SOCIAL

TikTok Launches ‘Creator Fund’ to Pay Platform Influencer for Their Efforts

Amid rising speculation about the future of the app, with authorities in several regions calling for potential restrictions due to its links with the Chinese Government, TikTok is looking to deepen its economic roots, in order to make it harder to justify removing it from circulation.

Earlier this week, TikTok announced that it plans to hire 10,000 staff in the U.S. over the next three years, as it looks to maximize its growth opportunities. And today, TikTok has unveiled a new TikTok Creator Fund, which will pay prominent creators for their videos on the platform.

As per TikTok:

“To further support our creators, we’re launching the TikTok Creator Fund to encourage those who dream of using their voices and creativity to spark inspirational careers. The US fund will start with $200 million to help support ambitious creators who are seeking opportunities to foster a livelihood through their innovative content. The fund will be distributed over the coming year and is expected to grow over that time.”

The program could help TikTok on two fronts – for one, monetizing short-form video is difficult.

Vine found this out hard way – after establishing itself as a key cultural reference point, and building a significant audience, Vine eventually collapsed because it wasn’t able to monetize effectively. With Vine’s main content offering being only six-seconds in length, that made it increasingly difficult for Vine to implement ads, as users would either skip by them or ignore them in-stream. And that made it impossible for Vine to adequately compensate its top creators.

Vine did try to counter this, adding longer-form videos and pre-roll ads in its dying months, but with greater revenue opportunities elsewhere, Vine’s top creators gradually migrated away, taking their audiences with them. Many of them went on to become millionaires via YouTube and Facebook, while Vine was shut down, as usage continually declined.

That’s why Vine creator Dom Hoffman was so adamant that creators on his new short-form video app, Byte, get paid from the outset, even if that means dipping into its own funding to make it happen.

Now TikTok is following a similar playbook. As TikTok creators build their followings, the lure of monetization on other platforms will become harder to ignore, and TikTok will be hoping that by ensuring they get paid, even without a comparable ad network, it can keep them around through this allocated funding.

That could keep more creators posting more often, which keeps the audience engaged, which builds the platform, etc.

It doesn’t seem like a sustainable system, long-term, but with the economic impacts of COVID-19 looming, it could well be a key element in further solidifying TikTok’s place in the broader digital eco-system. Which brings us to the next key point.

As noted, TikTok has already announced that it’s willing to create local jobs if the US lets it remain in operation, and with this initiative, it will further embed itself into the American economic landscape by additionally becoming a payment stream for many creators. At a time when jobs are getting harder to come by, the US Government will need to find ways to ensure more people are getting paid. Can they really block TikTok when it could be a provider of so many opportunities?

That seems like a fairly clever play from TikTok – by becoming a bigger provider for more Americans, it will be able to put more pressure on US regulators to reconsider any moves to ban the app, if indeed the talks end up getting that far. US President Donald Trump has said that he’s considering banning TikTok as part of China’s punishment for the COVID-19 outbreak – but if doing so would also see the reduction of 10k jobs, as well as impacting many creators, that decision becomes more strategic than symbolic.

It’s certainly an interesting initiative, on both fronts, and while TikTok creators will be happy to have more opportunities to make money from their efforts, it’ll no doubt lead to additional scrutiny from US regulators.

TikTok’s Creator Fund will open to applications from US creators beginning in August. Eligible creators need to be 18 years or older, meet a baseline for followers, and “consistently post original content in line with our Community Guidelines“.

SOCIAL

Snapchat Explores New Messaging Retention Feature: A Game-Changer or Risky Move?

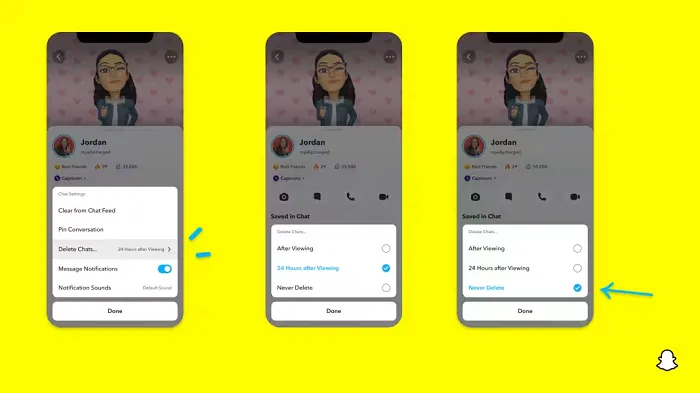

In a recent announcement, Snapchat revealed a groundbreaking update that challenges its traditional design ethos. The platform is experimenting with an option that allows users to defy the 24-hour auto-delete rule, a feature synonymous with Snapchat’s ephemeral messaging model.

The proposed change aims to introduce a “Never delete” option in messaging retention settings, aligning Snapchat more closely with conventional messaging apps. While this move may blur Snapchat’s distinctive selling point, Snap appears convinced of its necessity.

According to Snap, the decision stems from user feedback and a commitment to innovation based on user needs. The company aims to provide greater flexibility and control over conversations, catering to the preferences of its community.

Currently undergoing trials in select markets, the new feature empowers users to adjust retention settings on a conversation-by-conversation basis. Flexibility remains paramount, with participants able to modify settings within chats and receive in-chat notifications to ensure transparency.

Snapchat underscores that the default auto-delete feature will persist, reinforcing its design philosophy centered on ephemerality. However, with the app gaining traction as a primary messaging platform, the option offers users a means to preserve longer chat histories.

The update marks a pivotal moment for Snapchat, renowned for its disappearing message premise, especially popular among younger demographics. Retaining this focus has been pivotal to Snapchat’s identity, but the shift suggests a broader strategy aimed at diversifying its user base.

This strategy may appeal particularly to older demographics, potentially extending Snapchat’s relevance as users age. By emulating features of conventional messaging platforms, Snapchat seeks to enhance its appeal and broaden its reach.

Yet, the introduction of message retention poses questions about Snapchat’s uniqueness. While addressing user demands, the risk of diluting Snapchat’s distinctiveness looms large.

As Snapchat ventures into uncharted territory, the outcome of this experiment remains uncertain. Will message retention propel Snapchat to new heights, or will it compromise the platform’s uniqueness?

Only time will tell.

SOCIAL

Catering to specific audience boosts your business, says accountant turned coach

While it is tempting to try to appeal to a broad audience, the founder of alcohol-free coaching service Just the Tonic, Sandra Parker, believes the best thing you can do for your business is focus on your niche. Here’s how she did just that.

When running a business, reaching out to as many clients as possible can be tempting. But it also risks making your marketing “too generic,” warns Sandra Parker, the founder of Just The Tonic Coaching.

“From the very start of my business, I knew exactly who I could help and who I couldn’t,” Parker told My Biggest Lessons.

Parker struggled with alcohol dependence as a young professional. Today, her business targets high-achieving individuals who face challenges similar to those she had early in her career.

“I understand their frustrations, I understand their fears, and I understand their coping mechanisms and the stories they’re telling themselves,” Parker said. “Because of that, I’m able to market very effectively, to speak in a language that they understand, and am able to reach them.”Â

“I believe that it’s really important that you know exactly who your customer or your client is, and you target them, and you resist the temptation to make your marketing too generic to try and reach everyone,” she explained.

“If you speak specifically to your target clients, you will reach them, and I believe that’s the way that you’re going to be more successful.

Watch the video for more of Sandra Parker’s biggest lessons.

SOCIAL

Instagram Tests Live-Stream Games to Enhance Engagement

Instagram’s testing out some new options to help spice up your live-streams in the app, with some live broadcasters now able to select a game that they can play with viewers in-stream.

As you can see in these example screens, posted by Ahmed Ghanem, some creators now have the option to play either “This or That”, a question and answer prompt that you can share with your viewers, or “Trivia”, to generate more engagement within your IG live-streams.

That could be a simple way to spark more conversation and interaction, which could then lead into further engagement opportunities from your live audience.

Meta’s been exploring more ways to make live-streaming a bigger consideration for IG creators, with a view to live-streams potentially catching on with more users.

That includes the gradual expansion of its “Stars” live-stream donation program, giving more creators in more regions a means to accept donations from live-stream viewers, while back in December, Instagram also added some new options to make it easier to go live using third-party tools via desktop PCs.

Live streaming has been a major shift in China, where shopping live-streams, in particular, have led to massive opportunities for streaming platforms. They haven’t caught on in the same way in Western regions, but as TikTok and YouTube look to push live-stream adoption, there is still a chance that they will become a much bigger element in future.

Which is why IG is also trying to stay in touch, and add more ways for its creators to engage via streams. Live-stream games is another element within this, which could make this a better community-building, and potentially sales-driving option.

We’ve asked Instagram for more information on this test, and we’ll update this post if/when we hear back.

-

PPC6 days ago

PPC6 days ago19 Best SEO Tools in 2024 (For Every Use Case)

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 19, 2024

-

SEARCHENGINES7 days ago

Daily Search Forum Recap: April 18, 2024

-

WORDPRESS6 days ago

WORDPRESS6 days agoHow to Make $5000 of Passive Income Every Month in WordPress

-

SEO6 days ago

SEO6 days ago25 WordPress Alternatives Best For SEO

-

WORDPRESS6 days ago

WORDPRESS6 days ago7 Best WooCommerce Points and Rewards Plugins (Free & Paid)

-

WORDPRESS5 days ago

WORDPRESS5 days ago13 Best HubSpot Alternatives for 2024 (Free + Paid)

-

MARKETING6 days ago

MARKETING6 days agoBattling for Attention in the 2024 Election Year Media Frenzy