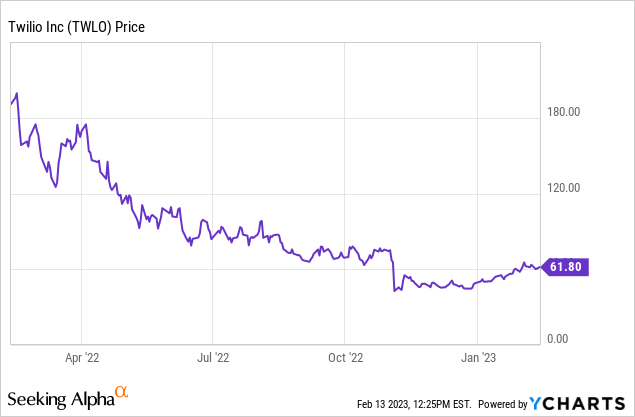

Twilio Q4 Earnings Preview: Buy Ahead Of A Substantial Rebound

Drew Angerer

It’s a big year for tech rebounds, but we have to be extra vigilant that the stocks we’re investing in also have fundamental firepower to justify these gains. So far earnings season is playing out well for most companies, but post-earnings reactions have generally been very volatile – with companies jumping double-digits (which has been more common), or sliding dramatically on weakened profitability or lowered expectations (like Lyft).

Twilio (NYSE:TWLO), in my view, is well-positioned for an earnings rally. Already up more than 20% so far, I think Twilio has a lot of lost ground to reclaim and good news in Q4 could be the catalyst to spark the fire:

I remain very bullish on Twilio and recommend adding the stock ahead of earnings. Twilio next reports on Wednesday, February 15 – and I think we could be in for substantial gains after the report.

Positive read-through from other internet companies

The first topic we should discuss: as a reminder for investors who are newer to Twilio, the company primarily drives growth via a “land and expand” business model. Twilio’s software is entirely usage-based: meaning every single time somebody uses the Twilio API to send an internet-powered text or voice call, Twilio gets paid.

Yes, like many other software companies, Twilio has seen the macroeconomy drag its sales cycles. New deals are taking longer to close. But customers who are already installed on the platform are presumably still using their applications in the same way and at the same pace, so Twilio’s “expansion” growth is not at risk.

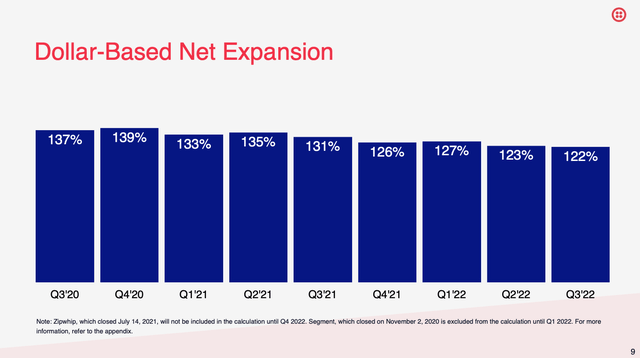

The chart below shows Twilio’s most recent trend of dollar-based net retention rates; so far, Twilio customers have been trending toward a 20%+ net expansion:

Twilio dollar-based net retention (Twilio Q3 earnings deck )

Now let’s turn to reports from some of Twilio’s key customers. Now, Twilio has reached a far more diversified customer base than immediately after its IPO, when Uber (UBER) and Facebook (META) made up a huge chunk of revenue. Even though these companies are a smaller chunk of revenue today, they still provide directional color on how usage trends might play out.

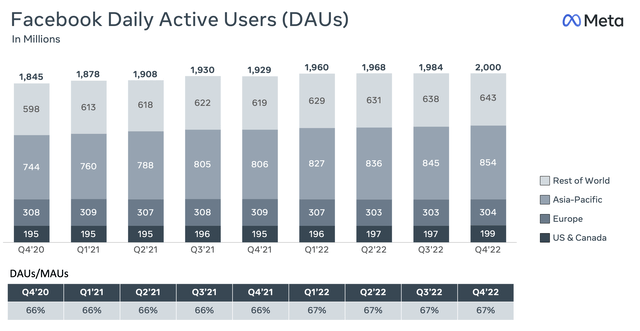

Let’s start with Meta, which reported earnings earlier in February. DAUs rose 4% y/y to 2.00 billion, including a 2-million user sequential increase in users in the US and Canada, which are the highest revenue-generating region.

Facebook DAUs (Meta Q4 earnings deck)

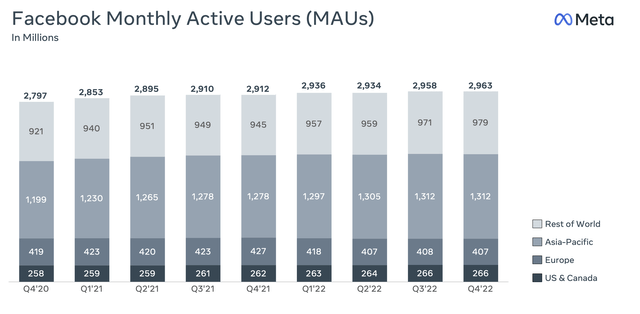

Moreover, Facebook’s ratio of DAUs to MAUs reached a record 67.5%, up from 67.1% in Q3 and 66.2% in the year-ago Q4. On top of this, Meta reported that ad impressions served grew 23% y/y in the fourth quarter.

Facebook MAUs (Meta Q4 earnings deck)

All of this data suggests that activity/usage is up across the core Facebook family of apps, and Twilio – which powers the Messenger function – should benefit from this increase in usage.

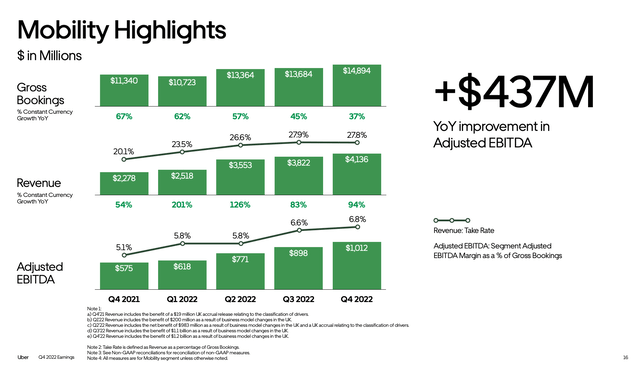

Uber also has positive read-through. Gross bookings in the mobility/rideshare segment grew 37% y/y (lapping against a difficult post-COVID opening comp last year as well):

Uber mobility bookings (Uber Q4 earnings release)

Needless to say, the more people are hailing Uber rides, the more opportunities there are for them to contact their Uber drivers through voice or text – which use the Twilio API, and for which Twilio gets paid per instance.

Focus on cost-cutting

Note as well that just two days before its earnings print, Twilio announced that it would be laying off 1,500 workers, representing a huge 17% chunk of its overall workforce.

On top of this, the company is shrinking its real estate portfolio, which will further reduce its opex run rates.

Already as of Q3, Twilio was nearing a single-digit pro forma operating margin loss. Assuming consistent revenue performance (which will hopefully turn up better than expectations, due to the positive read-through from other internet ecosystem companies), these cost-cuts should help Twilio push above breakeven from a pro forma standpoint.

Twilio is, above all, a company that relies on economies of scale. In particular, it relies on its “land and expand” motion to drive increased usage from its existing install base. If the company can keep up its trend of 120%+ net expansion rates (which activity readings from other internet companies seem to be supporting), on top of a lower expense base, 2023 can really be the year where Twilio’s profitability shines.

Valuation and key takeaways

At current share prices near $62 (factoring in the lift in the stock after Twilio announced its new layoffs), Twilio trades at a market cap of $11.40 billion. After we net off the $4.21 billion of cash and $987 million of debt on the company’s most recent balance sheet, Twilio’s resulting enterprise value is $8.18 billion.

Meanwhile, for the upcoming fiscal year FY23, Wall Street analysts are expecting Twilio to generate $4.43 billion in revenue, up 17% y/y (data from Yahoo Finance). This puts Twilio’s valuation at just 1.8x EV/FY23 revenue.

To me, this valuation (especially when compared to double-digit multiples at Twilio’s peak during the pandemic) signifies plenty of upside opportunity, even after this year’s substantial gains to date. In my opinion, even a whiff of good news during the Q4 earnings release has the potential to send Twilio roaring higher.

Take advantage of current low prices to buy Twilio ahead of a more substantial rebound.

You must be logged in to post a comment Login