AFFILIATE MARKETING

How Nvidia Pivoted From Graphics Card Maker to AI Chip Giant

A decade ago, Nvidia was a major graphics card maker, vying with competitors like AMD and Intel for dominance. Now it’s an AI giant with 70% to 95% of the market share for AI chips, and the brains of OpenAI’s ChatGPT. It’s also the best-performing stock with the highest return in the past 25 years.

Why did Nvidia invest in AI chips over 10 years ago, ahead of the competition? CEO Jensen Huang and board member Mark Stevens, Nvidia’s two largest individual shareholders, talked to Sequoia Capital partner Roelof Botha to explain what Botha called “one of the most remarkable business pivots in history.”

Nvidia’s original product was 3D graphics cards for PC games, but company leaders noticed by the mid-2000s that the PC market was hitting a growth limit.

“We felt we were always gonna be boxed into the PC gaming market and always knocking heads with Intel if we didn’t develop a brand new market that nobody else was in,” Stevens explained.

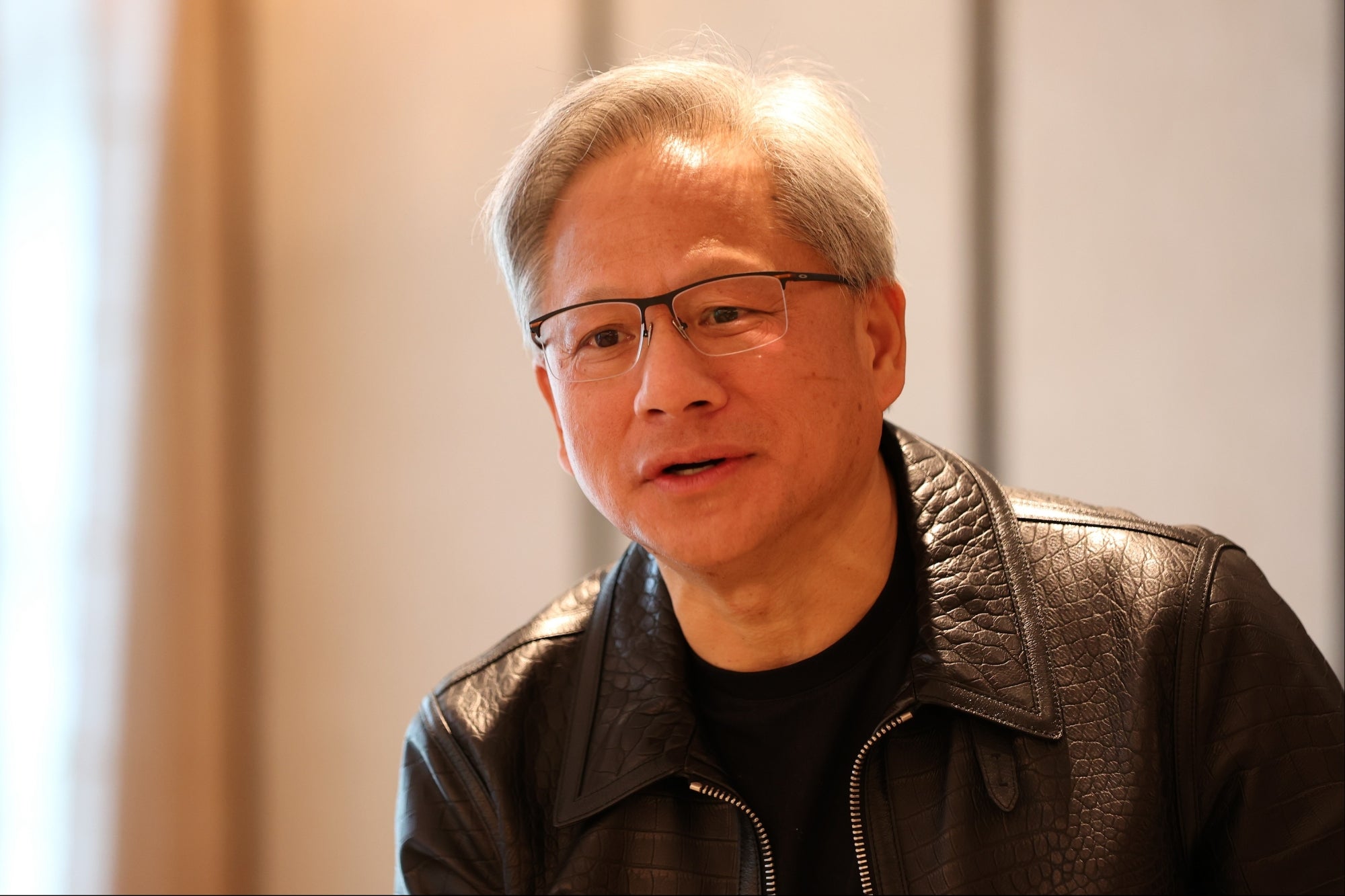

Jensen Huang, co-founder and chief executive officer of Nvidia. Photographer: Lionel Ng/Bloomberg via Getty Images

That need for a new market intersected with a product Nvidia already had on hand: its graphics processor unit, or GPU, which could be used to power tasks outside of gaming. Researchers at universities across the world began exploring the graphics cards, eventually building advanced computers with them.

Related: Is It Too Late to Buy Nvidia? Former Morgan Stanley Strategist Says ‘Buy High, Sell Higher.’

Huang recalled meeting a quantum chemist in Taiwan who showed him a closet with a “giant array” of Nvidia’s GPUs on its shelves; house fans were rotating to keep the system cool.

“He said, ‘I built my own personal supercomputer.’ And he said to me that because of our work… he’s able to do his work in his lifetime,” Huang said.

Other researchers, like Meta AI chief Yann LeCun in New York, began reaching out to Nvidia about the computing power of its chips. Nvidia began considering the AI market when AI had yet to enter the mainstream and was a “zero billion dollar market” or a market that had yet to materialize.

“There was no guarantee that AI would ever really emerge because, keep in mind, AI had had many stops and starts over the last 40 years,” Stevens said. “I mean, AI has been around as a computer science concept for decades. But it had never really taken off as a huge market opportunity.”

Huang and other company leaders still believed in AI and decided to invest billions in the tech in the 2010s.

“This was a giant pivot for our company,” Huang said. “The company’s focus was steered away from its core business.”

Huang highlighted the extra cost, talent, and skills Nvidia had to account for with the pivot, as it affected the entire company. It took 10 to 15 years of effort, but that business decision led to Nvidia powering the AI revolution with an early ChatGPT partnership.

“Every CEO’s job is supposed to look around corners,” Huang said. “You want to be the person who believes the company can achieve more than the company believes it can.”

Related: How to Be a Billionaire By 25, According to a College Dropout Turned CEO Worth $1.6 Billion

![How AEO Will Impact Your Business's Google Visibility in 2026 Why Your Small Business’s Google Visibility in 2026 Depends on AEO [Webinar]](https://articles.entireweb.com/wp-content/uploads/2026/01/How-AEO-Will-Impact-Your-Businesss-Google-Visibility-in-2026-400x240.png)

![How AEO Will Impact Your Business's Google Visibility in 2026 Why Your Small Business’s Google Visibility in 2026 Depends on AEO [Webinar]](https://articles.entireweb.com/wp-content/uploads/2026/01/How-AEO-Will-Impact-Your-Businesss-Google-Visibility-in-2026-80x80.png)