AFFILIATE MARKETING

How to Diversify Your Income Into Multiple Revenue Streams

This article originally appeared on Business Insider.

This as-told-to essay is based on a conversation with Grace Ryu, a 23-year-old content creator based in Houston. The following has been edited for length and clarity.

I quit my tech job in March 2023 to explore other income streams. My 9-5 took up too much of my time, and I wanted to focus on ways to make money while I was sleeping or traveling.

Chasing different income streams aligns with my personality — it satisfies my desire to explore and try as much as possible. If I grow bored with one area, I can shift my focus to another, and if one stream isn’t that profitable, I have others to fall back on.

Here’s a breakdown of my eight income streams, with earnings, difficulty level, and time spent each week:

1. Luxury picnic business

Easy rating: 9/10

Lucrative rating: 7/10

I run a luxury picnic business with my best friend and my boyfriend. We initially posted our products on Facebook Marketplace and school flyers and broke even the first week of promoting them.

We re-invested all that money into expanding the business model, like buying more equipment for group picnics. We’ve since worked with businesses like Kendra Scott, local hotels, and Texas A&M University.

We have a six-person team, so I no longer do the physical setup and tear down, and I only put in one hour a week. During March through May, October, and November (peak picnic months), I can take home up to $3,000 a month.

It’s easy and affordable to start and doesn’t require many skills besides having an eye for aesthetics. It’s also lucrative because profit margins are very high since there are little to no variable expenses.

2. Influencer brand deals

Easy rating: 8/10

Lucrative rating: 10/10

I’m a micro influencer, and I have a TikTok account where I post about my life, my streams of income, and product promotions.

Brands reach out and ask me to post a dedicated or integrated TikTok video. I used to make content for brands for free, but now I charge at least $1,000 per post.

I spend around one hour a week on brand deals. At first, making content and editing was hard because I had to get used to the software and apps. After doing this for two years, I’m very fast at it because I know exactly which clips to add and how to do voiceovers.

It takes time to build a following on a platform, but once you get to that point, it’s very easy to work with brands for sponsorships. I make between $1,000 and $2,000 per post for about an hour of work.

3. Affiliate marketing

Easy rating: 7/10

Lucrative rating: 9/10

I started doing affiliate marketing through Amazon’s influencer program and make anywhere from $500 to $2,000 monthly.

In my TikToks, I feature work-from-home essentials from Amazon and link them. Then, people go to my storefront and buy through the links, and I get paid a commission.

It takes about five minutes to apply for the program, but you have to have a social media profile that promotes content.

If you never post anything, you’ll likely get rejected. I have friends who only have a few hundred followers, but they make unboxing videos, so they were accepted.

Anyone can do affiliate marketing because it’s easy to start, but the money isn’t always guaranteed. It takes lots of time and patience on any social media platform for a post to go viral, which will bring in sales. Once that happens, money comes in fast over a few months, and it’s all passive income.

4. User-generated content

Easy rating: 4/10

Lucrative rating: 8/10

User-generated content (UGC) differs from sponsorships because it’s content for brands to use directly. I used to work with a lash company, which paid me to make TikToks, but I don’t post that content on my account.

I have a few retainer clients, which means I’m paid a regular monthly fee in exchange for a set amount of content.

I earn about $6,000 to $8,000 a month from UGC. It takes around eight hours a week and can be more demanding than other income streams. I need to craft videos that convert well in sales, which takes extra brainpower.

5. Pet sitting

Easy rating: 10/10

Lucrative rating: 10/10

I got into pet sitting as a side gig while working in tech. I started on Rover, an app that links pet owners with sitters. Setting up a profile and passing a background check is quick, and you can start earning as soon as you’re booked.

It’s ideal for remote workers like me — getting paid to hang out with cute animals is great, and I can still manage other tasks, like checking up on my picnic business, answering emails, or creating content.

In January 2024, I was pet-sitting almost every day, and I enjoyed it because it was such a relaxing job. The only downside is I didn’t get to travel as much since I needed to stay with the pets.

It’s an extremely easy side hustle if you understand pet care and behavior. Pets are super easy to work with as long as they’re not puppies — puppies are more work.

6. Airbnb arbitrage

Easy rating: 2/10

Lucrative rating: 4/10

Airbnb arbitrage is my least favorite income stream — I may be letting go of this soon because the Airbnb market isn’t as hot as it used to be a few years ago.

How it works is I rent a property from a landlord for $1,700, for example, and once my business partner and I get the green light to use it as a short-term or mid-term rental, we list the property on platforms like Airbnb and VRBO. We’re tenants but act more like property managers, and we then earn profits from these listings.

After splitting earnings with my business partner, my net profit is around $600 per month. Since we focus primarily on mid-term stays, which require less frequent turnovers, my partner and I spend about five to six hours monthly on maintenance and cleaning, typically at the end of each stay.

It’s my least favorite side hustle because the financial risk is the highest — you have to accommodate guest needs, and the work is not enjoyable either. After monthly expenses, I don’t think the payout is enough to justify the effort.

7. Selling digital products

Easy rating: 10/10

Lucrative rating: 4/10

I created a content creation e-book because I’ve had many people on social media ask me to coach them. Whenever people ask me about content creation, I direct them to my link so they can buy my e-book.

I sell it for $20, and each month I make $60 to $80. I don’t promote it that much since I only have it as a resource for when people ask.

Anyone with enough knowledge about a specific topic can create an e-book or digital product, so it’s easy to do. However, it does take time and effort to bring in sales.

8. Nannying

Easy rating: 8/10

Lucrative rating: 9/10

I nanny for a family that flies me from Houston to New York three or four times a year. I stay for two to three weeks and get paid $1,200 a week.

My day-to-day is very simple — I take the girls to school in the morning, and when I come back, I can make content or go outside and explore the city. When the girls come home, I eat dinner, play with them, and then put them to sleep.

The families I babysit for in Houston and the family I nanny for in New York are all amazing to me and compensate me generously, which makes my job enjoyable and easy. The hardest part is when the kids are sick because I have to be more hands-on. Aside from that, once you become familiar with their routines, it’s super chill.

I wish I had diversified my income sooner

Although building my income streams took a lot of hustling upfront, I wish I had started sooner. I went from making $8/hour working a labor-intensive job as a ranch hand to now making over $100,000 a year from only working around 40 hours a month.

For those who are considering creating more income streams, don’t be reckless or stingy with your spending. Be courageous in investing in yourself, a business idea, or in others. If your dreams don’t scare you a little, they might not be big enough.

AFFILIATE MARKETING

Unlock Simplified, Pro-grade Design Capabilities with Ashampoo 3D CAD Professional 11

Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a small share of the revenue from the sale from our commerce partners.

For entrepreneurs and design professionals who are looking to elevate their projects, Ashampoo 3D CAD Professional 11 offers a powerful yet user-friendly solution that combines precision, versatility, and an extensive object library—all for just $39.99 (reg. $330).

Whether you’re a seasoned architect or a DIY enthusiast, this software offers a seamless blend of simplicity and sophistication. Its intuitive interface guides you through every step of the design process, from sketching floor plans to visualizing your space in stunning 3D.

This Windows-only software is designed to make your workflow more efficient and your designs more precise. It has a host of powerful tools and features that simplify complex tasks. For instance, the program offers dedicated input modes for walls, windows, and doors, allowing you to quickly and accurately define key elements of your project. Additionally, numerical editing tools provide even greater precision, ensuring that every measurement and modification is spot on.

Ashampoo 3D CAD Professional 11 has auto-save functionality and reminders to save your work manually, so you never have to worry about losing progress. The context menu supports cut, copy, and paste functions, making it easier to manage different elements of your design. With powerful floor plan analysis and correction features, you can quickly identify and address any issues before they become problems.

It has extensive object catalogs that provide a wide range of 3D objects and more than 250 ready-to-use object groups. From pre-designed garages and kitchen lines to garden houses and saunas, these objects make adding detail and realism to your projects easy. You can also create your own catalog directories and use them directly in the software, customizing your designs to fit your unique vision.

With more than 20 million users, this software provides all the tools you need to help bring your vision to life.

Get a lifetime license to Ashampoo 3D CAD Professional 11 now and pay just $39.99 (reg. $330) for a limited time.

StackSocial prices subject to change.

AFFILIATE MARKETING

4 Tips for Building Stronger Relationships Between IT and Non-Technical Teams

Opinions expressed by Entrepreneur contributors are their own.

Most companies have some form of dedicated IT management. According to a workforce survey, the common IT to non-technical staff ratio is typically around 4% of all personnel.

These IT individuals and departments often need to communicate with the other staffers throughout a company. From basic day-to-day activities to long-term collaborations, meeting deadlines and maintaining security, it’s important that the relationship between IT and the non-technical workforce is not just existent but effective.

If you’re aware of a lack of quality in your IT-related inter-departmental collaborations, here are four ways to enhance communication and build better professional relationships between technical and non-technical teams.

1. Establish and promote healthy communication

Communication cannot be overlooked in any business setting. As the workforce becomes more geographically diversified by distance and time zones, it’s important to maintain communication, not just with teams but between departments. This is ground zero, especially in an isolated area like IT.

One way to enhance communication is through regular cross-team meetings. Many companies hold recurring meetings where everyone comes together to hear company-wide updates and generally realign themselves. If the thought of a full company meeting sounds like a mammoth, intimidating and time-sucking use of resources, never fear. There are multiple ways you can implement this concept efficiently.

For instance, Zappos holds its well-known all-hands meetings three times a year. Spacing out these larger communal moments helps make them special.

If meeting is a problem in any quantity, you can go a different route: pre-recorded messages. If you choose this option, though, be warned that simple video messaging can become just as confusing and lengthy as a meeting. Instead, look for tools that help you send purposeful, value-centered messages.

Marketing platform Drift, for instance, used the communications tool Zight to improve its internal communication. The company used screen recorder technology to send annotated, knowledge-based videos to their employees. This organized and enhanced the purpose of each message, making it easier to reference later on without rewatching the entire thing.

The takeaway? Invest in some form of healthy cross-departmental communication that fits with your workflow.

2. Use jargon-free language

Removing jargon and technical terms from basic inter-departmental communication starts at the top. IT leaders must demonstrate how to remove dense language when talking, recording, typing and otherwise engaging with coworkers.

This isn’t just because leading by example is effective. It’s also because workplace jargon often finds its largest adherents in the upper echelons of a business. One study from MyPerfectResume found that 33% of those asked considered upper management to be the most likely to overuse workplace jargon.

Even worse? A third of those asked had also used jargon that they didn’t even understand. Use jargon-free language. It keeps communication transparent and avoids peer pressure and embarrassment from undermining effective understanding between IT and other teams.

Related: Here’s Why You Absolutely Have to Stop Using Jargon at Work

3. Bridge knowledge gaps with cross-functional training

Specialization and niche knowledge are defining factors for IT teams. Tech workers’ value comes from their ability to bridge the gap between humans and machines. However, this expertise isn’t as effective if the communication gap between IT staff and other personnel widens too far.

One way to keep all staff on the same playing field is to engage in cross-functional training. This is the process of educating employees from various departments in disciplines that are complementary to their own focus. It emphasizes shared knowledge and helps teams both respect and understand their respective duties in the larger context of business operations.

Google has mastered the art of cross-departmental training. On the one hand, the company famously used its whisper courses — a series of micro-lessons in email form — to teach small teamwork lessons. In addition, the search engine giant encourages employee-to-employee training. This shares knowledge in a peer-to-peer fashion and maintains a culture of learning.

Again, the takeaway here is that you don’t have to follow a formula for cross-departmental training. Find something that works for your setup, and then invest in it.

4. Cultivate a culture of inclusivity

Inclusivity is a common workplace culture goal. It emphasizes making all members of a workforce feel welcome. It seeks to embrace gender, age and other demographic differences and to incorporate the strengths of each individual and team into a company’s operations.

This is a powerful way to keep IT and non-technical personnel connected and respectful of one another’s contributions. As a central focus of how a company operates, an emphasis on empathy and respect helps keep those all-important communication channels open and healthy.

No company has demonstrated genuine, effective inclusivity in business activity quite as well as Pixar. The media company is famous for its ability to develop high-quality ideas and, at the same time, make sure everyone feels welcome and part of the conversation.

The company’s “Notes Days” are a poignant example. These are days when the entire company shuts down and comes together to collectively brainstorm. The result is some of the best inter-departmental collaboration in modern history.

If you want your tech and non-tech teams to connect, make them feel included.

Related: How to Build an Inclusive Culture That Permeates All Levels of the Organization

Breaking down barriers between IT and the rest of the professional work world

The IT department has become an integral part of most modern businesses. But it cannot operate in a vacuum. Miscommunications can lead to confused expectations, missed deadlines and even compromised safety and security.

It’s essential that leaders make an effort to align their IT and non-technical teams. This keeps everyone informed and up-to-date as you work together to achieve the same goal as a business.

AFFILIATE MARKETING

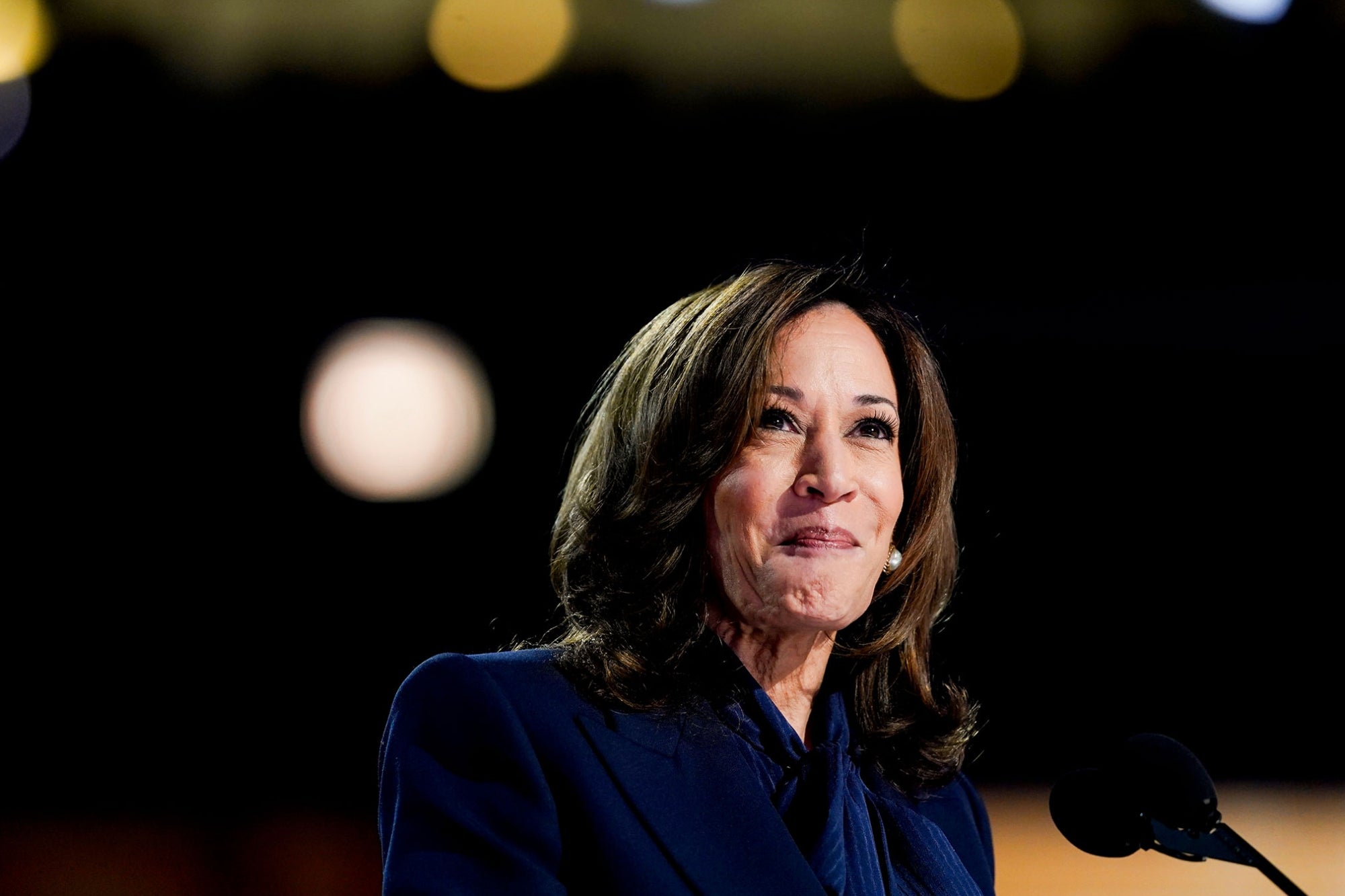

5 Ways Kamala Harris Can Support The Franchise Community

Opinions expressed by Entrepreneur contributors are their own.

The five weeks between the Republican and Democratic conventions could have been a lifetime, as a brand-new Democratic ticket formed in record speed. As always, the International Franchise Association (IFA) is neutral in presidential elections and we will work with whoever is in the White House for the betterment of our model. Just as we were in Milwaukee for the RNC, we were on the ground in Chicago, educating candidates and campaigns about all the good franchising provides, especially for minority-owned businesses.

More highlights from championing franchising with lawmakers in Chicago at the #DNC2024. IFA is proud to work with members across the aisle on policies that support the franchise business model and its 9M employees in the U.S. pic.twitter.com/vexxskHpuK

— IFA (@Franchising411) August 21, 2024

Like many Americans, the franchise community is interested in learning more about Vice President Harris’ vision and policy priorities, which she characterized in her acceptance speech as an Opportunity Agenda. It is encouraging that one of her early commercials features her time working at McDonald’s. In fact, if elected, Harris, along with her husband Doug Emhoff, will share a common thread with the 1 in 8 Americans

who have worked at McDonald’s. To genuinely support the franchise business model, here are five concrete ways Vice President Harris can appeal to the franchise community.

Be a champion for franchising

First, Vice President Harris should be a champion for franchising and use every day on the campaign trail to visit franchises and meet their employees in swing states — and everywhere in between. Doing so will unlock franchising as a component of the Opportunity Agenda, including the unique benefits of franchising for all stakeholders involved in the model.

Those stakeholders are substantial — from the nearly 9 million employees who work for America’s 800,000 franchise businesses (and earn higher wages and better benefits than non-franchised employees) to the franchise owners themselves, who are more diverse in race and gender than non-franchises.

Abandon an expanded joint employer rule

Second, Vice President Harris talked at the DNC about working with business and labor. Yet, one of labor’s top priorities has been a joint employer rule that would effectively destroy franchising. A Harris administration that wants to support small business creation must abandon efforts to implement an expanded joint employer rule.

Bipartisan majorities in congress and a federal court have rejected expanding the joint employer test to include reserved and indirect control. Even Democratic supermajorities in the California legislature, and her home-state Governor Gavin Newsom, rejected joint employer liability. This created a pathway to negotiate a bill with organized labor that preserved franchisee equity in their business, and creating predictable increases in the minimum wage.

Call for pro-small business tax policies

Third, Vice President Harris should call for pro-small business tax policies, given the expired and expiring provisions of the Tax Cuts & Jobs Act (TCJA). These include extending the qualified business income deduction (QBID), also known as the section 199A deduction, and restoring a pro-growth interest deductibility standard that expired at the end of 2022.

Extending the 199A deduction, along with passing the bipartisan Tax Relief for American Families and Workers Act — which garnered overwhelming bipartisan support in the House this year — would greatly benefit franchise owners. This legislation would increase the amount of interest owners can deduct from their income taxes, offer temporary bonus depreciation for the purchase of equipment and short-lived capital assets and include other pro-business and pro-worker provisions.

These actions would provide small business entrepreneurs with a competitive edge over large corporations and demonstrate that Vice President Harris is committed to addressing the needs of the small business community. She can chart a new path and extend an open hand to the business community by putting the politics aside and commit to extending a policy they have come to rely on. Without action, every business owner in country wakes up on January 1, 2026, facing a tax increase.

Increase lending limits at the SBA

Fourth, increase lending limits at the Small Business Association (SBA) and boost access to the 7(a) Working Capital Pilot (WCP) program. During her acceptance speech, Harris pledged to, “provide access to capital for small-business owners and entrepreneurs and founders.” Launched earlier this year, WCP is a line of credit product that features an annual guaranty fee structure that works to offer greater flexibility than a traditional term loan to meet specific business needs.

Accessing capital is increasingly challenging in such a high-interest rate environment. The SBA pitched the concept as a means of breaking down barriers seeking to start their own pathway to entrepreneurship, where the franchise model is poised to continue playing a major role.

Outline a future for the Federal Trade Commission

Finally, Harris should outline a future for the Federal Trade Commission (FTC) that includes a modernization of the Franchise Rule, a federal regulation solely enforced by the FTC that governs the sale of a franchise. Currently under review by the FTC, the Franchise Rule hasn’t been updated since 2007 — the same year the first iPhone was introduced.

Research published in the Wall Street Journal showed it took more than 20 years of education to understand a Franchise Disclosure Document (FDD), and a federal investigation found many prospective franchisees did not read the disclosures at all. This needs to change, especially during the pre-sale process when a prospective franchisee is deciding whether to invest significant financial resources in a franchise.

A Harris administration would be wise to course-correct the FTC to foster entrepreneurial development in franchising and double-down on the true mission of the FTC — to protect consumers and prospective franchisees. The franchise business model encourages workforce development and small business formulation in local communities, we look forward to working with any administration and any political party toward that important goal.

Related: Is Franchising Right For You? Ask Yourself These 9 Questions to Find Out.

Matt Haller is the President and CEO of the International Franchise Association (IFA). Greg Flynn is the Founder, Chairman, and CEO of Flynn Group and Flynn Properties, and an IFA Board Member. With 2,700+ Applebee’s, Taco Bells, Paneras, Arby’s, Pizza Huts, Wendy’s and Planet Fitness units generating $4.7+ billion in sales and employing 75,000+ people in 44 states and 3 countries, Flynn Group is the largest franchise operator in the world.

-

SEO7 days ago

SEO7 days agoGoogle’s Revamped Documentation Shows 4 Reasons To Refresh Content

-

SEARCHENGINES5 days ago

Daily Search Forum Recap: August 26, 2024

-

SEARCHENGINES7 days ago

SEARCHENGINES7 days agoGoogle Ranking Bug Fixed, August Core Update Swings, AI Overviews, Google Ads Bug & More

-

SEARCHENGINES4 days ago

Daily Search Forum Recap: August 27, 2024

-

WORDPRESS7 days ago

WORDPRESS7 days agoHow to Secure Your WordPress Store

-

AFFILIATE MARKETING7 days ago

AFFILIATE MARKETING7 days agoBusiness Owners are Batting 1,000 With This All-in-One Management Hub

-

SEARCHENGINES6 days ago

SEARCHENGINES6 days agoGoogle Migrating All To Google Merchant Center Next By September

-

WORDPRESS5 days ago

WORDPRESS5 days ago10 Best StudioPress Alternatives (Genesis Framework)