SEO

Google Business Profile Optimization For The Financial Vertical

The financial vertical is a dynamic, challenging, and highly regulated space.

As such, for businesses in this vertical, optimizing local search presence and, specifically, Google Business Profile listings requires a greater level of sensitivity and specialization than industries like retail or restaurant.

The inherent challenges stem from a host of considerations, such as internal branding guidelines, accessibility considerations, regulatory measures, and governance considerations among lines of business within the financial organization, among others.

This means that local listings in this vertical are not “one size fits all” but rather vary based on function and fall into one of several listing types, including branches, loan officers, financial advisors, and ATMS (which may be inclusive of walk-up ATMs, drive-through ATMs, and “smart ATMs”).

Each of these types of listings requires a unique set of hours, categories, hyper-local content, attributes, and a unique overall optimization strategy.

The goal of this article is to dive deeper into why having a unique optimization strategy matters for businesses in the financial vertical and share financial brand-specific best practices for listing optimization strategy.

Financial Brand Listing Type Considerations

One reason listing optimization is so nuanced in the financial vertical is that, in addition to all the listing features that vary by business function as mentioned above, Google also has essentially different classifications (or types) of listings by definition – each with its own set of guidelines (read “rules”) that apply according to a listing scenario.

This includes the distinction between a listing for an organization (e.g., for a bank branch) vs. that of an individual practitioner (used to represent a loan officer that may or may not sit at the branch, which has a separate listing).

Somewhere between those two main divisions, there may be a need for a department listing (e.g., for consumer banking vs. mortgages).

Again, each listing classification has rules and criteria around how (and how many) listings can be established for a given address and how they are represented.

Disregarding Google’s guidelines here carries the risk of disabled listings or even account-level penalties.

While that outcome is relatively rare, those risks are ill-advised and theoretically catastrophic to revenue and reputation in such a tightly regulated and competitive industry.

Editor’s note: If you have 10+ locations, you can request bulk verification.

Google Business Profile Category Selection

Category selection in Google Business Profile (GBP) is one of the most influential, and thus important, activities involved in creating and optimizing listings – in the context of ranking, visibility, and traffic attributable to the listing.

Keep in mind you can’t “keyword optimize” a GBP listing (unless you choose to violate Business Title guidelines), and this is by design on Google’s part.

Because of this, the primary and secondary categories that you select are collectively one of the strongest cues that you can send to Google around who should see your listing in the local search engine results pages (SERPs), and for what queries (think relevancy).

Suffice it to say this is a case where quality and specificity are more important than quantity.

This is, in part, because Google only allows for one primary category to be selected – but also because of the practice of spamming the secondary category field with as many entries as Google will allow (especially with categories that are only tangentially relevant for the listing) can have consequences that are both unintuitive and unintended.

The point is too many categories can (and often do) muddy the signal for Google’s algorithm regarding surfacing listings for appropriate queries and audiences.

This can lead to poor alignment with users’ needs and experiences and drive the wrong traffic.

It can also cause confusion for the algorithm around relevancy, resulting in the listing being suppressed or ranking poorly, thus driving less traffic.

Governance Vs. Cannibalization

Just as we already discussed the distinction between the choice of classification types and the practice of targeting categories appropriately according to the business functions and objectives represented by a given listing, these considerations play together to help frame a strategy around governance within the context of the organic local search channel.

The idea here is to create separation between lines of business (LOBs) to prevent internal competition over rankings and visibility for search terms that are misaligned for one or more LOB, such that they inappropriately cannibalize each other.

In simpler terms, users searching for a financial advisor or loan officer should not be served a listing for a consumer bank branch, and vice versa.

This creates a poor user experience that will ultimately result in frustrated users, complaints, and potential loss of revenue.

The Importance Of Category Selection

To illustrate this, see the example below.

A large investment bank might have the following recommended categories for Branches and Advisors, respectively (an asterisk refers to the primary category):

Branch Categories

- *Investment Service.

- Investment Company.

- Financial Institution.

Advisor Categories

- *Financial Consultant.

- Financial Planner.

- Financial Broker.

Notice the Branch categories signal relevance for the institution as a whole, whereas the Advisor categories align with Advisors (i.e., individual practitioners.) Obviously, these listings serve separate but complementary functions.

When optimized strategically, their visibility will align with the needs of users seeking out information about those functions accordingly.

Category selection is not the only factor involved in crafting a proper governance strategy, albeit an important one.

That said, all the other available data fields and content within the listings should be similarly planned and optimized in alignment with appropriate governance considerations, in addition to the overall relevancy and content strategy as applicable for the associated LOBs.

Specialized Financial Brand Listing Attributes

GBP attributes are data points about a listing that help communicate details about the business being represented.

They vary by primary category and are a great opportunity to serve users’ needs while boosting performance by differentiating against the competition, and feeding Google’s algorithm more relevant information about a given listing.

This is often referred to as the “listing completeness” aspect of Google’s local algorithm, which translates to “the more information Google has about a listing, the more precisely it can provide that listing to users according to the localized queries they use.”

The following is a list of attributes that are helpful for the financial vertical:

- Online Appointments.

- Black-Owned.

- Family-Led.

- Veteran-Led.

- Women-Led.

- Appointment Links.

- Wheelchair Accessible Elevator.

- Wheelchair Accessible Entrance.

- Wheelchair Accessible Parking Lot.

The following chart helps to illustrate which attributes are best suited for listing based on listing/LOB/ORG type:

Managing Hours Of Operation

This is an important and often overlooked aspect of listings management in the financial space and in general.

Hours of operation, first and foremost, should be present in the listings, not left out. While providing hours is not mandatory, not doing so will impact user experience and visibility.

Like most of the previous items, hours for a bank branch (e.g., 10 am to 5 pm) will be different than those of the drive-through ATM (open 24 hours), and that of a mortgage loan officer and financial advisor that both have offices at the same address.

Each of these services and LOBs can best be represented by separate listings, each with its own hours of operation.

Leaving these details out, or using the same set of operating hours across all of these LOBs and listing types, sets users up for frustration and prevents Google from properly serving and messaging users around a given location’s availability (such as “open now,” “closing soon,” or “closed,” as applicable.)

All of this leads to either missed opportunities when hours are omitted, allowing a competitor (that Google knows is open) to rank higher in the SERPs, or frustrated customers that arrive at an investment banking office expecting to make a consumer deposit or use an ATM.

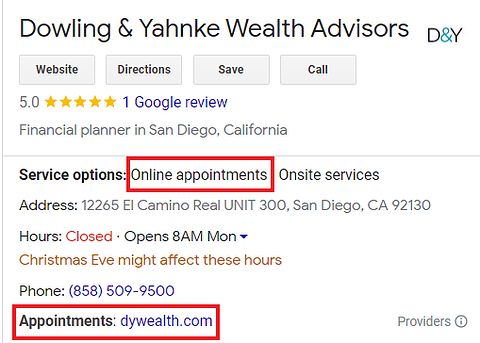

Appointment URL With Local Attribution Tracking

This is especially relevant for individual practitioner listings such as financial advisors, mortgage loan officers, and insurance agents.

Appointment URLs allow brands to publish a link where clients can book appointments with the individual whose listing the user finds and interacts within search.

This is a low-hanging fruit tactic that can make an immediate and significant impact on lead generation and revenue.

Taking this another step, these links can be tagged with UTM parameters (for brands using Google Analytics and similarly tagged for other analytic platforms) to track conversion events, leads, and revenue associated with this listing feature.

Editorial note: Here is an example of a link with UTM parameters: https://www.domain.com/?utm_source=source&utm_medium=medium&utm_campaign=campaign

Image from Google, December 2022

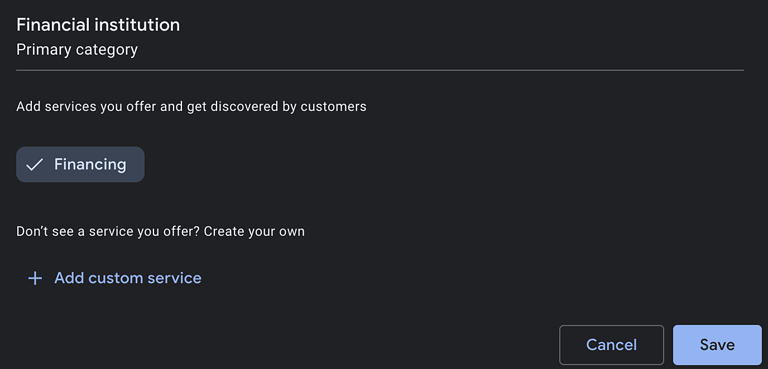

Image from Google, December 2022Leveraging Services

Services can be added to a listing to let potential customers know what services are available at a given location.

Screenshot from Google, January 2023

Screenshot from Google, January 2023Services in GBP are subject to availability by primary category, another reason category selection is so important, as discussed above.

Specifically, once services are added to a listing, they will be prominently displayed on the listing within the mobile SERPs under the “Services” tab of the listing.

Screenshot from Google, January 2023

Screenshot from Google, January 2023This not only feeds more data completeness, which benefits both mobile and desktop performance, and increases engagement in the mobile SERPs (click to website, call, driving directions) which are bottom-funnel key performance indicators (KPIs) that drive revenue.

Google Posts

Google Posts represent a content marketing opportunity that is valuable on multiple levels.

An organization can post relevant, evergreen content that is strategically optimized for key localized phrases, services, and product offerings.

While there is no clear evidence or admission by Google that relevant content will have a direct impact on rankings overall for that listing, what we can say for certain from observation is that listings with well-optimized posts do present in the local SERPs landscape for keyword queries that align with that content.

This happens in the form of “related to your search” snippets and has been widely observed since 2019.

This has a few different implications, reinforcing the benefits of leveraging Google Posts in your local search strategy.

First, given that Post snippets are triggered, it is fair to infer that if a given listing did not have the relevant post, that listing may not have surfaced at all in the SERPs. Thus, we can infer a benefit around visibility, which leads to more traffic.

Second, it is well-documented that featured snippets are associated with boosts in click-through rate (CTR), which amplifies the traffic increases that result from the increased visibility alone.

Additional Post Benefits

Beyond these two very obvious benefits of Google Posts, they also provide many benefits around messaging potential visitors and clients with relevant information about the location, including products, services, promotions, events, limited-time offers, and potentially many others.

Use cases for this can include consumer banks that feature free checking or direct deposit or financial advisors that offer a free 60-minute initial consultation.

Taking the time to publish posts that highlight these differentiators could have a measurable impact on traffic, CTR, and revenue.

Another great aspect of Google Posts is that, for a while, they were designed to be visible according to specific date ranges – and, at one time, would “expire” or fall out of the SERPs once the time period passed.

Certain post types will surface long after the expiration date of the post if there is a relevancy match between the user’s query and the content.

Concluding Thoughts

To summarize, the financial vertical requires a highly specialized, precise GBP optimization strategy, which is well-vetted for the needs of users, LOBs, and regulatory compliance.

Considerations like primary and secondary categories, hours, attributes, services, and content (in the form of Google Posts) all play a critical role in defining that overall strategy, including setting up and maintaining crucial governance boundaries between complementary LOBs.

Undertaking all these available listing features holistically and strategically allows financial institutions and practitioners to maximize visibility, engagement, traffic, revenue, and overall performance from local search while minimizing cannibalism, complaints, and poor user experience.

More resources:

Featured Image: Andrey_Popov/Shutterstock

![How AEO Will Impact Your Business's Google Visibility in 2026 Why Your Small Business’s Google Visibility in 2026 Depends on AEO [Webinar]](https://articles.entireweb.com/wp-content/uploads/2026/01/How-AEO-Will-Impact-Your-Businesss-Google-Visibility-in-2026-400x240.png)

![How AEO Will Impact Your Business's Google Visibility in 2026 Why Your Small Business’s Google Visibility in 2026 Depends on AEO [Webinar]](https://articles.entireweb.com/wp-content/uploads/2026/01/How-AEO-Will-Impact-Your-Businesss-Google-Visibility-in-2026-80x80.png)

You must be logged in to post a comment Login