SOCIAL

Meta Will Shut Down its Newsletter Platform Early Next Year

In news that will surprise no-one, Meta has today confirmed that it’s shutting down its ‘Bulletin’ newsletter platform, just 18 months after its initial launch.

Another sign of Meta’s fleeting interest in the latest trends, the company launched Bulletin in April 2021, as part of an effort to take a piece of the growing newsletter market, with platforms like Substack seeing massive growth in facilitating direct connection between writers and their audiences. Twitter also acquired newsletter platform Revue, and it had seemed, at the time, that newsletters could offer a new, supplementary income stream for creators, aligned with social apps.

In addition to this, Meta also saw an opportunity to provide a platform for local publications that had been shut down due to the pandemic. With ad dollars from local businesses drying up, due to lockdown measures, many smaller publications had to shut down, and Meta viewed this as a chance to make Facebook an even more critical element of community engagement, by providing a direct pathway for independent journalists to serve their audiences through the app.

As part of its initial push, Meta allocated $5 million in funding for local publications to convert to Bulletin instead.

And it sort of worked. Bulletin, at last at one stage, supported over 115 publications, with more than half of the creators on the platform reaching over 1,000 subscribers.

But this year, amid tougher market conditions, Meta lost interest.

The company has been gradually scaling back its investment in news and original content in recent months. Back in July, The Wall Street Journal reported that Meta had reallocated resources from both its Facebook News tab and Bulletin, in order to ‘heighten their focus on building a more robust Creator economy’

In other words, Reels – Meta’s main investment focus for the future of the Creator Economy is short-form video content, which drives more views, more engagement, and is the big trend that Meta’s chasing right now.

As a result, Meta says that it will shut down Bulletin by early next year.

As per Meta:

“Bulletin has allowed us to learn about the relationship between Creators and their audiences and how to better support them in building their community on Facebook. While this off-platform product itself is ending, we remain committed to supporting these and other Creators’ success and growth on our platform.”

So long as they create Reels, I guess.

Again, the decision here is no surprise, but it does serve as another reminder that Meta chases whatever trends it can, and it has no real, long-term commitment on any of its new pushes.

Video is the thing, as it has been several times before, and Meta will keep pushing that till audiences lose interest. Then it’ll be something else that Meta’s pitching to brands, publishers, users, etc.

Logically, Meta follows the latest trends in order to maximize the benefit of such within its tools. But it is worth noting that, when it does lose interest, it tends to move on entirely, leaving anyone who’s invested in its last whim out in the cold.

Overall, Bulletin isn’t huge, and it won’t impact a heap of writers and publishers, as such. But even so, for those that have invested in the platform, in good faith, it’s a bitter pill, and while they will now be able to move on to other platforms as well, it’s good to remind yourself that Meta chases trends, and moves on quick.

‘Don’t build on rented land’. ‘Don’t put all of your eggs in one basket’. Don’t trust social platforms to keep supporting that feature or platform that you’ve come to rely on.

The closure of Bulletin may seem like a side note to many, but it’s an important reminder that you need to diversify your strategy to avoid such impacts.

SOCIAL

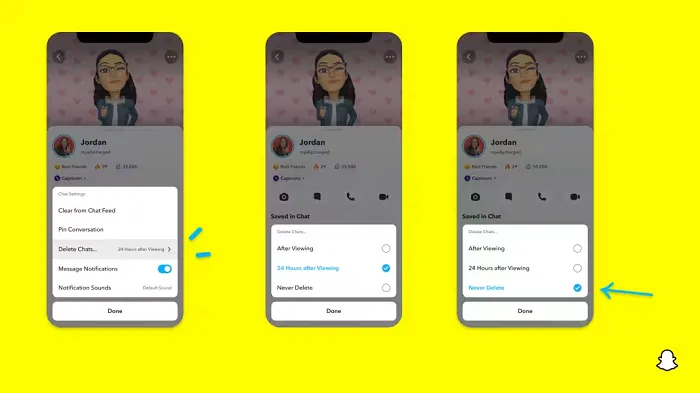

Snapchat Explores New Messaging Retention Feature: A Game-Changer or Risky Move?

In a recent announcement, Snapchat revealed a groundbreaking update that challenges its traditional design ethos. The platform is experimenting with an option that allows users to defy the 24-hour auto-delete rule, a feature synonymous with Snapchat’s ephemeral messaging model.

The proposed change aims to introduce a “Never delete” option in messaging retention settings, aligning Snapchat more closely with conventional messaging apps. While this move may blur Snapchat’s distinctive selling point, Snap appears convinced of its necessity.

According to Snap, the decision stems from user feedback and a commitment to innovation based on user needs. The company aims to provide greater flexibility and control over conversations, catering to the preferences of its community.

Currently undergoing trials in select markets, the new feature empowers users to adjust retention settings on a conversation-by-conversation basis. Flexibility remains paramount, with participants able to modify settings within chats and receive in-chat notifications to ensure transparency.

Snapchat underscores that the default auto-delete feature will persist, reinforcing its design philosophy centered on ephemerality. However, with the app gaining traction as a primary messaging platform, the option offers users a means to preserve longer chat histories.

The update marks a pivotal moment for Snapchat, renowned for its disappearing message premise, especially popular among younger demographics. Retaining this focus has been pivotal to Snapchat’s identity, but the shift suggests a broader strategy aimed at diversifying its user base.

This strategy may appeal particularly to older demographics, potentially extending Snapchat’s relevance as users age. By emulating features of conventional messaging platforms, Snapchat seeks to enhance its appeal and broaden its reach.

Yet, the introduction of message retention poses questions about Snapchat’s uniqueness. While addressing user demands, the risk of diluting Snapchat’s distinctiveness looms large.

As Snapchat ventures into uncharted territory, the outcome of this experiment remains uncertain. Will message retention propel Snapchat to new heights, or will it compromise the platform’s uniqueness?

Only time will tell.

SOCIAL

Catering to specific audience boosts your business, says accountant turned coach

While it is tempting to try to appeal to a broad audience, the founder of alcohol-free coaching service Just the Tonic, Sandra Parker, believes the best thing you can do for your business is focus on your niche. Here’s how she did just that.

When running a business, reaching out to as many clients as possible can be tempting. But it also risks making your marketing “too generic,” warns Sandra Parker, the founder of Just The Tonic Coaching.

“From the very start of my business, I knew exactly who I could help and who I couldn’t,” Parker told My Biggest Lessons.

Parker struggled with alcohol dependence as a young professional. Today, her business targets high-achieving individuals who face challenges similar to those she had early in her career.

“I understand their frustrations, I understand their fears, and I understand their coping mechanisms and the stories they’re telling themselves,” Parker said. “Because of that, I’m able to market very effectively, to speak in a language that they understand, and am able to reach them.”Â

“I believe that it’s really important that you know exactly who your customer or your client is, and you target them, and you resist the temptation to make your marketing too generic to try and reach everyone,” she explained.

“If you speak specifically to your target clients, you will reach them, and I believe that’s the way that you’re going to be more successful.

Watch the video for more of Sandra Parker’s biggest lessons.

SOCIAL

Instagram Tests Live-Stream Games to Enhance Engagement

Instagram’s testing out some new options to help spice up your live-streams in the app, with some live broadcasters now able to select a game that they can play with viewers in-stream.

As you can see in these example screens, posted by Ahmed Ghanem, some creators now have the option to play either “This or That”, a question and answer prompt that you can share with your viewers, or “Trivia”, to generate more engagement within your IG live-streams.

That could be a simple way to spark more conversation and interaction, which could then lead into further engagement opportunities from your live audience.

Meta’s been exploring more ways to make live-streaming a bigger consideration for IG creators, with a view to live-streams potentially catching on with more users.

That includes the gradual expansion of its “Stars” live-stream donation program, giving more creators in more regions a means to accept donations from live-stream viewers, while back in December, Instagram also added some new options to make it easier to go live using third-party tools via desktop PCs.

Live streaming has been a major shift in China, where shopping live-streams, in particular, have led to massive opportunities for streaming platforms. They haven’t caught on in the same way in Western regions, but as TikTok and YouTube look to push live-stream adoption, there is still a chance that they will become a much bigger element in future.

Which is why IG is also trying to stay in touch, and add more ways for its creators to engage via streams. Live-stream games is another element within this, which could make this a better community-building, and potentially sales-driving option.

We’ve asked Instagram for more information on this test, and we’ll update this post if/when we hear back.

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 19, 2024

-

WORDPRESS6 days ago

WORDPRESS6 days ago13 Best HubSpot Alternatives for 2024 (Free + Paid)

-

MARKETING6 days ago

MARKETING6 days agoBattling for Attention in the 2024 Election Year Media Frenzy

-

WORDPRESS6 days ago

WORDPRESS6 days ago7 Best WooCommerce Points and Rewards Plugins (Free & Paid)

-

MARKETING5 days ago

MARKETING5 days agoAdvertising in local markets: A playbook for success

-

SEO6 days ago

SEO6 days agoGoogle Answers Whether Having Two Sites Affects Rankings

-

SEARCHENGINES5 days ago

SEARCHENGINES5 days agoGoogle Core Update Flux, AdSense Ad Intent, California Link Tax & More

-

AFFILIATE MARKETING6 days ago

AFFILIATE MARKETING6 days agoGrab Microsoft Project Professional 2021 for $20 During This Flash Sale

You must be logged in to post a comment Login