SEO

A Complete Guide to Competitive Intelligence

In the business world, risks and opportunities are everywhere. For example, an industry trend may be sweeping the market for a limited time and favor early adopters, while a competitor that went bust can be a good source for acquiring new customers.

These types of news are not readily available, and by the time you purchase expensive analyst reports, they’re already outdated. So how do you make sure you understand your competition and stay ahead of market trends in a way that’s proactive and doesn’t break the bank?

Competitive intelligence is the answer to ensuring your business doesn’t get caught off guard. Notably, it’s not all data collection. Rather, it’s also about enabling the entire team to win through an actionable and repeatable process.

In this guide, you’ll learn the following:

Competitive intelligence (CI) is the process of gathering, analyzing, and sharing information about competitors, customers, and other market indicators to increase a company’s competitive edge.

It involves a coordinated competitive intelligence program and a centralized collection of data from various sources.

To succeed in business, knowing your competitors’ moves is not enough. Companies also need to be aware of market trends and how those changes will impact stakeholders. For example, unforeseen events in your industry may be cutting your financial gains this quarter.

This is where competitive intelligence steps in as a process to make more informed business decisions, reducing the uncertainty of external events. CI can also help you to:

- Generate more revenue.

- Spot growth opportunities early on.

- Anticipate market shifts with confidence.

- Develop counter-strategies for each of your competitors.

- Benchmark against competitors to discover areas of improvement.

- Measure brand perception in the eyes of your customers.

- Streamline product launches.

All these points can be effectively translated into a competitive intelligence program. But first, let’s look at what you came here for: competitive intelligence sources.

Like any system, the quality of the data you put into your CI program is a good predictor of its success. In the end, your goal is to create a complete profile of your competitor.

To do so, here are eight competitive intelligence sources that you can use today:

Your competitor’s website

It’s no surprise that a good starting point to gather competitive intel is to check out your competitor’s website.

Pay close attention to these:

- Positioning and messaging changes

- Solutions and vertical pages

- Pricing

- Product updates

First, go over the homepage and any marketing-related pages. Have they changed their tagline? What customer logos are they featuring? What buyer personas are they targeting? Signals like these will show you how your competitor wants to be perceived in the customers’ minds and what verticals they are pushing for.

You can learn a lot by analyzing your competitor’s homepage.

Second, move on to the product-related pages, particularly the pricing page. But don’t just settle for the price. Dig deeper. Find out the trial period length, pricing model, onboarding costs, etc.

Your competitor’s FAQ can also be a source of intel—not just for sales reps but also for marketers who can create marketing assets focused on solving difficult-to-solve pain points.

Content

Your competitor’s content is a trove of insights for showing what customers they’re looking for and where they seek to develop thought leadership.

Pay close attention to these:

- Type of content and format

- Frequency of posting

- Keywords and SEO

- Overall CTAs

For example, posting four case studies in a row is a clear indicator of their priorities on chasing a buyer persona. At the same time, the posting frequency can be used as a benchmark to create a sound content strategy.

Here’s how to check your competitor’s posting frequency in Ahrefs, using Asana as an example. I’ve chosen Asana because it’s probably a company you already know and use.

- Go to Ahrefs’ Content Explorer

- Plug in your competitor’s blog URL and switch the search mode to In URL

- Check the published vs. republished ratio in relation to yours

The real challenge is identifying the knowledge gaps between your content. You can then take advantage and develop informative content for keywords that your competitor doesn’t rank for to improve your search ranking.

Here’s how to do it in Ahrefs using the Content Gap tool, using the same Asana example:

- Plug your website into Ahrefs’ Site Explorer

- Go to the Content Gap report and enter your competitor’s website

From this screenshot, we see that Paymo (an Asana competitor) is already ranking for “working remotely” and “fun team building activities”—topics that Asana could target.

Social media

Another valuable competitive source is social media. Although sometimes overwhelming, messages and mentions go a long way in pointing out competing campaign patterns.

Pay close attention to these:

- What channels the competitor is active on

- Frequency of posting

- Who they follow

- Ads

Now, social media ROI is hard to quantify and platform-dependent. The lesson here is to analyze key strategies you can steal from your competition and spot potential pain points. For example, one of your competitors may use Twitter to answer customer inquiries. Let’s look at a conversation from Asana’s Twitter.

@asana I love your product, but it would be really cool if you could list subtasks so that those outstanding were positioned at the top. Even better if it was in due date order.

— Gary Butterfield (@GaryBPT) March 10, 2022

The paint point is clear: There is no possibility to sort subtasks within a task. While this may be an edge case, you may find out that it’s a deal-breaker for large organizations that work with many subtasks.

So if you were a competitor, you could arm your sales reps with this information and formulate a few questions (in a battle card) that would lead prospects to this weakness.

Besides showing your competitor’s employees, LinkedIn is another go-to platform that gives you a feeling about your competitor’s culture, future webinars, and overall content used to promote its brand.

Customer reviews

Customer reviews, either testimonials or case studies, are living proof of a company’s value. They are perhaps the most honest source of external competitive intel.

Pay close attention to these:

- B2B review platforms (Capterra, G2, TrustRadius)

- Analyst reports (Forrester, Gartner)

- Question platforms (Quora, Reddit)

B2B review platforms like Capterra, G2, and TrustRadius are a good starting point to identify what kind of customers your competitor sells to, their buyer journeys, pain points, and satisfaction ratings. You want to pay particular attention to negative reviews that can be brought up in sales conversations.

Next in line, analyst reports like Gartner’s Magic Quadrant and Forrester’s Wave will give you hints on your competitor’s market presence, vision, and how well they execute the said vision. These reports will also hint at the industry and business size your competitor caters to, as they also include anonymous customer reviews.

Source: Cheetah Transformation.

Finally, question platforms such as Quora and Reddit are a great way to see the main concerns and buying process of your competitor’s customers. You can even go undercover and ask an anonymous question about your industry to gauge how well people understand the market.

Resellers

Resellers are equally important for CI as customer reviews and analyst reports, especially since they’re from an intermediary acting on behalf of your competitor.

Pay close attention to these:

- Pricing structures

- Conditions for upsales

- Free add-ons

Resellers sell your competitor’s products and assist with market analysis reports on how to sell them better. If you’ve built a relationship with them, you can get your hands on these reports and gain access to your competitor’s selling strategy.

For example, you may find that your competitors are hitting their enterprise clients hard with storage overcharges. Or that they’re increasing their prices with every yearly renewal. This type of information wins sales deals when you’re head-to-head against a market leader or a competitor with better market exposure.

Don’t forget to also look at what extras they offer with each package. You can match your competitor’s offering and add other services on top to make your product more appealing.

Press

An easily accessible way of conducting competitive research is to go through a company’s news, events, and press releases.

Pay close attention to these:

- Press releases

- Events

- Financial results reports

A company’s news page is a quick teller of its overall direction—whether it has received new funding, wants to tackle new markets, or has acquired a market leader. Some even have public financial reports that can give you the edge to act toward market shifts proactively.

The news page is just one piece of the puzzle. You can research publishers already covering your competition but not your business. Build relationships with them. And who knows? You may get access to a bigger platform to spread the word about your product.

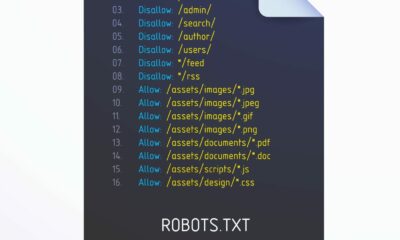

Here’s an easy way to do this using Ahrefs:

- Plug your competitor’s website into Site Explorer

- Go to Backlink profile, then choose Referring Domains

- Check DoFollow links only and Exclude subdomains

It looks like Asana’s competitor, Paymo, has some press coverage for writerraccess.com—a service for covering copywriters. And we’ve got our hands on a reseller too.

Events are also an opportunity to spy on your competition ethically. Find out what events they attend, how regularly, and the messages used on booths, banners, flyers, t‑shirts, and other swag.

Some may even sponsor events to reinforce their brand to a specific customer segment. This will give you an idea about what events to join and the messages to use for brand awareness.

HR

Your competitor’s employees—perhaps the most overlooked CI resource—and their HR practices are the best barometer for a competitor’s growth.

Pay close attention to these:

- About Us page/Careers page

- Job positions by department

- C‑level hires

- Feedback on culture, salaries, and interviews (Glassdoor)

No one is more well-versed in your competitor’s strengths and weaknesses than their employees. And while the employees may be loyal, they are still having discussions and leaving trails behind that can serve as competitive ammunition.

You can check the overall job satisfaction of current and former employees on Glassdoor. What are the pros and cons of the competitor’s culture? What does the interview process look like? Average salaries? Questions like these can put your HR in a better position to address weaknesses when hiring similar candidates.

Another great place to dig for competitive intel is your competitor’s About Us page or Careers page. The gist is to look beyond job posting details, such as the location, role, and requirements.

If a job goes unfilled for a long time, this probably means the competitor has lots of things going on and needs a high-level specialist to take over the workload.

Similarly, if different positions are advertised within the same department, this can mean they’re putting all their efforts into a specific business area. Are they hiring more engineers? A new product may be just around the corner. Are marketers and customer success reps in high demand? Expansion is close.

Your customers and colleagues

Finally, it’s time to talk about the most accessible source of internal intel: your customers and colleagues.

Before choosing your business, your customers have gone through many hoops trialing other competitors. As a result, they’ll know the problems your competition is trying to solve and what works and doesn’t within the context of their vertical, saving you precious time on research.

One way to extract this information is to get it directly from customers through interviews or surveys. The other is to contact your colleagues.

Check each department for new insights they can share with you. Sales can inform you about common objections, support has intel on the top recurring questions, product knows all feature differentiators, and marketing can advise what collaterals have more priority. Your goal is to pick key takeaways as you carefully comb through the data.

Unfortunately, data will be spread across CRMs, support chat tools, and notes for most cases. A better solution is to use dedicated competitive intelligence tools that centralize this type of data, which brings us to the next point.

A competitive intelligence program needs to be scalable enough to arm every employee with the correct intel and processes for their role.

We’re not talking only about C‑level executives but also sales reps, marketers, and engineers that can benefit from these insights to better fight objections, reach new audiences, and optimize product launches.

The good news is that CI programs are now more affordable than ever—even for SMBs with small budgets—given how easy it is to find information online.

So without further ado, here are the most important steps that go into building an effective CI program:

1. Identify your direct competitors

You may think you don’t have any competitors. But if you’re solving a problem, chances are someone else has already thought about solving it.

In fact, Crayon’s 2022 survey has shown that companies of all sizes experience an 18% increase in competitors every year. The average number of new competitors is 29 in 2020.

Knowing which competitors to keep tabs on is critical for the success of a CI program, but that’s not so obvious. Hence, we need to kick things off with some terminology:

- Direct competitors act in the same market as yours and sell similar products. It’s usually a zero-sum game: If customers don’t buy from you, they buy from them. Think Burger King vs. McDonald’s.

- Indirect competitors act in the same market but sell different products that satisfy the same need. Think Burger King vs. KFC. They are both fast-food restaurants that curb hunger differently.

- Replacement competitors don’t act in the same market, but they can replace your product to satisfy the same need. Think Burger King vs. Beyond Meat (vegan) burgers.

Now that competitor types are clear, gather a list of 5–10 direct competitors and five indirect competitors.

Replacement competitors shouldn’t be your concern unless there are various ways to solve the problem your product is trying to solve.

A reliable way to find your competition is to check if you’re targeting the same keywords. Here’s a quick method using Ahrefs (with Asana as the example):

- Plug your website into Site Explorer.

- Go to Organic search and choose Competing Domains

- Check the Common keywords column

It looks like Asana has the most overlapping keywords with Monday.com.

2. Establish key objectives and metrics for each stakeholder

With your direct competitors mapped out, it’s time to set your key objectives and metrics. This goes hand in hand with identifying the stakeholders you need to get buy-in for the CI program.

A good starting point is to ask the C‑level executives what competitive threats keep them busy at night. This action won’t justify the need for a CI program, but it will point you to the departments that can solve them.

Remember, each function represents a touchpoint between your business and the customer, providing different perspectives of the buying journey.

Let’s look at the most common CI stakeholders and an example goal for each:

- Sales – Increase win rates in competitive deals

- Marketing – Create actionable battle cards

- Engineering – Build true differentiators

- Customer success/support – Retain customers

- C‑level executives – Analyze adjacent EMEA markets to break into

Now, this doesn’t mean goals do not overlap. On the contrary, improved positioning can bring in more leads, while a product that stands out can significantly increase customer retention.

The takeaway at this step is to find out the job roles that will contribute to the CI program and effective ways to measure it.

3. Gather data

Data collection is the foundation and perhaps most time-consuming part of any CI program. The challenge lies in finding qualitative insights to support your team members within their job roles.

We’ve already gone through competitive intelligence resources. On a meta level, though, know that you can categorize them into two data types.

There is external data. It’s the low-hanging fruit type of information available online, sitting on your competitor’s website, social media, review platforms, analyst reports, etc. Albeit harder to dig for, resellers are also a valid source of data on how users interact with your competitor’s product and their main offering’s strengths and weaknesses.

We also have internal data. It’s information that already exists within your business, such as call notes from a sales rep or a competitor’s pricing list sent to one of your customers.

Even though the latter is more qualitative, both are ethical and should be used together to arrive at actionable insights.

4. Analyze data

Great. You’ve identified your direct competitor, established CI goals and metrics, and probably spent a few hours gathering competitive intel.

What follows is transforming that raw data into actual deliverables (aka sales and marketing assets) and feeding them to the right stakeholders.

By far, the most common CI deliverable is the battle card, a sales asset that packs short insights about a specific competitor with the goal of “depositioning” them. Your sales team will love these cards, as long as they’re not too overwhelming and formulated word for word to be consumed right before a sales call.

While there’s no secret recipe on how to craft a battle card, an actionable one should include the following sections:

- Your competitor’s profile

- Quick dismisses to disqualify the competitor early on

- Arguments for why you win and why you lose

- Objection handling answers

- A list of landmine topics that put your competitor in a bad light

For more information on how to create more inclusive battle cards, Klue has already written extensively about a battle card framework.

Battle cards aside, other popular CI deliverables are product sheets—1:1 feature comparisons between your product and your competitor’s product—and executive slide decks to inform executives about the long-term strategy.

How many you can deliver will largely depend on your marketing team’s size and budget. This is only half of the story, though. Equally important is how and when you deliver them.

5. Share insights with key stakeholders

Competitive intelligence has no value if it sits in a corner and doesn’t impact stakeholders.

At the final step of the CI program, your job is twofold: (1) identify your stakeholder’s preferred communication channels and (2) increase the frequency of delivering competitive insights.

For the first endeavor, ask your stakeholders how they communicate. Sales reps may be more inclined to hang out in Slack channels, while executives probably rely heavily on email. Always meet them on their turf to ensure that information is consumed on time.

As for the second one, consider sharing competitive insights during daily and weekly stand-ups. According to a study by Crayon, businesses that do so frequently have seen a direct revenue impact; in the study, 69% of the respondents share competitive intent daily and 72% do so weekly.

Ultimately, sharing competitive insights is an ongoing process that will reinforce the adoption of a CI program and guarantee its success.

By now, you’ve probably realized how time-consuming competitive research is.

It doesn’t have to be. Even though you may not have a CI function, let alone a budget, you can collect, analyze, and share data about competitors with affordable, competitive software.

Owler

Best for: Digging into a company’s history

Pricing: Free trial available; paid plans start from $35/month

Alternative: Crunchbase

With a community of 3.5 million crowd-sourced users, Owler has the largest and most up-to-date data set of company insights.

This means you can surface all sorts of strategic information like funding, acquisitions, and the latest news to understand how a competitor has grown over time. The tool even goes the extra mile and compiles a brief analysis of your competitors.

You can also follow companies to receive daily or real-time notifications about their most relevant content, including press releases, blog articles, social media posts, or product videos.

Visualping

Best for: Monitoring website changes

Pricing: Free trial available; paid plans start from $10/month (personal account) and $50/month (business account)

Alternatives: Change Tower, Competitors App

Visualping is a competitive intelligence tool for monitoring website changes.

All you have to do is enter a competitor’s URL, select the website area you wish to monitor, the threshold of changes (1%, 10%, 25%, 50%), frequency checks (every day, week, month), and your email address to receive the alerts. Quite simple? You bet. But effective in identifying more subtle messaging and visual changes.

This is not all. Visualping also trains bots to perform actions on your behalf, such as entering passwords or clicking on elements, saving you time during the competitive research process.

Ahrefs

Best for: Analyzing website traffic and SEO

Pricing: Paid plans start from $83/month, but you can use Ahrefs Webmaster Tools for free

Alternatives: None

Ahrefs is an industry-leading SEO and marketing tool that can help you uncover a competitor’s website traffic and reverse-engineer their efforts.

Here are some of its most popular competitive intelligence tools:

- Site Explorer – Research competitor backlinks and get publishers to cover you too

- Content Gap tool – Find keywords that a competitor ranks for that you don’t

- Ads – Deconstruct your competitor’s ads from ad copy to CTAs

- Email alerts – Stay in the loop about new backlinks and mentions of your competitor

Social Searcher

Best for: Comparing social media strategies

Pricing: Free trial available; paid plans start from €3.49/month for 200 searches/day

Alternatives: Talkwalker, Rival IQ

Social Searcher works like a search engine for social media, gathering mentions about your competitor’s brand.

The tool crawls data across 11 social media networks, displaying keywords, post types, and users. In addition, its “audience insights” feature gives you hints about the preferred post types, publishing times, and go-to social media channels of your competitor’s customers.

But perhaps the most vital feature in its arsenal is the sentiment analysis report, making it easy to spot negative feedback about your competitor’s products and services. You can translate these weaknesses into sales enablement material later on.

SendView

Best for: Tracking competitor email marketing

Pricing: Plans start from $49/month for 10 company newsletters

Alternative: Owletter

SendView is an excellent tool for tracking your competitor’s email marketing efforts.

The process goes something like this: You create a separate email address and then subscribe to your competitor’s newsletter. After that, all emails go straight into SendView without bloating your inbox.

On top of this, you can access each email to analyze its subject line length, word count, email provider, spam score, source code, and whether or not it’s mobile-friendly. These are all valuable sources of inspiration for optimizing email marketing campaigns that resonate with your audience.

Final thoughts

Despite the abundant information about markets and competitors, teams today are hungrier than ever for knowledge and guidance—whether that’s ways to do an SEO competitor analysis or conduct a market analysis from A to Z (including mystery shopping).

Competitive intelligence is the long-awaited answer to navigate the business world with more clarity. Don’t think of it as a one-off action. Rather, see it as an ongoing process that equips every team member with information relevant to their job role and tools to make better business decisions.

Feel free to use this guide to start your own CI program or to convince your executive board about the importance of competitive intelligence.

Got questions? Ping me on Twitter.

You must be logged in to post a comment Login