AFFILIATE MARKETING

How I Used Pinterest to Build a Six Figure Blogging Income

Overview

Business Name: FinSavvy Panda

Website URL: https://www.finsavvypanda.com

Founder: Bonnie (Ling) Thich

Business Location: Online (Canada)

Year Started: 2017

Number of Employees/Contractors/Freelancers: 2

Tell us about yourself and your business.

Hi, I’m Ling, the founder of the personal finance blog, FinSavvy Panda.

I started blogging in November 2017 and I’ve been doing it full-time since 2019. The topics covered on FinSavvy Panda include ways to save money, make extra money, and some beginner tips on how to start a profitable blog.

I also work on a few other blogs on the side to test my ideas in other niches that are outside of the personal finance space.

Prior to running an online blogging business, I worked as an Analyst in the wholesale banking area for a major financial institution. It was pretty comfortable, and I enjoyed working with different stakeholders, but my heart just wasn’t there. Deep down, it felt like I needed to do something different from the regular 9-5 but I just didn’t know what it was. Then, one day, when I was looking for profitable hobbies, I stumbled upon the idea of blogging. That’s when there was a calling within me to start a personal finance blog.

And here I am! I’ve been running my blog, along with other websites, and earning a six-figure full-time income for 6 years!

How does FinSavvy Panda make money?

I earn an income through a mix of affiliate marketing, display ads, and digital products.

A chunk of my earnings come from affiliate marketing where I would recommend products and services I love and personally use to my readers. Whenever a reader buys or signs up for one of my recommendations, I would earn a small commission. One of my favorite affiliate networks is Impact Radius. They offer a variety of affiliate programs for bloggers in any niche.

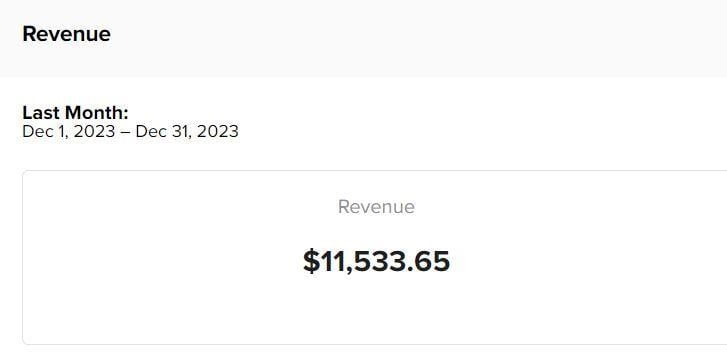

Aside from affiliate marketing, I also earn money through Mediavine display ads, which require a blog or website to receive at least 50,000 sessions (approximately 60,000+ monthly pageviews) to apply. Here is an example of how much one of my blogs earned from Mediavine display ads last month.

Lastly, I provide a range of digital products specifically designed for my audience, including The Power-Up Budget Binder, The Treasure Map To Blogging Success in 30 Days, The Golden Compass To Pinterest Traffic, and PinSavvy Pinterest Canva Templates. These are products I created to help my readers learn how to budget, save, and earn extra money from home.

What was your inspiration for starting FinSavvy Panda?

Back in 2017, I was always searching on Google for ways to make money online. I was also searching for business ideas that I could do from home. I accidentally stumbled upon the idea of starting a blog and I never really knew what that meant.

But as I was reading more and more about bloggers’ stories and how they generated anywhere from six to seven figures a year, I was convinced that this may work out for me. Since my circle of friends, coworkers, and family members always asked me for money advice, I decided to start a blog about personal finance where I document all my favorite ways to save and earn extra money.

How and when did you launch FinSavvy Panda?

I started playing around with the idea of blogging somewhere in November 2017. Though I didn’t have a “launch” day, I guess you could say I launched it in November. That’s the month where I started publishing blog posts and creating a Pinterest business account for my website.

How much money did you invest to start FinSavvy Panda?

Starting a blog is so cheap that I don’t think I really invested much money. During that time, I didn’t even think of it as an investment since it was just a hobby that I wanted to try. I spent only $100 for a 3-year hosting plan, which is equivalent to $3 a month.

Aside from the hosting plan, I also purchased a beginners’ blogging toolkit for $100 in addition to an affiliate marketing course for $200. In total, I spent $400 including the hosting plan for the first couple of years to learn how to start a profitable blog.

How did you find your first few clients or customers?

Since I hadn’t developed a product or offered any service when I started my blog, I didn’t have any clients or customers.

In fact, most of my income stemmed from display ads and affiliate marketing programs, which were purely driven by traffic from Pinterest. To get those pageviews, I created a Pinterest business account. It was through Pinterest that I attracted my first readers and e-mail subscribers.

Once my readers warmed up to me, they began asking me questions about budgeting in addition to questions about how they can achieve financial independence by saving and earning extra money online. That’s when I created my budgeting binder, The Power-Up Budget Binder, in addition to a few profitable blogging resources like The Treasure Map To Blogging Success in 30 Days and The Golden Compass To Pinterest Traffic to serve my first clients and customers.

What was your first year in business like?

If I had to be honest, the first year felt very frustrating because I didn’t feel like I was getting any results, especially during the first several months.

I didn’t get much traffic and I didn’t make much money. I had only earned like $20 from Google AdSense in my first few months combined. During that time, I also didn’t know that it would take longer for me to see results because I was naïve and believed other bloggers’ stories of how they made over $300 within their first month of publishing their blog posts (of a brand-new blog), and a full-time income by 3 to 5 months.

Despite those claims, I just chipped away and continued learning many aspects of blogging including Pinterest, Google SEO, affiliate marketing, e-mail marketing, etc. That all took time but the good thing is it didn’t feel like work to me because I genuinely enjoyed the learning process. I was still at my full-time job, so I spent mornings and evenings tackling this project. I would say I spent anywhere from 10 to 25 hours a week. I kept doing it and I was pretty consistent without showing any signs of stopping.

By 5 to 6 months, I finally earned my first $1,000 and from there it just grew. And within my first year of blogging, I was able to earn my first $5,000 monthly income, which was a huge milestone for me.

What strategies did you use to grow FinSavvy Panda?

I would say mostly Pinterest marketing in addition to nurturing my e-mail list. I also spent time learning Google SEO and implementing what I learned, but in hindsight, it was a distraction since I never really got any mind-blowing results with Google.

Most of my efforts were spent on building relationships with my readers and helping them by answering their questions. A lot of people would call me crazy and say it’s a waste of time because this strategy isn’t very passive. Though this wasn’t one of my passive ways to earn money, I have to admit that this effort resulted in a high ROI for me.

There is a saying by Thomas A. Edison that goes “Opportunity is missed by most people because it is dressed in overalls and looks like work.”

Tell us about your team.

I have a writer and VA on the team. It’s a personal blog so I’d like to keep it simple.

How did you make the transition from side hustle to full-time?

I quit my job once I earned my first $5,000 monthly income within my first year of blogging. However, I still viewed it as a hobby and I did not know what I was getting myself into, so I didn’t consider it a full-time income yet. I just took the plunge to see how things would turn out.

Once I earned my first net six-figure annual income in 2019, that’s when I felt it in me to transition to a full-time blogging career. Still, it didn’t feel like this was “full-time” because I was feeling iffy. I just wasn’t sure if I could sustain the income since the idea of running a blog felt foreign to me. Needless to say, as each month passed with a healthy amount of net earnings, I felt comfortable enough to say, “Hey, being self-employed online is my life now. That’s my new normal so I’m going to learn how to adapt to this lifestyle.”

It wasn’t until now, December 31, 2023, as I’m writing this, that I am starting to feel more and more comfortable with the uncertain nature of running an online business. It’s been 6 years since I started blogging full-time, and throughout all those years until now, it has sustained a net six-figure income. Looking back, it all seemed fine, but a lot of times felt uncertain and I just didn’t know what was going to happen. As we speak, I am just going with the flow. It’s always a learning process for me, so I will continuously adapt, learn, and implement different strategies.

To answer your question, it’s hard to say when the transition from side hustle to full-time happened. It just happened gradually over time as I developed a habit of being self-employed working anywhere I want with a laptop.

What is your best-selling product?

My best-selling product is The Treasure Map To Blogging Success in 30 Days. This is an A-Z guide that teaches beginners how to start and launch a successful blog from scratch. Many people have the desire to earn money by working from home or becoming a digital nomad, so I created this product to help my readers achieve their dreams of making money online.

What was the biggest challenge you had to overcome?

The biggest challenge I had to overcome was acknowledging and accepting the fact that my blog, or any business, is never going to feel “safe,” no matter what social media and entrepreneurs claim. While they often paint a rosy image of their business’s success, you’ll rarely hear about the dark side or the struggles and challenges they face.

For example, in the early days of my blogging journey, my Pinterest account was suspended, and I lost all my Pinterest traffic overnight. It took months before I managed to get my account reinstated. I feared it was the end of my blogging career because you often hear stories from content creators that if you’re suspended for over a month, it’s pretty much hopeless, and you’ll never get your account back. However, I didn’t follow that advice. I persisted, and after many attempts, I finally got my Pinterest account back! Had I listened to the negative and false advice out there, I wouldn’t be here today.

As I went through more bumpy roads, I came to realize that there will be good times and bad times. During the good times, you need to save for the rainy days to help you ride out the bad times.

What are some of your favorite books?

My favorite books are Atomic Habits, The Four-Hour Work Week, and The Monk Who Sold His Ferrari.

What is your favorite quote?

Be fearful when others are greedy and be greedy when others are fearful.

Warren Buffett

AFFILIATE MARKETING

Gear up for Summer Camping with $22 Off This Power Bank Flashlight

Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a small share of the revenue from the sale from our commerce partners.

Summer is almost here and spending time outdoors is known to ease stress and anxiety and enhance cognition. If you plan on spending some time in the great outdoors with clients, employees, or family, you should make sure you have the right tools. We’re not talking about tents and camping stoves; we’re talking about emergency tools, like this Outdoor Flashlight with Flame Simulator & 2400mAh Power Bank.

This light can keep your devices powered up, which keeps you reachable and able to handle any potential work emergencies. It also has a cool LED screen that simulates a campfire to add to the fun.

Most importantly, this outdoor flashlight provides ultra-bright LED lighting to give you visibility at night. The fireplace simulator mode also adds some light, with an adjustable flame setting that helps set the ambiance and provides some additional visibility while mimicking a real fire.

The durable flashlight is made with COB technology to provide a bright and even light output and is rechargeable via a USB-C charger or via solar panels during the day. It can last for up to 24 hours on a single charge and is built to withstand all weather conditions.

And perhaps best of all, it features a compact, portable design that makes it easy to pack in your car or carry in your backpack. Whether you’re going fully off the grid or just spending a night in the backyard with the family, it will come in handy.

Gear up for summer entertaining and fun.

Right now, you can get this Outdoor Flashlight with Flame Simulator and 2400mAh Power Bank for just $39.99, a 36% savings from the original price of $62.

StackSocial prices subject to change.

AFFILIATE MARKETING

How to Know When to Hire Your First Employee

Opinions expressed by Entrepreneur contributors are their own.

At some point as an entrepreneur, you’ll face a challenging decision: When is it time to hire your first employee? After incubating the idea of your startup. then deploying your resources and making it all happen, at some point you may realize it’s time to bring someone else in to help you achieve your vision and grow the business. It’s exciting, but at the same time, can be daunting. What if the new hire doesn’t work out? What if you hire too many people or too few?

Entrepreneurs are inherently self-starters and ambitious, and shifting responsibilities to new workers can be difficult – but it’s a necessary step for growth. A company needs support to grow and thrive. You can’t do it all on your own, which makes hiring employees — especially the early ones — a crucial step toward entrepreneurial success. Before you do anything, though, ask yourself: Is this the right time to hire?

Knowing when you shouldn’t hire

Before addressing best practices for hiring, it’s vital to recognize common pitfalls entrepreneurs face when starting to grow their workforce – that starts with knowing when not to hire. Similar to making big life decisions, you should avoid hiring employees out of anxiety or uncertainty. Your choices should be deliberate and strategic. Take a step back and reconsider hiring employees if you find yourself in the following situations:

You’re desperate

If you have more work than you can humanly handle and you just need to get another body behind a desk, it’s tempting to find someone right away. However, a hasty decision born of desperation is rarely a good one. Take the time to find the right person for the job.

You don’t have specific responsibilities for an employee

Unless you have a defined set of tasks and expectations for your new hire, do them a favor and don’t hire anyone. A new hire at this stage will rightfully be confused and ineffective. You may need help, but if you don’t know exactly what that help will look like, consider hiring a coach instead of an employee.

You’ll take anyone

If you’re lucky, the first applicant will be an absolute rockstar who can bring your business to the next level – but that’s not the norm. You’ll learn a lot about yourself, the applicant market and your own position by interviewing more candidates. The variety of skill sets on display can also hone your focus for what your future employee will do.

Hiring your first employee

Hire someone too early and you could have cash flow problems, a worker who has nothing to do and the added stress of management. Hire too late, and you could be inundated with work you can’t accomplish, which could lead to missing deadlines and losing out on business.

Finding the right moment to hire, therefore, can make the difference between a failed enterprise and a successful business. But how do you know when the time is right? The following tips can make this process a little less painful and provide options for making that first hire:

Start with a cofounder

If you’re a solopreneur looking to make that next step, bringing on an employee can be intimidating. Instead, hire a cofounder, or at least someone who thinks like one.When making that first hire, look for someone with cofounder potential and traits, such as complementary skills, similar values and vision, teachability, passion, emotional intelligence, flexibility and honesty. Your first employee will hopefully be one of your longest lasting and most knowledgeable.

Ask yourself: Will these tasks generate money?

It’s been said that the only two purposes of an employee are to: 1) make money for the business, or 2) save money for the business. If you’re confident a new hire will do at least one of those two things, go for it. In the early stage of a company, making money is more important than saving it. Typically, these early roles involve creating products (designers, developers, etc.), marketing products (growth hackers, content marketers, etc.) and supporting products (customer support, help desk, etc.).

Know your desired skill set

Before you search for an employee, you need to know what kind of candidate you’re looking for. It’s not enough to simply know that you “need some help” or “need a developer.” Get specific: You don’t want just a “developer.” You want a Javascript developer with GitHub experience able to create machine learning algorithms with educational applications, for example. The clearer your set of responsibilities are, the more effectively you can hire someone to fulfill those duties r.

Delay the decision by hiring a contractor

You may still be undecided over whether or not it’s time to hire. Don’t sweat it. Instead, test it. Try hiring a contractor with the same set of parameters you’re looking for in a full-time employee. The introductory hassle of onboarding a contractor is relatively low compared to that of hiring an employee. You can create a contract for one month, six months or a year. If it works out, you can transition this person into an official hire or look for a full-time employee.

The differences between hiring freelancers, contractors and employees

The major differences between freelancers, contractors and employees has to do with their relationship with the business owner. Freelancers and contractors are self-employed individuals, while employees are hired by the company. Freelancers and contractors typically set their schedules based on the needs of their clients and work out a payment schedule (typically upon completion of a job).

Employees, on the other hand, work the schedule established by the company and receive a regular paycheck on a schedule set by the company. As a business owner, you’re responsible for tax reporting on your payroll employees. But since freelancers and independent contractors are considered self-employed, they are responsible for reporting their taxes.

So what’s the best decision for your company? It depends on your needs, your resources and your ambitions.

When should you hire a freelancer?

Some people use the terms “freelancer” and “contractor” interchangeably, but there is a difference in the type of professional you are hiring. Freelancers usually work on smaller, short-term projects, while contractors work on larger, more long-term projects.

Freelancers are great options for specific support — for example, bringing on a digital marketer to get your social media up and running. If you’re not financially ready to bring on full-time employees for whom you have to provide employee benefits, a freelance relationship may be a better setup.

When should you hire a contractor?

Contractors generally come with a team of expert professionals who can get you the help you need, whatever it may be. They can handle specialized projects, such as IT, remodels, design and consulting. As your business grows, financial consultants can keep you on track with your financial goals. If you need highly specialized work that requires a team, contracting a company will ensure the job gets done right.

When should you hire an employee?

Not every company needs a large number of employees, but if you hold frequent meetings, rent an office space or interact with customers, you’ll want reliable employees to help support the business. Remember, just because someone looks good on paper doesn’t mean they’re a good fit for your business. They must fit into your company’s culture. Consider bringing on full-time staff if they can make you more money or improve the customer experience.

Why hiring globally might be your best move

The growing popularity of remote work has meant dramatic growth in the pool of available talent. Don’t limit yourself to just domestic workers, though. By hiring workers outside your country, you can save money, increase efficiency and still provide customers with superior service. Consider the following benefits to hiring globally.

A wider talent pool

As unemployment levels drop, the demand for skilled workers rises — especially for roles in software engineering or data science. By looking past your own borders, you can grow your pool of potential employees and have access to a wider swath of workers. For example, Poland, Slovakia and India are renowned for their pool of highly qualified tech professionals available to work remotely for international companies. Tap into this talent network to find the right fit for your company.

Cost efficiencies

Hiring overseas means access to employees who live somewhere with a much lower cost of living, which generally means lower salary expectations. The requirements for compulsory employer contributions and payroll taxes that increase business costs also vary by country. For example, countries like Germany and Japan generally require that employers deduct a certain amount of the employee’s pay for health insurance. But Australia and New Zealand, with public healthcare systems, do not require such employer insurance contributions.

Access to resilient international markets

If you run a growing, ambitious business, you may be eyeing overseas expansion. One of the biggest factors in your success will be having employees familiar with that market. You have a few options for growing an international presence: set up a local entity or subsidiary (abiding by local employment laws) or use an Employer of Record (EOR) solution, in which you designate a third-party company to handle payroll, HR compliance and employee tax withholding.

Compliance benefits

Employer compliance can vary depending on the country, and some are more strict than others. Whether you’re concerned about at-will employment, parental leave allowance or pension contributions, you can hire from countries whose labor laws align with your needs.

24/7 customer support

Customers expect fast and capable support, no matter where they’re based or when they contact the company. With just 9% of customers able to solve business queries on their own, customer service channels are more important than ever. Having staff in multiple international locations and time zones ensures someone will always answer the support line and provide 24/7 support for your customers.

Before you hire globally, though, you should look into any logistical challenges it might create. Despite the many benefits, hiring international talent can lead to internal communication challenges, scheduling conflicts across time zones, cultural differences, and discrepancies in pay scales. While these challenges can be overcome, they’re worth considering before building a continent-spanning workforce.

Related: 10 Pros (and Cons) of Hiring International Employees

Can college students solve your employee needs?

Different hires provide varying solutions for business, and hiring college students can infuse your company with young energy and ambitious workers. Whether you develop an internship program or employ them part time or seasonally, college students are often more affordable to hire than full-time employees and can support your team’s specific needs.

Creating a pipeline between universities and your business could be a worthwhile investment. Students are trying to get their foot in the door, and they can also provide your company with much-needed help. Here are a few benefits of hiring college students:

They bring fresh perspectives and new ideas

College students are at a unique stage in their lives and are just beginning to form professional identities. Eager to develop skill sets and apply classroom lessons in the professional world, they often bring welcome new perspectives to the table. This can be especially valuable in industries that are constantly changing or in need of innovation.

They’re highly motivated and ready to learn

The most ambitious college students are proactive and eager to take on new challenges — both promising traits for future employees. When you empower college workers, they’ll go above and beyond to learn and contribute to your organization. Additionally, young people are generally tech-savvy and comfortable with digital tools and platforms — a huge asset in today’s business landscape.

They’re cost-effective employees

Because school is the main priority, students are often willing to work for less pay than more experienced candidates; they’re also more open to part-time or internship positions, helping small businesses bring in new talent without breaking the bank. These internships can act as trial runs for potential full-time employment.

How to attract and hire the best salespeople

Just about any business needs persuasive salespeople. In order to sustain and grow your company, you need someone who can bring in new clients while you focus on the business itself. No matter what role someone in your company fulfills, everyone does some kind of selling on a regular basis — pitching investors or bankers, selling coworkers on a new project idea or vision, providing customer service, negotiating with vendors, etc.

Ultimately, though, it will be your sales team that drives your company’s growth. If you want to add top-notch talent to this group and increase your revenue, keep these things in mind:

Your mission should be exciting and purposeful

What are you looking to achieve with your business? Most people these days are looking to join a company because of its mission — its goal to change the world in some meaningful way. According to a 2021 McKinsey study, 70% of Americans say work defines their sense of purpose. Your mission doesn’t need to save lives, it just needs to inspire workers and point to a larger goal. Find salespeople who buy into this mindset, and they’ll evangelize the company or product for you.

Be the best salesperson you can be

If you’re looking to hire salespeople, you should also know how to sell. You may get to a point in your business where you’re not the main person bringing in new clients, but you still have ideas you need to sell to investors, journalists or marketers — and your own team. When interviewing a potential candidate, pay attention to your own energy level. Are you charismatic? Are you enthusiastic about the position and the opportunity? When the interview is done, you’ll want the candidate to feel like they’re ready to jump on your bandwagon and get started right away.

Know what else you can offer

If you can’t compete in the market with a high salary, you can at least offer other incentives that attract top talent and keep your business afloat. Many employees are looking for better work-life balance. Can you offer a flexible work schedule? Consider offering profit sharing or a higher commission in the near future. If your product or services are innovative or revolutionary, that can also be an incentive, as employees are eager to join a business that’s about to rapidly expand.

The best recruiting platforms for small business hiring

When it’s time to hire, finding quality candidates doesn’t need to be complicated. Job search sites can help you recruit and retain talent no matter your company’s budget or size. Some companies advertise jobs across a variety of platforms, and the sites you choose will determine who applies for your open roles.

Similar to reaching a target audience, you want to meet candidates where they already are — think industry-specific forums, alumni networks or on social media. But there’s also value in casting a wide net and posting on major job boards with millions of visitors. With so many platforms to choose from, which will best support your mission? Here are some of the top recruiting platforms to consider:

ZipRecruiter

ZipRecruiter allows you to post job openings and receive applications from relevant candidates, as well as organize applicants in a resume database. Applicant tracking tools, including providing candidates with notes and feedback, also help you manage the hiring process.

LinkedIn is particularly effective for recruiting candidates in the business, finance and technology sectors. To help you find and hire top talent in — and outside of — your network, it offers job postings, resume searches and applicant tracking.

Indeed

One of the world’s largest job search websites, Indeed allows you to search for candidates based on their location, experience and skills. It also provides rates for sponsored listings that prioritize your job openings in the search results.

Glassdoor

In addition to job postings, Glassdoor features reviews from people who’ve worked at various companies. By providing insight into a company’s culture and employee satisfaction, the site can help attract candidates to your open positions.

Workable

With affordable pricing plans and an easy-to-use interface, Workable is a recruiting platform that’s particularly effective for small- and medium-size businesses looking to streamline their hiring process. It offers a variety of features, including job postings, applicant tracking and candidate sourcing.

Writing job advertisements to attract remote workers

The pandemic ushered in a widespread adoption of work-from-home policies that may be here to stay. These policies allow for more flexible working situations, and they’re an excellent way for businesses to stay competitive in the job market.

When writing your job advertisements, keep in mind it’s still just a listing, so you need to effectively communicate the benefits of working remotely and the job requirements. Consider the following tips for writing job advertisements to attract remote workers:

Communicate the remote nature of the job

Specify that the job is a remote position and include details about the type of work environment and equipment that will be required. Does this person need to work certain hours or be in a certain time zone? Spell everything out. If the job advertisement doesn’t say remote up front, many people will assume that it’s not.

Highlight the benefits to employees working remotely

Make it clear that the job offers the flexibility and autonomy of working remotely. Mention any perks or benefits that come with the position, such as a flexible schedule or the ability to work from anywhere.

Clearly outline the job requirements

Your job advertisements should clearly state the skills, experience, and qualifications that are required for the position. This will help you attract the right candidates and weed out those who are not a good fit.

Use language that resonates with remote workers

Use language that speaks to the realities of working remotely. For example, mention the ability to work from anywhere or the need for strong self-motivation and discipline. Also mention skills necessary for collaborating remotely, such as clear and concise communication.

Include information about your company culture

Whether in-person or working remotely, employees place a high value on company culture. In fact, this may be even more crucial in a remote environment, where your only coworker interactions are happening in chats and on video calls. Include information about your company’s values and mission in your job advertisements to help attract candidates who are a good fit.

It’s time to start hiring

By following these tips, you can make the most effective hiring decisions for your business. Keep in mind: no two companies are the same. Before you make a hire — or post a job, for that matter — consider the work you need done, the kind of worker you need to complete it, and where that person should be located. By outlining your needs early, you’ll save money (and headaches) in the long run.

AFFILIATE MARKETING

Franchising Is Not For Everyone. Explore These Lucrative Alternatives to Expand Your Business.

Opinions expressed by Entrepreneur contributors are their own.

Not every business can be franchised, nor should it. As the founder and operator of an exciting, new concept, it’s hard not to envision opening a unit on every corner and becoming the next franchise millionaire. It’s a common dream. At one time, numerous concepts were claiming to be the next “McDonald’s” of their industry.

And while franchising can be the right growth vehicle for someone with an established brand and proven concept that’s ripe for growth, there are other options available for business owners who want to expand their concept into prime locations before their competition does but who don’t want to go it alone for a number of reasons. For instance, they may not have the resources or cash reserves to finance a franchise program (it is important to note that while franchising a business does leverage the time and capital of others to open additional units, establishing a franchise system is certainly not a no-cost endeavor). Or they don’t want the responsibilities and relationship of being a franchisor and would rather concentrate on running their core business, not a franchise system.

Related: The Pros and Cons of Franchising Your Business

But when you have eager customers asking to open a branded location just like yours in their neighborhood, it’s hard to resist. You might think: What if I don’t jump on the deal, and I miss out on an opportunity that might not come around again?

Licensing your intellectual property, such as your name, trademarks and trade dress, in exchange for a set fee or percentage of sales is one way to accomplish this without having to go the somewhat more laborious and legally controlled franchise route. Types of licensing agreements range from granting a license to allow another entity to manufacture or make your products to allowing someone to use your logo and name for their own business. Unlike in a franchise, your partner in a licensing situation will only be allowed certain predetermined rights to sell your products and services, not an all-in agreement to give them a turnkey business, accompanied by training and support, in exchange for set fees. A licensing agreement spells out each party’s rights, responsibilities, and what they can and cannot do under the terms of the agreement. Having a lawyer draw up the paperwork is vital, as well as consulting with a trusted business advisor who has helped others along this path and can shorten your learning curve while protecting your rights. License agreements are governed by contract law as opposed to franchise laws. However, care must be taken: To ensure that you’re staying in your lane and not crossing over into franchisor territory, you’ll want your advisers to detail what you can and can’t do as a licensor.

For instance, a license agreement excludes you from being involved in the day-to-day operations of the licensee’s business. While having no oversight may sound like a relief, it can be a double-edged sword, especially for people who are used to controlling all aspects of their products or services. You won’t have to provide licensees with ongoing services, such as marketing materials and continuous training, but it also means you have no control over how they run their business, their product mix or even how they decorate their space. If you’re a type-A, this may be hard for you.

Most people are more familiar with trademark licensing with a third party because these agreements are big in the sports and entertainment industries, where a celebrity lends their name to endorse a product, whether it’s branded athletic wear or trendy foodservice menu items such as pizza, chicken, or even gelato.

Using a celebrity’s cache garners media attention you might otherwise never get. But not everyone who comes up with a great concept or product has the recognition that would allow them to attract famous business partners or endorsements, and rabid fans that follow.

There are other methods of getting your products in front of more consumers. Some coffee concepts, including Caribou for example, have created market saturation by both franchising traditional stores and granting licenses for nontraditional locations, such as airports, big-box stores, and college campuses. Others, on the other hand, like Starbucks, employ a combination of company-owned stores and licensees in high-traffic locations where a small kiosk can service a high-density population of shoppers. And, of course, bags and pods of these brands’ coffee blends are also sold in retail locations such as grocery stores.

Related: Startups Must Protect Their Trademark. Here’s How and Why

But again, here’s that cautionary note: If you go the licensing route for your products or services, be careful not to cross over into trying to direct the way that licensees do their business, from selecting locations to training employees.

While licensing or franchising may be valid business growth vehicles for many brands, additional business structures that can be considered include:

- Company-owned stores: Opening corporate locations using bank loans and/or the profits from already opened units.

- Dealerships or distributorships: In a distributor relationship, products are purchased from a manufacturer and then sold through local dealers.

- Agency relationships: These are similar to the relationships you’d have with dealers, but in this case, an agent or representative of your company sells your services to a third party. The important distinction to remember so that the relationship doesn’t cross over into franchise territory is that you, as the provider of the services, pay the agent (as an independent sales rep) rather than the agent collecting the money and paying you.

- Joint ventures: In this case, you, as the concept owner, would take on an operating partner who also invests his own funds in the business. The two of you would then share in the equity and profits at the percentage rate of your investment.

The appropriate method to grow your business depends on several factors, including your type of concept, service, or products; your risk aversion factor; your access to capital; where you’re located; and current market conditions. So, if you choose another option to franchising, be cognizant of not slipping into becoming a franchise. The Federal Trade Commission’s regulations define a franchise as meeting at least three standards: a shared name, fees and royalty payments paid to the company by the franchisee, and ongoing support and control of the day-to-day operations by the franchisor.

Keep in mind that if you start with one expansion method, you can consider changing that structure with legal and professional guidance should your business needs merit a shift in strategy. Case in point: some licensors will eventually convert licensees to franchises under a newly crafted agreement and program if they see the need to change the fee structure and maintain additional control over operations.

Slow growth can be detrimental to a business, but not picking the right vehicle for that growth can be worse than standing still. That’s why doing your homework — consulting with professionals, such as attorneys, accounting and franchising advisors, and talking to others in the same boat as you will save you from drifting too far from shore.

-

PPC5 days ago

PPC5 days ago10 Most Effective Franchise Marketing Strategies

-

SEARCHENGINES6 days ago

SEARCHENGINES6 days agoGoogle Needs Very Few Links To Rank Pages; Links Are Less Important

-

SEO6 days ago

SEO6 days agoHow to Become an SEO Lead (10 Tips That Advanced My Career)

-

MARKETING6 days ago

MARKETING6 days agoHow to Use AI For a More Effective Social Media Strategy, According to Ross Simmonds

-

PPC6 days ago

PPC6 days agoBiggest Trends, Challenges, & Strategies for Success

-

AFFILIATE MARKETING7 days ago

AFFILIATE MARKETING7 days agoSet Your Team up for Success and Let Them Browse the Internet Faster

-

SEARCHENGINES5 days ago

SEARCHENGINES5 days agoGoogle Again Says Ignore Link Spam Especially To 404 Pages

-

SEARCHENGINES4 days ago

SEARCHENGINES4 days agoGoogle Won’t Change The 301 Signals For Ranking & SEO

![The Current State of Google’s Search Generative Experience [What It Means for SEO in 2024] person typing on laptop with](https://articles.entireweb.com/wp-content/uploads/2024/04/The-Current-State-of-Googles-Search-Generative-Experience-What-It.webp-400x240.webp)

![The Current State of Google’s Search Generative Experience [What It Means for SEO in 2024] person typing on laptop with](https://articles.entireweb.com/wp-content/uploads/2024/04/The-Current-State-of-Googles-Search-Generative-Experience-What-It.webp-80x80.webp)