SOCIAL

Snap: Downgrading To ‘Hold’ As Turnaround Has Been Slow (NYSE:SNAP)

stockcam

Back in March, I said that while Snap (NYSE:SNAP) was facing a number of issues that it had a valuable platform and expectations were low for the company. Since then, the stock is down -14% versus a 7% increase for the S&P 500. Let’s catch up on the name.

Company Profile

As a quick reminder, SNAP is a social media company whose primary offering is Snapchat, a messaging app where users share videos, photos, texts, and other forms of media. Users can apply filters, graphics, stickers, and animation to photos and videos using one of SNAP’s over one million different lenses. The platform also has other features such as Snap Map, Stories and Spotlight. The company generally generates most of its revenue from advertising, although it does as a subscription service as well.

Q3 Results

For the most-recent quarter, SNAP saw revenue increase 5% to $1.13 billion. That topped the analyst consensus of $1.11 billion. North American revenue fell -3% to $786 million. European revenue jumped 24% to $200 million, while Rest of World revenue soared 20% to $202 million.

The company saw its Snapchat+ subscription service reach more than 5 million subs and revenue grow more than 250%. Based on its $3.99 monthly cost, that would be about $60 million in revenue by my calculation.

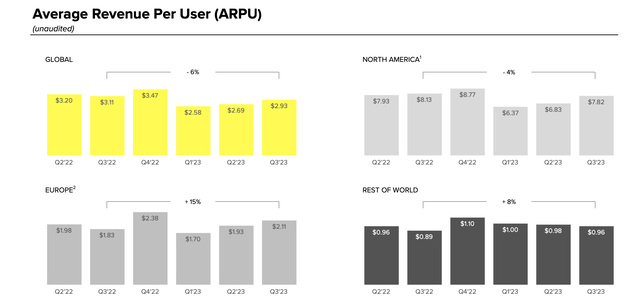

Average revenue per user (ARPU) came in at $2.93, down -6% from $3.11 a year ago. However, it increased 9% sequentially from $2.69.

North American ARPU fell -4% to $7.82 from $8.13 and was up 14% quarter over quarter. European ARPU jumped 15% to $2.11 from $1.83 and was up 9% sequentially. Rest of World ARPU climbed 8% to 96 cents, but was down -2% quarter over quarter.

A big part of my earlier thesis was that SNAP had some nice room to improve its ARPU, especially outside the U.S. That has been happening. However, U.S. APRU has struggled, as advertisers overall started to pull back on spending earlier this year. Now there has been some sequential improvement as advertising spending has returned, but SNAP is not seeing as big as a positive impact as many others such as Meta (META), owner of Facebook and Instagram, and “Buy” rated Pinterest (PINS), which saw a 5.4% year over year jump in North American ARPU. That shows advertisers are coming back, but spending their marketing dollars on other platforms.

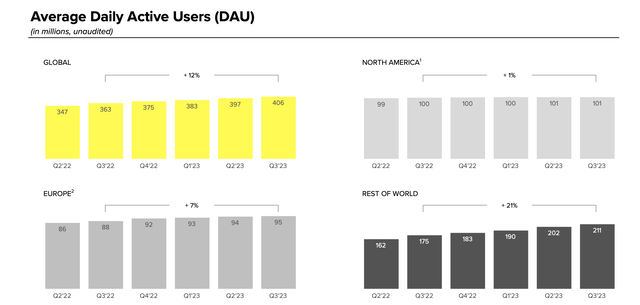

Daily active users (DAUs) jumped 12% to 406 million and was up 2% sequentially. North America DAUs rose 1% to 101 million users and was flat quarter over quarter. European DAUs climbed 7% to 95 million and rose 1% sequentially. ROW DAUs soared 21% to 211 million and increased 4% quarter over quarter.

SNAP DAU (Company Presentation)

This is nice gain for SNAP and shows its growing popularity. However, most of this in coming from regions that have much lower monetization, so without the bigger ARPU increases it doesn’t have a huge impact on numbers.

Adjusted EBITDA came in at $40.1 million, down -45% from $72.6 million a year ago. The company had $357.9 million in stock-based comp in the quarter that gets removed from EBITDA. I’ve long said, stock based comp is a real expense, and the fact the company will buy back shares to offset the dilution shows this. As such, the positive EBITDA number doesn’t indicate the stock is profitable in my view.

Adjusted EPS came in at 2 cents, surpassing analyst estimates by 7 cents. It recorded adjusted EPS of 8 cents a year ago. This number once again removes stock comp.

SNAP generated $12.7 million in operating cash flow, while free cash flow was -$60.7 million.

Looking ahead, the company said it was imprudent to provide formal Q4 guidance but that its internal forecast is for revenue of between $1.32-1.375 billion, representing between 2-6% growth. It is projecting EBITDA of between $65-105 million. It is looking to reach between 410-412 DAUs in the quarter.

Asked on its earnings call why the company was predicting a deceleration in Q4 compared to Q3, CFO Derek Andersen said:

“As we move into Q4, Q4 is a little bit different as a quarter. Historically, we’ve seen a little bit larger share of the revenue coming from brand products in Q4. And then the Q4 business being a little bit more back-end weighted than other quarters historically as well. So both of those things sort of impacting visibility and brand having grown at a slower rate in Q3, and being a larger share of the business in Q4 sort of brings a little bit of a mix shift headwind. And then last, the point that you raised very specifically, which is what we’ve seen since the onset of the war in the Middle East is, we have had a number of primarily brand-oriented campaigns pause spending in the early period after the onset of the war there in the Middle East. I will say that we have seen a lot of those campaigns resume spending. And the impact to our daily run rate has reduced significantly as a result of that. But we also have seen a very small amount of incremental campaign positives triple in more recently. And so one of the things that we’ve tried to do here when we’re thinking about giving forward-looking information for Q4 is, number one, be transparent about what we’ve seen quarter-to-date on that side. And then — I think when we look back historically, for example, to what we all experienced at the onset of the war in Ukraine and the impact that, that had on folks’ business and the operating environment. I think we’ve very realized that war is fundamentally unpredictable. And as a result, it would be imprudent to provide a formal guide in that kind of an environment.”

Overall, it was a mixed quarter from SNAP. The company is still seeing solid DAU growth outside of the U.S. and it is also growing ARPU in these regions. Improving ARPU internationally is a big opportunity, so that is a nice positive.

However, ARPU continues to be down meaningfully in North America despite the company continuing to invest a lot of resources into the product for users and advertisers. Now the company did see some sequential improvement, but the continued year over year declines isn’t something you’d like to see, especially when peers are seeing year over year increases as the ad market has started to bounce back.

At the same time, the stock-based comp expenses that the company is paying out is pretty egregious on pace for well over $1.2 billion. While its non-cash, this is a real expense and the company continues to look to buy back shares to offset the dilution from it. This is just shuffling the deck to make EBITDA look better.

Valuation

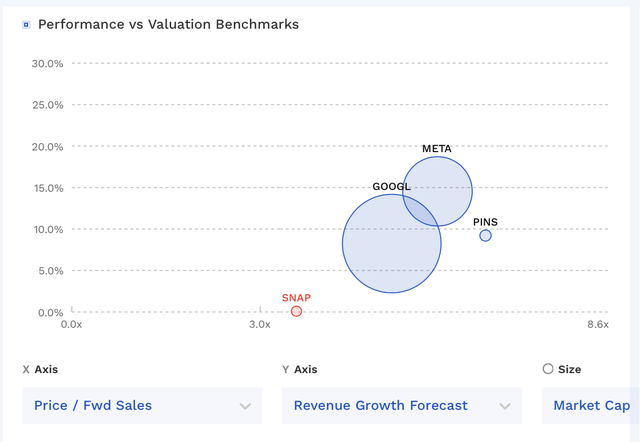

SNAP trades at a P/S ratio of 3.6x based on the 2023 revenue consensus of $4.61 billion and 3.2x based on the 2024 revenue consensus of $5.18 billion. Its growth for this year is projected at only 0.1%, before climbing over 12% next year.

On an EV/EBITDA basis, it trades at around 171x based on the 2023 consensus of $96.3 million. Based on the 2024 consensus of $269 million, it trades at a around a 61x multiple. These estimates are down monumentally since I last looked at the stock.

SNAP trades at a similar P/S multiple as its social media peers, but at a higher EV/EBITDA multiple. Notably, it and Pinterest (PINS) are still in their earlier days on monetization compared to companies like Meta (META) and Alphabet (GOOGL).

SNAP Valuation Vs Peers (FinBox)

Conclusion

SNAP has a valuable platform that reaches a key marketing demographic. However, the company has struggled to execute, as evidenced by the stock falling after earnings seven straight quarters, and by double digits four of those times. At the same time, while the advertising market for social media has bounced back, competitors have benefited much more than SNAP.

When taking into account its stock-based comp, the company is nowhere near being profitable anytime soon, as adjusted EBITDA is not expected to surpass its $1.2 billion in stock comp until 2028, according to analyst estimates. As a percentage of revenue, stock comp is about 30%, which is a huge amount.

At the end of the day, SNAP is probably best off selling itself to a company that can better operate it and monetize its user base, while taking out costs. However, finding a buyer might not be an easy thing and founders Robert Murphy and CEO Evan Spiegel control over 99% of the company’s voting power.

As such, in this current environment, I think it is best to downgrade the stock to “Hold.” Given the market sell-off, there are better investment opportunities out there.