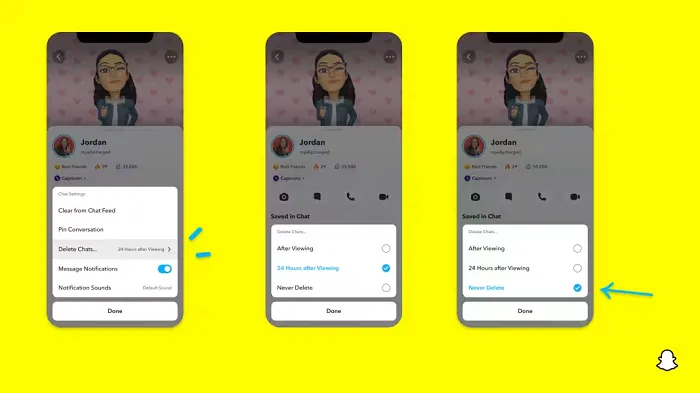

In a recent announcement, Snapchat revealed a groundbreaking update that challenges its traditional design ethos. The platform is experimenting with an option that allows users to defy the 24-hour auto-delete rule, a feature synonymous with Snapchat’s ephemeral messaging model.

The proposed change aims to introduce a “Never delete” option in messaging retention settings, aligning Snapchat more closely with conventional messaging apps. While this move may blur Snapchat’s distinctive selling point, Snap appears convinced of its necessity.

According to Snap, the decision stems from user feedback and a commitment to innovation based on user needs. The company aims to provide greater flexibility and control over conversations, catering to the preferences of its community.

Currently undergoing trials in select markets, the new feature empowers users to adjust retention settings on a conversation-by-conversation basis. Flexibility remains paramount, with participants able to modify settings within chats and receive in-chat notifications to ensure transparency.

Snapchat underscores that the default auto-delete feature will persist, reinforcing its design philosophy centered on ephemerality. However, with the app gaining traction as a primary messaging platform, the option offers users a means to preserve longer chat histories.

The update marks a pivotal moment for Snapchat, renowned for its disappearing message premise, especially popular among younger demographics. Retaining this focus has been pivotal to Snapchat’s identity, but the shift suggests a broader strategy aimed at diversifying its user base.

This strategy may appeal particularly to older demographics, potentially extending Snapchat’s relevance as users age. By emulating features of conventional messaging platforms, Snapchat seeks to enhance its appeal and broaden its reach.

Yet, the introduction of message retention poses questions about Snapchat’s uniqueness. While addressing user demands, the risk of diluting Snapchat’s distinctiveness looms large.

As Snapchat ventures into uncharted territory, the outcome of this experiment remains uncertain. Will message retention propel Snapchat to new heights, or will it compromise the platform’s uniqueness?

Only time will tell.

SOCIAL

Catering to specific audience boosts your business, says accountant turned coach

While it is tempting to try to appeal to a broad audience, the founder of alcohol-free coaching service Just the Tonic, Sandra Parker, believes the best thing you can do for your business is focus on your niche. Here’s how she did just that.

When running a business, reaching out to as many clients as possible can be tempting. But it also risks making your marketing “too generic,” warns Sandra Parker, the founder of Just The Tonic Coaching.

“From the very start of my business, I knew exactly who I could help and who I couldn’t,” Parker told My Biggest Lessons.

Parker struggled with alcohol dependence as a young professional. Today, her business targets high-achieving individuals who face challenges similar to those she had early in her career.

“I understand their frustrations, I understand their fears, and I understand their coping mechanisms and the stories they’re telling themselves,” Parker said. “Because of that, I’m able to market very effectively, to speak in a language that they understand, and am able to reach them.”Â

“I believe that it’s really important that you know exactly who your customer or your client is, and you target them, and you resist the temptation to make your marketing too generic to try and reach everyone,” she explained.

“If you speak specifically to your target clients, you will reach them, and I believe that’s the way that you’re going to be more successful.

Watch the video for more of Sandra Parker’s biggest lessons.

SOCIAL

Instagram Tests Live-Stream Games to Enhance Engagement

Instagram’s testing out some new options to help spice up your live-streams in the app, with some live broadcasters now able to select a game that they can play with viewers in-stream.

As you can see in these example screens, posted by Ahmed Ghanem, some creators now have the option to play either “This or That”, a question and answer prompt that you can share with your viewers, or “Trivia”, to generate more engagement within your IG live-streams.

That could be a simple way to spark more conversation and interaction, which could then lead into further engagement opportunities from your live audience.

Meta’s been exploring more ways to make live-streaming a bigger consideration for IG creators, with a view to live-streams potentially catching on with more users.

That includes the gradual expansion of its “Stars” live-stream donation program, giving more creators in more regions a means to accept donations from live-stream viewers, while back in December, Instagram also added some new options to make it easier to go live using third-party tools via desktop PCs.

Live streaming has been a major shift in China, where shopping live-streams, in particular, have led to massive opportunities for streaming platforms. They haven’t caught on in the same way in Western regions, but as TikTok and YouTube look to push live-stream adoption, there is still a chance that they will become a much bigger element in future.

Which is why IG is also trying to stay in touch, and add more ways for its creators to engage via streams. Live-stream games is another element within this, which could make this a better community-building, and potentially sales-driving option.

We’ve asked Instagram for more information on this test, and we’ll update this post if/when we hear back.

-

PPC5 days ago

PPC5 days ago19 Best SEO Tools in 2024 (For Every Use Case)

-

MARKETING6 days ago

MARKETING6 days agoStreamlining Processes for Increased Efficiency and Results

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 17, 2024

-

SEO6 days ago

SEO6 days agoAn In-Depth Guide And Best Practices For Mobile SEO

-

PPC6 days ago

PPC6 days ago97 Marvelous May Content Ideas for Blog Posts, Videos, & More

-

SEARCHENGINES5 days ago

Daily Search Forum Recap: April 18, 2024

-

MARKETING5 days ago

MARKETING5 days agoEcommerce evolution: Blurring the lines between B2B and B2C

-

SEARCHENGINES4 days ago

Daily Search Forum Recap: April 19, 2024

You must be logged in to post a comment Login