MARKETING

How to Understand Market Penetration and Create a Strategy With STP Marketing

Everyone wants their business to grow. This seems pretty intuitive considering effective and successful growth means your business is experiencing boosts in revenue, brand awareness, brand loyalty, and more — and we know this to be true by looking at the most successful and well-known companies today (e.g. Apple, Amazon, etc.).

The question is: What do these highly-successful companies do to ensure they put themselves in a position for strong and consistent growth?

Of course, there are a number of answers to this question based on who you ask. However, the one we’re going to focus on in this blog post is market penetration. So, what is market penetration?

Market Penetration

Market penetration is the amount of a product or service that is sold to customers compared to the estimated total market for that product or service. It’s a measurement that can determine the potential market size or help develop a strategy for increasing the market share of a specific product or service.

How to Calculate Market Penetration

If you’re using market penetration as a measurement, use the following formula to discover how much a product or service is used by customers compared to its total estimated market. In other words, take the current sale volume for your product or service and divide it by the total sale volume of all similar products available in the market.

(Number of Customers / Target Market Size) x 100 = Market Penetration Rate

Frequently monitoring your market penetration is important in order to identify any increases or decreases in penetration. If you’re wondering how often to calculate market penetration, a good rule of thumb is to calculate it after every marketing and sales campaign you run. This will highlight any changes in penetration — and, as a result, you’ll also have a better idea of the success of your campaign(s).

Next, let’s dive a little deeper into what market penetration is and why it’s such an effective growth strategy.

Understanding Market Penetration

A company can use market penetration at the industry level to review the potential for specific products or services or on a smaller scale as a way to gauge the market share of a product or service. It offers insight into how the market and your customers view your product or service.

What is high market penetration?

When it comes to market penetration, you want yours to be high. There are many benefits to high market penetration.

For instance, think about Nike. The company is a market leader in athletic shoes. When you go to the sneakers section of a store like Foot Locker or Dick’s Sporting Goods, Nike consistently takes up a large portion of the space.

That’s because retailers like Foot Locker and Dick’s know Nike delivers in sales. They also know their customers expect a wide selection of Nike products in their stores. Nike’s popularity and brand name warrant better shelving space and visibility, too. This is all a result of Nike’s high market penetration.

Similar to Nike, when you have a high market penetration…

- You’re an industry leader.

- You sell products or services that are already established within the industry.

- You have a widely-recognized brand.

- You have good visibility in the market.

- You have strong brand equity.

- You likely make your product for less than you would be able to if you were a less-established business due to the scale of your operation.

- You have a high sales volume which means you have leverage among suppliers and sellers.

High market penetration offers a marketing advantage and more potential for continued growth and success as a business. Needless to say, high market penetration is the goal — but, how do you achieve it? Well, market development is a good place to start.

Market Development vs. Market Penetration

You may have heard of the term market development used in relation to market penetration before. Market development is a necessary strategy or action when trying to increase market share or penetration — it requires a clear set of steps that will lead to a boost in the number of potential customers.

To increase market penetration, focus on market development first. Let’s look at an example.

Example of Market Development Increasing Market Penetration

A successful leggings brand, Booty by Brabants, has made waves in recent years in the athletic-wear industry. The brand has established itself as a seller of high-quality and unique leggings for women of all sizes.

By reviewing their market penetration, BBB was able to identify a small, existing market they could tap into — kids’ leggings. They determined that selling kids’ leggings could help them broaden their target audience and customer base for little added cost and effort.

Although BBB Kids leggings aren’t a major source of revenue for the company, they’re complementary to its existing product line and bring in new customers. BBB was able to identify an existing market they hadn’t taken advantage of yet and determine clear steps to successfully enter that market. As a result, they expanded their product line, customer base, and market penetration.

Now, let’s look at the most effective ways to get started on your market penetration strategy.

Market Penetration Strategy

A market penetration strategy is when a company works towards a higher market share by tapping into existing products in existing markets. It’s how a company (that already exists in the market with a product) can grow business by increasing sales among people already in the market.

As you begin working on your market penetration strategy, you may hear the words: Ansoff Matrix.

The Ansoff Matrix is a tool with four growth strategies listed for businesses to consider.

As you move to the upper-right quadrant of this matrix, the growth strategies become riskier for businesses. We’ve included information about the Ansoff Matrix in this article because it further proves and highlights the fact that market penetration is a highly-valuable and achievable way to effectively grow a business, even for the risk-averse.

At this point, you might be wondering about the specific strategies under the umbrella of market penetration that you can deploy at your company — let’s talk about some of those next.

Market Penetration Strategies

Here are some examples of effective market penetration strategies that you may choose to focus on and/or implement at your company.

1. Change your pricing.

Lower or raise the cost of one of your products.

2. Revamp your marketing.

Rework your marketing plan and/or roadmap.

3. Identify the need for a new product and launch it.

Survey and analyze your customers and target audience to identify the need for a new product (or feature). Then, create that product and sell it.

4. Update or change your product (or a specific feature of your product).

Resolve the challenges of your customers and buyer personas more effectively by updating or changing a product or feature.

5. Grow business in new territories and offer franchise opportunities.

Identify new territories in which you can expand and grow your business. Ask yourself: Which new areas can we open our stores or prospect? You might also begin offering franchise opportunities to expand your brick-and-mortar business.

6. Identify a business partner to work with.

Partner or merge with another business in a mutually beneficial way (e.g. run a co-marketing campaign).

7. Purchase a small business or competitor in your industry.

If you have the resources, consider acquiring a small business or competitor in your industry to broaden your base of customers and your offerings/ capabilities. (HubSpot did this a while ago.)

8. Offer a promotional program to boost loyalty.

Give customers an opportunity to sign up for a loyalty program that provides them with perks in return for giving you their contact information (e.g. discounts, birthday gifts, inside information, etc.).

9. Develop a new marketing campaign.

Create and launch a marketing campaign or initiative to promote your product line in a unique and new way that your customers haven’t seen before. Analyze your campaign’s success so you can refer to it in the future.

10. Boost sales rep activity.

Encourage sales reps to increase the number of interactions they have with qualified prospects (e.g. focus on social selling and meeting prospects where they are).

Segmentation, Targeting, and Positioning

STP marketing stands for segmentation, targeting, and positioning. This is a three-step model that helps you to examine your products or services and how you communicate them to your market. Step one is to divide your market into segments. Step two is to target each segment with tailored marketing campaigns. Step three is to position your business and marketing in a way that will appeal the most to each segment.

What’s an example of a successful market penetration strategy?

There are several examples of companies using market penetration to grow their business. For the sake of this piece, let’s look at Dunkin’.

Dunkin’ (formerly, Dunkin’ Donuts) was started in Quincy, MA back in the 1940s. Since then, Dunkin’ has become a globally-recognized brand. Dunkin’ has since grown substantially and opened stores in 46 countries — yet, the company’s most-loyal customers remain in New England. In fact, there are 12,500 Dunkin’s worldwide (9,000 of which are in the U.S.) In terms of market penetration, Dunkin’ continues to tap into their large and loyal market by opening and maintaining that large portion of their stores in New England.

Check out the following map for example — Boston is a small city, and you can walk between almost all 10 of these Dunkin’ locations in just minutes.

Dunkin’ knows where their customers are and that those customers want a Dunkin’ store every… well, city block.

Not only has Dunkin’ successfully penetrated their market by opening and maintaining so many stores in New England, but they’ve also increased market penetration by making specific changes to their branding and menu.

Most notably, they changed their name from Dunkin’ Donuts to Dunkin’. The company does 60% of their business in coffee and other drinks, so the “Donuts” aspect of their original name was arguably a bit misleading. The CEO of Dunkin’ said this move was important because the new name, “… speaks to the breadth of our offerings.”

The brand name change also gives a signal to customers that there are a number of other menu items available, aside from donuts. In fact, the name change was paired with many menu additions, including healthier options as well as offerings for non-dairy and vegan customers including their Beyond Sausage and almond milk.

All of these changes broadened Dunkin’s customer base and target audience by accommodating more people within the market they were already penetrating.

Invest in Market Penetration to Grow Better

We just covered several reasons why market penetration is so beneficial to your business’s long-term success. And as you’ve learned throughout this blog post, it’s a highly effective growth strategy that’s typically low-risk.

There are many market penetration strategies to choose from, plan, and implement at your company, so pick the best option for your goals and get started.

Editor’s note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Source link

MARKETING

Streamlining Processes for Increased Efficiency and Results

How can businesses succeed nowadays when technology rules? With competition getting tougher and customers changing their preferences often, it’s a challenge. But using marketing automation can help make things easier and get better results. And in the future, it’s going to be even more important for all kinds of businesses.

So, let’s discuss how businesses can leverage marketing automation to stay ahead and thrive.

Benefits of automation marketing automation to boost your efforts

First, let’s explore the benefits of marketing automation to supercharge your efforts:

Marketing automation simplifies repetitive tasks, saving time and effort.

With automated workflows, processes become more efficient, leading to better productivity. For instance, automation not only streamlines tasks like email campaigns but also optimizes website speed, ensuring a seamless user experience. A faster website not only enhances customer satisfaction but also positively impacts search engine rankings, driving more organic traffic and ultimately boosting conversions.

Automation allows for precise targeting, reaching the right audience with personalized messages.

With automated workflows, processes become more efficient, leading to better productivity. A great example of automated workflow is Pipedrive & WhatsApp Integration in which an automated welcome message pops up on their WhatsApp

within seconds once a potential customer expresses interest in your business.

Increases ROI

By optimizing campaigns and reducing manual labor, automation can significantly improve return on investment.

Leveraging automation enables businesses to scale their marketing efforts effectively, driving growth and success. Additionally, incorporating lead scoring into automated marketing processes can streamline the identification of high-potential prospects, further optimizing resource allocation and maximizing conversion rates.

Harnessing the power of marketing automation can revolutionize your marketing strategy, leading to increased efficiency, higher returns, and sustainable growth in today’s competitive market. So, why wait? Start automating your marketing efforts today and propel your business to new heights, moreover if you have just learned ways on how to create an online business

How marketing automation can simplify operations and increase efficiency

Understanding the Change

Marketing automation has evolved significantly over time, from basic email marketing campaigns to sophisticated platforms that can manage entire marketing strategies. This progress has been fueled by advances in technology, particularly artificial intelligence (AI) and machine learning, making automation smarter and more adaptable.

One of the main reasons for this shift is the vast amount of data available to marketers today. From understanding customer demographics to analyzing behavior, the sheer volume of data is staggering. Marketing automation platforms use this data to create highly personalized and targeted campaigns, allowing businesses to connect with their audience on a deeper level.

The Emergence of AI-Powered Automation

In the future, AI-powered automation will play an even bigger role in marketing strategies. AI algorithms can analyze huge amounts of data in real-time, helping marketers identify trends, predict consumer behavior, and optimize campaigns as they go. This agility and responsiveness are crucial in today’s fast-moving digital world, where opportunities come and go in the blink of an eye. For example, we’re witnessing the rise of AI-based tools from AI website builders, to AI logo generators and even more, showing that we’re competing with time and efficiency.

Combining AI-powered automation with WordPress management services streamlines marketing efforts, enabling quick adaptation to changing trends and efficient management of online presence.

Moreover, AI can take care of routine tasks like content creation, scheduling, and testing, giving marketers more time to focus on strategic activities. By automating these repetitive tasks, businesses can work more efficiently, leading to better outcomes. AI can create social media ads tailored to specific demographics and preferences, ensuring that the content resonates with the target audience. With the help of an AI ad maker tool, businesses can efficiently produce high-quality advertisements that drive engagement and conversions across various social media platforms.

Personalization on a Large Scale

Personalization has always been important in marketing, and automation is making it possible on a larger scale. By using AI and machine learning, marketers can create tailored experiences for each customer based on their preferences, behaviors, and past interactions with the brand.

This level of personalization not only boosts customer satisfaction but also increases engagement and loyalty. When consumers feel understood and valued, they are more likely to become loyal customers and brand advocates. As automation technology continues to evolve, we can expect personalization to become even more advanced, enabling businesses to forge deeper connections with their audience. As your company has tiny homes for sale California, personalized experiences will ensure each customer finds their perfect fit, fostering lasting connections.

Integration Across Channels

Another trend shaping the future of marketing automation is the integration of multiple channels into a cohesive strategy. Today’s consumers interact with brands across various touchpoints, from social media and email to websites and mobile apps. Marketing automation platforms that can seamlessly integrate these channels and deliver consistent messaging will have a competitive edge. When creating a comparison website it’s important to ensure that the platform effectively aggregates data from diverse sources and presents it in a user-friendly manner, empowering consumers to make informed decisions.

Omni-channel integration not only betters the customer experience but also provides marketers with a comprehensive view of the customer journey. By tracking interactions across channels, businesses can gain valuable insights into how consumers engage with their brand, allowing them to refine their marketing strategies for maximum impact. Lastly, integrating SEO services into omni-channel strategies boosts visibility and helps businesses better understand and engage with their customers across different platforms.

The Human Element

While automation offers many benefits, it’s crucial not to overlook the human aspect of marketing. Despite advances in AI and machine learning, there are still elements of marketing that require human creativity, empathy, and strategic thinking.

Successful marketing automation strikes a balance between technology and human expertise. By using automation to handle routine tasks and data analysis, marketers can focus on what they do best – storytelling, building relationships, and driving innovation.

Conclusion

The future of marketing automation looks promising, offering improved efficiency and results for businesses of all sizes.

As AI continues to advance and consumer expectations change, automation will play an increasingly vital role in keeping businesses competitive.

By embracing automation technologies, marketers can simplify processes, deliver more personalized experiences, and ultimately, achieve their business goals more effectively than ever before.

MARKETING

Will Google Buy HubSpot? | Content Marketing Institute

Google + HubSpot. Is it a thing?

This week, a flurry of news came down about Google’s consideration of purchasing HubSpot.

The prospect dismayed some. It delighted others.

But is it likely? Is it even possible? What would it mean for marketers? What does the consideration even mean for marketers?

Well, we asked CMI’s chief strategy advisor, Robert Rose, for his take. Watch this video or read on:

Why Alphabet may want HubSpot

Alphabet, the parent company of Google, apparently is contemplating the acquisition of inbound marketing giant HubSpot.

The potential price could be in the range of $30 billion to $40 billion. That would make Alphabet’s largest acquisition by far. The current deal holding that title happened in 2011 when it acquired Motorola Mobility for more than $12 billion. It later sold it to Lenovo for less than $3 billion.

If the HubSpot deal happens, it would not be in character with what the classic evil villain has been doing for the past 20 years.

At first glance, you might think the deal would make no sense. Why would Google want to spend three times as much as it’s ever spent to get into the inbound marketing — the CRM and marketing automation business?

At a second glance, it makes a ton of sense.

I don’t know if you’ve noticed, but I and others at CMI spend a lot of time discussing privacy, owned media, and the deprecation of the third-party cookie. I just talked about it two weeks ago. It’s really happening.

All that oxygen being sucked out of the ad tech space presents a compelling case that Alphabet should diversify from third-party data and classic surveillance-based marketing.

Yes, this potential acquisition is about data. HubSpot would give Alphabet the keys to the kingdom of 205,000 business customers — and their customers’ data that almost certainly numbers in the tens of millions. Alphabet would also gain access to the content, marketing, and sales information those customers consumed.

Conversely, the deal would provide an immediate tip of the spear for HubSpot clients to create more targeted programs in the Alphabet ecosystem and upload their data to drive even more personalized experiences on their own properties and connect them to the Google Workspace infrastructure.

When you add in the idea of Gemini, you can start to see how Google might monetize its generative AI tool beyond figuring out how to use it on ads on search results pages.

What acquisition could mean for HubSpot customers

I may be stretching here but imagine this world. As a Hubspoogle customer, you can access an interface that prioritizes your owned media data (e.g., your website, your e-commerce catalog, blog) when Google’s Gemini answers a question).

Recent reports also say Google may put up a paywall around the new premium features of its artificial intelligence-powered Search Generative Experience. Imagine this as the new gating for marketing. In other words, users can subscribe to Google’s AI for free, but Hubspoogle customers can access that data and use it to create targeted offers.

The acquisition of HubSpot would immediately make Google Workspace a more robust competitor to Microsoft 365 Office for small- and medium-sized businesses as they would receive the ADDED capability of inbound marketing.

But in the world of rented land where Google is the landlord, the government will take notice of the acquisition. But — and it’s a big but, I cannot lie (yes, I just did that). The big but is whether this acquisition dance can happen without going afoul of regulatory issues.

Some analysts say it should be no problem. Others say, “Yeah, it wouldn’t go.” Either way, would anybody touch it in an election year? That’s a whole other story.

What marketers should realize

So, what’s my takeaway?

It’s a remote chance that Google will jump on this hard, but stranger things have happened. It would be an exciting disruption in the market.

The sure bet is this. The acquisition conversation — as if you needed more data points — says getting good at owned media to attract and build audiences and using that first-party data to provide better communication and collaboration with your customers are a must.

It’s just a matter of time until Google makes a move. They might just be testing the waters now, but they will move here. But no matter what they do, if you have your customer data house in order, you’ll be primed for success.

HANDPICKED RELATED CONTENT:

Cover image by Joseph Kalinowski/Content Marketing Institute

MARKETING

5 Psychological Tactics to Write Better Emails

Welcome to Creator Columns, where we bring expert HubSpot Creator voices to the Blogs that inspire and help you grow better.

I’ve tested 100s of psychological tactics on my email subscribers. In this blog, I reveal the five tactics that actually work.

You’ll learn about the email tactic that got one marketer a job at the White House.

You’ll learn how I doubled my 5 star reviews with one email, and why one strange email from Barack Obama broke all records for donations.

5 Psychological Tactics to Write Better Emails

Imagine writing an email that’s so effective it lands you a job at the White House.

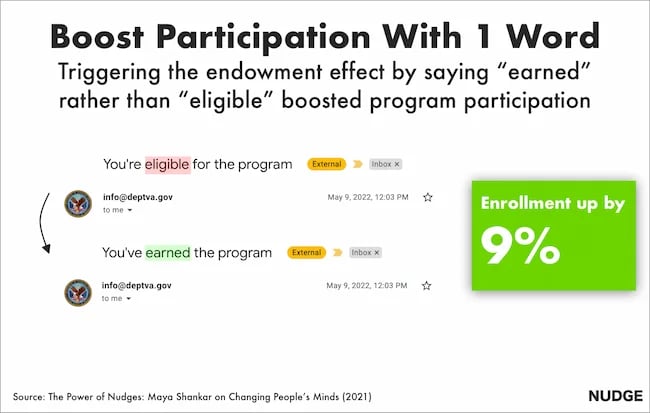

Well, that’s what happened to Maya Shankar, a PhD cognitive neuroscientist. In 2014, the Department of Veterans Affairs asked her to help increase signups in their veteran benefit scheme.

Maya had a plan. She was well aware of a cognitive bias that affects us all—the endowment effect. This bias suggests that people value items higher if they own them. So, she changed the subject line in the Veterans’ enrollment email.

Previously it read:

- Veterans, you’re eligible for the benefit program. Sign up today.

She tweaked one word, changing it to:

- Veterans, you’ve earned the benefits program. Sign up today.

This tiny tweak had a big impact. The amount of veterans enrolling in the program went up by 9%. And Maya landed a job working at the White House

Inspired by these psychological tweaks to emails, I started to run my own tests.

Alongside my podcast Nudge, I’ve run 100s of email tests on my 1,000s of newsletter subscribers.

Here are the five best tactics I’ve uncovered.

1. Show readers what they’re missing.

Nobel prize winning behavioral scientists Daniel Kahneman and Amos Tversky uncovered a principle called loss aversion.

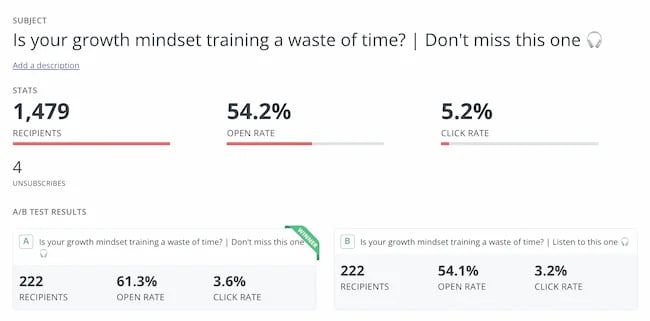

Loss aversion means that losses feel more painful than equivalent gains. In real-world terms, losing $10 feels worse than how gaining $10 feels good. And I wondered if this simple nudge could help increase the number of my podcast listeners.

For my test, I tweaked the subject line of the email announcing an episode. The control read:

“Listen to this one”

In the loss aversion variant it read:

“Don’t miss this one”

It is very subtle loss aversion. Rather than asking someone to listen, I’m saying they shouldn’t miss out. And it worked. It increased the open rate by 13.3% and the click rate by 12.5%. Plus, it was a small change that cost me nothing at all.

2. People follow the crowd.

In general, humans like to follow the masses. When picking a dish, we’ll often opt for the most popular. When choosing a movie to watch, we tend to pick the box office hit. It’s a well-known psychological bias called social proof.

I’ve always wondered if it works for emails. So, I set up an A/B experiment with two subject lines. Both promoted my show, but one contained social proof.

The control read: New Nudge: Why Brands Should Flaunt Their Flaws

The social proof variant read: New Nudge: Why Brands Should Flaunt Their Flaws (100,000 Downloads)

I hoped that by highlighting the episode’s high number of downloads, I’d encourage more people to listen. Fortunately, it worked.

The open rate went from 22% to 28% for the social proof version, and the click rate, (the number of people actually listening to the episode), doubled.

3. Praise loyal subscribers.

The consistency principle suggests that people are likely to stick to behaviours they’ve previously taken. A retired taxi driver won’t swap his car for a bike. A hairdresser won’t change to a cheap shampoo. We like to stay consistent with our past behaviors.

I decided to test this in an email.

For my test, I attempted to encourage my subscribers to leave a review for my podcast. I sent emails to 400 subscribers who had been following the show for a year.

The control read: “Could you leave a review for Nudge?”

The consistency variant read: “You’ve been following Nudge for 12 months, could you leave a review?”

My hypothesis was simple. If I remind people that they’ve consistently supported the show they’ll be more likely to leave a review.

It worked.

The open rate on the consistency version of the email was 7% higher.

But more importantly, the click rate, (the number of people who actually left a review), was almost 2x higher for the consistency version. Merely telling people they’d been a fan for a while doubled my reviews.

4. Showcase scarcity.

We prefer scarce resources. Taylor Swift gigs sell out in seconds not just because she’s popular, but because her tickets are hard to come by.

Swifties aren’t the first to experience this. Back in 1975, three researchers proved how powerful scarcity is. For the study, the researchers occupied a cafe. On alternating weeks they’d make one small change in the cafe.

On some weeks they’d ensure the cookie jar was full.

On other weeks they’d ensure the cookie jar only contained two cookies (never more or less).

In other words, sometimes the cookies looked abundantly available. Sometimes they looked like they were almost out.

This changed behaviour. Customers who saw the two cookie jar bought 43% more cookies than those who saw the full jar.

It sounds too good to be true, so I tested it for myself.

I sent an email to 260 subscribers offering free access to my Science of Marketing course for one day only.

In the control, the subject line read: “Free access to the Science of Marketing course”

For the scarcity variant it read: “Only Today: Get free access to the Science of Marketing Course | Only one enrol per person.”

130 people received the first email, 130 received the second. And the result was almost as good as the cookie finding. The scarcity version had a 15.1% higher open rate.

5. Spark curiosity.

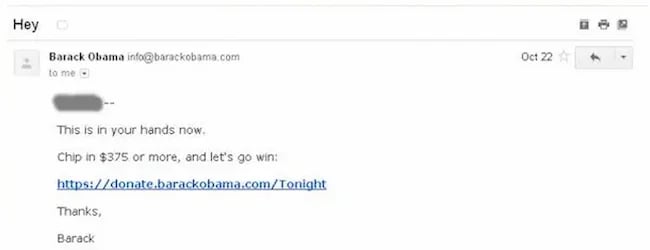

All of the email tips I’ve shared have only been tested on my relatively small audience. So, I thought I’d end with a tip that was tested on the masses.

Back in 2012, Barack Obama and his campaign team sent hundreds of emails to raise funds for his campaign.

Of the $690 million he raised, most came from direct email appeals. But there was one email, according to ABC news, that was far more effective than the rest. And it was an odd one.

The email that drew in the most cash, had a strange subject line. It simply said “Hey.”

The actual email asked the reader to donate, sharing all the expected reasons, but the subject line was different.

It sparked curiosity, it got people wondering, is Obama saying Hey just to me?

Readers were curious and couldn’t help but open the email. According to ABC it was “the most effective pitch of all.”

Because more people opened, it raised more money than any other email. The bias Obama used here is the curiosity gap. We’re more likely to act on something when our curiosity is piqued.

Loss aversion, social proof, consistency, scarcity and curiosity—all these nudges have helped me improve my emails. And I reckon they’ll work for you.

It’s not guaranteed of course. Many might fail. But running some simple a/b tests for your emails is cost free, so why not try it out?

This blog is part of Phill Agnew’s Marketing Cheat Sheet series where he reveals the scientifically proven tips to help you improve your marketing. To learn more, listen to his podcast Nudge, a proud member of the Hubspot Podcast Network.

-

WORDPRESS7 days ago

WORDPRESS7 days agoTurkish startup ikas attracts $20M for its e-commerce platform designed for small businesses

-

MARKETING6 days ago

MARKETING6 days agoRoundel Media Studio: What to Expect From Target’s New Self-Service Platform

-

SEO5 days ago

SEO5 days agoGoogle Limits News Links In California Over Proposed ‘Link Tax’ Law

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 12, 2024

-

SEARCHENGINES7 days ago

SEARCHENGINES7 days agoGoogle Search Results Can Be Harmful & Dangerous In Some Cases

-

MARKETING7 days ago

MARKETING7 days agoUnlocking the Power of AI Transcription for Enhanced Content Marketing Strategies

-

SEO5 days ago

SEO5 days ago10 Paid Search & PPC Planning Best Practices

-

SEARCHENGINES5 days ago

SEARCHENGINES5 days agoGoogle Core Update Volatility, Helpful Content Update Gone, Dangerous Google Search Results & Google Ads Confusion

![5 Psychological Tactics to Write Better Emails → Download Now: The Beginner's Guide to Email Marketing [Free Ebook]](https://articles.entireweb.com/wp-content/uploads/2023/02/11-Free-Email-Hacks-to-Step-Up-Your-Productivity.png)

You must be logged in to post a comment Login