Seeking Schadenfreude – Part 1: The One That Got Away

Devonyu/iStock via Getty Images

~ Tim Murphy, Investing Groups Success Manager

Today we start a two-part series where Investing Groups leaders share their investing mistakes and lessons learned. We have all made several investing mistakes. Maybe like me, that’s what first brought you to Seeking Alpha – I realized I needed to be learning from like-minded investors and analysts. Unfortunately, there are always a few stocks that haunt us on very emotional levels. The very first stock I bought still stays with me. It was a small fiber optics company, JDS Fitel (now VIAV), which was highlighted in the Ottawa Citizen’s business section in December 1997. I was in the second year of my B. Commerce and was eager to start investing. The article discussed the growth potential of fiber optics and I wanted to invest. So I did. To “diversify” my two stock portfolio, I also bought shares in TD Bank (TD).

A year later while in Wales for a 3rd year exchange, I was strapped for cash (maybe a few too many pub visits with friends) and I decided to sell JDS to capture the 20% gains and keep the safer TD stock. A month later, the stock went on a two-year run and went up 20x. Even now as I go back to research the charts, my heart hurts. As expected, it lost 90%-plus during the dot.com bubble and there’s no way of knowing at what point I would have actually sold it. But in my mind, of course I imagine I would have sold it at the peak. I learned a lot from that experience – mainly that it’s good to let the winners run, while also taking partial gains along the way. Below are the questions we shared with Investing Groups leaders and their responses. In the comments below, please feel free to share the journey of an investing decision that still haunts you today. And a shout out to Investing Groups analyst SomaBull for suggesting the series name.

Discuss one stock/idea that still haunts you. Briefly take us on your journey – why did you initially invest? what did you get wrong? What did you learn from this specific stock/idea?

Trading Places Research – Long View Capital: My Seeking Alpha bio warns that the primary risk in following me is “I am also wrong sometimes.” It’s funny because it’s true.

The first thing I wrote about Facebook, before IPO:

“(Facebook) is still in the same social media business that sunk MySpace and Friendster. There is a central flaw to the whole model: Once your mother is on Facebook, you will no longer want to be on Facebook. This will be true for every social media platform; as soon as it gets popular, young people will move on to the next VC-funded funhouse, and I do not believe that anyone will be able to gain dominance for an extended period. There is too low a barrier to entry, and Facebook doesn’t have a moat.

On top of this, everything has already moved to mobile, and the Facebook app is a disgrace, even after multiple retakes on the project. They are finally giving in and moving to native apps, but are way behind everyone else.

I also question their ability to compete with Google in advertising long-term, and I also think there will be a backlash to all this privacy invasion by advertisers.”

Wow. So where did I go wrong?

The FTC let them buy incipient competition. Facebook ads were not only competitive, they were better. They got their act together on mobile, finally. The privacy backlash was much smaller and later than I thought.

I was too slow to change my opinion. Confirmation bias is your enemy.

Disclosure: N/A

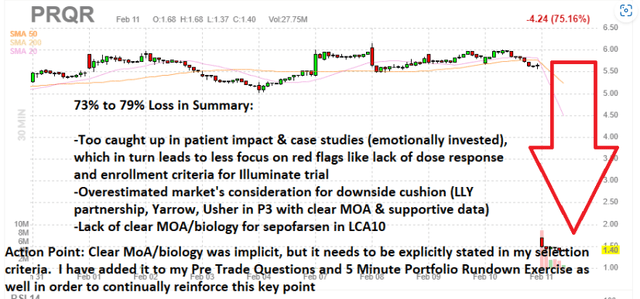

Jonathan Faison – ROTY Biotech Community: ProQR Therapeutics (PRQR) comes to mind in response to the above question. I took a 79% loss in this name after being throwing the dice on a binary catalyst that I had no business being invested in.

The loss was entirely my own fault, as an experienced biotech veteran in our Live Chat reminded me that the MoA and target biology was not clear (lowers the probability of success). I often get too caught up in patient stories, and such was the case with a couple case studies here of super responders to sepofarsen who had this particular form of the eye disease Leber congenital amaurosis. As a result of this and related losses, I’ve tried to focus exclusively on situations where probability of success is highest and where the biology is clear cut. I also try to stick to situations where there’s high downside cushion (other assets in the pipeline, substantial cash position, partnerships, etc.).

ROTY Biotech Community Winners & Losers Page

Disclosure: N/A

Laurentian Research – The Natural Resources Hub: It still hurts that I missed buying Cameco (CCJ) in March 2020, when the stock traded at merely $6. I knew full well the tremendous potential of Cameco – a vertically-integrated uranium fuel vendor in an oligarchic industry – in a uranium bull market, which at the time was unfolding. However, my bid fell short by a few cents, and I watched in shock as the stock gapped up the next day. Regret overwhelmed me as the stock doubled in the next four months.

You might think I have learned from my mistake. Well, I made the same mistake again eight months later: I hesitated to buy a pullback as I still lamented missing the absolute bottom. Today, CCJ trades at around $31 per share.

Laurentian Research for The Natural Resources Hub, modified from barchart

Disclosure: Long CCJ

Edmund Ingham – Haggerston BioHealth: It was January 2022 and the pandemic was raging. Biotech indices were riding high after the industry had successfully delivered two messenger-RNA vaccines with >90% efficacy. This new mRNA technology looked as if it might be successfully pivoted into a range of other disease indications.

The pharma giant Pfizer (PFE) – developer of the Comirnaty mRNA COVID vaccine – made a small investment into a company called Codex DNA, developing synthetic mRNA projects using its DNA technology and workstations, with $240m more in milestone payments on the table.

Despite poor performance since its IPO, with shares falling from >$20, to $6, I liked the deal and acquired shares in Codex. What followed was a near-12 month biotech bear run as investors lost faith in pre-revenue, largely experimental biotechs as a post-pandemic recession loomed.

Codex did generate some revenue from its biotech clients – but not nearly enough – posting revenues of just $27.4m in FY22, and a net loss of $46.5m. A name change to Telesis Bio (TBIO) initially did little to change the downward momentum, although shares are +27% year to date, and guidance for 2023 is for $45m, although profits remain elusive – and I’m down nearly 85%.

What did I learn? Codex / Telesis’ technology is compelling, but uses cases for the technology have not been well established long enough for the products to make meaningful sales. Without an achievable commercial business model in place, the value proposition for investors is absent.

Disclosure: Telesis Bio (TBIO)

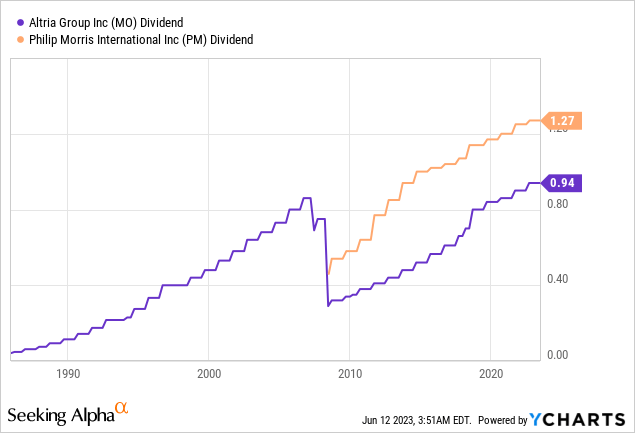

Tariq Dennison – The Expat Portfolio: Overall, my biggest investment mistakes have been in missing the upside rather than in riding the downside. Of these, my No. 1 biggest boo-boo that still haunts my decision-making process 20 years later was the decision to sell my shares in Philip Morris/Altria (MO) after a mere 150% return.

I started buying in 1999, putting an “irresponsibly high” percentage of my then limited savings into this stock because I saw it as a wonderful business irrationally beaten down to a wonderful price, with far more upside than downside. Having lived most of my life outside the US, I still saw plenty of value in the tobacco business at a time this stock was selling at less than the value of just the stakes in Kraft Foods and Miller Beer.

I sold in 2003 because I started a new job with an investment bank with a strict personal trading policy, which I followed too conservatively by selling all my individual stock holdings that year, even though I could have held on to a few wonderful ones like Altria without trading them. Part of my regret was thinking I was giving up Altria for the benefit of my career with the bank, but I was also giving up years when I could have learned to become a better fundamental investor. I have since learned to become less of a trader and more of a long-term owner of the world’s best businesses.

YCharts

Disclosure: Long Altria (MO), Philip Morris (PM) and Kraft Heinz (KHC)

Long Player – Oil & Gas Value Research: America Midstream (AMID) and Buckeye Partners (BPL). These companies were undervalued and then got taken private so investors could not participate in the recovery. I had to learn that undervalued alone did not make a good investment in midstream as too undervalued meant they would go private and come public later (or be sold).

This went with the lesson that the smaller oil and gas companies had too many fraud and manipulative type situations to be able to guide investors through that minefield. So in both cases I don’t cover those areas anymore because it’s too easy for a buy and hold investor to lose money.

Disclosure: N/A

Laura Starks of Econ-Based Energy Investing: Smart Sand (SND) was emblematic of the siren call of frac sand generally, which has disappointed me time and again. It looks like a commodities play but is (cheap) real estate, with very low barriers to entry, or at best a very attenuated third derivative of oil prices. Worse, Smart Sand is a Wisconsin (Northern) white sand supplier far from Texas drilling activity and the market had moved to Permian in-basin or local (brown) sand. See Quick Take: Microcap Smart Sand Upswing (NASDAQ:SND)

Grant Gigliotti – Good Stocks@Bargain Prices: I got the bright idea to invest $40,000 on margin in Herbalife (HLF). I was confident in the fundamentals and that I was buying a good company at a bargain price. At the same time, there was a popular hedge fund manager (Bill Ackman), who was having a short-selling war with HLF and he was doing a good job of promoting his reasons, as to why he thought HLF was going to drop to zero.

The fund manager had a much bigger effect than I had thought possible. I underestimated him and I knew that if HLF dropped low enough in price, it would trigger the sale of my shares through a margin call. I had even considered this before I purchased, but I again underestimated the amount that HLF could possibly decrease by. Long story short, the unthinkable happened, and in a short time frame, HLF fell so low that I had lost $15,000 in a flash! And because I bought on margin, and had to face the consequences of a margin call I wasn’t able to hold and wait it out.

HLF eventually came back and continued to make large gains beyond my original buy price. My lesson learned was that using leverage can be extremely dangerous, especially in the case of using leverage in margin accounts, where if the price drops low enough (and it can happen momentarily), you might not even have a chance to defend yourself, or to wait it out, and you might be forced to take the loss. By the way, I haven’t bought on margin since.

Disclosure: N/A

Chris DeMuth Jr – Sifting the World: I’ve made plenty of mistakes; here’s one that might still be salvaged. Last year was rough for takeover candidates but one bright spot was MLP buyouts. I owned all of them and they all worked. Bids got bumped 20%-40%, allowing buyers to take private MLPs that lost most of their reasons to exist as separate trading companies. But I reached for one last one, GasLog Partners (GLOP), that has been a stinker so far. Their GP made a lowball offer and bumped only modestly, securing a deal at an absurd price – nominally $8.65 but $3.28 is double counted; that’s a special dividend of cash already belonging to GLOP owners.

Units are conservatively worth $10-$12 and traded at $15-$20 before the dividend suspension. Was the special committee innumerate or corrupt? Whatever the reason, they caved to the buyer on every point, making this the worst governance abuse in today’s capital markets: Putting The G In ESG With GasLog (NYSE:GLOP). Holders can save me from this debacle; their vote on this atrocious deal is July 6. We deserve better and can demand better. One shareholder, Tourlite, has led the charge against this inadequate offer, independently reaching conclusions broadly aligned with my own (see nearby image).

Heads we win; tails we tie. If we get the offer bumped to a fair $12 per unit, that would be a return of over 40% from here. If the deal goes through, we get a $0.10 net spread offering a 13% IRR to a close by this time next month.

Disclosure: Long GLOP

Andrew Hecht of The Hecht Commodity Report: It’s more of a repeating mistake I must remind myself of constantly with all risk positions. The initial risk-reward dynamics include profit and risk targets. One is set in stone, the other is variable.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.