AMAZON

The Amazon Table is Open. Place Your Bets!

Marketing on Amazon resembles a game of poker in 2020. You bet, you win, you lose. You can get fantastic wins and you can generate losses. It all depends on your agility, and on who else is playing at your table. And there tends to be more and more players at Amazon Marketing. We interviewed around 25 professional players; Amazon marketing experts, Sellers, Vendors, technology providers, powerful agencies and also a new breed of agencies, fully dedicated to the game.

We discovered this game when we asking a seemingly innocent question to a group of leading Search agencies in 2018. “Are you active on Amazon?”. Whereas 80% of the respondents were involved in shopping campaigns, only 32% were active on Amazon Ads. We discovered this gap in our research for the Search Trends Report and already then, the idea for the new Amazon Marketing Report was starting to take form.

Seven expert interviews, over twenty respondents to a 64-question survey and 67 pages later, we have acquired insight into this magnificent universe of crazy growth, huge gains, and intense competition.

Who plays and who wins?

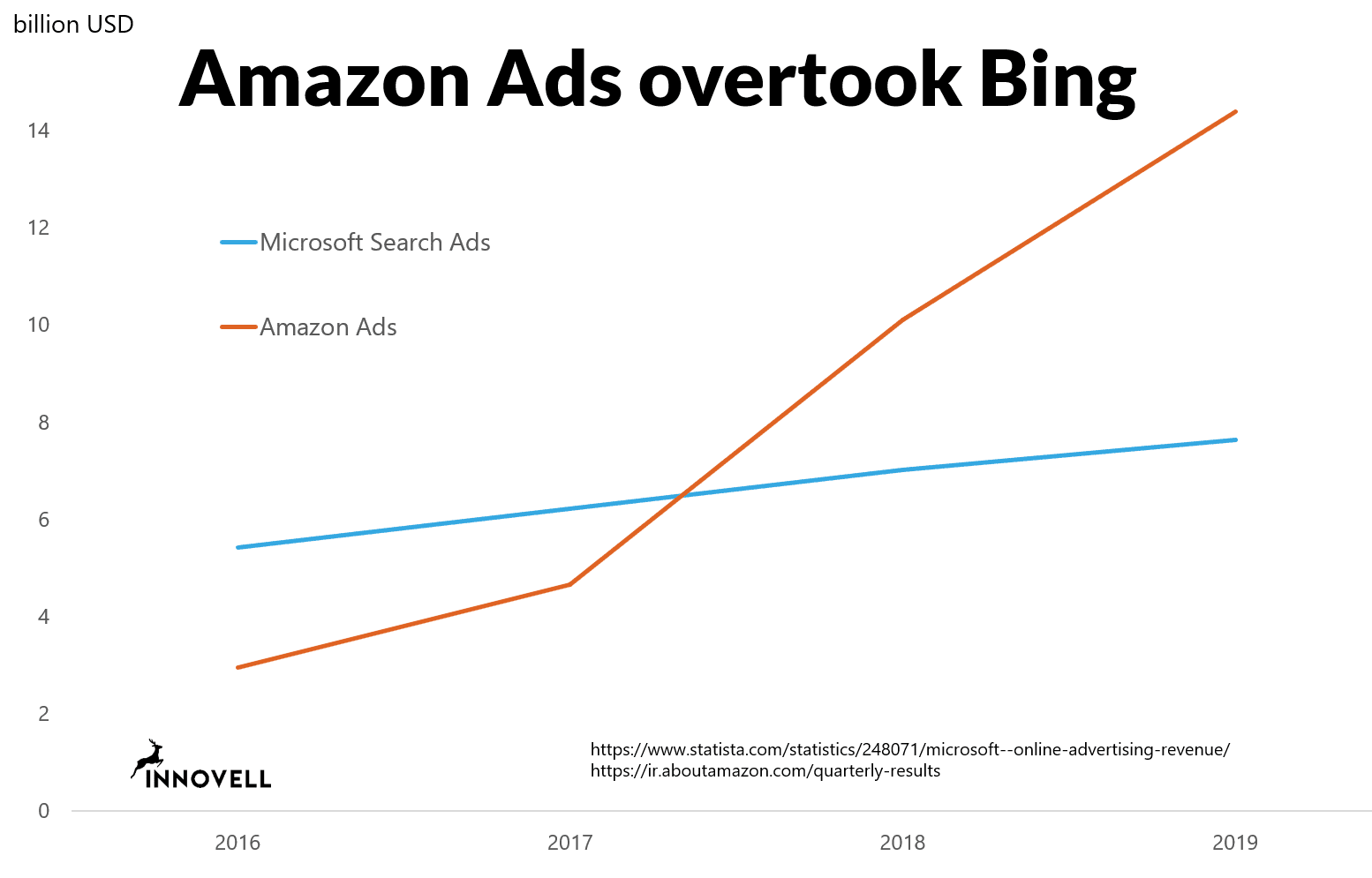

Amazon Ads grew by 41% between 2018 and 2019 and passed the volume of advertising revenue generated by Bing already some time ago. Amazon is now considered part of the Triopoly of global digital giants: Google, Facebook, Amazon. This notion does ignore some major Asian players, but from a European and North American scope, which is what we had in our research project, it is a very useful notion. Amazon is still the smaller player representing around 23% the size of Facebook and 12% of Google, but its’ growth is much higher than the others, and it is therefore taking market share within the Triopoly.

And advertising is not even Amazon’s primary activity. As global ecommerce leader with a 12% market share, Amazon becomes a major force to be counted within several of the strongest growth markets in the economy with consistent double-digit growth.

Operating behind the two types of players mentioned, we find the marketing operators and these are inhouse teams, digital marketing agencies and this new type of agency which we have called the Amazon-specific agencies; fully dedicated to marketing on Amazon and often created by ex-Amazonians. It is almost like history repeating itself. How many search agencies were created by Xooglers (ex-Googlers), I wonder?

However, the biggest surprise in the game is that Amazon is a player itself. Either as an operator for Vendors, or with its’ own brands like Amazon Basics and all the time aiming to perform on its’ two obsessions: user experience and sales growth.

So, who is winning this game? Our experts gave a large range of opinions, like Megan Harbold of Kenshoo explaining how it used to be the brands and then it used to be the size of the budgets that matters, but today it is about being present and optimizing for the entire user journey to succeed.

Some inputs were surprising, like the input from Tanner Schroeder of Hanapin Marketing who simply stated that Prime is the big winner presently. For Nils Zündorf from factor-a, a tools provider it is clearly the end user who is the winner and finally for Evan Facinger from Foremost Media it is Amazon. « Because Amazon is forcing everybody to do it the way they want ». Lots of winners but not necessarily the ones we expected.

What are the rules of the game?

You can explain the marketing mix on Amazon in a very simple manner by revisiting one of the most well-known marketing models created by McCarthy in the 1960’s, the 4 P’s of marketing. The product, its definition and description, the price which plays a major role, the place which we define both as the geographic dimension for delivery as well the semantic territory (keyword positions) where the product is placed, and finally promotion incorporating advertising, special operations and peak events. Operation on the Amazon platform really requires one to optimize all 4 dimensions of this model and not just one of two. The importance of managing price was put in perspective by Nils Zündorf: « Advertisers are worried that Amazon will destroy their price if they launch their products on the platform. But Amazon already destroyed the price. »

Beyond these four marketing dimensions, it is important to remember, that Amazon is first and foremost a search engine and has an algorithm deciding, what the user will see. « It is a bit like Google 10 years ago ». Similar yes, but also different, because the sale will be a contributing factor to deciding, what products will appear in search and in the buy box. The faster a product is selling, the better its’ position. This « sales velocity » is part of the algorithm and thanks to this factor, there is an almost direct positive impact of advertising on positioning in the search results. This is very different from Google, where we have heard ourselves explain again and again that: “NO, there will be no direct beneficial impact on your SEO from your Google Ads spend”. Advertising is not a ranking factor. On Google.

Obviously, there are many other factors than the Sales velocity. We have categorized them in 3 sections: User experience obsessions, Sales maximization and Product attractivity. The successful Amazon marketer will act on the 4 P’s and aim to optimize the user experience and product attractivity and maximize their sales. They will do this with data. Amazon is a data-driven platform and the marketer is a Data marketer tracking KPIs, applying optimization cycles and testing all along.

How do you win?

To win a game of poker, you need to decide what cards you are betting on. To win at marketing on Amazon, you need to select the products you want to put in the game. Product selection is the first strategic choice you need to make, and it can have an impact beyond the Amazon platform. In the Amazon Marketing report, we detail four different winning strategies. They are not contrary strategies rather they correspond to different maturity stages in Amazon marketing. All the strategies have an advertising element to them. It is similar to betting – if you don’t bet, we believe it is difficult to win on Amazon today. A strong brand is not enough, products without competition hardly exists, and we rarely see players who have a significant price advantage over competing products.

We named one of these strategies “Holistic takeover”, and it was inspired by an expert Amazon marketer named Cherie Yvette. This strategy is for mature Amazon marketers, and is a real all-in poker game, where you identify a product with a strong position, analyse competitors and especially the category leader, build a feasibility and risk assessment for a category takeover, and then saturate the entire competitive space with advertising, in order to build the necessary sales velocity to become the top seller. If the strategy succeeds, you will typically have more than doubled your sales and probably lost money in the process – money you will win back quickly by maintaining your category position at a much higher leverage.

So, to win at this poker game…

Before placing your bets, you need to analyse your cards carefully. Do you have strong hand? Should you rather quit or wait for better cards? How many cards do you need to change to have a winning hand? And how fierce do your adversaries look?

Do you have the right hand? Yes? Then it is time to go all-in and dominate the table.

Source : « Marketing on Amazon in 2020 », Innovell February 2020, https://www.innovell.com/amazon-marketing-report/