SOCIAL

Facebook Loses a Million Daily Active Users, Posts Big Revenue Result for Full Year 2021

Meta has posted its Q4 2021 and full-year performance result, showing a rise in monthly active users, and significant growth in revenue, as it continues to evolve towards the next shift in digital connection.

Though there are also some concerns, with Facebook’s growth momentum slowing, even declining in some respects, which could reflect growing disinterest in that platform specifically.

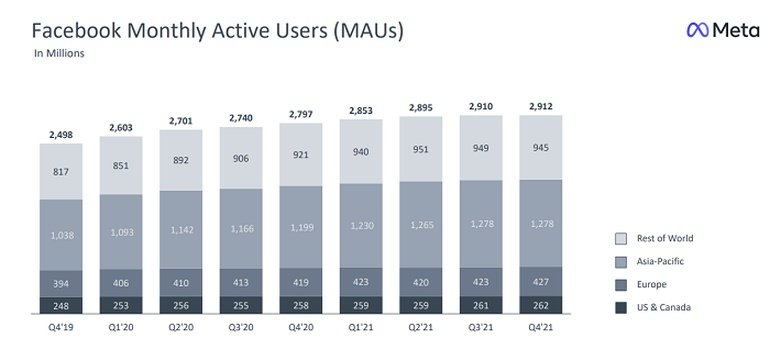

First off, in terms of active users – Meta’s main social app Facebook rose by just 2 million monthly actives from Q3, the slowest quarter-on-quarter growth rate in its history.

But that’s not even the whole story – the bigger concern for Meta is in daily actives, where Facebook actually declined for the first time ever.

As you can see here, Facebook did add users in the Asia Pacific and European regions, but overall, it lost a million actives.

Which is a lot. It’s difficult to get a real sense of what that means when the numbers are honed down to more compact metrics like those displayed above, but a million people decided that they no longer needed to check in on Facebook every day, and likely a lot more than that when you consider that it also added new users in some regions.

Is that a problem? I mean, as you can also see, Facebook usage has been stagnant in the North American region for some time, which most would put down to market saturation – everyone who’s going to use Facebook is now doing so, and there’s not many more new people to add in. But now we’re seeing the same in other markets, which could be a big issue for Facebook’s broader growth.

Which is why, of course, Meta’s more keen to highlight this stat instead, its ‘Family of Apps’ usage, which combines total unique users across Facebook, Messenger, Instagram and WhatsApp.

As you can see, across all of its apps, Meta actually added a million more users, which likely means that WhatsApp and Instagram are still growing. Meta doesn’t break out individual usage stats for these apps, but broadly speaking, it maintains at least some growth momentum, and its apps are still the most used social media platforms by far, with close to 3 billion DAU.

But still, the fact that Facebook saw a decline, especially over the Christmas period, when people are generally more active online, is a concern. That’s likely part of the reason why Meta announced its re-focus on younger users last year, and why it’s increasingly putting more emphasis on the metaverse and the next stage of digital connection.

Maybe, its evolving focus will reduce concerns around declining usage of its apps – though it will be interesting to monitor these stats moving forward, to see whether this is in fact an ongoing trend.

In terms of revenue, Meta posted another strong result, bringing in $33.6 billion for the quarter.

Which, again, is just an unfathomable number, really. For the full year, Meta generated $117.9 billion, with the vast majority coming from ads.

And for the first time, Meta has also provided full revenue split data between its apps and its Reality Labs division (AR/VR projects).

VR sales jumped in Q4, bringing in $877 million, which is only a small fraction of overall revenue for the company. But still, as it eyes the next stage of immersive connection, that’s another key element to keep in mind, and you can expect Meta to put even more focus on this as those sales continue to rise.

And with its AR glasses also coming soon, you would logically anticipate those numbers to trend upwards in future.

Meta went through some big changes in Q4, most notably its corporate name change from ‘Facebook’ to ‘Meta’, signalling its shift in focus to the next stage of digital connection. That essentially sparked a whole new industry, with many investors and businesses now rushing to cash in on the metaverse opportunity, keen to avoid missing out on the next big thing, as many did with social media in the first place.

In many ways, Meta’s name change legitimized a concept that doesn’t exist, and created a new, theoretical model, which has already seen billions of dollars change hands on the back of an experience which is not even close to being fully realized or built.

Indeed, Meta itself has re-stated many times that it will take years to establish all of the building blocks of the metaverse concept that it envisions. Still, that hasn’t stopped Web3 enthusiasts from considering new possibilities, with trends like NFTs tangentially connected back to the broader metaverse concept, even though we don’t know how it will work, and what it will look like just yet.

What we do know, however, is that Meta is working to be at the forefront of what comes next, and with its developments in VR, AR and other advanced technologies, it does look set to be a key voice in that shift, which will likely see it dictate various aspects of advanced connection, and secure the company’s future moving forward.

I mean, we don’t know, because nobody knows how all of these elements will actually come together, but Meta’s certainly re-aligned its resources and entire company focus around the shift.

In terms of product developments, Meta continues to push ahead with its full messaging encryption plan – despite the opposition of many law enforcement groups in many regions – while its VR social tool Horizon Worlds is also evolving, which could soon become a key connection tool in the virtual space.

Meta’s also laid the groundwork for advanced digital avatars, which could define your presence in the metaverse shift, with avatar tools that can now be used across Facebook, Horizon, Instagram and Messenger in a range of ways.

If Meta can create the best, most customizable, most interoperable avatars, that could be a big step in better aligning users to its platforms, which is another advantage of the company’s massive scale, with these avatar tools already enabling new forms of connection in the world’s most used social apps.

Meta also continued to face more legal challenges, with the FTC winning approval to re-state its case against the company over its acquisitions of Instagram and WhatsApp, which the FTC claims were specifically aimed at eliminating competition in the market. That seems unlikely to result in the forced break-up of Meta’s various elements, which is what the FTC is pushing for, but it has seemingly opened the door to further investigations into Meta’s broader conduct, and how it’s looking to dominate the metaverse space.

Will that impede the company’s progress moving forward, or is Meta now in such a dominant market position that it likely won’t need to rely on acquisitions as much as it has in the past to win out the sector?

Really, its metaverse shift is also a way to re-align its entire market, which, going on current activity, is clearly working, and has clearly placed Meta at the top of the heap in the next stage of development, by combining various technologies under a broader ‘metaverse’ umbrella, of which Meta is the leading proponent.

Will there really be a metaverse, as such, a singularly-aligned digital experience platform which will facilitate all kinds of activity in a fully-immersive space, or will it be a range of technological advances, in a range of ways, which Meta wouldn’t necessarily be leading on each front? But by re-aligning it all under a single banner, maybe Meta has changed the game entirely, without us knowing, and everyone’s now trying to compete on a broader, combined shift which they’ll never match Meta on. If Snapchat, for example, launches the best AR glasses, will they gain as much traction if they’re not compatible with the amorphous ‘metaverse’ concept?

It’s interesting to consider Meta’s market power and influence in this respect, and how that could then translate into the next stage, and how potential competitors look to assess their ambitions when matched against Zuckerberg’s ever-growing behemoth.

Source link

You must be logged in to post a comment Login