SOCIAL

TikTok Continues to Gain Momentum, But Challenges Remain in Maximizing the App’s Growth

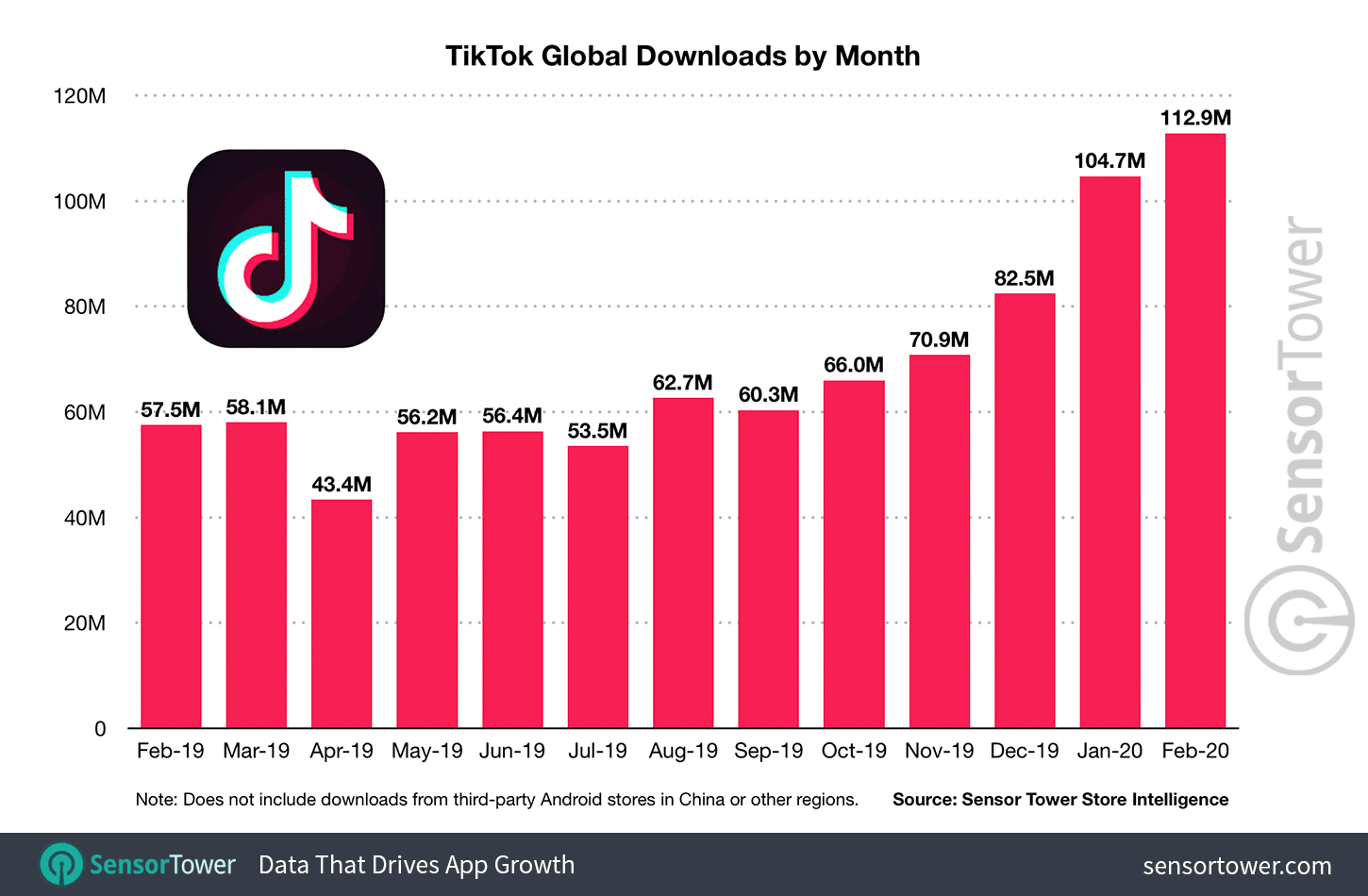

Despite various content moderation and data privacy concerns, TikTok continues to gain momentum, with the latest data from app analytics firm SensorTower showing that February 2020 was TikTok’s best performing month, in terms of total app downloads, to date.

As per SensorTower:

“TikTok was downloaded by close to 113 million App Store and Google Play users worldwide in February, making it the app’s best month ever for both installs and revenue according to Sensor Tower Store Intelligence estimates.”

SensorTower further notes that TikTok was the most downloaded non-game app worldwide last month, outperforming both WhatsApp and Facebook. TikTok installs are up 96% year-over-year, with the COVID-19 outbreak seemingly fueling increased adoption as people look to keep themselves entertained while reducing their time spent in public.

In total, TikTok is now closing in on 2 billion lifetime installs, which is a huge number, and should represent significant opportunity for brand outreach and engagement. But there is a little more to the upfront data than it may seem – so before you latch onto that 2 billion installs count and pit TikTok against Facebook, it’s worth breaking the figures down to understand exactly what they represent.

First off, app installs are not active users. Various reports on TikTok have seemingly equated the two, but having 2 billion people download and install your app is not the equivalent of getting 2 billion users active and engaged on your platform on a regular basis. If TikTok had 2 billion active users, it would be the second-biggest social platform in the world, and closing fast on Facebook. But it doesn’t.

The only official number we have on TikTok’s global user base is that the app reached 500 million active users back in 2018, with the majority of them using the Chinese version of the app, called ‘Douyin’. Since then, TikTok has not been forthcoming about its actual user count.

Which makes sense – much of the narrative around TikTok has been pumped up by download counts, which, as noted, are close to reaching 2 billion. If TikTok were to come out and say that it actually has, say, 700 million monthly active users, that would only work to water down those download stats – but realistically, this is probably closer to the truth, while the audience geographic split is also important to understand.

Breaking down the data, based on the estimates and figures that have been made available, TikTok seems to have:

Other nations follow in lower user counts from there, but as you can see, the regional splits are relevant in TikTok’s overall download and usage counts. Yes, TikTok is very popular, but from an advertising and marketing perspective, it may not be comparable, at least in Western markets, to most other platforms in terms of relevant audience reach.

Indeed, in SensorTower’s extended breakdown of TikTok’s revenue information, it notes that:

“TikTok also saw its highest-ever monthly user spending in February, with the $50.4 million it generated equalling a 784.2% YoY increase. This made it the third highest-grossing non-game app worldwide for the month behind Tinder and YouTube.”

Which is an amazing result, but again, the regional split here is significant.

“China – where TikTok is known as Douyin – was responsible for the majority of this spending with nearly $46 million, or 91% of all revenue for the month. The U.S. ranked No. 2 with $3 million, while Great Britain came in third, with $216,000.”

So, again, TikTok is driving user interest and action, but possibly not as much as you would expect in your local market, based on the hype and top-line download counts.

That’s not to say that TikTok isn’t growing its audience base in all regions, and becoming a more relevant consideration for marketers. But it is worth noting that, by comparison, the app is not on the same level as even Snapchat (86m North American DAUs) in terms of reach to the US market at this stage, putting it well behind Twitter Facebook, Instagram, and others.

This is the key question for TikTok. Yes, it has momentum and hype, and yes, the download figures are encouraging. But can TikTok make short-form video into a relevant, viable and engaging option?

Vine, the first short-form video app of this type, eventually buckled because it wasn’t able to monetize effectively – with Vine’s main content offering being only six-seconds in length, at most, that made it increasingly difficult for Vine to implement ads, as users would either skip by them or ignore them in-stream. Eventually, Vine’s inability to monetize effectively left it unable to create a viable revenue funnel for its top creators, who subsequently migrated to YouTube, Instagram and Facebook, where they could post longer-form content, and make real money from ads.

Vine did try to counter this, adding longer-form videos and pre-roll ads in its dying months, but with its top creators moving on, their fans shifted with them.

While Twitter often gets the blame for Vine’s failure, really, it was the inability for the company to effectively monetize that lead to its demise – and Twitter couldn’t do a lot about that.

Which then leads to TikTok.

Sure, TikTok has people’s attention, it has users tuning in, and it is growing. But Vine had 200 million active users at peak, and it couldn’t map out a revenue-generation framework. Will TikTok eventually fare any better?

As noted, it’s still not generating significant revenue in the US, and it’s still spending big on promotion. At some stage, it will need to establish a means for its top creators to monetize.

In China, Douyin has moved into eCommerce as a means to add in revenue options, which is how it’s seen such significant revenue growth in that region.

Will the same work in the US market?

TikTok is already testing eCommerce tools and external links, in order to provide more revenue generation options for creators, while it’s also got its own influencer marketing marketplace, which it recently opened up to more businesses.

Basically, TikTok knows that it needs to move fast and build a real revenue generation pipeline for these popular users – because if it doesn’t, they’ll take their talents elsewhere, and their established audiences with them. Then TikTok will go the same way as Vine.

So while it seems like all the momentum is with TikTok, and massive numbers like ‘a billion downloads’ are regularly thrown around, there’s more to it than the surface figures. And that’s critical to note in terms of brand use, and the future viability of the platform more broadly.