MARKETING

Research: Re-opening is Driving New Online Search Opportunities

New research by BrightEdge shows emerging post-pandemic consumer trends are creating new opportunities for online search. There are clear winners in many areas from local search to travel. Other previously booming industries are experiencing a sharp pullback.

Shifts in Consumer Spending

The pandemic caused dramatic changes to how consumers spend and what they spend it on. The re-opening of the economy is causing similarly dramatic changes to online spending habits that may accelerate as the year progresses.

Re-opening Economy

Approximately 28% of the United States population fully vaccinated which in turn may be influencing changes in these verticals:

- Local Search – Dining

- Travel and Hospitality (Hotels, Flights )

- Digital Transformation

- E-commerce

Local Search – Dining

Pandemic trends saw increasing searches for take-out related phrases with a decrease in dine-in search queries. That trend is now reversing.

Take-out related phrases are trending lower while dining-in related search queries are trending upward.

The BrightEdge report notes:

“Within the Restaurant category we’re seeing a shift away from Take Out & Delivery and an increase in search using the “Dine in” qualifier.”

Changes in Travel Searches

These changes are reflected in 2021 search trends.

Head terms are seeing dramatic upward trends. Searches like “Flights” and “Cheap Flights” are trending upwards.

While there may be more volume in International Flights keyword phrase, Domestic Flights is seeing a more dramatic upturn. This may be an indication that families are keen to get together, driving more growth in domestic flights related keyword phrases.

Top Ten Dining Related Queries by Growth

- Happy hour

- Dessert

- Brazilian

- Seafood

- Chili

- Sushi

- Italian

- Mexican

- Vegan

- Japanese

Negative Trending Dining Queries

Interestingly there were four types of dining queries that were trending negatively by losing search queries.

- Chinese

- Thai

- Pho

- French

Slower Growth Dining Queries

While the following queries types were experiencing growth they were doing so at noticeably lower rates of growth.

- Ramen

- Mediterranean

- Pizza

What Do Negative and Slow Growth Trends Mean?

It could be that Chinese and pizza search queries experienced so much growth during the pandemic that people are ready for other dining-in options at an expanding range of cuisines.

Single people and couples may be re-entering the dining out scene, as evidenced by increased queries for happy hour.

Vacations Trending Upward

Vacation related keyword phrases are also trending upward. According to BrightEdge, searches for AirBnB are recording strong growth.

Hotel related phrases are trending a remarkable 350% in April 2021 over April 2020.

According to BrightEdge:

“Interest in Hotels reached the highest point in more than a year with nearly 35 million searches for Hotels in March by searchers in the US.”

Markets in the south are leading as destinations in hotel search queries.

Top Ten Hotel Search Queries

- Hotels in South Carolina

- Hotels in Alabama

- Hotels in Florida

- Hotels in Texas

- Hotels in Missouri

- Hotels in Tennessee

- Hotels in Hawaii

- Hotels in Virginia

- Hotels in California

- Hotels in Georgia

Travel Related Ecommerce Queries

Demand for luggage is experiencing a strong upward trend, reflecting how general travel trends can spill over into ecommerce. Look for renewed interest in travel guides as well, with searches also strongly trending upwards.

There is also strong demand for vacation and business related travel apparel. The top ten apparel type queries are dominated by seasonal and vacation clothing. But BrightEdge notes that suits also is trending upward, reflecting how the post-pandemic re-opening is causing changes that ripple out into ecommerce.

Top Ten Clothing Queries by Growth

- Shorts

- Swimwear

- Sandals and Slides

- Bottoms

- T-shirts

- Cleats

- Dresses and Skirts

- Suits

- Tops

- Casual

Digital Transformation

Digital Transformation has to do with taking businesses online, which includes video conferencing. BrightEdge notes that while this area is experiencing a contraction they note that “demand remains at levels dramatically higher than historic norms.”

Trends for a Time of Transition

These trends are indicators of what may soon become explosive growth. However it is too soon to say we’ve reached a new normal or to say what that normal will be when we reach it.

BrightEdge offered their opinion of what they feel are clear trends:

- The areas that saw the biggest surges in interest from COVID are mostly pulling back.

- The areas that were hurt most by the Pandemic are also recovering as the vaccine rolls out.

- A few key areas look they are here to stay as a “new normal” begins to emerge.

Citation

Read the full BrightEdge Report

Beyond the Search Evolution: How Vaccines Will Shape the Future of SEO and Digital

MARKETING

The Current State of Google’s Search Generative Experience [What It Means for SEO in 2024]

![The Current State of Google’s Search Generative Experience [What It Means for SEO in 2024] person typing on laptop with](https://articles.entireweb.com/wp-content/uploads/2024/04/The-Current-State-of-Googles-Search-Generative-Experience-What-It.webp.webp)

SEO enthusiasts, known for naming algorithm updates after animals and embracing melodrama, find themselves in a landscape where the “adapt or die” mantra prevails. So when Google announced the launch of its Search Generative Experience (SGE) in May of 2023 at Google/IO, you can imagine the reaction was immense.

Although SGE has the potential to be a truly transformative force in the landscape, we’re still waiting for SGE to move out of the Google Labs Sandbox and integrate into standard search results.

Curious about our current take on SGE and its potential impact on SEO in the future? Read on for more.

Decoding Google’s Defensive Move

In response to potential threats from competitors like ChatGPT, Bing, TikTok, Reddit, and Amazon, Google introduced SGE as a defensive maneuver. However, its initial beta release raised questions about its readiness and global deployment.

ChatGPT provided an existential threat that had the potential to eat into Google’s market share. When Bing started incorporating it into its search results, it was one of the most significant wins for Bing in a decade. In combination with threats from TikTok, Reddit, and Amazon, we see a more fractured search landscape less dominated by Google. Upon its launch, the expectation was that Google would push its SGE solution globally, impact most queries, and massively shake up organic search results and strategies to improve organic visibility.

Now, industry leaders are starting to question if Google is better off leaving SGE in the testing ground in Google labs. According to Google’s recent update, it appears that SGE will remain an opt-in experience in Google Labs (for at least the short term). If SGE was released, there could be a fundamental reset in understanding SEO. Everything from organic traffic to optimization tactics to tracking tools would need adjustments for the new experience. Therefore, the prospect of SGE staying in Google Labs is comforting if not entirely reliable.

The ever-present option is that Google can change its mind at any point and push SGE out broadly as part of its standard search experience. For this reason, we see value in learning from our observations with SGE and continuing to stay on top of the experience.

SGE User Experience and Operational Challenges

If you’ve signed up for search labs and have been experimenting with SGE for a while, you know firsthand there are various issues that Google should address before rolling it out broadly to the public.

At a high level, these issues fall into two broad categories including user experience issues and operational issues.

Below are some significant issues we’ve come across, with Google making notable progress in addressing certain ones, while others still require improvement:

- Load time – Too many AI-generated answers take longer to load than a user is willing to wait. Google recommends less than a 3-second load time to meet expectations. They’ll need to figure out how to consistently return results quickly if they want to see a higher adoption rate.

- Layout – The SGE layout is massive. We believe any major rollout will be more streamlined to make it a less intrusive experience for users and allow more visibility for ads, and if we’re lucky, organic results. Unfortunately, there is still a decent chance that organic results will move below the fold, especially on mobile devices. Recently, Google has incorporated more results where users are prompted to generate the AI result if they’d like to see it. The hope is Google makes this the default in the event of a broad rollout where users can generate an AI result if they want one instead of assuming that’s what a user would like to see.

- Redundancy – The AI result duplicates features from the map pack and quick answer results.

- Attribution – Due to user feedback, Google includes sources on several of their AI-powered overviews where you can see relevant web pages if there is an arrow next to the result. Currently, the best way to appear as one of these relevant pages is to be one of the top-ranked results, which is convenient from an optimization standpoint. Changes to how attribution and sourcing are handled could heavily impact organic strategies.

On the operational side, Google also faces significant hurdles to making SGE a viable product for its traditional search product. The biggest obstacle appears to be making the cost associated with the technology worth the business outcomes it provides. If this was a necessary investment to maintain market share, Google might be willing to eat the cost, but if their current position is relatively stable, Google doesn’t have much of an incentive to take on the additional cost burden of heavily leveraging generative AI while also presumably taking a hit to their ad revenue. Especially since slow user adoption doesn’t indicate this is something users are demanding at the moment.

While the current experience of SGE is including ads above the generative results now, the earliest iterations didn’t heavily feature sponsored ads. While they are now included, the current SGE layout would still significantly disrupt the ad experience we’re used to. During the Google I/O announcement, they made a statement to reassure advertisers they would be mindful of maintaining a distinct ad experience in search.

“In this new generative experience, Search ads will continue to appear in dedicated ad slots throughout the page. And we’ll continue to uphold our commitment to ads transparency and making sure ads are distinguishable from organic search results” – Elizabeth Reid, VP, Search at Google

Google is trying to thread a delicate needle here of staying on the cutting edge with their search features, while trying not to upset their advertisers and needlessly hinder their own revenue stream. Roger Montti details more of the operational issues in a recent article digging into the surprising reasons SGE is stuck in Google Labs.

He lists three big problems that need to be solved before SGE will be integrated into the foreground of search:

- Large Language Models being inadequate as an information retrieval system

- The inefficiency and cost of transformer architecture

- Hallucinating (providing inaccurate answers)

Until SGE provides more user value and checks more boxes on the business sense side, the traditional search experience is here to stay. Unfortunately, we don’t know when or if Google will ever feel confident they’ve addressed all of these concerns, so we’ll need to stay prepared for change.

Experts Chime in on Search Generative Experience

Our team has been actively engaging with SGE, here’s a closer look at their thoughts and opinions on the experience so far:

“With SGE still in its early stages, I’ve noticed consistent changes in how the generative results are produced and weaved naturally into the SERPs. Because of this, I feel it is imperative to stay on top of these on-going changes to ensure we can continue to educate our clients on what to expect when SGE is officially incorporated into our everyday lives. Although an official launch date is currently unknown, I believe proactively testing various prompt types and recording our learnings is important to prepare our clients for this next evolution of Google search.”

– Jon Pagano, SEO Sr. Specialist at Tinuiti

“It’s been exciting to watch SGE grow through different variations over the last year, but like other AI solutions its potential still outweighs its functionality and usefulness. What’s interesting to see is that SGE doesn’t just cite its sources of information, but also provides an enhanced preview of each webpage referenced. This presents a unique organic opportunity where previously untouchable top 10 rankings are far more accessible to the average website. Time will tell what the top ranking factors for SGE are, but verifiable content with strong E-E-A-T signals will be imperative.”

–Kate Fischer, SEO Specialist at Tinuiti

“Traditionally, AI tools were very good at analytical tasks. With the rise of ChatGPT, users can have long-form, multi-question conversations not yet available in search results. When, not if, released, Google’s Generative Experience will transform how we view AI and search. Because there are so many unknowns, some of the most impactful ways we prepare our clients are to discover and develop SEO strategies that AI tools can’t directly disrupt, like mid to low funnel content.”

– Brandon Miller, SEO Specialist at Tinuiti

“SGE is going to make a huge impact on the ecommerce industry by changing the way users interact with the search results. Improved shopping experience will allow users to compare products, price match, and read reviews in order to make it quicker and easier for a user to find the best deals and purchase. Although this leads to more competitive results, it also improves organic visibility and expands our product reach. It is more important than ever to ensure all elements of a page are uniquely and specifically optimized for search. With the SGE updates expected to continue to impact search results, the best way to stay ahead is by focusing on strong user focused content and detailed product page optimizations.”

– Kellie Daley, SEO Sr. Specialist at Tinuiti

Navigating the Clash of Trends

One of the most interesting aspects of the generative AI trend in search is that it appears to be in direct opposition to other recent trends.

One of the ways Google has historically evaluated the efficacy of its search ranking systems is through the manual review of quality raters. In their quality rater guidelines, raters were instructed to review for things like expertise, authority, and trustworthiness (EAT) in results to determine if Google results are providing users the information they deserve.

In 2022, Google updated their search guidelines to include another ‘e’ in the form of experience (EEAT). In their words, Google wanted to better assess if the content a user was consuming was created by someone with, “a degree of experience, such as with actual use of a product, having actually visited a place or communicating what a person has experienced. There are some situations where really what you value most is content produced by someone who has firsthand, life experience on the topic at hand.”

Generative AI results, while cutting-edge technology and wildly impressive in some cases, stand in direct opposition to the principles of E-E-A-T. That’s not to say that there’s no room for both in search, but Google will have to determine what it thinks users value more between these competing trends. The slow adoption of SGE could be an indication that a preference for human experience, expertise, authority, and trust is winning round one in this fight.

Along these lines, Google is also diversifying its search results to cater to the format in which users get their information. This takes the form of their Perspectives Filter. Also announced at Google I/O 2023, the perspectives filter incorporates more video, image, and discussion board posts from places like TikTok, YouTube, Reddit, and Quora. Once again, this trend shows the emphasis and value searchers place on experience and perspective. Users value individual experience over the impersonal conveyance of information. AI will never have these two things, even if it can provide a convincing imitation.

The current iteration of SGE seems to go too far in dismissing these trends in favor of generative AI. It’s an interesting challenge Google faces. If they don’t determine the prevailing trend correctly, veering too far in one direction can push more market share to ChatGPT or platforms like YouTube and TikTok.

Final Thoughts

The range of outcomes remains broad and fascinating for SGE. We can see this developing in different ways, and prognostication offers little value, but it’s invaluable to know the potential outcomes and prepare for as many of them as possible.

It’s critical that you or your search agency be interacting and experimenting with SGE because:

- The format and results will most likely continue to see significant changes

- This space moves quickly and it’s easy to fall behind

- Google may fix all of the issues with SGE and decide to push it live, changing the landscape of search overnight

- SGE experiments could inform other AI elements incorporated into the search experience

Ultimately, optimizing for the specific SGE experience we see now is less important because we know it will inevitably continue changing. We see more value in recognizing the trends and problems Google is trying to solve with this technology. With how quickly this space moves, any specifics mentioned in this article could be outdated in a week. That’s why focusing on intention and process is important at this stage of the game.

By understanding the future needs and wants SGE is attempting to address, we can help you future-proof your search strategies as much as possible. To some extent we’re always at the whims of the algorithm, but by maintaining a user-centric approach, you can make your customers happy, regardless of how they find you.

MARKETING

How to create editorial guidelines that are useful + template

Before diving in to all things editorial guidelines, a quick introduction. I head up the content team here at Optimizely. I’m responsible for developing our content strategy and ensuring this aligns to our key business goals.

Here I’ll take you through the process we used to create new editorial guidelines; things that worked well and tackle some of the challenges that come with any good multi – stakeholder project, share some examples and leave you with a template you can use to set your own content standards.

What are editorial guidelines?

Editorial guidelines are a set of standards for any/all content contributors, etc. etc. This most often includes guidance on brand, tone of voice, grammar and style, your core content principles and the types of content you want to produce.

Editorial guidelines are a core component of any good content strategy and can help marketers achieve the following in their content creation process:

- Consistency: All content produced, regardless of who is creating it, maintains a consistent tone of voice and style, helping strengthen brand image and making it easier for your audience to recognize your company’s content

- Quality Control: Serves as a ‘North Star’ for content quality, drawing a line in the sand to communicate the standard of content we want to produce

- Boosts SEO efforts: Ensures content creation aligns with SEO efforts, improving company visibility and increasing traffic

- Efficiency: With clear guidelines in place, content creators – external and internal – can work more efficiently as they have a clear understanding of what is expected of them

Examples of editorial guidelines

There are some great examples of editorial guidelines out there to help you get started.

Here are a few I used:

1. Editorial Values and Standards, the BBC

Ah, the Beeb. This really helped me channel my inner journalist and learn from the folks that built the foundation for free quality journalism.

How to create editorial guidelines, Pepperland Marketing

After taking a more big picture view I recognized needed more focused guidance on the step by step of creating editorial guidelines.

I really liked the content the good folks at Pepperland Marketing have created, including a free template – thanks guys! – and in part what inspired me to create our own free template as a way of sharing learnings and helping others quickstart the process of creating their own guidelines.

3. Writing guidelines for the role of AI in your newsroom?… Nieman Lab

As well as provide guidance on content quality and the content creation process, I wanted to tackle the thorny topic of AI in our editorial guidelines. Specifically, to give content creators a steer on ‘fair’ use of AI when creating content, to ensure creators get to benefit from the amazing power of these tools, but also that content is not created 100% by AI and help them understand why we feel that contravenes our core content principles of content quality.

So, to learn more I devoured this fascinating article, sourcing guidance from major media outlets around the world. I know things change very quickly when it comes to AI, but I highly encourage reading this and taking inspiration from how these media outlets are tackling this topic.

Learn more: The Marketer’s Guide to AI-generated content

Why did we decide to create editorial guidelines?

1. Aligning content creators to a clear vision and process

Optimizely as a business has undergone a huge transformation over the last 3 years, going through rapid acquisition and all the joys and frustrations that can bring. As a content team, we quickly recognized the need to create a set of clear and engaging guidelines that helps content creators understand how and where they can contribute, and gave a clear process to follow when submitting a content idea for consideration.

2. Reinvigorated approach to brand and content

As a brand Optimizely is also going through a brand evolution – moving from a more formal, considered tone of voice to one that’s much more approachable, down to earth and not afraid to use humor, different in content and execution.

See, our latest CMS campaign creative:

It’s pretty out there in terms of creative and messaging. It’s an ad campaign that’s designed to capture attention yes, but also – to demonstrate our abilities as a marketing team to create this type of campaign that is normally reserved for other more quote unquote creative industries.

We wanted to give guidance to fellow content creators outside the team on how they can also create content that embraces this evolved tone of voice, while at the same time ensuring content adheres to our brand guidelines.

3. Streamline content creation process

Like many global enterprises we have many different content creators, working across different time zones and locations. Documenting a set of guidelines and making them easily available helps content creators quickly understand our content goals, the types of content we want to create and why. It would free up content team time spent with individual contributors reviewing and editing submissions, and would ensure creation and optimization aligns to broader content & business goals.

It was also clear that we needed to document a process for submitting content ideas, so we made sure to include this in the guidelines themselves to make it easy and accessible for all contributors.

4. 2023 retrospective priority

As a content team we regularly review our content strategy and processes to ensure we’re operating as efficiently as possible.

In our last retrospective. I asked my team ‘what was the one thing I could do as a manager to help them be more impactful in their role?’

Editorial guidelines was the number 1 item on their list.

So off we went…

What we did

- Defined a discrete scope of work for the first version of the editorial guidelines, focusing on the Blog and Resources section of the website. This is where the content team spends most of its time and so has most involvement in the content creation process. Also where the most challenging bottlenecks have been in the past

- Research. Reviewed what was out there, got my hands on a few free templates and assembled a framework to create a first version for inputs and feedback

- Asked content community – I put a few questions out to my network on LinkedIn on the topic of content guidelines and content strategy, seeking to get input and guidance from smart marketers.

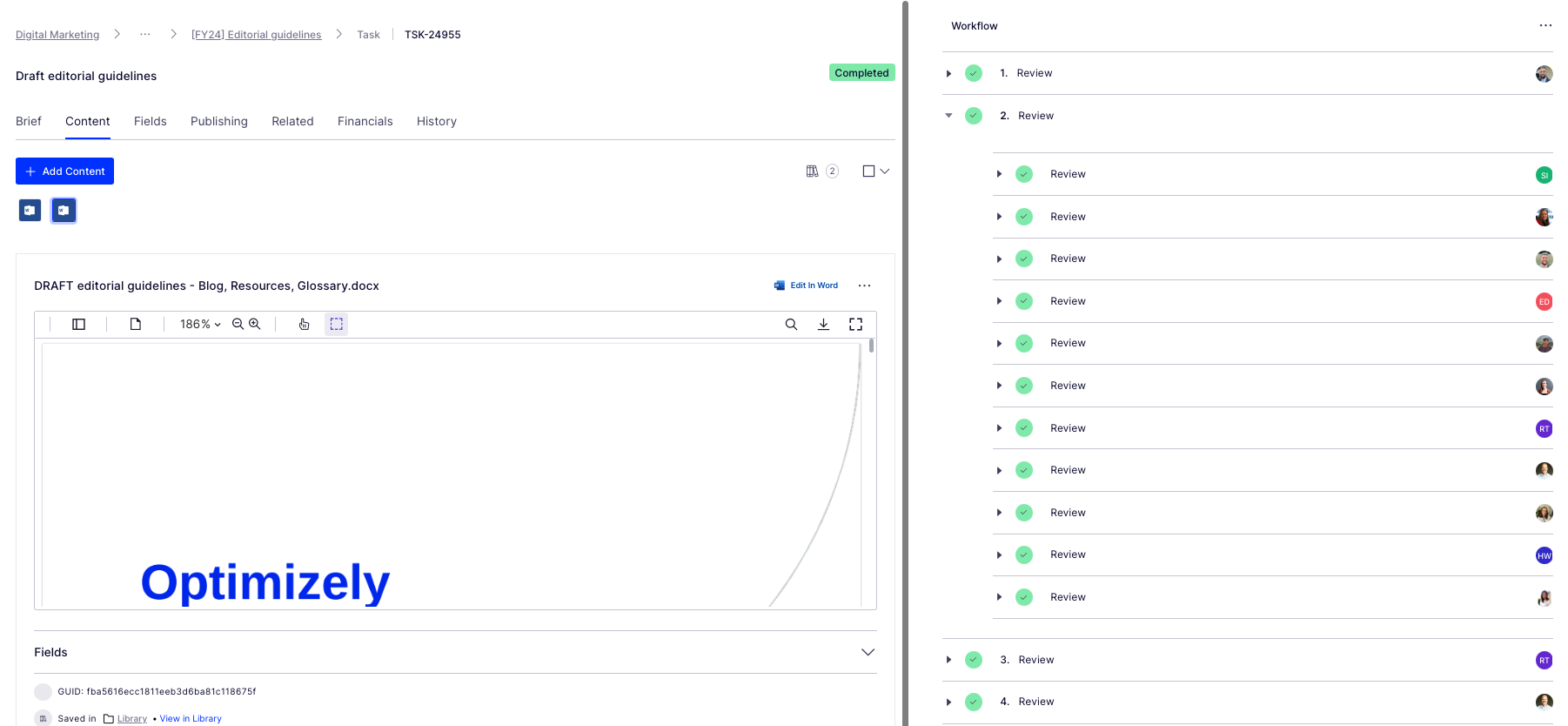

- Invited feedback: Over the course of a few weekswe invited collaborators to comment in a shared doc as a way of taking iterative feedback, getting ideas for the next scope of work, and also – bringing people on the journey of creating the guidelines. Look at all those reviewers! Doing this within our Content Marketing Platform (CMP) ensured that all that feedback was captured in one place, and that we could manage the process clearly, step by step:

Look at all those collaborators! Thanks guys! And all of those beautiful ticks, so satisfying. So glad I could crop out the total outstanding tasks for this screen grab too (Source – Optimizely CMP)

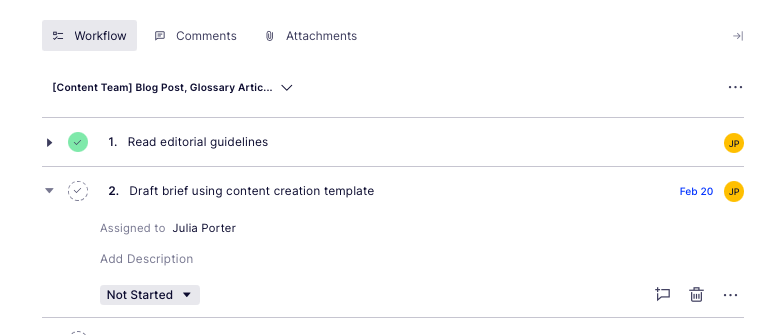

- Updated content workflow: Now we have clear, documented guidance in place, we’ve included this as a step – the first step – in the workflow used for blog post creation:

Source: Optimizely CMP

Results

It’s early days but we’re already seeing more engagement with the content creation process, especially amongst the teams involved in building the guidelines (which was part of the rationale in the first place :))

Source: My Teams chat

It’s inspired teams to think differently about the types of content we want to produce going forwards – for the blog and beyond.

I’d also say it’s boosted team morale and collaboration, helping different teams work together on shared goals to produce better quality work.

What’s next?

We’re busy planning wider communication of the editorial guidelines beyond marketing. We’ve kept the original draft and regularly share this with existing and potential collaborators for ongoing commentary, ideas and feedback.

Creating guidelines has also sparked discussion about the types of briefs and templates we want and need to create in CMP to support creating different assets. Finding the right balance between creative approach and using templates to scale content production is key.

We’ll review these guidelines on a quarterly basis and evolve as needed, adding new formats and channels as we go.

Key takeaways

- Editorial guidelines are a useful way to guide content creators as part of your overall content strategy

- Taking the time to do research upfront can help accelerate seemingly complex projects. Don’t be afraid to ask your community for inputs and advice as you create

- Keep the scope small at first rather than trying to align everything all at once. Test and learn as you go

- Work with stakeholders to build guidelines from the ground up to ensure you create a framework that is useful, relevant and used

And lastly, here’s that free template we created to help you build or evolve your own editorial guidelines!

MARKETING

Effective Communication in Business as a Crisis Management Strategy

Everyday business life is full of challenges. These include data breaches, product recalls, market downturns and public relations conflicts that can erupt at any moment. Such situations pose a significant threat to a company’s financial health, brand image, or even its further existence. However, only 49% of businesses in the US have a crisis communications plan. It is a big mistake, as such a strategy can build trust, minimize damage, and even strengthen the company after it survives the crisis. Let’s discover how communication can transform your crisis and weather the chaos.

The ruining impact of the crisis on business

A crisis can ruin a company. Naturally, it brings losses. But the actual consequences are far worse than lost profits. It is about people behind the business – they feel the weight of uncertainty and fear. Employees start worrying about their jobs, customers might lose faith in the brand they once trusted, and investors could start looking elsewhere. It can affect the brand image and everything you build from the branding, business logo, social media can be ruined. Even after the crisis recovery, the company’s reputation can suffer, and costly efforts might be needed to rebuild trust and regain momentum. So, any sign of a coming crisis should be immediately addressed. Communication is one of the crisis management strategies that can exacerbate the situation.

The power of effective communication

Even a short-term crisis may have irreversible consequences – a damaged reputation, high employee turnover, and loss of investors. Communication becomes a tool that can efficiently navigate many crisis-caused challenges:

- Improved trust. Crisis is a synonym for uncertainty. Leaders may communicate trust within the company when the situation gets out of control. Employees feel valued when they get clear responses. The same applies to the customers – they also appreciate transparency and are more likely to continue cooperation when they understand what’s happening. In these times, documenting these moments through event photographers can visually reinforce the company’s messages and enhance trust by showing real, transparent actions.

- Reputation protection. Crises immediately spiral into gossip and PR nightmares. However, effective communication allows you to proactively address concerns and disseminate true information through the right channels. It minimizes speculation and negative media coverage.

- Saved business relationships. A crisis can cause unbelievable damage to relationships with employees, customers, and investors. Transparent communication shows the company’s efforts to find solutions and keeps stakeholders informed and engaged, preventing misunderstandings and painful outcomes.

- Faster recovery. With the help of communication, the company is more likely to receive support and cooperation. This collaborative approach allows you to focus on solutions and resume normal operations as quickly as possible.

It is impossible to predict when a crisis will come. So, a crisis management strategy mitigates potential problems long before they arise.

Tips on crafting an effective crisis communication plan.

To effectively deal with unforeseen critical situations in business, you must have a clear-cut communication action plan. This involves things like messages, FAQs, media posts, and awareness of everyone in the company. This approach saves precious time when the crisis actually hits. It allows you to focus on solving the problem instead of intensifying uncertainty and panic. Here is a step-by-step guide.

Identify your crisis scenarios.

Being caught off guard is the worst thing. So, do not let it happen. Conduct a risk assessment to pinpoint potential crises specific to your business niche. Consider both internal and external factors that could disrupt normal operations or damage the online reputation of your company. Study industry-specific issues, past incidents, and current trends. How will you communicate in each situation? Knowing your risks helps you prepare targeted communication strategies in advance. Of course, it is impossible to create a perfectly polished strategy, but at least you will build a strong foundation for it.

Form a crisis response team.

The next step is assembling a core team. It will manage communication during a crisis and should include top executives like the CEO, CFO, and CMO, and representatives from key departments like public relations and marketing. Select a confident spokesperson who will be the face of your company during the crisis. Define roles and responsibilities for each team member and establish communication channels they will work with, such as email, telephone, and live chat. Remember, everyone in your crisis response team must be media-savvy and know how to deliver difficult messages to the stakeholders.

Prepare communication templates.

When a crisis hits, things happen fast. That means communication needs to be quick, too. That’s why it is wise to have ready-to-go messages prepared for different types of crises your company may face. These messages can be adjusted to a particular situation when needed and shared on the company’s social media, website, and other platforms right away. These templates should include frequently asked questions and outline the company’s general responses. Make sure to approve these messages with your legal team for accuracy and compliance.

Establish communication protocols.

A crisis is always chaotic, so clear communication protocols are a must-have. Define trigger points – specific events that would launch the crisis communication plan. Establish a clear hierarchy for messages to avoid conflicting information. Determine the most suitable forms and channels, like press releases or social media, to reach different audiences. Here is an example of how you can structure a communication protocol:

- Immediate alert. A company crisis response team is notified about a problem.

- Internal briefing. The crisis team discusses the situation and decides on the next steps.

- External communication. A spokesperson reaches the media, customers, and suppliers.

- Social media updates. A trained social media team outlines the situation to the company audience and monitors these channels for misinformation or negative comments.

- Stakeholder notification. The crisis team reaches out to customers and partners to inform them of the incident and its risks. They also provide details on the company’s response efforts and measures.

- Ongoing updates. Regular updates guarantee transparency and trust and let stakeholders see the crisis development and its recovery.

Practice and improve.

Do not wait for the real crisis to test your plan. Conduct regular crisis communication drills to allow your team to use theoretical protocols in practice. Simulate different crisis scenarios and see how your people respond to these. It will immediately demonstrate the strong and weak points of your strategy. Remember, your crisis communication plan is not a static document. New technologies and evolving media platforms necessitate regular adjustments. So, you must continuously review and update it to reflect changes in your business and industry.

Wrapping up

The ability to handle communication well during tough times gives companies a chance to really connect with the people who matter most—stakeholders. And that connection is a foundation for long-term success. Trust is key, and it grows when companies speak honestly, openly, and clearly. When customers and investors trust the company, they are more likely to stay with it and even support it. So, when a crisis hits, smart communication not only helps overcome it but also allows you to do it with minimal losses to your reputation and profits.

-

SEARCHENGINES7 days ago

Daily Search Forum Recap: April 19, 2024

-

WORDPRESS6 days ago

WORDPRESS6 days ago13 Best HubSpot Alternatives for 2024 (Free + Paid)

-

MARKETING6 days ago

MARKETING6 days agoBattling for Attention in the 2024 Election Year Media Frenzy

-

WORDPRESS6 days ago

WORDPRESS6 days ago7 Best WooCommerce Points and Rewards Plugins (Free & Paid)

-

MARKETING5 days ago

MARKETING5 days agoAdvertising in local markets: A playbook for success

-

SEO6 days ago

SEO6 days agoGoogle Answers Whether Having Two Sites Affects Rankings

-

SEARCHENGINES5 days ago

SEARCHENGINES5 days agoGoogle Core Update Flux, AdSense Ad Intent, California Link Tax & More

-

AFFILIATE MARKETING6 days ago

AFFILIATE MARKETING6 days agoGrab Microsoft Project Professional 2021 for $20 During This Flash Sale

![The Current State of Google’s Search Generative Experience [What It Means for SEO in 2024] person typing on laptop with](https://articles.entireweb.com/wp-content/uploads/2024/04/The-Current-State-of-Googles-Search-Generative-Experience-What-It.webp-400x240.webp)

![The Current State of Google’s Search Generative Experience [What It Means for SEO in 2024] person typing on laptop with](https://articles.entireweb.com/wp-content/uploads/2024/04/The-Current-State-of-Googles-Search-Generative-Experience-What-It.webp-80x80.webp)