SOCIAL

Meta Stock: Still Room For Upside In A Maturing Market (NASDAQ:META)

Derick Hudson

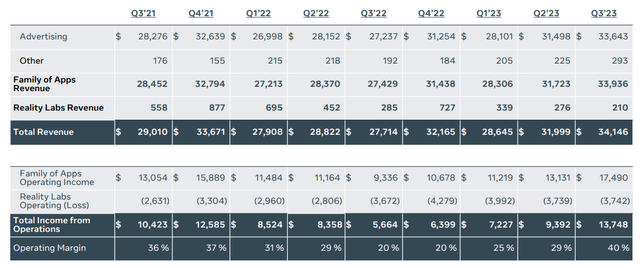

Meta’s (NASDAQ:META) remarkable turnaround accelerated following its third-quarter results. Revenue surged an impressive 23% to $34.1 billion, while earnings per share (EPS) soared 168% to $4.39.

Introduction

After a remarkable 167% surge this year, the social media behemoth Meta has demonstrated that there is still room for growth, achieving a 24% share of the advertising market and a 40% expansion in its operating margin.

Moreover, the company has upgraded its outlook for the remainder of the year, providing guidance that reflects an impressive 19% growth over the prior year period.

Q3-23 Highlights

Meta delivered consolidated revenues of $34.1 billion, marking a 23% increase from the previous year. This impressive growth was driven by a surge in advertising revenue and a reduction in costs and expenses, including legal-related costs and marketing and promotional expenses. Consequently, operating margin expanded by 40% to $13.7 billion.

Based on its historical seasonality, Meta is on track to achieve nearly 15% growth for the entire fiscal year, surpassing my initial expectations and exceeding the company’s initial guidance by a significant margin.

Meta Q2-2023 Earnings Presentation (Meta Q2-2023 Earnings Presentation)

Revenue for the Family of Apps surged 24% year-over-year, reaching $33.9 billion, while Reality Labs revenues declined 26% to $210 million.

The Family of Apps operating margin soared to 52%, surpassing historical highs and representing all-time highs in operating margin. However, the operating loss in Reality Labs remains concerning, reaching $3.7 billion. For every dollar of revenue generated by the segment, it incurs an astounding loss of $17.8.

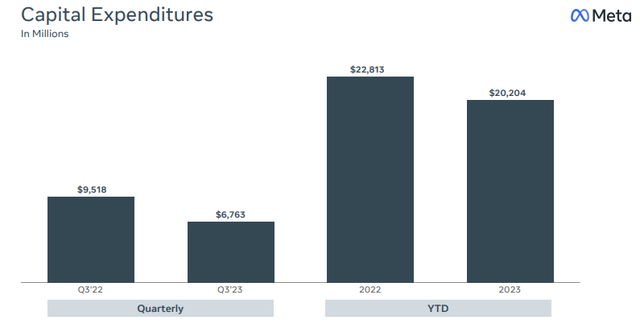

Meta Capex (Meta Q2-2023 Earnings Presentation)

As observed above, capital expenditures decreased during the third quarter. This led to a revised capex outlook for the entire year of $28 billion. Management anticipates that capex in 2024 will exceed $32.5 billion, with the majority of investments allocated to artificial intelligence (AI), infrastructure, and the Metaverse.

Operational Achievements

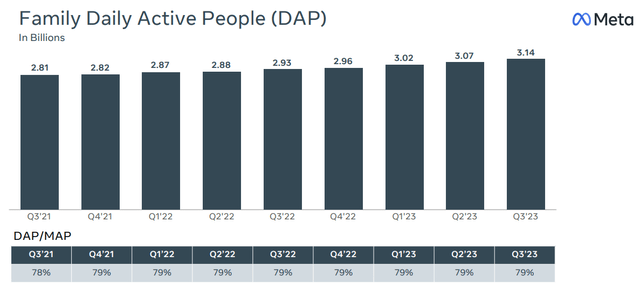

Family Daily Active People (Meta Q2-2023 Earnings Presentation)

Meta’s Family of Apps continues to grow, with daily active people (DAP) across the entire platform reaching 3.14 billion users in the third quarter of 2023. This represents a year-over-year growth of 21 million people or 7%. The growth was driven by strong performances from all of Meta’s core apps, including Facebook, Instagram, and WhatsApp.

Facebook remains Meta’s most popular app, with 2.08 billion daily active users. This represents a year-over-year growth of 5%. Instagram is Meta’s second most popular app, with 2.01 billion daily active users. This represents a year-over-year growth of 11%. WhatsApp is Meta’s third most popular app, with 2 billion daily active users. This represents a year-over-year growth of 4%.

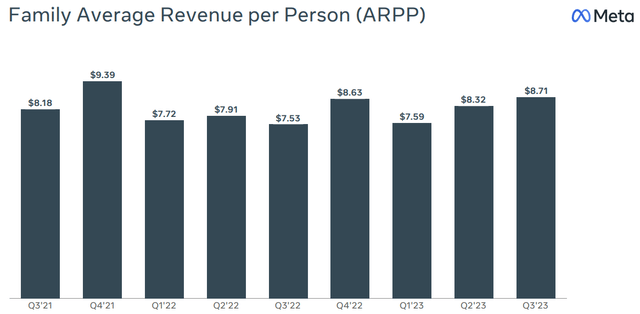

Family average revenue per person (Meta Q2-2023 Earnings Presentation)

Continued growth in the advertising market and a focus on enhancing the user experience have led to an impressive increase in average revenue per person (ARPP) to $8.71. This positive trend reflects Meta’s commitment to improving ad effectiveness and delivering value to its users.

As Meta expands its ad market share and continues to develop innovative solutions for ad efficiency, I believe the company is well-positioned to return to historical levels of Family of Apps margins.

Valuation

Before delving into the financial model, let’s examine the valuation from a straightforward perspective. Current consensus estimates for Meta’s 2024 EPS stand at $17.29, resulting in a P/E ratio of 19.09x at its current price of $330. Historically, Meta has traded within a range of 23x to 25x. Assuming a P/E of 24x, the implied upside potential is approximately 25%.

Financial Model

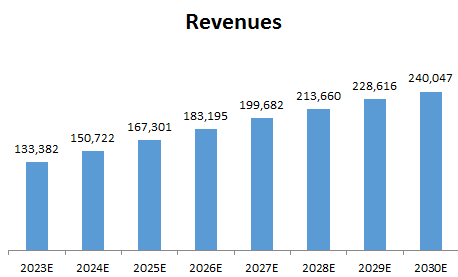

Meta’s revenue projection (Authored using Meta financial data and the author’s projections)

Employing a discounted cash flow (DCF) methodology, I have estimated Meta’s fair value to be $372 per share. This valuation is underpinned by the assumption that the company will achieve a compound annual growth rate (CAGR) of 8.8% in revenue between 2023 and 2030, reflecting my expectations that Meta will continue to expand its market share and witness continued growth in its WhatsApp business. This projection incorporates a weighted average cost of capital (WACC) of 8.5% and accounts for Meta’s net debt position. Additionally, the FCF yield for the 2023 exit is 3.2%.

Based on Meta’s Q3-23 results, I project that the company will generate revenue of $38.6B in Q4-23, which is in line with the consensus forecast.