SOCIAL

TikTok Continues to Lead the Download Charts in Q1, Sees Record In-App Spending

Despite every effort to steal its thunder, by replicating its features, and diluting the ‘uniqueness’ of the app, Meta just can’t seem to slow TikTok’s growth.

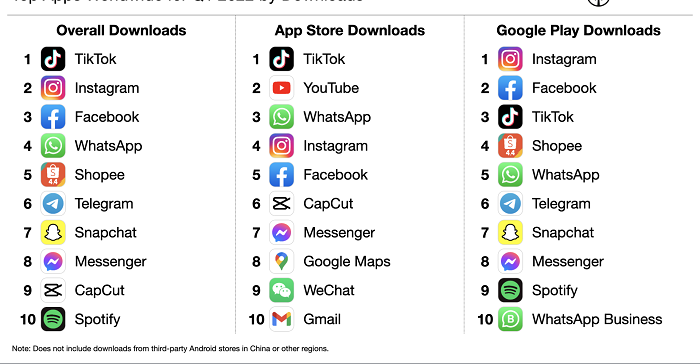

As per the latest app rankings data from Sensor Tower, TikTok was once again the most downloaded app in Q1 2022, beating out a phalanx of Meta-owned apps.

To be clear, Meta’s apps remain hugely popular, while the continued interest in Shopee highlights the expanding eCommerce market. But TikTok downloads are still rising, which would be a source of frustration for Meta’s team.

As you can see in the chart listings, CapCut, which is essentially a video editing tool for TikTok, also owned by ByteDance, has also held its place in the top downloads chart, following on from last quarter, which further underlines TikTok’s ongoing growth momentum. Which, again, would infuriate Zuck and Co. no end, because while they only ever seem to be talking about the metaverse these days, and looking towards the future of the web, at least part of that future focus has come about because it’s losing the present battle, with Facebook user numbers slowing and Instagram not providing an official update on its user count for years.

What’s more, a look at the consumer spend chart further highlights TikTok’s strength.

An important proviso here is that TikTok’s numbers also include consumer spend on Douyin, the Chinese version of TikTok, which contributes around 60% of its overall revenue. But even with that in mind, TikTok had a record quarter for in-app spending, reaching $840 million in Q1, as per insights from data.ai.

Importantly, data.ai also notes that US spending in TikTok increased 125% quarter-over-quarter, showing that US users are indeed looking to spend more in the app, a positive sign for its evolving eCommerce plans. That could present significant opportunities, which would make TikTok an even bigger problem for Meta, at least in a competitive spend sense.

It’s difficult to predict, then, how the social commerce race plays out, with Meta also looking to make in-app spending a bigger element of both Facebook and Instagram.

Just this week, Instagram took another step towards leaning into product tags as a bigger revenue consideration for creators, by removing in-stream video ads as a placement option. The eventual progression will likely see Instagram make a bigger push to encourage more in-stream product discovery and purchase activity, which again seems like a move designed to blunt TikTok’s momentum in the same space.

But TikTok just keeps growing. As per data.ai:

“We forecast that TikTok would surpass the 1.5 billion MAU milestone in 2022, and after just 1 quarter in 2022, TikTok has indeed shattered that prediction. Not only does TikTok have a growing user base, the app has fostered deep engagement – with global users outside of China spending 19.6 hours per month on average in the app during 2021.”

TikTok’s growth is unprecedented, and its addictive ‘For You’ feed just keeps drawing more and more people in. It’s already one of the biggest social media apps in the world, and it looks set to become the clear second leading platform by the end of the year, as per App Annie’s prediction.

For clarity, Instagram is rumored to have around 2 billion total users at present, as per recent reportage, but Instagram and Meta have not officially confirmed this stat. That means TikTok could possibly have already surpassed Instagram usage, and is now inching slowly closer to Facebook itself.

Now you know why Meta’s so keen on looking towards the next digital plain.

It’s amazing to consider how significant TikTok has become, as it continues to expand into new markets. There are still concerns around its Chinese ownership, and the potential obligations that it has in regards to sharing user data with the CCP. That remains a key risk for the platform, especially as China takes a more aggressive stance on world issues. But all the signs suggest that TikTok is the platform of the moment, and where more and more people are spending more and more of their time.

The only other key challenge is effective monetization, and ensuring that TikTok stars get adequately paid for their efforts. That’s where eCommerce comes in, but it remains to be seen whether TikTok can translate its eCommerce and subscription type tools into an effective monetization pathway, comparable to YouTube and Facebook.

There is still a chance it could lose out on this front, but right now, TikTok remains the focal point for the current generation of web users.

You can check out Sensor Tower’s Q1 apps update here and data.ai’s latest TikTok performance update here.

Source link

You must be logged in to post a comment Login