PPC

Tools to Analyze Your PPC Competition

It seemed like our PPC Hero audience really enjoys competitor research so I thought maybe a little more creeping was in order. I’m going to focus, however, on the various tools on the market that you can use to see estimated metric performance, keyword and ad copy information on those competitors.

Why is competitor analysis so important?

Generally speaking, competitive analysis is top of mind when beginning a new PPC account or opening up a new segment within PPC, however it’s very easy to get bogged down in optimizing to your own data once things are going and forget to revisit this area. Here is “The Complete PPC Account Audit Guide” to see what other items to consider when performing an audit.

My purpose with competitive analysis using these tools is never to run directly after the strategy my competition is using and throw mine out the window, but checking in to your competition’s messaging and possible targets can increase creativity when you least expect it. Is my competition offering a benefit we do better? Are they bidding on a group of keywords I’ve missed? Again, maybe the best idea isn’t to copy what the competition is up to, but at the very least explore what they’re doing and see if it’s applicable to you and your accounts.

This competitive analysis can also help drive conversations with clients if their competition is gobbling up a large amount of market share. If you’re hitting KPI and/or ROI goals, why not invest a bit more budget and tackle as much of that market share as possible?

What tools are available?

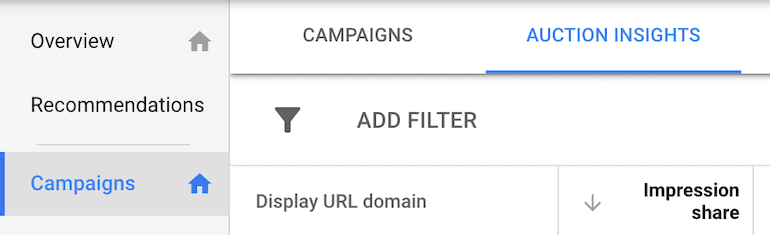

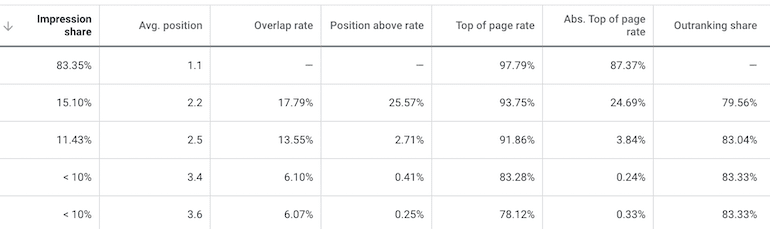

Auction Insights via Google Ads Campaign

In Google Ads, you can review the Auction Insights to determine what competitors are competing with you for the same keywords. The data will help you determine if your competition is more aggressive in their bids or budget. The Impression share data details market share and if you might benefit by improve your budget, quality score, or bids. The Overlap rate will show you how often you and the competitor appear in the same auction search results. We can see the #1 competitor has a 17% impression share compared to the next highest one at 13%.

Another important detail can be found in the Outranking share. This metric shows you how often you outrank the competition when you appear in the same auction. In the above Auction Insight results we can see there is not a big difference in the three positions above us which suggest the bids are close. This data indicates that minor bid increases could increase our average position and it might be worth testing if an improved average position also increases ROAS.

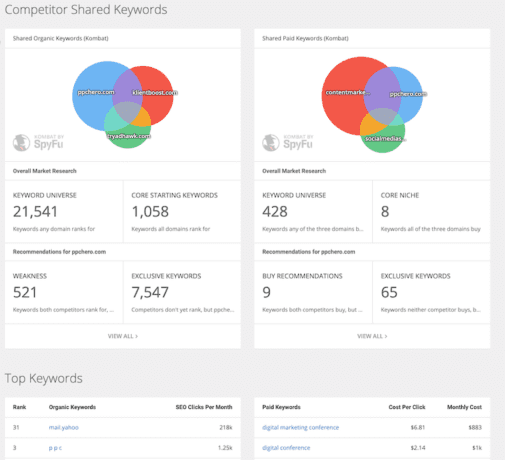

Spyfu

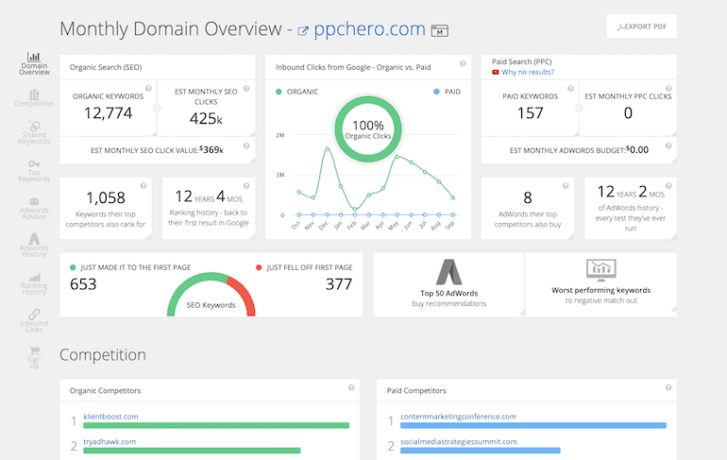

This site is one I use regularly, but with definite caution as I’ve seen it report some inaccurate traffic and budget numbers in the past. However, it provides rather specific information regarding keywords your competition is bidding on and seeing the greatest success with. Further, you can view actual ad copies they may have been running as recently as the month previous. And that’s just in the free version! Simply type in the web address for one of your competitors and you’ll see estimated monthly AdWords budget, paid keywords, top paid competitors, ad position, clicks per day, keywords and ad texts.

The paid version of the Spyfu interface also gives you access to about 90% more data, including keyword overlap, CPC estimates and other advanced keyword statistics, and the ability to track your own performance.

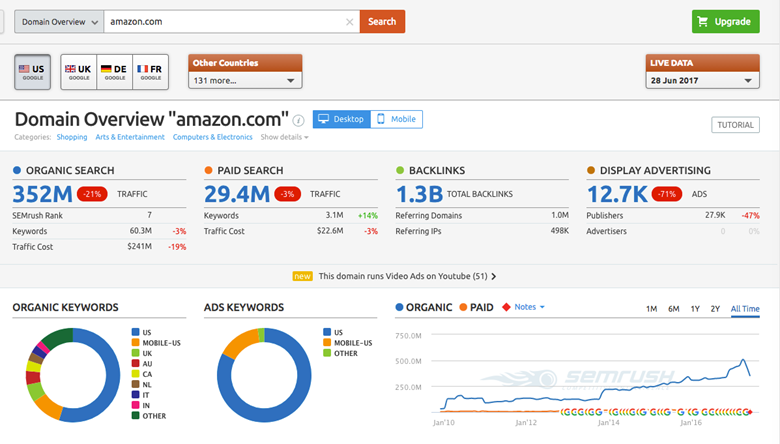

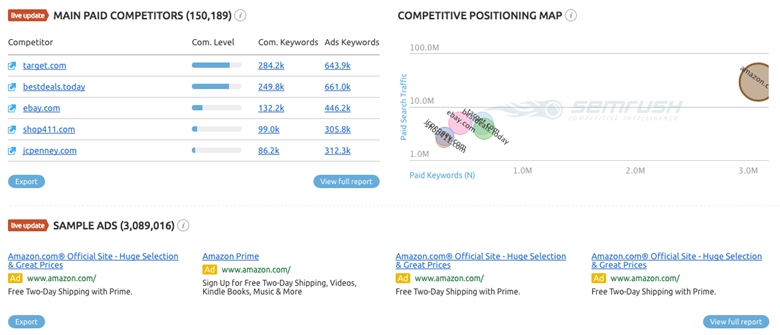

SEMRush

The SEMRush site is rather like Spyfu, providing you with top information about competitors to your brand. Within the free version, you can type in your competitors website and view their biggest competitors (are you on the list?), ad texts, average position for the top keywords and the percentage of their total budget and traffic that is allocated those keywords. Of course, with the paid version, all these results and statistics are increased so you can see more data.

SEMRush will also allow you to track information for your competitors Facebook and Bing accounts.

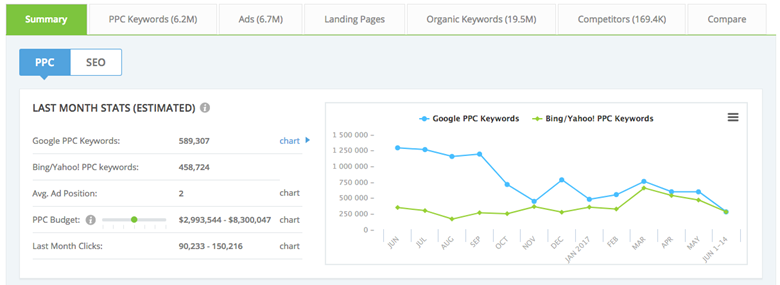

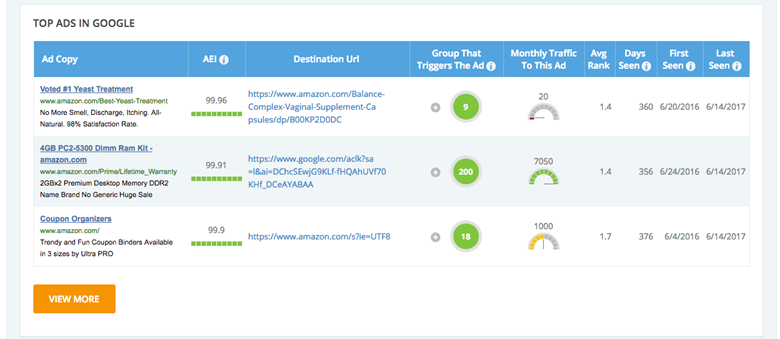

iSpionage

Again, iSpionage is a site that offers quite a bit of information for free, with even more becoming available with the paid version. In addition to showing keywords your competitors are bidding on and ads they are running with accompanying ranking information, if you do upgrade you gain the ability to build new campaigns with the information you find.

Essentially, within the iSpionage interface, you can review the top keywords, top ads, top landing pages, and a list of competitors. This data can certainly help you identify keyword gaps in your Google or Bing campaigns.

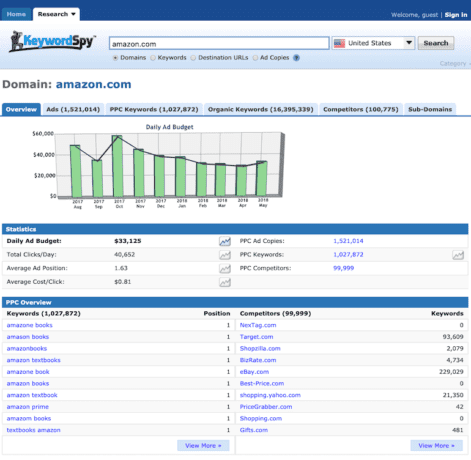

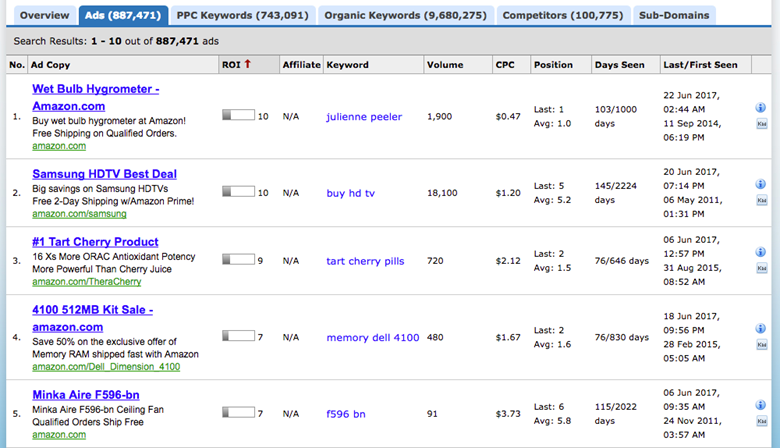

KeywordSpy

KeywordSpy is another tool on the market that is like the other tools. This software allows you to see see competitor’s keywords, domains, ad copy, and AdWords spend. Their program also will suggest specific keyword and ad combinations they say are profitable. Their software refreshes regularly and they state their data is real time. This software lists some big names as their clients, including; Toyota, American Express, and IBM. You can take a free trial in this program and see up to 10 keywords, ads, and competitor domains.

How do you process & utilize all this research?

The most important key here is not to fully trust all the research you just did. This sounds counter intuitive, I’m sure, but the fact of the matter is that none of these tools have direct access to your competition’s accounts. They are simply compiling information from the search engines and making that information available to you. Also, of course, using the free versions of those tools may not allow you to get a full view of what’s going on.

I encourage you to average out your findings after completing competitor research through a few of these tools, that way you’re not relying completely on one source, but you’re making some effort to analyze that competitive data and make changes as needed.

Overall, make sure you look at competitor research with an investigative eye and don’t lose sight of your overall account goals and progress. Competitive research is only useful if you use it as a part of your PPC strategy, not the lead driver in how you determine the best ways to move forward.