SOCIAL

Inside the creator marketing trends expected to go viral in 2024

In a world that’s increasingly online, the creator economy is primed for the spotlight. Digital video consumption has reached an all-time high, led by creator content, and advertisers are shifting more dollars toward smartphone-yielding creatives. Some are willing to bet that the days of creators being viewed as a supplement to advertisers’ playbooks are gone. Instead, creators could become the foundation.

“Starting first with creators when it comes to advertising is definitely the wave of the future,” said Ali Fazal, vice president of marketing for creator management platform Grin.

This year, 44% of marketers plan to up their creator investment, with an average spending increase of 25%, according to a creator economy report by IAB and TalkShoppe. The landscape was last valued at $250 billion and is expected to grow to a whopping $480 billion by 2027, Goldman Sachs forecasts. As creators become more cemented in advertiser budgets, the role they play could grow, graduating from the experimental bucket to a category of their own. While the terms creator and influencer are often used interchangeably, the key difference is purpose, with an influencer being a type of a creator that uses their platform to promote products and influence buying decisions.

Influencer marketing agency Billion Dollar Boy is among those experimenting with the concept of creator-led advertising. The agency last year teamed with Lipton Iced Tea for an international creator-led campaign that spanned digital out-of-home, social media and experiential and was centered around an original song performed by TikToker Matt Storer with support from a slew of other creators. In total, the campaign achieved a video view-through rate of 23.9% while the brand saw a sales uptick of 15% in Australia during the campaign’s two-week run.

The example above signals the edge that creator-based advertising provides over traditional tactics in the digital age, according to Ed East, Billion Dollar Boy’s founder and global CEO.

“[Previously] you would have had creator activity, influencer marketing, bolted onto a plan. Now, creator activity needs to be at the heart of your plan,” said East.

As advertisers ramp up their creator investments, trends anticipated for 2024, like new ways of measuring success and long-form video’s resurgence, could change strategies for some. Meanwhile, growing hype around generative artificial intelligence (AI) and social commerce could offer brands fresh opportunities to break through.

The science of being #influenced

Beyond consumers’ general appreciation of creator content are signs that such content is more meaningful than studio-made ads, like scripted video content that appears on TV, per the IAB’s report. Creator ads have a 1.4-times greater impact on building brand loyalty and a 1.3 times greater impact on inspiring brand advocacy, according to the findings.

It’s worth noting that an appreciation for creator content comes as consumers are posting less content of their own across social channels, according to Ellyn Briggs, a brands analyst for decision intelligence company Morning Consult. The insight could help lend more visibility to brand and creator collaborations, though what Briggs forecasts to be an “uber volatile landscape” for social media marketers this year could usher in more consumer skepticism.

“Influencers especially are going to need to fill a content void,” Briggs said. “But with that brings an additional level of attention and potential scrutiny to influencer activity, which, as we’ve seen [in 2023], can increase the chances of backfiring.”

Creator campaigns gone wrong are nothing new, Briggs added, pointing to Shein’s all-expenses-paid influencer trip last year, which faced backlash when those involved gushed about the company’s often-criticized labor practices. Though consumers these days are increasingly likely to call out inauthentic content, they continue to place deep trust in creators, tasking creatives to rethink how they reach their audiences.

“I think we can officially say that in 2024, using follower count to determine an influencer’s potential success is dead.”

Ali Fazal

Vice president of marketing, Grin

“The way influencers sell is going to change because we are seeing that consumers are voicing their frustrations with things like overconsumption and constantly being sold to,” said Megumi Robinson, vice president at digital PR firm Belle Communication.

A trend Robinson expects to grow in 2024 is that brands and creators will be more selective around who they partner with, and repeat partnerships will be more common. This year is also likely to see less pay-to-play tie-ups where creators take on brand deals despite having no real connection to them, according to Fazal, who noted that consumers aren’t blind to such partnerships.

“It’s pretty obvious to me that Nicole Kidman does not use Lancôme makeup,” Fazal said with a laugh.

For more relevant content, Fazal also anticipates that marketers will increasingly hire creators to produce content specifically for brand-owned channels, versus sharing the content to the creator’s pages. Such is the case for Uber, which built out a TikTok creator strategy that leverages no more than six creators at any given time to make content for the brand.

“Creators being on their own and working with no confines are able to be a lot more innovative, bold, daring, and as a result, the content is more effective,” Fazal said.

Follower count is ‘dead’

A focal point in the creator space has often been the use of either micro or macro influencers, each lauded for different reasons: micro influencers typically carry stronger engagement rates despite smaller followings, while macro influencers have massive reach. However, Robinson anticipates the best of both worlds will be found in a rising mid-tier category, classified by the exec as those yielding 50,000-800,000 followers.

“What we’re seeing is a lot of these micro creators, who might have a little bit smaller audiences but really strong engagement rates, they are gaining more followers and growing, but they’re able to retain that level of engagement rate,” Robinson said.

As the landscape evolves, the use of follower count as a sole consideration is likely to fizzle out of the conversation, Fazal predicts, noting that the metric alone isn’t as strong of a success indicator compared to aspects like engagement. Additionally, as brands strive to build a more diverse creator strategy — another forecast from the exec — follower count often favors those not from diverse backgrounds.

“I think we can officially say that in 2024, using follower count to determine an influencer’s potential success is dead,” said Fazal.

Fazal also anticipates more variety in content formats, noting that while short-form videos aren’t expected to fall from popularity, longer-form content will see a resurgence as consumers indicate a want for granular insights and deeper connections. Such has become the norm on top-dog TikTok, where viewers often request a part two and three on shorter videos, a sentiment TikTok appeased with the addition of 10-minute videos. For marketers, the opportunity to tell a longer story could make a difference, especially during the key holiday marketing period.

“Over time there has become this perception that millennials and Gen Z in particular can’t focus, we have to make things quick, and we’ve seen that this bet has failed time and time again,” Fazal said.

Still, short-form has been a growing focus for platforms, particularly TikTok, Instagram and YouTube, with the latter two consistently layering in new features and monetization tools for their Reels and Shorts products in a bid against TikTok. Social media is expected to see increased spend from advertisers in 2024, forecasted to account for $227.2 billion of ad spending this year. The boost comes as e-commerce marketing remains strong, with social platforms often fitting well into marketers’ customer acquisition and loyalty strategies.

Beyond what Fazal labels as the “big three” platforms for influencer content, others have similarly ramped up efforts to court both creators and advertisers. Snapchat recently began experimenting with a creator-led content series concept and added sponsored links to its My AI generative AI chatbot. Accordingly, East anticipates the platform could take a bigger role in the creator landscape.

“[Snapchat] appears to be the talk of the town because of engagement and the monetization opportunity they’re now offering,” East said.

Social commerce, AI present opportunity

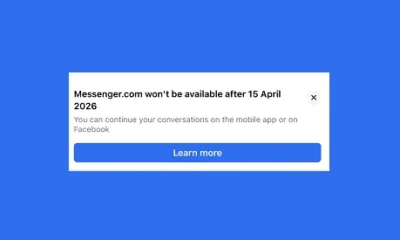

As marketers map out their creator plans this year, a key focal point has the potential for social commerce. The interest follows the recent debut of TikTok Shop in the U.S., which has so far seen tepid results, though brands have expressed excitement. For some, it has proven to be a major opportunity — beauty brand BK Beauty activated TikTok Shop and within three months said it had more than doubled revenue, according to Adweek.

“We’ve already seen a lot of early signs that TikTok Shop is a big success,” Fazal said.

Total social commerce sales in the U.S. are expected to grow steadily from $67 billion in 2023 to over $144 billion by 2027, per Insider Intelligence. More broadly, for brands using influencers, Briggs recommends that they take note of the types of content favored by social media users, like product hauls and daily routine videos, which have been successful for driving purchases. Specifically, 53% of Gen Zers made a purchase after watching a “review” video on social, while haul and get ready with me (GRWM) videos drove 40% and 37% to purchase, respectively, per Morning Consult data.

The seamless shopping experience touted by social commerce could be what elevates the playing field, with 46% of buyers indicating that they are interested in buying products from social media with a one-stop shop experience, according to 2023 Comscore data shared with Marketing Dive. Still, as experiments in the space grow, Fazal urges marketers to adjust their expectations for social away from being a path to instant purchase.

“A lot of times when people think of influencer marketing, they will compare it or benchmark it against other advertising channels like paid ads, which are meant to be first touch conversion. But I would say to think of influencer marketing the same way you would think of a TV commercial or a billboard in that it requires multiple impressions to be successful,” Fazal said.

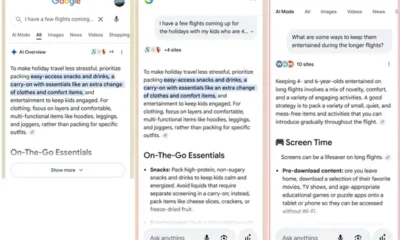

Among other questions under consideration is how generative AI could serve the creator space. Particularly, the tech could provide efficiencies for creators by streamlining back-end tasks like planning and organizing, Fazal said. Influencer-focused companies, including both Billion Dollar Boy and Grin, have also joined the hype with services that hone a focus on the tech.

“I do think in 2024 we might see more of this influencer-plus-AI combination.”

Ellyn Briggs

Brands analyst, Morning Consult

There’s also the concept of virtual influencers, like Miquela, who has already teamed with brand Pacsun, that could potentially come more into the mainstream as AI helps the computer-generated figures look more lifelike.

“These virtual personalities, created using advanced AI technologies, can offer brands new and innovative ways to engage with audiences, especially in the realms of fashion, technology, and entertainment,” said Alex Dahan, founder and CEO of global creator marketing company Open Influence.

Still, while virtual influencers offer some advantages over actual creators, like the ability to promote anything without qualms, the human element is key to forming authentic connections. Likely not a shock, analysis from Morning Consult has found that consumers trust recommendations by influencers far more than those from AI.

“That being said, I do think in 2024 we might see more of this influencer-plus-AI combination,” Briggs added.

Similar to broader applications of AI, the question of where AI fits within creator marketing is yet to be answered. While creators could benefit from using the tech for mundane tasks, allowing for extra time to be creative, those who grow overly reliant on it could raise red flags among an already observant consumer base, Robinson said.

“It will be very apparent, those who might just totally rely on AI, and that’s going to erode trust and authenticity, and could then make consumers even more skeptical,” the exec said.